Robinhood Review 2025

See the top 3 alternatives to Robinhood or the best UK brokers list for options.

|

|

Robinhood is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Robinhood |

| Robinhood Facts & Figures |

|---|

Robinhood is a stock broker and financial services firm based in California. The broker offers commission-free stocks, cryptos and ETFs, plus other products such as cash cards and retirement accounts. Despite its robust regulation, Robinhood has been involved in numerous scandals and security breaches since 2020. We urge investors to exercise caution. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs, ADRs |

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | $1 |

| Regulated By | FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | No |

| Islamic Account | No |

| Stocks | Robinhood offers thousands of stocks, ETFs and options, as well as fractional shares and IPOs. However, investors should take care when investing in stocks with this broker. |

Robinhood is a well-known American investing platform that has launched operations in the UK. In this Robinhood review, I evaluate the trading app to find out how it compares to other UK brokers.

Our Take

- Robinhood will best serve new investors looking to trade 6000+ US markets on a user-friendly app.

- The app delivers an excellent mobile trading experience with helpful research and stock discovery tools, though it lacks the advanced charting features found at alternatives like AvaTrade.

- The pricing model is transparent with zero commissions, zero inactivity fees and an accessible $1 minimum investment.

- The firm is regulated by the FCA in the UK, though its track record of regulatory fines for misleading customers means it doesn’t earn the trust of our experts.

Is Robinhood Regulated In The UK?

Robinhood UK Ltd is regulated by the Financial Conduct Authority (FCA). The FCA maintains its position as one of the most respected financial regulators in the world, setting the highest standard of safeguarding for retail investors.

Additionally, UK clients will still be protected under the US Securities Investor Protection Corporation (SIPC) compensation scheme, which covers clients up to $500,000.

Looking at the negatives, our research reveals questionable trading practices since the platform launched in 2015. The firm was handed a $70 million fine by the US Financial Industry Regulatory Authority (FINRA) for misleading customers on multiple issues, including how much money they had in their accounts and whether they could trade on margin, costing clients over $7 million.

As a result, it doesn’t rival our most trusted UK brokers like Pepperstone, which continues to hold an excellent reputation and a clean track record with no major regulatory breaches.

Investment Offering

Robinhood offers a decent range of investments, especially if you want to trade US-listed stocks and American Depositary Receipts (ADRs).

It’s also good to see that both whole shares and fractional shares are supported, catering to those on a budget.

You can expect popular equities including TSLA, AMZN and AAPL, plus a range of ETFs covering indexes, commodities, real estate and more.

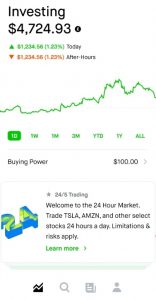

Additionally, Robinhood’s unique 24 Hour Market feature allows you to place limit orders on 150 of the most popular stocks around the clock. Serious investors can uncover opportunities from 1:00 am on Monday to 1:00 am on Sunday (GMT).

There’s also the opportunity to earn 5% AER on uninvested cash under the broker’s cash sweep program, which is insured for up to $2.25 million.

However, where Robinhood falls short is access to UK and European markets, which we would like to see in the future. As you can see from my analysis below, the top brokers provide access to US stocks as well as UK and European equities.

| Robinhood | Interacative Investor | IG | |

|---|---|---|---|

| Number of Assets | 6,000+ | 40,000+ | 17,000+ |

| US Stocks | Yes | Yes | Yes |

| UK Stocks | No | Yes | Yes |

| European Stocks | No | Yes | Yes |

Fees

Robinhood offers competitive fees, especially for beginners looking for a straightforward pricing model with zero commissions.

UK clients can convert between GBP and USD when they deposit or withdraw from their account, with a small 0.03% third-party charge.

Additionally, you can start investing with as little as $1 while there are no minimum balance requirements or inactivity fees, catering to casual investors.

With that said, there are other fees to be aware of, most of which are industry-standard and set by US exchanges and regulations. I’ve listed the key charges below:

- Regulatory Fee: $8.00 per $1,000,000 of principal (sells only), rounded to the nearest penny

- Trading Activity Fee: $0.000166 per share (sells only), rounded to the nearest penny

- Stock transfers ACATS (outgoing): $100

- Margin rate: 12%

I have compared Robinhood’s fees with suitable alternatives in the UK below, and as you can see, it offers competitive pricing.

| Robinhood | Interactive Investor | IG | |

|---|---|---|---|

| Stock Commission | £0 | £3.99 | £0 or £10 if <3 trades/month |

| Foreign Exchange Fee | 0% | 1.5% | 0.5% |

| Inactivity Fee | £0 | £0 | £12 |

Trading App

The Robinhood app is best for beginners looking for a user-friendly, one-stop shop for their investing needs.

You can access the broker’s stock trading platform via the web portal or via the downloadable iOS/Android mobile app.

Where the platform excels is its clean, intuitive interface which I find easy to navigate. The charts are also sleek, offering real-time data alongside various analysis tools.

That said, it lacks the large selection of 90+ indicators offered by alternative apps like AvaTradeGO, making Robinhood less suitable for advanced traders interested in technical analysis.

Notably, the platform delivers strong research and stock discovery tools which can help with finding trading opportunities. I’ve pulled out the key features which I think elevate the investing experience:

- Newsfeed and company data: There’s an excellent array of fundamental data available, including market cap and volume, plus an extensive newsfeed covering headlines around the clock.

- Analyst insights: You can access comprehensive market commentary from Wall Street analysts and top third-party research sources, including Morningstar.

- Categorised stock searching: It’s straightforward to discover new stocks using the platform’s Collections tool – with handy sector categorisation and sorting features.

Education

Robinhood is clearly committed to providing accessible education for self-directed investors in the UK.

I have been impressed with the comprehensive library of in-app tools within Learn, including articles and tutorials.

Resources are geared towards all experience levels, although the beginner-level content, in particular, is of a high standard and noticeably better than rivals like Freetrade.

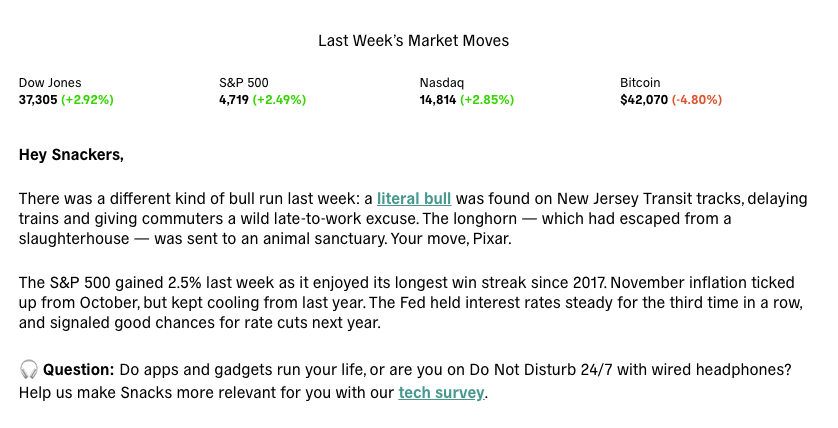

Another useful feature is the ‘Snacks’ newsletter, which delivers digestible financial news directly to your inbox. The content is engaging and presents market news in an informal and fun way.

Helpfully, it also simplifies investment jargon for novice traders by including integrated quizzes, key takeaways, and fun facts.

Snacks

Customer Support

Robinhood offers around-the-clock customer support to UK traders.

Unlike many brokers, Robinhood’s customer service team is available 24/7 on both the web platform and mobile app.

I have been pretty impressed with the service overall, which is available via live chat or telephone (by requesting a call only).

There’s also a comprehensive help centre covering a range of technical issues and account queries, including how to sign up and documents you need to send.

Should You Invest With Robinhood?

Robinhood offers a compelling trading app for aspiring investors in the UK. There are thousands of US stocks and ADRs available while fees are lower than many competitors with no GBP to USD exchange fees and zero commissions.

The web and mobile investment platforms are simple but offer enough resources to keep new traders informed about the markets. The broker’s commitment to expanding its learning resources and regular market newsletters is also a bonus.

Yet despite its strengths and FCA oversight, the company’s regulatory issues and reputation for harming customers cannot be overlooked in our opinion.

FAQ

Is Robinhood Safe For UK Investors?

Robinhood UK is regulated by the FCA and offers SIPC protection which means British traders will receive some of the strongest regulatory safeguards. However, the firm’s questionable trading practices and regulatory breaches raise serious safety concerns for us.

Does Robinhood UK Offer Low Fees?

Robinhood is a low-cost stock broker. The brokerage offers commission-free trading while new traders can get started with just $1. The Robinhood app also offers flexible account funding, with no exchange fees charged on GBP to USD transactions.

Is Robinhood Suitable For Beginners?

Yes, Robinhood is suitable for beginners, which its trading products have largely been designed for. There is a strong suite of educational and research tools to help aspiring traders discover market opportunities. The app is also super easy to learn with straightforward navigation and beginner-friendly features and guides.

Is Robinhood Good Or Bad For UK Traders?

Robinhood offers an attractive package for UK traders, with FCA authorisation, 6000+ US stocks and ADRs, zero commissions and a user-friendly app. However, it lacks a clean track record, advanced analysis tools and access to UK and European markets offered by the best brokers in the UK.

Article Sources

Robinhood U.K. Ltd – FCA License

Robinhood Fine 2021 – Financial Industry Regulatory Authority (FINRA)

Top 3 Robinhood Alternatives

These brokers are the most similar to Robinhood:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Robinhood Feature Comparison

| Robinhood | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| Rating | 0.9 | 4.3 | 4.7 | 4 |

| Markets | Stocks, ETFs, ADRs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $0 | $0 | $0 | $1,000 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | - | - | MT4 | MT4, MT5 |

| Leverage | - | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Robinhood Review |

Interactive Brokers Review |

IG Index Review |

Swissquote Review |

Trading Instruments Comparison

| Robinhood | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

Robinhood vs Other Brokers

Compare Robinhood with any other broker by selecting the other broker below.

Popular Robinhood comparisons: