Borsa Italiana

Borsa Italiana, sometimes referred to as the Milan Stock Exchange or the Italian Bourse, is Italy’s main stock exchange. With a diverse set of companies and high liquidity, this stock market provides opportunities to trade equities, bonds and derivatives products. This 2025 guide will explain how to compare the best Borsa Italiana brokers and what the main features of this stock exchange are. Our experts have also compiled a list of the top UK brokers with Borsa Italiana trading below.

UK Brokers With Access To Borsa Italiana Stocks

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Instruments Regulator Platforms Forex, CFDs, Stocks, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Futures, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable 1:30 -

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) -

InstaForex is a forex and CFD broker founded in 2007. The broker offers diverse market coverage to millions of clients, spanning traditional assets like currencies and shares, as well as other interesting opportunities such as IPOs.

Instruments Regulator Platforms Currencies, Cryptocurrencies, Stocks, Indices, Metals, Oil and Gas, Commodity Futures and InstaFutures BVI FSC MT4, MT5 Min. Deposit Min. Trade Leverage $1 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) 1:30 for retail clients, 1:500 for professional -

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA CFXD, MT4, MT5, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $1,000 0.01 Lots 1:30 -

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto ASIC, CySEC, FSA, CMA Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $40 0.01 Lots 1:30 (UK), 1:500 (Global)

Choosing Borsa Italiana Brokers

Although Borsa Italiana is not the largest stock exchange, many popular brokerages provide access to the stocks or derivatives that trade on it. Before using these companies, assess the following factors:

- Fees – The cost of investing is a key consideration as this can greatly impact your profitability. Of course, brokers must get paid somehow and trading fees (commissions and spreads) are the most common way that this is achieved. For example, eToro has no commission on stocks but imposes wider bid/ask spreads. Interactive Brokers, on the other hand, does not have a markup on spreads but charges commission on Italian stocks at 0.05-0.10% for users with a monthly trading volume of less than or equal to EUR 50m. Exchange fees, clearing fees, market data fees, margin rates and regulatory fees may also apply. Expense ratios are often attached to ETFs that track Italian indices. If in doubt, check the broker’s fee schedule on its website.

- Trading Platforms – The MetaTrader 4 and MetaTrader 5 platforms are usually considered the industry standard for retail Borsa Italiana brokers. MT4 alone has nine timeframes, 23 analytical objects, 30 technical indicators, built-in automated trading and historical data that can be downloaded for the last week, month, year or longer. The platforms are suitable for both beginners and advanced traders and have mobile apps on iOS and Android with all key features and quotes in real time. Other popular investing platforms include cTrader and TradingView. Trading platforms will often have demo accounts that you can login to so you can explore and test strategies in real time using virtual money.

- Instruments – Some prefer to invest in equities whilst others favour derivatives. Check that the broker in question offers the asset types and instruments you want, whether stocks, ETFs, CFDs, options, bonds, or warrants. Some Borsa Italiana brokers may only have a limited number of Italian stocks compared to other European and US equities. Do your research first and make sure you understand whether assets are valued fairly in terms of price or yield.

- Regulation – Our experts recommend choosing Borsa Italiana brokers that are regulated by and have a license with a reputable authority, such as the FCA or CySEC. IG Index is one such broker regulated by the FCA. Opting for an unregulated firm carries more risk as the company will likely be subject to less stringent monitoring requirements. There also tends to be less protection for consumers with often fewer restrictions on high-leverage investing and little to no insurance in the event of insolvency. Regulated brokers likely have more lengthy registration forms and KYC verification checks.

- Additional Features – All traders must analyse the market and understand how current news and corporate actions are influencing asset prices and other YTD financial statistics in real time. Borsa Italiana brokers like Plus500 have regular market analysis articles, as well as educational resources. Also, beginners may want to look for firms that offer fractional shares as these are more accessible to low-capital traders. A single share in Ferrari currently costs around EUR 244.

- Payment Methods – Some Borsa Italiana brokers offer free deposits and withdrawals, whilst others charge fees to credit or debit your account. If possible, choose a broker that has GBP as an account base currency. eToro has a $5 withdrawal fee and currency conversion fees for non-USD deposits and withdrawals.

- Customer Support – The Borsa Italiana market is Monday-Friday, so 24/5 customer support is important. However, 24/7 assistance is a nice touch that can be invaluable for weekend analysis and strategy generation. Borsa Italiana brokers each have different customer support options but the best will offer live chat, phone and email contact methods.

How Does The Borsa Italiana Exchange Work?

Borsa Italiana is now part of the European exchange operator and market infrastructure, Euronext, having previously been bought by the London Stock Exchange Group. Its official name is Borsa Italiana S.p.A and its headquarters are in the Palazzo Mezzanotte building in Milan.

The stock exchange lists both Italian and international companies across a range of sectors. The number of listed companies is currently 423, with the member list covering financial services, energy, consumer goods, healthcare, technology and more. This means that many of the indices listed by Borsa Italiana brokers that track this exchange are diverse, allowing investors to spread their risk across multiple Italian and international industries and sectors.

The regulatory authority for a listing on the EXM market (the main Italian stock exchange market) is CONSOB.

History

Borsa Italiana brokers provide access to one of the oldest stock exchanges in the world, with a history going back more than 200 years. The main events in this period are:

- 1808: La Borsa di Commercio di Milano (Milan Stock Exchange) is established, becoming the first stock exchange in Italy

- 1850: The Turin Stock Exchange is established

- 1855: The Genoa Stock Exchange is established

- 1994: The Milan Stock Exchange begins using electronic trading and the Italian Derivatives Market (IDEM) is launched

- 1997: The Italian stock exchanges merge

- 1998: The Milan Stock Exchange is privatised and becomes Borsa Italiana S.p.A.

- 2007: Borsa Italiana is acquired by the London Stock Exchange Group

- 2021: Borsa Italiana becomes part of the pan-European stock exchange operator, Euronext, following a successful acquisition, resulting in the migration of its data centre from the UK to Italy

Biggest Players

When comparing the Borsa Italiana vs the S&P 500 and FTSE 100, it cannot compete with the size of some companies on those indices. However, its main index, the FTSE MIB, does contain significant large-cap stocks. The stock exchange has also featured large IPOs – in 2020, there was the IPO of Ferrari, which raised $1.1 billion and was the biggest in Europe that year.

The five biggest listed companies by market cap on Borsa Italiana:

- Enel (EUR 55.7bn) – electricity and gas

- Stellantis (EUR 50.9bn) – automobiles

- Intesa Sanpaolo (EUR 42.3bn) – financial services

- Eni (EUR 42.1bn) – crude oil and natural gas

- UniCredit (EUR 33.8bn) – financial services

A directory of companies is available on the Borsa Italiana website and many brokers will provide relevant information on these companies.

Price Chart

Markets

Borsa Italiana is split into different markets, which are characterised by the instruments they list or the types of companies on them.

Euronext Milan (EXM)

This was referred to as the Main Market before a name change in 2021 after the outcome of Euronext’s acquisition was confirmed.

The EXM is the main equity market in Italy and is where large and mid-cap companies can be found. It has more stringent listing requirements than the EGM, including higher financial thresholds. Examples of the requirements include a minimum capitalisation of EUR 40m and a free float of at least 25%. One major company on the EXM is Banco BPM, a large Italian bank.

Borsa Italiana brokers will usually focus on this market as this is where the most liquidity is.

Euronext Growth Milan (EGM)

Although the EGM is also an equities market, it contains smaller companies than the EXM that are still in their growth phase. Several stock exchanges around the world have a market for large-cap companies and a separate market for smaller companies with less stringent requirements for financial filings. The goal of this market is to allow small to mid-cap stocks to raise capital without having to meet the robust criteria of the EXM.

Companies listed on the EGM include Jonix, an indoor air sanitisation company, and Kolinpharma, an Italian nutraceutical company. The trading of Ki Group, which was also in this market, has recently been suspended.

Mercato Telematico Obbligazionario (MOT)

The MOT is a fully electronic market for trading fixed-income securities, including government bonds, corporate bonds and other debt instruments.

Some Borsa Italiana brokers may offer access to such bonds, in addition to equities from other markets.

Italian Derivatives Market (IDEM)

The IDEM is an electronic derivatives market offering a variety of futures and options contracts. These range from equity derivatives to interest rates futures on Italian and European government bonds.

Indices

Several indices track stocks on the Borsa Italiana, providing investors with a useful indicator of the Italian and European economy, as well as the opportunity to diversify their portfolios.

FTSE MIB 40

This is the main index of the Italian stock market and comprises the 40 most traded companies on Borsa Italiana. It represents approximately 80% of the total domestic market cap of the Italian stock market. Of the brokers that offer indices that track the Italian stock exchange, this index is most often included as it represents large-capitalisation and highly liquid companies.

IG is one such broker that offers this index to its users.

FTSE Italia All-Share

This index tracks the performance of all companies listed on the FTSE MIB, FTSE Italia Mid Cap and FTSE Italia Small Cap indices.

This means it includes large, mid and small-cap stocks, providing even greater diversification than the FTSE MIB, alongside potentially higher risk.

FTSE Italia Mid Cap

This index tracks the performance of the top 60 companies not listed on the FTSE MIB index, usually with a market cap between EUR 1bn and EUR 10bn. It is a benchmark for the performance of the mid-cap sector in the Italian equities market.

FTSE Italia Small Cap

This index tracks the performance of smaller companies outside the FTSE MIB and FTSE Italia Mid Cap indices. The market cap of these companies is generally below EUR 1bn.

This index is more niche and, therefore, many Borsa Italiana brokers will not offer it. That said, our traders have found it can be a useful indicator for retail and institutional investors of the Italian small-cap market and how growth companies are performing.

FTSE Italia Brands

The FTSE Italia Brands is a basket of Italian companies that are leaders in their respective sectors, whether that is luxury goods, fashion or food and beverage. Companies include Moncler (MONC) and Juventus Football Club (JUVE).

How To Trade With Borsa Italiana Brokers

Like all stock exchanges, Borsa Italiana moves up, down and sideways and this volatility creates opportunities to profit. Once you have chosen a broker and deposited funds, the next step is to identify an investment product.

Choose A Trading Vehicle

With many different ways to trade stocks and other instruments with Borsa Italiana brokers, investors need to decide what the best method is for them.

Derivatives like CFDs can not only be a cost-effective way to speculate on the short-term price movement of an instrument without owning the underlying asset but also provide a way to trade with leverage. Margin can increase exposure, leading to higher potential profits and losses.

Alternatively, investors may wish to directly buy shares of equities. ETFs and mutual funds can also be good ways to diversify your portfolio as these will typically track a basket of stocks.

Identify A Strategy

The two main types of trading strategies when investing with Borsa Italiana brokers involve technical and fundamental analysis.

Charts and indicators are a key part of a technical analysis strategy. For example, Bollinger Bands may be utilised to identify overbought or oversold territory on the graph when deploying a range trading strategy, when the market is fluctuating sideways between a support (lower) and resistance (upper) level. Being able to identify the support and resistance level allows traders to potentially profit from these fluctuations.

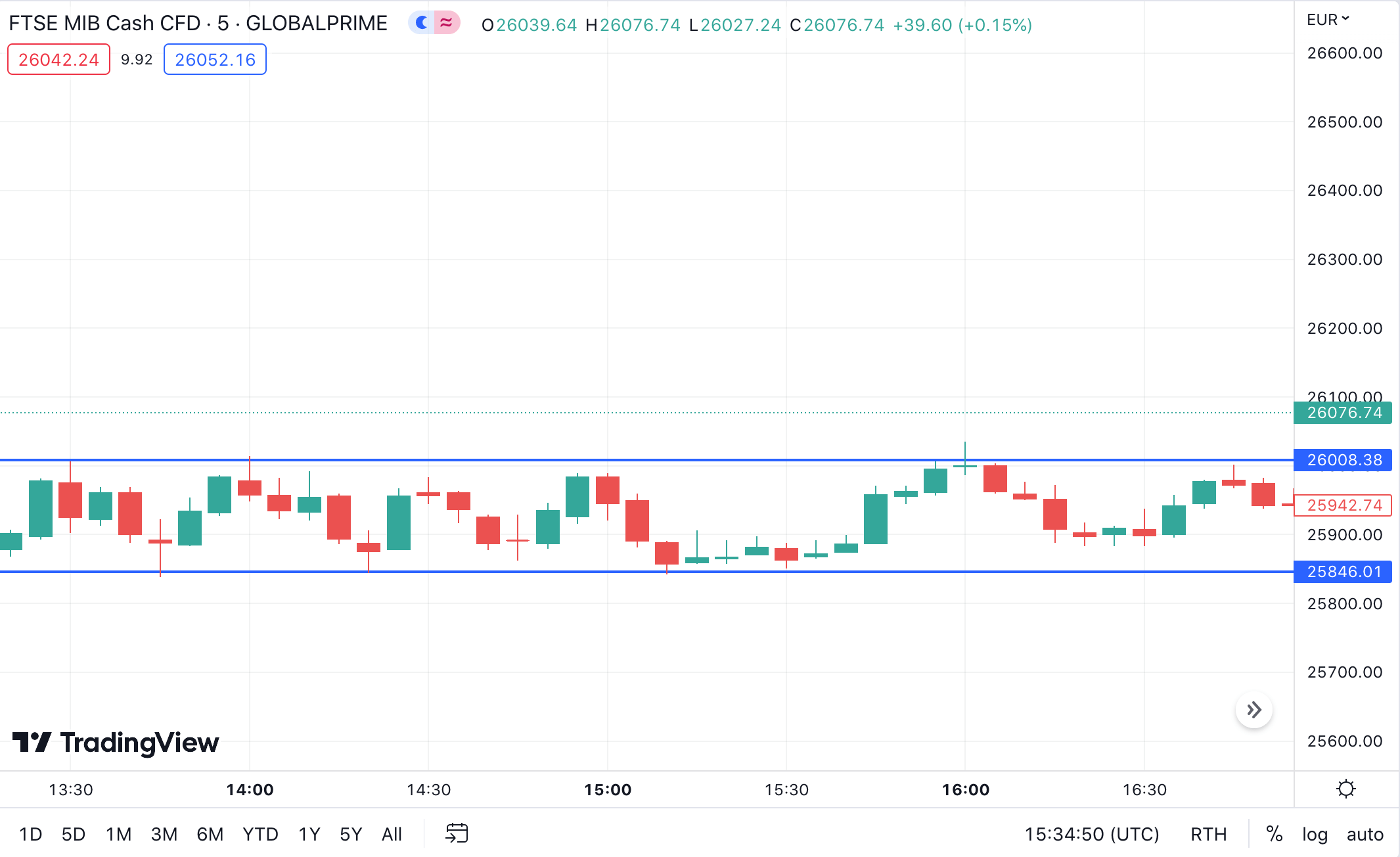

FTSE MIB 40 Range Trading

Alternatively, investors may focus on fundamental analysis, which looks at the intrinsic value of individual companies and the wider macroeconomic conditions. One factor that can heavily influence the indices that track Borsa Italiana equities is the interest rate decisions of the European Central Bank. If interest rates go down, this enables consumers and businesses to borrow money more easily, usually resulting in increased spending and investment. This is likely to benefit companies listed on the Italian stock exchange and could lead to more investors purchasing their shares.

Political stability, inflation and economic growth (measured in GDP) are other factors that fundamental analysis traders may look at. Some Borsa Italiana brokers have dedicated fundamental analysis sections.

In terms of the intrinsic value of the individual companies, investors should look at key ratios like the p/e ratio and forward p/e ratio to see whether the price of the stock is overvalued or undervalued relative to its earnings and future earnings. Check the company’s financial statements and reports for up-to-date information.

Open Your Position

Timing the market is key to making profitable trades. Many Borsa Italiana brokers and their investing platforms will allow you to set alerts when certain conditions are met. For example, you may wish to be informed when the price reaches a particular level, which would trigger the next step in your strategy.

Most major trading platforms have one-click trading, which means long and short positions can be opened instantly from the chart screen. Copy trading may also be available, where users can outsource the legwork to experienced traders, although additional fees may be applicable for this. Some brokers also have APIs so that investors can integrate their own trading bots.

Close Your Position

The MT4 and MT5 trading platforms offer multiple advanced order types, including stop loss and trailing stop orders, so that positions can be closed automatically once a required price condition is met. Some will close their positions if a trend is showing signs of reversal or if the price breaks out of a predetermined range.

Other investors will only close their position after holding a stock for several years in the hope that its value will rise over the long term.

Opening Hours

Borsa Italiana is open Monday-Friday, except on national holidays like Christmas Day, Good Friday and Easter Monday. Make sure to check a trading calendar to see whether the market is open today, although note that many Borsa Italiana brokers will not provide a calendar specific to this exchange. The stock exchange opening hours are as follows:

- Pre-Market Session: 07:00-08:00 GMT

- Main Trading Hours: 08:00-16:30 GMT

- Post-Market Session 17:00-19:30 GMT

Bottom Line On Borsa Italiana Brokers

Borsa Italiana brokers provide access to a major European market with Italian and global equity and derivative products. Although it isn’t the largest stock exchange in the world, it does offer electronic investing on small, mid and large-cap stocks, including popular luxury car brands and football teams. This gives users plenty of opportunities to build a portfolio with Borsa Italiana brokers that aligns with their risk preferences and strategic approach.

Check out our directory of the top UK Borsa Italiana brokers.

FAQ

Which Borsa Italiana Brokers Are The Best?

No broker can be considered the best. Each has its pros and cons and we recommend that traders compare the fees, investing platforms, customer support, UK regulation, and instruments of each firm before making a decision. Alternatively, choose from our ranking of top-rated Borsa Italiana brokers.

Do Borsa Italiana Brokers Offer Different Trading Vehicles?

The best brokers offer a range of investment products, including shares, spread betting, and CFDs. Others may specialise in particular asset classes or products. For example, eToro does not offer spread betting accounts but boasts a wealth of CFDs.

Do Borsa Italiana Brokers Charge A Fee If You Trade ETFs That Track The FTSE MIB?

There will usually be fees involved for trading ETFs that track an index like the FTSE MIB. Commissions, spreads, expense ratios and other fees may also be applicable.

Do Pattern Day Trading (PDT) Rules Apply When Trading Stocks With Borsa Italiana Brokers?

Brokers with no PDT rules can be found in most countries outside of the US. If investing in the Italian stock exchange through a UK broker, PDT rules will generally not apply.

Which Indices That Track The Italian Stock Exchange Are Available At Online Brokers?

The FTSE MIB index is a common product offered by Borsa Italiana brokers as it includes the largest and most liquid companies on the exchange. Many brokers will not offer more niche indices like the FTSE Italia Small Cap.