DAX 40

The DAX 40 is Germany’s most significant stock index and acts as an indicator of wider economic performance across Europe and the rest of the world. The DE 40 is a popular index to trade as it includes many large blue-chip stocks and provides investors with impressive diversification across central and western Europe. This 2026 review will explore how to compare DAX 40 brokers, how the index works and what strategies traders can adopt to profit from it. Moreover, check out our list of the best brokers for DAX 40 speculation below.

Top DAX 40 Brokers In The UK

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30

Safety Comparison

Compare how safe the DAX 40 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the DAX 40 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the DAX 40 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ |

Beginners Comparison

Are the DAX 40 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots |

Advanced Trading Comparison

Do the DAX 40 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the DAX 40.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Forex.com | |||||||||

| eToro | |||||||||

| Vantage FX |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

Cons

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- The trading firm provides narrow spreads and a clear pricing structure.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Leading traders participating in the broker's Popular Investor Programme can earn yearly compensation of up to 1.5% of the copied assets.

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

- The broker offers excellent services for beginners, featuring commission-free stock trading, a low minimum deposit, and an unlimited demo account.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The only significant contact option, besides the in-platform live chat, is limited.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

How To Compare DAX 40 Brokers

As one of the leading indices in the world, the DAX 40 is available to trade with many UK and international brokers. The competition this draws means that investors can access low fees at reputable brokers but also that investors must spend time comparing them. We have detailed some of the key areas you should look at closely when comparing brokers:

- Costs – this is one of the most important aspects to look at, particularly if you are a high-volume trader opening and closing positions on the asset multiple times a day or every few days. The two main ways DAX 40 brokers make their money is through commission and spreads. Although some brokers will advertise zero commission, make sure to look closely at the instrument’s spread as this may include a hefty markup from the firm. On the other hand, some brokers may offer close to a 0.0 pip spread and then charge large commissions. To give you an idea of how much trades cost, IG charge £3 commission on its DAX 40 ETFs. Brokers should list any deposit and withdrawal charges, expense ratios on ETFs, inactivity fees and currency conversion charges. Fees can also be impacted by whether the firm is a market maker or a no-dealing desk (NDD) broker.

- Trading Platform – although some DAX 40 brokers will have an in-house platform, many will provide access to MetaTrader 4 (MT4), MetaTrader 5 (MT5) or TradingView. Each of these has its pros and cons, so work out what your investing strategy will be for the DAX 40 (i.e technical or fundamental analysis) and then look for the features on the platform that will allow you to execute this strategy. For example, MetaTrader has an abundance of built-in and community-built indicators, making it a popular choice for those undertaking technical analysis.

TradingView Platform

- Customer Service – technical issues are likely to occur when investing over a long period, which is why it is important to ensure you have access to real-time support with DAX 40 brokers. The index’s main trading hours are on weekdays, so 24/5 support may be sufficient, although there are some brokers now that provide 24/7 support. The best companies have live chat, phone and email contact methods, making them easily available to all.

- Regulation – we always recommend choosing a regulated DAX 40 broker. The FCA and CySEC are both examples of reputable regulatory authorities. These agencies provide more protection to investors and monitor the firms they regulate to ensure they comply with the rules. In addition, many DAX 40 brokers are members of an investor compensation fund, which insure clients up to a certain amount should the broker go into insolvency.

What Is The DAX 40?

Overview

The DAX 40 began as the DAX 30, which was established in 1988 and contained the 30 largest companies on the Frankfurt Stock Exchange by market capitalisation. In September 2021, the 30 became 40 when ten new companies were added to the index, meaning DAX 40 brokers could offer a more diversified index. It is also known as the GER 40, the DE 40 and the Deutscher Aktien Index. One explanation for the change is that the Frankfurt Stock Exchange wanted to shake things up after the 2019 Wirecard scandal.

This index is a blue-chip index, which means it contains some of the most famous companies in the world, including BMW, Siemens and Airbus. This, alongside the fact that it is the primary index for Germany, Europe’s largest economy, means that it is trusted by many investors around the world.

The DE 40 is a performance-based index, which means dividends are taken into account. This is not the case with many indices elsewhere in the world. Prices are calculated every second by Xetra, which is an electronic trading system. The Frankfurt Stock Exchange is also home to the MDAX index.

Composition

The concentrated nature of the DAX 40 has led to many comparing it with the Dow Jones, which consists of 30 US companies. Despite being relatively concentrated when compared with indices like the UK’s FTSE 100 or the Nasdaq 100 and S&P 500 in the USA, the addition of ten new companies in 2021 did allow DAX 40 brokers to offer a more diversified index and reduce the influence of any one company.

The GER 40 covers several different sectors of the economy, including automobiles, financial services and clothing. The chemical industry represents around 16% and the insurance industry around 10%. Although there are other indices linked to the Frankfurt Stock Exchange, roughly 80% of the average market cap of the FSE is represented by the DAX.

Opening Hours

DAX 40 brokers support investing during the FSE’s opening times, which are 07:00 to 21:00 GMT on weekdays, although some offer opportunities to trade extended hours. City Index allows investors to buy and sell the instrument from 23:00 GMT on Sunday to 21:15 GMT on Friday (with regular trading breaks).

What Is The DAX 40 Used For?

German Economy

Given that companies on the DAX 40 must have a legal or operating base in Germany, the index can provide a strong indication of the strength or weakness of the German economy. That said, there are only 40 companies on the index and, despite being spread across multiple sectors, there are still large numbers of companies unrepresented, which limits its value as an indicator of the domestic economy. In addition, many of the companies have strong links to other economies, particularly the US.

Global Economy

Many of the companies available from DAX 40 brokers, such as BMW and Porsche, focus heavily on overseas markets, making the index a good indicator of the global economic mood. For example, the DE 40 may lose value if the US economy goes into recession as this could reduce exports and revenue for some of its members. In fact, around three-quarters of sales from DAX 40 companies are earned abroad. Some investors may therefore use DAX 40 brokers to help assess global economic performance.

Diversification

Warren Buffet said that “a low-cost index fund is the most sensible equity investment for the great majority of investors.” The diversification that indices provide makes them popular choices for investors and the DAX 40 is no different. One company may lose value in a day but if others have increased their share price, this may still mean investors achieve a profit once the investing session closes.

Trade & Speculate

DAX 40 brokers are popular with traders around the world because the index provides an opportunity to profit from changes in its value. Some investors may wish to keep their money in the DAX 40 for months and years in the hope that its value increases over time. Others may look to profit from an upcoming announcement. For example, if the European Central Bank or Federal Reserve is meeting to decide interest rates. The latter is a riskier approach but may produce greater profits, though sometimes it is better to watch the dust settle after a major announcement and then make your move.

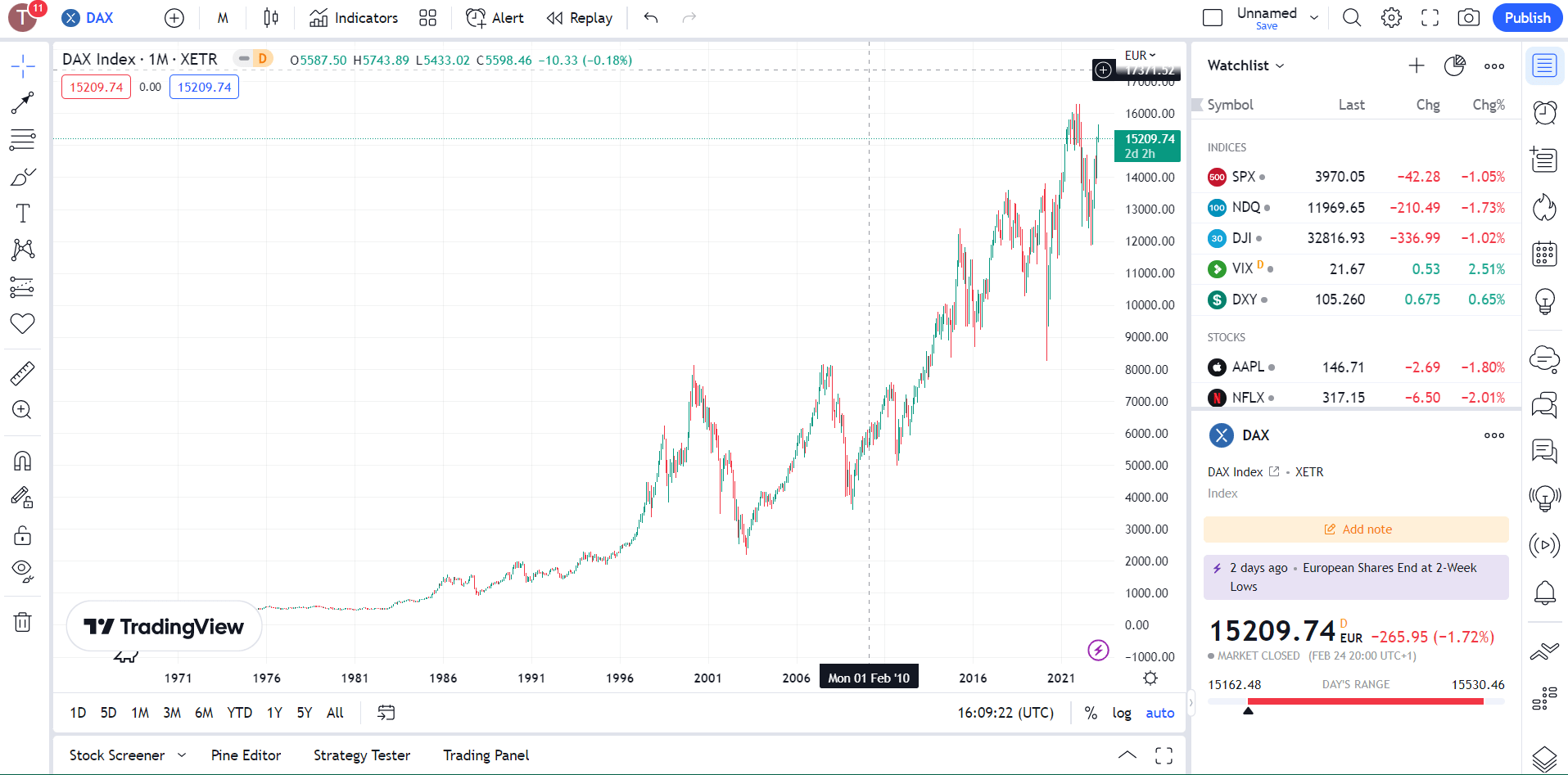

Live Price Chart

How The DAX 40 Works

Qualification

DAX 40 companies must be on the Frankfurt Stock Exchange and have at least 10% of their shares held by the public (i.e not by insiders). This is also referred to as the free-float methodology. New members must report two years of positive earnings before interest, taxes, depreciation and amortisation (EBITDA) and have a legal or operating base in Germany. The company must also be listed in the Prime Standard segment of the Frankfurt Stock Exchange, which has higher transparency standards than the General Standard segment.

Changes

The DE 40 index is reviewed every quarter with any changes determined by the Board of the German Stock Exchange. Companies lose their place if they are no longer in the top 45 and gain a place on the index if they enter the top 25. This avoids unnecessary changes to the index if a company were to temporarily move just outside of the top 40. The changes are then updated on the platforms used by DAX 40 brokers.

Weighting

When investing with DAX 40 brokers, it is important to remember that not all companies affect the index in the same way when their value changes. Companies with larger market caps impact the index more than smaller ones, although no single company can have a weighting of more than 10% of the index. An example that shows this weighting in action is that, in October 2020, SAP dropped 20% but only produced a 2.6% decline in the index, despite being the largest company at the time.

Key Facts

- A high of 16,271.75 was reached in 2022

- The return in 2019 on the DAX 40 was +25.48%

- The addition of ten new companies in 2021 reduced the impact of each company

- Since 2010, there have been three years with negative returns (2011, 2018 and 2022)

- Between January 1999 and December 2022, the average annual return of the DAX was 4.24%

- On the DAX’s 40th birthday, 15 companies present when the index was established were still there

Biggest Players

Below we have listed the largest companies on the index that most DAX 40 brokers will also have available as stock instruments to trade:

- Linde (LIN) – a global industrial group with a market cap of $165.20bn

- SAP (SAP) – a software company with a market cap of $141.24bn

- Siemens (SIE.DE) – the largest industrial manufacturing company in Europe with a market cap of $128.60bn

- Porsche (P911.DE) – automobile company with a market cap of $113.28bn

- Deutsche Telekom (DTE.DE) – telecommunications company with a market cap of $108.85bn

- Airbus (AIR.PA) – aircraft manufacturer with a market cap of $100.19bn

- Allianz (ALV.DE) – insurance company with a market cap of $96.90bn

- Merck kGaA (MRK.DE) – a multinational science and technology company with a market cap of $86.24bn

- Mercedes-Benz (MBG.DE) – an automobile company with a market cap of $84.46bn

- Volkswagen (VOW3.DE) – an automobile company with a market cap of $81.62bn

Why Trade With DAX 40 Brokers?

There are several reasons why traders may wish to invest in the DAX 40:

- Diversification – the DAX 40 is made up of 40 different companies. This means that investors are not putting all their eggs in one basket and, should one company fail, the impact is reduced.

- Easier To Spot Trends (Sometimes) – some say that it is easier to spot trends when trading the DAX 40. This makes it more attractive to those undertaking technical analysis and may open up more opportunities for profitable positions.

- Large Market Cap Companies – because the index is made up of the 40 largest companies in Germany by market capitalisation, all the firms in it have a market cap of at least $9.16bn. These large companies are often a safer investment than trading penny stocks.

- Hedging – some traders may use DAX 40 brokers to hedge against other assets they hold. For example, the Euro is often negatively correlated to the index. This is because, as the euro strengthens, it makes exports from Germany (and the wider Eurozone) more expensive, which can impact the profits of firms in the DAX 40. Therefore, one holding euros may wish to invest in the DE 40 to protect their position should the euro decline in value.

How To Invest In The DAX 40

Indices cannot be invested in directly with brokers in the same way that you may invest in an individual stock as they are not an instrument in themselves. Instead, many use derivatives that track the value of the index. DAX 40 brokers like Admiral Markets offer ETFs and CFDs that do this.

Tracker ETFs are the simplest way to invest in an index as the fund’s performance will be specially designed to mimic that of the index. CFDs are leveraged derivatives, which means you can gain more exposure to the index, though for increased risk.

Other derivatives that DAX 40 brokers may offer include futures, options and spread betting. Exchanges like Nadex offer DAX 40 binary options contracts. In addition, you can choose to invest in individual companies within the index. We look at how to review these companies in more detail below.

Choosing A DAX 40 Stock

When choosing constituent stocks to gain full or partial exposure to the index, there are a few important considerations. The key idea is to assess the intrinsic value and fundamentals of the company. Have a look at the company’s income statement, balance sheet and cash flow, which some DAX 40 brokers may provide access to directly.

A large positive free cash flow can indicate that the company’s financial health is strong. It is also important to ensure you buy the stock at the right time. This means entering the market when the stock is undervalued rather than overvalued. Indicators like the p/e ratio and forward p/e ratio can help to understand the value of the stock. Also, look at what the analysts are saying and whether they are bullish or bearish.

Volume

Volume data showing the number of shares traded for a particular period helps confirm when a price movement in a DAX 40 stock is significant. The price of a stock may move sharply but, if the volume is low, you should be cautious before adding weight to this. The higher the volume, the stronger the signal. Investors often use volume as part of their technical analysis strategy to understand whether a trend is strengthening or whether it is losing momentum and possibly indicating a trend reversal.

Not all DAX 40 brokers have access to the same level of data. After all, data costs money. When choosing a broker, look carefully at what they can offer you.

Volatility

Volatility in the DAX 40 creates opportunities for traders to profit. That said, too much volatility can create unnecessary risk. The main measure of local volatility is called beta, which compares a stock’s return with a corresponding benchmark. So, if the beta is 1.5, this means the stock moves 150% for every 100% in the benchmark. Numbers below 1 indicate that the stock is less volatile than the benchmark. Another way to look at it is that, if the DE 40 rises 5%, a stock with a beta of two would move 10%.

DAX 40 Broker Investing Strategy

Before picking a strategy to use with DAX 40 brokers, you need to get your timing right and operate when the market is most liquid. This is often in the first hour of the asset’s trading session, which means you need to be up early before the session opens to see whether there has been any overnight news that could influence the market. We would also recommend limiting exposure to 2% account capital on all open positions. Those using technical analysis may want to adopt one of the following popular strategies.

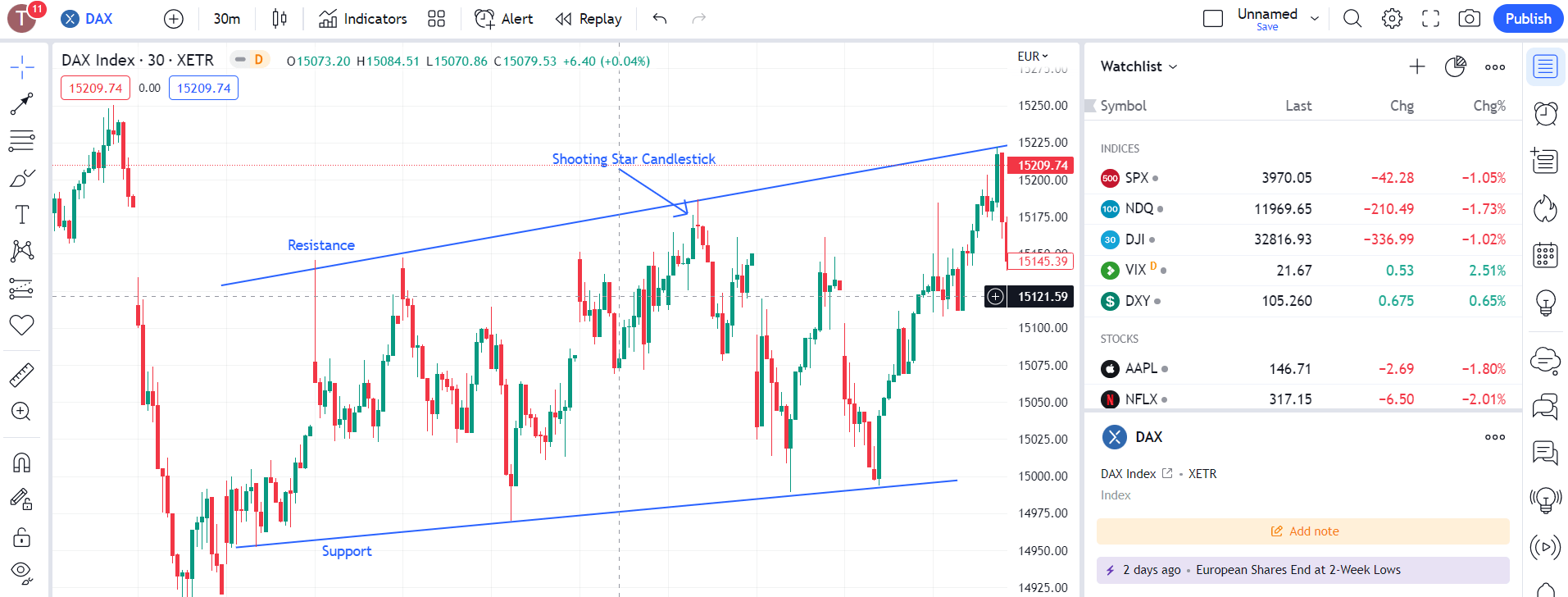

Range Trading

The DAX 40 sometimes fluctuates within a range between a support (lower) level and resistance (higher) level, rather than trending either positively or negatively. Those that can identify this limited range can profit from these fluctuations. The first step is to draw the support and resistance levels on the chart using horizontal lines. There must be at least two points where the price has failed to pass both the support and the resistance levels. Bollinger Bands can also be used as an indicator. We recommend you use candlesticks to look for signs that the price movement is reversing once it reaches either the support or resistance levels.

Suppose the price is approaching a defined resistance level. You may then identify a shooting star candlestick, which indicates that the price movement may go from positive to negative. Next, open a short position and close it once the price reaches the support level. You can also use a stop loss to protect against any significant breakouts from the range.

DAX 40 Range Trading

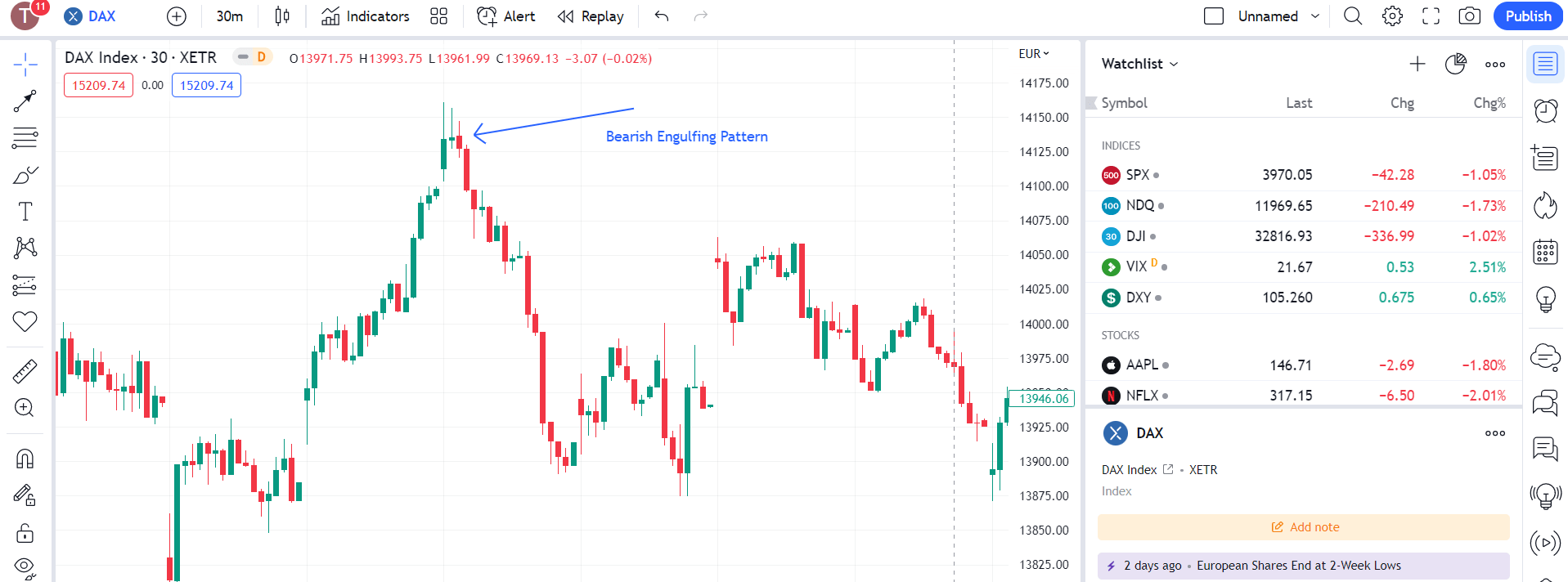

Bullish/Bearish Engulfing Patterns

Another strategy that can be used with DAX 40 brokers is the bullish/bearish engulfing patterns. The bullish pattern appears when the price has been dropping and then there are two candlesticks (using either a one-hour (H1) or one-day (D1) timeframe) – the first is a bearish candlestick and the second is bullish and completely covers the first. The higher the second candlestick rises, the stronger the signal. It indicates that the downward trend could be reversing. A bearish engulfing pattern is the opposite, where a positive trend reverses to become a negative one.

Bearish Engulfing Pattern

DAX 40 Tips

News

Always follow the news when investing with DAX 40 brokers. The index can respond heavily to current events so you must be aware of these to help you navigate the market. Examples of key events include interest rate decisions of the Federal Reserve or European Central Bank, changes in national governments, significant constitutional events like Brexit, terrorist attacks or a slowdown in major global economies like the US and China. Also, keep an eye out for changes in the value of the EUR/USD currency pair, which can impact the revenue of stocks on the DAX 40 as many of them have multinational operations.

Bloomberg, Yahoo Finance and Reuters are excellent and reliable sources of news impacting the markets. Much of this information is free, although some stories may sit behind a paywall. The Motley Fool is another good source of analysis, much of which is easy for beginners to understand.

Many DAX 40 brokers themselves often have market news, forecasts and economic calendars on their websites that you can use for free. In addition, there is market analysis and data on the Frankfurt Stock Exchange website.

Educational Resources

We recommend that investors of all abilities make use of the educational resources provided by DAX 40 brokers, particularly beginners and those without experience in trading the index. The best brokers will have the following:

- Glossary – these provide a list of trading jargon with clear and concise definitions

- Webinars – DAX 40 brokers may host a mix of live and pre-recorded webinars, which may be free or come at a cost

- Guides/Articles – DAX 40 brokers may put together a simple guide explaining what the index consists of and how they recommend trading it

- Tutorial Videos – we recommend watching tutorial videos if you learn visually as they can often help to explain complex factors influencing the index in a simple way

Automation

Investing in the DAX 40 using automated trading may involve copy trading or algorithmic investing with a bot. Copy trading can be an excellent choice for beginners who want to mimic more experienced traders. Some DAX 40 brokers offer this directly but many copy traders charge for this service.

More experienced investors may wish to develop their own bots to trade the index. Apart from saving time, this also helps remove human emotion from the equation. MT4 and MT5 have their own programming languages (MQL4 and MQL5), which you can use to develop their bots. Other platforms will often provide API access for self-built automation tools.

Backtesting

Backtesting is an important part of any investing strategy used with DAX 40 brokers. No trading strategy is perfect and it requires constant refining to make it more successful. Testing the system on historical DAX 40 data can be a useful way to identify its strengths and weaknesses and make appropriate changes.

Journals

Many retail traders fail to learn from their mistakes and end up repeating them. One way to avoid this is by keeping an investing journal, perhaps on an Excel spreadsheet, and reviewing it to adapt your strategy. Important details to note in the journal are the opening and closing positions, position size, date, strategy and, of course, whether the trade was successful or not.

Bottom Line On DAX 40 Brokers

Investing with DAX 40 brokers from the UK is an excellent way to profit from volatility in the German economy and gain exposure to a diversified basket of European stocks. The best firms are those that provide simple, low-cost access to the index, such as via a tracker ETF and have market forecasts and analysis. When trading the index, it is important to remember that it is not just impacted by the German economy but also global events, given the multinational operations of many of its members.

To see our list of the five best UK brokers offering the DAX 40.

FAQs

Which DAX 40 Brokers Are The Best?

The best DAX 40 brokers are those with low trading fees (low or zero commission and/or raw spreads), a good investing platform like MT4 or MT5, excellent customer support options and a strict regulator like the FCA.

What Are The DAX 40’s Opening Hours?

The main Dax 40 trading hours are 07:00 to 21:00 GMT on weekdays. However, some brokers offer extended hours, which operate after the FSE has closed.

What Factors Can Influence The Price Of The DAX 40?

The DAX 40 can be influenced by a range of factors including, interest rate decisions of the ECB and the Fed, economic growth forecasts in Germany and elsewhere in the world, changes in national governments and events like Brexit.

What Is The Difference Between The DAX 30 & The DAX 40?

The DAX 30 is the predecessor of the DAX 40. In 2021, ten companies were added to the index to make it the DAX 40.

Do All Companies On The DAX 40 Affect The Index In The Same Way?

No. Companies have different weights on the index depending on their relative market cap. The larger the market cap of the company, the more its performance will impact the index. No company can hold more than a 10% weighting.