Spread Co Review 2025

|

|

Spread Co is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to Spread Co |

| Spread Co Facts & Figures |

|---|

Spread Co offers spread betting and CFDs with competitive trading conditions. |

| Instruments | Spread betting, CFDs, forex, indices, shares, commodities, ETFs, ADRs |

|---|---|

| Demo Account | Yes |

| Min. Deposit | £200 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | £0.10 |

| Regulated By | FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade with leveraged CFDs on popular financial markets. |

| Leverage | 1:20 |

| FTSE Spread | 1.0 |

| GBPUSD Spread | 1.0 |

| Oil Spread | 4.0 |

| Stocks Spread | Variable |

| Forex | Spread Co offers trading on a long list of online currencies with competitive spreads. |

| GBPUSD Spread | 1.0 |

| EURUSD Spread | 0.8 |

| GBPEUR Spread | 1.0 |

| Assets | 38 |

| Stocks | Start trading on major stock exchanges and equities with up to 20% leverage at Spread Co. |

| Spreadbetting | Spread betting is available in three simple steps with no setup or inactivity charges. |

Spread Co is an FCA-regulated CFD and spread betting broker that offers some innovative features such as its Mini Markets on a proprietary platform and a fixed-spread pricing structure. In this review, we test Spread Co’s products, payment methods, account types, and more to give traders the lowdown on this broker. Our UK team also share their verdict on trading with Spread Co.

Our experts liked that Spread Co is authorised in the UK with a good reputation. We also rated the straightforward pricing model and spread betting service. On the downside, the trading platform is clunky and outdated. The broker also falls short in terms of education for beginners.

Market Access

Most traders will be satisfied by the range of instruments at Spread Co, which covers all of the most commonly traded asset classes via CFDs or spread betting.

One of our favourite features is Mini Markets trading. This is a unique offering, similar to brokers that offer penny stocks. These assets are ideal for beginners or those with limited access to capital, with stake sizes from 10p.

We found Spread Co’s list of forex pairs less impressive – at 38, it is good, but eclipsed by many rival brokers. The commodities and indices on offer are also limited, and traders who tend to focus on these assets may prefer an alternative broker.

Supported assets:

- Commodities – Trade gold, silver and US crude oil

- Shares – Invest in 1000+ UK and US company shares such as Aviva, Hargreaves Lansdown, HSBC, and Walmart

- Forex – Trade 38 major, minor, and exotic currency pairs including the EUR/GBP, GBP/USD, and AUD/CAD

- Indices – Speculate on six indices plus futures and mini-stake versions. This includes the FTSE100 and Germany 30

- ETFs – Invest in 100+ exchange-traded funds tracking several categories including countries, commodities, and bonds

Fees

Unlike the majority of brokers, Spread Co offers fixed spreads. Regardless of market conditions, you can be assured of stable pricing, though the spreads available for spread betting are tighter than CFDs.

Importantly, Spread Co’s fees are competitive. We were offered the FTSE 100 at 0.8 points (spread betting) and 1 point (CFD) during standard UK market hours. The GBP/USD currency pair was offered with a 2-pip spread (CFDs) and 1 pip (spread betting).

You will be liable for commission charges for equities trading which are from 0.05% for UK shares, though this is included in the spread rather than as an additional fee.

Another advantage that we were glad to see at Spread Co is the lack of inactivity fees, as many rival brokers charge between £5-£10 per month to inactive accounts.

Accounts

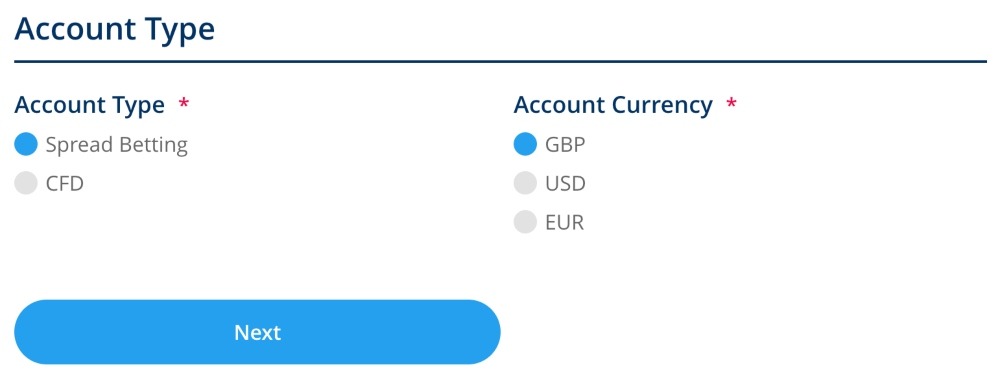

Spread Co’s two live account types are categorised by trading vehicle – CFD or spread betting – which is a straightforward and logical approach.

- CFD Account – Commission-free trading, no stamp duty payments, 0% financing on short index positions, minimum deposit requirement of £250, trade 1000+ instruments

- Spread Betting Account – Spreads from 0.8 pips, 0% financing on short index positions, access to trade Mini Markets with stakes from just £1, retail margins from 3.33% on major forex pairs and 5% on indices, minimum deposit requirement of £200, trade 1000+ instruments

Professional accounts can also be obtained upon request; eligible traders will benefit from increased leverage and other improved trading conditions, but will lose the negative balance protection and other FCA protections that cover retail traders.

On the downside, we were disappointed to find that Spread Co lacks a Sharia-compliant Islamic account.

How To Open A Spread Co Account

We found the account registration process straightforward. Sign-up does involve entering quite comprehensive details, including declarations of trading experience and current employment status, but this did not take long.

To get started:

- Choose an account type (CFD or spread betting) and an account base currency (GBP, EUR, or USD) and click ‘Next’

- Add personal details such as nationality, DOB, email, and phone number, then select ‘Next’

- Enter your address

- Confirm your employment status and income details, then click ‘Next’

- Input your previous trading experience and select ‘Next’

- Review and agree to the T&Cs

Spread Co processes all registrations within 24 hours, which is pretty standard. All in all, we are confident that traders can complete the joining process quickly as long as they are able to provide proof of address and identity.

Funding Options

Deposits

We were disappointed to find that Spread Co only accepts bank wire transfers or credit/debit card payments, with the lack of e-wallet options striking.

Fortunately, GBP funding is accepted, meaning you won’t be charged any currency conversion fees, beneficial vs international brands.

We found the minimum deposit requirement a little high at £200 for the spread betting profile and £250 for a CFD account, especially compared to other UK brokers like CMC Markets with no minimum and XM at £5.

Our team was pleased to see that Spread Co does not charge any deposit fees. Processing times vary, however, you can expect credit/debit card payments to be received within one working day.

How To Make A Deposit

We found adding funds to a Spread Co account easy.

- Log in to the trading platform

- Click on the ‘Payments’ tab and then choose ‘Deposit’

- Enter the deposit value and add your card details

- Review the payment and confirm your deposit

Withdrawals

We were not surprised to see that withdrawals must be processed back to the original payment method, as this is standard at FCA-regulated brokers.

The minimum withdrawal limit of £50 is higher than some rivals, though this shouldn’t be too much of a deal breaker, given there are limited brokerage fees.

Note that it may take up to 24 hours for Spread Co to approve a withdrawal request. UK bank transfers can take up to three working days to receive funds. We found card withdrawals to be much quicker, though this does vary by issuer.

UK Regulation

We were pleased to see that Spread Co Ltd is authorised and regulated by the Financial Conduct Authority (FCA). This is a reputable financial body, renowned for its customer protection and retail investor safeguarding, which includes measures such as negative balance protection and segregated client funds.

Additionally, British traders will have access to the Financial Ombudsman Service to deal with complaints, and the Financial Services Compensation Scheme in the case of business failure.

Overall, we feel that traders can be confident when trading with Spread Co thanks to the strong regulatory coverage.

Spread Co Leverage

As an FCA-regulated broker, Spread Co adheres to relevant leverage limits, with maximum leverage of 1:30 for major forex pairs and 1:5 for individual equities. This is in line with comparable brands.

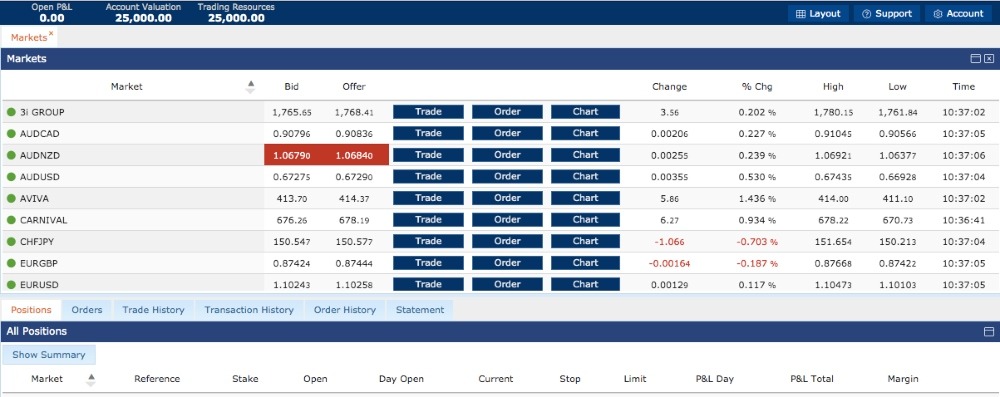

Trading Platform

We were slightly frustrated by the platform options on Spread Co, which only offers a proprietary terminal, available as a WebTrader with no download option or as a mobile app available for iOS and Android (APK) devices.

At first view, the Spread Co terminal looks a little outdated, though we did see some similarities to the interface of the MetaTrader platforms. A little exploration left us more reassured of the simple navigation and tools available.

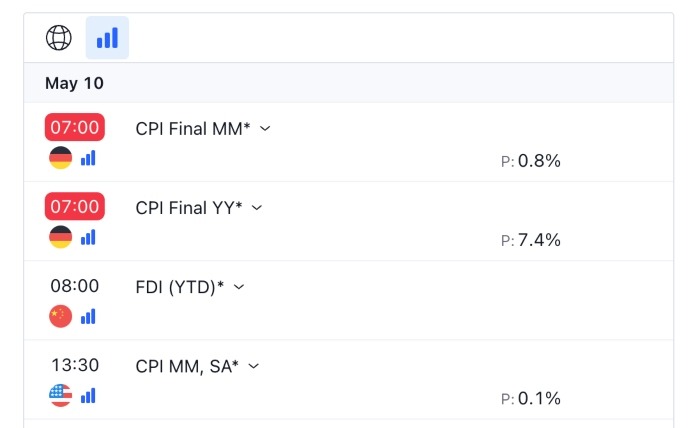

The best feature is the integrated charts hosted by TradingView, providing a wealth of functions including 12 timeframes, seven chart types, 50+ technical indicators, and 10+ pattern drawing tools. Other useful tools include:

- Watchlist creation

- Custom price alerts

- Fully customisable interface

- Drag & drop risk parameters

- Integrated economic calendar

How To Place A Trade

We found it simple to place a new trade on Spread Co’s platform.

- Choose an instrument to trade from the ‘Market Browser’ window, watchlist, or search bar

- Single-click on the symbol and choose ‘Trade’ from the menu list

- Choose ‘Buy’ or ‘Sell’ in the new window pop out

- Use the toggles to add a stake and choose the order type (fill or kill, or force position)

- Add a risk parameter and set the level (optional)

- Select ‘Confirm’ to open the position

Extra Features

We were satisfied with the amount of market information and educational content offered by Spread Co. The brand provides plenty of user guides/manuals suitable for beginners and experienced traders, including details of how to get started with CFDs or spread betting, plus strategy guides and tips on how to implement technical indicators.

We did, however, feel the text-heavy content could be improved by the addition of alternatives such as webinars, videos or podcasts, which are provided by several of the larger online brokers. Even the ‘Platform Tours’ were not interactive, with screenshots only.

We were pleased to see that traders benefit from market news and a TradingView economic calendar. However, we felt it is a shame the news articles were not supported with further analyst insights or time stamps, and there are no advanced trading tools or services such as a VPS or copy trading.

Demo Account

Our experts found that Spread Co offers a free demo account allowing prospective investors to practise trading on a spread betting or CFD account with a GBP base currency, £25,000 in virtual funds and access to live pricing conditions.

With that said, it is a drawback that access is limited to two weeks, with demo trading working only on a narrow range of markets. Simulator accounts are useful tools to practise trading anytime and test new strategies, so we prefer brokers that provide continuous access to them.

To sign up:

- Select the ‘Demo’ icon from the top right of the broker’s website

- Choose an account type and base currency from the list

- Complete the personal details section below including name, email, phone number, and country of residency

- Agree to the T&Cs and confirm the captcha requirements

- Select ‘Apply’

- Login credentials will be displayed on the following screen and sent to your registered email address

- Select ‘Log In Now’

- Sign in with your credentials and change your password

Customer Service

We were glad to see the Spread Co trading team is available from Sunday 10 PM to Friday 10 PM (GMT) and contactable via email or telephone, though the customer service department is available for more general enquiries only during standard office hours, Monday to Friday 8 AM to 6 PM (GMT).

Other contact methods include WhatsApp and live chat. We tested the service and received a response instantly which is reassuring. You can also use the broker’s FAQ section to source help.

- Live Chat – Via the ‘Contact’ webpage

- Client Services Email – cs@spreadco.com

- Trading Team Email – info@spreadco.com

- Trading Team Phone Number – +44(0)1923832609

- Client Services Phone Number – +44(0)1923832682

Company Background

We found Spread Co’s company details easily, and the company, established in 2006, has a long track record behind it.

The broker offers CFD trading and spread betting opportunities, operating from a headquarters in London, UK.

Spread Co is authorised and regulated by the Financial Conduct Authority (FCA).

Opening Hours

The Spread Co platform is open between 10 PM Sunday to 10 PM Friday (GMT). Within this, trading hours will vary between instruments. This includes the FTSE 100 index available to trade between 8 AM and 4:30 PM (GMT). The forex market, on the other hand, is available for trading 24/5, though associated with four market sessions.

Should You Trade With Spread Co?

We liked Spread Co’s fixed spread pricing model, especially for spread betting, but we didn’t feel that Spread Co offers anything special in terms of additional features and trading tools and the services are fairly basic.

Although Mini Market trading is an intriguing offering, we would not rate the brand as the best choice for beginners, though it may appeal to traders who have a special interest in spread betting.

FAQ

Does Spread Co Offer Tight Spreads?

Spread Co uses a competitive fixed spread pricing model, allowing traders to speculate on the FTSE 100 index with spreads as low as 0.8 points. Commission fees are applied to stocks only, however, these are as low as 0.05% when trading UK equities.

Is Spread Co Legit Or A Scam?

Spread Co is authorised and regulated by the Financial Conduct Authority (FCA), registration number 446677. Overall, we are comfortable that the firm is legitimate and trustworthy.

Is Spread Co A Good Broker For Beginners?

Spread Co offers a demo account, though the educational content is disappointing. There is also no copy trading service, which is a letdown since this is an attractive feature for those new to online trading.

Consider utilising the brand’s Mini Markets solution when starting out, with minimum stake sizes from just 10p.

Does Spread Co Offer A Choice Of Trading Platforms?

No, Spread Co offers a proprietary terminal only, available as a WebTrader or as an iOS and Android-compatible mobile app. We were disappointed to find no MetaTrader 4 or MetaTrader 5 platform options. On the positive side, charting is hosted by TradingView.

Does Spread Co Provide Good Market Access?

We were satisfied with the Spread Co product lineup, with 1000+ assets from several asset classes including stocks, indices, commodities, and forex. You can trade the FSTE 100 index, leading UK company shares, and major forex pairs including GBP crosses.

Article Sources

Top 3 Spread Co Alternatives

These brokers are the most similar to Spread Co:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Admiral Markets - Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

Spread Co Feature Comparison

| Spread Co | IG Index | Swissquote | Admiral Markets | |

|---|---|---|---|---|

| Rating | - | 4.7 | 4 | 3.6 |

| Markets | Spread betting, CFDs, forex, indices, shares, commodities, ETFs, ADRs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting |

| Minimum Deposit | £200 | $0 | $1,000 | $100 |

| Minimum Trade | £0.10 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4 | MT4, MT5 | MT4, MT5 |

| Leverage | 1:20 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (EU), 1:500 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Spread Co Review |

IG Index Review |

Swissquote Review |

Admiral Markets Review |

Trading Instruments Comparison

| Spread Co | IG Index | Swissquote | Admiral Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Spread Co vs Other Brokers

Compare Spread Co with any other broker by selecting the other broker below.

Popular Spread Co comparisons: