Stake Review 2025

|

|

Stake is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Stake |

| Stake Facts & Figures |

|---|

Stake is an Wall Street brokerage offering 6,000+ stocks on a mobile investing app. This multi-reglated broker has gained a strong reputation since its inception in 2017, with over 450,000 customers. The brand offers competitive fees, with just a $3 brokerage charge and 0.5% for FX conversion, making it popular with global traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs |

| Demo Account | No |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | Variable |

| Regulated By | FCA, ASIC, FMA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

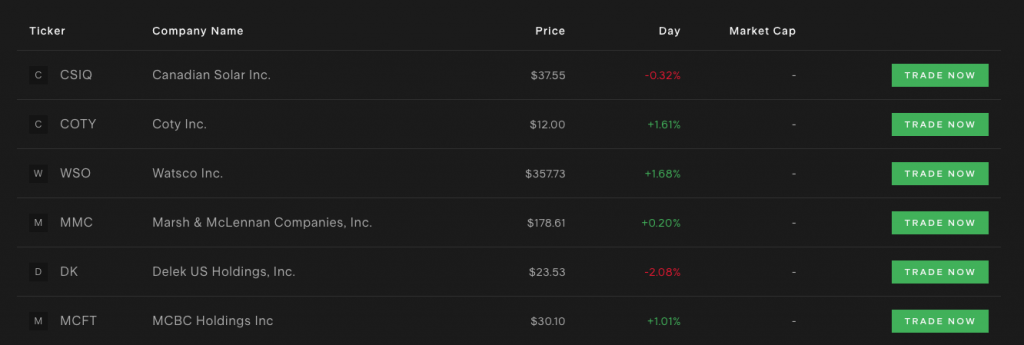

| Stocks | Trade over 6,000 US stocks and ETFs with just a $3 brokerage fee, as well as commission-free fractional shares. Investors can also benefit from the broker's time-saving digital and automated US tax forms. |

Stake is a mobile trading app, providing UK clients with investment opportunities on the US stock market. The user-friendly online broker is regulated by the Financial Conduct Authority (FCA), with a competitive and transparent fee structure. This review will share our key findings after putting Stake to the test.

Our Take

- Stake allows users to buy and sell an impressive selection of 6,000+ US stocks on a beginner-friendly app

- Fees are low and compare well with rivals, starting at a flat $3 for positions up to $30,000

- The broker is regulated in the UK with strong client protection measures

- The lack of a demo account and limited payment methods are key drawbacks

Market Access

The Stake instrument list is not the largest, but provides US-specific products which can be difficult to find at alternatives. We particularly rated the fractional stocks, which offer partial ownership of equities, making shares accessible to beginners.

- American Depository Receipts – 200+ ADRs of global listed firms with a presence on the US market

- Fractional Shares – Purchase fractional shares with market and stop orders from as little as a $1 increment

- US Stocks And ETFs – 6000+ US listed company shares and exchange-traded funds. Stocks are listed on major US exchanges including the NASDAQ and NYSE

We were also pleased to see that Stake plans to offer margin trading, short selling, and options.

Fees

Trading Fees

Stake is transparent when it comes to trading fees with a simple pricing structure. Customers will be liable for a $3 brokerage fee for positions up to $30,000 or a 0.01% charge on trades over $30,000. These rates are competitive compared to leading share dealing brokerages like IG Index.

I was also pleased to see the applicable fees published on the order screen before confirming a position.

Non-Trading Fees

The good news is, Stake does not charge any inactivity fees, which is comparable to similar brands. Additionally, we were pleased to see the brokerage does not apply any account opening costs or holding fees.

With that said, UK traders should be aware of currency conversion fees, as all positions will be executed in USD. A fee of 0.5% applies to convert currencies, which is around the industry standard.

While using Stake, we also uncovered several additional costs:

- Withdrawals – $2 bank processing fee

- ACATS Portfolio Transfer – $65 flat fee

- DTC Portfolio Transfer – $50 fee per position ($200 minimum)

- SEC Fee – $8 fee per $1 million of securities sold. Minimum $0.01 per trade

- Instant Deposit – 0.5% additional charge with a minimum $2 fee for faster account funding

- TAF Fee – $0.000019 fee per product with a $5.95 maximum cap per transaction. Minimum $0.01 per trade

Accounts

All UK investors will be registered under a standard profile, with no perks for high-volume users. There are no restrictions on the number of transactions that can be made, and basic market data is available.

For UK clients, I found the lack of account options limiting, especially as residents in Australia and New Zealand can register for a ‘Stake Black’ membership. This membership provides several benefits such as instant fund settlement and access to price target data from Stake’s team of analysts.

Nonetheless, I was pleased to see a seamless incoming and outgoing portfolio transfer process to/from a Stake account. Stake supports ACATS or DTC product transfers. I would recommend using the ACATS process as it is typically faster and cheaper than DTC transmissions.

How To Open A Stake Account

You can sign up on the Stake website or via the mobile app. I found the sign-up process very thorough and it took me more than 10 minutes to complete the application.

- Provide your email address and create a password

- Select ‘Register’

- Verify your registration by adding the five-digit verification code sent to your email address

- Automatic redirection to the registration form will be activated

- Add your details (citizenship, title, name, mobile number, and date of birth). Select ‘Next’

- Add the security code sent to your mobile number

- Add your address and select ‘Next’

- Choose your employment status using the tickboxes

- Choose your investment style from the menu

- Confirm your projected investment value and source of funds

- Declare financial affiliate status and tax residency. Add your NI number

- Review the T&Cs and choose ‘Agree’ to sign up

- Complete your application by uploading a proof of address, an identity document, and a selfie

Funding Options

Deposits

The deposit options are disappointing for UK investors. Stake clients can add money via bank wire transfer only, using the brand’s integrated Open Banking service.

You can choose Express (same-day processing) or Regular (next-day processing), though both have a cut-off time of 1:00 pm which is misleading. An instant processing option is available, though you will be liable for a 0.5% additional charge.

On a positive note, the broker has a minimum deposit requirement of $50, which is reasonable. There are also no fees to make a payment, but a 0.5% currency conversion charge applies to covert GBP to USD.

Withdrawals

Withdrawals from a Stake account can take up to four working days to be processed. This is around the norm, but slower than some firms that offer same-day withdrawals, such as XTB.

There is a minimum withdrawal limit of $10 and a 0.5% fee applies for all transfers, with a minimum $2 charge which is a drawback vs competitors that provide fee-free withdrawals, such as CMC Markets.

How To Make A Withdrawal

I appreciated that you can request a withdrawal quickly from the mobile trading platform:

- From the Stake app, select the ‘Wallet’ icon and then choose ‘Withdraw’

- Enter the amount and confirm the bank account for funds to be processed to

- Review the withdrawal transaction summary and process the request

- Confirm the withdrawal with a one-time-password sent to your email address

Mobile App

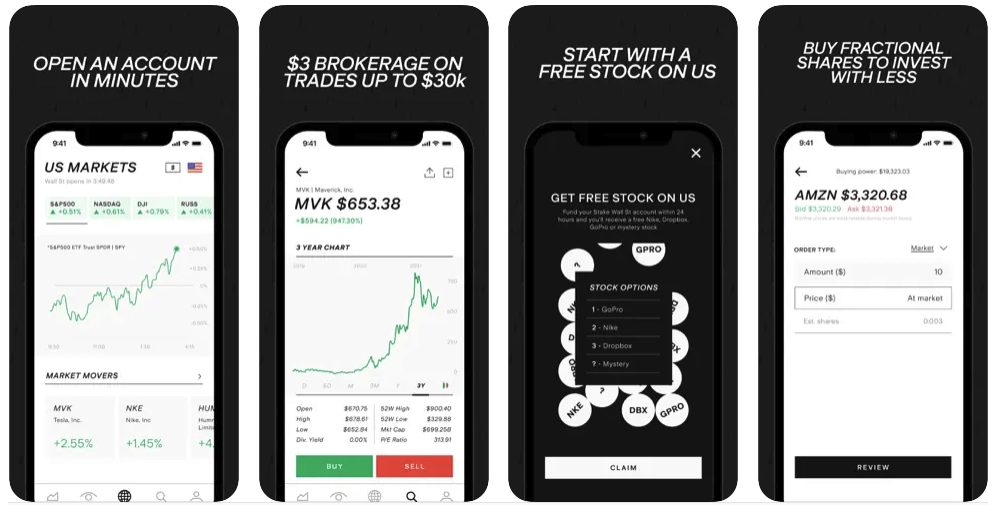

Stake is a solely mobile-based trading platform, which aligns with similar brands such as Freetrade. The app is available for free download to iOS and Android (APK) devices.

I found the application offers a well-designed interface, which was easy to navigate with a sleek design. You can view basic charts and graphs of an instrument, create watchlists, and monitor your portfolio performance. I also thought opening and closing positions was straightforward, with no complex order screen.

However, you will be disappointed if you’re looking for advanced trading tools and technical analysis features. There were no drawing tools, technical indicators, or advanced order types found on popular platforms such as MetaTrader 4. As a result, Stake only supports basic investing strategies such as buy-and-hold.

Another disadvantage I found when I used Stake is the lack of custom price alerts and notifications. This is an important feature, especially when trading on a portable device.

With that said, I did find a decent financial news stream and market data section, which are available from the terminal interface. You can simply input an asset name or ticker symbol into the search bar.

How To Buy Stocks On Stake

The broker accepts three basic order types; stop, limit (GTC or EOD), and market. To place a trade:

- Open the Stake mobile application and sign in with your registered credentials

- Search for an instrument using the navigation bar

- Review price patterns and chart details

- Select ‘Buy’ or ‘Sell’ to open a position

- Choose the order type from the dropdown menu

- Add the amount to invest and review the estimated number of shares

- Select ‘Review’ and ‘Submit’ to execute the position

Orders are executed using the best prices on the US markets through the National Best Bid Offer (NBBO) process. Email confirmation will be provided for opened positions, or available in the ‘Account’ section of the app.

Leverage

Stake does not offer leverage trading. This means there is no option to increase your purchasing power using borrowed funds from the broker. This is sub-standard vs alternative firms, which are permitted to offer leverage in line with FCA regulations.

Having said that, this does mean there is no risk of amplified losses.

Demo Account

It is disappointing that Stake does not provide a demo account, particularly for beginners. This means you won’t have the opportunity to practise trading with virtual funds before signing up.

I found this to be a major downside vs competitors, especially for a brokerage with proprietary software.

UK Regulation

Stake is the trading name of Hellostake Limited. The company is registered in the UK and authorised and regulated by the Financial Conduct Authority (FCA), license number 830771. This is a reputable financial watchdog, renowned for its strict member guidelines and operating requirements.

However, it is worth noting that all orders are executed by the company’s partner brokerage, DriveWealth LLC. DriveWealth is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). This means you may be entitled to all the protection measures gained by US customers, including compensation insurance to the value of up to $500,000 ($250,000 for cash claims).

I was also pleased to see that two-factor authentication can be enabled, requiring approval for login attempts and withdrawal requests.

ETF Regulations

Our review found that US ETFs can only be traded by UK retail investors who have passed an appropriateness test. To be eligible, you must adhere to two of the three requirements listed below:

- An existing portfolio value of at least €500,000

- At least one year of financial sector work experience

- Previous trade experience with an execution frequency of 10 orders per quarter for the last year

Bonus Deals

Stake does not offer any traditional bonus rewards such as a no deposit bonus. This is aligned with FCA restrictions.

Having said that, I was offered a free Nike, GoPro, Dropbox, or mystery stock when I signed up (to the value of $10). To be eligible, you must open a Stake account and fund your profile within 24 hours.

Extra Tools & Features

We were impressed by the online learning academy, ideal for beginners or those new to trading the US stock market. The ‘Stake Academy’ has a wealth of information and articles.

On the downside, we did find that some of the categories do not provide up-to-date material, which is a shame, particularly for topics around trending instruments and product insights.

When testing the platform, I did like the ‘Under The Spotlight’ feature. This offers background information on some of the largest company stocks, or those with significant price movements thanks to internal or external company influences.

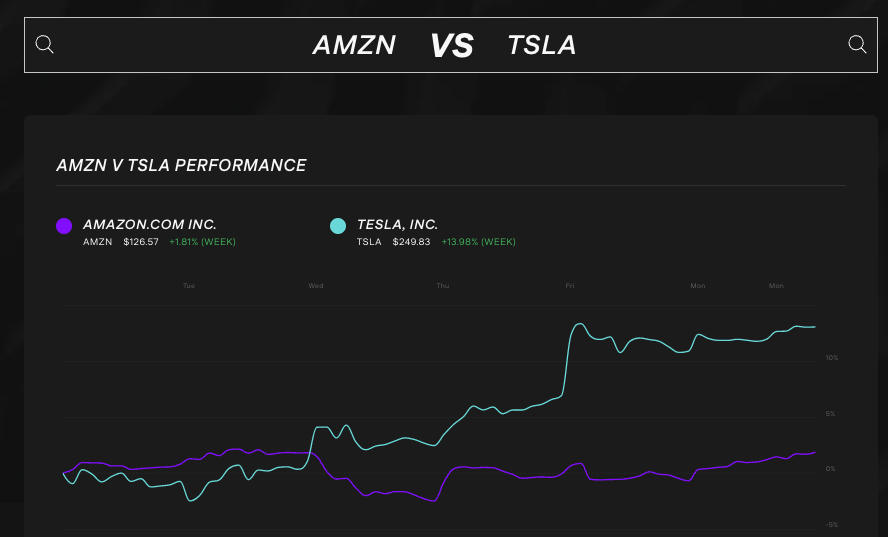

There is also a stock comparison tool, where you can select two stocks to compare and the tool generates a price chart and corresponding monthly or yearly stats for both.

Stock Comparison Tool

Customer Service

Stake customer support is very limited. The broker does not provide a telephone number, email address, or live chat function, which means it will be difficult to source information or contact an agent for an urgent query.

There is an online contact form though I did not receive a response for more than 24 hours, which is very poor considering it is the only option.

We did like the online support page, with FAQs organised by topic. Questions include how to trade on the Stake platform, applicable brokerage fees, and how to fund your account. You can also use the article search function to source relevant information.

Company Details & History

Stake was established in 2017, primarily as an app-based platform for international customers to trade on the US market. The broker aims to remove all the complexities of investing in the US market such as slow order executions and long registration requirements.

Today, the brand has an impressive 540,000+ registered customers worldwide with services available to UK clients as well as those in New Zealand and Australia. The brokerage has also been referenced by several financial publications including the Business Insider and The Motley Fool.

Trading Hours

You can use the Stake mobile app 24/7, though trading hours will vary. You will be limited to US market opening hours when trading shares for instance, which are 9:30 am to 4:00 pm ET (2:30 pm to 9:00 pm GMT). You can initiate orders outside of these times, but these trades will not be executed until the next opening.

We were disappointed not to find any published information on upcoming market closures though the Stake Twitter page is updated and we did find public holiday dates here.

Should You Invest With Stake?

Stake is an easy-to-use trading app that offers thousands of US securities. Though lacking analysis features, the application provides simple navigation and digestible price data. We were also pleased with the broker’s regulatory status, client fund protection, and decent security features.

We would like to see improved customer support features as this is a major downside of the brand. Our team would also welcome leverage and a GBP trading account.

FAQ

Is Stake Legit And Safe?

We are confident Stake is a safe brokerage brand. The Financial Conduct Authority (FCA) authorises and regulates the company. US market orders are executed by DriveWealth, a member of FINRA and SIPC, which are reputable financial bodies in the United States. You can also enable two-factor authentication (2FA) for login attempts and withdrawal requests.

Does Stake Offer Low Trading Fees?

Stake trading fees are relatively competitive, with a flat $3 charge for all orders under $30,000 or a 0.01% charge on trades over $30,000. There are no additional commissions or spread mark-ups. With that said, it is worth noting that UK traders may need to pay a 0.5% fee to convert GBP into USD.

Is Stake A Good Broker For Beginners?

Stake is a good broker for beginners investing in the US stock market. The mobile application is easy to navigate, with basic features. It is a shame the broker does not offer a demo service, but a free stock is available at sign-up. Decent educational content is also available.

How Long Do Withdrawals Take From A Stake Brokerage Account?

Withdrawals from a Stake brokerage account can take up to four working days to be processed. Importantly, money can be withdrawn via bank wire transfer only.

Does Stake Have A Mobile App?

Yes, Stake is a mobile-based trading platform. UK investors will be able to download the application to iOS and Android devices for free.

Article Sources

Top 3 Stake Alternatives

These brokers are the most similar to Stake:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Stake Feature Comparison

| Stake | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 2.9 | 4 | 4.7 | 4.3 |

| Markets | Stocks, ETFs | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | $50 | $1,000 | $0 | $0 |

| Minimum Trade | Variable | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA, ASIC, FMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | MT4 | - |

| Leverage | - | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:50 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Stake Review |

Swissquote Review |

IG Index Review |

Interactive Brokers Review |

Trading Instruments Comparison

| Stake | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | No | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

Stake vs Other Brokers

Compare Stake with any other broker by selecting the other broker below.

Popular Stake comparisons: