SolidusX Review 2025

See the top 3 alternatives to SolidusX or the best UK brokers list for options.

|

|

SolidusX is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to SolidusX |

| SolidusX Facts & Figures |

|---|

SolidusX offers thousands of assets with proprietary trading tools and high leverage. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, ETFs, Cryptos, Commodities |

| Demo Account | No |

| Min. Deposit | $500 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SVGFSA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| CFDs | Use leveraged CFDs to speculate on popular assets with floating spreads. |

| Leverage | 1:200 |

| FTSE Spread | Variable |

| GBPUSD Spread | Variable |

| Oil Spread | Variable |

| Stocks Spread | Variable |

| Forex | Trade major and minor currency pairs with low fees. |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Assets | 35+ |

| Stocks | Trade over 1200 stocks from a selection of major exchanges. |

| Cryptocurrency | Trade crypto cross pairs and digital currencies against the USD. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

SolidusX is a UK affiliated broker with an extensive instrument list, a proprietary trading platform and a mobile app. This brokerage offers a good choice of account types to suit the needs of traders with different strategies but our experts have concerns. Our review will cover how to register for a SolidusX trading account. We also provide our opinion on the brand’s regulatory status, accepted payment methods, security features, and more.

Our Take

- The broker provides good market access with 5000+ instruments available

- Trading takes place via a proprietary platform only with no MT4 or other third-party options

- SolidusX’s pricing is not transparent, with limited information on spreads or commission charges

- The broker also has inconsistencies regarding regulation and awards with unverified claims made in its marketing

Market Access

SolidusX offers 5000+ instruments across six major asset classes. This is a standout feature of the broker with a wide range of opportunities, especially in terms of stocks. UK traders will also appreciate access to the FTSE.

- Indices – Popular indices including FTSE 100, NASDAQ 100, and DAX 30

- Stocks – 1000+ company shares including Apple, Tesla, Boeing, and Meta

- Commodities – Precious metals and energies including Gold, Silver, and UK Brent Oil

- Forex – Major, minor, and exotic currency pairs such as GBP/USD, USD/JPY, and AUD/CAD

- Cryptocurrency – Popular digital currency coins such as Bitcoin, Litecoin, Ethereum, and Cardano

- ETFs – Popular global exchange-traded funds including SPDR S&P 500 ETF TRUST, Invesco DWA Technology Momentum ETF, and AdvisorShares Pure Cannabis ETF

SolidusX Fees

We were disappointed with the lack of pricing transparency. No information is provided on spreads and commissions by account type – instead, the broker states that the Tyro profile offers ‘variable spreads’ and ‘low commission fees’ but does not provide any additional information on the average spreads or per-lot fee. This is a serious red flag – reputable brokers are upfront about trading costs.

Swap fees apply on positions held overnight but there are no account funding charges.

Accounts

SolidusX offers five live account types with different pricing models and minimum investment amounts. Again, it is a shame the broker does not provide transparent pricing details per profile.

On a more positive note, all account types benefit from instant order execution and GBP/EUR/USD base currency options. An ‘Elite Club’ is also offered, but this is for retail investors with a high balance requirement of $500,000+ which will be out of reach for most traders.

Our review found very small differences between the highest tier accounts, except for improved pricing conditions. There are no major stand-outs aside from this which is disappointing, particularly given the step-up in initial deposit amounts.

We have highlighted the key account conditions below.

Tyro

- Variable spreads

- No leverage access

- Restricted asset list

- Low commission fees

- £500 minimum deposit

- Financial market newsletter

Optio

- Small asset list

- Tighter spreads

- £2500 minimum deposit

- Entry-level leverage access

- Improved commission fees

- Financial market newsletter

- Devoted investment professional

- Unrestricted access to education and webinars

- Access to trading signals and live news streams

Primus

Access to the above plus:

- Market-grade spreads

- Access to industry events

- Increased leverage access

- Access to the full asset list

- £25,000 minimum deposit

- Devoted investment professional

- Personalised commission fees available

Centurion

Access to the above plus:

- No commission fees

- Institutional spreads

- Increased leverage access

- £100,000 minimum deposit

Legatus

Access to the above plus:

- Loyalty package

- Priority transactions

- £250,000 minimum deposit

- Access to the maximum leverage limit by instrument

How To Sign Up To A SolidusX Account

It only took me a few minutes to sign up for an account which compares well with alternatives. To register:

- Select the ‘Sign Up’ icon on the broker’s homepage

- Add your email address, create a password, and input your mobile number on the following screen

- Choose an account base currency (GBP, EUR, or USD)

- Select ‘Sign Up’

- Add the six-digit verification code sent to your registered email address

- Input your name, date of birth, and country of residency on the following page

- Select ‘Start Trading’

Funding Methods

SolidusX accepts only cryptocurrency or bank wire transfers and credit/debit cards, and with no e-wallets such as PayPal or Skrill, this is fairly limiting for traders.

We were pleased, however, to see that the brand does not impose any funding charges, though third-party fees may apply. Processing times will vary by method. We found the brand recommends notifying them of an initiated payment via email or live chat to ensure the fastest transaction times.

Importantly, the minimum deposit requirement is high, even for the ‘beginner’ account from $500. The Legatus profile has the highest initial payment at an eye-watering $250,000. This is disappointing since many leading brands in the UK like Pepperstone and CMC Markets let you open an account for free.

When we tested SolidusX, our experts found that withdrawals can be made to a linked bank account or a cryptocurrency wallet. Bank wire transfer withdrawals are slow, with funds available within four working days. Withdrawals to a crypto wallet are much faster, with average an processing speed of 30 minutes.

How To Make A Payment

- Login to the SolidusX dashboard

- Choose ‘Deposit’ from the side menu

- Select a payment method from the top (crypto, wire transfer, or card) – in this instance, we chose a bank wire transfer

- Input the amount to fund and add your banking institution name and location

- Select ‘Submit Request’

- Payment details will be sent to your registered email address

- Follow the directions in the email to complete the payment

Trading Platforms

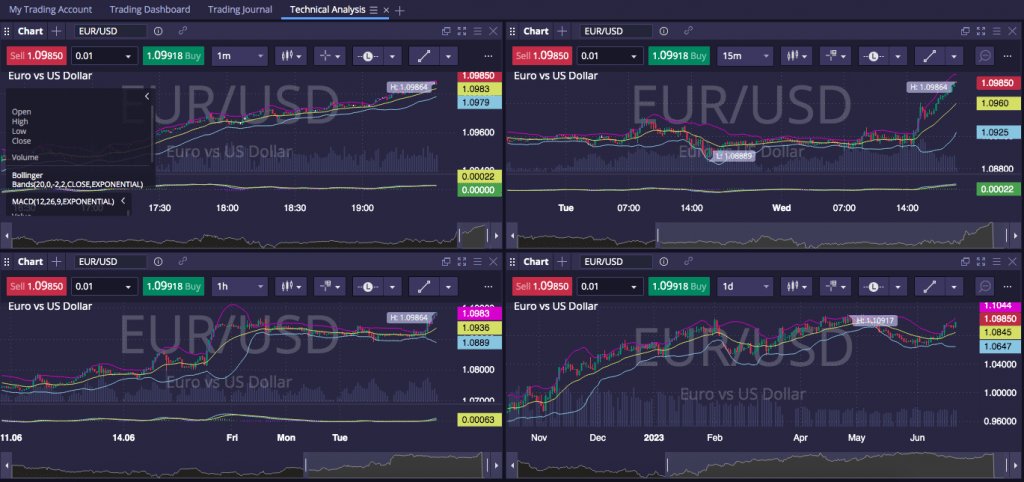

SolidusX offers a proprietary trading terminal only, which will put off many traders who favour third-party platforms such as MetaTrader 4 or cTrader. The platform is web-based only, with no desktop download option. You can access several order types and risk management parameters including limit, market, stop, and OCO orders.

At first glance, we thought the platform seemed a little overwhelming. The platform is jam-packed with features, including algorithmic analysis with real-time data feeds and market insights. Similar to the industry-renowned MetaTrader terminals, the bespoke platform offers extensive charting options with multiple views and drawing tools for technical analysis.

You can access live news streams, a detailed trade history performance dashboard, and journaling for trade objective notes. Downloadable reports include monthly performance statements and trade confirmations, and charts can be synced with customisable watchlists.

Although we thought at first the platform was overly busy, after getting to grips with it we really liked the scope it offers for personalisation. You can create multiple different workspaces with layout tailoring and drag-and-drop functionality. You can also save templates and re-boot them every time you want to trade a new asset class.

SolidusX Multiple Workspaces

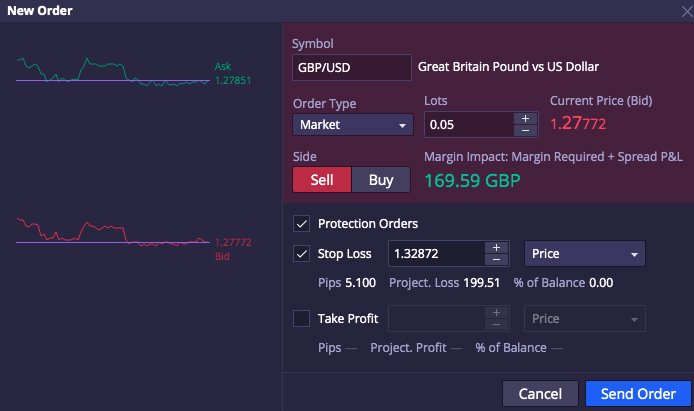

How To Make A Trade

Although the terminal seems quite complex at first, we found it straightforward to open a new position:

- Double-click on an instrument from the favourites menu to update the chart view

- Click on either the ‘Buy’ or ‘Sell’ icons above the chart to open the new order screen

- Choose the order type from the dropdown menu (market, limit, stop, or OCO)

- Add the trading volume using the ‘+’ and ‘-‘ toggles

- Choose trade size (buy or sell)

- Tick the ‘Protection Orders’ box to add a stop loss or take profit value

- Review order details and choose ‘Send Order’ to complete the transaction

Mobile App

SolidusX launched its bespoke terminal with iOS and Android (APK) mobile app compatibility in 2022. You can trade all instruments and utilise instant order execution types, as well as add up to five technical indicators per chart for in-depth price analysis, choosing from a catalogue of 35+ in-built tools.

Importantly, we would recommend implementing two-factor authentication to protect your account whilst on the go.

Leverage

SolidusX offers leverage up to 1:200, which is higher than FCA-regulated brokers that can offer up to 1:30.

We did find margin restricted by account type, and we think this will be another limiting factor for many traders – there is no access to leverage at all on the Tyro profile, for instance.

If you do choose to trade with leverage, we always recommend having risk management parameters in place to protect against potential losses.

Demo Account

Our experts were dissatisfied that SolidusX does not offer a demo account. This is a major disadvantage vs alternative brands, especially as it is a standard service offered by the majority of top brokers.

It is even more of a drawback as SolidusX uses bespoke software, meaning prospective clients have no way to test the suitability of the terminal before risking funds.

Regulation

SolidusX is the trading name of Digital Genius LLC. The broker’s website mentions registration by Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). However, we searched the entity register and did not find any legitimate registration.

The broker is not registered by the FCA to provide services in the country, therefore we cannot recommend this brand as safe. You will not have access to financial safeguarding initiatives such as the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service if anything goes wrong.

This is typical of offshore brokers, which many UK traders sign up with to access higher leverage and perks like bonuses. However, we urge traders to be aware of the heightened risks if they do so.

Our experts found the broker does, however, comply with Know Your Customer and Anti Money Laundering protocols, steps to protect against fraudulent behaviours. We were also pleased to find that negative balance protection and segregated client funds are adhered to.

Security

Despite the questionable regulatory status, we were somewhat reassured by SolidusX’s security stance. The broker’s trading platform operates from a secure cloud server, with two-factor authentication (2FA) integration for additional safety protection.

We also found the broker’s website has SSL technology, with encrypted data transmissions.

Bonus Deals

While using SolidusX, we were not offered any bonus rewards, which we found surprising given the brand is regulated offshore with no restrictions preventing this.

We were, though, offered a friends and family referral programme, for existing customers to appoint new traders. Rewards are provided based on the deposit value of your referred customer.

Extra Tools & Features

SolidusX does not provide much added value to traders through its additional tools and content, which we found to be severely lacking.

An investment blog is available, with some interesting information such as tips on trading cryptocurrency and different investment styles. However, posts are outdated, and there is not a huge choice of articles.

An online ‘academy’ is set to be launching ‘soon’ though no launch dates are provided. Currently, the broker does not offer any learning materials which is disappointing, particularly for beginners.

Aside from this, we rank the brand down due to its lack of alternative features such as copy trading services. For comprehensive education and excellent additional tools, we recommend top brands like AvaTrade or IG Index.

Customer Service

SolidusX offers several contact options, including a UK-based telephone number. We were pleased to find that help is available 24/5. There is also a small self-help FAQ section, with details of how to get started and how to deposit and withdraw funds to your live account.

We tested the live chat function and received a response within two minutes, which is reasonable.

- Telephone – +(44)2081576122

- Email – support@solidusx.com

- Live Chat – Icon bottom right of the website

- Online Contact Form – Via the ‘Support’ page

Company Details & History

SolidusX is a UK-based brokerage, established in 2021. The broker executes all orders via tier 1 liquidity providers, plus has access to additional liquidity from a bespoke order matching system.

The brand is an umbrella entity of Solidus Capital, a UK-based wealth management firm. SolidusX reports having 12,000+ daily users.

SolidusX’s website says it is overseen by Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), though we could not find the company’s listing on this regulator’s register. Traders should also be aware of an FCA warning about this brand operating in the UK without authorisation.

Another inconsistency we found related to SolidusX is its claim to have won industry awards including the Best Trading Technology at the Benzinga Fintech Awards 2022 and the Best Crypto Trading Platform at the Fund Intelligence Operations and Services Awards 2021. We checked the records and could find no mention of this broker at either of these awards events.

Trading Hours

SolidusX trading hours will vary by the instrument you are investing in. For example, the crypto market is open 24/7, with no market closures for events such as public holidays.

Stocks are available to trade during the opening hours of the relevant exchanges. London Stock Exchange shares, for instance, will be available to trade between 8:00 am and 4:30 pm BST.

Should You Trade With SolidusX?

SolidusX has some good things going for it, including a good platform, an extensive instrument list, and high leverage. However, warnings from the FCA raise red flags for us. This, alongside the lack of fee transparency, inconsistent claims on its website, lack of a demo account and high minimum deposit, do not make it a contender for us.

FAQ

Is SolidusX Legit?

SolidusX is an offshore broker with a slick website and apparent regulation by the SVGFSA, but several of its claims regarding regulation and awards do not stack up with the information our experts found. To top it off, the FCA has issued a warning about this brand, so we advise traders to be careful as they will not be covered by the UK financial watchdog.

If you are looking for a reputable broker, there are some better-known and trusted brands available such as IC Markets.

Who Owns SolidusX?

SolidusX is operated by Digital Genius LLC which is registered offshore with the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). However, our experts did not find a listing under this reference, which raises serious concerns. We recommend exercising caution with this broker.

Does SolidusX Have A Low Minimum Deposit?

SolidusX minimum deposit requirements vary by account type. The lowest initial payment is £500, under the Tyro profile, which is high, particularly for beginners. You can deposit with fiat currency via wire transfer, credit/debit card, or a cryptocurrency wallet. For those with a more reasonable budget, there are plenty of alternatives.

How Long Do Withdrawals Take From A SolidusX Account?

Withdrawal times vary by payment method. Crypto wallet withdrawals are the fastest, with an average processing time of 30 minutes. Wire transfers can take up to four working days to complete. Note that some users have reported withdrawal issues and delays.

Does SolidusX Offer A Good Mobile App?

SolidusX offers a decent proprietary mobile app, with all the functionality of the desktop terminal including access to all account management functions and the option to trade all instruments. We were impressed with the fully customisable dashboard and mobile-optimised charting features. The app can be downloaded to iOS and Android (APK) devices for free.

Article Sources

Top 3 SolidusX Alternatives

These brokers are the most similar to SolidusX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

SolidusX Feature Comparison

| SolidusX | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 1.3 | 4 | 4.7 | 4.3 |

| Markets | CFDs, Forex, Stocks, ETFs, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | $500 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | SVGFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | MT4 | - |

| Leverage | 1:200 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:50 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | SolidusX Review |

Swissquote Review |

IG Index Review |

Interactive Brokers Review |

Trading Instruments Comparison

| SolidusX | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

SolidusX vs Other Brokers

Compare SolidusX with any other broker by selecting the other broker below.

Popular SolidusX comparisons: