Plum Review 2025

|

|

Plum is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Plum |

| Plum Facts & Figures |

|---|

Plum is an financial app that empowers users to save and trade. The investing platform is available in 10 European countries with offices in the UK, Greece and Cyprus. Over 1.5 million clients and have invested more than £1 billion with the firm. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs |

| Demo Account | No |

| Min. Deposit | £2 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | £1 |

| Regulated By | FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Stocks | Plum offers 3000+ shares including Amazon, Meta and Tesla. Trade with as little as £1 and no commission fees. Fractional shares are also available providing access to high-value stocks with less capital. |

Plum Fintech is an investment app that offers customers cash savings and stock and crypto trading. Founded in the United Kingdom in 2016, Plum uses artificial intelligence to help users save money, invest, manage their finances and even put money aside for their pension. In this Plum review, we look at the features available, funding requirements, investing fees, and more. Our UK team also consider how Plum stacks up to competitors.

Plum is FCA-regulated with a £1 starting investment and automated deposits. However, fees are expensive if you invest in small amounts. The app is also not geared towards short-term trading and market insights are lacking. Ultimately, there are better investment platforms in the UK, including Interactive Investor.

What Is Plum?

Plum is a financial management application that helps users save money by automating their savings. It is designed to analyse users’ spending habits and income and then make intelligent decisions about how much money they can afford to save.

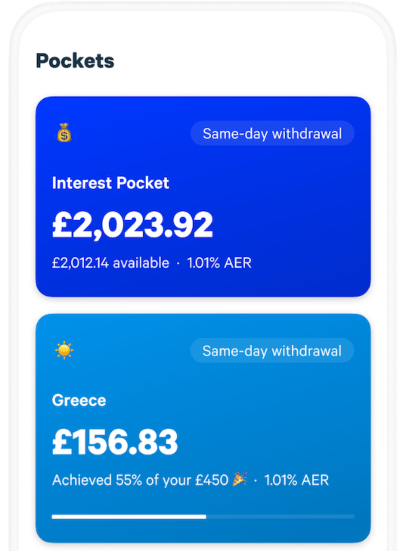

One of Plum’s selling points is its ‘pockets’. These are essentially discrete sections of your saving account where you can save for different purposes. For example, you might have one pocket for your holiday savings, another to save for Christmas presents, and so on. The pockets pay interest and different account types offer different numbers of pockets.

Importantly, the app links to your bank accounts and uses artificial intelligence to analyse your spending patterns, identify areas where you can save money, and automatically transfer money into a savings account. Users can set savings goals, track their progress, and receive regular updates on their savings.

Another of Plum’s popular features is its ‘gamification’ of money savings, whereby the company encourages users to save by setting challenges. Typical challenges include a ‘rainy day challenge’ in which users are encouraged to put aside a certain amount for unexpected expenses and a ‘1% challenge’ which involves saving 1% of your income per week.

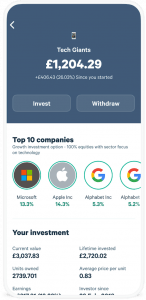

Plum also offers investment products. Commission-free trading is available on thousands of stocks with a minimum investment of £1. Alternatively, users can gain exposure to the likes of the FTSE through the platform’s funds.

The application is available for download on both iOS and Android devices.

Products & Services

- Savings Accounts: Plum’s primary feature is its automatic savings function, which enables users to save money without thinking about it. Plum uses algorithms to analyse users’ spending habits and income, and then transfers small amounts of money into a savings account.

- Stocks and Shares ISAs: Plum offers stocks and shares ISAs, which are investment accounts that allow users to make tax-efficient investments in stocks, bonds, and funds. Plum’s investment platform is managed by BlackRock, one of the world’s largest investment management companies.

- Pensions: Plum users can put part of their money aside in a self-invested personal pension and benefit from tax relief and a 25% bonus when their pension matures.

- Ethical Investment Portfolios: These portfolios invest in companies that meet certain environmental, social, and governance (ESG) criteria.

- Cryptocurrencies: Plum also allows users to invest in a range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Accounts

Plum offers a good range of accounts to suit different user needs:

- Basic: The basic account is free to use and includes a single pocket earning a lower interest rate compared to the paid accounts. It also offers commission-free trades on 1200 stocks and features including pension management, automated deposits and unlimited withdrawals. This is a good selection of the basics that anyone can use for free, but does not allow access to some of the more advanced features like gamified deposits, fund investing with as little as £1, or goal setting.

- Pro: The £2.99/month Pro account allows for 15 interest-earning pockets, 12 funds with which users can invest with as little as £1, gamified deposits, goals setting, and cashback. For a small monthly subscription, users can access 5 features that aren’t available with the free account and make for easier money management.

- Ultra: For £4.99 users can upgrade to the Ultra account and access 33% more cashback as a money maximiser tool for splitting spending into weekly allowances. Users also receive a Plum Visa debit card that can be pre-loaded according to their budgetary needs.

- Premium: The premium account is the most expensive coming in at £9.99 per month. In addition to all of the tools listed above, users can also repeat stock investments with a fixed amount each day, week or month, invest with £1+ in 21 different funds, access 3,000 different stocks, and access price alerts for chosen assets.

Is Plum Cheap?

Plum appears cheap when you get started, but fees rise as you unlock more features.

The pricing structure for Plum changes according to which kind of account you open, from the free basic account, to £2.99 for the Pro account, £4.99 for the Ultra account, and £9.99 per month for the Premium one.

In addition, there are the following fees:

- Investment fees: If you choose to invest in stocks and shares ISAs through Plum, you may incur fees associated with the underlying investments. These fees vary depending on the investment funds you choose.

- Cryptocurrency fees: Plum charges a 1% fee for buying or selling cryptocurrencies.

- Overdraft fees: If you link your bank account to Plum and use the app to manage your finances, you may incur overdraft fees from your bank if you spend more than you have available in your account. These fees are charged by your bank and not by Plum.

- Foreign transaction fees: If you use your Plum card to make purchases or withdraw cash outside of your home country, you may incur foreign transaction fees charged by your card issuer.

- ATM fees: If you use your Plum card to withdraw cash from an ATM that is not in your bank’s network, you may incur ATM fees charged by the ATM operator.

Investing

Plum offers a modest selection of investment portfolios for different risk profiles and financial goals.

The investment portfolios are managed by renowned investment managers, including BlackRock and Vanguard, and are diversified across a range of asset classes and sectors to minimise risk.

You can choose a portfolio that suits your investment objectives and Plum will invest your money in a portfolio of exchange-traded funds (ETFs).

Plum’s investment portfolios are designed to be accessible to anyone, regardless of investment experience or knowledge. The app also provides detailed information about each portfolio, including its historical performance, asset allocation, and the fees charged.

You can also set up automatic investments or make one-off investments, and Plum will handle the rest.

Moreover, the app provides regular updates on your investment performance, so you can monitor your progress and adjust your investment strategy accordingly.

Importantly, investing with Plum is relatively secure, as the app is regulated by the Financial Conduct Authority (FCA) in the UK.

Additionally, Plum uses bank-level security measures to protect your personal and financial information.

Overall, Plum’s investment portfolios offer a simple and convenient way for users to invest their money and build wealth over the long term.

Saving

Plum offers an interest-bearing savings account in partnership with Investec, a well-established financial institution.

The account pays interest on the funds that you deposit, with the interest rate depending on the current market conditions. Interest is paid monthly, and there is no minimum deposit requirement or withdrawal fee.

When we used Plum, we were pleased to see that the savings account is protected by the Financial Services Compensation Scheme (FSCS), which means that your deposits are protected up to £85,000.

In addition to providing a secure place to save your money, the Plum savings account is also integrated into the app. This means you can easily transfer money between your Plum savings account and your other accounts and set up automatic savings rules to help you achieve your financial goals.

With Plum’s AI technology, the app can also analyse your spending habits and suggest a savings rate that works for you.

Overall, the Plum savings account is a valuable tool for anyone looking to save money and build financial stability.

SIPP

Plum also offers a Self-Invested Personal Pension (SIPP), which is a tax-efficient retirement savings account for UK residents. With a SIPP, you can choose your own investments and benefit from tax relief on your contributions.

Plum’s SIPP is designed to be accessible and user-friendly, with low fees and a range of investment options. Choose from a selection of investment portfolios, including passive index-tracking funds and actively managed funds from leading fund managers such as BlackRock and Vanguard. Or, invest in individual shares and exchange-traded funds (ETFs) for a more hands-on approach.

Plum’s SIPP offers flexible contributions, so you can invest as much or as little as you like, subject to the annual allowance set by HM Revenue & Customs.

The app also provides tools to help you calculate how much you need to save for retirement and track your progress towards your goals.

What Can I Use Plum For?

- Savings – Plum analyses your income and spending habits to calculate a personalised savings rate. You can set savings goals and Plum will automatically transfer money into your savings account based on your spending and income.

- Investments – Plum offers a range of investment portfolios designed to suit different risk profiles and financial goals. You can choose a portfolio that suits you and Plum will invest your money in a portfolio of ETFs.

- Budgeting – Plum creates a personalised budget for you based on your income and spending habits. You can track your spending by category and set alerts to notify you when you’re close to reaching your budget limits.

- Bill Analysis – Plum analyses your bills to help you find better deals on your utilities, insurance, and other recurring expenses.

- Overdraft Protection – Plum offers an overdraft protection feature that can help you avoid costly overdraft fees. If you’re at risk of going into overdraft, Plum will automatically transfer money from your savings account to cover the shortfall.

- Spending Insights – Plum provides insights into your spending habits, including how much you spend on different categories and how your spending changes over time.

- Money Management – Plum offers a range of tools designed to help you manage your money more effectively, including a spending report, transaction history, and goal-tracking tool.

How To Use Plum Fintech

- Download and install the Plum app from the App Store (for iOS) or Google Play Store (for Android).

- Sign up for a Plum account by providing your email address, phone number, and password. You will also need to link your bank account to Plum by providing your online banking credentials.

- Once your bank account is linked, Plum will analyse your spending habits and income to create a personalised budget for you.

- You can set savings goals in the app by selecting the “Goals” tab and choosing a goal from the list or creating your own. Plum will then automatically save money for you.

- You can also invest money through Plum by selecting the “Investments” tab and choosing a portfolio that suits your needs. Plum will invest your money in a portfolio of ETFs.

- If you want to adjust your budget or savings settings, you can do so by selecting the “Settings” tab and choosing “Budget” or “Savings.” Here you can adjust your budget categories or change your savings rate.

Is Plum Regulated?

Plum Fintech is regulated by the Financial Conduct Authority (FCA) in the United Kingdom and can be found on the FCA register. This is a promising sign that the company is legitimate and trustworthy.

The FCA is an independent regulatory body that oversees financial services firms in the UK to ensure they operate fairly and transparently and that they protect their customers’ interests.

As a regulated entity, Plum is required to meet certain standards and regulations. This includes ensuring that customer funds are kept separate from company funds, maintaining adequate levels of financial resources, and complying with strict data protection and security requirements.

Plum is also a member of the Open Banking Implementation Entity (OBIE), which is responsible for implementing and maintaining the UK’s Open Banking standards. This allows Plum to securely access customers’ financial information from their bank accounts, with their consent, in order to provide financial management services.

In addition, Plum is authorised as an electronic money institution by the FCA, which means that it can issue electronic money and provide payment services. This authorisation allows Plum to offer features such as savings accounts and investment services to its users.

Customer Support

We were impressed with the customer service at Plum Fintech. Our experts found that the customer support team typically responds to emails within one working day. They also offer live chat support through the Plum app, with support agents available to chat from 9am to 5pm, Monday to Friday.

In addition to email and chat support, Plum offers phone support. Users can contact Plum’s customer support team by calling the contact number listed on their website.

On the downside, it is worth noting that phone support is not available 24/7 and may have limited hours. Another drawback is that priority customer support is only available with the most expensive Premium account.

Company Background

Plum Fintech Ltd was established as a fintech startup in 2016 by founders and CEOs Victor Trokoudes and Alex Michael, two former investment bankers who wanted to make saving money easier and more accessible for everyone.

The company is headquartered in London, UK, and has since expanded to serve customers in Europe and the United States.

The startup company has raised over $19 million in funding and has partnered with several financial institutions to provide its services to customers.

Plum has also received numerous awards and accolades for its innovative approach to personal finance, including being named “Best Money Saving App” at the 2020 British Bank Awards.

Should You Invest With Plum?

Plum is an interesting financial management app that offers a range of features to help users save money, invest, and manage their finances more effectively. With its personalised savings rate, investment portfolios, budgeting tools, bill analysis, and overdraft protection, the app provides useful services for individuals looking to take control of their finances. In addition to its core features, Plum also offers a range of money management tools, insights into your spending habits, and an interest-bearing savings account.

However, the app doesn’t score well in several areas. It is not the best pick for active traders with limited market insights or educational tools. Premium features also come with a monthly price tag. Ultimately, there are better options for active investors.

FAQ

Is Plum Fintech Safe?

Plum is regulated by the Financial Conduct Authority (FCA) in the UK, which means it is subject to strict data protection and security requirements. Plum also uses bank-level security measures to protect your sensitive information.

With that said, online investing is risky, so do not risk more than you can afford.

Can I Invest With Plum?

Plum offers various investment portfolios to meet different risk appetites and financial objectives. You can choose a portfolio that suits you and Plum will automatically invest your money in ETFs. Clients can also buy and sell cryptos or invest in 3000+ stocks.

How Does Plum Calculate Savings Rates?

Plum calculates your savings rate by analysing your income and spending habits. It takes into account your regular bills, spending, and income to determine how much you can afford to save each month.

Is Plum The Best Investing App?

Plum has some attractive features, including AI analysis of your spending and savings ability. It also invests money in ETFs from reputable providers like BlackRock. However, it is not designed for short-term trading with a relatively narrow product range and limited expert insights and market data.

Article Sources

Top 3 Plum Alternatives

These brokers are the most similar to Plum:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Plum Feature Comparison

| Plum | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.7 | 4.3 |

| Markets | Stocks, ETFs | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | £2 | $1,000 | $0 | $0 |

| Minimum Trade | £1 | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | MT4 | - |

| Leverage | - | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:50 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Plum Review |

Swissquote Review |

IG Index Review |

Interactive Brokers Review |

Trading Instruments Comparison

| Plum | Swissquote | IG Index | Interactive Brokers | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | No | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

Plum vs Other Brokers

Compare Plum with any other broker by selecting the other broker below.

Popular Plum comparisons: