RoboForex Review 2025

|

|

RoboForex is #6 in our rankings of CFD brokers. |

| Top 3 alternatives to RoboForex |

| RoboForex Facts & Figures |

|---|

RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android, R StocksTrader |

| Trading App |

RoboForex continues to excel with its wide range of iOS and Android-friendly platforms to meet short-term trading needs, including MT4 and MT5. The R StocksTrader app performed particularly well during testing, with a vast selection of stocks and ETFs, portfolio analytics, customizable watchlists, an events tracker, plus a fast and dependable mobile trading environment. The only notable absence in the RoboForex offering is the increasingly popular cTrader app, that’s favored by many traders. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | IFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping. |

| Leverage | 1:2000 |

| GBPUSD Spread | 0.4 |

| Oil Spread | 1.7 |

| Stocks Spread | 0.01 |

| Forex | RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders. |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.4 |

| Assets | 30+ |

| Stocks | RoboForex provides one of the broadest selections of real equities and stock CFDs spanning the US and 14 regional European markets, including direct access to the NASDAQ. It’s also one of the few brokers to offer a dedicated platform for stock trading, sporting leverage up to 1:20 and a robot builder that enables traders to automate and backtest stock trading strategies. |

RoboForex is an award-winning online brokerage that offers forex, CFD and equity investing services to clients both in the UK and internationally. This review will delve into the key aspects of the firm’s services, including trading platforms, account types, regulation, fee structure and transaction methods. Read on to discover whether you should register for a RoboForex trading account today.

RoboForex Ltd and its affiliates do not target EU/EEA/UK clients. Please be aware that you are able to receive investment services from a third-country firm at your own exclusive initiative only, taking all the risks involved.

About RoboForex

RoboForex Ltd. was founded in 2009, becoming regulated by Belize-based overseer the FSC in the same year, license number 000138/437, registration number 128.572.

Part of the larger RoboForex Group, the broker’s HQ and head office are in Belize and provide services to more than one million global clients. There are several account types available to cover different investing needs, each offering different execution methods, margin options and trading platforms.

The platform has received over 30 industry awards and is well known amongst online traders, aided by high-profile sponsorship deals with BMW M Motorsport and German Bundesliga side Eintracht Frankfurt.

Markets

RoboForex boasts over 12,000 total trading assets across markets such as forex, stocks and shares, commodities, and indices. These assets are available as CFDs, investable equities and ETFs.

Forex

The firm boasts more than 40 forex instruments, consisting of major, minor and exotic currency pairs. Spreads are variable for all forex assets and start at 1.4 pips on EUR/USD in STP execution type accounts and zero spread (0.0 pips) in ECN variants.

Stock & ETF CFDs

The broker claims to offer over 8,400 shares and ETF CFDs from global exchanges, including the US NASDAQ, Dow Jones (US30), UK LSE, Germany’s Deutsche Boerse and Switzerland’s SIX Swiss Exchange. The offered ETFs track groups of assets across the world from specific industries, such as health and fitness stocks and the S&P 500, or market characteristics such as volatility.

Despite this, only 50 US stocks and four ETFs are listed on the website. For these assets, spreads start at 3.0 pips when using a ProCent or Pro account, while the average ECN spread on the lowest asset is 1.0 pips.

Index CFDs

Indices are one of the most popular investment vehicles for those that wish to speculate on the economic health of a specific country or industry. RoboForex offers more than ten markets for CFD trading, including major US indices like the S&P 500 and Dow Jones, as well as the German DAX 40 and UK FTSE 100.

Spreads begin at 0.7 pips on the DAX for STP accounts, while typical spreads for ECN variants are around 0.5 pips.

Commodities

RoboForex offers 150+ commodities CFDs. Energy, soft commodity and precious metal markets are all available on the platform, with users able to invest in or speculate upon everything from wheat and coffee to gold and oil.

The gold spread is not very competitive, with Pro and ProCent accounts subject to 17.5 pips and typical spreads for ECN accounts around 9.5 pips on XAU/USD. Brent crude oil markets fare better, with typical spreads at 5.7 pips on STP accounts and 3.7 for ECN.

Equities & ETF Investing

RoboForex differentiates itself from many other forex and CFD brokers by providing traditional investing services. Over 3,000 stocks and 1,000 global ETFs are available through the platform, featuring assets from sectors as varied as technology, healthcare, finance and energy.

Trading Platforms

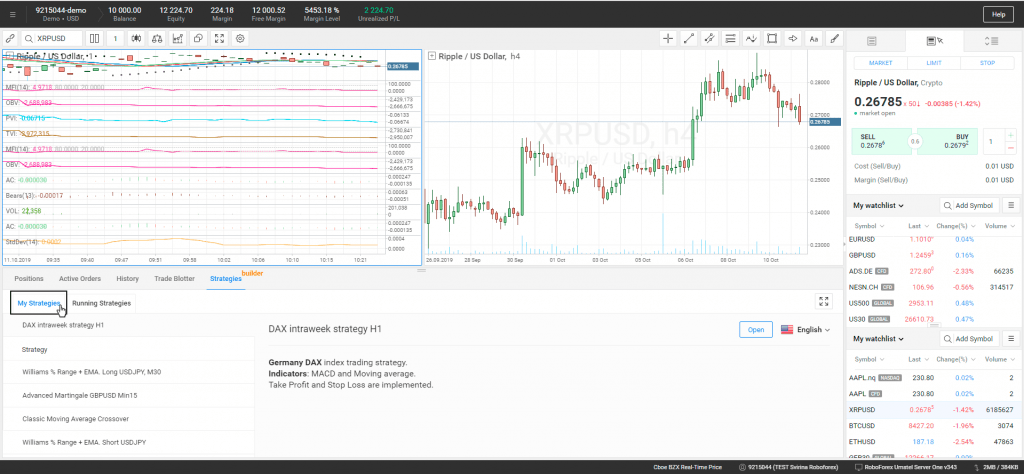

An area in which RoboForex excels is its wide variety of available trading platforms. In addition to industry favourites MetaTrader 4 and MetaTrader 5, the broker supports its proprietary trading platform, R StockTrader.

MetaTrader 4 And 5

Experienced traders and investors will likely be familiar with the MT4 and MT5 platforms. The two software packages a very popular throughout the industry due to their great customisability and seamless expert advisor (EA) integration. These platforms are available to download on Mac, PC and Linux, through the browser-based WebTrader and in mobile app form on iOS and Android (APK).

MetaTrader 5

R StocksTrader

The proprietary RoboForex trading platform is R StocksTrader, which provides access to the entire 12,000+ assets offered by the broker. Suitable for CFD speculation and global stock and ETF investing, this platform is available as a browser-based WebTrader or as an app on Android and iOS devices.

R StocksTrader

Leverage

Many brokers are limited in the leverage rates they can offer clients due to stringent regulations from overseers like the UK FCA. However, as the FSC regulates RoboForex, the platform’s maximum leverage is significantly higher than domestically regulated brokers.

The amount of margin available through the firm depends on the specific market and the account type used for trading. The brokerage provides a margin calculator so that you can quickly compute the leverage available and what it means for the margin call and stop out level of each position.

Clients with a Pro or ProCent account can access up to 1:2,000 leverage on forex currency pairs. ECN account holders can access leverage up to 1:500. R StockTrader and Prime account users are also restricted to 1:300 leverage on forex.

For other trading assets, leverage is universal to all account types. For example, when investing with stock and ETF CFDs, the maximum leverage is 1:20, while the whole selection of global indices supports a margin of 1:100. Commodities like gold are subject to a maximum margin of 1:20.

Account Types

RoboForex offers five distinct live account types, each catering to a specific trading need. These accounts vary in numerous aspects, such as deposit bonus, rebate eligibility, available assets, execution type and leverage.

Prime Account

- Spreads from 0.00 pips

- 28 currency pairs

- US stock, index, and hard commodity CFDs

- $10 per lot round turn commission

- 1:300 maximum forex leverage

- USD, EUR & gold base currencies

- MT4, MT5 & RoboForex WebTrader

- $10 minimum deposit

- No deposit bonuses

- All loyalty offers

- ECN execution

ECN Account

- Spreads from 0.00 pips

- USD, EUR, CNY & gold base currencies

- 36 currency pairs

- ECN execution

- $20 per lot round turn commission

- MT4, MT5, RoboForex WebTrader

- 1:500 maximum leverage

- $10 minimum deposit

- US stock, index, hard commodity CFDs

- No deposit bonuses

- All loyalty offers

R StocksTrader Account

- R StocksTrader

- ECN execution

- $100 minimum deposit

- Spreads from 0.01 pips

- 1:300 maximum leverage

- All 12,000+ assets

- $15 per lot round turn commission

- USD & EUR base currencies

- No deposit bonuses

- No loyalty offers

ProCent Account

- MT4, MT5 & RoboForex WebTrader

- 36 currency pairs

- Precious metal CFDs

- Spreads from 1.3 pips

- STP execution

- 1:2,000 maximum leverage

- All deposit bonuses

- All loyalty offers

- USD, EUR, CNY & gold base currencies

- No commissions

- $10 minimum deposit

Pro Account

- MT4, MT5, RoboForex WebTrader

- $10 minimum deposit

- All deposit bonuses

- All loyalty offers

- Spreads from 1.3 pips

- 36 currency pairs

- US stock, index, and hard commodity CFDs

- 1:2,000 maximum leverage

- USD, EUR, CNY & gold base currencies

- STP execution

- No commissions

Islamic Account

RoboForex caters to the many clients who cannot receive or pay interest by providing a swap-free variant of its Pro and ProCent accounts. To set up an Islamic account, prospective clients must contact customer support through the live chat system.

Demo Account

Whether you want to gain more experience in the markets or are looking to test new trading strategies or algorithms, a risk-free demo account is an invaluable weapon in your arsenal. RoboForex provides three types of demo accounts for paper trading: the Demo Pro, Demo ECN and Demo R StocksTrader accounts, each styled after its live counterpart. We would recommend that you open a demo account with the broker before a live one, so you can ensure the services are to your liking.

Trading Fees

The trading fees levied by a particular broker often have a decisive impact on the firm’s feasibility. The RoboForex platform offers both ECN and STP execution-style accounts, providing users with the choice between lower spreads and zero commission trading.

ECN commission starts at $10 per round lot in the Prime account and can reach up to $20 per round lot for the pure ECN account. However, rebates are offered on commissions and broker profits from STP trades. There is no commission charged on stock and ETF investments.

Swap fees for holding positions overnight vary from asset to asset but details can be found on the website or any supported trading platform. There are no inactivity fees levied on accounts, regardless of when the last login or trade occurred.

Deposit & Withdrawal Fees

While all RoboForex wallet deposit options are free from charges, several withdrawal methods are subject to fees. For example, SEPA bank withdrawals levy a 1.5% commission and Visa withdrawals cost 2.6% plus a $1.30 flat fee. Skrill and Neteller fees are 1% and 1.9%, respectively.

However, on the first and third Tuesday of every month, the broker runs a free withdrawal promotion in which clients can make one transaction with any supported payment method with no fees.

Payment Methods

Clients that wish to deposit to their RoboForex wallet directly with GBP are quite restricted. The only supported payment methods are AstroPay, AdvCash and Visa or MasterCard credit and debit cards; PayPal is a notable omission. While traders that make transactions in either EUR or USD have far more deposit and withdrawal methods, their payments will likely be subject to unfavourable exchange rates or even significant fees.

Deposits can take between one and three days to process, depending on the payment method, while withdrawal times across the board sit as low as one working day.

Minimum deposits start at $10 or equivalent, though minimum withdrawals are as low as $1 with specific methods.

Security & Regulation

Safety is the most crucial consideration for many investors when looking for a broker as scams are rife within the CFD and investment sphere.

RoboForex is a popular and reputable broker with over ten years of trading experience and more than a million global clients. However, the firm’s regulation by the Financial Services Commission (FSC) leaves something to be desired, with the regulator not providing the protection of a tier 1 body such as the UK FCA.

That being said, the firm does take several measures to protect its traders, such as negative balance protection, an anti-fraud system and stringent KYC identity verification checks. The broker is also signed up to a fund protection scheme that covers up to €20,000 per client. Additionally, clients can set up two-factor authentication (2FA) to further protect their accounts.

Note, the company’s license number is 000138/437.

Customer Support

Whether you have a general inquiry like how to register for a real account or a time-sensitive trading issue like a login problem, RoboForex provides several help options for fast and effective assistance.

In lieu of contacting the broker’s Belize headquarters directly, support is available via a 24/7 phone helpline, messaging apps including Telegram and WhatsApp, an email contact form and a live chat facility.

Users can often find answers to more straightforward queries on the website forum or FAQ section, such as how to delete an account, information on upcoming trading competitions and trading platform guides.

- Phone: +65 3158 8389

The firm’s headquarters address is 2118 Guava Street, Belama Phase 1, Belize City, Belize.

Educational Content

In addition to the aforementioned forum, RoboForex has a dedicated education section. This area is designed to help traders decide which account and trading platform are best for them, detailing the pros and cons of the MT4 and MT5 offerings.

Unfortunately, the investing education offering is very brief. It does not cover many of the basics required to trade CFDs effectively, such as technical analysis. However, additional resources are available to those with a fully registered trading account.

Promotions

Many brokers in the forex and CFD industry use promotions to entice new clients to sign up to their platform or existing customers to deposit more funds. RoboForex runs several such promotions, including a welcome bonus, deposit match offer, trading commission rebate program and a free monthly giveaway, though the broker does not offer a no deposit bonus.

The welcome offer is a free $30 bonus that clients earn upon completing KYC verification and depositing $10 or equivalent via credit or debit card. Often referred to as the “30 bonus”, this initial deposit promotion is followed up by the profit share bonus and classic bonus for subsequent deposits. All of these schemes feature important terms and conditions that involve wagering requirements and withdrawal restrictions, so ensure you understand what each bonus entails before committing to it.

Investors can receive up to 15% cashback on company revenue from spreads and commissions through the broker’s rebate program, with the percentage refunded based on trading volume. While the free monthly giveaway celebrating RoboForex’s 11th birthday ended in April 2022, the firm runs a monthly demo contest with a prize pool of $6,000 shared amongst the top-performing clients.

Additional Features

RoboForex offers clients several additional functionalities, including a margin calculator to preview positions and liability, free VPS access, a blog and both EA Wizard and StrategyQuant, the firm’s EA creator and analytics tools. Clients can also partake in copy trading through the CopyFX platform, which works similarly to ZuluTrade. This allows you to imitate the positions of successful investors and traders, taking much of the manual labour out of investing.

Trading Hours

While RoboForex clients can login to their accounts, monitor positions and make wallet transactions at any time, open asset trading hours differ from market to market. The broker’s forex and CFD trading hours run 24/5, excluding holidays, while stocks, indices and ETF investments are available during their local exchange opening times.

RoboForex Verdict

With over ten years of industry experience and more than 12,000 trading instruments, RoboForex is an appealing brokerage firm. Clients of all forms are well supported, with both STP and ECN accounts, derivatives and investment products and four popular trading platforms. Many may also be enticed by the wide range of promotions and bonus programs, low minimum deposits, massive leverage rates or the free VPS. However, the firm does impose relatively high trading commissions and limits base currencies to USD, EUR, CNY and gold.

FAQ

Is RoboForex A Good Broker?

RoboForex is a substantial online investing broker for UK clients, boasting thousands of derivatives and investment assets, several renowned trading platforms, leverage rates of up to 1:2,000 and an array of bonus schemes and extra features.

What Execution Types Does RoboForex Offer?

RoboForex clients can open one of several account types, incorporating both STP and ECN execution styles. This means that you can benefit from either zero-commission investing or raw-spread trading.

Does RoboForex Allow Hedging?

Yes, RoboForex allows hedging and several of its trading platforms have inbuilt tools to make this easier.

Does RoboForex Support PayPal?

Unfortunately, the RoboForex wallet payment methods do not include PayPal. However, alternative e-wallet services Skrill and Neteller are supported.

Is There A RoboForex Demo Contest?

Every month, RoboForex clients can compete in a demo contest and win up to $800 with no wagering requirements.

Top 3 RoboForex Alternatives

These brokers are the most similar to RoboForex:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

RoboForex Feature Comparison

| RoboForex | Pepperstone | IC Markets | Vantage FX | |

|---|---|---|---|---|

| Rating | 4.5 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting |

| Minimum Deposit | $10 | $0 | $200 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | IFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | FCA, ASIC, FSCA, VFSC |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:2000 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:500 |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | RoboForex Review |

Pepperstone Review |

IC Markets Review |

Vantage FX Review |

Trading Instruments Comparison

| RoboForex | Pepperstone | IC Markets | Vantage FX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Futures | Yes | No | Yes | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

RoboForex vs Other Brokers

Compare RoboForex with any other broker by selecting the other broker below.

Popular RoboForex comparisons: