Spot Trading

Spot trading is the purchase and sale of an asset at the present market rate for instant delivery on a set date. This guide will cover what spot trading and spot markets are, simple definitions of the underlying concepts, plus how they compare to futures strategies. See our list of the best spot trading brokers to get started:

Top Spot Trading Brokers UK

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

-

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Eightcap is an award-winning, FCA-regulated broker offering industry-low trading fees. They are also the highest-rated brand by TradingView’s 100 million-strong users, who can trade directly on the platform. UK traders can sign up for a live account with an accessible £100 minimum deposit.

-

Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

-

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

-

eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

-

Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

-

BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

-

Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

-

Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

Established in 2017, Pocket Option is a binary options broker offering high/low contracts on forex, stocks, indices, commodities and cryptocurrencies. With over 100,000 active users and a global reach, the platform continues to prove popular with budding traders.

-

GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

-

Founded in 2008, NordFX is an offshore CFD broker offering forex, stock, commodities, indices and crypto trading to over 1.7 million clients in 190 countries. Traders access markets through the MT4 and MT5 platforms and benefit from low commissions, spreads from zero and decent extra features. Minimum deposits start from just $10 and very high leverage is available up to 1:1000.

-

BitMEX is a crypto exchange and derivatives trading platform, launched in 2014. The firm offers a fiat–crypto onramp, spot trading, and crypto derivatives including perpetual contracts, traditional futures and quanto futures. BitMEX offers amongst the largest market liquidity of any cryptocurrency exchange.

-

Markets.com is a respected broker, offering multi-asset trading opportunities through CFDs or spread betting (UK only). Established in 2008, the brand has an impressive 4.3 million registered customers and is overseen by trusted regulators, including the FCA, ASIC and CySEC. 79.1% of retail accounts lose money.

-

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

-

NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

-

EagleFX is an ECN/STP broker that offers spot forex and CFD trading on a small collection of 170+ assets to active traders worldwide. The catch is that it’s registered in the weakly regulated jurisdiction of the Commonwealth of Dominica, providing limited safeguards.

-

Founded in 2015, VT Markets maintains its position as a top Australian multi-asset CFD broker. With 1000+ tradeable instruments and support for the MetaTrader 4 and MetaTrader 5 platforms, this broker delivers a wide range of trading opportunities to over 200,000 clients worldwide. VT Markets is regulated by the ASIC, FSCA, and FSC.

-

OKX is a respected cryptocurrency firm, established in 2017, that offers a large suite of products, from mining pools to NFTs. Traders can access over 400 crypto tokens via OTC trading and derivatives. With an excellent web platform, developer tools and dynamic charts, OKX is a popular choice for technical traders.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

Webull is a multi-regulated trading app that offers stocks, options, forex, cryptos, ETFs, fractional shares and more. The firm is authorized by the SEC, FINRA and FCA and continues to uphold a strong trust rating. Low fees, no minimum investment and generous welcome bonuses have made the discount broker popular with online investors.

-

Trade.com is a trustworthy online broker with a global presence. The broker offers 2,100+ CFDs in major markets, as well as futures, options and more. The broker offers best-in-class platforms and superior analysis tools for experienced traders. The broker is also regulated by top-tier authorities including the FCA and CySEC.

-

Amega is an offshore STP broker offering CFD trading fon forex, stocks, indices and commodities with very high leverage up to 1:1000 and a zero-commission pricing structure. Traders access markets through the MT5 platform and can test the broker's services through a demo account.

-

Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

-

Grand Capital is a MetaTrader broker with welcome bonuses, trading competitions and an intuitive copy trading service. Several account types and 400+ assets provide trading opportunities for various types of investors and strategies. New users can also open an account and start trading in a matter of minutes.

-

IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

-

Ingot Brokers is a multi-regulated brokerage established in 2006. The broker offers CFD trading opportunities on 1000+ instruments including forex, stocks, indices, commodities and cryptocurrencies. The broker supports the MetaTrader 4 and MetaTrader 5 platforms and offers both raw spreads and commission-free account options.

-

Uphold is a digital asset platform offering a range of services, from crypto trading and staking to payment cards that provides rewards and easy multi-currency payments. The company was established in 2015 and has enabled $4+ billion in transactions. Uphold is now active in 180+ countries and deals in 200+ crypto and fiat currencies.

-

Scope Markets offers trading and investing in multiple spot and CFD instruments. The group of brokers is regulated in several locations, including Belize, Kenya and South Africa. Users get competitive trading conditions, a range of payment methods, strong support and can get started in a few straightforward steps.

-

xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

-

RaceOption is a binary options broker operating from the Marshall Islands. With over 1,500 clients, the broker aims to offer fast funding, low fees and a secure trading environment. Traders can access over 100 binary options and CFDs, plus copy trading and weekly prizes.

-

Revolut has emerged as the most downloaded financial app in 11 countries with over 45 million users and more than $23 billion held in customer balances. It facilitates commission-free trading on over 2000 stocks and commodities, alongside 185 cryptos with a minimum investment of just $1. The mobile trading experience remains market-leading for casual investors seeking low, transparent fees.

-

TMGM is an ASIC-regulated forex and CFD broker with a vast range of tradeable assets covering forex, stock, index, crypto and commodity markets. The account types on offer provide a flexible choice between no commission or zero spreads, with competitive pricing all-round.

-

Switch Markets is a multi-asset CFD brokerage, regulated by ASIC and SVGFSA. The new brand offers trading on the MT4 and MT5 platforms and leverage up to 1:500. The broker boasts over 2000+ instruments, with some additional tools including copy trading services and free VPS hosting.

-

Nexo is a centralized crypto exchange founded in 2018 in Bulgaria and today operates across some 200 jurisdictions from its base in Switzerland. It provides services including spot trading, futures trading, peer-to-peer loans, cold wallet storage and fiat-on ramps to buy crypto tokens. The crypto firm is registered with some respected financial authorities, such as the ASIC, and offers some fairly unique additional services including a credit card.

-

AdroFx is an offshore ECN/STP broker that has offered CFD trading since 2018. The firm supports 100+ tradable assets on the popular MetaTrader 4 platform as well as a web trader, Allpips. Eight live accounts are available with no restrictions on trading strategies.

-

Established in 2012, Hong Kong-based Bitfinex is a formidable player in the crypto industry. It boasts a powerful proprietary platform, 180 cryptocurrencies and more than 430 market pairs available for spot or perpetual swaps derivatives trading. With new payment methods, lower entry barriers and fresh products like crypto futures, Bitfinex is attracting a wider range of active crypto traders.

-

Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

-

MultiBank FX is an established broker offering forex and CFD products since 2005. With 20,000+ instruments, plenty of local payment methods and 24/7 multilingual customer support, the broker is a popular choice among traders globally. New clients can also access a variety of bonus offers and access the hugely popular MT4 and MT5 trading platforms.

-

Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

-

Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

-

HYCM is an online broker with authorization from four international bodies including the FCA and CySEC. The broker offers short-term CFD trading on forex, shares, commodities, indices, ETFs and Bitcoin, and supports the MT4 and MT5 platforms, as well as Trading Central analysis.

-

Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

-

Hantec Markets was established in Hong Kong in 1990. Initially, the company concentrated solely on the Chinese and Taiwanese markets. In 2008, the broker rebranded and expanded its presence in the UK, Australia, Japan, and various other countries, before enhancing its footprint in Latin America in 2022. Hantec now stands as a multinational brokerage with 18 offices across Europe and Asia.

-

OANDA is an award-winning global broker, established in 1996. The hugely respected brand offers competitive trading accounts and serves clients from 196 countries. It remains a popular option with both beginners and experienced traders thanks to its user-friendly and sophisticated web platform, no minimum deposit and premium currency products and services. The company is also overseen by reputable regulators, including the FCA, ASIC and CIRO.

-

Saxo Markets is a multi-award-winning trading brokerage, investment firm and regulated bank. With a huge 72,000+ trading instruments, plus investment products and managed portfolios, clients have no shortage of opportunities. The trusted brand also offers transparent pricing and top-tier regulatory protection from 10+ agencies including FINMA, FCA & ASIC.

