Professional Trading Accounts

Professional trading accounts offer higher leverage with fewer regulatory protections for eligible investors. This guide explains how to become an elective professional client, in line with FCA requirements. Our traders have also listed the best pro trading accounts in the UK:

Brokers With Professional Trading Accounts

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

Established in 2006, FxPro has emerged as a trusted non-dealing desk (NDD) broker offering trading on over 2,100 markets to more than 2 million clients worldwide. It has scooped over 100 industry awards and counting for its competitive conditions for active traders.

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

-

GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

-

Markets.com is a respected broker, offering multi-asset trading opportunities through CFDs or spread betting (UK only). Established in 2008, the brand has an impressive 4.3 million registered customers and is overseen by trusted regulators, including the FCA, ASIC and CySEC. 79.1% of retail accounts lose money.

-

Spreadex is an FCA-regulated broker that offers spread betting opportunities on an impressive 10,000+ CFD instruments including 60 forex pairs. Traders can also take short-term positions on sporting events. The brand has been around for over 20 years and has won multiple awards.

-

Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

-

Trade.com is a trustworthy online broker with a global presence. The broker offers 2,100+ CFDs in major markets, as well as futures, options and more. The broker offers best-in-class platforms and superior analysis tools for experienced traders. The broker is also regulated by top-tier authorities including the FCA and CySEC.

-

ActivTrades is a UK-headquartered CFD and forex broker established in 2001. The award-winning brokerage has secured licenses from trusted bodies, notably the UK’s FCA, and facilitates trading on over 1000 instruments spanning 7 asset classes, with over 93.60% of orders are executed at the requested price.

-

HYCM is an online broker with authorization from four international bodies including the FCA and CySEC. The broker offers short-term CFD trading on forex, shares, commodities, indices, ETFs and Bitcoin, and supports the MT4 and MT5 platforms, as well as Trading Central analysis.

-

Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

-

Hantec Markets was established in Hong Kong in 1990. Initially, the company concentrated solely on the Chinese and Taiwanese markets. In 2008, the broker rebranded and expanded its presence in the UK, Australia, Japan, and various other countries, before enhancing its footprint in Latin America in 2022. Hantec now stands as a multinational brokerage with 18 offices across Europe and Asia.

-

Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

-

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme.

-

FXTM is a forex and CFD broker established in 2011 and operating across four continents. The company is secure and regulated by leading authorities, including the FCA. Offering 1,000+ markets and three account types, they cater to all levels of trader.

-

Capital.com offer CFDs on a range of markets with competitive spreads and zero commissions. The broker also offers the Investmate app, negative balance protection and leveraged trading.

-

LegacyFX is a multi-asset broker offering an MT5 download & free signals.

What Is A Professional Trading Account?

A professional trading account is offered to investors who meet certain requirements, including experience in the finance sector, a minimum portfolio size, and the placement of large trades in the last 12 months.

These profiles provide several advantages over standard trading accounts, from higher leverage and lower margin rates to competitive fees, dedicated account managers and support for out-of-hours trade execution.

However, a professional trading setup often lacks various protection measures, with no negative balance protection, limited money segregation requirements, and a greater assumption that clients will understand the risks associated with certain trading products.

Ultimately, professional trading accounts are only suitable for individuals with previous or current experience in financial services.

How To Get A Professional Trading Account

In the UK, the requirements for the professional trader designation are set by the Financial Conduct Authority (FCA).

Elective Professional Status

The elective professional trader status is obtained based on previous experience and available capital rather than formal trading certifications.

The FCA requires brokers to ensure elective professional clients meet at least two of the following definitions:

- Has placed 40 trades of significant size within the last year on relevant markets – ideally at an average frequency of 10 per quarter over the previous four quarters.

- Has a total cash and financial instruments portfolio of £500,000 or more – excluding company pensions, property and other non-financial investments.

- Has worked or currently works in the financial sector in a professional trading or associated role – with specific knowledge of the type of instruments available on the trading account.

Make An Application

If these conditions are met, you must put in writing your request to be treated as a professional client, giving evidence that the minimum requirements are met and stating your intentions to trade on specific markets, such as commodities or forex.

If this is satisfactory, the firm will reply to your written request with a full breakdown of the professional trading setup. The FCA requires this to include “a clear written warning of the protections and investor compensation rights the client may lose”.

The next correspondence from your side must be an acknowledgement of the implications and risks of losing such protections.

Open An Account

Once the legal and regulatory formalities are complete, finish any further verification and deposit funds into the account.

At this stage, a personal account manager may become involved, guiding you through the remainder of the process and helping you navigate your new broker.

Institutional Professional Status

Another way to gain a professional trading setup is to trade on behalf of a regulated or authorised entity. Qualifying companies include:

- Pension funds

- Local authorities

- Investment firms

- Insurance companies

- Commodity derivatives dealers

Hedge funds that meet capital requirements can also qualify as professional clients, as can local and regional banks.

This list is not exhaustive, and several other types of financial institutions meet the FCA criteria for per se professional clients.

Advantages Of Pro Trading Accounts

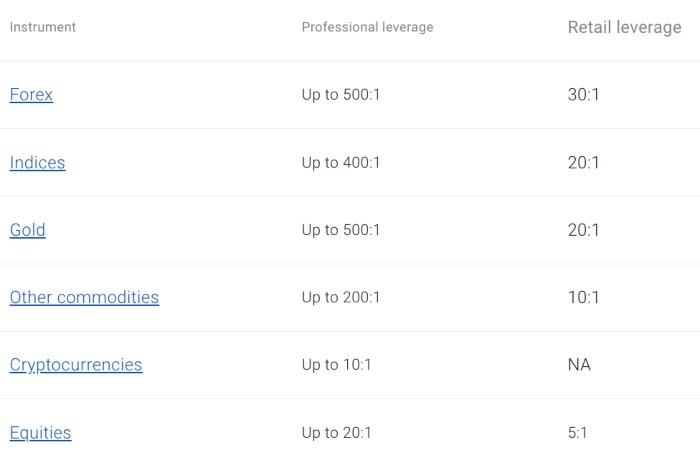

- Higher Leverage – The FCA caps the leverage available to regular traders at 1:30. However, professional clients can access higher leverage of up to 1:500.

- Exclusive Markets – Some markets, such as swaps or complex derivatives, may only be accessible to professional investors through select brokerages. Moreover, brokers that offer professional trading accounts may take bespoke trading requests on behalf of professional or institutional clients.

- Rebates & Lower Fees – One way brokers try to entice professional traders and their significant capital to their platforms is through lower fees and rebates. Some pro trading brokers may even offer zero fees for maker transactions.

- Bespoke Support – Many brokers offer personal account managers to help professional traders manage their profiles. These dedicated support staff are more knowledgeable and available than traditional customer service representatives and often proactively monitor accounts or pass on bespoke trades to a dealing desk.

Disadvantages Of Pro Trading Accounts

- Stringent Eligibility Criteria – Pro trading accounts are limited to those working on behalf of institutions or working in relevant jobs in the financial sector. There is no formal trading certification that allows investors to qualify for this type of account. In addition, there are significant capital requirements.

- Lack Of Protection – Several protections available to retail investors, such as negative balance protection and automatic stop-outs are not provided to professional clients. This makes trading with a professional account riskier.

How To Compare Brokers With Professional Trading Accounts

Instruments & Markets

Ensure that the brokerage offers the specific markets and instruments that you wish to trade, or has the ability to execute bespoke trades if that is a facility you require.

Note, specialised brokers may require prospective clients to have specific experience in their market to register for a pro trading account.

Trading Platforms

Professional traders may need multi-asset platforms with complex analysis tools, sophisticated order types, and support for deep market data.

Check if the broker supports your preferred platform, or offers API access so you can use your own trading programs and algorithms.

Leverage & Margin

In addition to offering high leverage, the best brokers with professional trading accounts offer low margin rates on products like CFDs and spread betting.

Pepperstone Professional Trader Leverage

Fees & Commissions

Professional traders may need to shop around to find the lowest fees and commissions. With high-volume and high-capital trades, finding the best deal can have a significant impact on profits. Some brokers also offer fee rebates.

Alternatively, see our list of professional trading accounts with competitive fees.

Further Considerations

Professional Trader Tax

Investors may want to consult with a qualified tax professional. Activity in a professional trading account may be classified as self-employed or business income.

This means that professional trader tax may be in line with regular income tax rather than speculative or capital gains tax.

Extended Hours

Professional traders may have access to after trading hours, depending on the broker and the market being traded.

This can provide additional opportunities for profits, but it also carries additional risks, such as increased volatility and lower liquidity.

Bottom Line On Professional Trading Accounts

While the hurdles to qualifying for a professional trading account in the UK are significant, benefits such as lower fees, higher leverage and extended trading hours are attractive. This said, professional trader status is not all positive, as investors may lose protections such as negative balance protection and automated stop-out levels.

See our ranking of the best pro trading accounts to find a suitable provider.

FAQ

What Is A Pro Trading Account?

A professional trading account is an account designed for experienced investors that have or currently work in professional trading jobs. It offers advantages such as higher leverage and lower fees compared to standard trading accounts. On the downside, elective professional status comes with fewer regulatory protections, including no negative balance protection.

What Are The Professional Trading Account Requirements In The UK?

For brokers and investors based in the UK, the FCA requires investors to have professional experience in a finance role (minimum one year), a significant existing portfolio of trading products (minimum £500,000), and a demonstrable record of high volume transactions in the last four quarters (minimum 10 per quarter).

Can A Person Have 2 Trading Accounts – Pro And Retail?

It is possible for an investor to have a combination of trading accounts, including both retail and professional trading setups. However, a professional trader using a retail account may still be liable for professional trader tax implications.