Prospero Markets Review 2025

|

|

Prospero Markets is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Prospero Markets |

| Prospero Markets Facts & Figures |

|---|

Prospero Markets was established in 2012, boasting access to more than 300 investment products under the safety of ASIC regulation. The broker also extends its services beyond Australia to the majority of the globe, allowing retail traders to access low-spread CFDs on reliable trading software. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Metals, Energies, Stocks, Indices, VIX |

| Demo Account | Yes |

| Min. Deposit | A$500 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Prospero Markets offers an impressive range of CFD assets, with a focus on equities, indices and futures that can be hard to find. More than 300 instruments are offered in total, with 58 of these based on futures products. CFDs can be traded with leverage up to 1:400. |

| Leverage | 1:30 (Australia), 1:400 (Global) |

| FTSE Spread | From 1.27 |

| GBPUSD Spread | From 0.5 |

| Oil Spread | From 2.5 |

| Stocks Spread | NA |

| Forex | Prospero Markets offers 38 forex pairs spanning majors, minors and exotics. Spreads are fairly tight on the Standard account and commissions are very competitive for VIP clients. |

| GBPUSD Spread | From 0.5 |

| EURUSD Spread | From 0.1 |

| GBPEUR Spread | From 0.5 |

| Assets | 38 |

| Stocks | Clients looking for equity-based investment opportunities will be pleased to see over 100 Australian company shares and 95 US stock on offer. However, Prospero Markets provides access to more economies and stock markets through its 11 indices, plus the VIX 75. |

Prospero Markets is the Australian trading name of The Prospero Group, which also encompasses Prospero Global. Both these entities support UK investors and offer a similar range of CFD instruments, account types and financial services. This 2025 review will outline the key aspects of Prospero Markets’ features, including platforms, fee structures and deposit options, with a focus on accessibility for UK traders.

Our Verdict

Prospero Markets is an unremarkable broker with a strong range of commodities products, though limited services and instruments in other markets.

We liked the firm’s fee structure and were pleased to see ASIC regulation for the Australian branch, though the top FCA-regulated brokers boast more competitive trading conditions and payment options that allow for GBP deposits and withdrawals.

Market Access

Prospero Markets offers a mediocre range of instruments via contracts for difference (CFDs) from a range of markets. These assets include US and Australian shares, popular forex pairs, commodities and indices.

- Shares: Over 150 US and Australian shares, including the likes of Google, Apple, and Netflix

- Forex: Over 30 currency pairs, including seven major pairs, such as GBP/USD, EUR/USD and USD/JPY

- Commodities: 15 commodities instruments, including energies like natural gas, soft commodities like wheat and precious metals like gold and silver

- Indices: 10 index CFD products, including the FTSE 100, NASDAQ 100 and ASX 200

Overall, we think Prospero Markets offers a moderate selection of instruments. Clients can invest in assets from all the most popular markets besides cryptocurrencies, though stocks and shares from the UK and Europe are not available outside the relevant indices. However, the firm offers a surprisingly competitive range of commodity products.

Prospero Markets Fees

While using the broker, our experts found that the fee structure you will need to consider varies with the account type you hold.

The Standard Account has floating spreads starting from 0.5 pips and zero commission per trade for non-stock assets. The VIP (ECN) Account has very tight floating spreads from 0.1 pips but charges a commission fee per position, starting from £2.80.

US and Australian share CFDs charge a commission of £0.03 per share, on top of a rollover cost. This charge is levied if you hold a US asset after 17:00 GMT-4, charging the underlying risk-free rate of +/- 3.5%. There is also a 2.5% per annum financial charge on US stock contracts.

These fees are almost impressive for the Standard Account, demonstrating tight spreads on forex, commodities and indices for an STP execution model. However, we were disappointed by the additional costs involved with stock trading, especially when combined with the fairly high commission charges levied on VIP clients.

Accounts

We had hoped to see more variation when it came to account options with Prospero Markets, instead, we were limited to one of two choices. These are the Standard (STP) Account and VIP (ECN) Account. Both offer the same range of assets, leverage rates of up to 1:400, daily and weekly market analyses and a dedicated account manager.

The characteristics that define the two account types are given below.

Standard (STP) Account

- Minimum deposit of £80

- Spreads from 0.5 pips

- Zero commission

VIP (ECN) Account

- Commission starting from £2.80

- Premium ATG Account Manager

- Minimum deposit of £2,400

- Spreads from 0.1 pips

- Weekly market recap

- VIP seminars

We were also disappointed to find that there is no Islamic swap-free account option suitable for Muslim investors that want a halal way to speculate using derivatives.

How To Set Up An Account

- Press the Open Account button on the broker’s site

- Provide the necessary information (residence, name, telephone number, etc.)

- Click Sign Up

- Fill out the KYC form to allow for a live account with a deposit. This will require proof of identification (e.g. a passport or driver’s licence)

- Deposit money into your account from the client portal

- Use the platform login details sent to your email address to log into the MT4 platform

- Begin investing using your desired strategy

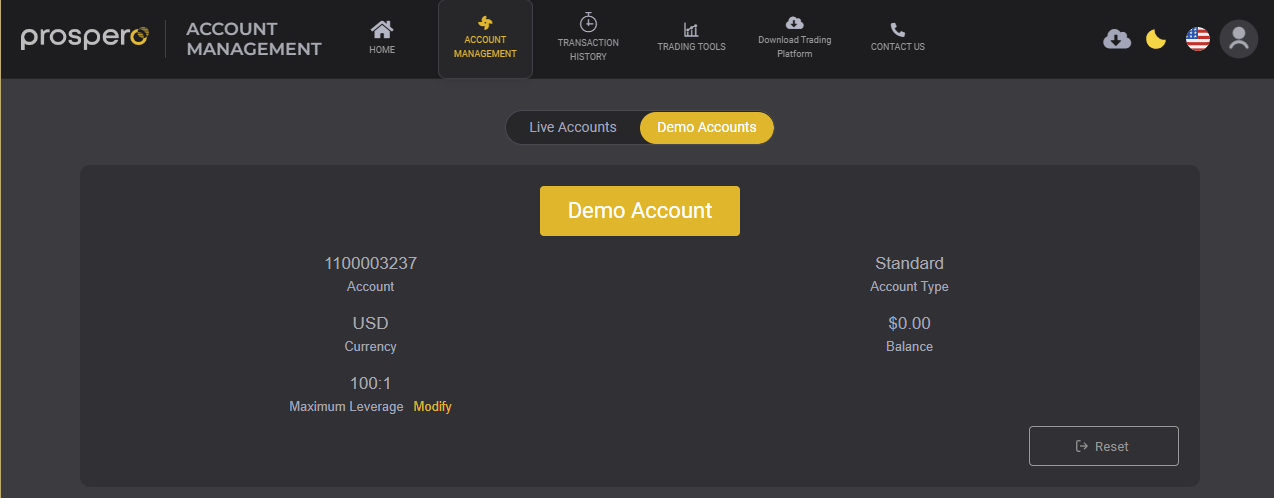

Prospero Markets Client Portal

Funding Methods

Payment methods to Prospero Global are very limited, with only three options detailed. These are Electronic Fund Transfers, Tether (USDT) payments and bank transfers. Other methods are advertised as supported, including Neteller, but no details are given.

- Electronic Fund Transfer: No fees, execution times up to two business days

- USDT: £8.00 per transaction, deposit execution time 5-10 minutes, withdrawal time 1-2 business days

- Local Bank Transfer: No fees, deposit execution time 5-10 minutes, withdrawal time 2-3 business days. Only available in THB, PHP, IND, VND, CNY

Prospero Markets is similarly limited, only offering Electronic Fund Transfers, BPay and payment cards (Visa and Mastercard).

- Electronic Fund Transfer: No fees, execution times up to two business days

- BPay: No fees, execution times up to two business days

- Payment Cards: No fees, execution times 1-2 hours

Overall, we dislike that the number of payment methods is lacking compared to many competitors, with major solutions like Skrill missing. Furthermore, information on supposedly available methods is also lacking.

UK Regulation

The Australian Securities and Investment Commission (ASIC) regulates the broker’s Australian branch, Prospero Markets. The international branch, Prospero Global, is registered with the FSA of St. Vincent and the Grenadines. Unfortunately, the firm is not regulated by the UK Financial Conduct Authority (FCA).

Our experts were pleased to see the broker regulated by an authority as stringent as the ASIC, which is one of the top agencies for financial fair play and retail trader protection. That being said, the global branch’s FSA regulation is much less impressive, as many brokerage firms set up offices in SVG for lax licensing and regulatory requirements.

However, both the global and Australian branches offer negative balance protection and segregate traders’ funds. Moreover, UK clients are accepted at both branches, so it is up to the investor whether they opt for better protection or additional opportunities, such as greater leverage rates and promotional bonuses.

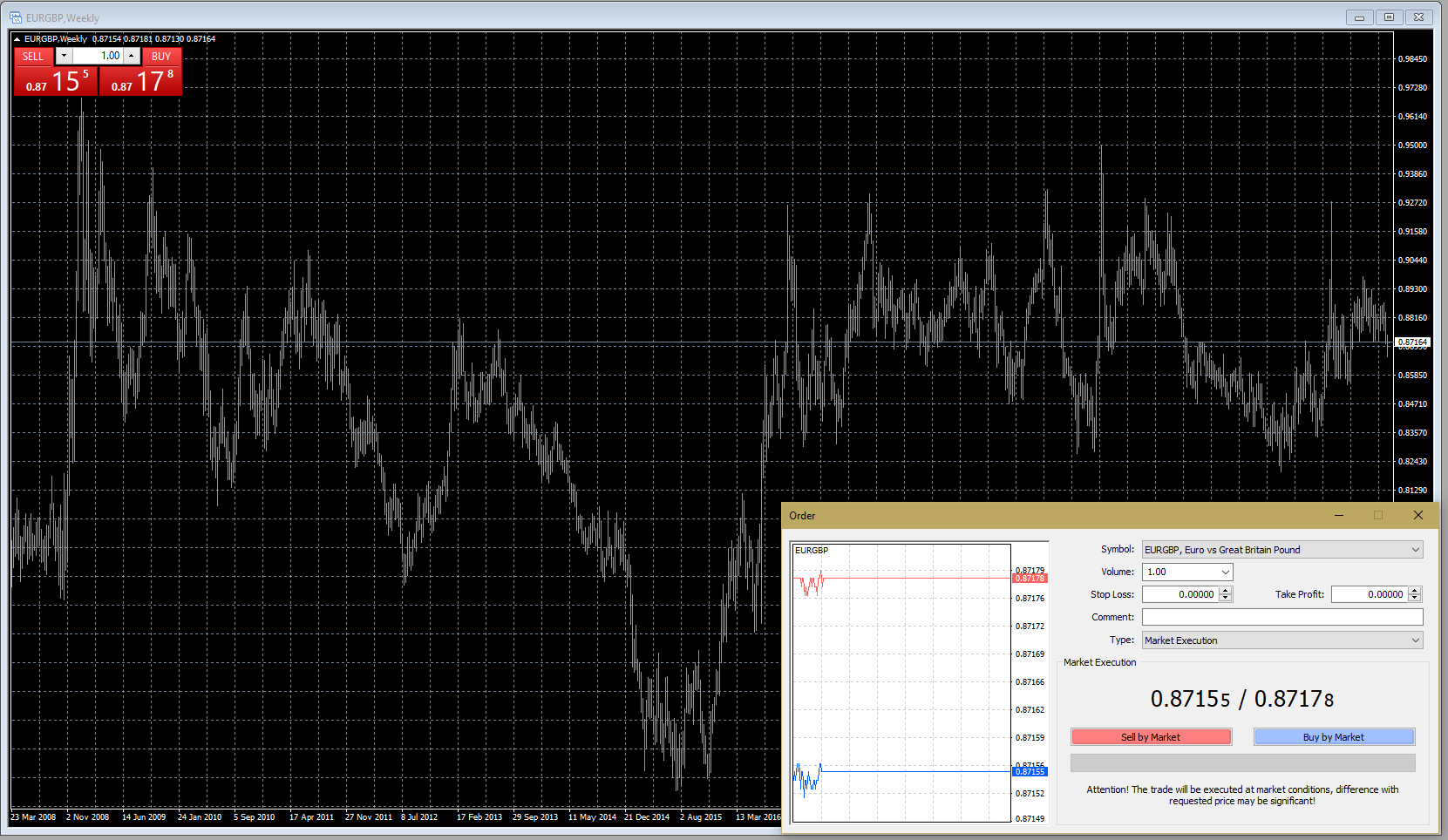

Trading Platforms

We were pleased to see that Prospero Markets gives clients access to financial speculation through the MetaTrader 4 (MT4) trading platform. This is one of the most popular and widely used online platforms, with a myriad of features and tools to build any kind of manual or automated strategy.

Key features include:

- Nine time frames

- 31 graphical objects

- 30 technical indicators

- Four pending order types

- Automated trading via expert advisors (EAs)

- MQL4 programming language for plug-ins, APIs, VPS & automation

MT4 can be downloaded for free on desktops and mobile devices (iOS and Android) or accessed directly within a web browser through its WebTrader function. The download link can be found on the broker’s website and the client portal.

While it is good to see MT4 offered by the firm, we were disappointed to see that there were no alternatives included. Many competitive brokers offer a range of platforms, often including MetaTrader 5, cTrader or TradingView, alongside a user-focused proprietary tool.

MetaTrader 4

How To Place A Trade On MetaTrader 4

- Login to the MetaTrader 4 desktop terminal or WebTrader

- Open the chart for your desired asset in the Market Watch window

- Perform your technical and fundamental analysis to identify the best time to open your trade

- Click the New Order button at the top of the screen

- Adjust the parameters of your position in the order window (symbol, volume, stop loss, take profit, etc.)

- Choose to Sell by market or Buy by market to place your order in the chosen direction (bullish or bearish)

- When it comes time to close your order, go to the bottom of the terminal and click on the Trade tab

- Right-click on the order you want to close and choose the Close Order option

Mobile App

The MetaTrader 4 platform is also available on Apple iOS and Android devices. The application provides many of the basic features that the desktop terminal provides, allowing traders to track assets, perform standard technical analysis and place orders. We found the platform easy to use and very intuitive, making it perfect for mobile trading.

It is available to download for free from the Apple App Store and Google Play Store.

MetaTrader 4 Mobile

Leverage

Prospero Global facilitates investing with leverage, offering rates of up to 1:400 for both account types. While this is much greater than the rates offered by FCA, ASIC and ESMA-regulated firms, some offshore companies offer rates in the thousands in return for the lack of protection.

The maximum available leverage rates on offer also vary depending on asset types as follows:

- Forex: 1:400

- Equities: 1:10

- Indices: Up to 1:100

- Commodities: 1:400

- Precious Metals: Up to 1:400

Prospero Markets offers much more limited leverage opportunities due to the restrictions put in place by the ASIC to protect retail investors.

- Gold: 1:20

- Equities: 1:5

- Forex: Up to 1:30

- Indices: Up to 1:20

- Commodities: 1:10

Trading with leverage magnifies the maximum returns from any position, though it also greatly increases the size of the potential losses. We always recommend that clients use caution when trading on margin and employ strict risk management approaches, reducing the chances of wiping out their account capital.

Demo Account

We were pleased to see that Prospero Markets offers free demo trading accounts with access to the MT4 trading platform. Clients can open demo accounts from the Account Management tab within the client portal. Here, you can choose the desired demo account type (Standard or VIP), maximum leverage rate and starting balance. You will then be emailed the login details for the MT4 platform.

The demo account gives traders a great opportunity to get accustomed to the trading platform, fee structure and markets offered by the firm before investing their hard-earned capital. Furthermore, it is a great place to continuously develop trading strategies before applying improvements to your live account.

Bonuses & Promotions

Prospero Markets does not offer any bonus deals or promotional offers, whether you are investing with the ASIC-regulated or global branch. We find this somewhat disappointing as many offshore brokers take advantage of their lack of regulation to offer financial incentives and free rewards in the form of deposit bonuses, demo competitions and giveaways.

Extra Tools & Features

Prospero Markets offers a decent range of additional features to better its clients’ investing experiences. An economic calendar is available to help traders prepare for planned future events such as earnings reports. Financial news is also provided, covering popular assets.

Moreover, the firm holds financial investment courses that cover in-depth content in a digestible manner with a team of 20 experienced investors, though it will set you back more than £4,000.

We quite liked the educational Knowledge section available on the broker’s website, covering all of the fundamental information required for a new trader to get started. This includes a glossary covering the key terminology of trading and brief explanations of some popular investing strategies.

However, the offerings are, at best, on par with many other brokers, lacking the quality and quantity that top firms provide. For example, an Academy for beginners could be a great way to expand on the short Knowledge section, providing longer, more in-depth articles and guides on essential topics for new traders.

Company Background

The Prospero Group is an Australian and Asian Pacific derivatives broker that holds an ASIC license under Prospero Markets Pty Ltd and registration with St. Vincent and the Grenadines’ FSA under Prospero Global LLC.

The Australian branch gained its ASIC license in 2012, growing in Australia until deciding to expand into the Chinese and international markets in 2020. Prospero Global gained its license with the FSA that year and saw growth in China.

The global branch was aimed mostly towards the South East Asian market but is open to many other countries, including the UK. The broker currently has over 25,000 clients.

Customer Service

Prospero Markets’ customer support can be found via several methods. Both account types get a dedicated account manager, giving traders a direct way to communicate with the broker’s team.

Alternatively, an online live chat box is available on the broker’s website, as is an online callback form. Clients can also find help via email or any of the firm’s social media channels on Facebook, Twitter, Instagram and LinkedIn.

- Email Address: enquiries@prosperoglobal.com

We were disappointed to see that the broker does not provide a contact telephone number, an important support option that allows for immediate help and provides a personal touch. Furthermore, there is no office outside of Australia or China, making physical support difficult for UK clients.

Security

We were pleased to see that Prospero Markets implements solid data security measures, such as web data encryption and client fund segregation. Moreover, your capital is protected in the case of liquidation and insolvency thanks to the Australian Client Money Rules put in place for financial firms by the ASIC.

Trading Hours

The trading hours for Prospero Markets assets are dependent on the underlying market’s opening hours. For example, ASX stock CFDs will only be available while the Australian Securities Exchange is open. However, forex instruments are available 24/5 from Sunday 21:00 GMT to Friday 20:55 GMT due to the international nature of the market.

Should You Trade With Prospero Markets?

Prospero Markets offers many popular forex, commodity, crypto and index assets, while also giving access to US and Australian company shares. A decent fee structure is also in place and clients can make use of MT4 for advanced technical analysis and automation.

However, the broker falls short in many areas, providing limited details on payment methods, offering lacklustre additional features and supporting a poor range of payment methods that do not accept GBP deposits and withdrawals.

While the company’s Australian branch is regulated by a reputable agency, the international entity does not offer enough in the way of enhanced trading conditions and bonuses to make up for its lack of effective regulation

FAQ

Is Prospero Markets A Good Broker For Beginners?

Prospero Markets offers much of the asset range that a beginner might hope for, alongside decent fees, though the limited payment options that do not support GBP transfers, poor suite of customer service contact methods and lack of user-focused proprietary trading platform may point newer investors to other options.

Does Prospero Markets Offer A Good Platform?

Prospero Markets and Prospero Global both offer the MetaTrader 4 trading platform. This reliable software is available on desktop, in a web browser or on mobile devices. It will meet the requirements of most beginners and seasoned traders.

Does Prospero Markets Offer High Leverage?

Yes, Prospero Global offers leverage rates of up to 1:400, while Prospero Markets offers up to 1:30. This makes trading with the global firm relatively high-risk for beginners who could see losses significantly amplified.

Is Prospero Markets Legitimate?

The global firm, Prospero Global, is registered with the SVG FSA and is effectively unregulated, while the Australian firm, Prospero Markets, is regulated by ASIC, a much more reliable and legitimate financial agency. Overall though, we are comfortable that the firm is a legitimate brokerage.

Does Prospero Markets Offer A Free Practice Account?

Both Prospero Markets and Prospero Global offer MetaTrader 4 demo accounts. These can be set up in the client portal after making an account. This is a good way to try the firm before risking money.

Where Is Prospero Markets Based?

Prospero Markets is headquartered in Melbourne, Australia, but with offices across Australia and China, including Sydney, Brisbane, Shanghai and Beijing. However, UK investors can still open an account with either of the company’s entities.

Article Sources

Prospero Global FSA Registration Page – Registration Number 533

Prospero Markets ASIC Registration Page

Top 3 Prospero Markets Alternatives

These brokers are the most similar to Prospero Markets:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Prospero Markets Feature Comparison

| Prospero Markets | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.7 | 4 |

| Markets | CFDs, Forex, Metals, Energies, Stocks, Indices, VIX | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | A$500 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, SVGFSA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 (Australia), 1:400 (Global) | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Prospero Markets Review |

Swissquote Review |

IG Index Review |

FP Markets Review |

Trading Instruments Comparison

| Prospero Markets | Swissquote | IG Index | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | Yes | Yes | Yes | Yes |

Prospero Markets vs Other Brokers

Compare Prospero Markets with any other broker by selecting the other broker below.

Popular Prospero Markets comparisons: