Sage FX Review 2025

|

|

Sage FX is #46 in our rankings of CFD brokers. |

| Top 3 alternatives to Sage FX |

| Sage FX Facts & Figures |

|---|

SageFX is an offshore, unregulated CFD broker that offers highly leveraged trading on forex, stocks, commodities, indices and crypto via the TradeLocker platform. Traders can access commission-free trading or an ECN account with tight spreads. While the broker's regulatory status is weak, it does provide segregated accounts and two-factor authentication. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, indices, cryptos |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS and Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | Pending |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | No |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on forex, stocks, metals, energies, indices, cryptos and dollar futures. Sage FX offers tight spreads and high leverage on all instruments from 1:100 to 1:500. |

| Leverage | 1:500 |

| FTSE Spread | 5.0 |

| GBPUSD Spread | 0.9 |

| Oil Spread | 0.04 |

| Stocks Spread | N/A |

| Forex | Trade 7 major, 21 minor and 29 exotic forex pairs with high leverage and a choice between STP or ECN accounts. Support is available around the clock and the TradeLocker forex software is provided. |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.9 |

| GBPEUR Spread | 2.5 |

| Assets | 57 |

| Stocks | Speculate on price movements of 37 US and European blue chip stock CFDs, including Adidas, Intel and Volkswagen. On the negative side, the selection of stocks is limited vs alternatives and direct share dealing isn't provided. |

| Cryptocurrency | Trade CFDs with leverage up to 1:100 on 23 crypto pairs with USD including popular tokens like Bitcoin and Ether and lesser-known options like OMG. On the downside, crypto-only pairs are not offered. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Sage FX is a forex and CFD trading broker that offers UK and international clients high leverage speculation services on various financial markets, including cryptocurrency. This 2025 Sage FX broker review will explore essential aspects of the company, such as regulation, trading fees, minimum deposit amount, available leverage and any bonus schemes offered.

About Sage FX

Founded in 2020, Sage FX is a newcomer to the online trading scene. However, it boasts decades of trading experience through its staff of industry experts. The broker specialises in STP and ECN trade execution styles and does not operate as a market maker.

Sage FX is based on the Caribbean island of Saint Vincent and the Grenadines and is not currently regulated by an official body. While this may be a red flag to some investors, the lack of regulation is likely due to how recently the company was founded. UK investors should generally seek a broker regulated by a top-tier regulator like the FCA for maximum protection unless they are searching for specific services not allowed under FCA regulation.

Markets

Sage FX offers CFD products on a wide range of assets, including forex and cryptocurrency pairs. However, this broker does not provide alternative forms of speculation, such as binary options, equities and spread betting.

Forex

Over 50 currency pairs are available, with significant representation from major, minor and exotic forex pairs. Spreads are as low as 0.1 pips on major pairs when using the ECN account variant.

Indices

With nine major global indices and the US dollar index futures market, Sage FX provides some support for index trading. However, while the broker offers CFDs on popular assets like the UK FTSE 100 and US S&P 500, some traders may miss more specialised markets like the VIX 70 and ASX 200.

Stocks

A small selection of US and EU shares are provided for CFD trading, with just under 40 total equities markets available. This is somewhat disappointing as many competitors offer thousands of global share CFDs, including UK assets.

Cryptocurrencies

An asset class in which Sage FX excels is its crypto CFDs, with more than 20 pairs available to UK clients. With spreads as low as 0.1 pips, users can trade well-known tokens like Bitcoin, Ethereum, Neo and Dogecoin.

Commodities

A total of eight commodities instruments are available, covering fuels and metals markets, though soft commodities like cotton and coffee futures are conspicuously absent. Gold is provided as a USD and EUR pair, though there is no GBP pair alternative.

Users can take advantage of spreads as low as 0.06 pips on UK Oil through the Sage FX ECN account.

Leverage

As a non-regulated broker, there are no restrictions on the leverage that Sage FX can offer to clients. Indeed, users can access margins far above what FCA or ASIC regulated companies provide, with 1:500 leverage rates on major, minor and exotic FX pairs and metals markets. A margin of 1:200 is available on energies and indices and 1:100 on shares, crypto and the US dollar futures index.

The margin call level is 100%, while the stop out level stands at 70% on all trades.

Account Types

Sage FX offers ECN and STP execution-style accounts so traders can choose between raw spreads or commission-free trading.

With a standard account, clients have no account funding requirements but cannot access the lowest spread markets. The pro account enforces an initial minimum deposit of $500 but allows clients to trade the broker’s PRO symbols from 0.1 pips. The commission rate of both ECN accounts stands at $4 per side per lot.

The VAR commissions STP account allows clients to eliminate the standard commission rate of $4 per side per lot for those who prefer commission-free trading. However, spreads are marked up somewhat to account for this.

Sage FX does not provide a swap-free Islamic account for traders that cannot pay interest due to religious beliefs. However, this account type may be introduced when the broker integrates the MT5 trading platform.

Demo Account

Many clients appreciate the chance to trade risk-free on a demo account before opening a real account with a broker. To this end, Sage FX provides a fully funded MT4 demo account to clients who wish to practise new trading strategies or learn new markets before committing to a live account.

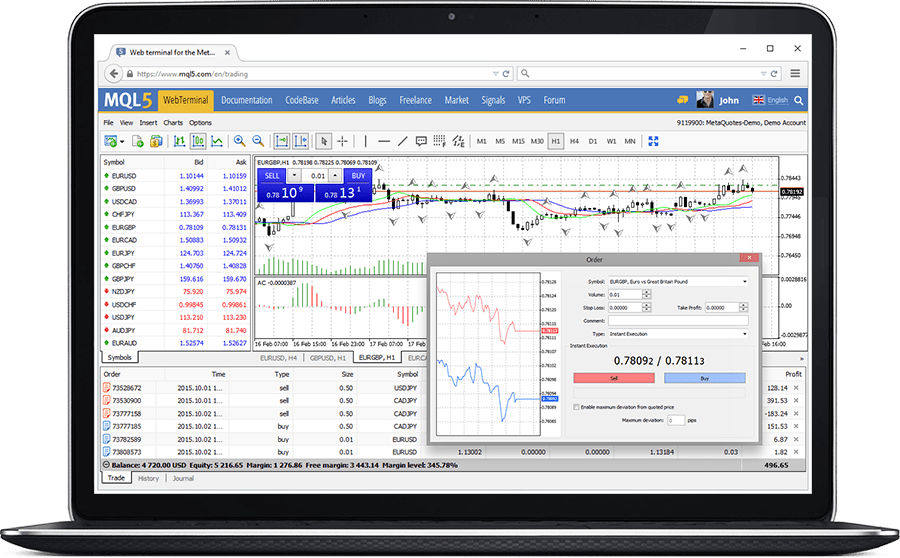

Trading Platforms

There is currently only one trading platform that Sage FX traders can utilise, MetaTrader 4 (MT4). With nine timeframes and 30 technical indicators as standard alongside great customisability, the MT4 platform is a trader favourite due to its seamless expert advisor (EA) and custom indicator integration.

MetaTrader 4

MT4 is available as a browser-based web trader and a free standalone program to download for Windows, Mac and Linux.

In addition to MetaTrader 4, Sage FX plans to support the MetaTrader 5 (MT5) platform. While not a direct replacement to MT4, this platform features an additional twelve timeframes and eight indicators as standard and an updated MQL5 coding language for enhanced algorithmic trading.

Mobile Apps

MetaTrader 4 has a mobile app available for Android and iOS devices for clients who want to monitor their positions from wherever they are. The MT4 mobile platform features impressive functionality, with up to ten simultaneous charts supported and the same standard technical indicator capacities as the desktop platform.

There is no proprietary Sage FX mobile app, so clients must use the MT4 mobile site or a desktop computer to manage their accounts, positions and funding.

Payment Methods

Investors are presented with four options for deposits and withdrawals from Sage FX – crypto wallet transfers, credit card, debit card and VLoad prepaid card. The crypto tokens accepted are Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Dogecoin (DOGE) and Tether (USDT). There is a minimum deposit of $10. However, this may not be a viable transaction amount for crypto transfers due to network fees.

Deposit times vary for each method, with some crypto deposits processing instantly, depending on the token. Card payments take 3-5 business days and VLoad transactions also occur instantly. Withdrawal times are not specified by the broker but are usually slightly longer than deposit times for the same method.

While Sage FX plans to support bank wire transfer payments soon, popular e-wallet methods such as PayPal, Skrill and Neteller are absent entirely.

Trading Fees

Commission rates on the low spread ECN accounts are very competitive and stand at $8 per round lot traded. Swap fee rates are different for each asset and can be found through the MT4 platform.

The brokerage does not charge inactivity fees on funds held in accounts without recent activity. However, frequent deposits and withdrawals without trading activity may lead to fees or account suspension.

Deposit & Withdrawal Fees

Prospective clients will be pleased to hear that Sage FX operates a 0% deposit and withdrawal fee rate on all methods. However, crypto transfers may be subject to network gas fees, which the broker has no control over.

Security & Regulation

Sage FX is not a regulated broker and thus loses credibility as a safe service. Clients are exposed to fraud and company insolvency with no regulatory body overseeing its operations. However, the company does hold client funds in segregated bank accounts to help shield them from any solvency issues.

The broker fares better with account safety measures. The client hub supports two-factor authentication, a significant asset for preventing unauthorised account access. Security is enhanced further by the separate login information used for the MT4 platform.

Customer Support

A solid customer support team can provide speculators with the ability to trade with confidence. To this end, Sage FX operates a live chat service that is available 24/7, a dedicated support email address and an online ticket facility to submit more complex queries. However, there is no support telephone number, which may inconvenience some investors.

- Email Address: support@sagefx.com

Additionally, there is an FAQ section on the broker’s website with answers to common queries regarding account funding, demo account management, swap fee rates and much more.

Educational Content

Aside from a few brief paragraphs detailing the basics of forex and crypto trading, Sage FX does not provide any standalone educational content. This is not a huge issue, as free educational content on forex and CFD trading is commonly available online for beginners and experienced traders alike.

Advantages Of Sage FX

- 2FA

- MT4 access

- Demo trading

- STP & ECN accounts

- Leverage up to 1:500

- Crypto trading & funding

- No deposit or withdrawal fees

Disadvantages Of Sage FX

- Unregulated

- No Islamic account

- No bank deposits or withdrawals

- No free VPS or margin calculator

Promotions

While many brokers utilise promotions such as a welcome bonus or trading fee rebate to encourage new clients to their platforms, Sage FX does not offer new clients any bonuses. This is unusual for an unregulated broker, though these programs often feature confusing terms and conditions and lofty wagering requirements on bonus funds.

Additional Features

Additional features such as copy trading platform integration, free VPS access and a margin calculator are provided by many brokers to enhance the trading experience of their clients. However, Sage FX offers none of these additional components, though the MetaTrader 4 platform offers native copy trading support and an economic calendar with upcoming market news.

Trading Hours

Trading hours for Sage FX instruments follow the standard forex market hours, with the MT4 platform available to trade on 24/5. However, this schedule may differ during public holidays. In addition, some markets, such as indices and share CFDs, may be limited to their local exchange operating hours.

Users can access the client portal at any time to make deposits and withdrawals or update account information.

Sage FX Verdict

While Sage FX provides enticing features, such as crypto CFD support and high leverage capabilities, investors should exercise caution before signing up for an unregulated broker service. The broker provides useful security measures, including two-factor authentication and segregated bank accounts for client funds. However, those who seek some peace of mind may be better off with an FCA regulated forex and CFD provider.

FAQ

Is Sage FX Regulated?

Unfortunately, Sage FX does not currently hold a licence from any regulatory body. While this may be because the brokerage is still relatively new, UK traders may prefer an FCA regulated broker.

Does Sage FX Have A Minimum Deposit Amount?

Sage FX has a minimum deposit amount of $10 for all supported payment methods. However, investors may wish to deposit a significantly higher amount due to high network or gas fees for its crypto token funding options.

What Are Sage FX’s Commission Rates?

The broker levies a commission of $4 per side per lot on its ECN trades. However, Sage FX also provides an STP account for zero commission speculation.

Is The Sage FX Login Secure?

Sage FX employs two-factor authentication (2FA) to add an extra layer of security to its login portal.

Does Sage FX Offer A Welcome Bonus?

There are no promotions or sign up bonus schemes available to Sage FX clients at this time.

Top 3 Sage FX Alternatives

These brokers are the most similar to Sage FX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Sage FX Feature Comparison

| Sage FX | Swissquote | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.3 | 4.8 |

| Markets | Forex, indices, cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $10 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | Pending | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Sage FX Review |

Swissquote Review |

Interactive Brokers Review |

Pepperstone Review |

Trading Instruments Comparison

| Sage FX | Swissquote | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Sage FX vs Other Brokers

Compare Sage FX with any other broker by selecting the other broker below.

Popular Sage FX comparisons: