Short-Term Trading

Short-term trading is an investment style where each trade is generally open for no longer than a few hours or from one day to the next. With the chance to profit multiple times in a day from short-term movements in the price of forex, commodities, stocks and other assets, short-term trading is an attractive option for active investors.

This tutorial will review the basics of short-term trading, discussing how it works, potential strategies, its pros and cons and anything else UK traders should know. We also list the best short-term trading brokers in 2025.

Top Short-Term Trading Brokers in the UK

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

How Short-Term Trading Works

Short-term traders typically aim to open and close positions in a tight timeframe that can range from seconds to hours but will usually not exceed one trading day.

A range of vehicles can be used to make short-term trades, but price movements over the course of a day are generally not significant enough to generate significant profits unless you stake a large amount of capital. For this reason, leveraged derivatives such as CFDs (contracts for difference) are a good fit for short-term traders.

Leverage acts as a multiplier to your stake so you can increase your trading volume without increasing your initial investment. For instance, 1:10 leverage would increase the trading power of a £100 stake to £1000, scaling up profit potential by 10. Of course, the potential losses in leveraged trades are also amplified, so traders should take care and practice risk management.

What Counts As Short-Term Trading?

Short-term traders typically engage in day trading as they generally open and close positions within a single trading day. Day traders rely more on technical analysis than the fundamental analysis techniques often used in long-term trading. Technical indicators and patterns such as the relative strength index, moving averages and Bollinger Bands can be helpful in mapping out short-term trades. We explain how these work in more detail below.

Importantly, short-term traders using leveraged products like CFDs normally close out positions by market close to avoid the swap fees charged by brokers for holding positions open overnight. Additionally, there is the risk that prices could swing due to changes in trader sentiment by the time market opens again the following day.

Note, short-term trading is considered riskier than long-term trading and investing. This is because financial markets often experience sharp and difficult to predict volatility in the short term.

Pros Of Short-Term Trading

Benefits of short-term trading include:

- Opportunity to generate quick profits

- Possible to start trading with small deposits using leverage

- Multiple markets you can trade on including stocks, forex, commodities and cryptocurrencies

- Able to open and close positions without exposure to overnight swap fees

- Good list of short-term trading brokers and apps to choose from

- Range of viable short-term trading strategies that work

Cons Of Short-Term Trading

The key drawbacks of short-term trading are:

- Difficult to produce positive returns with

- Traders may owe capital gains tax on profits

- An active trading style that demands constant attention and focus

- Elevated risk of short-term trading vs long-term investing

- Can be a high-stress way of online trading

How To Start Short-Term Trading

Register With A Broker

Find short-term trading brokers that accommodate your strategy and the markets you want to trade in. Generally, this means you should avoid websites and companies such as Vanguard and Fidelity as their fee structures are not catered to short-term trading.

When evaluating brokers for short-term trading, consider factors such as spreads and commissions, account types, customer support, minimum deposits, mobile app compatibility and whether it is FCA-regulated. Another key aspect is the trading platform, as it is where you will be conducting any analysis and planning as well as executing and monitoring your trades.

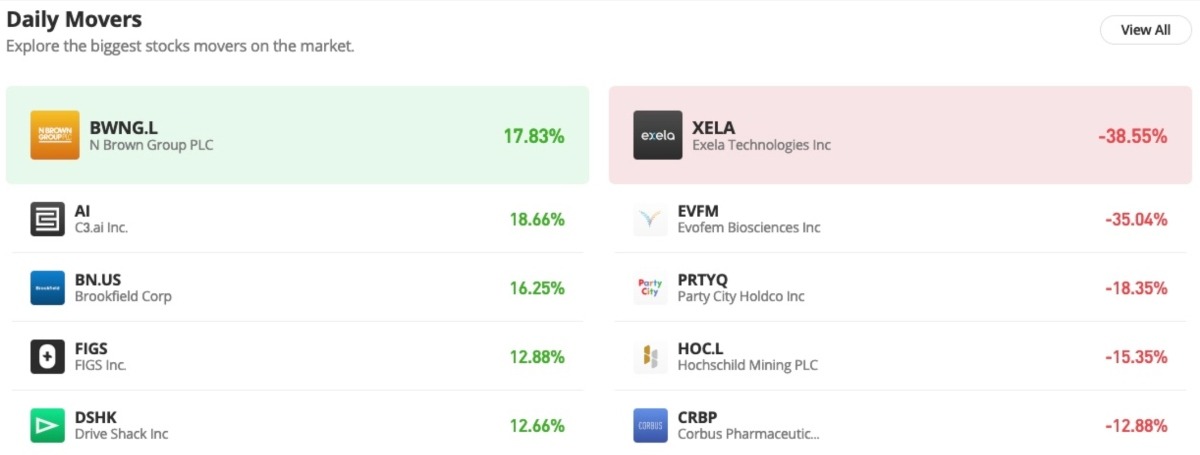

For example, eToro offers its proprietary platform that comes with a wide range of technical indicators and patterns that you can use to complete any research. There is also a useful dashboard showing information such as the biggest moving assets over a 24-hour period, which is a good way to discover new opportunities.

In addition, access to a free demo account is a nice bonus. These paper trading accounts use simulated funds so that you can practise short-term trading in a risk-free environment. They provide a method for testing out any new strategy you may want to use before investing with real capital.

Choose A Vehicle

You can execute short-term trades with various trading instruments, but in practice, it will be difficult for most retail traders to make large profits by playing the spot markets. As a result, many retail day traders use derivatives products to place short-term trades:

- CFDs – One of the most popular ways to speculate on financial markets, contracts for difference allow retail traders to open positions without needing to buy or sell the underlying asset, such as forex, stocks or precious metals. As explained above, CFDs can be traded with leverage, allowing traders to make significant profits from relatively small price movements.

- Spread Betting – This derivative works in a similar way to CFDs, with traders placing leveraged bets on the direction and extent an asset’s spread will move past the current price. Profits generated from spread bets are also tax-free in the UK.

- Binary Options – A straightforward derivative that simply asks the trader to bet on an asset’s price movement (up or down), with potential profits and losses predetermined and staying the same regardless of the extent the price moves. This means you can earn the same from a 1p price movement over 30 seconds as you would from a 100p price movement over a week.

Decide What To Trade

There are many potential markets and assets that you could invest in with a very short-term trading strategy. The most popular include:

Forex

Over $6 trillion worth of currency trades happen each day, showing how popular forex is amongst short-term traders. Attractive for their high volatility and 24/7 access, there is a wide range of major, minor and exotic currency pairs that investors can trade on.

A key benefit of forex is the high liquidity and low spreads, making it low-cost, easy and quick to open and close positions. This is important, especially with short-term trading strategies such as scalping where any delay in trade completion can lead to a big impact on profits. Generally, majors have the tightest spreads so consider trading currency pairs such as GBP/USD.

Stocks & Shares

Stocks are popular assets among short-term traders thanks to their availability and the ease with which they can be traded with CFDs and other derivative products.

Stocks are traded on exchanges in countries around the world. In the UK, the main exchange is the London Stock Exchange. Certain brokers such as eToro also offer UK-based clients short-term trading on some of the best global stocks, including those traded on the New York Stock Exchange (NYSE) of the USA, the Australian Stock Exchange (ASX), and the National Stock Exchange of India (NSE).

ETFs & Indices

Indices and exchange-traded funds, or ETFs, are investment vehicles made up of groups of stocks that are treated as single instruments. Generally, they are not as volatile as single stocks because they are heavily diversified – the overall value of the index or ETF could remain relatively stable even if there’s a drastic price movement in one or two stocks.

There are more than 2,000 ETFs that can be traded through the London Stock Exchange. Pepperstone is a popular provider of ETFs including products that track indices such as the FTSE 100 and S&P 500 on the LSE and NYSE. These can often be traded with CFDs and other derivatives, allowing day traders to make profitable short-term trading bets on the price movement of an index.

Cryptocurrency

Compared to traditional markets, cryptocurrency is relatively new, however, since the launch of Bitcoin in 2008, it has grown to become a popular short-term trading option. Similar to forex, crypto trading is highly accessible as tokens can be traded on a range of online exchanges and platforms 24 hours a day, seven days a week.

Cryptocurrencies are attractive to many traders thanks to the high volatility that exists on a short-term basis. For instance, on the 30th January 2023, the price of BTC at 9 am was £19,038 and by 10 am it had dropped to £18,713, a change of £325 in just an hour.

Due to this high volatility and the associated risks, the Financial Conduct Authority introduced a ban in January 2021 preventing retail investors from trading derivatives on crypto assets. Because of these restrictions on short-term trading, no FCA-regulated broker will allow you to open CFDs on cryptocurrency and you will only be able to spot trade.

When trading in this market with certain cryptos such as Ethereum, there are additional charges you need to account for. As you are executing transactions using blockchains, you need to pay gas fees, which can vary depending on how busy the network is at the time of trading. It is important to factor in these fees as they can quickly make short-term trading expensive if you are investing at times when there is a high demand on the network.

UK traders who want to make short-term crypto trades and avoid high fees should look for an exchange or broker like eToro that provides crypto transactions with set fees – 1% in eToro’s case – or a foreign-registered broker that provides CFD crypto trading or crypto binary options. Take care to research and find a trustworthy and reputable broker if you go down this route.

Commodities

Commodities are another market that is well suited to short-term trading, with a huge number of assets available to trade from gold and silver to natural gas and oil.

Like stocks, commodities are typically traded on exchanges and at online brokers. Many firms facilitate trading 24 hours a day between Sunday evening and Friday evening with only hour breaks each day. Individual brokers may also specify their own hours for commodities trading.

Develop A Strategy

Scalping

Scalping is a popular short-term trading strategy that involves making many trades in a short space of time to capitalise on discrepancies in an asset’s price. Throughout the day, investors may execute hundreds of scalping trades, each lasting just a few minutes at most.

The idea behind scalping is to build up your profits through numerous short-term trades. However, one risk from this strategy is that a single significant price swing can wipe out the small profits from these trades and leave the trader in the red. For this reason, a big part of scalping is knowing when to cut your losses and ensuring you have an effective exit strategy.

Short-term scalping requires good technical analysis skills and it can be difficult to master as traders need to consistently be on the lookout for new opportunities.

Trend Reversal

Many short-term traders try to profit by predicting when an asset’s price movement is about to change direction. Traders will generally try to identify support and resistance levels and monitor trading volume when trying to predict an upcoming trend reversal. Technical indicators such as the Stochastic Oscillator are useful for this type of short-term trading strategy.

This indicator uses a signal line created using the lowest and highest prices from the previous 14 timeframes and a 3-period moving average (MA) of the signal line. Using a 0 to 100 scale, these two lines show when an asset is overbought (80 or higher) or oversold (20 or lower) as well as when a trend reversal is likely.

To demonstrate how this would work, here is an example of a short-term trend reversal trade.

The image below is a price chart for Unilever (ULVR) stock traded on the London Stock Exchange. At 10:44 am, there is a bearish crossover over as the purple signal line decreases past the black MA line, indicating the potential for a downtrend. This sentiment is then confirmed as both lines have values greater than 80, which indicates ULVR is currently overbought and overvalued. To capitalise on this reversal, you could open a short CFD contract or a put options contract.

This trend then continues until there is a bullish crossover by the signal line just after 10:58 am in the oversold region, which is when the stochastic lines equal 20 or less. At this point you could close your short CFD or put position and open a long CFD or call position, assuming the price will begin to trend upwards. Following the bullish crossover, the price begins to increase.

Trend Continuation

A trend continuation strategy uses a similar analysis to the trend reversal strategy as you are again looking to evaluate the strength of a trend of a given asset. If the trend remains strong even as the price approaches a resistance or support level, you open positions assuming the trend continues. For this, you could use an indicator such as the moving average convergence divergence (MACD) as it shows trend strength and indicates whether the market is overbought or oversold.

Let’s look at an example to see how the MACD indicator could be used for a short-term trend continuation strategy…

The MACD is made up of three parameters. These are the MACD line, the signal line and a histogram. The MACD line comes from taking an exponential moving average (EMA) covering the previous 12 timeframes from an EMA from the previous 26 timeframes. The signal line is an EMA produced using the previous 9 timeframes. The histogram simply shows the difference between the MACD line and the signal line.

In this example, a price history chart of British Petroleum (BP) stock on the LSE will be used. At 2:08 pm the histogram begins to decrease and following this, the price of BP begins to follow a downward trend. However, the strength of the downward trend is not confirmed until the bearish crossover of the black MACD line and the purple signal line. At this point, you could open a short CFD position on BP stock until soon after 2:32 pm when there is a bullish crossover between the MACD and signal lines.

Tips For Short-Term Trading

Research

Short-term trading is difficult to get right and can be risky. Take time to research and understand the market and assets you are trading as well as your chosen strategy inside out.

To help you with research there are plenty of resources available both online and in-person, including PDF guides, digital lessons, training courses, books, ebooks and short-term trading 101 YouTube videos.

If you want short-term trading concepts and definitions explained in depth, there are many detailed books that can be found in shops or downloadable as a PDF. Popular examples include Short-Term Trading Strategies That Work by Larry Conners and Cesar Alvarez, Short-Term Trading in the new Stock Market by Toni Turner and Short-Term Trading With Price Patterns by Michael Harris. You may also want to look at Long-Term Secrets To Short-Term Trading, 2nd Edition by Larry Williams and Day Trading For Dummies by Ann C. Logue.

There are also many online trading communities where you can discuss short-term strategies, such as Telegram channels, Facebook trading groups, and pages on Reddit and Quora.

Practise

Try to practise your short-term trading strategy before using it with a live account and real capital. A demo account helps to improve your discipline and avoid noise while trading. As short-term trading is a high-risk high-reward activity, it can be easy to let your emotions get the better of you and trade on sentiment. Practising with a demo account helps you to get used to market fluctuations and develop good habits.

Implement Risk Management

Most successful day traders use techniques to mitigate the risks that come with short-term trading. Some of these focus on managing your trading funds – a popular technique is the 1% model whereby you only invest 1% of your total capital in any single trade. By doing this, you reduce the impact that a single bad trade can have on your entire portfolio.

Another option is to implement stop loss and take profit orders. These are triggers that will automatically close your trade to prevent a losing position from getting worse or secure a profit from a winning situation.

Note that FCA regulations also state that licensed brokers must implement negative balance protection for leveraged positions. This prevents clients from becoming indebted to their broker by automatically closing out a position when losses would exceed the amount of funds in their brokerage account.

Bottom Line On Short-Term Trading

Short-term trading is not easy to get right, but with countless assets and strategies to choose from it can prove profitable for investors. For beginners and experienced traders alike, it is important to take necessary precautions to help mitigate risk, from signing up with reputable trading platforms to making use of demo accounts and practising good money management.

Use our recommendations of the best short-term trading brokers to get started.

FAQ

What Is The Best Short-Term Trading Strategy?

There are many viable methods for short-term trading, from momentum trading to scalping and high-frequency trading. The right strategy for you will depend on your goals, risk tolerance and the trading tools available. Our experts also recommend testing your short-term trading strategy in a demo account before risking real capital.

Which Broker Should I Use For Short-Term Trading?

This depends on your needs, however consider aspects such as FCA regulation, vehicles and instruments, platform access, spreads and fees, payment methods, mobile app support as well as extras such as education and market analysis. Alternatively, use our picks of the best short-term trading brokers in the UK.

Can I Use An Expert Advisor For Short-Term Trading?

Yes, expert advisors can be used for short-term trading. These trading bots make it easier to carry out short-term trading online, especially when using high-frequency strategies such as scalping. EAs use algorithms to identify suitable opportunities and execute trades according to a set of instructions.

Is Short-Term Trading Worth It?

Short-term trading can be worthwhile but it requires study and practice to get right consistently. As it is a high-risk and high-reward trading style, you will need to be careful and stick to your own rules on when to cut your losses and when to open a trade. Use our full guide to short-term trading for more tips and the steps to get started.

Is Short-Term Trading Haram?

Whether short-term trading is in violation of Sharia law is open to interpretation. Some scholars argue it is permissible if you do not invest in prohibited industries, such as alcohol or tobacco. The top short-term trading brokers also offer Islamic-friendly trading accounts where no overnight interest fees are charged. Speak to a local religious authority if you are unsure whether short-term trading is Halal or Haram.

What Is A Short-Term Trading Fee At Fidelity?

There is a range of charges that mean Fidelity is not ideal for short-term trading. For example, there is a £7.50 fee for every deal on stocks, ETFs and investment funds that are made online. For forex, there is a 0.75% fee on all trades below £10,000. In general, Fidelity is better suited to longer-term trading.