Cyclical and Defensive Stocks

Economies move in cycles. They expand, to a point where they overheat and inflation may get out of control, and then they cool down, most commonly to standstill or contraction. Growth and recession seems to be part of the modern world, and is most commonly measured by reference to the Gross Domestic Product (GDP) of a nation.

The GDP is the value of all goods and services within an economy, and can be measured in a simple form by adding up everyone’s income or spending (logically these two should be equal, but spending on credit distorts these numbers). GDP is usually measured on an annual basis, and then announced in terms of percentage change from the previous quarter and the previous year.

At the top of the economic cycle, most money is being spent. But spending habits change through an economic cycle. When times are good, consumers will buy more of what they want, and when times are bad this spending becomes restricted to necessary items. In other words, discretionary spending increases as the economy improves and peaks at the top of the cycle whilst necessary spending is likely to remain fairly constant throughout.

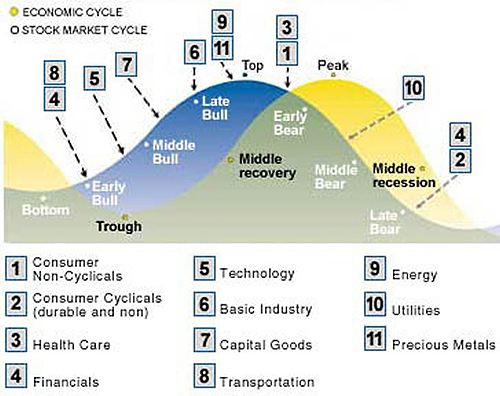

It is the economic cycle and our habits as consumers that define the difference between cyclical and defensive stocks.

Cyclical stocks are likely to outperform defensive stocks as the economy is improving and while it is operating at peak, while defensive stocks are likely to outperform cyclical stocks when the top of the economic cycle has passed and through the recessionary phase.

Top Stock Brokers UK

-

You can trade a dozen major indices, including the Dow Jones, NASDAQ and S&P 500 with competitive spreads at FXCC. However, it’s disappointing that FXCC doesn’t offer any individual stocks - a huge drawback against competitors like CMC Markets, which offers thousands of shares.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

There are hundreds of major global shares and indices available. You can also trade IPO shares and ETFs in the MT4 platform, depending on jurisdiction. You can expect a reasonable 0.1% commission on US shares, plus a range of analysis features to help you stay ahead of stock market news.

Instruments Regulator Platforms Currencies, Cryptocurrencies, Stocks, Indices, Metals, Oil and Gas, Commodity Futures and InstaFutures BVI FSC MT4, MT5 Min. Deposit Min. Trade Leverage $1 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) 1:30 for retail clients, 1:500 for professional -

FxPro offers a strong selection of stock CFDs, covering over 2,000 equities from prominent US and European stock exchanges, including big names like Tesla and Apple. The broker also continues to expand its financial services through its BnkPro e-money and investment products.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

FOREX.com provides access to a wide array of US, EU, and UK stock CFDs, featuring spreads as narrow as 1 point. This enables you to speculate on established household names and emerging IPOs, fostering ample opportunities for diversification within stock portfolios. US stocks are accessible from as low as 1.8 cents per share.

Instruments Regulator Platforms Forex, CFDs, Stocks, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

IG offers 13,000+ shares to trade or invest in, with more listed firms than nearly every competitor. The broker also excels for its zero commissions on US shares, while out-of-hours trading provides access to 70+ shares, plus popular ETFs and trusts, when the markets are closed. IG has also added an AI Index, providing opportunities on top US companies working in artificial intelligence and machine learning, such as Nvidia.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Eightcap offers 590+ US, Australian, and European shares as well as a modest range of indices, including the Dow Jones and FTSE. Its Labs offer excellent educational tools, notably the ‘Navigating Stock Market Volatility’ guide, while Capitalise.ai lets you automate stock trading strategies in plain English. On the downside, Eightcap still doesn’t offer fractional shares for budget traders, which are available at brokers like XTB.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

eToro offers access to thousands of stocks and shares from all over Europe, the US and beyond, with new opportunities on Dubai's top stocks added in 2024. Traders can invest alone or join millions of other traders in eToro's popular social trading community. Buy-and-hold investors can also try out the broker's Smart Portfolios, covering exciting thematic collections like Big Tech.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

City Index offers 4,700+ shares from major stock exchanges via CFDs and spread bets, including big names like Tesla and Apple. Pre-market and after-hours trading is also available on 70+ US stocks, while it shines with indices that reflect growing consumer interests like AI, NFTs, ESG.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Plus500 continues to offer an extensive range of shares across UK, US, and European markets via CFDs, with notable additions in 2025 spanning quantum computing and AI, such as IonQ, Rigetti, Duolingo, and Carvana. The ESG and cannabis sector opportunities are also enticing features not commonly found among other platforms. There also an impressive 30+ indices available with leverage up to 1:20.

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Futures, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable 1:30 -

Axi has expanded its range of stock CFDs over the years, now providing opportunities in major markets like the US, UK, Europe and Hong Kong, though it still lacks the market access of category leaders. What’s really neat is the Axi Academy, especially the Share CFDs Trading Course 101 that’s a great starting point for beginners.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30

Cyclical Stock Sectors

When identifying cyclical stocks and sectors, it is perhaps easiest to think about the types of goods and services that we will be more likely to use when we have excess cash in our pockets. Our spending habits change, and we begin to buy the items that we would like to own rather than (or as well as) the items we need.

When times are a little harder, our spending is dictated at least as much by affordability as by desire. When work is plentiful, wages rising, job offers ten-a-penny, we are more likely to visit a car showroom and buy the cabriolet we always wanted, but when we are living in fear of losing our jobs, then perhaps taking our current model to the service station is more appropriate. Car manufacturers and dealers are most definitely on the list of cyclical stocks.

We all need to eat, of course, but when we have cash in our pocket we are more likely to take the family to a restaurant, maybe even high end, rather than face the drudgery of the washing up after a meal. Restaurant chains are also on the list of cyclical stocks.

Other sectors that prosper most through the good times include house builders, hotels, airlines, and travel companies. Any company that manufactures or sells luxury goods and services also belong on the list of cyclical stocks.

Defensive Stock Sectors

On the other hand, when times are tough, and we are living in fear of losing our jobs, then our spending contracts. We tend to see the future with pessimism and spend accordingly.

That car that would be bought in the good times can wait a year or two. But there are essentials that we all require to live, and live in comfort.

For example, we all need to eat. But it’s cheaper to eat at home rather than eat out. As a treat we might take the children to MacDonald’s, or visit a ‘proper’ restaurant once a fortnight. Other than this, we’ll buy more at the supermarket and eat in. Food retailers, particularly no frills chains, and fast food restaurants are defensive stocks.

We need heat and lighting, too. And water, to drink, cook with, and bath in. Utility companies are top of the list of defensive stocks, and often have a captive audience as their customer base.

The same with healthcare companies: health is important to most people, and governments tend to spend more on healthcare when times are tough. Pharmaceutical companies, drugs manufacturers, and medical insurance companies weather an economic downturn well.

Companies that produce non-durable goods, such as household supplies, soaps, detergents, and toothpastes hold sales steady throughout an economic cycle.

Price performance of cyclical and defensive stocks

When the economy is roaring, and we are doing well and spending more, companies that produce goods or services that pander to our desires rather than our needs sell more. Revenues increase, companies can raise prices more easily and margins grow. When the economy falters, so too does our spending. Cyclical companies have to respond to falling demand by cutting prices, and margins retreat. Cyclical stocks tend to rise and fall with the economic cycle.

Dividends, too, paid by cyclical companies will be better when the economy is expanding, and worsen when the economy comes back.

Defensive stocks tend to see sales remain relatively stable throughout a cycle (though some discount manufacturers benefit more due to pricing policy). Revenues, earnings and dividends tend to stay ion an even keel, as do dividends.

Theoretically at least, an investor should buy a cyclical stock as the economy is recovering and prepare for the share price rises to come. As the economy hits its peak, and GDP growth starts to ease back and turn neutral or negative, then defensive stocks will outperform cyclical stocks.

In conclusion

Understanding how cyclical and defensive stocks behave through an economic cycle will help you to make better investment decisions and time fund switches with better accuracy for long term portfolio health. Of course, defensive stock prices may also fall during a large scale recession, but they are likely to hold better than cyclical stocks, and also more likely to continue to pay dividends.