Rakuten Securities Review 2025

|

|

Rakuten Securities is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Rakuten Securities |

| Rakuten Securities Facts & Figures |

|---|

Rakuten Securities is an ASIC-regulated multi-asset brokerage offering CFD trading on forex, commodities, indices and cryptos. The broker offers fixed spreads and the popular MetaTrader 4 platform, plus a good selection of educational content. On the negative side, the broker's pricing structure and market access is less suitable for experienced traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Indices, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade forex, commodities and index CFDs with leverage up to the ASIC-sanctioned 1:30 maximum, a 70% margin call level and 50% stop-out. The limited selection of assets is a disappointing downside given the broker's decent all-round package. |

| Leverage | 1:30 (Retail), 1:400 (Pro) |

| FTSE Spread | 0.6 |

| GBPUSD Spread | 0.8 |

| Oil Spread | 0.06 |

| Stocks Spread | NA |

| Forex | Trade 40 forex pairs including majors and minors with tight fixed spreads and no added commissions. We like this pricing model, which we feel offers a stable way for less experienced traders to access currency markets. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.5 |

| GBPEUR Spread | 1.0 |

| Assets | 40+ |

| Stocks | We were disappointed to find no stock trading, but traders can access leveraged CFDs on 11 indices covering diverse regions including the UK 100, Japan 225, and Euro Stoxx 50. Leverage up to 1:20 is available for major indices and 1:10 for minors. |

| Cryptocurrency | Rakuten offers a bare minimum in the way of crypto trading, with only Bitcoin CFDs paired with the US dollar and with a maximum leverage of 1:2. We don't recommend this brand for serious crypto traders. |

| Coins |

|

| Spreads | 110 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Rakuten Securities is an established brokerage that offers multi-asset trading opportunities on the MT4 platform. Tradeable assets include forex, indices and commodities, and the broker also offers copy trading, VPS hosting, and a learning academy. Our review will cover markets, fees and all the other most important features to consider before signing up with Rakuten, as well as details on how to open a live account and accepted payment methods.

Our Take

- Rakuten Securities is a well-regulated broker overseen by trusted bodies like the ASIC

- The copy trading platform will appeal to beginners and the free VPS to experienced traders

- A GBP account is available for UK traders with no deposit fees and fast processing times

- Rakuten’s market access is its biggest weak point with fewer than 100 instruments

- The broker offers just one terminal with no in-house trading platform or app

Market Access

With just 66 tradeable instruments, the Rakuten Securities instrument list is very small and traders who seek diverse portfolios will be better off with almost all other brokers. The majority of opportunities are on the forex market, with no stocks available.

- Oil – 4 energy instruments featuring UK and US Crude Oil

- Indices – 11 major stock index funds such as FTSE 100, DAX 30, and CAC 40

- Metals – 11 precious metal and fiat currency pairs including XAU/GBP and XAG/EUR

- Forex – 40 major, minor, and exotic currency pairs such as GBP/USD, EUR/JPY, and EUR/GBP

Rakuten Securities Fees

Rakuten Securities is transparent with its trading fees, and we were pleased to see no commission charges any instrument as well as very competitive spreads for a zero-commission broker. Pricing is sourced directly from top-tier liquidity providers in Tokyo.

Spreads are fixed for forex trading and variable for all other products, and we were pleased to see that retail account holders benefit from the same spreads as customers registered under the Pro 1 and Pro VIP accounts. These were competitive, and we were offered a 0.8 pip spread on the GBP/USD pairs and a 0.5 pip spread on the EUR/USD. We were also offered tight spreads when trading CFD indices at 0.6 on the FTSE 100 and 0.5 on the S&P 500.

We were impressed that an inactivity fee does not apply for dormant accounts, which is competitive vs alternative brands such as XTB, which charges £10 per month after 12 months.

Swap rates apply for positions held overnight. This is standard in the industry.

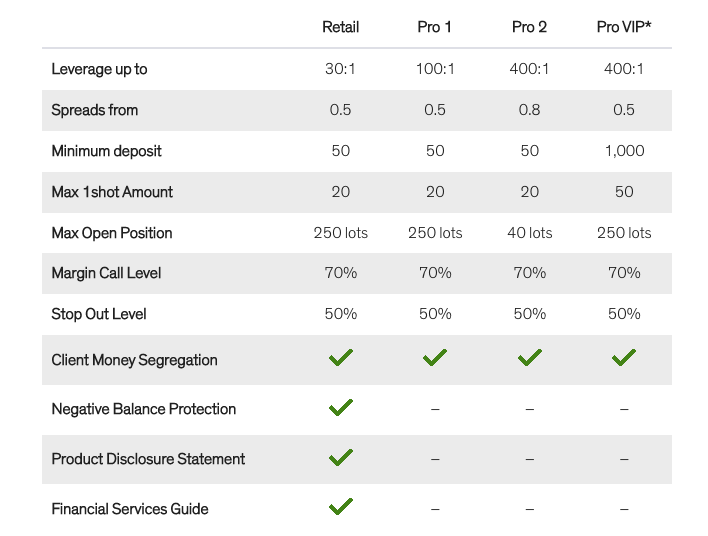

Accounts

Rakuten Securities offers just one account type for retail investors. We were pleased to see an Islamic take available on the retail profile, removing swap fees for Muslim traders.

The key features of the retail account are:

- Spreads from 0.5 pips

- £50 minimum deposit

- Maximum leverage 1:30

- Minimum lot size 0.01 lots

- Maximum 250 lots open positions

There are three ‘Professional’ profiles, which offer improved trading conditions and more generous leverage, but to access these traders must pass eligibility requirements. These are substantial, but there are two different routes to take. It is worth noting that protection for these is more limited vs the retail account, with no negative balance protection.

To qualify for a professional profile, traders must satisfy the following conditions:

- Asset Test – Either net assets with a value of at least 2.5 million or a gross income of at least 250,000 for the last two consecutive years

- Sophisticated Test – Comply with two of the following four criteria; at least 50 trades executed in the last 12 months or a minimum of one year of work experience in the financial industry or a portfolio with assets with a value of more than 250,000 or at least 500,000 in value of trades for the last 12 months

Account Types

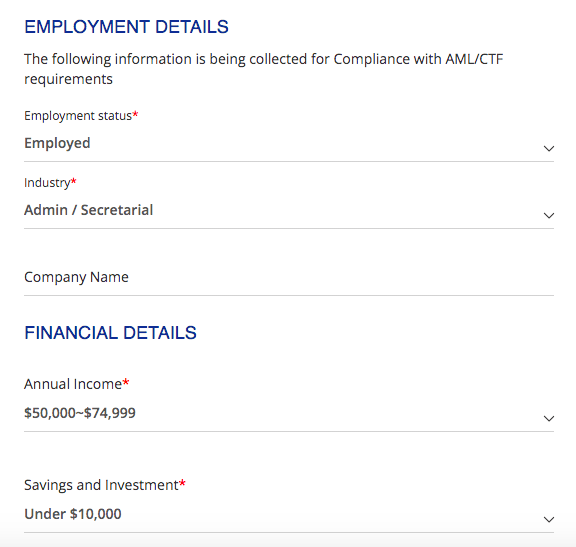

How To Open A Rakuten Securities Account

We appreciated the easy sign-up process at Rakuten. It only took us a few minutes. To register:

- Choose ‘Open Live Account’ from the broker’s website

- Add your personal details on the first screen (name, country of residence, nationality, email, date of birth, and mobile number)

- Complete your address details on the following screen and select ‘Next’

- Complete employment details, financial status, and the trading experience questionnaire

- Choose either a live account or an Islamic profile (swap-free)

- Select an account base currency

- Review and agree to the T&Cs

- Upload a photo ID document, proof of address and other supporting documents

- Click ‘Submit’ to confirm your application

Funding Methods

Rakuten Securities has a low minimum deposit requirement of £50, and we were pleased to see GBP accepted as an account base and funding currency. This allows UK traders to fund their accounts without costly conversion charges.

Accepted payment methods relevant for UK traders include Neteller, Skrill, and international bank wire transfers to the National Australia Bank, which is a reasonably good selection though we would prefer to see more e-wallet options. We were also sorry to see that VISA and MasterCard credit/debit cards are only available for USD or AUD base currencies.

Importantly, we were pleased to see that deposit fees are not imposed by the broker. Skrill and Neteller are the most competitive when it comes to processing times, offering instant account funding. International wire transfers are slow, with up to a five working day expected processing time.

How To Make A Payment

- Sign in to your Rakuten Securities client portal

- Choose ‘Funding’ from the side menu and then ‘Deposit To Account’

- Select the account funding method and add the amount to deposit

- Complete the relevant payment details and confirm the deposit

As is standard, profits must be withdrawn back to the original payment method. Withdrawal fees do apply for all methods, which is disappointing. This includes a £15 fee for NAB withdrawals and a 2% charge for Neteller and Skrill.

Withdrawal processing times are certainly not the fastest, with even e-wallet solutions taking up to two working days for fund clearance.

Trading Platform

Rakuten Securities offers MetaTrader 4, which is one of the industry’s best platforms though we would like to see more options added. There is no bespoke software or additional third-party platforms, leaving traders who are not keen on MT4 without any other options.

However, the MetaQuotes platform is popular with traders worldwide thanks to its customisability and reliability, and we are sure it will serve most Rakuten traders well. The platform offers many advanced tools including automated trading functions via Expert Advisors (EAs). You can create custom scripts and indicators, and programme trade parameters for positions to be opened and closed automatically.

We have used the terminal extensively and are confident it is suitable for traders of all experience. The number of chart types is limited to just three, though there are nine time-frame views from one minute to one month. Additionally, there are 30 in-built technical indicators such as RSI and MACD, with a comprehensive library of additional plugin options. Other features include three order execution modes, six pending order types, and single-thread strategy testing.

Unfortunately, our experts found the broker does not provide MT4 web browser compatibility. Instead, the platform must be downloaded to desktop devices.

How To Make A Trade

I didn’t have any issues navigating the order process on MT4. To get started:

- Log in to the MetaTrader 4 platform

- Review the list of trading instruments and decide what you want to trade

- Double-click on the instrument to open the ‘New Order’ screen

- Input the order details including volume, risk management parameters, and order execution mode

- Select ‘Buy’ or ‘Sell’ to confirm the position

Mobile App

Rakuten Securities traders can invest on the MetaTrader 4 mobile app, which provides access to all the features and functions of the desktop terminal, allowing clients to trade on the go.

We like that you can still use the complete set of orders, analyse stock price data, view your full trading history, customise the interactive charts, and integrate technical analysis, meaning you don’t lose any of the desktop app’s functionality. You can also make use of custom alerts and notifications to keep you in the loop of price shifts and volatility.

It is a shame the brand does not offer a proprietary application, though we are confident you can access all the items you need from the MT4 app.

Rakuten Securities Leverage

Rakuten Securities offers leverage up to 1:30 for retail investors due to regulations. This aligns with the limits set by the FCA, which are designed to protect retail traders.

Leverage varies by instrument:

- Major Currency Pairs – 1:30

- Minor Currency Pairs/Major Stock Indices/Gold – 1:20

- Commodities – 1:10

- Shares – 1:5

- Cryptocurrency – 1:2

Traders eligible for professional status can access more generous ratios up to 1:400.

All accounts have a 70% margin call and a 50% stop-out level.

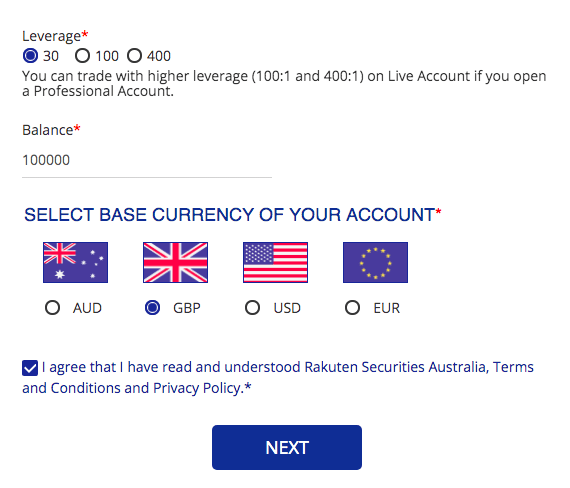

Demo Account

Rakuten Securities offers a free demo account for all customers, with a virtual trading balance and access to real market pricing, which we always like to see – this sometimes-ignored feature is important as it allows you to test the broker and platform before you sign up.

We were slightly disappointed, though, that the broker allows only one demo account per email address and closes demo accounts after 30 days of inactivity. Nonetheless, it is a great way to practise trading with no risk and learn all the functions of the MT4 terminal.

How To Sign Up For A Demo Account

- Click on the ‘Open Demo Account’ logo from the header of the broker’s website

- Add your personal details to the online application form (title, name, country of residency, email address, and mobile contact number)

- Choose a leverage amount

- Input a virtual balance amount

- Choose an account base currency (GBP, AUD, USD, or EUR)

- Review and agree to the T&Cs and select ‘Next’

- Review demo account details on the following screen and select ‘Confirm’

- Login credentials will be sent to your registered email address

- Download the MT4 terminal or sign in to the client dashboard

Regulation

Our experts are confident Rakuten Securities is a safe and trustworthy broker-dealer. Rakuten Securities Australia PTY Ltd is authorised and regulated by the Australian Securities and Investments Commission (ASIC), with an Australian Financial Services License (AFSL) number 418036. This is a very reputable financial watchdog, with many similarities to the UK’s Financial Conduct Authority (FCA).

Protection measures for retail investors include segregated client funds, which are held with the National Australia Bank. Additionally, you will have access to negative balance protection, which means you cannot lose more than your account balance and will not become indebted to your broker.

The brand’s parent company, Rakuten Group, Inc. is also listed on the Tokyo Stock Exchange, which boosts the brand’s credibility for us.

One downside, our experts flagged the lack of FSCS protection. This is available to customers trading with FCA-regulated firms only, so you will not have up to £85,000 of your funds insured in the case of business failure.

Bonus Deals

Rakuten Securities is not permitted to offer any bonus incentives, due to regulations, so you will not be entitled to welcome rewards or no-deposit bonuses. This is the same for FCA-regulated brands so we do not consider this a disadvantage.

Extra Tools & Features

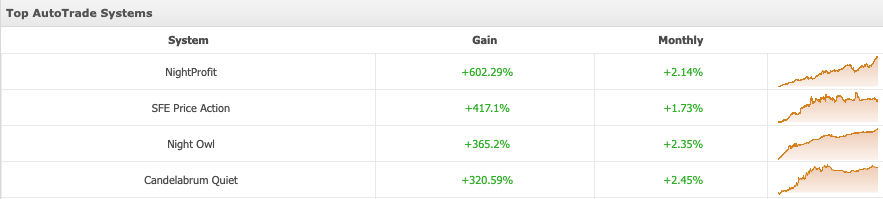

Copy Trading

We were pleased to see that Rakuten Securities offers MyFXBook copy trading services via the MT4 terminal. This is ideal for beginners or those with limited time to study the market and stay up to date with price trends, allowing you to instead choose from hundreds of professional traders and duplicate their positions in real-time.

We were reassured to see the performance history published, so you can make informed decisions when it comes to choosing a signal provider.

To get started, you will need to register for an MT4 account, and then sign up with MyFXBook. We found the minimum account balance to be quite high at £1000, which is about five times the minimum amount needed to copy trade on eToro, and a commission charge will apply for the positions executed in your account. These are competitive, however, with a £0.10 fee per £1000 traded.

MyFXBook

Education

Our experts rated Rakuten Securities’ education academy, which is loaded with a wealth of interactive resources on topics from forex basics to trading psychology and advanced strategies.

We are confident the information is suitable for investors of all experience levels, but we would have liked to have seen some integrated supporting videos, as seen as top brokers like IC Markets.

The broker has also put together some useful user guides, with screenshots and step-by-step tutoring. We found it most useful to download these in PDF format and follow along while using the platform. Topics include how to customise the MetaTrader terminal interface and how to install VPS.

VPS & Order Execution

Rakuten Securities is a market-maker broker. Retail investors will benefit from instant execution and little or no slippage as the brand can fulfil orders with its own liquidity source. Server locations are in Tokyo and Australia.

VPS hosting may be ideal to reduce your execution speeds, which can fulfil orders in less than three milliseconds. This is offered for free to customers, offering 24/7 connectivity to the Tokyo server. We were pleased to see all trading styles are accepted, except for news trading.

Customer Service

Rakuten Securities customer support is decent, with live chat, telephone, and email alongside an FAQ section.

It was disappointing, though, that there is no UK telephone contact and access for UK traders is limited due to time zone differences. We tested the live chat function at 2:00 pm (GMT) and received an error message that this is outside of the brand’s operating hours.

- Telephone – +61292472483

- Email – support@sec.rakuten.com.au

- Chat – Online chat, WhatsApp, Facebook Messenger and Telegram. Links are available at the bottom right of the broker’s website

Company Details & History

Rakuten Securities Australia (RSA) is part of the Rakuten Securities Inc brokerage group. The Australian entity welcomes global clients, including those from the UK to trade multiple asset classes spanning forex, commodities, and indices.

The brand was founded in 1999, with Rakuten Securities Australia Pty Ltd established in 2011. Other subsidiaries include Rakuten Securities HK and Rakuten Securities Bullion Hong Kong Limited.

The group has provided financial services to almost three million clients and continues to expand worldwide. The brokerage has a head office presence in Sydney, Australia as well as global headquarters in Japan, Hong Kong, and Malaysia.

Trading Hours

Trading hours will vary depending on the instrument. For example, the forex market is open from midnight Monday to 11:55 pm on Friday. You can view specific timing by product via the MetaTrader terminal. Right-click on a product in the ‘Market Watch’ window, click ‘Specification’ and then scroll to the bottom for trading hours information.

We like that the broker offers email updates for all customers with market closures and changes to trading hours.

Should You Trade With Rakuten Securities?

Rakuten Securities has built good credibility in the financial market, thanks to its ties with the Rakuten Group with over 20 years of services as well as robust regulation. We liked the competitive fees, the option of VPS hosting and copy trading services, and support for the industry-renowned MT4 platform, all of which make this a good broker for beginner or experienced traders.

However, we do feel this brand is let down by the lack of tradeable instruments, and UK traders will find much more variety in reliable, FCA-regulated brokers which also offer competitive pricing.

FAQ

What Is Rakuten Securities?

Rakuten Securities is a forex and CFD broker, authorised and regulated by ASIC. The brand offers a small list of instruments to trade on the MetaTrader 4 platform. It is a subsidiary of Rakuten Securities Inc.

Is Rakuten Securities Safe And Legal?

Our experts are confident that Rakuten Securities is a relatively secure brand. Operating as an entity of Rakuten Securities Inc brokerage group, the company is regulated by the Australian Securities and Investment Commission (ASIC) and offers fund security measures such as negative balance safeguarding and segregated funds from business money.

Can Rakuten Securities Be Trusted?

We are confident Rakuten Securities can be trusted. The brand’s parent company, Rakuten Group, Inc. is listed on the Tokyo Stock Exchange, making the firm very credible. Be aware, however, that access to FSCS compensation is not permitted, as the brokerage is not overseen by the FCA.

When Can You Withdraw Money From A Rakuten Trading Account?

You can withdraw funds from a Rakuten Securities account at any time. As standard, you must withdraw back to the original payment method. Fees apply for all payment types, which is a shame.

Can you Buy ETFs With Rakuten Securities?

No, Rakuten Securities Australia does not offer exchange-traded funds (ETFs). The broker covers a small range across forex, indices and commodities, which we found quite limiting.

Article Sources

Rakuten Securities Australia ASIC License

Top 3 Rakuten Securities Alternatives

These brokers are the most similar to Rakuten Securities:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Rakuten Securities Feature Comparison

| Rakuten Securities | Swissquote | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 4 | 4.8 | 4.8 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $50 | $1,000 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:30 (Retail), 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Rakuten Securities Review |

Swissquote Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| Rakuten Securities | Swissquote | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

Rakuten Securities vs Other Brokers

Compare Rakuten Securities with any other broker by selecting the other broker below.