-

Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining.

-

Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators.

-

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme.

-

BinaryCent is an unregulated binary options broker that offers 24/7 trading on forex, cryptos and stocks with payouts up to 95%. Despite its lack of regulation, this broker takes client security seriously and stores client funds in European banks. The broker also offers CFDs with very high leverage up to 1:500.

-

World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

-

FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

-

Binance is one of the best-known crypto exchanges. The company is available in more than 180 countries with over 120 million registered customers. The platform offers a suite of crypto trading products, from staking and NFTs to derivatives.

-

FXCentrum is an offshore broker that offers highly leveraged, commission-free trading on diverse instruments with tight spreads. Traders can access forex, equity and commodities markets via MetaTrader 5 or the proprietary FXC platform and use the award-winning ZuluTrade platform for copy trading.

-

Vault Markets is an award-winning brokerage headquartered in Namibia. It is an accessible direct-market-access CFD broker with affordable minimum deposits, flexible funding methods and high leverage. This broker offers a very large range of forex pairs as well as commodities and indices through MetaTrader 4 or MetaTrader 5.

-

Exinity provides flexible low-cost trading in FX, commodities, indices and equities alongside unique education and support provided by teams located across the world. Now operating in the Middle East, through regulation from the Financial Services Regulatory Authority in Abu Dhabi and the Financial Services Commission of Mauritius, Exinity provides a range of services to traders and investors looking for new opportunities in the financial markets.

-

FXTM is a forex and CFD broker established in 2011 and operating across four continents. The company is secure and regulated by leading authorities, including the FCA. Offering 1,000+ markets and three account types, they cater to all levels of trader.

-

Capital.com offer CFDs on a range of markets with competitive spreads and zero commissions. The broker also offers the Investmate app, negative balance protection and leveraged trading.

-

LegacyFX is a multi-asset broker offering an MT5 download & free signals.

What Is Spot Trading?

Spot trading is the buying and selling of financial instruments at the current market rate, which is also known as the spot price. This style of investing has instant delivery of the asset, making it a popular form of trading for short-term speculators like day traders. This is because the nature of the product means there is no expiry date and spreads are typically low.

Trading on the spot market, also known as the cash market, can be done directly with popular assets like stocks, forex and indices, alongside derivatives like CFDs and spread betting. With these derivatives, you do not need to own or deliver the underlying assets, instead deriving profits directly from movements in their values.

IG Index, for example, provides UK traders with the choice to spot trade both the underlying asset as well as CFDs and spread bets.

What Is The Spot Market?

The spot market is a financial marketplace where investors and speculators carry out spot trading, whether on equities or derivatives. It is a publicly available market that allows for instantaneous trading of assets and products between buyers and sellers. The underlying assets of these trades are usually transferred immediately, resulting in it being called trading “on the spot”.

While the two parties agree for instant delivery, the UK standard settlement periods still apply; for example, this is a T+2 settlement period for equities.

Many of the world’s most popular exchanges are spot markets, including:

Spot Price Explained

The spot price is the current price of the financial asset. It is at this price that traders can immediately buy or sell the instrument in question.

The spot price is created by buyers and sellers posting their buy and sell orders to a broker/exchange. Every time an order gets filled, the spot price adjusts according to the next order. Therefore, very liquid spot trading markets can see their spot prices changing many times each second, while more illiquid markets could have substantial periods of inactivity.

Spot Trading Vs Futures Trading

Spot trading is often contrasted with futures. This is because spot positions are traded at the spot price for instant delivery (or the earliest possible delivery). Futures, on the other hand, agree on a price at the present but deliver the payment and underlying assets at a chosen later date. This means that you set a target price that determines the success of the position, while spot positions are successful simply by rising above (or below) the spot price.

While this may appear to make spot trading the superior approach, the associated fees over long periods can bring its potential profitability below futures over the long term.

Comparing Spot Trading Brokers

When it comes to spot trading, choosing the best broker is key to optimising your experience. Brokers offer different features, restrictions, benefits and disadvantages. Some allow for speculating upon direct equity assets while others are focused on CFD trading. Some may offer access to exotic stock exchanges or cryptocurrency derivatives that others do not, meaning you can access a greater range of investment opportunities.

Key areas to compare spot trading brokers include:

Assets

Online brokers have access to different exchanges and asset ranges. Most UK spot trading firms will have access to the London Stock Exchange but some may also grant access to foreign exchanges like the NYSE or TYO. Furthermore, some firms may offer the underlying assets directly from these exchanges, while others may trade CFDs or spread bets based on those assets.

The type of assets you want to speculate upon and the exchanges that sell these products will help narrow down which brokers you should choose from.

Trading Platforms

The trading platform is where you will spend your time placing orders and performing technical analysis. As such, it is one of the most important things to consider when choosing a spot trading broker.

Some platforms, such as MetaTrader 4 and MetaTrader 5, are designed to provide sophisticated and powerful tools to retail investors, allowing for complex technical analysis and the creation of automated trading bots.

Other spot trading brokers offer bespoke platforms, which are usually designed with ease of use and intuitive navigation in mind, making them more accessible to newer traders.

Fee Structure

Securing spot trading profits involves maximising returns and minimising costs. As such, you will want to find a brokerage that offers all of the features you need at the lowest cost possible.

How fees are designed varies between spot trading brokers. Some will have incredibly tight or even raw spreads but may also place a commission on opening/closing trade. Others may have wider spreads but with the benefit of zero commission. Moreover, some brokers charge deposit or withdrawal fees, while others may follow a freemium model, giving access to more features with monthly payments.

Muslim traders should check for specialised Islamic accounts offered by most major CFD brokers. These halal accounts forgo overnight swap rates, which can be debited or credited.

Regulation

Regulated brokers are much safer to trade with, especially if regulated by a top financial regulator, such as the UK’s FCA. Such firms will have better investor protection measures in place, such as negative balance protection and investor compensation insurance.

Unregulated brokers may entice traders with welcome bonuses and high leverage opportunities but bring additional risks.

Education & Research

Newer or less experienced traders may want to find a broker that offers competitive educational resources. Many top spot trading firms offer educational facilities on their platforms, websites or social media accounts. These typically include guides on how to trade on their platforms, glossaries of key terms, webinars or seminars on spot trading principles, strategy guides and more.

Research is another important factor to consider. Brokerage firms that offer insightful research resources will help in your understanding of the current financial landscape and an asset’s recent price movement, allowing you to make more informed investing decisions.

Spot trading brokers typically provide research through news articles, earnings reports, trading analyses, signals, financial analyses and analytical tools.

Advantages Of Spot Trading

- Real-time pricing

- Immediate delivery

- Simple to understand

- Typically high liquidity

- Lower minimum volumes

- Equities & derivatives supported

Disadvantages Of Spot Trading

- Physical delivery may be difficult

- Short positions only available with derivatives

How To Start Spot Trading

Spot trading is a straightforward approach to financial speculation and is popular because of this. It is simple to get started with this investing style as the concepts involved are more intuitive than some alternatives. Follow our step-by-step guide below to begin spot trading today.

- Choose A Broker: Picking the right broker is important in ensuring your online spot trading experience is efficient and relatively secure. Above, we go through how to best compare spot trading brokers for your needs.

- Set Up An Account: Registration processes vary but most require you to fill out personal details like your name, country of residence, nationality, phone number and email address. You may also have to complete a KYC section, typically providing some proof of identification.

- (Optional) Open A Demo Account: This will let you practise spot trading on the broker’s platform using virtual funds. Using this, you can get accustomed to the platform and try implementing your investing strategy without risking real capital.

- Deposit Funds: This can usually be done by going into your broker’s account portal and finding the Deposit tab. Here, you will need to choose your deposit method (e.g. debit/credit card, bank transfer, Neteller). Follow the steps and guide and provide the required details, including the amount you want to deposit.

- Choose An Asset: Which asset you choose to speculate upon will depend on what you know and how much you want to research. The more you understand about an asset, the more informed your decisions will be. Even if you are looking to invest purely through technical analysis, understanding the background market of the asset in question will give you an advantage when developing your indicators and signals.

- Place A Trade: Once you have decided upon an asset for spot trading, wait for the right time and then buy the asset. When it is time, go to the asset’s page or price chart and click the Buy asset button. Here, you will be able to choose the parameters of the order, including volume, order type and a stop loss limit. Once you are happy with the details of your order, confirm the transaction.

- Close Your Position: Spot trades have no expiry date, so the asset can be held for as long as you want. Following your strategy, you will reach a point when it is time to sell the asset and realise your returns.

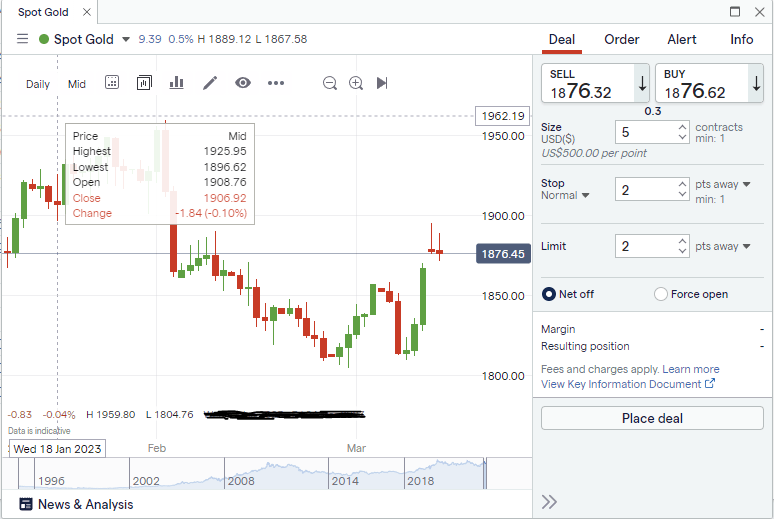

Spot Trading Order Screen – IG

Should You Start Spot Trading?

Spot trading is one of the most popular forms of investing as it is available for most financial assets and allows for immediate delivery of assets, funds and results. Most of the world’s leading exchanges, such as the LSE and NYSE, are spot exchanges. As such, understanding spot markets is key in the realm of online retail investing.

Use our ranking of the best spot trading brokers to start trading.

FAQ

What Is Spot Trading?

Spot trading is the act of buying/selling a financial instrument for instant delivery on the spot date at the spot price. This often involves the physical delivery of the asset in question, although derivative spot contracts may not require this.

What Assets Can You Spot Trade?

Spot trading is buying or selling an asset for its current price at an agreed time. As such, most financial instruments can be speculated upon in this way, including shares, commodities, forex, cryptocurrencies, indices, ETFs and even interest-rate products like bonds.

Is Spot Trading Halal?

Spot trading is arguably halal as it is simply buying or selling an asset instantly at any point in time. When you place the order, the asset or funds can be delivered immediately. However, some derivative products have associated overnight swaps for longer-term positions and these can be taken from or credited to your account, potentially making them haram. This can be avoided by opening a specialised Islamic account, which most major UK brokers offer.

Is Spot Trading Available To British Traders?

The London Stock Exchange is one of the world’s most important stock exchanges and it is a spot exchange, allowing for the instant purchase or sale of LSE equities. As such, many UK brokers will offer spot trading on the LSE, if not on foreign exchanges as well. Any broker that allows you to instantly buy or sell an investment product is a spot trading broker.

What Is The Best Spot Trading Broker In The UK?

There is no “best” broker for every type of trader. Firms will offer access to different exchanges and assets, trading platforms, fee structures, deposit and withdrawal methods, educational and research resources and trading conditions. Investors will then need to find the broker that suits their preferences and goals to find the best brokerage for them. Alternatively, choose from our list of top-rated spot trading brokers.