Quotex Review 2025

|

|

Quotex is #11 in our rankings of binary options brokers. |

| Top 3 alternatives to Quotex |

| Quotex Facts & Figures |

|---|

Established in 2019, Quotex is a binary broker that offers 400+ assets, including forex, stocks, indices, commodities, and cryptocurrencies. The platform emphasizes user-friendly features, complete with short-term contracts that span 5 seconds to 4 hours alongside payouts that can reach 95%. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Binary Options on Stocks, Indices, Forex, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Trading App |

Quotex offers a fully-featured trading app that’s packed with helpful tools, from dynamic charting to in-built signals. It follows the same user-friendly design as the web-based desktop platform, ensuring a smooth transition whether you’re trading from a computer, tablet or mobile device. The flexible design with light and dark modes is a nice touch. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | $1 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | No |

| Signals Service | Daily Trading Signals |

| Islamic Account | No |

| Commodities |

|

| Forex | You can trade binaries on 40+ currency pairs including majors, minors and exotics. This is a smaller range of forex assets than some competitors but payouts are reasonable, climbing to over 80% on the EUR/USD during testing. |

| GBPUSD Spread | N/A |

| EURUSD Spread | N/A |

| GBPEUR Spread | N/A |

| Assets | 40+ |

| Stocks | Quotex offers a modest selection of OTC shares, including big names like Facebook, Microsoft and Pfizer. That said, you can only take positions on US shares and there aren't some big-name volatile equities like Tesla. You can also speculate on 10+ major indices, including the Dow Jones and the FTSE, but no S&P 500. |

| Cryptocurrency | Quotex only offers binary options trading on three cryptos. Yet while the range of digital currencies is narrow, there are leading tokens, including Bitcoin and Dogecoin. Payouts on cryptocurrencies are also above average based on our latest tests. |

| Coins |

|

| Spreads | N/A |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Binary Options | Quotex continues its streak near the top of the industry with ultra-short-term binaries on a growing selection of 400+ assets and payouts up to 95%. The firm provides a web platform that delivers a smooth user experience with a clean design, multiple charting styles, dozens of indicators and daily signals for actionable trading ideas. |

| Expiry Times | 5 seconds - 4 hours |

| Payout Percent | 95% |

| Ladder Options | No |

| Boundary Options | No |

Quotex is a digital options broker, which offers market signals and copy trading services on its proprietary web platform. This review covers the account registration process, deposit and withdrawals fees, regulatory status and available assets. Find out whether you should start trading with Quotex.io today.

Quotex Headlines

Established in 2020, Quotex is an off-shore broker and a trademark of Awesomo Ltd. The company is based in the Seychelles and is regulated by the International Financial Markets Regulatory Center (IFMRRC). The Quotex team has 200+ years of experience and is dedicated to creating a modern trading platform.

Unfortunately, Quotex is not regulated by the FCA and does not have offices in the UK. Nonetheless, British traders can still open a live trading account.

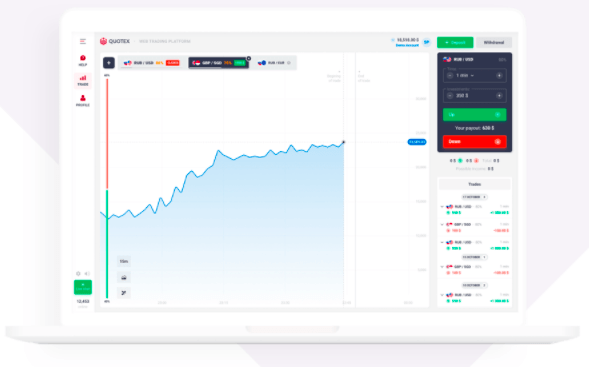

Web Platform

Quotex offers an easy to use proprietary web-based trading platform. The broker’s main goal is to make trading as simple and straightforward as possible. Traders can view data on multiple graphs and time frames from 5 seconds to 1 day. Other features include 9 indicators, 15 drawing tools, copy trading and market signals. Placing trades can be easily done through ordering screens on the terminal.

Navigating the platform and executing trades is simple:

- Choose an asset on the top left of the screen

- Select an expiration date between 1 minute and 1 month

- Enter the amount you wish to invest in the market position

- Predict where the asset price will move by the expiration date. You have the choice to ‘Go Up’, ‘Go Down’, ‘Sell Now’ or ‘Sell Later’

Quotex platform

Products

Quotex offers digital options trading on 410+ assets, including 27 major, minor and exotic currency pairs, top cryptos like Bitcoin and Ethereum, plus over a dozen major stock exchanges i.e. the FTSE 100 and Dow Jones. Clients can also trade digital options on gold, silver, oil, energies and metals. The range of products is decent compared to other binary options brokers.

Pricing

The broker does not list any spreads or commission rates on the Quotex.io website. However, the profit percentage available on each instrument is set by the broker. This varies by factors such as liquidity, time of the trade, tariffs and economic events. According to the Quotex, profit potential could be up to 98% of the amount invested.

To determine the profit percentage, the platform will automatically display a figure after you set an expiration date on your trade. This means you can be certain of the profit potential you can earn before placing a trade. Should you make the correct prediction, your earnings will automatically be added to your balance.

Mobile Trading

The broker does not currently offer a mobile app. However, their web-based platform can be accessed using any browser on any mobile phone. So, monitoring markets and executing trades can be done anywhere. Quotex is also looking to launch a mobile app in the future.

Deposits & Withdrawals

You can start trading on Quotex with a minimum deposit of £10. This can be done through your personal account or in the trade execution window. Deposit methods include credit/debit cards, cryptocurrencies and e-payment systems such as Skrill and Neteller. Quotex does not charge any fees on deposit or withdrawals. GBP is also accepted so UK traders won’t have to pay currency conversion fees.

Withdrawals have to be made with the same method chosen for deposits. For example, if you deposited your account with a credit/debit card, you would also have to withdraw using the same card.

Additional documents are not usually required to withdraw funds. However, when withdrawing a large amount, it is under the broker’s discretion to request documents. Withdrawal times can take between 1 to 5 days but Quotex endeavours to make payments on the same day the request was submitted.

Demo Account Review

Quotex offers a demo account free of charge, which is automatically funded with 10,000 units. The demo account simulates a live trading environment, with access to analysis tools, signals and indicators. However, the demo account offers a limited range of assets. The trial account is a great way for beginners and professional traders to practice their strategies.

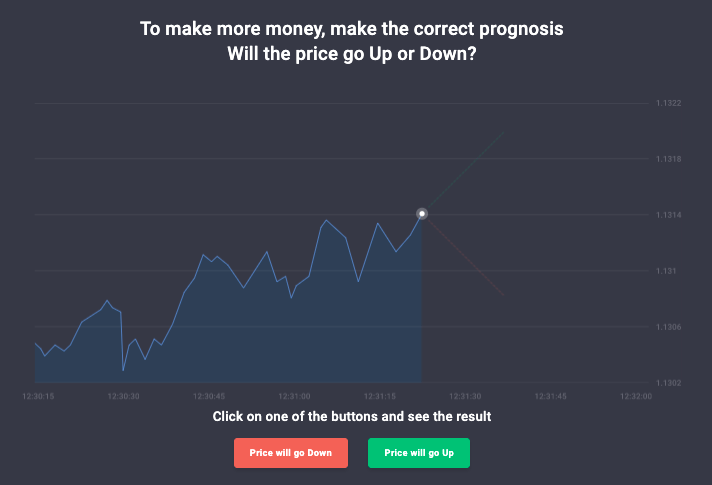

How Quotex works

Bonuses & Promos

At the time of writing, Quotex is offering a 30% bonus on first deposits. Historically, Quotex has offered various deals and promotions. For example, the broker offered an 80% welcome bonus on first deposits up to $100. These deals are a great way to increase original trading capital. Check the company website for the latest promotions and always read terms and conditions before accepting a bonus.

UK Regulation

Awesomo Limited is regulated by the International Financial Market Relations Regulation Centre (IFMRRC) under license number TSRF RU 0395 AA V0161. The regulatory body offers a compensation fund, where customers can be reimbursed should the brokerage violate their license or fail to pay.

However, traders should be aware that IFMRRC is a self-issuing body rather than an established agency like the FCA, FSA, or CySEC. As a result, it does not hold any legal authority to regulate brokers.

Note that since April 2019, the FCA has prohibited investment firms from selling binary options in the UK. British consumers have been advised to only deal with financial services firms authorised by the FCA. While UK traders can still open an account with an offshore digital options broker, you should do so at your own discretion.

Quotex Live Account

Quotex recently introduced three account levels that provide different trading advantages. Access depends on your account balance:

- Standard – This level is automatically applied after registration. The Standard level offers basic percentages of profitability for all instruments.

- Pro – This level is only available for accounts with a balance of £1,000. A 2% increase in profitability percentages is applied on all instruments and promotional codes are offered via e-mail.

- VIP – This level is available after an account balance of £5,000 is met. A 4% increase in profitability percentages is applied on all instruments and promotional codes are offered via e-mail.

To open a live account, you need to fill out a questionnaire and some personal details. Occasionally, new traders may need to go through an additional account verification process, where Quotex will request some documents. The verification process can take up to 5 days. Once your account has been verified, you can simply log in via the Quotex.io website.

Pros

- Copy trading & market signal services

- Low minimum deposit requirement

- Proprietary web trading platform

- No deposit or withdrawal fees

- Deposit bonus promotions

- Free demo account

- Easy login

Cons

- No educational tools

- No leverage offered

- No FCA regulation

- No mobile app

Trading Hours

Quotex customers can trade on the platform at any time, though specific opening and closing hours depend on the instrument traded. For example, cryptocurrency is available 24/7 while the forex market is open Monday to Friday. You can find more details on Quotex’s trading terminal.

Contact Support

Traders can contact customer support on the trading terminal through the live chat bot. You can also submit a message on the website under ‘Contacts’. For financial issues, you can email finance@quotex.io or for technical support, you can email support@quotex.io.

Safety & Privacy

Quotex states that they use specialised technologies and high-security standards to maintain client confidentiality and third party protection. However, the broker does not outline what type of encryption software is used or its security procedures. Additionally, Quotex runs on a proprietary platform, which is not as secure as MT4 and MT5.

Should You Trade With Quotex?

Quotex may seem like an unusual digital options broker. Nonetheless, it offers an easy to use trading platform with copy trading and a market signals service. The brokerage also has competitive fees, a low minimum deposit and a wide asset range. The only major drawback for UK traders is the lack of FCA regulation.

FAQ

Is Quotex.io A Regulated Broker?

Yes. Quotex is regulated by the International Financial Market Relations Regulation Centre (IFMRRC) under license number TSRF RU 0395 AA V0161. However, traders should be aware that the IFMRRC is a self-authorised body rather than a legal fiscal body with official authority to regulate brokers.

Does Quotex Offer A Demo Account?

Quotex offers a free demo account, which is automatically funded with £10,000. You can update your account without any limit and learn to trade without risking real money. However, there is a limited number of assets available on the demo account.

How Much Capital Do I Need To Start Trading With Quotex?

You don’t need large capital to start trading with Quotex. The minimum deposit requirement is £10. Deposits can be made in GBP/pound sterling, so UK traders won’t have to pay currency conversion fees.

Is Quotex A Scam?

Quotex claims it uses specialised technologies to maintain client confidentiality. Furthermore, it is regulated by the IFMRRC. However, the broker does not outline what its security processes are or what technologies it uses. Therefore, we can’t be certain of the broker’s legitimacy.

How Can I Make Money On Quotex?

Before making a trade on an instrument, a profit percentage is outlined. Traders can earn up to 98%, though these figures are at Quotex’s discretion. You will then predict the direction of the asset and set the expiration date. Should you make the right forecast, the agreed profit percentage will be automatically credited to your account.

Top 3 Quotex Alternatives

These brokers are the most similar to Quotex:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Quotex Feature Comparison

| Quotex | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 4.4 | 4.8 | 4.8 | 4.7 |

| Markets | Binary Options on Stocks, Indices, Forex, Commodities, Cryptos | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $10 | $0 | $0 | $0 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5, cTrader | - | MT4 |

| Leverage | - | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Quotex Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Quotex | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Binary Options | Yes | No | No | No |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Quotex vs Other Brokers

Compare Quotex with any other broker by selecting the other broker below.

Popular Quotex comparisons: