Rockfort Markets Review 2025

|

|

Rockfort Markets is #52 in our rankings of CFD brokers. |

| Top 3 alternatives to Rockfort Markets |

| Rockfort Markets Facts & Figures |

|---|

RockGlobal is a New Zealand based and regulated CFD broker. They offer competitive spreads from 0.1 pips and a large range of trading assets, trading platforms and educational services, with up to 1:500 leverage. Operating in a Tier 1 regulated environment, RockGlobal offers peace of mind and excellent customer support. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Options, Futures |

| Demo Account | Yes |

| Min. Deposit | $200 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSP, FMA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Rock Global offers low-price CFDs on forex, shares, indices and commodities. The broker charges zero-commission trading on commodities and indices, and zero-spread, commission-only trading on shares. Leverage varies by instrument with 1:200 available on indices and 1:10 on blue-chip stocks. |

| Leverage | 1:500 |

| FTSE Spread | 0.015% per trade |

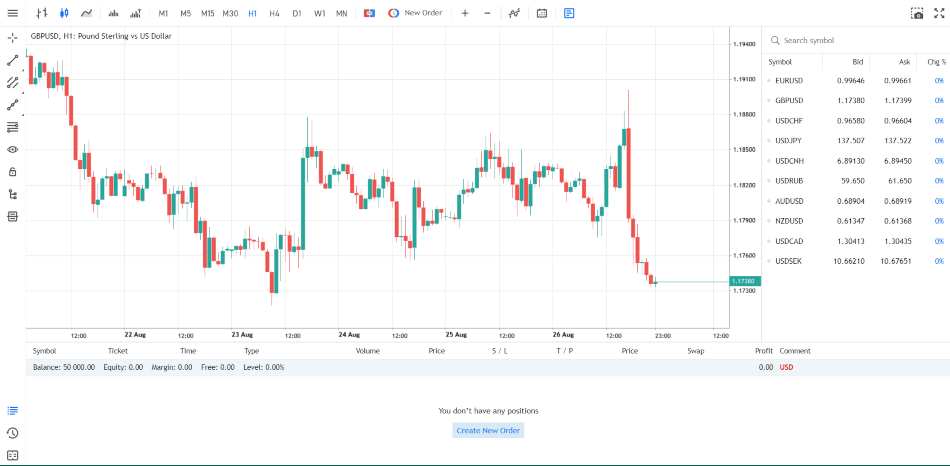

| GBPUSD Spread | 1.0 |

| Oil Spread | 0.05 |

| Stocks Spread | $0.02 per share |

| Forex | Rock Global clients can access 50+ currency pairs via CFDs with leverage up to 1:500, world class liquidity and fast execution on the MT4 or TWS platforms. The tight spreads from 0.9 with no commission are a particularly attractive feature. |

| GBPUSD Spread | 1.0 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 1.0 |

| Assets | 50 |

| Stocks | Rock Global traders can either trade company shares directly or speculate on stock markets via CFDs. The broker covers an excellent range of markets spanning Asia-Pacific, North America and Europe. Brokerage fees start at $9.95 for US shares. |

| Cryptocurrency | With just five crypto CFDs and trading only available 24/5 rather than the usual 24/7, Rock Global is not the best for dedicated crypto traders. However, there are some attractive spreads on offer from 0.62 for Litecoin and 1.24 for Ethereum. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Rockfort Markets is a New Zealand-based online shares and derivatives broker, offering CFDs, forex, futures and options from a wide selection of international exchanges. This 2025 broker review has explored crucial aspects of the firm’s offering, such as deposit and withdrawal fees, supported trading platforms and whether a demo account is available. Stay tuned to learn more about what it is like to invest with Rockfort Markets.

About Rockfort Markets

Formerly known as GPP Markets, Rockfort Markets Limited was acquired by the parent company Rockfort Holdings in 2019. It has been trading under its current company name since.

Clients can trade forex and CFDs using the MT4 platform or use the Trader Workstation (TWS) software to invest in its whole range of markets.

The Auckland-based broker is licensed as a financial services provider by the local regulatory authority in its home jurisdiction, the NZ FMA.

Asset Classes

Rockfort Markets is not limited to forex and CFD markets, with the broker also providing options, futures and investments in shares and ETFs.

Forex

The international foreign exchange, often shortened to forex, markets are some of the most popular for online traders. Rockfort Markets offers over 60 currency pairs, 49 of which are available to trade through MT4.

ECN account holders can access tight, variable spreads from 0.1 pips on major forex instruments. STP investors can trade commission-free with capped spreads starting at 0.9 pips.

CFDs

An additional 20+ CFD products are provided by the broker, spanning the indices, commodities and cryptos markets. However, this offering pales compared to the almost 9,000 single-stock and ETF CFDs available from a host of international exchanges in the UK, US, Asia and Europe.

Futures

Commodities and indices investors will be pleased to learn that Rockfort Markets customers can trade more than 200 futures contracts from 22 global exchanges.

Options

The final derivatives asset class is options trading. Clients can buy and sell options contracts through the broker and employ income strategies such as covered calls in combination with the firm’s stock investment facilities.

Shares & ETFs

Shares and ETFs from over 14 global jurisdictions are provided by Rockfort Markets, with customers able to go long or short on equities or make long-term investments.

Leverage

While many brokers that offer CFDs to UK and European clients are limited by FCA or ESMA regulations, Rockfort Markets provides leverage rates of up to 1:500 to retail investors.

Both Standard and Pro MT4 account holders can utilise this high margin. However, we found that maximum leverage for each specific market varies significantly.

Account Types

Out experts found two MT4 account types available from Rockfort Markets allow clients to speculate on 60+ forex and CFD instruments. The broker also offers a TWS account to enable clients to trade its full range of markets and asset classes.

All accounts are available as a swap-free Islamic variant for traders who cannot pay interest due to religious reasons.

MT4 Standard Account

The Rockfort Markets Standard Account utilises the STP execution style to provide zero-commission trading across the broker’s range of forex and CFD products. When we used this account, spreads started from 0.9 pips and a £170 minimum deposit was required.

MT4 Pro Account

With a £1,700+ initial minimum deposit, clients can open a Pro account with Rockfort Markets, providing users with tight-spread ECN trading. Commissions are low, starting from just £5 per round traded lot, and there is no monthly minimum activity requirement. However, a monthly inactivity fee does apply to accounts left dormant for six months or more (more on this later).

TWS Account

Despite the TWS account providing access to the vast majority of the broker’s instruments, the company website has no information on this variant. As a result, prospective clients are left entirely in the dark about minimum deposit requirements or product spreads.

However, there is information regarding the fees for the TWS account, which we will discuss in the Trading Fees section below.

Demo Account

Creating a demo account is a great way to trial a broker’s trading conditions before committing to a live account.

Rockfort Markets offers a free demo account to prospective clients, in which investors can preview either the MT4 or TWS platform using paper funds and delayed market data.

Trading Platforms

Rockfort Markets customers can choose from two supported platforms – MetaTrader 4 or Trader Workstation.

MetaTrader 4

MetaTrader 4 is widely regarded as the industry standard for forex speculation. This platform has stood the test of time since its 2005 release and remains a popular choice with traders today due to its ease of use and comprehensive device compatibility.

With nine time frames, 30 indicators and 31 graphical objects in the standard software for technical analysis, users can also add custom tools from the MQL4 marketplace. In addition, investors can download expert advisors (EAs) from the marketplace to automate their trading.

MT4 is available as a browser-based WebTrader or to download for Windows, Mac, Linux, iOS and Android.

Trader Workstation

We also found the broker to support the Trader Workstation platform for those who require access to Rockfort Markets’ non-CFD products. The software features real-time access to news, research, market data and an integrated economic calendar.

While not as beginner friendly as MetaTrader platforms, users can harness a multitude of indicators, as well as over 100 order types for precise technical analysis and trade execution.

Trader Workstation is available on Windows and Mac desktop computers or as a mobile app for Android and iOS devices.

Payment Methods

We found three supported payment options for UK traders depositing to a Rockfort Markets account. These are Visa and MasterCard credit and debit cards and SWIFT international bank transfers. Withdrawals, however, can only be made via SWIFT bank transfer.

There is no support for GBP deposits and withdrawals, leaving investors at the mercy of usually unfavourable payment provider international exchange rates. SWIFT bank transfers take 2-4 business days to clear, though card payments typically process within 1-2 hours during the week.

Deposit & Withdrawal Fees

Unfortunately, Rockfort Markets charge hefty deposit and withdrawal fees for UK traders who wish to make deposits or withdrawals in GBP.

Card deposits are subject to fees of up to 5% of the total deposit value and GBP bank deposits are subject to a £12.50 flat fee on top of further processing fees. The same flat fees are levied on withdrawals, with an additional £17 charge for payments to non-NZ bank accounts.

Trading Fees

Investors are becoming increasingly savvy about trading fees. As a result, many brokers offer low or even zero-commission trading to tempt new clients.

Commissions

Rockfort Markets offers highly competitive forex and CFD ECN commissions of just £5 per round traded lot, while STP spreads are also low.

When investing in futures, our experts found commissions to range from £6 to £2.50 per contract, varying with the exchange and the trading volume. Depending on region and order size, options contracts can be as cheap as £2 per contract.

For equities investing, Rockfort Markets levies an £8.50 per trade/ 2 pence per share commission on US stocks, with the higher value preferred. This is capped at a 1% total cost for orders over 10,000 shares. For UK equities, this climbs to an eye-watering £18 per trade, which is capped at a 0.15% total cost for trade values exceeding £50,000.

Other Fees

For accounts that have had no trading activity for six months or more and hold an account balance below £85, Rockfort Markets applies a £10 per month inactivity charge.

Swap fees for holding leveraged positions overnight vary from asset to asset. These can be found on the page for each product in the MT4 or TWS platform.

Security & Regulation

Choosing a broker regulated by a reputable body is crucial to ensuring safety in the online trading sphere.

To this end, Rockfort Markets holds a licence as a Financial Service Provider and a Derivative Issuer with the local regulator of New Zealand, the NZ FMA. Additionally, the firm holds client funds in segregated, tier-1 bank accounts and is signed up to the Financial Services Complaints scheme, to whom traders can refer complaints for an impartial ruling.

However, the broker does not support two-factor authentication, a measure that offers enhanced login protection. That being said, the MT4 platform supports 2FA.

Customer Support

Rockfort Markets provides several options for prospective clients and registered traders to contact the support team. Interested parties can use a 24/5 live chat feature on the website, email, call or message the broker on Facebook Messenger or Telegram. We found the broker’s customer service team to be responsive and helpful.

- Email Address – info@rockfortmarkets.com

- Phone Number – (+64) 9281 2012

The firm also provides a well-populated Q&A section on its website. This can help answer common queries regarding deposits and withdrawals, login issues, fund security and the two supported trading platforms.

Educational Content

Rockfort Markets offers a free and regularly updated educational content section on its website to make its service as beginner-friendly as possible. From recent market news, different asset types and investing basics, the area offers something for every level of trader.

Advantages Of Rockfort Markets

- Solid educational content

- Great leverage capabilities

- Reputable and regulated broker

- Two class-leading trading platforms

- Plenty of asset types to choose from

- Exceptional range of futures, stock and options instruments

Disadvantages Of Rockfort Markets

- No additional features

- Few payment methods

- Limited non-stock CFD products

- Massive deposit and withdrawal fees

- Missing TWS account type information

Promotions

While many brokers offer welcome offers to encourage new clients to their platform, Rockfort Markets does not offer promotions to new traders. However, the company claims that active traders can contact the firm to negotiate preferential fees on their instruments.

Additional Features

Additional features such as free VPS access, an economic calendar or trading calculators can help clients enhance their trading experience. Unfortunately, we found no such features to be provided by the firm.

Trading Hours

Forex and CFD instruments are available through Rockfort Markets 24/5, mirroring the opening hours of the larger markets. However, Trader Workstation users can invest with options and futures contracts round-the-clock, where markets permit.

Investors can log in to the client portal for account management tasks such as deposit and withdrawal at any time.

Rockfort Markets Verdict

This review has been impressed by the range of asset types offered by Rockfort Markets, with more than 20,000 total markets provided across forex, CFD, options, futures and equities. The firm is regulated, has competitive spreads and commissions and has two solid trading platforms. However, the high deposit and withdrawal charges for GBP payments are not great for UK investors. In addition, the lack of additional features, such as free VPS access or trading calculators, may also dissuade some prospective clients.

FAQ

Which Payment Methods Does Rockfort Markets Support?

UK investors are unfortunately limited to Visa and MasterCard credit and debit cards or SWIFT bank transfers for deposits. Withdrawals are only available through bank transfers.

Is Rockfort Markets Regulated?

Rockfort Markets holds two licences with the NZ FMA– one as a Financial Service Provider and another as a Derivative Issuer.

Does Rockfort Markets Offer A Demo Account?

Before signing up for a live account with Rockfort Markets, prospective clients are encouraged to open a risk-free demo account for either the MT4 or TWS platform.

Where Is Rockfort Markets Based?

Rockfort Markets is headquartered in Auckland, NZ.

What Are The Rockfort Markets Trading Fees For Forex & CFDs?

ECN account holders pay a competitive commission of £5 per round traded lot. STP traders have fees integrated into spreads, which start at 0.9 pips.

Top 3 Rockfort Markets Alternatives

These brokers are the most similar to Rockfort Markets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Rockfort Markets Feature Comparison

| Rockfort Markets | Swissquote | IG Index | IC Markets | |

|---|---|---|---|---|

| Rating | 3.6 | 4 | 4.7 | 4.8 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Options, Futures | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $200 | $1,000 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSP, FMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Rockfort Markets Review |

Swissquote Review |

IG Index Review |

IC Markets Review |

Trading Instruments Comparison

| Rockfort Markets | Swissquote | IG Index | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Rockfort Markets vs Other Brokers

Compare Rockfort Markets with any other broker by selecting the other broker below.

Popular Rockfort Markets comparisons: