Remitano Review 2025

|

|

Remitano is #79 in our rankings of crypto brokers. |

| Top 3 alternatives to Remitano |

| Remitano Facts & Figures |

|---|

Remitano is a peer-to-peer crypto exchange with margin trading, investing, swapping and news services. The firm has been operating since 2014 and is trusted by 1+ million customers in 50+ countries with $15+ billion in executed orders. The community feel, alongside 24/7 customer support and no minimum deposit, make the brand attractive to aspiring crypto investors. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Min. Trade | $0 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

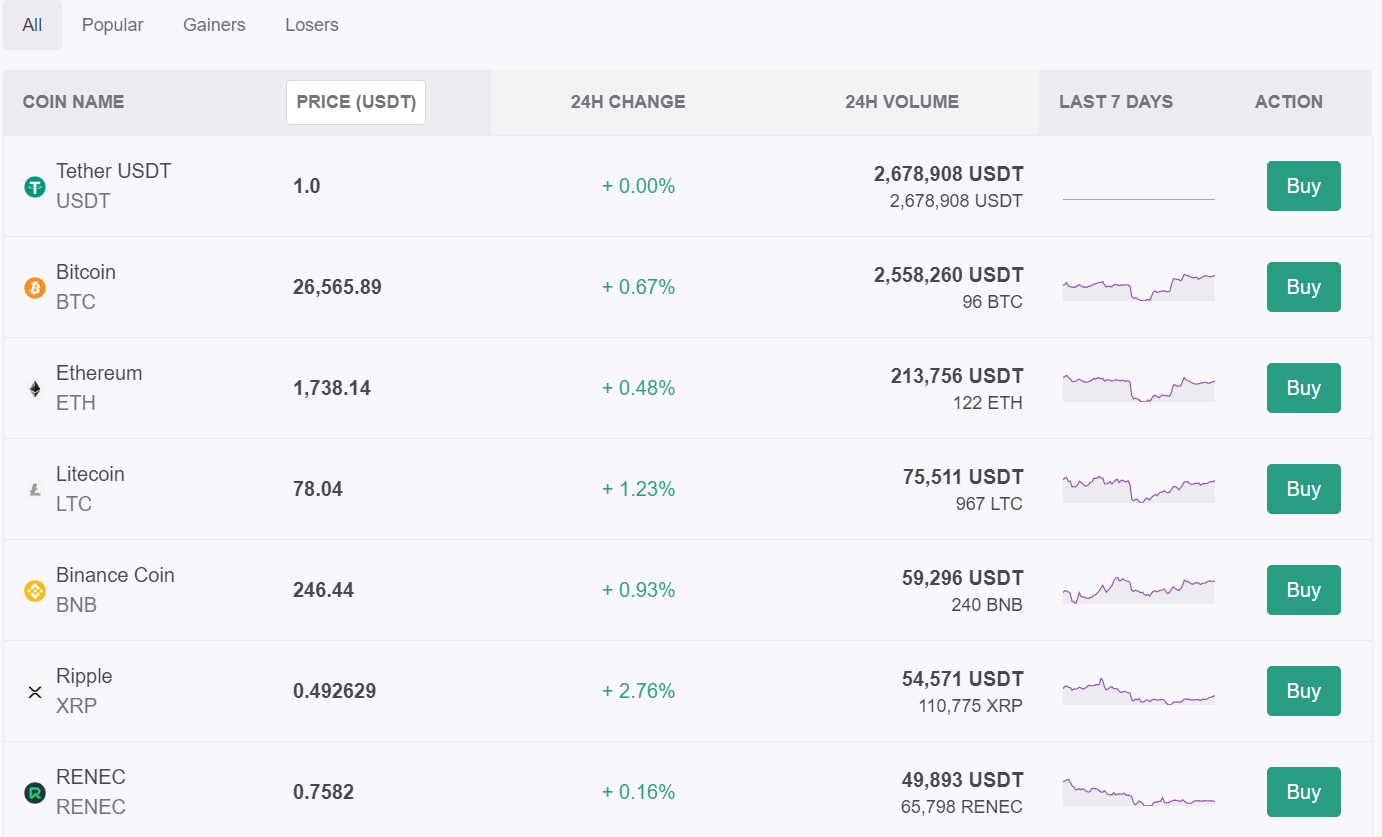

| Cryptocurrency | Remitano supports the purchase, sale, trading and investing in 23 major cryptocurrency tokens through its proprietary web and mobile trading platforms. This includes leading tokens like Bitcoin, Ethereum and Ripple. |

| Coins |

|

| Spreads | N/A |

| Crypto Lending | No |

| Crypto Mining | Yes |

| Crypto Staking | No |

| Auto Market Maker | No |

Remitano is a global crypto exchange that offers peer-to-peer (P2P) DeFi trading, investing, swapping, lending and borrowing services. The exchange also enables the transfer of fiat currency into crypto for UK cryptocurrency backers. This 2025 exchange review will explore the digital assets that Remitano offers, as well as its fees, deposit and withdrawal options, customer support and more.

Our Verdict

- The lack of market analysis and help for beginners is disappointing and reduces the firm’s accessibility

- The exchange would suit low-capital crypto investors with some prior knowledge about the industry

- We generally recommend cryptocurrency brokers over exchanges, due to their increased security, accountability and derivative products

Markets & Instruments

Our team found an average range of crypto coins to choose from at Remitano, including the largest, high-value and most liquid cryptocurrency. We explain the different ways you can invest in these digital assets at Remitano below.

Swing (Invest)

There are 24 cryptos available to trade through Remitano Swing (or Invest as it is sometimes referred to), including 10 altcoins.

This range is smaller when compared vs major exchanges like Binance. Instead, this exchange is more similar to Luno, which, despite also having a smaller selection of cryptos, still features more of the most popular and liquid markets.

The cryptos available at Remitano include:

Remitano Asset List

P2P Trading

Investors can buy and sell crypto, such as BTC and ETH, as well as fiat currency using P2P trading.

This is where buyers and sellers can place ads based on the current market price today of a particular crypto or fiat currency, from GBP/USDT to USD/ETH. These ads will usually state limits on the amount of crypto that can be bought or sold, as well as the payment method that the buyer must use.

A range of cryptos and fiat currencies can be traded this way at Remitano.

Liquidity

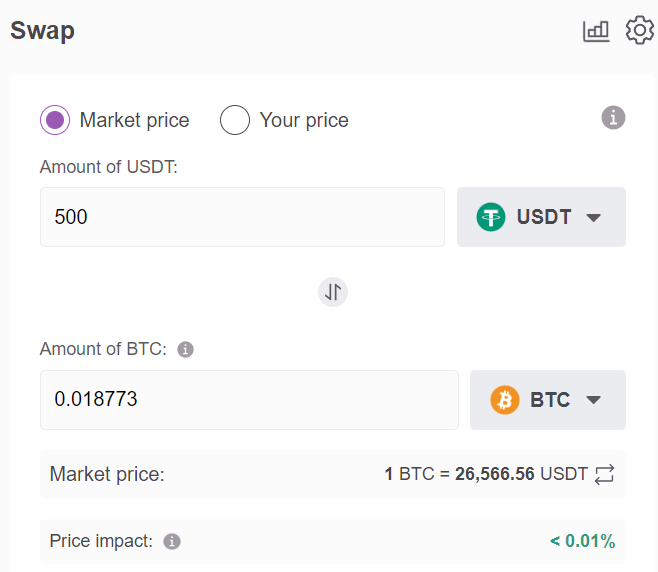

Remitano Liquidity is an impressive service that involves the generation of liquidity pools to exchange assets.

A liquidity pool will typically feature two assets. Those using the pool to swap assets pay a fee and part of this fee goes to the liquidity providers as an incentive for adding assets to the pool.

The benefits of these pools are faster transaction times and tighter spreads for all clients.

Fees

When we used Remitano, we found that the fees were relatively low compared to other crypto exchanges.

The fee for its Swing section is 1% of the total amount of USDT received after closing a position. The charge is only applicable if a profit is made and the amount of USDT received will not be less than the initial investment if a fee is deducted.

There is also a 1% fee for P2P trading, although this is charged regardless of whether the investor makes a profit or not. For example, if buying 1 BTC, the fee would be 0.01 BTC. Only the advertiser (maker) pays the fee; the taker is exempt.

We were pleased to see that, whether trading Bitcoin (BTC), Ethereum (ETH) or another coin, the price in the ad is always inclusive of the trading fee.

For liquidity pool swaps, the fee is 0.25% if the trader sets the price they wish to trade at. If the trader wants to trade immediately at the current market price, the fee will usually be between 0.07% and 0.75%.

There are no deposit or withdrawal fees for GBP transactions, although many cryptos have associated costs.

Remitano offers commissions to those that maintain fiat buying and selling ads to encourage more investors to maintain liquidity on the platform, thereby enhancing the trading experience of other users.

In addition, P2P buyers can be refunded 50% of the transaction fee if it takes more than 15 minutes for a seller to release a trade.

Accounts

There are no separate account types at Remitano, which means traders are mostly subject to the same fees. This can be frustrating for high-capital traders who, at many crypto brokers like IC Markets, may be eligible for lower fees than fellow traders due to the amount of capital they put in. That being said, this is partly compensated by the fact that this exchange’s fees are low on average.

The main difference between different traders’ accounts relates to verification levels. There are four different identity verification levels and the one allocated to each investor depends on the extent of the KYC checks they have undertaken. These levels are not trivial as they can impact account limits for buying, depositing and withdrawing.

How To Sign Up For A Remitano Account

- Click Login / Register

- Link the account to Google, Facebook, Apple ID or your email account

- Verify your phone number

- Buy crypto tokens

Funding Methods

Deposits

We were pleased to see that this exchange enables the purchase of cryptos like Bitcoin using GBP through P2P trading, as well as the capability to deposit GBP into a Remitano GBP fiat wallet from your bank account at no extra cost. This makes the exchange accessible, particularly for those who do not yet own a wallet or have any crypto.

P2P transactions are usually completed within 15 minutes, which is quick. The payment method for P2P ads can vary but common payment methods include:

- Wise

- PayPal

- Bank Transfer

- Remitano GBP Wallet

- Visa/Mastercard (via Simplex)

Investors can also deposit eligible cryptocurrencies directly onto the platform. The processing times for such deposits can vary considerably depending on blockchain traffic. For Bitcoin deposits, the process can take anywhere from a minute to a few hours.

We were also pleased to see that there are no fees for any crypto deposits. However, minimum deposit limits do apply. For Bitcoin (BEP20), this is 0.000035 BTC.

How To Deposit Crypto

- Login to your account

- Click Dashboard and then Wallets

- Choose your preferred crypto coin and click Deposit

- Transfer the coins to the wallet address provided (either copy and paste or scan the QR code – you will need to remember your wallet login so you can transfer the coins)

Remitano Deposit Form

Withdrawals

We were disappointed to see fees applied to most crypto withdrawals at Remitano, although this is not uncommon on crypto exchanges. Minimum withdrawal limits also apply.

We have listed the fees and minimum withdrawals for some of the most popular cryptocurrencies below:

- XRP – 1 XRP minimum withdrawal and a 0.25 XRP fee

- USDT – 1 USDT minimum withdrawal and a 1 USDT fee

- BTC (BEP20) – 0.000035 BTC minimum withdrawal and a 0.000015 BTC fee

Crypto withdrawal requests are usually processed instantly.

In addition to withdrawal fees, there are daily withdrawal quotas that vary according to your account verification level. The maximum increment of withdrawal quota for Level 1 is £40, Level 2 is £800, Level 3 is £2,000 and Level 4 is £80,000.

The maximum increment means the amount by which your withdrawal quota (i.e. your withdrawal limit) will increase if your coin balance is greater than your withdrawal quota.

How To Withdraw Crypto

- Login to your account

- Click Dashboard and then Wallets

- Choose the relevant coin and click Withdraw

- Enter the address and the amount

Note that two-factor authentication (2FA) confirmation may be required for withdrawals.

Regulation

Crypto assets in the UK are generally not regulated. Our experts found no details of any regulatory bodies at Remitano, which came as no surprise. Most crypto exchanges forgo any form of regulation to provide an anonymous and liquid DeFi investing experience.

However, unregulated trading carries more risk, which retail investors must be aware of. Traders will often not have access to investor compensation schemes should the firm go into insolvency and the exchange will also be subject to less scrutiny and monitoring.

This includes specified levels of cybersecurity, access to financial statements and fair practice. As a result, we typically recommend that retail investors look towards crypto brokers.

Trading Platform

Trades can be made on Remitano’s own platform with ease and we were impressed with the exchange’s intuitive layout, which makes the platform accessible to investors of all abilities. The main information that clients need to be aware of is clearly displayed and P2P ads include fees, meaning there are no hidden charges.

Price charts are available too and trades can be made on both Windows and macOS.

Remitano Trading Platform

How To Open A Position With Remitano

- Choose your preferred asset and click Invest

- Choose either Normal or Margin 2x

- Enter the amount and click Open Investment

Mobile App

The Remitano mobile app can be downloaded from the Apple App Store and Google Play Store, making it accessible on both iOS and Android (APK download available).

This means that investors can trade on the go from around the world.

Leverage

Remitano offers what we feel is a conservative leverage on positions, with a maximum of only 1:2. Investors may find that some crypto brokers like PrimeXBT offer 1:10 leverage.

However, this comes with high risks given the volatility of the crypto market. That being said, the 1:2 leverage rate at Remitano also comes at a cost as the annual interest rate is around 9%.

Demo Account

We were disappointed to see that Remitano does not offer a demo account. Although other popular exchanges like Coinbase do not have a paper trading account either, we feel a demo account is an important feature in making exchanges accessible to beginners.

This is particularly true in the crypto industry, where retail traders are often unfamiliar with how such markets operate.

Bonuses Deals

Remitano is limited in its promotional offers to customers, with a simple referral scheme offering a 40% commission on referee trading fees.

Extra Tools & Features

Remitano has a decent range of additional features, including lending services. However, we would prefer to see further regular expert analysis of crypto news, so retail traders can make informed decisions in this ever-changing market.

Lending & Borrowing

It is possible to borrow and lend certain cryptocurrencies and fiat currencies at Remitano. Interest is calculated based on the number of hours funds have been borrowed for.

The APY for lending BTC, for instance, is 0.01% and the rate is 0.65% for borrowing it. Those who borrow funds will usually have to put collateral down.

How To Borrow Crypto Or Fiat Currency

- Deposit crypto to use as collateral

- Borrow your chosen crypto or fiat currency

- Repay the loan

Education

Although there is some limited analysis of the cryptocurrency market on the Remitano website, our experts would prefer to see deeper insight and more regular updates.

We felt the educational material was not sufficient for the task at hand, with the online courses primarily focused on health and wellbeing, rather than trading. There is a small glossary in the FAQs section dealing with topics such as ‘What is Bitcoin?’. However, this could also be more extensive to help guide readers more effectively.

RENEC Token

The exchange’s own token is named RENEC (Remitano Network Coin). The free airdrop programme (used to incentivise mining) has now ended but, since October 2022, users have been able to complete a RENEC/USDT swap at the current market rate/price.

Other Features

Other interesting features at this exchange include:

- Discussion forums

- Crypto games, where extra coins can be earned

- Remitano Payment Gateway as a means to purchase online goods and services using crypto

- Public API so users/developers can link their own software to the exchange (such clients may also find the exchange’s GitHub page of interest)

Company History & Overview

Remitano is an entry-level exchange that was established in 2014. Today, it has a trading volume of over £12bn and has more than 50 supported countries. Its owner and founder is Babylon Solutions Ltd and its headquarters and head office are offshore in the Seychelles.

One of the main objectives of the exchange is ‘bridging the fiat-crypto divide’. This explains why the exchange has a strong emphasis on purchasing crypto using fiat currency and attempts to make this process as easy as possible.

Customer Service

We were pleased to see 24/7 customer support provided by Remitano in case users experience technical issues or have a query about the exchange.

24/7 support is vital given the continuous and decentralised nature of the cryptocurrency market, unlike any other financial market. However, many competitors will limit their support to the working week, neglecting clients that like to invest on the weekends

The following customer support options are available:

- ‘AI’ Bot

- Email – support@remitano.com

- Live chat (the exchange claims a typical response time of within a few minutes)

Unfortunately, the customer care number provided on the official website is only an outbound number. However, there is an extensive FAQs section in the Help Center (including how to buy and sell and how to use different aspects of the platform).

There are also social media accounts on platforms like Facebook and YouTube, as well as a Telegram channel (rather than a group).

Trading Hours

The trading hours for the crypto market are 24/7, meaning investors have much greater flexibility as to when they trade compared to more traditional markets like stocks or even forex.

Safety & Security

Although this exchange has implemented various security measures, there are fundamental security risks associated with crypto, particularly concerning hacks of platforms and wallets.

Fortunately, the exchange uses an escrow service to protect user funds on the P2P trading exchange. The seller must confirm that they have received the payment before the funds are released. If the seller does not release the funds after they have received payment, the buyer should be protected by the escrow. However, they will need to raise a dispute with Remitano and provide proof that they made the payment. Our experts were pleased to see that disputed trades are usually resolved fairly promptly, typically within 24-48 hours.

Account security can be enhanced by enabling two-factor authentication (2FA) using Authy or Google Authenticator. A VPN can be used to shield your IP address. There is also a Bug Bounty Program for users who identify software security vulnerabilities.

As is the case with any broker or exchange, traders should ensure they know how to identify email spam and fraudulent communications.

Traders should also know that, in 2021, the Securities Commission Malaysia (SC) decided to block access to Remitano, implementing the ban because the exchange was operating a Digital Asset Exchange (DAX) without authorisation in Malaysia. This prevented residents of the country from being able to login using the normal domain and banned traders in Malaysia from using the platform.

Should You Invest In Crypto With Remitano?

Remitano provides a mediocre selection of the largest crypto coins, including Bitcoin, Ethereum and Ripple, available for peer-to-peer trading and liquidity pool provision. We were pleased to see that the exchange offers low trading fees and enables the purchase of crypto using fiat currency. However, some of the payment methods (particularly those involving bank transfers and payment references) can be tedious.

Our experts stress that there are fundamental risks associated with all crypto exchanges and the security of investor funds, including Remitano. Despite the firm’s escrow service, there is no financial authority overseeing the company’s activities and actively protecting clients.

FAQ

Is Remitano Legit?

Remitano has been established since 2014 and has plenty of positive reviews online. We have limited reason to doubt that it is a legitimate company. However, the Malaysian Securities Commission has raised issues with the exchange in the past. Moreover, the firm does not fall under FCA regulation, which does not suggest trustworthiness.

Is Remitano Good For UK Traders?

We think Remitano offers a reasonable DeFi investing experience, with low trading fees and P2P trading with some of the more popular crypto assets. However, the lack of regulation, limited asset list and reduced additional features like market analysis and bonuses lead us to recommend bigger, reputable firms like Uphold.

Does Remitano Have A Demo Account?

No. Remitano does not provide a demo account, so we recommend that traders begin by investing small amounts until they are more familiar with the market.

Is It Safe To Use Remitano?

Remitano is registered offshore and is unregulated, which increases the risk for retail clients. While the company has implemented security measures of its own, such as an escrow service to protect users, a reputable alternative is recommended.

Can Crypto Options & Futures Be Traded On The Remitano Exchange?

No, Remitano does not provide DeFi derivatives. The firm acts purely as an equity exchange, swapping various fiat and cryptos amongst its users via P2P trading and liquidity pools.

Articles Sources

Securities Commission Malaysia (SC) Remitano Warning

Top 3 Remitano Alternatives

These brokers are the most similar to Remitano:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Remitano Feature Comparison

| Remitano | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 2.3 | 4 | 4.3 | 4.7 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $0 | $1,000 | $0 | $0 |

| Minimum Trade | $0 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Remitano Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| Remitano | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Remitano vs Other Brokers

Compare Remitano with any other broker by selecting the other broker below.

Popular Remitano comparisons: