BP Stock Trading

BP has made record-breaking profits in recent years and many retail traders have set out to find BP brokers and get a piece of the action. British Petroleum is an energy giant and one of the largest companies in the world by revenue and profit. It provides heat, light, and mobility to customers globally via the production and supply of oil, gas and fuel. As well as explaining how to get started in BP stock trading, this tutorial will cover share price influences, highs and lows, and company release dates. Our experts also rank the best BP trading brokers in the UK:

Top UK Brokers For Trading BP Shares

-

You can trade a dozen major indices, including the Dow Jones, NASDAQ and S&P 500 with competitive spreads at FXCC. However, it’s disappointing that FXCC doesn’t offer any individual stocks - a huge drawback against competitors like CMC Markets, which offers thousands of shares.

-

RoboForex provides one of the broadest selections of real equities and stock CFDs spanning the US and 14 regional European markets, including direct access to the NASDAQ. It’s also one of the few brokers to offer a dedicated platform for stock trading, sporting leverage up to 1:20 and a robot builder that enables traders to automate and backtest stock trading strategies.

-

There are hundreds of major global shares and indices available. You can also trade IPO shares and ETFs in the MT4 platform, depending on jurisdiction. You can expect a reasonable 0.1% commission on US shares, plus a range of analysis features to help you stay ahead of stock market news.

Company Background

BP PLC is a multinational gas and oil company with operations in more than 80 countries worldwide. It has a presence across Australasia, Asia, Africa, Europe, and North and South America. The company provides customers with fuel for transportation, energy for heat and light, retail services, and petrochemical products for everyday items. Its operations also span energy exploration, extraction, distribution, marketing, refining, and more.

As of 2023, BP had a market cap of $110+ billion, behind Shell with a market cap of $200+ billion. The company reported staggering profits of £23 billion in 2022, following the increased energy demand and wholesale oil prices, up from profits of £10.5 billion in 2021. Following these earnings reports, BP announced it would boost shareholder payouts by 10% and introduce a stock buyback scheme.

BP’s headquarters is located in St James’ Square, London. The company also maintains an office presence in cities across the world including New York and Hamburg.

Early History

BP as we know it today was originally founded in 1908 following the discovery of oil in Persia under the instruction of William D’Arcy. The company was registered under the trading name Anglo-Persian Oil Company in April 1909. Shipment of crude oil began in 1912. In 1914, the firm won a 20-year contract with the UK government to source and provide 40 million barrels of oil to the Royal Navy.

Today, energy demand looks a little different thanks to the sustainability attention of countries around the world. BP has stated that it aims to shift its focus toward reducing emissions and striving for a low-carbon-emission future. How successfully it does this will impact retail investors looking to start trading BP stocks.

Release Dates

The company operates on a standard financial year, with full-year earnings reports typically released in February of the previous year ending 31st December. For example, the full-year 2022 results were announced on 7th February 2023. Typically, first-quarter results are published in May, second-quarter performance in August, and third quarter in October.

If the company has been profitable, the share price will usually increase initially after the information is released. The days leading up to an earnings release can be particularly volatile for BP stock trading due to prediction analysis from financial experts and speculation among investors.

Price Chart

Share Price Influences

To start trading BP stocks online, you need to understand the key drivers behind its share price:

- Renewable Energy – Today ever more consumers demand renewable energy sources, and if BP is to stay so successful, it will need to invest heavily in low-carbon emission opportunities. BP aims to have developed the capacity to provide 20GW of renewable resources by 2025. The future share price of BP will be partly dependent on how well the firm transitions towards cleaner forms of energy while protecting its profit margins

- Energy Costs – Thanks to increasing demand, limited supplies, and the shock to the supply chain caused by the conflict in Ukraine, huge increases in the cost of oil and gas have caused serious issues for households in the UK. For BP, however, the increase in energy prices has meant vast profits. The potential of oil and gas supply problems has led to the wholesale price soaring, attracting many investors to BP stock trading and the promise of future rewards from their current successes.

- Taxes And Regulation – Regulations that affect the energy sector are sure to impact BP’s share price. For example, the UK government announced it would increase the Energy Profits Levy to 35% from January 2023, with this additional tax set to be in place until March 2028. This is a surcharge cost for all energy firms, to raise funds for people struggling with the cost of living. The scheme is designed to raise over £40 billion over six years. Although this will barely make a dent in the recent profits raked in by BP, the impact on the business topline is certainly worth a thought when energy prices begin to settle.

- Russia Exit – In 2022, BP decided to exit its 20% shareholding in Rosneft, an integrated crude oil and gas energy company with headquarters in Moscow, following the invasion of Ukraine. Following this, BP experienced a significant financial impact, equating to a reduction in reported earnings of $2 billion a year and a 1/3 loss of oil and gas production. This undoubtedly impacted shareholder confidence, but the company maintains this stance as the right thing to do.

- News Events – BP has many rigs and other interests around the world, and an accident or other event that hits one of these can have a huge impact on the company’s market performance. On the other hand, news of new hydrocarbon discoveries or other positive events affecting BP should boost the company’s share price.

Highs & Lows

The BP share price jumped by a third in the space of 12 months in 2022, but some investors have doubts about how long the company can maintain these highs. In early 2023 BP stock was trading above £56. Following the company’s bolstered 2022 full-year earnings, BP saw a 6% increase in end-of-day share price post-publication.

However, it hasn’t always been so prosperous. BP shares fell by almost 5% when the firm announced a retraction from its ties with Rosneft. The most severe losses came after the Deepwater Horizon spill in 2010 when the company’s share price dropped around 50% on the London Stock Exchange between the end of April and the end of June that year. Additionally, the Covid pandemic saw BP report its first losses in a decade, with a loss of £4.2 billion in 2020 and a one-day share price drop of 5% following the earnings announcement.

BP currently trades on a forward price-to-earnings ratio (PE) of 5.7% and a competitive dividend yield of 3.8%.

- Lowest End-Of-Day Price – $1.61 on 21st May 1970

- Highest End-Of-Day Price – $79.70 on 11th June 2007

How To Trade BP Stocks

There are several ways that you can get involved in BP stock trading, and most of them can be accessed through online brokers. With that said, the available trading vehicles will vary between BP brokers:

Buy Shares

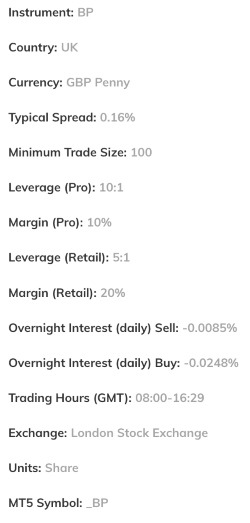

AvaTrade – BP CFD Trading Conditions

The easiest way for UK traders to invest in BP stocks is by purchasing the shares directly through an online brokerage. Commission fees to buy, sell or hold shares will vary between BP brokers.

Ordinary shares can be traded on the London Stock Exchange, open for trading from 8 am to 4:30 pm (GMT), and on the Frankfurt Stock Exchange under the ticker symbol BP. You will need access to trustworthy BP brokers that provide trading opportunities on these exchanges.

Alternatively, BP has a low-cost share dealing service (the BP Registrar is Link Asset Services) for shareholders looking to buy and sell shares without the high expense. There is no minimum trade size and the commission fee for certificated UK shares is 1.5%.

Trade CFDs

UK investors can also speculate on the rise and fall of the BP share price by trading CFDs (contracts for difference). Short-selling shares via CFDs means you will make a profit if the share price drops. Going long means you will make a profit if the share price rises.

CFDs are a good choice for retail traders who want to make leveraged trades on BP price movements without directly buying the underlying asset. Fortrade, for example, offers BP CFDs with leverage of 1:5 and an average spread of 1.5 pips.

Indices

BP is also a major listing on the FTSE 100 index. Trading indices enable retail investors to achieve exposure to a sector with one single position. Some of the top organisations of the FTSE 100 by market cap include BP, Shell, and HSBC.

Indices are a great alternative to invest in BP shares due to the auto rebalancing of other companies in the index fund. As one organisation struggles, another may bolster overall profits due to overperformance.

ETFs

Another way to trade BP stocks is via ETFs (exchange-traded funds). Similar to mutual funds, they are a good way to diversify a portfolio without having to speculate on individual company stock.

The ETF with the largest weighting of BP shares is the SPDR MSCI Europe Energy UCITS ETF.

Binary Options

Traders who want a quick and straightforward way to trade BP stocks regularly can also turn to binary options, which are a simple bet on whether the asset’s price will rise or fall.

Since the timeframe, potential profit and price of the contract are predetermined before the contract begins, these are relatively straightforward derivatives that can bring in good levels of profit even from small price movements.

Comparing BP Brokers

Fees, reliability, and available trading products are just some of the key considerations when choosing between BP brokers. Having said that, the decision will most likely come down to individual priorities and investment goals. We outline some key points to compare when choosing between brokers with BP stock trading:

Fees

Review the commissions associated with your preferred investment product. For example, some BP brokers will charge a commission to buy and sell stocks. This may be a flat rate per trade or share. Minimum and maximum charges may apply.

Having said that, the majority of brokers in today’s competitive landscape provide commission-free opportunities on some major stocks, like BP.

Platform

An intuitive yet easy-to-use platform will be key to trading success. The interface must provide simple navigation alongside all the features needed to review and analyse BP stock trading data. Look out for customisable features and graphs. Industry-recognised platforms include MetaTrader 4 and TradingView.

Look for BP brokers that have a platform you are comfortable with; some may also offer in-depth analysis tools or access to additional investment data for a fee.

Mobile App

Mobile trading apps are transforming online trading. The best BP brokers will provide their customers access to mobile applications with the facilities to open and close positions, make account changes and market analysis tools.

The best mobile apps provide users with all the trading functions of desktop terminals, allowing them to start BP stock trading on the move from their smartphone or tablet device.

Deposit Methods

The best UK-based BP brokers will accept all established payment methods as well as electronic transfer solutions. You will need reliable deposit options to make swift and cheap deposits to your live trading account and start BP stock trading within minutes. This may include via bank wire transfer, credit/debit cards, or e-wallets such as PayPal or Neteller.

Processing times and commission charges should also be reviewed as this can impact your speed to market.

How To Sign Up With A Broker

Most BP brokers that accept UK traders enable new accounts to be opened directly from their website or mobile app. You will need some personal information to hand, including proof of residency and identity documentation. This is so brokers with BP stock trading can comply with know-your-customer and anti-money laundering rules.

- Complete the online registration form (you may need to provide an email address and telephone number)

- Some BP brokers may request additional verification details such as employment and previous trading history

- Create a user ID and password

- Once the new account registration is approved, you can log in to your client portal and deposit funds to your live trading account

- Start BP stock trading online

How To Buy And Sell BP Stocks

When you are ready to start trading BP shares, navigate to your broker’s app or trading platform to make a trade. The exact procedure to open a position will vary between BP brokers, but usually, it will involve the following:

- Login to your investment account

- Search for BP’s ticker symbol, BP

- Select the number of shares to buy or the amount of money to invest

- Implement a stop-loss or take-profit risk parameter (optional)

- Submit the order

Continue to keep abreast of BP’s company earnings reports and the macroeconomic climate of the energy industry after you have opened your position. You may need to adjust your holdings, and buy or sell shares accordingly.

The right time to close your BP stock trading position will depend on your investment strategy and risk appetite. The process to sell a stock is relatively similar to purchasing. Search for BP in your open trade positions and select the number of shares to sell. There may be a slight time lag between requesting to close a position and this being executed.

UK retail traders may also be liable to pay Capital Gains Tax (CGT) if they achieve a substantial profit.

Bottom Line On Trading BP Stocks & Shares

BP shares have proven a good investment in recent years thanks to the increased wholesale prices of oil and gas, leading to record profits for the company. This has made it a worthwhile opportunity for many people involved in BP stock trading, though there is no guarantee this impressive performance will continue. Nevertheless, with a healthy dividend yield and many favourable opportunities ahead of the company, BP is certainly a stock to watch. Open an account with reliable BP brokers and keep track of the stock for trading opportunities.

FAQ

What Is BP Stock Trading At Today?

The share price of BP fluctuates daily, but the 52-week high range had reached £57 and stocks were selling for more than £54 in early 2023. See the real-time price chart in our BP stock trading guide for the price now.

Can You Buy BP Shares?

Yes, UK investors can buy, sell and hold BP company shares. The most common way to trade BP stocks is via an online brokerage. You can determine the number of shares to purchase or input the value of an investment. Alternatively, BP has a registrar named Link Asset Services for individuals looking to buy and sell shares.

Should I Buy BP Stock Right Now?

Some financial analysts consider BP a good stock to buy today. The record profits for the full year 2022 have seen market confidence increase drastically, thanks to the booming wholesale prices of oil and gas. However, as with all investments, profits are not guaranteed. Keep an eye on company earnings releases and energy company competitors.

How Can I Invest In BP Shares?

There are many different products available for anyone interested in BP stock trading. This includes direct share purchasing, index funds, and CFDs. There are also ETFs with exposure to BP shares, SPDR MSCI Europe Energy UCITS ETF has the largest weighting.

Is BP Shares A Good Investment?

BP has been trading at record-breaking highs in recent years, with 2022 profits exceeding expectations following increased wholesale prices due to supply concerns. However, in the long term the company’s ability to transition to clean and sustainable practices will likely impact British Petroleum’s share price. Keep an eye on the latest company news to stay up-to-date with price movements.