Purple Trading Review 2025

|

|

Purple Trading is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to Purple Trading |

| Purple Trading Facts & Figures |

|---|

Purple Trading is a legitimate forex and CFD broker with ECN and STP execution for a range of markets on two top commercial trading platforms. The broker is heavily regulated with authorization from the CySEC. Purple Trading also offers a good selection of account types to suit different traders, including beginners, pros and passive investors. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Futures, Commodities |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC, CONSOB |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | Yes |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Purple Trading supports CFD trading through MetaTrader 4 and cTrader on stocks, commodities, futures, forex and indices. You can go long or short with up to 1:30 leverage, free deposits and competitive pricing. |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| FTSE Spread | 1 (ECN) |

| GBPUSD Spread | 0.00004 (ECN) |

| Oil Spread | 0.03 (ECN) |

| Stocks Spread | Variable |

| Forex | Purple Trading clients are in a great position to speculate on foreign exchange markets with over 60 major, minor and exotic currency pairs. Forex indices are also available offering a holistic view of popular currencies like the USD. |

| GBPUSD Spread | 0.00004 (ECN) |

| EURUSD Spread | 0.00004 (ECN) |

| GBPEUR Spread | 0.00005 (ECN) |

| Assets | 59 |

| Currency Indices |

|

| Stocks | Purple Trading offers access to 100+ equities including large brands like Apple, American Express and Boeing. While the range of equities is fairly narrow, spreads are tight, 1:5 leverage is available, and there is positive slippage with no requotes. |

| Coins |

|

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Purple Trading is an ECN and STP brokerage that provides direct market access to a competitive range of instruments, from commodities and forex to ETFs and equities. The regulated broker also offers a low minimum deposit with leverage and copy trading. This 2025 review of Purple Trading will outline its fees, deposit and withdrawal options, customer support, and platforms.

Purple Trading is a popular CFD broker with a wide range of assets that can be traded on MT4 and cTrader. Moreover, clients are protected by ESMA regulation, negative balance protection and access to the Investor Compensation Fund.

Company History & Overview

Purple Trading was established in 2016 and is now owned and operated by L.F. Investment Limited, a licensed Cyprus investment firm regulated by the Cyprus Securities and Exchange Commission (CySEC). The firm was founded by a group of Czech and Slovak ‘trading enthusiasts’ and David Varga is its CEO.

The broker is big on technology and innovation. This is why, in addition to offering industry-leading trading platforms, it provides investors with its own trading resources, such as indicators that can automatically plot support and resistance lines, which can easily be integrated with the platforms. The firm strives to make investing easier for retail and professional investors, equipping them with the tools needed to identify profitable opportunities.

Markets & Instruments

Purple Trading has a range of CFD markets, allowing investors to speculate on price movement without owning the underlying assets. The following instruments are offered:

- 100+ stocks, including blue chips like Apple, Amazon and Alphabet

- Eight commodities, including gold, silver and Brent Crude Oil

- Nine indices, including the US 30, UK 100 and S&P 500

- 60+ forex pairs, including majors and exotics

- Five ETF portfolios

- CFD futures

ETF portfolios consist of a basket of more than one ETF. This makes them excellent for those looking to increase diversification and is something that many other brokers do not offer.

Purple Trading Platforms

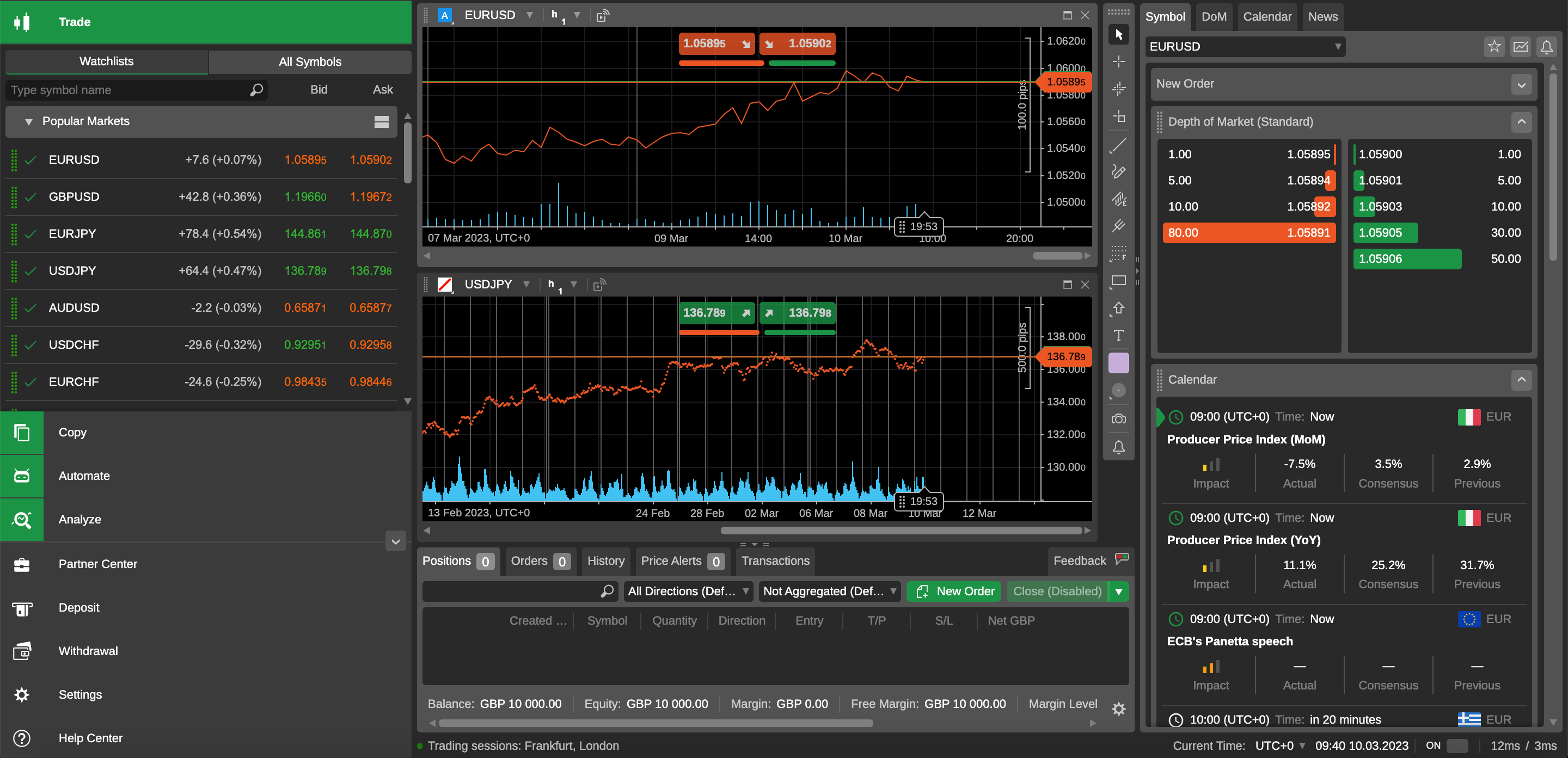

Our experts were pleased to see that the broker uses the industry-recognised MetaTrader 4 (MT4) platform, in addition to offering cTrader, which has become a significant player in the online investing market in its web, desktop and mobile formats. We were disappointed to see that MetaTrader 5 (MT5) is not on offer.

When investing on these platforms, remember that Purple Trading is a no-dealing desk (NDD) broker, meaning that trades are placed directly with liquidity providers.

A major benefit of this is that there is no conflict of interest; the broker makes money from the volume traded rather than from the client’s losses.

Also, our experts found that there are no requotes, as more than 80% of trades are filled with zero or positive slippage.

cTrader

- 28 timeframes

- Six chart types

- Pending orders

- One-click trading

- User-friendly interface

- Market depth indicator

- Integrated economic calendar

- 55+ pre-installed technical indicators

- Windows, iOS, Android and web versions

- Automated trading with programming and backtesting

cTrader

How To Make A Trade On cTrader

- Login to cTrader

- Click on the desired asset from the list on the left

- Click on New Order (either above the chart or to the right of it)

- Choose the desired quantity

- Enter a stop-loss or take-profit order if necessary

- Click Place Order

MetaTrader 4

- Nine timeframes

- 23 analytical objects

- Multiple order types

- 30 built-in technical indicators

- Investing signals and copy trading

- Desktop, web, iOS and Android versions

- Algorithmic trading using the dedicated MQL4 programming language

- Online public marketplace for technical indicators and expert advisors (EAs)

Fees

Fees at Purple Trading depend on whether you have an ECN or STP account. The ECN option is essentially a low-spread scheme with commission charges, whereas the STP profile has higher spreads but zero commission.

ECN spreads generally start from 0.3 pips, which is competitive compared to other brokers, but the commission is between £5 and £10 per lot. STP spreads typically start from 1.3 pips. Note that discounts may apply depending on your status, which is explained in more detail later on.

Swap rates, a charge for the interest from maintaining derivative positions, may apply on positions held overnight.

Research shows that dormant and inactivity fees are also applicable; the monthly charge is £15 for accounts that have been dormant for over six months.

Due to the way ETFs are administered, they come with a different fee structure. There is an ETF management fee of 0.99% per annum and the products also have their own fees of around 0.2% per annum, on average. The minimum deposit for ETFs on Purple Trading is £20.

Fees for copy trading (referred to as strategy fees) may include performance fees, management fees and front fees (deposit fees).

Currency conversion fees may apply if the currency used to deposit or withdraw is different from the account’s base currency. There is a maximum 1% conversion fee of the total amount transferred.

Mobile App

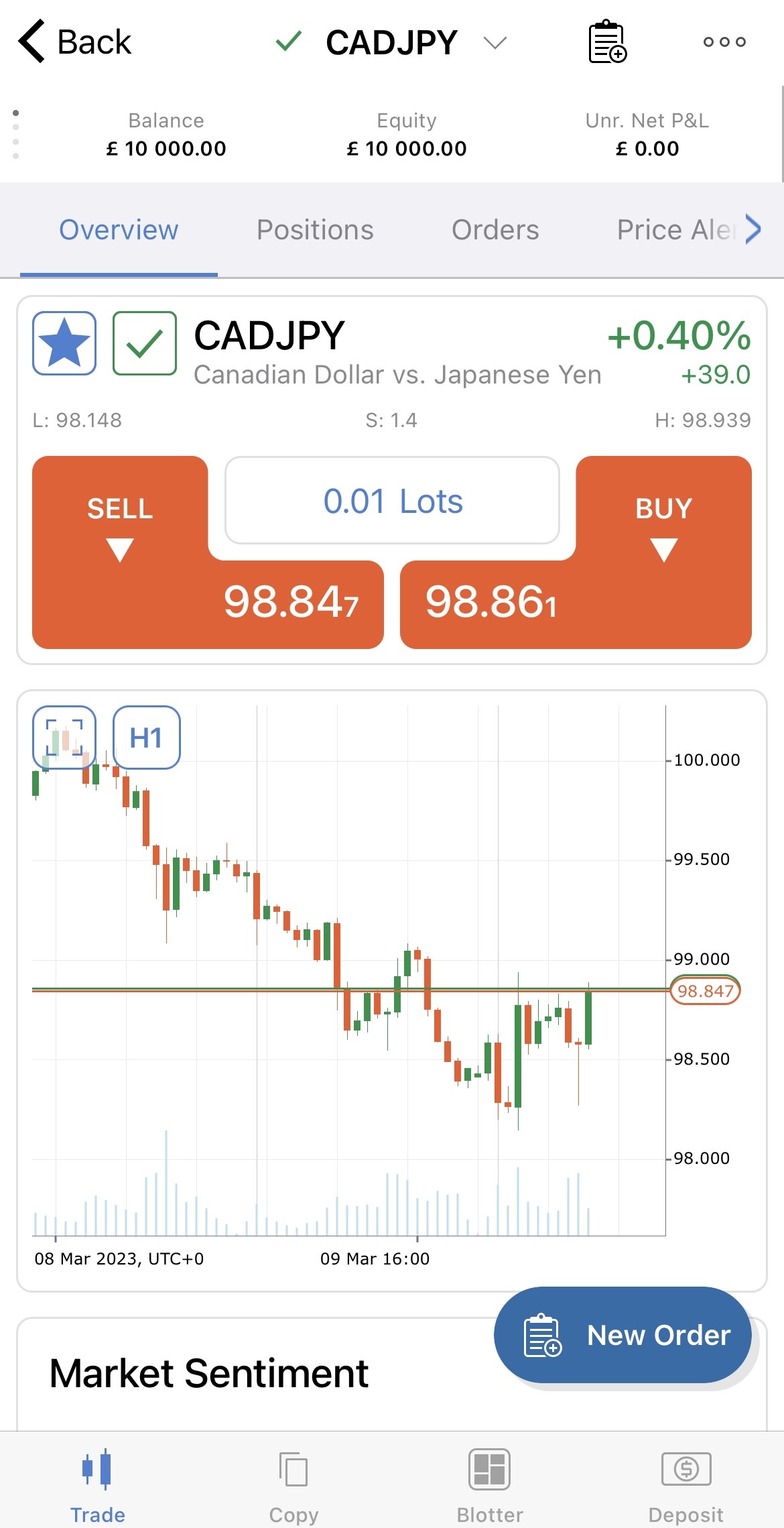

The Purple Trading cTrader app is available on iOS and Android. This intuitive app allows users to easily open and close orders, deposit funds and view charts. Although we prefer analysing price movement on the desktop or web version, this is a decent alternative.

There is also the MT4 app available for download from the App Store and Google Play.

This app has all the main features from the desktop version but allows investors to trade on the go from wherever they are in the world. Simply use the login details provided by the broker to access these platforms.

cTrader Mobile

Payment Methods

Below we list the deposit and withdrawal options, as well as their associated fees and processing times. Deposits and withdrawals can be made from PurpleZone, which is a client area from which investors can perform various account activities.

Deposits

Purple Trading has the following deposit options. When completing a bank transfer, the base currencies offered by the broker are EUR, USD, GBP, PLN and CZK.

- Visa/Mastercard Credit & Debit Card – within a few minutes and free

- International Wire Transfer In GBP – 3-5 business days with a 0.5% fee (minimum £5, maximum £100)

There is no minimum deposit for card and international wire transfer deposits.

Manual approval can take up to one working day for the first deposit made using a card.

How To Deposit On Purple Trading cTrader

- Login to cTrader

- Click on Deposit on the left panel

- Enter the desired amount

- Click Deposit

Withdrawals

The same options are available for withdrawals but with different processing times and fees:

- Visa/Mastercard Credit & Debit Card – usually within a few days (but up to 14 days) and free

- International Wire Transfer – usually up to five days and a 0.5% fee (minimum £5 and maximum £100)

Banks or intermediaries may charge additional fees.

Withdrawals made using payment cards cannot exceed the amount deposited using the same card, a bank withdrawal must be used for any profits.

Traders who deposited using a card or wire transfer must withdraw funds using the same card or account.

Withdrawal requests that result in your margin level dropping below 200% will not be approved by Purple Trading.

How To Withdraw From Purple Trading

- Login to your account

- Navigate to PurpleZone

- Proceed to the Withdraw section

- Complete your withdrawal request

Account Types

Purple Trading has two main account types, alongside Investment and Pro alternatives. While using Purple Trading, we were unable to locate an Islamic (swap-free) option.

Note that the spreads and commissions stated below do not apply to stocks and futures CFDs, which have their own trading conditions.

ECN Account

- Ideal for intraday trading

- Low spreads from 0.3 pips

- Commission between £5-10/lot

- Spreads sourced directly from liquidity providers

STP Account

- Zero commission

- Ideal for swing trading

- Spreads from 1.3 pips (discounts may apply depending on trader status)

Investment Account

- Ideal for increased diversification

- Save time by letting others do the work

- Access to ETFs, copy trading and low-capital investment strategies

PRO Account

- Up to 1:500 leverage available

- Must be a professional trader (criteria examines whether the investor has made large trades, what the size of their portfolio is and whether they have experience in the financial sector)

How To Register For An Account On Purple Trading

- Click on Open Account at the top of the website

- Complete the registration form (includes personal details, account details and an investment questionnaire that evaluates knowledge, experience and investment objectives)

- Upload proof of identity and address (processed within one working day)

Demo Account

Purple Trading provides access to a demo account, which imitates live market conditions. The demo account is free and investors can choose whether to use it on the MT4 or cTrader platforms.

Despite being a standard feature of the best brokers, demo versions provide an excellent opportunity for beginners to familiarise themselves with the investing platforms and for more experienced investors to test a new strategy.

How To Open A Demo Account On Purple Trading

- Click on Demo at the top of the broker’s website

- Complete the demo account registration form (including account type, margin, currency, trading platform and initial deposit)

- Login to the selected platform using the credentials sent to your email address

Alternatively, those with a live account can create a demo account through PurpleZone:

- Login to PurpleZone

- Click on the FX and Crypto Demo Tab

- Click on the + create a new account button

Bonuses & Promotions

As this broker is regulated by CySEC, it is more restricted in the promotions it can offer compared to offshore and unregulated brokers. When we used the brokerage, we were unable to find any no-deposit bonuses or similar promotions.

However, Purple Trading does offer discounts on spreads and commissions through its trader status categories. Improving your trader status can lead to commission rates being cut by up to 50%.

Purple Trading Regulation

Purple Trading is regulated by CySEC. These are reputable regulatory bodies that ensure increased scrutiny and monitoring of the broker’s activities compared to some international regulators. This results in greater protection for investors.

We were also pleased to see that the broker is a member of the Investor Compensation Fund, which insures clients for up to EUR20,000 if the broker goes bankrupt.

This should give users more confidence about the security of their deposits.

Leverage Review

As a CySEC-regulated broker, leverage is limited to 1:30 for retail clients, although some markets have even tighter limits:

- Indices – 1:20

- Stocks – up to 1:5

- Forex – up to 1:30

- Commodities – up to 1:20

Extra Tools & Features

Our experts found a strong range of educational resources and market analysis products in the Purple Trading Academy, including the following:

- Videos

- Ebooks

- Articles

- Glossary

- Tutorials

- Market forecasts

- Lectures/webinars

- Stock recommendations

These resources make this broker a good option for investors of varying abilities. While using this firm, we were particularly pleased to see up-to-date stock recommendations presented in a clear and accessible manner, which many competitors lack. There were also articles on how to manage risk using FTMO apps.

Traders undertaking fundamental analysis should regularly check the built-in economic calendar for upcoming market announcements and news.

Our experts found the currency indices on Purple Trading to be a useful tool to evaluate the fundamental strength of a particular currency against multiple other currencies, rather than just analysing a single pair.

Copy trading is available, supporting a wide range of strategies to suit your risk appetite and investing preferences. Mini strategies built by professional forex traders are on offer with lower minimum deposits. This makes them an accessible option for those with less time and money to commit.

How To Download An Ebook

Ebooks are a great way to learn and Purple Trading has many that can be downloaded, covering topics from How to trade forex to How to trade CFD shares. To download an ebook, follow these steps:

- Hover over the Education tab at the top of the broker’s webpage

- Click on Ebooks

- Choose the ebook you want and then click Download ebook

- Enter your details in the short form

- Click Submit

Trading Hours

Trading hours vary according to the market in question. US stock CFDs can be traded from 13:30-20:00 GMT, whereas EU stock CFDs trade from 08:00-16:30 GMT. Forex, indices, commodities and futures markets also have their own opening hours, so check these before you begin investing.

The broker’s time zone is GMT+3.

Customer Service

When we used Purple Trading, we found a solid range of customer support options, including:

- Live Chat – icon on webpages

- Phone – +44 14 46 506 711 (Monday-Friday 07:00-15:00 GMT)

- Email – info@purple-trading.com (new clients) or support@purple-trading.com (existing clients)

The broker has a social media presence on Facebook, Twitter, Instagram and a YouTube channel.

Should You Invest With Purple Trading?

Purple Trading is an excellent choice for those seeking low spreads or a zero-commission account. It is reassuring that the broker is regulated by CySEC and is a member of the Investor Compensation Fund. Our experts were also pleased to see a strong education and market analysis section that assists clients in making profitable trades. Despite some deposit and withdrawal fees, Purple Trading is likely to be an attractive choice for many investors and the option to use the excellent MT4 is a bonus.

FAQ

Does Purple Trading Have Fast Order Execution?

Yes. Purple Trading has low latency, in part because its servers are based at LD4 Equinix in London, which enables data to be transferred faster, leading to quick order execution.

Is Purple Trading Safe Or A Scam?

This broker is regulated by CySEC, which means more protection for investors. The firm is also a member of the Investor Compensation Fund. Overall, Purple Trading is a legitimate online broker.

Which Is The Best Account Type On Purple Trading?

When comparing the STP vs ECN accounts, the best one depends on your strategy. The STP account is more suited to swing trading, whereas the ECN account is better designed for higher-volume intraday traders.

Should I Rely On Stock Recommendations From Purple Trading?

The recommendations in the market analysis section should act as a guide to what could potentially be wise investments. However, it is key that traders undertake their own risk analysis and only invest if the asset and market conditions align with their strategy preferences.

Top 3 Purple Trading Alternatives

These brokers are the most similar to Purple Trading:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Purple Trading Feature Comparison

| Purple Trading | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.5 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Cryptos, Futures, Commodities | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, CONSOB | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, cTrader | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

69% of retail CFD accounts lose money. |

||

| Review | Purple Trading Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Purple Trading | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | No | No | No |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Purple Trading vs Other Brokers

Compare Purple Trading with any other broker by selecting the other broker below.

Popular Purple Trading comparisons: