Robo-Advisors

Brokers with robo-advisors automatically invest their clients’ money based on straightforward questionnaires. With no human intervention, these automated trading platforms offer a hands-off approach to online investing. This guide lists the best robo-advisor brokerage accounts in the UK, considering performance and average returns, fees and costs, plus key pros and cons.

Top Brokers With Robo-Advisors

-

Upon evaluating IG's robo-advisor, we discovered its rare transparency among automated tools. The clear fee structure was approximately 0.65% annually, with no concealed rebalancing costs. Portfolios offered broad ETF diversification, with risk levels adapting responsively to market volatility—an area where many "smart" advisors falter.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Upon detailed review, Interactive Brokers’ robo advisor, IBKR Automated Portfolio, excelled in accuracy and affordability. With a management fee of only 0.20%, it's one of the most cost-effective options. It features automated rebalancing and tax-loss harvesting. The portfolio allocation is truly data-driven, adapting to market changes rather than adhering to fixed models.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Swissquote's robo advisor excelled in personalisation. Rather than standard ETF combinations, it adjusts portfolios with real-time data and user-selected themes, such as sustainability or technology. Fees were about 0.75% per year, but its dynamic rebalancing and clarity offered a private-bank feel over automation.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA CFXD, MT4, MT5, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $1,000 0.01 Lots 1:30 -

In our evaluation, SimpleFX lacked a traditional robo-advisor but provided semi-automated portfolio tools that were quite effective. Traders can use strategy templates that adapt automatically to market trends and risk levels. This streamlined, economical model incurs no management fees, perfect for those favouring active control with algorithmic assistance.

Instruments Regulator Platforms CFDs, Forex, Indices, Stocks, Commodities, Cryptos FSC WebTrader, MT4 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:1000

Safety Comparison

Compare how safe the Robo-Advisors are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Swissquote | ✔ | ✔ | ✘ | ✔ | |

| SimpleFX | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Robo-Advisors support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Swissquote | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| SimpleFX | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Robo-Advisors at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Swissquote | iOS & Android | ✘ | ||

| SimpleFX | iOS, Android + WebTrader | ✘ |

Beginners Comparison

Are the Robo-Advisors good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Swissquote | ✔ | $1,000 | 0.01 Lots | ||

| SimpleFX | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Robo-Advisors offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Swissquote | Expert Advisors (EAs) on MetaTrader and FIX API solutions | ✘ | 1:30 | ✘ | ✔ | ✔ | ✘ |

| SimpleFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:1000 | ✘ | ✔ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Robo-Advisors.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IG | |||||||||

| Interactive Brokers | |||||||||

| Swissquote | |||||||||

| SimpleFX |

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On Swissquote

"Swissquote is ideal for traders seeking a tailor-made platform, like its CXFD, which incorporates Autochartist for automated chart analysis to support trading decisions. Yet, its moderate fees and high $1,000 minimum deposit could deter novice traders."

Pros

- Swissquote offers robust platforms for traders, including MetaTrader 4/5 and its proprietary CFXD (formerly Advanced Trader). During testing, these platforms stood out with their adaptable layouts, advanced charting tools, and comprehensive technical indicators.

- Swissquote offers sophisticated research tools such as Autochartist for technical analysis and real-time news from Dow Jones. The firm's exclusive Market Talk videos and Morning News provide daily expert insights, catering to active traders.

- Swissquote is designed for rapid trading strategies, including scalping and high-frequency approaches. With an average execution speed of 9ms and a 98% fill ratio, it also supports FIX API.

Cons

- Swissquote focuses on serving professional and high-net-worth clients, requiring substantial initial deposits, such as $1,000 for Standard accounts. This approach is less favourable for smaller traders who prefer brokers offering higher leverage and no deposit requirements.

- Analysis indicates that Swissquote's charges are relatively high. Forex spreads on Standard accounts begin at 1.3 pips, whereas brokers such as Pepperstone or IC Markets offer starting spreads of 0.0 pips. Additionally, transaction fees for non-Swiss stocks and ETFs could accumulate significantly for active traders.

- Unlike brokers like eToro that offer social trading capabilities, Swissquote does not provide tools for community interaction or replicating successful traders. This absence can reduce its attractiveness to those who prioritise peer-to-peer learning.

Our Take On SimpleFX

"SimpleFX is perfect for those wishing to deposit, trade, and withdraw in popular cryptocurrencies like Bitcoin and Ethereum. It also introduces its own SimpleFX Coin, offering rebates and exclusive benefits to holders."

Pros

- In 2021, SimpleFX refreshed its platform, introducing a more streamlined client area with improved load speeds. It also launched a social trading community for idea exchange.

- With leverage reaching 1:1000, traders can significantly boost their positions. This offers increased market exposure and the chance for amplified profits or losses.

- The variety of cryptocurrencies for trading includes popular choices like ADA, BTC, and ETH, alongside niche options such as YFI, YFII, and ZEC.

Cons

- SimpleFX functions with limited regulatory oversight, enabling it to provide high leverage. This means it is subject to less stringent scrutiny from regulators than brokers such as IG, which operate under strict regulatory environments.

- The limited availability of non-crypto funding methods is a drawback for traders who prefer more diverse and convenient ways to manage their accounts.

- The educational resources are adequate but could be improved. The 'Opinion' section requires more frequent updates. Adding video tutorials on market analysis and risk management would greatly benefit novice traders.

What’s A Robo-Advisor?

The concept of a robo-advisor originated back in 2005 from the fintech company, Mint. To reduce the reliance on in-person financial consultant meetings, a semi-automated finance management system was developed.

In 2008, these systems and business models were made available for day-to-day investors. In the years following, the evolution of these tools saw numerous platforms being introduced to the investing landscape, including IG, eToro, Fidelity, Betterment and Wealthfront.

It is estimated that the number of assets managed by the robo-advisor industry reached almost $1 trillion in 2020, with forecasted expectations that this will reach $3 trillion by 2025. Today it has become a global concept, with traders being able to access bespoke platforms in many countries worldwide, including the UK.

The largest financial management system is Vanguard Personal Advisor Services with over $200 billion in assets under management (AUM) valuations. However, there are good robo-advisor alternatives to Vanguard.

How Does A Robo-Advisor Work?

Robo-advisors are digital platforms that provide algorithm-based, automated financial services to traders with minimal human interaction. After providing initial investment goals, risk adherence, financial comparisons and preferred trading styles, clients can choose one of the broker’s bespoke investment plans. Growth charts and trading suggestions, such as ESG stock picking, are then generated using the latest market news and forward projections.

Investors are often recommended an asset allocation of index funds, government bonds and emerging markets in varied weightings, meaning a more stable potential for income returns. Of course, no robo-advisor has the power to predict exactly what will happen in the financial market, but it can provide a starting point for new investors or those looking to develop an existing portfolio. Traders can then instruct the system to invest capital according to these recommendations and track record.

Once an investment plan is established, robo-advisors continue to monitor portfolios to ensure that the optimal asset weightings are maintained and reflective of market movements. Many of the top brokers with robo-advisors allow traders of all capabilities access to low-cost investment support.

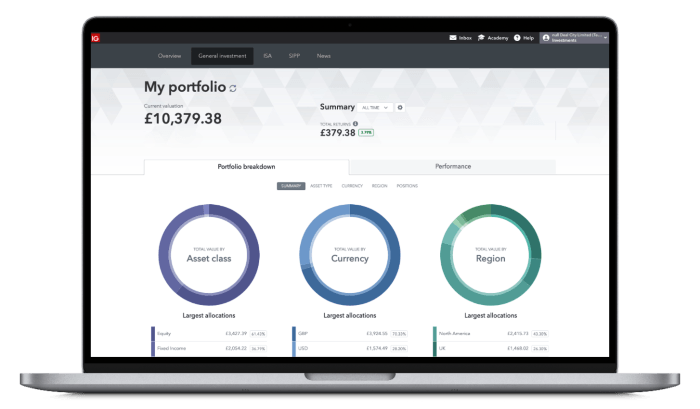

IG Smart Portfolio

Getting Started

There are various robo-advisors to choose from depending on your trading and investment goals. You should determine the types of financial advice and services that you require first. Most will automatically manage your portfolio, however, some offer added benefits such as financial planning, career advice and budgeting.

Once you have found one that will support your strategy, it is time to invest. The best robo-advisor brokerage sites will offer step-by-step guidance, but we have outlined the generic process below to help you get started:

- Complete Questionnaire – Robo-advisors begin by asking a selection of questions to determine your goals. This may include your financial commitments, risk appetite and reason for investment.

- Portfolio Construction – Using your answers from the initial questions, the platform will curate a trading plan. It may suggest you are a cautious investor or an aggressive trader willing to risk capital for a higher return potential.

- Confirm Goal-Based Investing Plan – Once you are happy with the plan, invest your money. Some advisors will have minimum investment amounts. Remember, no trading plan guarantees a return so only invest the maximum amount you are willing to lose.

- Monitor – The robo-advisor will manage your portfolio on an ongoing basis. Auto rebalancing is a common feature so fluctuations impacting an asset may be swapped for a reduced-risk alternative. Customers can request regular reporting to track the performance of investments.

Advantages Of Robo-Advisors

- Lower Cost – A significant advantage of using robo-advisors is that they are a lower-cost alternative to traditional in-person support. Reducing the requirement for human interaction has enabled brokers and financial platforms to host the same services for a reduced fee. Many robo-advisors implement a flat fee based on annual asset values managed (typically averaging 0.5%). This is significantly less than many personal finance managers who can charge anywhere up to 5% of investment values.

- Accessibility – Online robo-advisors can be accessed 24 hours a day, 7 days a week with no downtime or ‘working hours’ availability. If you have an internet connection, you can access the system and retrieve investment recommendations wherever you are. Platforms with low-cost infrastructure also enable auto-management capabilities for those starting with lower upfront capital.

- Easy To Use – Platforms can create clear investment pathways for new and inexperienced traders. Simple questionnaires can quickly determine a strategy without the need for a full understanding of the complex investment options available. The best firms with robo-advisors also provide simple weighting tools and statistics so you can implement changes and tweak the pre-suggested portfolio at any time.

- Spread Portfolio – Robo-advisors allow traders to access a strategic spread of assets, as they use mathematical algorithms and artificial intelligence (AI) to select optimum investment portfolios. By distributing funds across various asset classes, clients can reduce their exposure to risk from volatility in a particular market.

- Reduction Of Error – Robo-advisors not only make suggestions for investments but routinely react to market movements. As the program is always working in the background, there is no need for a trader to be constantly monitoring their portfolio. The hands-off approach can also reduce the likelihood of human error and counteract hasty reactions.

Limitations Of Robo-Advisors

Traders should also be aware of some key negatives of using robo-advisors vs ‘DIY’ or self-directed investing:

- Longer Outlook – Investors wishing to benefit from short-term wins may be disappointed when implementing the services of an automated wealth management system. Portfolios are typically designed for more dependable long-term growth strategies using stable markets, such as global index baskets and government bonds.

- Limited Advice – Investors may be reluctant to fully step away from human interaction for advice. Look for brokers offering a robo-advisor with a hybrid customer service element so you can speak to someone if needed.

- Fees – Brokers that offer robo-advisors will publish the fee schedule to implement the tool. These charges typically range from 0.15% to 0.50% of the assets under management (AUM). Set-up fees may also be applicable for new users. Although auto-managed platforms may be a great starting point for new traders, they may become expensive, particularly when investing in small amounts.

- Restricted Freedom – Utilising a robo-advisor can take away some of the fun of investing. Some traders prefer to be involved in the selection of assets based on their interests and experience level.

Top-Rated Robo-Advisors Reviewed

Below we review two of the most popular robo-advisor services available to investors in the UK, including their fees, features and minimum account funding requirements.

IG

Leading online trading provider, IG index, offers fully managed Smart Portfolios designed and curated by BlackRock, the world’s largest asset manager.

With a management fee of just 0.5% (capped at £250 per year), traders can choose from five different robo-advisor portfolios tailored for defined risk appetites.

As one of the market’s most notable success stories in offering low fees, IG clients can expect just a 0.72% estimated annual cost, based on a £40,000 investment. In comparison, you can expect to pay up to 1.04% with competitors such as Wealthify, Nutmeg and Moneyfarm.

eToro

Founded in 2007, eToro is an investment and social trading company regulated in multiple jurisdictions, including the UK. Known as Smart Portfolios, eToro’s robo-advisor solution offers long-term investment portfolios.

There is a range of individual funds and dividend stocks, covering various sectors, regions and asset classes. These include socially responsible and innovative technology portfolios, among others.

The minimum investment amount is £500 so you don’t have to be a high-net-worth client to invest. Additionally, there are no management fees or commissions, other than those applied to individual assets.

How To Choose The Best Robo-Advisor

Below we outline the key attributes to look for when reviewing the best brokerage accounts with robo-advisors:

Minimum Investment

You may need to invest a large sum upfront, as per the robo-advisor’s minimum account balance requirements. The starting amount can range from £10 to over £100,000.

Make sure that you do not invest more than you can afford.

Pricing

Fees are a key differentiator when deciding the best robo-advisor. Traders should look for a service that balances simplicity with low fees. Look out for advisory charges as well as fees for investing in individual ETFs. Commonly, most brokers will offer a fixed but competitive annual management fee based on the percentage of assets invested.

It is also worth checking the associated expense ratios, as these can quickly build up. Some robo-advisors will use proprietary ETFs. Well-known brands such as eToro and IG are widely used in the UK and known to be low-cost. Newer companies, however, may have low liquidity which can result in higher risk and a lack of historical return data.

Assets

The best brokers with robo-advisors provide a range of investment assets to create a tailored portfolio. This can include cryptocurrency, real estate and proprietary ETFs.

Spreading your funds across a range of asset classes can create diversification, however, this can come at the cost of increased management fees.

Platform Integration

It is worth checking the functionality of platform integration with your broker. Some allow you to maintain one profile where you can enjoy seamless visibility between live investment opportunities. Being able to track automated investments alongside day-to-day trading activities through one dashboard can ultimately save you time.

Before opening a live account with a robo-advisor, make sure you understand your broker’s capabilities to link external software, mobile web apps and supported tools.

Services & Support

Investing significant volumes in volatile markets can feel uncomfortable, so access to human interaction can be key. The best robo-advisor brokerage accounts will provide a customer support element so you can speak to a person if required. Be aware that higher management charges or a one-time fee may be applicable if a consultation is required.

Other services to consider include tax-loss harvesting, auto-rebalancing and budgeting advice.

UK License

Robo-advisors are typically subject to the regulations and laws of a traditional brokerage. Robo-advisor platforms developed in the UK, for example, must register with the Financial Conduct Authority (FCA).

Look out for those with access to insurance schemes, such as the Financial Services Compensation Scheme (FSCS), as this may cover your invested capital value in the case of business insolvency.

Note that whilst robo-advisors offered by regulated brokers are arguably safer to use than their unregulated counterparts, they cannot guarantee any higher returns than traditional trading methods.

Bottom Line On Brokers With Robo-Advisors

Opening a brokerage account with a robo-advisor can help clients looking for a more hands-off approach to online investing. Platforms can provide a tailored asset portfolio to meet medium to long-term financial goals. Many top brokers also offer a human hybrid approach with a stable communication stream, as they facilitate trading with more control and support.

Choosing between the best brokers with robo-advisors can seem complex, however, those with a low fee structure, diversified asset offering, the highest historical returns, UK regulation, good trust rating, and low minimum account balance should be the stand-out choices. See our rankings of the best brokers with robo-advisors to get started.

FAQ

Do Brokers With Robo-Advisors Have A Minimum Investment?

Yes – this varies by broker and robo-advisor but can start from just £10. At the other end of the scale, some robo-advisors require upwards of £100,000.

Note that no automated strategy can guarantee a profit so only invest what you can afford to lose.

How Do I Choose The Best Robo-Advisor?

Key factors to compare are annual advisory fees, FCA regulation, human interaction, minimum investment requirements, promotions and sign-up bonuses, plus access to a diverse range of assets, from stock markets, bonds and mutual funds to cryptos and real estate.

With that said, the best robo-advisor brokerage account will ultimately come down to personal preference.

Are Robo-Advisors Suitable For Beginners?

Brokers with robo-advisors can be suitable for new investors. Automated platforms can simplify the complex trading environment and provide tailored suggestions based on personal goals, capital requirements, and risk appetite. For instance, the best individual stocks for dividends to invest in for retirement.

Are Robo-Advisors Good Or Bad?

Brokers offering robo-advisor platforms may be suitable for investors looking for a hands-off approach to trading. However, automated investment services typically take a longer-term outlook so could be used alongside a traditional approach to short-term trading. This will give you the flexibility to trade specific forex or Bitcoin trends with a human touch and without the risks associated with robo-advisors. With that said, self-directed trading does not necessarily mean better rates, results or customer journey.

Are Robo-Advisors Safe To Use?

Robo-advisors cannot guarantee returns – your capital is at risk. However, for a more secure investing experience, look for brokers with robo-advisors that are regulated by top-tier authorities, such as the Financial Conduct Authority (FCA).