SimpleFX Review 2025

|

|

SimpleFX is #72 in our rankings of CFD brokers. |

| Top 3 alternatives to SimpleFX |

| SimpleFX Facts & Figures |

|---|

SimpleFX is an online broker specializing in CFD and cryptocurrency trading, with multi-currency accounts, STP execution, low pricing and no minimum deposit. Bringing innovation and gaining recognition at numerous industry events since 2014, SimpleFX now caters to retail traders from over 190 countries, boasting a client base exceeding 200,000 active users. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Indices, Stocks, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS, Android + WebTrader |

| Trading App |

SimpleFX provides a proprietary app for both Apple and Android mobile devices. The application boasts a user-friendly design, facilitating easy opening and closing of trades with access to the broker’s 220+ tradable assets. However, occasional unresponsiveness during testing, alongside an average charting package, means it won’t meet the needs of highly active traders. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | No |

| Commodities |

|

| CFDs | SimpleFX stands out with highly leveraged trading options up to 1:1000 covering popular asset classes, including stocks, indices, currencies and commodities. Additionally, the social community serves as an excellent resource for gathering CFD strategy tips and short-term trading ideas. |

| Leverage | 1:1000 |

| FTSE Spread | 1.3 |

| GBPUSD Spread | 1.2 |

| Oil Spread | 0.04 |

| Stocks Spread | Variable |

| Forex | SimpleFX provides a comprehensive selection of around 60 currency pairs, from majors like GBP/USD to exotics like CHF/PLN. Forex trading fees are competitive, averaging 0.9 pips on EUR/USD during testing, while MetaTrader 4, available on desktop, web and mobile, was built specifically for trading currencies online. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.9 |

| GBPEUR Spread | 1.0 |

| Assets | 57 |

| Stocks | SimpleFX offers a beginner-friendly platform to trade some of the most popular global stock CFDs commission-free, from Pfizer to Walt Disney, equipped with advanced integrated indicators. SimpleFX provides access to stock exchanges in key countries such as the US, UK, Germany, and Japan, though it doesn't offer fractional shares. |

| Cryptocurrency | SimpleFX’s strongest offering is its crypto trading environment, with a growing range of tokens, bolstered in 2024, including Bitcoin, Ethereum and Filecoin paired with the USD. Its crypto-based accounts also ensure a smooth trading experience for crypto enthusiasts, while the bespoke staking service allows capital to be utilized for margin trading. |

| Coins |

|

| Spreads | 45.57 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | Yes |

| Auto Market Maker | No |

SimpleFX is an online CFD and crypto trading brokerage that offers low spreads, fast STP execution and no minimum deposit restrictions. In this 2025 review, we will cover how SimpleFX works, whether it is safe, what trading platforms it offers, how to deposit funds and much more.

SimpleFX is a competitive CFD brokerage with a focus on cryptocurrencies and decentralised finance (DeFi). Open an account today for quick crypto deposits, low spreads and high leverage rates.

Company History & Overview

SimpleFX is an offshore broker that was founded in 2014 and is based in St. Vincent and the Grenadines. The firm is unregulated but protects traders’ funds through negative balance protection and segregated account funds.

SimpleFX offers its services to retail traders and investors from over 190 countries, including the UK, with more than 200,000 active clients on the platform. The company runs a straight-through processing (STP) operation model, meaning there is no dealing desk, which allows for super fast trade execution.

Markets & Instruments

SimpleFX provides access to over 220 tradable assets, ranging from forex pairs to indices.

Over 60 currency pairs, including many major, minor and exotics, are offered alongside popular instruments like the FTSE 100 index, Bitcoin (BTC) and Barclays stocks. In total, the firm boasts 228 forex, index, crypto, stock and commodity trading products.

Platforms

SimpleFX offers two platforms to traders: the MetaTrader 4 platform and its bespoke SimpleFX WebTrader. Both workstations offer users a wide range of tools to help implement and develop investment strategies, analyse market movements and manage accounts.

MetaTrader 4

MetaTrader 4 is one of the most popular online trading platforms. It offers an array of tools to help traders with technical and fundamental analysis, risk management and strategy generation.

This includes more than 30 built-in technical indicators, one-click trading, expert advisor (bot) automated trading, nine timeframes, customisable charting layouts, copy trading, access to MQL4 programming support and so much more.

MetaTrader 4 is available as a desktop application and anyone can download it directly from the SimpleFX website. Alternatively, the platform is available as a browser-based web trader and on mobile devices (from both the Apple iOS App Store and Android Google Play Store).

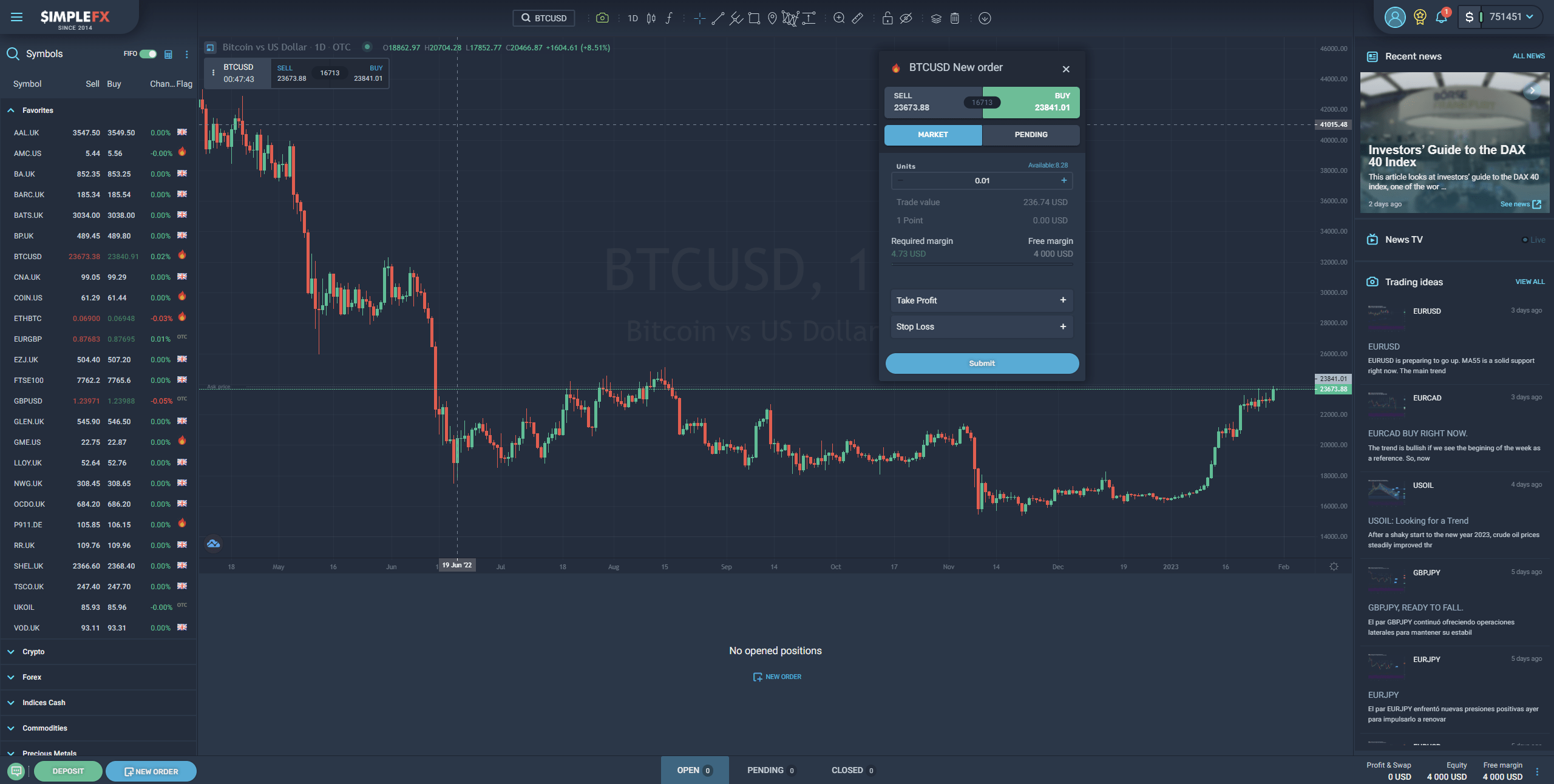

SimpleFX WebTrader

SimpleFX also offers its own, proprietary investing platform, which is in the form of a web trader. This is a robust trading platform that is accessible to beginners thanks to its sleek interface, easy-to-use design and live technical support features. Moreover, clients benefit from a built-in chat room, a news column, a quick-trading screen and an investing ideas section.

The platform’s charting window comes with nine timeframes, 104 indicators, 75+ graphical objects and five chart types. This is a competitive range of tools and technical analysis features.

SimpleFX WebTrader

How To Place A Trade On SimpleFX

- Login on the SimpleFX website and enter the client portal

- Open the WebTrader terminal and select your account

- Pick which asset you would like to trade from the list on the left

- Click the New Order button at the bottom of the window

- Select the parameters of your trade (Buy/Sell, Market/Pending, Units, etc.)

- Click Submit to place your trade

Fees & Charges

SimpleFX offers zero-commission trading. However, spreads are charged and differ depending on the asset and market conditions. Typical spreads for the FTSE 100 index are 1.3 pips, 0.00012 pips for GBP/USD, 0.03 pips for UK Brent oil and 0.25 pips for Tesco stocks.

Deposit and withdrawal fees vary by payment method. Most deposit methods have no fees but some withdrawal methods do incur costs. For example, withdrawing via Bitcoin may come with a maximum fee of 0.00005 BTC but withdrawing through the Bitcoin Lightning Network is free of charge.

Swap rates and fees are detailed for each asset on the broker’s trading conditions page and can vary drastically by the asset. An additional 3% fee (minimum of £25) may be added if an account is inactive.

SimpleFX Mobile App

SimpleFX offers its own, bespoke trading app (the SimpleFX App) on mobile devices for both Apple and Android phones. The app is designed to be easy to use, with a clear, mobile-friendly design that makes opening and closing trades simple. It also provides interactive news feeds and community interaction features. However, it lacks the more complex functionality of the web terminal and can be unresponsive at times (your mileage may vary).

SimpleFX Mobile App

The application can be downloaded directly from the Apple App Store or Google Play Store, with links available from the broker’s website.

MetaTrader 4 Mobile Platform

SimpleFX also supports the MT4 mobile app server for iOS and Android mobile devices. This application boasts many of the features of the desktop and WebTrader versions of MetaTrader 4, with strong charting tools, on-the-go alerts, easy order placement and more. The application is available to download from the Apple App Store or Google Play Store.

Payment Methods

SimpleFX offers several payment methods to UK traders, notably cryptocurrency transfers. A wide range of crypto coins and altcoins are supported, including Bitcoin (BTC), Cardano (ADA), Ethereum (ETH), Dogecoin (DOGE), Tether (USDT) and Ripple (XRP). UK traders can also deposit with fiat currency (like GBP) through Skrill, Neteller or Fasapay.

How To Make Deposits

- Log into your account in the client portal

- Click Deposit at the bottom of the window

- Choose which deposit method you would like to use

- Ensure you have completed the SimpleFX KYC process

- Input your account details (or wallet address) and choose an amount to deposit

- Once submitted, the transfer process will begin

Account Types

When we used SimpleFX, we found it to offer a single, multi-currency account type. This account gives access to all the tradable assets offered as well as both trading platforms. There are no minimum deposit amounts, a margin call of 50% and a stop-out level of 30%. Leverage can reach up to 1:1000, depending on the asset type, and minimum and maximum contract sizes range from 0.1 to 1000 lots, depending on the asset.

Opening an account requires you to create an account and fill in your details (including your email). To deposit, you will need to provide an identity verification as per the company’s KYC policy. Then, you will be able to deposit funds and start investing.

SimpleFX Demo Account

SimpleFX allows traders to open up to three demo accounts in each currency. This is available on both its proprietary trading platform and MT4. You can set the parameters of your demo account yourself, including choosing the base currency.

We highly recommend opening and using demo accounts to ensure you are comfortable with using the trading platform and the investing conditions offered before risking real capital.

Bonuses & Promos

SimpleFX offers a £2,500 instant bonus when new clients place their first deposits. The bonus is received as a cashback credit, available for trading, though not for withdrawal. The amount you receive is dependent on the amount deposited.

- £20 bonus for deposits over £100

- £50 bonus for deposits over £250

- £100 bonus for deposits over £500

- £500 bonus for deposits over £2,000

- £2,500 bonus for deposits over £10,000

SimpleFX claims to be bringing in new offers in the future.

UK Regulation

SimpleFX is not FCA regulated, nor does it receive oversight from another body. This means there is no guarantee that the broker will implement systems to protect clients’ funds through efforts such as liquidation compensation schemes. However, the broker does claim to protect funds through segregated accounts and negative balance protection. Traders should be wary and evaluate all risks before investing with unregulated brokers.

Extra Tools & Features

SimpleFX runs both a community forum and a blog. The forum provides a place for traders to keep up to date on changes to SimpleFX, post ideas, make requests and find help. While using the blog, our experts found it to have a wide range of useful resources for traders, including a trading academy, daily news articles, tutorials, updates, opinion pieces and more.

The trading academy may be extra beneficial to newer investors looking to find information about how to speculate different asset classes, how to set up investing strategies and more.

SimpleFX Trading Hours

Trading hours are dependent on the asset in question. Cryptocurrencies are open 24/7, while forex is limited to 24/5 and most other assets, such as indices, are only open during their respective exchange’s hours.

Customer Service

Customer service can be accessed via the broker’s helpful FAQ page, email and community forum. Another option is a live chat service, which can be accessed via the icon in the lower-right corner of the website.

- Email Address: support@simplefx.com

Client Security

Our review found that, while unregulated, SimpleFX claims to protect clients’ funds through segregated accounts using advanced security protocols to protect accounts from unauthorised access. The broker uses the highest encryption standards and offers two-factor authentication (2FA) support. Furthermore, client funds are fully insured and international standards for anti-money laundering (AML) are adhered to.

Should You Trade With SimpleFX?

SimpleFX is a forex and CFD broker whose users can speculate on hundreds of assets with both MT4 and the company’s own, easy-to-use platform. Trading conditions are competitive, with tight spreads, no commission and a high maximum leverage rate of 1:1,000. Additional features include an informative blog, helpful customer service and a huge £2,500 instant deposit bonus, all alongside support for a wide array of crypto and fiat payment methods. The culmination of these features makes SimpleFX a great option for both beginner and experienced traders alike. However, SimpleFX is unregulated, so readers should think carefully before risking their capital.

FAQ

Is SimpleFX A Good Broker?

SimpleFX offers a beginner-friendly, bespoke trading platform that is available on both web browsers and mobile phones, giving it a distinct advantage over many competitors. This is coupled with tight spreads, the opportunity to use MetaTrader 4, zero-commission trading and constant new updates through the company blog. The broker’s biggest downside is that it is unregulated, introducing some fairly substantial risk.

Is SimpleFX A Safe Broker?

While unregulated, the broker has been around for many years and has served hundreds of thousands of clients. The firm claims to protect clients’ funds through segregated accounts and implements negative balance protection to ensure traders cannot lose more than they invested. Strong encryption and the option for 2FA further increase the security of the client accounts.

Can I Practise Trading On A SimpleFX Demo Account?

You can open up to three demo accounts per currency with SimpleFX. These accounts can be accessed via the firm’s bespoke web trading platform and their MetaTrader 4 terminal.

Does SimpleFX Offer Reliable Trading Platforms?

Like many competitors, SimpleFX offers a MetaTrader 4 terminal, allowing users to invest with one of the world’s most popular online platforms. However, the company also offers a beginner-friendly, yet robust, proprietary web trading platform. Both MT4 and the SimpleFX investing platform can be accessed on desktop computers or via mobile phone applications.

How Much Do I Need To Deposit To Start Trading With SimpleFX?

SimpleFX has no minimum deposit requirements, meaning you can trade with as little as you want. However, minimum position lot sizes are present.

Top 3 SimpleFX Alternatives

These brokers are the most similar to SimpleFX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

SimpleFX Feature Comparison

| SimpleFX | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | 4.2 | 4 | 4.7 | 4.8 |

| Markets | CFDs, Forex, Indices, Stocks, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $0 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

75.1% of retail investor accounts lose money when trading CFDs |

||

| Review | SimpleFX Review |

Swissquote Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| SimpleFX | Swissquote | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

SimpleFX vs Other Brokers

Compare SimpleFX with any other broker by selecting the other broker below.

Popular SimpleFX comparisons: