PU Prime Review 2025

PU Prime is a popular online trading broker, offering forex and CFD products to clients worldwide. Boasting transparent pricing and industry-leading trade execution speeds, the firm has won several awards for its trading app, customer service and speed of growth. Our team of experienced investors has uncovered the details you need to know about PU Prime, such as its fee structure, account types, deposit and withdrawal options and supported trading platforms. Read on to discover whether this broker can meet your investing needs in 2025.

About PU Prime

Founded in 2015, PU Prime is owned and operated by Pacific Union, a Seychelles-based company regulated by the FSA of Seychelles. With over 200,000 clients and 17 offices worldwide, the firm serves investors in over 120 jurisdictions, including the UK.

By supporting MetaTrader 4 and 5, a copy trading platform and a proprietary mobile app, the broker ensures that every investor is provided for. The company also offers four account types, with a demo version of each.

Markets

PU Prime offers CFD trading for over 750 instruments, spanning the forex, indices, commodities, shares and cryptocurrencies markets.

Forex

Over 40 forex products are provided by PU Prime, with major, minor and exotic currency pairs all supported.

When we used an ECN Prime or Islamic account, our experts could trade with tight spreads from 0.0 pips. Spreads are also competitive when using the commission-free STP Standard and Cent accounts, starting from 1.3 pips.

Indices

We were pleased to learn that the broker offers a great range of 24 indices instruments, including spot cash and futures products from numerous global exchanges.

This review found that indices are offered with STP execution only, regardless of account type, with spreads from 0.7 pips.

Commodities

There are 20 commodities CFD products available from PU Prime, consisting of six metals, seven energies and seven soft commodities.

Shares

More than 650 total equities CFD instruments are provided by the broker from several jurisdictions, including the major US and EU exchanges.

We found that spreads are consistent between all account types, with many European stocks charged an additional trading commission.

Cryptocurrencies

Over 40 cryptocurrency CFD products are available from PU Prime. We found these to include Bitcoin, Ethereum and Cardano USD pairs, as well as cross-pairs such as Ethereum/Litecoin and Bitcoin/Bitcoin Cash. In addition, a small selection of EUR currency pairs is provided.

Leverage

While our experts recommend exercising caution when trading with a significant margin, the ability to open high-leverage positions is a welcome one for many. To this end, we found that PU Prime offers leverage of up to 1:500 – far higher than all FCA-licensed and ESMA-regulated brokers.

This margin level can be used on major forex pairs and indices, as well as some commodities. We discovered that some products, such as minor forex pairs and cryptocurrencies CFDs, have lower maximum leverage limits, though these are still ample for most investors.

Account Types

There are three account types available from PU Prime, catering to clients who prefer zero-commission STP trading and the tight spreads offered by ECN execution. In addition, low-stakes speculators have the option of a Cent account, while those who cannot pay interest for religious reasons can open an Islamic variant for either the Standard or Prime account.

Standard Account

The Standard account uses the STP execution model to provide investors with zero commission trading across the firm’s full range of markets. We found that UK clients are well catered for, with GBP as one of the nine base currencies supported by this account. Spreads start from 1.3 pips and leverage of up to 1:500 is supported.

We learned that a £45 initial minimum deposit is required to open a PU Prime Standard account. After that, clients can trade via the MetaTrader 4 or 5 platform, the PU Social app and the PU Prime app.

Prime Account

The second account type offered by the broker is the Prime variant, which utilises ECN trade execution to provide tight spreads from 0.0 pips. The commission for the Prime account stands at a £6 per round traded lot, which our team of experienced investors judged as competitive.

This account is available with GBP as a base currency and clients can use all the brokers’ supported platforms. However, a hefty £850 initial minimum deposit is required to open a Prime account.

Cent Account

A Cent account is provided for smaller stakes trades with a £17 initial minimum deposit and an £850 max deposit. This variant uses the STP execution style and offers spreads from 1.3 pips. However, the only supported base currency is USD and available trading platforms are limited to MT4 and the PU Prime mobile app.

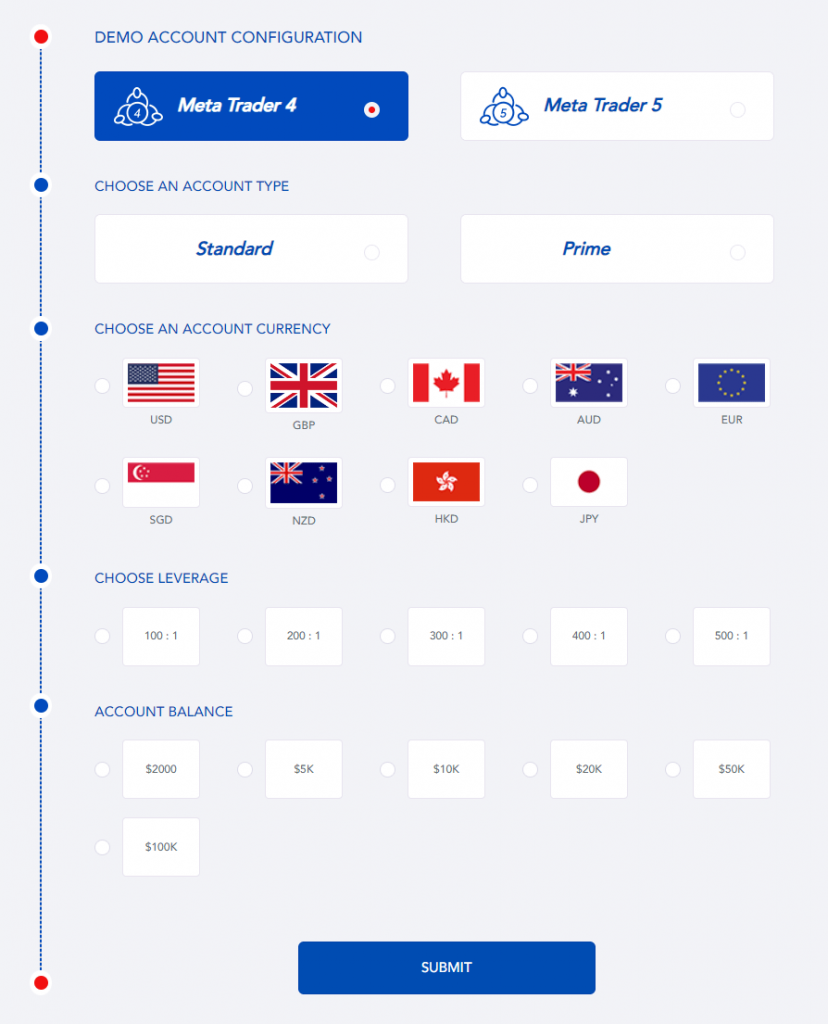

Demo Account

Our experts recommend that prospective clients open a demo account with a new broker before committing to a live account. This allows customers to trial the client portal, trading conditions and customer service of a company before adding real funds.

We found that PU Prime supports a demo account variant for the Standard and Prime account types, with maximum leverage from 1:100 to 1:500 and an account balance of up to £100,000 in paper funds.

Investors can use a demo account for a generous 60-day period before a live account is required to continue investing.

Trading Platforms

PU Prime supports two software packages from MetaTrader, MT4 and MT5, in addition to a pair of proprietary mobile apps.

MetaTrader 4

MT4 has been around for over 15 years and is still rated highly by our team of traders. With features such as strategy backtesting, expert advisor (EA) integration and custom alerts, the platform still punches well above its weight as a free software option.

MetaTrader 4 offers nine time frames, 30 indicators and 31 graphical objects, which we would recommend supplementing with custom indicators and trading tools from the MQL4 marketplace.

The trading solution is free to download on Windows, Mac and Linux operating systems or available through the browser-based WebTrader platform and as a mobile app for Android and iOS devices.

MetaTrader 5

Launched in 2010 as an update to the MT4 platform, MetaTrader 5 added support for more asset types and a host of new useful features. Chief among these was upgraded strategy backtesting, a new MQL5 coding language and a built-in economic calendar.

MetaQuotes built upon its previous solution by offering 38 indicators, 44 graphical objects and 21 timeframes as standard. Custom solutions from the MQL5 marketplace can supplement these tools. In addition, six pending order types means that investment positions can be more accurate and better automated.

MT5 is available as a free download for Windows, Mac, Linux, Android and iOS devices. Investors can also access it through the browser-based WebTrader service.

Mobile Apps

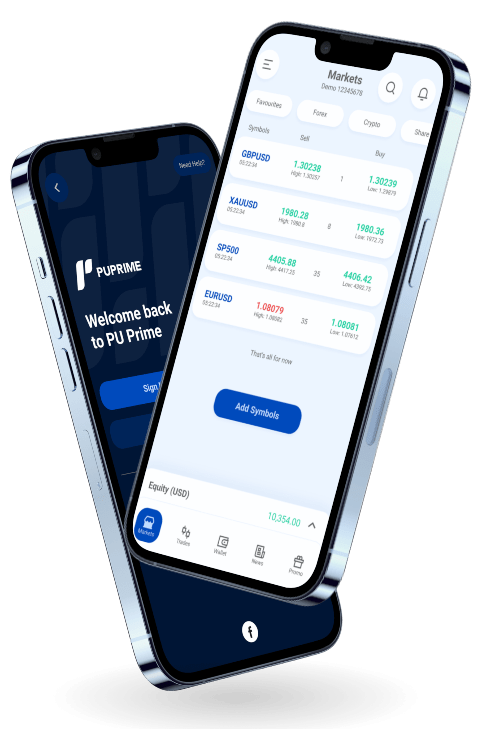

In addition to the MT4 and MT5 mobile apps, PU Prime offers two proprietary mobile solutions geared toward different types of investors.

PU Prime App

The PU Prime App is the proprietary solution developed by the broker for investing on the go. Our experts found this app intuitive and straightforward, though lacking the MetaTrader platforms’ advanced analysis tools and trade automation capabilities.

This app is available as a free download for Android (APK) and Apple (iOS) devices.

PU Social

The second mobile app offered by PU Prime is PU Social, the broker’s copy trading solution. This app is available for Android and iOS devices and allows users to automatically emulate other traders’ positions. Investors can also offer their own trades to the community and earn commission from those copying their successful strategies.

Payment Methods

PU Prime provides a good range of GBP funding options to clients. These are:

- Skrill

- Neteller

- Bank wire transfer

- BTC/ USDT crypto transfers

- Visa and MasterCard credit and debit cards

For all supported methods, there is a £45 minimum deposit requirement. Bank wire transfers take 2-5 business days to clear, while deposits by all other methods are instantly processed.

Withdrawals must exceed £100 for all funding options and transactions process within 24 hours for all GBP methods other than bank wire transfers, which take 2-5 business days to clear.

Deposit & Withdrawal Fees

We are happy to report that PU Prime does not levy charges for any deposit methods. However, bank wire transfers often require a bank processing charge of around £15 and crypto transactions are subject to gas fees.

The broker levies no withdrawal fees on bank wires, card payments or crypto transfers. However, our team discovered that Neteller withdrawals are subject to a 2% fee and that there is a 1% commission on Skrill transfers.

Trading Fees

Our specialists recommend that prospective clients pay specific attention to a company’s trading fees, as high prices eat into an investor’s hard-earned profits.

PU Prime charges a commission of £6 per round traded lot on ECN positions. At the same time, spreads start from a competitive 1.3 pips on the broker’s zero-commission STP accounts. Sporadic traders will be delighted to learn that the firm does not levy inactivity fees on dormant accounts.

Swap charges are applied to leveraged positions held overnight. These fees vary from asset to asset and can be viewed via an instrument’s MetaTrader 4 or 5 page.

How To Make A Trade With PU Prime

Our experts have put together a step-by-step guide to investing with PU Prime to help you get started. However, we recommend that beginners read up on forex and CFD speculation before diving into the markets.

1. Create An Account

The first step to making an investment with PU Prime is to create an account. This is achieved by navigating to the broker’s website and clicking the “Join Now” button at the top of the screen.

Investors can choose from the Standard, Prime and Cent accounts or opt for a demo account to gain valuable risk-free trading experience.

2. Funding An Account

Once an account is created, users can add funds via the client portal using any of the several supported payment methods. This initial deposit must be greater than the minimum funding requirement for the account created – £45 for the Standard, £850 for the Prime and £17 for the Cent variant.

3. Access A Trading Platform

PU Prime offers its clients four trading platforms – MetaTrader 4, MetaTrader 5, the PU Social app and the PU Prime app.

All four platforms are available for free from the PU Prime website or various official mobile device app stores. Speculators can also access MT4 and MT5 via the browser-based WebTrader service.

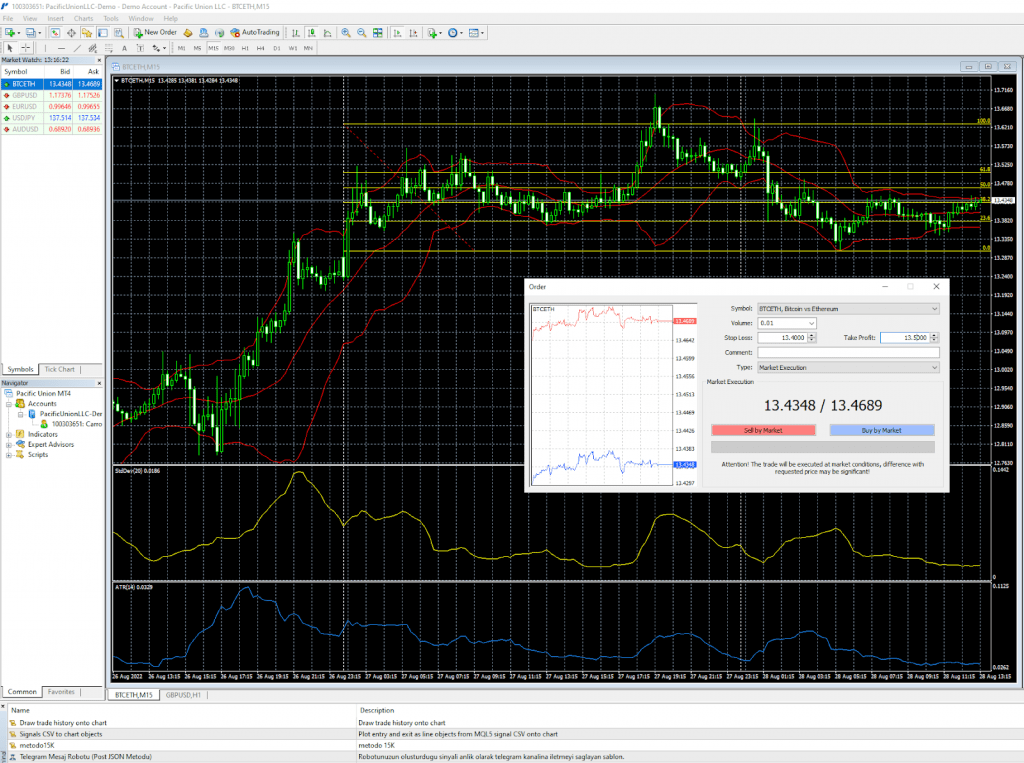

4. Open A Trade

Once your platform is downloaded, use your login details to access your live or demo PU Prime account via the broker’s server.

On MetaTrader 4 and 5, use the view menu at the top or the Ctrl+U shortcuts on Windows to find your desired symbol. Then, select your instrument(s) from the menu to bring up the price charts for each asset.

When you have completed your analysis and are ready to place an order, find the “New Order” button at the top of the screen and select your desired symbol. Now, investors can choose their trading volume and order type and set optional stop loss and take profit levels.

To go long on an asset, select a “buy” order and to short a product, select a “sell” order.

5. Close Your Position

Trades can be closed manually at any time by right-clicking on a position and selecting the “close trade” menu option. This can be done as a market order or by setting sell limits.

Alternatively, investors can set a trailing stop order by right-clicking their open trade on the bottom of the platform screen and selecting a value from the “trailing stop” menu.

Security & Regulation

While using any broker, clients want to be assured that their funds and data are safe. While we strongly advise investors only to trade with regulated firms, some regulatory bodies offer greater protection than others.

PU Prime is licensed by the Seychelles FSA, which does not provide the same protection as an organisation such as the UK’s FCA or the ASIC in Australia. However, we were pleased to learn that the broker offers its clients negative balance protection.

Unfortunately, the brokerage does not offer enhanced login protection through two-factor authentication (2FA). However, this measure can be set up independently for the MT4 and MT5 platforms.

Customer Service

We found several available avenues for support from PU Prime, including a live chat service, contact form, dedicated phone number and email address:

- Email Address: info@puprime.com

- Phone Number: +248 4671 948

Help is provided 24/5 and in 18 languages, including English. In addition to the general support team, each client is issued a dedicated account manager.

A help centre with answers to common questions is also provided on the firm’s website, though we found this section to be extremely slow to load and very brief.

Educational Content

PU Prime provides significant educational content to help its clients grow their knowledge of the financial markets. This provision includes articles on trading fundamentals, video tutorials, a blog with varied pieces on investing, a selection of free e-books and a key terms glossary.

Advantages Of PU Prime

- No inactivity fees

- MT4 & MT5 access

- Several promotions

- Good leverage rates

- ECN and STP accounts

- Great educational content

- GBP base currency support

- English-speaking customer service

- Selection of mobile trading platforms

- Competitive spreads and commissions

Disadvantages Of PU Prime

- Weak regulator

- Forex & CFDs only

- No UK shares support

- High minimum deposit limits

Promotions

PU Prime runs regular promotions, such as deposit bonus schemes, swap fee rebates and commission cashback. However, these programs change regularly, so it is worth checking the broker’s website to ensure you can view the most up-to-date schedules.

Currently, both new and existing traders can claim a 50% deposit bonus on their first transaction up to £450, with a 20% bonus up to £8,100 on subsequent deposits.

As with all promotions, our experts strongly suggest that investors read any wagering requirements or terms and conditions thoroughly to avoid having real funds locked up.

Additional Features

When we used the PU Prime brokerage, the broker provided several helpful additional features to enhance our trading experience. These include top-level signals from Autochartist, an economic calendar and daily and weekly market news articles.

However, unlike many of its competitors, the company does not offer a free or subsidised VPS to facilitate round-the-clock automated trading. Nor does the firm provide any trading or margin calculators on its website.

Trading Hours

PU Prime clients can trade on forex and CFD markets 24/5, with extended 24/7 market hours for cryptocurrency CFD products.

PU Prime Verdict

After our experts’ thorough review of PU Prime, our team has concluded that the broker has many positive aspects. These include excellent support for investors using GBP, various account types and several solid trading platforms. In addition, commissions are competitive and spreads are tight. However, some prospective clients may worry about the relatively weak regulation from the Seychelles FSA. There is also a hefty £850 initial minimum deposit requirement to consider to open a Prime ECN account.

FAQs

What Is The Minimum Deposit For PU Prime?

An initial minimum deposit of £17 or more is required to open a Cent account, rising to £45 for a Standard account and increasing to a substantial £850 amount for a Prime account. Subsequent deposits must exceed £45 for all supported payment methods.

Who Is The Owner Of PU Prime?

PU Prime is owned by Pacific Union Limited, a company registered in Seychelles.

Does PU Prime Have A Support Email Address?

Prospective clients and registered account holders alike can contact PU Prime via info@puprime.com.

Should I Use PU Prime For Online Trading?

Our team of experts can recommend PU Prime based on its low spreads, competitive commissions, solid range of account types and great supported platforms.

Does PU Prime Charge An Inactivity Fee?

No, there are no inactivity fees with PU Prime. However, accounts with no activity for 90 days or more may be disabled by the broker, though the firm will preserve any funds past this period.

Top 3 PU Prime Alternatives

These brokers are the most similar to PU Prime:

- Vantage FX - Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

PU Prime Feature Comparison

| PU Prime | Vantage FX | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 4.2 | 4.7 | 4.8 | 4.8 |

| Markets | Forex, Commodities, Cryptocurrencies, Stocks, Indices | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $50 | $50 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC (Australian Securities and Investments Commission), FSA (Financial Services Authority of Seychelles), FSCA (Financial Sector Conduct Authority), SVGFSA (Financial Services Authority St Vincent & The Grenadines) | FCA, ASIC, FSCA, VFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | 100% cashback up to $10,000 | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | PU Prime Review |

Vantage FX Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| PU Prime | Vantage FX | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | Yes | Yes |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | Yes | Yes | Yes | Yes |

PU Prime vs Other Brokers

Compare PU Prime with any other broker by selecting the other broker below.

Popular PU Prime comparisons:

|

|

PU Prime is #52 in our rankings of CFD brokers. |

| Top 3 alternatives to PU Prime |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Commodities, Cryptocurrencies, Stocks, Indices |

| Demo Account | Yes |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Regulated By | ASIC (Australian Securities and Investments Commission), FSA (Financial Services Authority of Seychelles), FSCA (Financial Sector Conduct Authority), SVGFSA (Financial Services Authority St Vincent & The Grenadines) |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:500 |

| Bonus | 100% cashback up to $10,000 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | AstroPay, Credit Cards, Debit Card, FasaPay, Mastercard, Visa, Wire Transfer |

| Copy Trading | Yes |

| Signals Service | None |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Copper, Corn, Cotton, Gold, Natural Gas, Oil, Orange Juice, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | Not Available |

| CFD GBPUSD Spread | From 0.5 pips |

| CFD Oil Spread | From 1.6 pips |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | From 0.5 pips |

| EURUSD Spread | From 0.2 pips |

| GBPEUR Spread | From 0.4 pips |

| Assets | 800+ |

| Crypto Coins | BCH, BTC, EOS, ETH, LTC, XLM |

| Crypto Spreads | From 0.7 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |