Sky Alliance Markets Review 2025

|

|

Sky Alliance Markets is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Sky Alliance Markets |

| Sky Alliance Markets Facts & Figures |

|---|

Sky Alliance Markets is a global broker that offers leveraged trading on the MT4 platform. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Indices, Commodities, Cryptos, Futures |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Use highly leveraged derivatives to go long or short on popular global markets. |

| Leverage | 1:400 |

| FTSE Spread | From 1 Pip (Standard Account) |

| GBPUSD Spread | From 1 Pip (Standard Account) |

| Oil Spread | From 1 Pip (Standard Account) |

| Stocks Spread | NA |

| Forex | Trade popular currency pairs on the MetaTrader 4 platform. |

| GBPUSD Spread | From 1 Pip (Standard Account) |

| EURUSD Spread | From 1 Pip (Standard Account) |

| GBPEUR Spread | From 1 Pip (Standard Account) |

| Assets | 57 |

| Currency Indices |

|

| Stocks | Trade major global indices with up to 1:400 leverage. |

| Cryptocurrency | Trade crypto CFDs with 1:5 leverage. |

| Coins |

|

| Spreads | From 1 Pip (Standard Account) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Sky Alliance Markets is a no dealing desk broker offering the popular MetaTrader 4 platform. The broker is regulated by a trustworthy financial body and provides high leverage to UK traders. In this review, we will assess the assets available, trading tools, funding methods, fees, accounts, and more.

Our Take

- Sky Alliance Markets is best for those looking for the familiar MT4 experience with highly leveraged trading opportunities

- There are several free, GBP-supported deposit and withdrawal methods available to UK traders

- The broker has limited customer service options, its fees are quite high and there are no stock investment products

Market Access

Our team was disappointed by the instruments available at Sky Alliance Markets. While, like many of its competitors, the firm gives traders access to a range of CFDs, there is a notable lack of any stocks. For equity investors, we recommend a firm like IG Index.

- Forex CFDs: Over 55 currency pairs are offered, including majors, minors and exotics like GBP/USD, AUD/CAD and EUR/CNH

- Commodity CFDs: Three metal and two oil commodities are available; silver, gold and platinum; US (WTI) and UK (Brent) oil

- Futures: A single futures contract is available for the US index (USIDX)

- Index CFDs: Nine different index assets can be traded, including the FTSE 100, NASDAQ 100 and Euro Stoxx 50

- Cryptocurrency CFDs: Five crypto coins can be speculated upon: Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ripple (XRP) and Litecoin (LTC)

Overall, the range and depth of instruments is nothing out of the ordinary.

Fees

I found the fee structure offered by Sky Alliance Markets to be quite expensive for the ECN account, though its STP option is a bit more competitive.

The Standard Account and its swap-free version both provide commission-free trading, with its main fees coming from the bid-ask spreads for each asset. For example, the EUR/USD spread starts from 1.0 pip with these accounts, which is reasonable but doesn’t compete with discount brokers.

The ECN Account and its swap-free version provide lower spreads at the cost of a commission per lot traded. This fee is £2.80 per order or £5.60 per round turn. However, spreads for EUR/USD start from 0.0 pips.

The non-Islamic accounts charge swap fees for positions held overnight. We were pleased to see that Sky Alliance Markets charges no deposit or withdrawal fees. Only third-party charges will occur when depositing or withdrawing funds.

Accounts

Our team was pleased with the range of account types offered by Sky Alliance Markets. With four different accounts designed for different types and scales of investing, as well as religious beliefs: Standard, Swap-Free Standard, ECN and Swap-Free ECN.

The main differences between the regular and Islamic swap-free versions of the accounts are that overnight swap fees will not be charged, though a more limited number of tradable assets is available to Islamic traders.

We have highlighted the key features of each profile below

Standard Account

Best for beginners

- No commission

- Leverage up to 1:400

- Minimum deposit of £80

- Minimum lot size of 0.01 lots

- EUR/USD spread from 1.0 pips

- Base currencies of GBP, USD, EUR, AUD, NZD

ECN Account

Best for experienced traders

- Leverage up to 1:400

- Minimum deposit of £800

- Commission of £5.60 per lot

- Minimum lot size of 0.01 lots

- EUR/USD spread from: 0.0 pips

- Base currencies of GBP, USD, EUR, AUD, NZD

Sky Alliance Markets also offers MAM and PAMM accounts, allowing money fund managers to control the investment of your funds. Corporate and IB accounts are also available to higher-tier and influential traders.

Overall, we were pleased with the account types offered and believe that they will cover the needs of most regular retail traders.

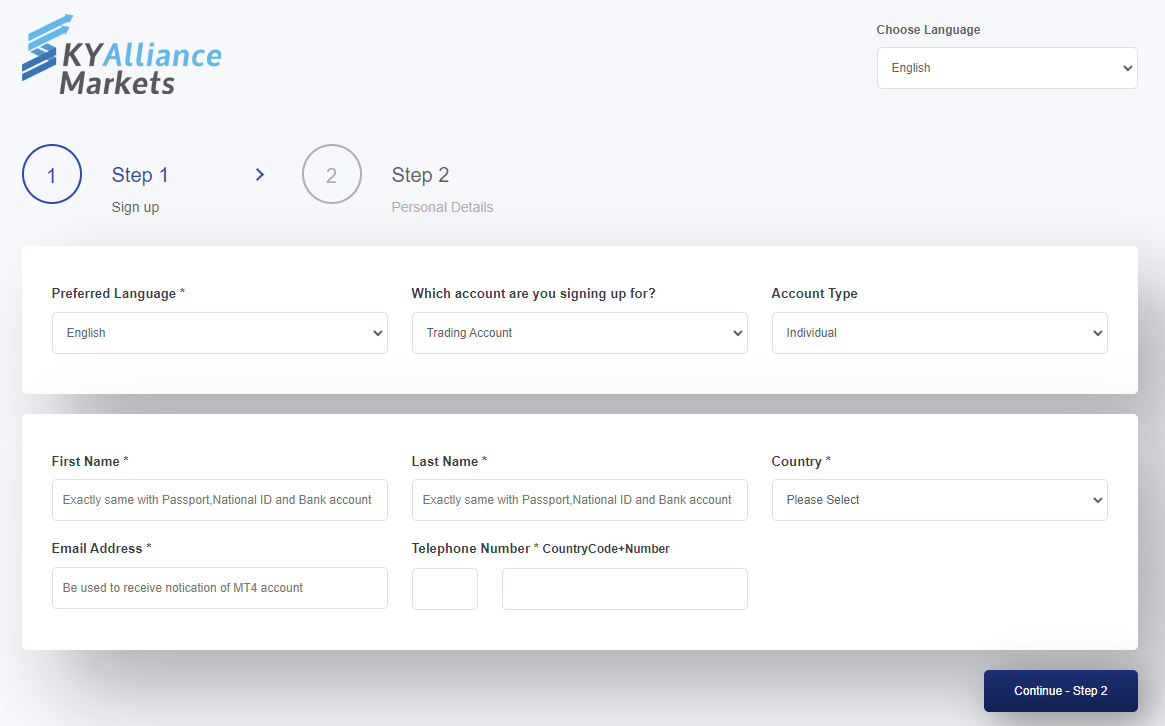

How To Open An Account With Sky Alliance Markets

The account opening process only took me a few minutes and required industry-standard details. To get started:

- Fill in the sign-up details (name, email address, country etc.)

- Click Continue

- Fill in the KYC details (including citizenship and ID details)

- Banking information will need to be provided

- Click Submit

- You will now be given an account in the Skyportal (client portal)

- You will be emailed your MetaTrader 4 account details

- Login to MT4 with the account details provided

- Deposit funds into your account from the client portal

- You can now begin investing

Funding Methods

Sky Alliance Markets’ payment methods are reasonably accessible to UK traders, with wire transfers and bank cards supporting GBP transactions. This is refreshing to see for a global broker, as some firms omit GBP support, and it is good to see zero deposit and withdrawal fees.

Deposit options for UK and GBP traders are:

- Bank Wire Transfer: GBP, USD, EUR, AUD, NZD – Processed in 2-5 business days

- Credit/Debit Card: GBP, USD, EUR, AUD, NZD – Processed in 24 hours

- Cryptocurrency: USDT, BTC – Processed in 24 hours

The most popular methods of payment, debit and credit card transfers, are available in GBP, though alternative methods like Neteller and Skrill are not, so currency conversion costs should be taken into consideration.

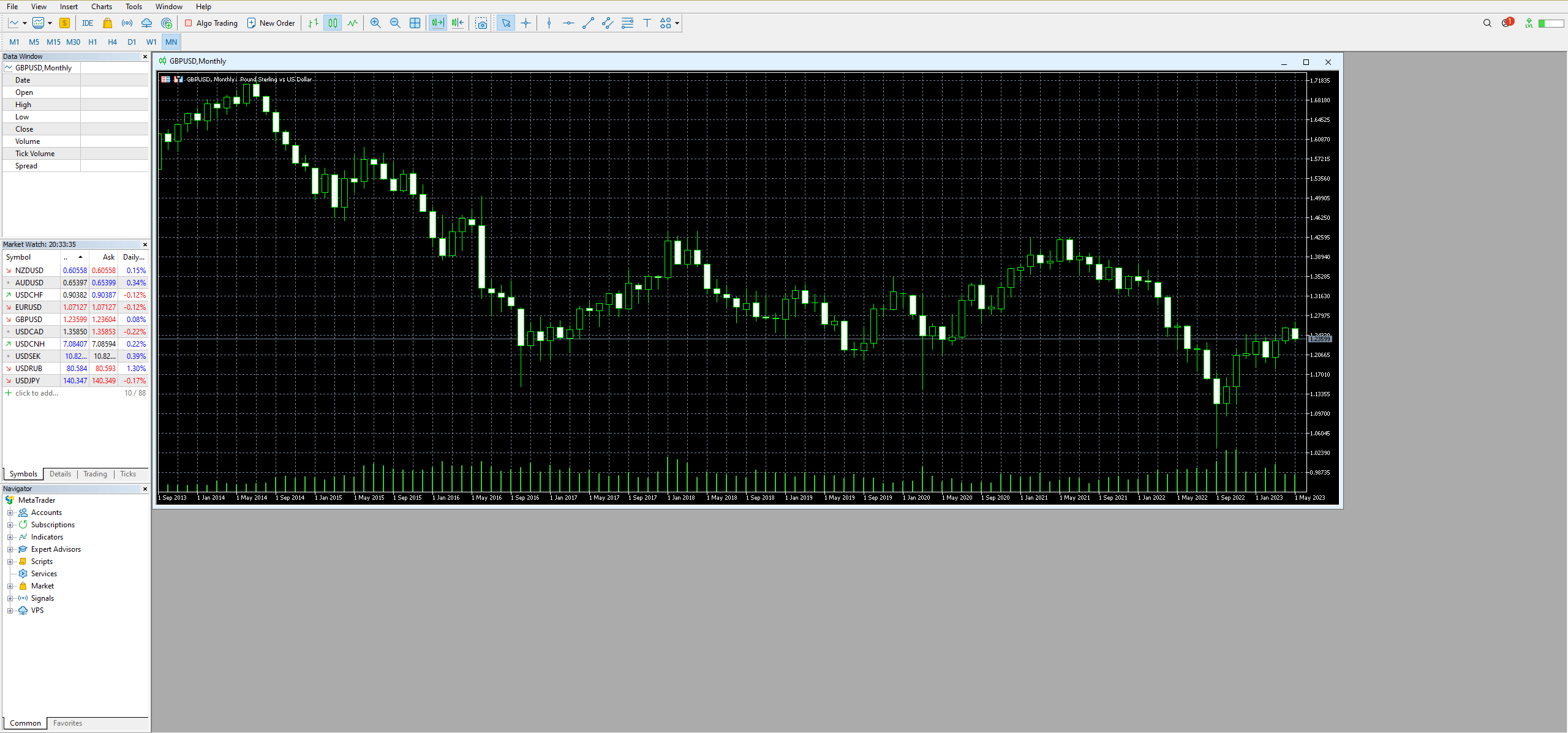

Trading Platforms

We were pleased to see that Sky Alliance Markets offers the popular MetaTrader 4 (MT4) platform. However, while it is a great platform, top CFD brokers like AvaTrade and XTB provide a selection of platforms to better suit a range of investors. For example, terminals like MetaTrader 5, TradingView or cTrader could also have been included.

Still, MT4 one of the most used online platforms, hosting a large suite of technical analysis features and graphical tools, great for new and experienced traders alike. We also rate the terminal for its versatility and potential for customisation. It also facilitates automated trading bots through its Expert Advisor function.

Among the best features of MT4 are:

- Nine timeframes

- Custom indicators

- 31 graphical objects

- Plug-in compatibility

- Four pending order types

- 30 built-in technical indicators

- Expert Advisors for algorithmic trading

- Bespoke programming language, MQL4

The MT4 platform can be downloaded on a desktop, accessed through their web trader or installed on Apple iOS and Android mobile devices. The platform is free to download from the MT4 website or on mobile device application stores.

MetaTrader 4

Mobile App

The MetaTrader 4 platform has a mobile application variant that is available on Apple iOS and Android devices. The app is free to download from the devices’ respective app stores.

It provides many of the features available on the desktop platform, including charting, technical analysis tools, graphical objects, timeframes and order placement. The application is also sleek and intuitively designed, making it easy for new traders to use.

On the downside, it does lack the customisable plug-in features and programmability of the desktop application.

MetaTrader 4 Mobile App

Leverage

Maximum leverage limits vary between asset classes, though they do not reach the levels of some of the high-leverage brokers that take advantage of their lack of FCA regulation.

The leverage rates available with the firm are given below and the stop-out level for all assets is 50%.

- Oil – 1:100

- Crypto – 1:5

- Forex – 1:400

- Metals – 1:200

- Indices – 1:100

- Futures – 1:100

Demo Account

When we used Sky Alliance Markets, we were pleased to see that it offers unlimited free demo accounts on the MetaTrader 4 platform.

Demo accounts are a great way for investors to become accustomed to the broker’s spreads, fee structure, markets and helpful extra features before opening a live account. Furthermore, they are great to test strategies before applying them to your real portfolios.

How To Open A Sky Alliance Markets Demo Account

I didn’t have any issues opening a simulator account at Sky Alliance Markets. To sign up:

- Go to the Sky Alliance Markets website

- Click the Try Demo Account button

- Fill out the signup form (make sure to specify the Demo account preference)

- Submit the form and you will be sent your details via email

- Download and install the MetaTrader 4 platform (or access the web trader/mobile app)

- Log into your account with the given details

- Begin trading

UK Regulation

Regulatory status is a key consideration when looking for a new broker and we found that Sky Alliance Markets performs quite well in this respect, though it isn’t regulated by the Financial Conduct Authority (FCA).

Sky Alliance Markets (AU) Pty Ltd (ABN: 40 114 266 698) is regulated by the Australian Securities and Investments Commission under AFSL 292464. Sky Alliance Markets Pty Ltd (ABN: 12 627 649 423) is authorised as a representative of the regulated entity and is granted the AFS Representative Number 001294747.

The ASIC is a top financial regulator, ensuring the financial practice of the broker is up to scratch and protects traders. The financial authority ensures that the broker segregates clients’ funds, periodically reports and audits its books, requires KYC procedures, discloses risks clearly and does not have conflicts of interest.

This regulation is like that of our FCA, providing traders with peace of mind that the broker is safe and legitimate. The broker is also subscribed to an indemnity insurance provider.

Sky Alliance Markets is also registered with St. Vincent & the Grenadines’ FSA under Limited Liability Company Number: 1885 LLC 2022. Unfortunately, this regulator does not robustly regulate forex brokers like Sky Alliance Markets, so traders will get limited legal protections.

Bonus Deals

Sky Alliance Markets does not offer any bonuses, promotions or financial incentives. The ASIC does not allow the use of promotions to influence risky investment decisions, so no welcome deposit bonus deals or no-deposit promotions are offered.

Extra Tools & Features

While using the broker and exploring its tools we could not help but be a bit underwhelmed. While there are some useful tools and services, the majority fall short of the level we would expect from leading brokers like Pepperstone and CMC Markets.

The broker has several features available to investors. These include PAMM and MAM accounts, copy trading, market news, an economic calendar, market insights and analytical articles.

The PAMM and MAM accounts essentially provide traders with a way to invest hands-off. They can invest their money into a pool for a money manager to control. They will invest using the pooled money and the profits will be split amongst the manager and clients.

Copy trading allows clients to copy other investors’ portfolios. Traders can invest proportionally to another’s portfolio, allowing them to make the same percentage of profits (or losses) as the chosen portfolio. Such tools have proven popular in recent years, especially with newer traders.

The market news and analytical insights provide news and analysis on current economic and financial topics. However, we noticed that these sections have not been updated since 2021. This is a major drawback vs many top brokers.

The economic calendar helps clients to keep up with planned economic activities, such as revenue report releases and central bank announcements. The market insights section covers some of the keywords and phrases used in the investing business to educate newer or inexperienced traders.

Overall, we were disappointed by the news sections being left out of date, a lack of educational resources and the generally weak presentation of data on the website. However, the inclusion of MAM/PAMM accounts and copy trading is a welcome addition.

Customer Service

We found that Sky Alliance Markets has very limited customer support. The team can only be contacted via email at the addresses below. Our experts were very disappointed in the lack of additional contact options, such as a phone number, live chat, callback request form or account manager.

- Client Email Address: client@skyallmarkets.com

- Info Email Address: info@skyallmarkets.com

Company History & Overview

Sky Alliance Markets Pty Ltd is an online CFD broker that was founded in 2005 and is based in Sydney, Australia. The broker is regulated by the ASIC, holding an Australian Financial Services License, as well as being licensed with the SVG FSA.

The broker aims to provide a secure and reliable trading experience through its popular trading platform, range of products and no-dealing-desk execution model.

Security

We were happy to see that the broker follows the protocols and standards required by the ASIC to provide a secure and reliable investing experience to its clients.

Furthermore, the MT4 platform provided is secure, with encrypted data between the user and server and two-factor authentication (2FA).

Trading Hours

Our experts found that most financial products offered by Sky Alliance Markets can be traded from Sunday 19:00 to Friday 19:00 GMT. This applies to all forex, commodities and cryptocurrencies. The futures product is available from Sunday 20:00 to Friday 19:00 GMT.

The index products all vary slightly depending on their underlying markets. The FTSE 100, for instance, is open from Sunday 20:00 to Friday 18:00 GMT.

Should You Trade With Sky Alliance?

Sky Alliance Markets offers investors a regulated avenue into trading popular assets on the MT4 platform and provides several account types to suit all types of clients, plus sufficient payment methods for UK traders.

However, the firm’s customer service and additional services are disappointing, falling far behind many of its competitors. Moreover, the company does not offer stocks and shares, which will be a deal breaker for some prospective clients.

FAQ

Is Sky Alliance Markets Good Or Bad?

UK traders can sign up and invest with Sky Alliance Markets. The broker features GBP as a base currency for its trading accounts, as well as a couple of payment methods with no GBP conversion necessary.

However, while the firm is regulated by the ASIC, an FCA licence would be better and several of the firm’s services are disappointing, including limited customer service and a noticeable lack of shares.

Which Trading Platform Does Sky Alliance Markets Offer?

Sky Alliance Markets offers the reliable MetaTrader 4 platform. This is suitable for new and experienced brokers, coming with plenty of built-in tools and customisable indicators. The platform can also be accessed on mobile devices for on-the-move investing.

Is Sky Alliance Markets Trustworthy?

Sky Alliance Markets is regulated by the ASIC, a top regulator similar to our FCA. The ASIC also enforces some strict regulatory practices to ensure brokers are secure. However, the FCA is still more stringent, providing greater regulation and additional compensation avenues for UK traders.

Is Sky Alliance Markets Good For Muslim Traders?

Both the standard and ECN accounts can be opened swap-free. These profiles are for Muslim traders with no overnight fees. On the negative side, they have a more limited pool of tradable assets.

Article Sources

Sky Alliance Markets ASIC Regulation

Sky Alliance Markets FSA Regulation – Registration Number 1885

Top 3 Sky Alliance Markets Alternatives

These brokers are the most similar to Sky Alliance Markets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Sky Alliance Markets Feature Comparison

| Sky Alliance Markets | Swissquote | IC Markets | FP Markets | |

|---|---|---|---|---|

| Rating | 2 | 4 | 4.8 | 4 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos, Futures | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $100 | $1,000 | $200 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:400 | 1:30 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | Sky Alliance Markets Review |

Swissquote Review |

IC Markets Review |

FP Markets Review |

Trading Instruments Comparison

| Sky Alliance Markets | Swissquote | IC Markets | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Sky Alliance Markets vs Other Brokers

Compare Sky Alliance Markets with any other broker by selecting the other broker below.