Skilling Review 2025

|

|

Skilling is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to Skilling |

| Skilling Facts & Figures |

|---|

Skilling is a multi-asset broker founded in 2016 and based in Cyprus. The brand offers hundreds of trading instruments with competitive spreads from 0.1 pips and beginner-friendly platforms. Skilling are also regulated in Europe and beyond with a transparent pricing structure. You can sign up and start trading in three easy steps. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Stocks, Indices, Commodities and Cryptos |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Skilling offers 800+ CFDs covering stocks, indices, forex and commodities. The powerful charting platforms facilitate ultra-fast execution times of 0.05 seconds and seasoned algo traders can execute complex CFD strategies using cTrader's C# programming language. |

| Leverage | 1:30 (Retail) |

| FTSE Spread | 22 |

| GBPUSD Spread | 0.6 |

| Oil Spread | 0.4 |

| Stocks Spread | 1.0 |

| Forex | Skilling offers Standard and Premium accounts with competitive leverage and low spreads from 0.1 pips across a wide range of major, minor and exotic forex pairs. A huge selection of over 70 currency pairs are available, including 7 pairs that can be traded on the weekend. |

| GBPUSD Spread | 0.6 |

| EURUSD Spread | 0.4 |

| GBPEUR Spread | 0.6 |

| Assets | 70+ |

| Stocks | Hundreds of stock CFDs are available including some of the most popular companies like Apple and Tesla. The slick proprietary platform also makes it easy for beginners to get started while the range of shares beats most rivals, including Eightcap. |

Skilling is a relatively green multi-asset online broker that offers global trading opportunities. UK investors can access 9,000+ popular forex and CFD assets, including exotic currency pairs, shares, indices and commodities. The broker offers proprietary trading platforms plus access to the industry-recognised MT4 and cTrader terminals. This Skilling.com review for UK traders 2023 will explore the firm’s regulation, trading platform features, deposit and withdrawal methods and much more.

Company Details

Skilling.com was established in 2016 and is a Scandinavian-owned FinTech organisation with the purpose to make trading simple and accessible to everyone. The online broker operates from headquarters located in Nicosia, Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC). Skilling Ltd UK clients are authorised under the company’s UK branch, which is overseen by the Financial Conduct Authority (FCA) Temporary Permissions Regime.

Trading Platform

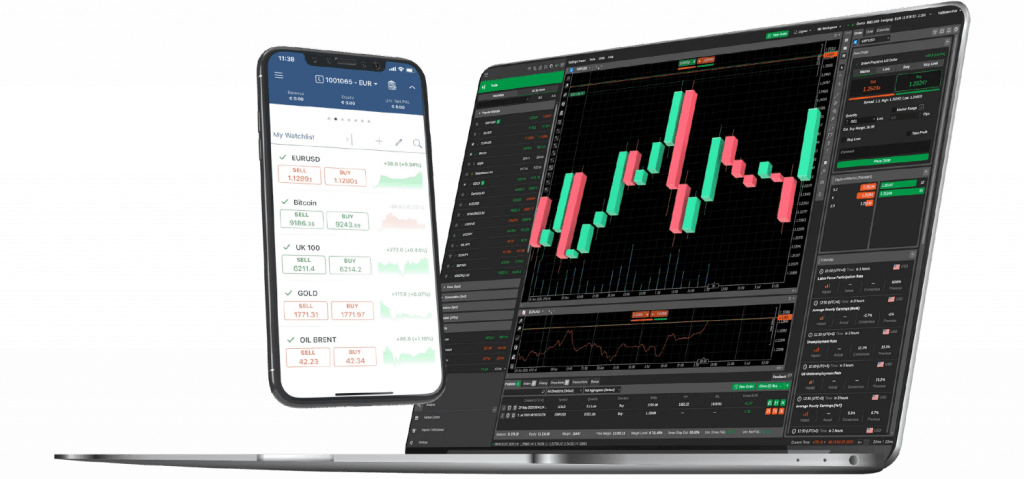

Skilling offers investors three trading platforms, one proprietary terminal and two established, third-party packages. All three platforms offer full access to all trading instruments and are available for download to desktop devices or can be used as a web trader via all major browsers.

Skilling Trader

The broker’s proprietary trading platform was designed in-house by expert traders and investors. The powerful yet user-friendly terminal is suitable for retail clients of all experience levels. Key functionality includes:

- Historical trading pattern analysis

- Seamless integration with cTrader

- 70+ technical indicators, including MACD

- Industry-leading execution time of 0.05 seconds

- Intuitive design with a range of chart and graph styles

- Access to ‘Skilling Trade Assistant’ for support and guidance on placing trades

- Fully customisable interface, including integrating filters and market exploration functions

Skilling cTrader

An advanced trading platform that integrates the established cTrader brand with Skilling’s proprietary features. The combination unlocks access to a powerful terminal with advanced capabilities. Features include:

- 65+ technical indicators

- Three market-depth assessment tools

- Historical trading analysis and statistics

- Ultra-fast execution time of 0.05 seconds

- Access all accounts within the one platform

- ’Automate’ Editor algorithm trading tool, compatible with C# and .net

- A range of charting and graphs, four chart types, five chart view options and eight chart drawings

Skilling cTrader

MetaTrader 4

An essential and popular platform. The terminal boasts a multilingual interface with easy-to-use navigation and highly practical search tools. Primary features include:

- Nine timeframes

- Price movement alerts

- Four pending order types

- Fully customisable charts

- One-click order execution

- Three order execution types

- MQL4 programming language

- 30+ built-in technical indicators

- Hedging tools and trading lots from 0.01

- Automated trading via Expert Advisors (EA)

MetaTrader 4

Products

Skilling offers various global asset opportunities for UK retail clients to invest in. Over 9,000 instruments can be speculated upon, outlined below:

- Forex: Speculate on 70+ currency pairs, comprising majors, minors and exotics like EUR/USD and GBP/USD, with 7 pairs also available for weekend trading

- Shares: Speculate on the price movements of more than 700 global company stocks, such as Tesla Motors Inc, Apple and Google

- Commodities: Access trading opportunities on 10+ soft commodities, energies and precious metals, including cotton, gold and Brent oil

- Indices: Speculate on some of the world’s largest markets across global index groups, including DAX 40, S&P 500 and NASDAQ 100

All trades are executed as contracts for difference (CFDs).

Commission & Fees

Skilling.com boasts full pricing transparency and fees vary between account types. The Standard Account has access to competitive spreads, reaching as low as 0.7 pips on major forex pairs like GBP/USD. Spreads on indices, such as the S&P 500, average 0.9 pips. Premium Accounts have access to raw spreads that go as low as 0.1 pips. However, a high minimum initial deposit of £5,000 is required. Note, commissions are also applicable on forex pairs and spot metals under the Premium Account. This starts from a £35 charge per million traded.

Rollover charges are applied to positions held open overnight. A £10 account inactivity fee applies for dormant accounts after 12 months. It is also worth noting a 0.7% currency conversion fee for all investments on instruments denominated in a currency that differs from an account base currency.

UK Leverage

UK customers will be subject to ESMA leverage capping regulations. This includes a maximum of 1:30 for major currency pairs. Always utilise risk management strategies when trading with high margins as losses will be amplified. Below, we outline maximum borrowing opportunities by asset class:

- Stocks: 1:5

- Commodities: 1:30

- Minor Indices: 1:10

- Major Indices: 1:20

- Major Forex Pairs: 1:30

- Minor Forex Pairs: 1:20

Mobile Platform

Skilling.com offers two proprietary mobile apps available for free download to Apple (iOS) and Android (APK) devices. The applications are fully customisable, with access to the tools, features and functionality found within the web terminal and desktop platform. Additionally, MetaTrader 4 is also available as a mobile app. All mobile platforms can be downloaded from the Google or Apple App Stores.

Investors can utilise a suite of analysis tools and implement automated trading algorithms via mobile platforms. Compatible graphs and charts are available to monitor price movements and execute live trades while on the go. Open and close positions, check live pricing and manage alerts from any portable device with an internet connection.

Payment Methods

Deposits

The broker offers several deposit methods to fund live trading accounts. There are no associated fees charged by Skilling, although third-party charges may apply for some payment methods. All funding can be implemented via the secure client login area. The minimum deposit requirement for the Standard Account type is £100, while the Premium Account requires £5,000. Funding methods available to UK investors include:

- Trustly

- Bank wire transfers

- E-Wallets: Skrill & Neteller

- Credit/Debit Cards: Visa & Mastercard

All deposits, except bank wire transfers, are processed instantly. Clients should allow 3-7 working days for wire transfers to become available.

Withdrawals

Skilling.com does not impose any withdrawal fees. However, again, third-party charges may apply. Our review found a £50 minimum withdrawal limit applies to all payment methods. Processing times vary. Bank wire transfers and credit card withdrawals can take up to five working days to process. E-wallets often boast faster fund processing.

Demo Account

Skilling.com offers a free demo account to prospective investors on the MT4, cTrader or proprietary trading platform. Virtual funds are provided to practise strategies with no risk and utilise platform features and tools. The paper trading account presents real market conditions and prices in a simulated environment. This is reflective of live trading conditions, so you can experience realistic market volatility. A simple online registration form is required to get started.

Regulation

The broker is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC). This is a top-tier regulatory body. Skilling Ltd UK clients are authorised under the company’s UK branch, which is overseen by the Financial Conduct Authority (FCA) Temporary Permissions Regime. This allows EEA-based firms to operate in the UK for a limited time whilst seeking full regulatory status. UK investors can still be assured of stringent security protocol, including negative balance protection, segregated funds and access to FSCS investor compensation.

Additional Features

Skilling.com offers a range of educational tools, blog content and tutorials that are ideal for beginners. This includes the ‘Skilling Academy’, an online portal designed for beginner and advanced traders. Various topics are covered, including trading basics, strategy types and technical analysis. These online courses can be accessed directly from the website and are organised into subcategories by experience level (basic, intermediate and advanced). The blog content includes trading articles, a definition dictionary, the latest news and market insights to help you make informed trading decisions. We outline some of the broker’s bespoke trading features below:

Skilling Copy

Skilling Copy is one of the world’s largest social trading communities with several strategies available. Copy trading with Skilling is simple, transparent and reliable. With the award-winning Skilling Copy platform, you can choose from 1,000+ different strategies and professionals to follow. This feature can be integrated within the cTrader terminal.

With Skilling Copy, retail clients can copy other investors and automatically mirror strategies and trades. In-depth performance statistics are available for you to research registered strategy providers and review their performance results and trading style to determine the one most suitable for you.

Trade Assistant

The Trade Assistant is a useful feature within the Skilling Trader platform, ideal for inexperienced investors. The tool is designed to take users through a step-by-step process of placing a trade and can be done for any asset. However, specific instruments will be suggested within the tool based on your personal preferences and risk appetite. While not all traders will need this tool, it is a huge advantage for beginners that need more guided support to get started.

Explore

The Explore feature within the Skilling Trader platform gives informed trading information, such as popular assets being invested in across the brokerage. Clients will have access to a range of filters to distinguish between asset classes and individual instruments. This includes categories such as risers, fallers, volatility and volume lists.

Account Types

Skilling offers three live account types available to UK retail clients; Standard, Premium and MT4. All trading accounts share similar features, with the same leverage opportunities and negative balance protection. Investors must complete the online registration form, upload identity documentation and provide proof of residency to open an account. Once your details have been approved, you may start trading immediately.

Standard Account

A zero commission account is available with Skilling Trader and Skilling cTrader, ideal for beginners.

- Scalping available

- 50% stop out level

- Spreads from 0.7 pips

- Minimum trade size 0.01 lots

- £100 minimum deposit requirement

Premium Account

A low spread trading account available with Skilling Trader and Skilling cTrader, ideal for more advanced traders. Volume commissions apply.

- Micro lot trading

- Scalping available

- 50% stop out level

- Spreads from 0.1 pips

- £5,000 minimum deposit requirement

MT4 Account

Access to the MT4 terminal, the world’s most famous trading platform for forex trading, only. Note, a reduced number of assets is accessible via this platform vs Skilling proprietary terminals.

- Micro lot trading

- Scalping available

- 50% stop out level

- Spreads from 0.7 pips

- £100 minimum deposit requirement

Advantages

- Copy trading

- Demo account

- Mobile trading

- MT4 & cTrader

- Live chat support

- Top-tier regulation

- Competitive spreads

- Wide range of instruments

- Competitive additional features

- Weekend forex trading on 7 currency pairs

Disadvantages

- No ETFs or cryptos

- Limited account options

- No weekend customer support

Trading Hours

Skilling trading hours vary by instrument. Typically, the forex markets offer 24/5 access. However, CFDs on stocks and indices are limited to the opening hours of their respective exchanges. Information on specific asset trading hours is available on the company’s website, including upcoming holidays and market closure dates.

The MetaTrader terminals operate on a GMT +2 server time and GMT +3 in the summer months.

Customer Support

Skilling offers several customer support options, available Monday to Friday:

- Email: support@skilling.com

- UK Telephone: +44 208 080 6555

- Live Chat: Available on the lower-right hand side of every webpage

Alternatively, UK traders can visit the online help centre page for FAQs. Topics include how to open an account, login issues, using profit forecast tools and deposit and withdrawal problems. The broker is also present on social media channels like Twitter.

Security

We are confident that the broker provides a relatively safe and secure trading environment. That being said, Skilling.com was only founded in 2016, so it does not have as long a track record of handling traders’ funds as many other online brokers in the UK. Alongside top-tier regulation, the proprietary platform is SSL protected. This provides an added layer of security via encryption that protects personal and financial data. Two-factor login authentication (2FA) and Secure Sockets Layer encryption protocols are applied as a security enhancement for MT4 accounts.

Skilling Verdict

Skilling.com certainly is an upcoming candidate within the broker landscape. UK investors can be assured of top-tier regulation, a good choice of assets, comprehensive education and responsive customer service. The broker is tailored to both new and experienced clients, with useful trading tools available, including a copy trading platform. While its fees may seem higher than some competitors, its features and tools ensure that even the most inexperienced traders could succeed.

FAQ

Is Skilling A Good Broker?

Skilling is a relatively new online brokerage that is popular with UK investors. It has solid platform options, a focus on customer security, useful educational tools and trade enhancing features.

What Are The Minimum Deposit Requirements To Open A Skilling Account?

The Standard and MT4 Accounts have a £100 initial deposit requirement. The Premium Account requires a £5,000 deposit to start trading.

Does Skilling Offer A Demo Account?

Yes, Skilling offers a demo account with access to virtual funds and simulated trading conditions. Head over to Skilling.com to get started.

What Payment Methods Does Skilling Accept?

You can deposit to your Skilling account with several payment methods. This includes credit/debit cards, Trustly and electronic wallets, such as Skrill and Neteller.

Is Skilling Safe For UK Traders?

Skilling Ltd UK clients are authorised by the Financial Conduct Authority (FCA) Temporary Permissions Regime. UK retail traders can still be assured of stringent security protocols, including negative balance protection and client segregated funds.

Top 3 Skilling Alternatives

These brokers are the most similar to Skilling:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Skilling Feature Comparison

| Skilling | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.4 | 4.8 | 4.8 | 4.7 |

| Markets | Forex, CFDs, Stocks, Indices, Commodities and Cryptos | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $100 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, cTrader | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:30 (Retail) | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 80% of retail investor accounts lose money when trading CFDs with this provider. |

75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

|

| Review | Skilling Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Skilling | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Skilling vs Other Brokers

Compare Skilling with any other broker by selecting the other broker below.

Popular Skilling comparisons: