Stock Brokers

The best online stock brokers in the UK offer a range of equities with low fees, a reliable platform and FCA oversight. This guide will explain how to compare stock brokers and investing apps, from minimum deposits and safety ratings to fractional shares for beginners. Our experts have also reviewed and listed the top-rated stock brokerages and platforms in 2025:

Stock Brokers UK

-

You can trade a dozen major indices, including the Dow Jones, NASDAQ and S&P 500 with competitive spreads at FXCC. However, it’s disappointing that FXCC doesn’t offer any individual stocks - a huge drawback against competitors like CMC Markets, which offers thousands of shares.

-

RoboForex provides one of the broadest selections of real equities and stock CFDs spanning the US and 14 regional European markets, including direct access to the NASDAQ. It’s also one of the few brokers to offer a dedicated platform for stock trading, sporting leverage up to 1:20 and a robot builder that enables traders to automate and backtest stock trading strategies.

-

There are hundreds of major global shares and indices available. You can also trade IPO shares and ETFs in the MT4 platform, depending on jurisdiction. You can expect a reasonable 0.1% commission on US shares, plus a range of analysis features to help you stay ahead of stock market news.

-

FxPro offers a strong selection of stock CFDs, covering over 2,000 equities from prominent US and European stock exchanges, including big names like Tesla and Apple. The broker also continues to expand its financial services through its BnkPro e-money and investment products.

-

FOREX.com provides access to a wide array of US, EU, and UK stock CFDs, featuring spreads as narrow as 1 point. This enables you to speculate on established household names and emerging IPOs, fostering ample opportunities for diversification within stock portfolios. US stocks are accessible from as low as 1.8 cents per share.

-

IG offers 13,000+ shares to trade or invest in, with more listed firms than nearly every competitor. The broker also excels for its zero commissions on US shares, while out-of-hours trading provides access to 70+ shares, plus popular ETFs and trusts, when the markets are closed. IG has also added an AI Index, providing opportunities on top US companies working in artificial intelligence and machine learning, such as Nvidia.

-

Eightcap offers 590+ US, Australian, and European shares as well as a modest range of indices, including the Dow Jones and FTSE. Its Labs offer excellent educational tools, notably the ‘Navigating Stock Market Volatility’ guide, while Capitalise.ai lets you automate stock trading strategies in plain English. On the downside, Eightcap still doesn’t offer fractional shares for budget traders, which are available at brokers like XTB.

-

eToro offers access to thousands of stocks and shares from all over Europe, the US and beyond, with new opportunities on Dubai's top stocks added in 2024. Traders can invest alone or join millions of other traders in eToro's popular social trading community. Buy-and-hold investors can also try out the broker's Smart Portfolios, covering exciting thematic collections like Big Tech.

-

City Index offers 4,700+ shares from major stock exchanges via CFDs and spread bets, including big names like Tesla and Apple. Pre-market and after-hours trading is also available on 70+ US stocks, while it shines with indices that reflect growing consumer interests like AI, NFTs, ESG.

-

Plus500 continues to offer an extensive range of shares across UK, US, and European markets via CFDs, with notable additions in 2025 spanning quantum computing and AI, such as IonQ, Rigetti, Duolingo, and Carvana. The ESG and cannabis sector opportunities are also enticing features not commonly found among other platforms. There also an impressive 30+ indices available with leverage up to 1:20.

-

You can trade a decent range of US and European share CFDs, with 1:5 leverage. There’s also a competitive choice of ETFs and indices across the three available platforms. It’s easy to stay updated with the stock market using the broker’s customizable trading alerts and the in-platform news feed.

-

Axi has expanded its range of stock CFDs over the years, now providing opportunities in major markets like the US, UK, Europe and Hong Kong, though it still lacks the market access of category leaders. What’s really neat is the Axi Academy, especially the Share CFDs Trading Course 101 that’s a great starting point for beginners.

-

IBKR provides access to an unparalleled array of equity products originating from 24 diverse countries. Whether seeking capital appreciation, dividends, or voting rights, you can directly invest in stocks. Alternatively, you can engage in speculative trading on price movements through CFDs, futures and more than 13,000 ETFs. IBKR also enhanced its European equity derivatives offering in 2024 by adding trading on CBOE Europe Derivatives (CEDX).

-

Trade binary options and CFDs on global stocks from US, European, Russian and Asian exchanges, as well as 37 indices covering a wide range of global markets. The access to stocks trumps many binary options brokers.

-

CMC provides opportunities on over 10,000 stock CFDs and offers reliable support during market hours based on tests. You also gain complimentary access to new and excellent analysis from reputable third-party outlets. On the downside, there’s no trading in real stocks in some countries.

-

IC Markets offers access to 2,100+ stocks from Australian and US markets - NASDAQ, NYSE and ASX. You can choose between 4 platforms, though cTrader excels for seasoned stock traders looking for the widest range of indicators, timeframes and chart types. Over 25 indices also provide exposure to diverse regions and economies.

-

Focus Option traders can access 21 global stocks via high/low binary options through a web-based platform or CFDs via a mobile app. This includes big firms like IBM, Tesla and Microsoft.

-

RedMars offers over 120 stock CFDs, covering popular US, UK and European markets. Commission-free trading on stocks is also available, providing straightforward pricing. However, there are zero stock screeners to aid trading decisions, while competitors like IG offer superior access to the stock market with over 17,000 shares.

-

Capitalcore offers just 18 stocks spanning major US firms like Apple, Netflix and Nvidia and a handful of futures indices. However, this falls way short of the 16,000+ global stocks and indices at alternatives like IG. Also, the lack of screeners and market insights results in a very limiting stock trading experience.

-

You can trade an excellent suite of 2000+ US stocks, fractional shares, options, ETFs, OTC and ADRs. There are no commissions on most assets. Additionally, extended hours trading is offered as well as optimized screeners and custom watchlists to aid investment decisions.

-

OspreyFX offers leveraged trading on US and European stocks and shares. There are no restrictions on strategies and traders benefit from competitive, real-time pricing and access to industry-leading software from MetaTrader.

-

Invest in over 40,000 US, UK and international stocks from 17 leading exchanges. The selection of shares beats most competitors while prices are fixed and transparent.

-

Trade 25+ global stocks with CFDs commission-free with fast execution and STP pricing. This is a narrow selection vs competitors, focussed on US markets. Eight indices are also available to speculate on the movements of US, European, UK and Australian markets.

-

Errante offers CFDs on 58 stocks of some of the world's largest companies. Trade big names like Alibaba, Amazon and Apple with low fees. Traders also benefit from top-tier liquidity and fast execution, but note that as these are CFDs, you cannot buy and own physical shares.

-

Coinexx traders can speculate on broad movements of global markets via five indices covering exchanges in the US, UK, Germany, and China. On the downside, there are no individual stocks which is a significant drawback.

-

You can trade a decent range of CFD shares from US, UK and EU markets, as well as 40+ ETFs and a variety of indices. US stocks are commission-free and you can get started with just a $100 minimum deposit. That said, it’s disappointing that there’s no stock market analysis on offer.

-

Trade CFDs on 25 global stocks including Alibaba, Netflix and Tesla. This is a very limited selection, but traders can also make highly leveraged bets on 18 indices covering a wide range of global countries and regions including the US, Europe, Russia, China and Japan.

-

Access a modest selection of 60+ US and European company stocks including Amazon and Volkswagen. Major global indices like the S&P 500 and FTSE 100 are also available. Stock traders can enjoy convenient access to the MT4 platform via desktop, web browser and mobile.

-

Firstrade offers commission-free stock trading on the NASDAQ, NYSE and OTC markets. Clients can invest in penny stocks through to blue chip stocks with extended hours trading, plus conditional orders and trailing stops. We also rated the dividend reinvestment program.

-

World Forex traders can speculate on price movements of 40+ stocks with CFDs and digital contracts with no commissions, tight spreads and high payouts. You can take positions on big names like IBM and American Express.

-

With 300+ stock CFDs from a variety of global exchanges, traders can choose between some of the world's biggest blue chip companies. FinPros charges no commission fees for shares trading, making this a competitive offering although not as diverse as some alternatives.

-

Trade CFDs on 134 high-market-cap US and global stocks including Alibaba, Microsoft and Pfizer. You can also speculate on broader market movements through 35 indices covering major global exchanges.

-

Take positions on major brands in multiple industries, from finance to manufacturing and technology. Popular indices like the Dow Jones also offer more diverse access to popular markets.

-

Zacks Trade offers a large selection of US and international stocks, including penny stocks, as well as ETFs and global indices. The broker also offers options as a way to speculate on stock price movements.

-

Buy and own thousands of shares commission-free, including blue chip companies like Apple and Microsoft from the NYSE and NASDAQ exchanges. Fractional shares also allow investments from as little as $1, which will appeal to beginners and those on a budget.

-

Scope Markets offers stock trading on 1500+ popular markets, as well as a decent range of cash and futures indices. Traders looking to diversify can explore some other interesting opportunities, like cannabis stocks. There are also some useful resources to help inform trading decisions, including a dividend calendar.

-

Traders who sign up to TMGM's IRESS account can access the broker's vast selection of around 10,000 stock CFDs, sourced from 12 global exchanges in the US, UK, Australia, EU, Hong Kong and Japan. This is one of the best ranges of equities of any CFD broker.

-

Anzo Capital traders can trade 30 US and European company stocks as well as several stock indices. Trading is done through CFDs, meaning traders do not own the underlying asset and can bet on rising and falling prices.

-

That said, I find the range of just 86 shares products is very limited compared to most other brands. The good news is that spreads are pretty competitive, coming in at around 0.11 for the Twitter (X) stock.

-

Rock Global traders can either trade company shares directly or speculate on stock markets via CFDs. The broker covers an excellent range of markets spanning Asia-Pacific, North America and Europe. Brokerage fees start at $9.95 for US shares.

-

Traders can access an excellent choice of 800+ share CFDs with up to 1:20 leverage and the option to trade with zero commission. The diverse selection covers US, EU, UK and HK exchanges, which should offer plenty of opportunities for more experienced investors.

-

Pocket Option continues to trail alternatives in the stock department with just several dozen of the most popular shares like Microsoft and Google. That said, the payouts are competitive on stocks reaching 92% while indices offer an alternative way to speculate on stock markets with returns up to 67%.

-

Exinity clients can speculate on shares from US and Hong Kong companies. Traders can choose between trading stock CFDs or directly buying stocks in large firms commission-free. On the negative side, there are no equities from European and UK markets.

-

xChief offers 100 US company stock CFDs for MT4 DirectFX and Classic+ account holders. Alongside popular multinationals like Apple and Coca-Cola, you can also speculate on several major stock indices with spreads from 2.

-

PU Prime traders can access CFDs on hundreds of shares from international exchanges, including some of the world’s top companies like Amazon, VISA, Tesla, and IBM. Stock trading takes place on the MT5 platform and features floating spreads starting near 0 but varying by account type and equity. Stocks are traded via CFD derivatives and are not directly owned. UK and US stocks all have 0 commissions.

-

SuperForex offers CFDs on a range of international stocks, with big names including Google, Disney and Apple as well as regional powerhouses such as Petrobras. This is not the widest range of stocks, but there is a diverse enough list to keep traders interested, especially beginners.

-

AdroFx offers 40+ stock CFDs on major US companies, including Tesla and Microsoft. These can be traded with leverage, but as they are CFDs you will not directly own a share in the companies. Also, the number of shares is woeful compared to alternatives like CMC Markets which offers over 10,000 stocks spanning different regions and sectors.

-

Invest in thousands of stocks and ETFs with no commissions or overnight fees. You can also make use of the broker's blog which publishes frequent stock market updates and investment ideas.

-

Speculate on price movements of 37 US and European blue chip stock CFDs, including Adidas, Intel and Volkswagen. On the negative side, the selection of stocks is limited vs alternatives and direct share dealing isn't provided.

-

You can trade a modest range of 140+ US and EU shares, including Amazon and Pfizer. There are also 13 major indices, providing exposure to other global economies. Average spreads are competitive, coming in at 0.12 pips for the Apple stock and 1.9 pips for NASDAQ.

-

Trade 20,000+ global equities with margins as low as 5% and powerful trading platforms. The selection of shares outstrips nearly all competitors and includes access to blue chip stocks.

-

Trade 6000+ US and UK stocks and hundreds of ETFs and funds with zero commissions and low fees via an easy-to-use proprietary trading app. More than a million users trust Freetrade for stock investing.

-

I was also pleased to find over 5000 stocks and options available to trade on several platforms, as well as 9 stock indices. Active traders can also enjoy flexible commission plans, superior low-latency DMA and a dedicated customer support line.

-

Global Prime traders cannot speculate on individual stock prices, but they can trade 12 global stock index CFDs with tight spreads, including the Dow Jones, UK 100, NASDAQ and S&P 500.

-

Access UK, European and Asian shares with a good selection of flexible deposit methods. The broker's useful educational insights can also help you develop robust strategies and stock analysis techniques.

-

Trade US, European and Asian markets with thousands of equities and competitive spreads. You can also take advantage of DMA pricing on the broker's MT5 platform, as well as IPOs.

-

As well as Just2Trade's 50+ stock CFDs, traders can access a huge variety of thousands of stocks traded on US and international exchanges. The chance to build an investment portfolio and benefit from dividends sets Just2Trade apart from most CFD brokers.

-

Direct stock trading isn't available, but traders can access 11 index CFDs, including the top US, British, European, Australian, and Japanese indices, with leverage up to 1:200.

-

Trade over 1000 stocks from US, UK and European markets with no commissions. Equities can be traded on the intuitive ActivTrader platform or third-party solutions, while the economic calendar can be used to plan potential trades. Fractional shares are also available, making high-value stocks accessible to newer traders.

-

BlackBull offers CFD trading on a market-leading range of 26000+ company shares, along with a growing selection of indices now featuring Asian equity indices. Spreads are competitive based on tests, with Apple coming in at 0.04. BlackBull has also introduced BlackBull Invest, providing direct share dealing for alternative trading options.

-

Swissquote offers a tremendous selection of stocks from major regions, including Europe, Asia, the US, and the UK. It’s also introduced fractional shares reducing the entry barrier to high-value equities. Yet where it truly excels is its stock market research, including its daily podcast that sheds light on major indices and stocks.

-

SimpleFX offers a beginner-friendly platform to trade some of the most popular global stock CFDs commission-free, from Pfizer to Walt Disney, equipped with advanced integrated indicators. SimpleFX provides access to stock exchanges in key countries such as the US, UK, Germany, and Japan, though it doesn't offer fractional shares.

-

EagleFX offers a modest collection spanning 70+ popular US and European stocks including Amazon and Tesla, as well as 10+ major indices. However, it lacks market insights and technical summaries from analysts to help inform stock trading decisions.

-

You can trade a small range of around 20 major NYSE and NASDAQ-listed stocks, including Apple, Google and Amazon. Commissions are also uncompetitive at $16 per round turn - over double the rate at most other brokers.

-

Traders can speculate on stock market movements through CFDs on dozens of individual equities. This is less than many rival brokers, but traders can also place bets on broad market movements through 15 indices covering diverse global markets including the US, China, UK, Spain and Germany.

-

FXTrading offers clients CFDs on 10,000+ global company shares from a list that includes all major and emerging stock exchanges on an institutional trading platform. Prices are competitive with a floating spread and leverage of 1:10 is available.

-

Trade hundreds of stocks from leading countries and economics, including Apple and Amazon in the US. 24/5 support is also available to help new stock traders get started with the broker.

-

FXGiants offers a very competitive range of stocks, providing access to markets in Hong Kong, the UK, the US and mainland Europe. We also rate the company's array of index products to get exposure to yet more stock exchanges and economies.

-

Trade CFDs on some of the largest stocks in the US and EU including big brands like Microsoft and Google. In total, 70+ global stock CFDs are available with leverage up to 1:5.

-

Fortrade offers leveraged CFDs on a wide range of stocks from the UK, US, Hong Kong, Australia and a range of European companies with variable spreads and no commissions. CFDs are derivative contracts that do not entail ownership of the underlying stock. Professional traders can also access a decent list of Direct Market Access stocks.

-

FP Markets offers CFDs on over 10,000 international stocks across a wide range of global markets, including exchanges in London, Hong Kong, Paris, Frankfurt, Madrid, Amsterdam, and New York. Yet while the broker offers extensive coverage in CFD trading, it does not support real stock trading or long-term investing.

-

IronFX traders can speculate on price movements of 150 US, UK and European shares via CFDs. Fractional shares are also available, which will appeal to beginners looking to trade in smaller volumes. There’s also a decent range of 15+ indices via spot and futures contracts.

-

Trade CFDs on an impressive range of 3400+ stocks from 17 different global exchanges with low commissions. Traders can also buy and own company shares directly with low commissions and fee-free trades available daily from some exchanges, and fractional share trading allowing micro-investments in international giants.

-

You can trade 68 stocks and shares with leverage of 1:5, as well as 4 indices: Dow Jones, Nasdaq, S&P 500 and DAX 30. This is a poor selection compared to most alternatives (who typically offer hundreds) and only covers US and German markets.

-

HYCM offers 11 individual company shares to trade via the MT4 platform. There are also 20 ETFs to give a broader view of market movements. All trading is done through CFDs, meaning traders will not own the underlying equities.

-

FXOpen has expanded its suite of stocks, now offering 600+ shares from US, UK and Hong Kong stock exchanges, including big names like Apple and Meta. An economic calendar, dividend calendar and analyst insights into major stock price movements are also on-hand to inform trading decisions.

-

Trade 750 stock CFDs sourced from eight exchanges from the US, EU and UK. Leverage up to 1:10 is available, commissions start from $6 and overnight fees are the LIBOR rate +/-3.5%. This represents a very competitive suite of stocks from a range of international markets covered by few competitors.

-

Hantec Markets offers more than 1,800 stock CFDs from exchanges in Europe, the UK, and the US. Additionally, the broker offers access to major indices including the S&P 500 and FTSE 100, allowing traders to gain a comprehensive perspective on global financial markets. On the downside, there is no option to invest in real stocks or factional shares, available at XTB.

-

Stocks can be traded by connecting the NinjaTrader platform to supporting brokers. The firm also provides access to a range of index futures via standard and micro contracts, including the E-Mini S&P 500 Index Futures and E-Mini Russell 2000 Index Futures.

-

GO Markets offers CFDs on stocks from US, UK, Hong Kong, Australian and German exchanges with 1:5 leverage, commissions from 0.08%, tight variable spreads, and access to powerful analysis tools on MetaTrader 5. Derivatives trading means traders will not own the underlying asset.

-

Access 23,500+ stocks from global markets with a $1 minimum commission on US shares and comprehensive market insights.

-

Trade thousands of global equities through spread betting and CFDs. Spreadex is one of the few online brokers to provide trading opportunities on a selection of lower market cap equities traded on exchanges such as the AIM sub-market of the London Stock Exchange.

-

Although the broker doesn’t offer real stocks, clients can trade CFDs on an impressive list of 3000+ shares with low commissions from $3.50 per side and no hidden fees. Spreads are also competitive, coming in at 0.08 pips for the Apple stock.

-

Traders can speculate on leading companies in the US, EU, UK and Australia including brands like Tesla and Apple. Short, medium and long-term trading strategies are catered for, as well as algo traders through Expert Advisors (EAs). There is also an excellent range of indices and ETFs for those who want to diversify portfolios.

-

Traders can take positions on thousands of stock CFDs sourced from various global markets, including the US, UK, EU, China, and Japan. For longer-term investors, Trading 212 facilitates direct share dealing on more than 8,500 global stocks within investment accounts and tax-efficient ISAs for UK customers. The key selling point is the zero commissions on equities.

-

OANDA expanded its suite of stocks in 2024 with more than 2,200 shares now available from leading stock exchanges, including blue chip firms like Apple and Meta. There are also no commissions on US stocks and traders benefit from free insights and market reports from Dow Jones and Oanda’s MarketPulse research tool.

-

Pepperstone presents a huge suite of share CFDs spanning the US, UK, Australian, and European stock markets. Whether you’re interested in iconic names like Tesla, Apple, or Netflix, Pepperstone provides the flexibility to take long or short positions, backed by deep liquidity and competitive commissions. The platform has also introduced 24-hour trading on 37 US stock CFDs, providing opportunities to trade following earnings reports and unexpected news.

-

FXTM offers a modest selection of several hundred US and European stock CFDs, with Advantage account spreads starting from just 0.1. You can also trade over 500 real shares from US exchanges. What’s great is the wealth of expertly curated market analysis to informed decision-making.

-

Trade dozens of shares in major US, European, and Asian companies.

-

You can trade major indices including the NASDAQ, S&P 500 and Nikkei. There’s a powerful platform for technical and fundamental analysis of the market, although it’s a shame that shares are not offered.

-

Despite introducing shares in 2019 and bolstering its range of equities, notably in 2021 and 2022, easyMarkets still only offers a modest selection of stocks from US, European and Asian markets. Its roster is tilted toward technology, finance and consumer goods based on our latest tests.

-

FXCM offers a strong suite of shares from the US, UK, Hong Kong, Australia and Europe. Extended hours trading is available on US shares, aligning the broker with top brands like IG. Additionally, fractional shares are available for those who want more control over their position sizes.

-

100+ stock CFDs are available spanning some of the biggest US companies with zero commissions. The economic calendar is great for tracking major events which could impact stock prices. However, Fusion only offers US shares whereas competitors like IC Markets provide 2000+ shares including Australian stocks.

-

XTB offers 3548 real stocks 2042 CFDs on stocks (CFD and real), encompassing prominent companies such as Amazon, Barclays, and BMW, with zero commissions. The xStation platform also shines for its analysis features that elevate the stock trading experience, from stock scanners and heatmaps to diverse fundamental data, including market cap and P/E ratios.

-

Trader can access global stock markets through binary options on blue chip company shares and a range of indices. Clients can trade high/low binaries on a user-friendly web platform.

-

AZAforex offers trading on a modest range of US stocks including Google, Apple and Amazon. You can also speculate on leading indices such as the FTSE, but there’s still no fractional shares, extended hours trading or extensive market research to rival the best stock brokers.

-

Go long or short on over 50 major global shares and map out your strategies using the intuitive charting tools. Those with $1,000+ starting capital can also enjoy their first 3 trades risk-free.

-

Capital.com offer 5,600+ stocks from around the globe. They also offer tight spreads, ideal for active traders

What Is A Stock Broker?

An online stock broker act as the intermediary between buyers and sellers of publicly-traded shares. Trades can be opened via the firm’s digital platform or mobile app and are executed using market prices.

Stock brokerages typically charge a commission or add a spread markup in return for executing positions on your behalf. With that said, some of the best stock brokers offer low to no fees.

The online stock broker industry in the UK has a market size of nearly £2 billion. Among the largest stock investing apps is AvaTrade with 400,000 customers.

How To Compare Online Stock Brokers

Markets & Vehicles

Top-rated stock brokers will offer investment opportunities on popular markets, such as the London Stock Exchange (LSE) and New York Stock Exchange (NYSE). This allows UK traders to invest in the largest companies both domestically and abroad, spanning multiple sectors from finance and technology to oil and gas.

Also consider how you want to start stock trading. Do you want to directly buy and sell shares, take on ownership rights and potentially receive dividend payments? Alternatively, many retail investors turn to derivatives like CFDs, whereby you can speculate on the rise or fall in stock prices online without taking ownership of them.

In addition, fractional shares and penny stocks may appeal to beginners or those with limited capital. With fractional stocks, investors can buy a portion of a high-value share, such as one-half or one-third, reducing entry barriers.

Fees

When comparing online stock brokers in the UK, look for a transparent fee schedule. Of course, the cheapest fees can lead to greater profit margins, but this should not come at the detriment of low-quality services and tools.

Generally, you can expect to pay a flat commission for share dealing and/or a spread. Also consider overnight rollover fees, inactivity penalties, deposit and withdrawal rates, plus charges for market data.

An increasing number of discount stock brokers and low-cost trading platforms also advertise low to no fees. eToro, for example, offers thousands of stocks with zero commission. Alternatively, Interactive Brokers offers low commissions of £3 per trade for UK and most European stocks, whilst US stocks start from $0.005 per share.

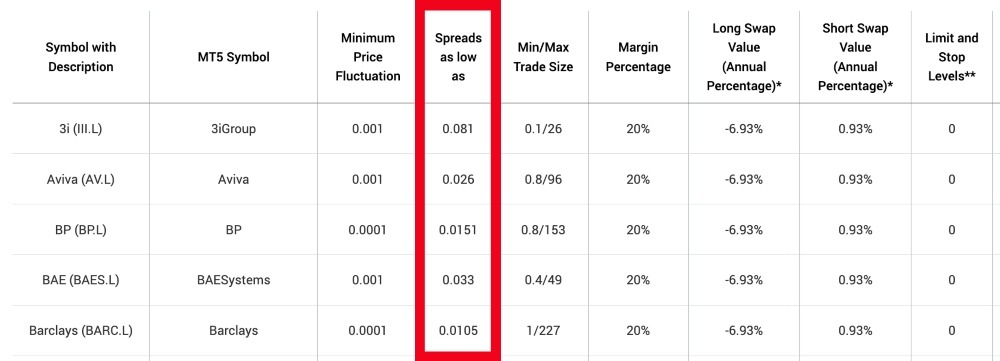

XM Spreads On UK Stocks

Platforms

The best online stock brokers in the UK provide third-party and/or proprietary terminals, which act as the gateway between investors and global stock markets. FxPro, for example, offers an in-house platform, plus MetaTrader 4, MetaTrader 5, and cTrader.

Importantly, check for real-time market data, watchlist builders, custom alerts, stock screeners, and multiple order types. Good stock brokers offer limit, market, and stop orders as standard, though the best stock buying platforms in the UK also offer trailing stop, fill-or-kill, and one-cancels-the-other.

Additionally, charts and graphs should be a factor in your internet stock brokers and platforms comparison, as well as access to technical indicators such as RSI, MACD and Bollinger Bands. These should be available on downloadable software or web browsers.

Mobile App

Major online brokers in the UK, such as Saxo Bank and CMC Markets, offer beginner-friendly stock trading apps with live market access and account management features. Also look for stock market analysis from the broker’s experts, push notifications and compatibility with iOS and Android devices.

The best mobile stock investing apps essentially facilitate seamless integration with desktop terminals, meaning you can manage positions and trade on the go.

Regulation

The best online stock brokers in the UK are regulated by the Financial Conduct Authority (FCA).

The FCA restricts the use of misleading bonuses and promotions and limits leverage. It also requires firms to provide negative balance protection and segregate client funds from company money. In addition, British traders will get access to the Financial Ombudsman Service in case of disputes and the Financial Services Compensation Scheme (FSCS) should the brokerage go bankrupt.

Among the top stock investment platforms authorised by the FCA are Plus500, CMC Markets, and XM.

Tools

The best online stock brokers worldwide offer insights from the broker’s analysts, third-party tools like Morningstar, integrated stock screeners, and live news streams. Copy trading is also favoured by beginners, allowing users to mirror the trades of experienced investors.

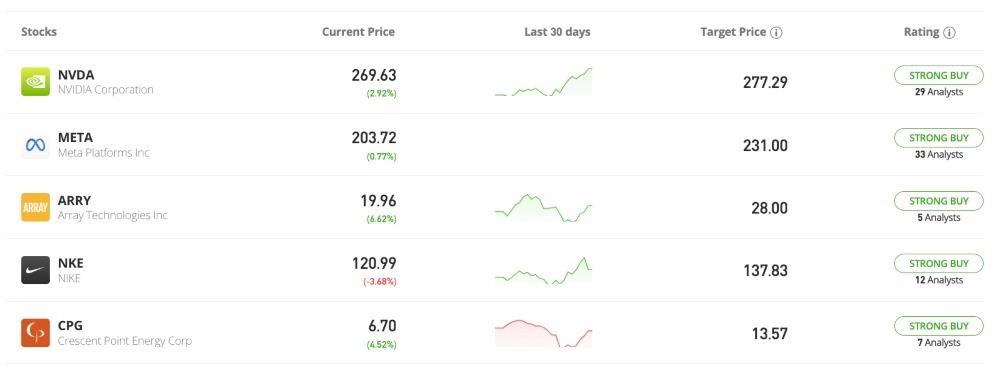

Interactive Brokers, for example, offers a wealth of market research, commentary, and news articles. Popular solutions include Alliance News Global500 reports for £25 per month, the QuantConnect algorithmic terminal from £48 per month, plus free access to The Motley Fool podcast and news column. Alternatively, eToro’s analysts collate key metrics on large stocks, including a buy/sell rating:

eToro Stock Analysis

Education

Leading stock investing platforms for new traders also provide free educational content. Look for live webinars, ‘how-to’ guides, video tutorials, and keyword glossaries.

The eToro Academy, for instance, is a best-in-class resource offering a wealth of courses, guides, podcasts, and videos, organised into beginner and advanced experience levels.

Demo Account

The top stock brokers for beginners offer demo accounts. These can be used to practise investing risk-free before committing to a live account. Paper investing accounts come with virtual money and access to live pricing. As such, you can simulate various stock strategies without risking real funds.

CMC Markets, for example, provides £10,000 in virtual funds to trade CFDs on stocks, indices, forex, and commodities. Prospective users can get familiar with platform tools alongside the full product library.

Deposits & Withdrawals

The largest online stock brokers that accept various payment methods, including debit cards, wire transfers, and e-wallets like Skrill, Neteller, and PayPal, are big brands like Pepperstone and IC Markets.

Also check for any fees. Leading stock exchange platforms offer commission-free deposits and low to zero charges on withdrawals. In addition, make sure processing times are fast. IG Index, for example, offers instant processing of card and PayPal payments, whilst bank wire transfers can take up to three days.

Note that most UK stock brokers have a minimum deposit requirement, which can range anywhere from £1 to £1000. There are also some stock broking platforms and apps with no minimum deposit, including XTB.

Promotions

Welcome bonuses and financial incentives can be a major draw for new traders. However, the FCA does not permit authorised stock brokerages to offer joining promotions. This is because they can encourage excessive risk-taking. Some bonuses also come with tough conditions, such as high volume requirements before withdrawals can be requested.

With that said, some leading stock brokers offer legitimate fee rebates to high-volume traders. This can be a good way for active traders to reduce their costs.

Customer Support

Customer service is a key source of information for platform guidance and account questions. There will often be several contact methods available, including live chat, email, and telephone. Also check that the stock broker’s support team is available during market opening hours at the minimum.

Pepperstone is a good example of a top-rated stock broker with strong support. They offer a UK telephone number, available 24/7.

Opening Hours

Online stock brokers should provide investment opportunities during market opening hours. The UK stock market, for example, is open from 8:00 AM to 4:30 PM (GMT) Monday to Friday.

Some stock brokers also offer extended hours, meaning you can trade before or after the market opens. Note, stock markets may be particularly volatile when fewer investors are participating.

Bottom Line On Comparing Stock Brokers

Shortlisting the best online stock platforms is an important first step in your investment journey. Whether it’s brokers with free stock investing platforms, fractional shares, instant deposit capabilities, good reviews, cryptos and options, or companies with no minimum balance requirements, there is a lot to consider.

Use our guide to compare stock investing apps across key metrics. Alternatively, see our list of the best online stock brokers. Rankings are based on the highest-rated and most popular platforms in the UK.

FAQ

What Are Online Stock Brokers?

Online stock brokers act as the middleman between buyers and sellers of shares. Clients can start purchasing stocks, indices, ETFs and other assets through the firm’s platform or app. Traders can also manage their accounts and pay any share dealing fees.

How Do Stock Brokers Work?

Typically, a retail investor will submit a buy or sell order, which is then sent to the stockbroker. On behalf of the investor, the broker would then transfer the order request to the relevant market or liquidity provider. Online stock brokers usually take a small fee in return for the service.

How Do Online Stock Brokers Make Money?

Online stock brokers typically make money through commissions and spreads. Platforms generally apply a markup on the price they get from their liquidity providers. Stock platforms and apps may also charge for deposits and withdrawals, holding positions overnight, and for access to additional tools like a VPS or exchange data.

How Do You Switch Between Online Stock Brokers?

The majority of stock brokers process transfer requests online. You will need to submit a request with your existing provider and complete a transfer form with your new stockbroker. The transfer will then be completed on your behalf.

Are Online Stock Brokers Safe?

The most reputable online stock brokers hold a license with the UK regulator, the Financial Conduct Authority. Authorised firms will offer negative balance protection, display risk warnings, limit leverage on derivatives, and restrict firms from offering misleading promotions.

With that said, there is always a risk to capital when investing in stocks online. The worst platforms also operate scams online targeting beginners, though they will not hold a license with the FCA.

Which Is The Best Online Stock Broker In The UK?

The best online stock brokers in the UK will depend on your investing style and financial goals. With that said, compare the range of stocks and indices available, share dealing fees, supported payment methods, FCA oversight, plus tools like demo accounts and copy trading.