Real Estate Investment Trusts

Real estate investment trusts, or REITs, can be an effective way for investors to gain exposure to the real estate market without the hassle and capital requirements of purchasing properties themselves. In this tutorial, we look at how UK traders can invest in real estate investment trusts, how to find the best REIT stocks and ETFs, plus the pros and cons of this style of investing. Our team have also rated the best brokers with REITs in 2025.

UK Brokers With REITs Trading

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

What Is A Real Estate Investment Trust?

Real estate investment trusts (REITs) are best described as companies that own, manage or invest capital in real estate. REITs enable retail investors to speculate on and receive payments from areas of real estate not traditionally accessible to non-licensed, everyday traders.

Invested capital is used for the purchase, maintenance and development of properties, which are then leased to users to return regular income. To qualify as a REIT, the company’s owned real estate must generate income, and the firm must compensate traders with dividends or add to the value of the fund in a total return setup.

These companies are traded like stocks, with investors able to put in as much or as little capital as they like. Traders can also purchase REIT ETFs, which facilitate a further focus on single industries or locations across several funds. ETFs also allow traders to speculate with leverage or go short on real estate markets.

This opens up excellent opportunities for real estate trading with significantly lower capital requirements than when purchasing real estate as an individual investor.

How Does A Company Qualify As A REIT?

For a firm to meet the real estate investment trust definition, it must meet several criteria. However, these regulations depend on the country in which they are registered.

Typically, a REIT must:

- Have at least 75% of its total assets under management invested in property or land

- Source 75% or more of its profits from property rent, mortgage interest or real estate sales

- Pay out 90% or more of its gross income to its shareholders through regular dividends

- Be a taxable entity in its registered country

- Be managed by a board of directors

- Have 100 or more shareholders

- Have over 50% of its shares owned by five or fewer shareholders

Types Of Real Estate Investment Trusts

There are many options for investors to choose from when investing in real estate investment trusts, spanning multiple real estate sectors and countries from across the world.

For example, investors can opt for REITs that specialise in specific regions, opting for developed markets such as the UK, Ireland, Canada, USA or Europe, or invest in developing countries such as Singapore or Kenya.

In terms of sectors, there is a wide range of professionally recognised categories of REIT. These include:

Office REITs

These firms own and manage commercial real estate. Investors can diversify further by selecting trusts that cater to specific types of tenants, such as tech firms or local governments.

Retail REITs

Retail REITs manage consumer-facing retail properties such as shopping centres, retail parks and outlets.

Residential REITs

Residential REITs manage properties that are rented out to tenants. Subcategories of residential REITs include student housing, apartments, individual homes and rural properties.

Mortgage REITs

It is also possible to invest in a real estate investment trust that generates its profits through lending. These are called mortgage REITs, or mREITs.

Funds invested in these companies are used to purchase and operate properties using the leverage of mortgage and to invest in mortgage-backed securities. Investors receive mortgage interest in exchange for offering their funds to be used towards properties.

Note, some investors are wary of mREITs and their associated mortgage-backed securities due to the subprime mortgage crash of 2008. These real estate investment trusts generally have higher risks than standard real estate investment trusts.

Other REITs

In addition to these types of real estate investment trusts, there are also:

- Hotel REITs

- Timberland REITs

- Health Care REITs

- Self-Storage REITs

- Diversified REITs

- Infrastructure REITs

- Data Center REITs

Investors can also opt for diversified REITs, which may operate across a range of locations, such as London or New York, or focus on one area.

Speciality REITs are also popular; these cater to highly specialised businesses in industries such as gambling, sports and farming.

Commissions & Fees Explained

The fees associated with a REIT can be divided into two categories. These are trading fees and management fees.

Management Fees

REIT management fees are a major factor when trading private funds. In order to invest in a non-publicly-traded REIT, there are often hefty initial investment fees of around 8-10%, but these can reach as high as 15% for some firms.

The trade-off for some of these private REITs is high returns from desirable and recession-resistant properties and strong, proactive management.

Another area where management fees come into play is with ETFs. ETF fees are typically much lower, even for managed funds, and will often reach only a 2% annual charge at worst. These fees will be deducted from the value of a fund, so investors do not have to worry about paying out of pocket.

Trading Fees

The fees for trading a REIT will vary from broker to broker. However, many brokers offer low or even zero-commission stock and ETF trading with tight spreads, so investors will be able to make low-cost investments in real estate investment trusts through many online platforms.

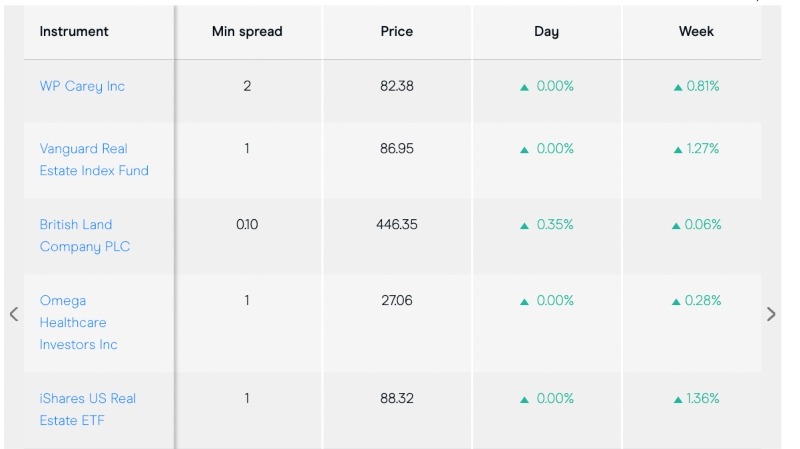

For example, trading fees on popular REIT stocks at CMC Markets are:

Safety & Regulation

When trading real estate investment trusts, it is important to be aware of the risks. As with many sectors of the finance space, there are convincing scams that can trick traders into giving their investment capital to bad actors.

As a result, we recommend that UK traders stick to publicly traded REITs rather than private funds unless they are confident about their legitimacy.

Publicly traded REITs are often subject to strict regulation by their local body. For example, US trusts are overseen by the SEC and UK REITs are subject to regulations imposed by the British government.

Advantages Of Trading REITs

Here are the main benefits of trading real estate investment trusts:

- Reliable Dividends – Whether through mortgage interest or rent payments, REITs generate reliable and competitive dividends. As US REITs are required to pay out 90% or more of their profit to shareholders, real estate investment trust yields are often higher than many top dividend stocks.

- Diversification – Investors can diversify their portfolios with REITs, giving traders an alternative market to commodities, stocks and forex to invest in. Traders can take this a step further by trading diversified REITs.

- Low Capital Requirements – Whether investing in properties to rent out to tenants or to flip for a profit, real estate investing has a notoriously high financial barrier to entry. With REITs, investors do not need the tens or likely hundreds of thousands of pounds required to go it alone. Instead, UK traders can invest from as little as £10 with the best REIT brokers.

- Passive Income – Real estate investment trusts are best suited to traders who prefer to let their money work for them. Taking a hands-on approach to real estate has both actual cost and opportunity cost implications– REITs enable investors to allow professionals to take on the work and reap the dividends.

Disadvantages Of Trading REITs

Real estate investment trusts have also been subject to criticism. Here are a few reasons why an investor may not want to trade REITs:

- Low Growth – While REITs can pay high dividends, many firms do not see share price growth anywhere close to traditional stocks.

- Market Risk – Despite the fundamental trust many investors put in the real estate market, the property market is as vulnerable as the stock market, if not more so. Indeed, the 2008 financial crisis saw global devastation due to the collapse of the same mortgage-backed securities that mREITs invest in.

- High Fees – With private REITs, fees can reach up to a hefty 15% to buy into some firms. For many investors, spending this much money on fees alone is a strong deterrent to trading a particular market.

- Fraud Risk – Investors may want to stick to publicly traded and regulated REITs, as private schemes can be a front for investor fraud.

- Hard To Pick – Some of the critical fundamentals that retail investors can use to analyse stocks, such as EPS and P/E, are not applicable to the REIT market. Instead, investors must learn unfamiliar and complex ways to analyse REITs. In addition, investors must research the property markets in individual sectors and countries when looking to invest in specific real estate investment trust companies.

Comparing REITs

When it comes to deciding which real estate investment trusts to buy, it can be challenging to know which company is best. As a result, we have put together a list of things to look for when searching for the highest-quality real estate investment trusts.

Private Vs Public

The first thing to look at in a list of the top 5 real estate investment trust factors to consider is the listing status of the company.

Publicly listed REITs can often offer advantages such as enhanced security through regulation, greater liquidity and lower fees.

However, private REITs often have higher returns and can have a more exclusive portfolio with properties and industries that offer more market-proof returns.

Sector & Region

The targeted market sector or region is very important to be aware of when investing in a REIT. When not trading diversified companies, understanding the relationship of a specific sector to larger market patterns will help traders decide whether to invest.

For example, holiday spending can often be the first area to take a hit when a local economy falters. As a result, the income from a hotel-focused REIT may falter as businesses struggle in tough market conditions.

Historical Performance

One of the first rules of investing is that historical performance is not an accurate indicator of future results.

However, a real estate investment trust with high dividends sustained over a long period of time is more likely to be able to offer good returns during future periods or market turbulence.

Furthermore, this return rate and company value research can help investors understand which sectors or regions do better under various historical market conditions. This can help traders find real estate investment trusts with obscured value or steer clear of underperforming companies.

Fees

As touched on previously, private REIT fees can reach as high as 15% in some cases, and REIT ETFs can also incur management fees of up to 2%. To decide whether a high fee is worth the investment, traders should study the past performance of a REIT.

We recommend traders be cautious of high-fee real estate investment trusts with large dividends but little historical data backing this up. These funds can falter under market pressures and lead to investors losing much of their investment, whether they are privately or publicly traded.

Balance Sheets

While some investors may only take a look at the key figures, we suggest that traders dive deeper into a company, especially when making a substantial capital investment. A balance sheet often tells more of the true story of a real estate investment trust public business plan.

For mortgage and hybrid REITs, it is important to know the amount of debt a firm is exposed to, as well as the class of debt. Adjusted funds from operations (AFFO) is another way to compare REITs and their cash flow.

Strategy Tips

Here are some strategies to consider when trading real estate investment trusts stocks and ETFs.

Diversification

To create a balanced investment portfolio and protect from risk, many investors look to spread their capital between different markets. REITs can help traders diversify their investments and provide stable, regular income into a portfolio that can be withdrawn or re-invested into the market.

Passive Income

REITs are a solid alternative to bonds or dividend stocks as a way of generating passive income. Many real estate investment trusts pay monthly dividends with high yields.

Those looking to supplement their income or enable regular payouts from self-invested personal pensions (SIPP) after retirement could consider REITs.

Targeted Sectors

Specialised real estate investment trusts stocks or ETFs can be used to speculate on specific sectors or countries. If investors believe that turbulence is ahead for a sector, they can use an ETF to go short on a REIT.

A depreciation in REIT value may be caused by a mortgage default, the vacation of rented premises or, for very specific REITs, a reduction in the value of a commodity such as timber.

Market Timing

Generating value in the market is all about knowing when to invest. For traders looking to get the most REIT equity for their money, and therefore the most dividend-qualifying shares, looking at historical trends can help investors identify potential discounts in the market.

More advanced investors can also use this strategy to “time the top” and sell REITs short, though traders should be aware that they are susceptible to paying an equivalent dividend to the share owner while they remain short.

How To Invest In REITs

Want to trade a real estate investment trust? Here is a short guide on how to start investing in REITs online.

Choose A Sector

Choosing a specific real estate investment trust stock or ETF can seem overwhelming, but the first step is to choose your sector. These include commercial, residential, hotel and infrastructure.

REITs are also sorted by country, with a range of developed and emerging market countries to choose from.

If you want a balanced investment in real estate, we suggest you opt for a diversified REIT or diversify yourself through investing in multiple REITs.

Compare REITs

Now you have decided on a sector and country, you can narrow your choice down using the REITs themselves.

While it is easy to be enticed by real estate investment trusts with high dividends, we recommend doing solid due diligence on any potential investment.

Remember to look further than a firm’s 1-year performance or current dividend to see how a company has performed in the long term. Bonds even beat some real estate investment trusts with the largest return rates in terms of total return over the long term.

Looking at a REIT’s business plan and balance sheet is also recommended for further insight into their assets, risk tolerance and management style.

Find A Broker

Now it is time to select a broker. Many US REITs are traded on the Nasdaq and NYSE, allowing British investors to trade through most UK-serving online brokers.

Note that private REITs are not traded on public stock markets and this investment process will not be applicable.

When choosing REIT brokers, here are key comparison criteria:

- Low trading fees, commissions and spreads

- Support for a range of fast, low-cost payment methods

- Regulation from a reputable body such as the FCA or CFTC

- A knowledgeable and available customer service team

- Support for at least one reliable and powerful trading platform

Create an account with your chosen broker and complete any verification needed to set you up. Deposit the trading funds needed to make your REIT investment.

Place A Trade

Now that you are all set up with a broker, you can invest in real estate investment trust stocks and ETFs. While it may be tempting to jump into your trade, look for a target price to enter your investment, even if your strategy does not focus on timing the market.

This said, to receive timely dividends, you should ensure that your position is cleared before the ex-dividend date of the stock.

UK Tax Considerations

For UK investors, British REITs have specific tax advantages over investing in a property company or even a physical property itself.

REITs have been granted special status by HMRC which exempts these firms from corporation tax. Taxation of UK real estate investment trusts only occurs once, on shareholders’ dividend income.

This means that UK REITs are able to pass on more of their earnings to shareholders.

It is with noting that REITs in other countries such as the US and Canada do not have the same UK tax advantages.

Bottom Line On Trading REITs

Real estate investment trusts can be a good way for traders to gain exposure to the real estate market without the hassle, opportunity cost and financial might required to invest in individual properties. Investors can gain access to specialised sectors that would usually be off-limits to retail traders, such as infrastructure and timberland, and receive regular income in the form of often high dividends.

However, significant market risk and high fees with some funds mean that traders should be careful which real estate investment trusts they finance, and should look at the long-term yields of these companies rather than being enticed by recent performance alone.

Head to our ranking of the best REIT brokers to get started.

FAQ

Do Real Estate Investment Trusts Pay UK Tax?

UK REITs are exempt from corporation tax but subject to tax on the dividends paid to investors. This is an advantage nonetheless, with investors only taxed once instead of twice.

Are Real Estate Investment Trusts Stocks?

Public real estate investment trusts are traded like stocks, ensuring low fees, high liquidity and greater transparency. REIT ETFs are also available, with many of the same benefits. Private REITs are not traded between investors and are purchased directly from a firm, with higher fees and liquidity for larger or more dependable returns.

What Types Of REITs Are There?

There are many types of real estate investment trusts, with properties as different as malls, gas stations, timberland and laboratories all available through specific sectors. Our full guide to trading REITs unpacks the various types available, plus their features, key activities, history, annual returns, and more.

Are There Real Estate Investment Trusts That Pay Monthly Dividends?

There are plenty of UK, US and Canadian REITs that pay out monthly dividends to investors, making these companies a good alternative to dividend stocks.