Pionex Review 2025

|

|

Pionex is #36 in our rankings of crypto brokers. |

| Top 3 alternatives to Pionex |

| Pionex Facts & Figures |

|---|

Pionex is a crypto trading platform that specializes in trading robots, offering a variety of ready made bots and strategies to traders as well as integrated AI to help customize a strategy or come up with your own. These can be used on spot crypto markets as well as crypto futures. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | No |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Min. Trade | 0.1 USDT |

| Regulated By | FinCEN |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Crypto bots |

| Islamic Account | No |

| Cryptocurrency | Make spot, future and leveraged trades on 120 cryptocurrencies via Pionex's proprietary platform with built-in trading bots and highly customizable automated trading options. On the negative side, the range of tokens is narrower than many alternatives. |

| Coins |

|

| Spreads | Market |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Pionex is one of many exchanges and brokers competing for an expanding client base in the cryptocurrency markets. The exchange markets itself as a simple tool to profit from the notorious volatility of crypto tokens, with much of its client activity revolving around its free trading bots. This 2025 Pionex review will explore the firm’s range of bots, payment methods, trading platform and how to create and use an account.

About Pionex

Pionex offers a unique automated trading service in the crypto space. The exchange focuses on providing distinct trading bots to suit any permutation of market conditions. Created in 2019, the platform has rapidly grown and boasts a monthly trading volume of well over $5 billion. The broker is based in Singapore but holds a license from FinCEN in the USA.

The complete automation of trading is designed to protect traders around the world from market changes that occur outside of practical operating hours. The crypto exchange thus provides round-the-clock robot trading throughout the unrestricted cryptocurrency market hours.

Pionex is owned and operated by parent company BitUniverse, which creates crypto trading bots for use on a range of other exchanges. While information regarding the founder of the exchange is not publically available, the platform is supported by a team of over 100 people and overseen by Chief Compliance Officer Larry Toh.

Traders from around the world are welcomed by the firm, with supported countries including Singapore, the USA, Germany, the UK and Malaysia.

Pionex Business Model

Pionex shares a liquidity pool with Binance and Huobi crypto exchanges, acting as a market maker on many major crypto pairs. This helps to ensure that trading fees remain low and clients have an abundance of liquidity.

Traders can choose between manual buy and sell orders, as well as the 16 free, integrated trading bots designed to facilitate hands-off, repeatable and profitable trading. 5

Trading Platform

Due to the unique nature of the Pionex exchange, the company operates a proprietary trading platform. This software is available via web browser on PC, Mac or Linux.

Historical data and asset charts are provided by TradingView, complete with a wide range of drawing and graphing tools. These include moving average lines, Fibonacci retracement measurements and volume bars. A range of temporal intervals are available, alongside an order books column that displays all requested trades on a particular asset pair.

Pionex Web Trading Platform

Some Pionex traders that are new to bots may wonder how to use them and how bot setup works. The range of bots that the firm provides are listed next to the main trading section, each with a short description and suggested market usage cases to guide beginners.

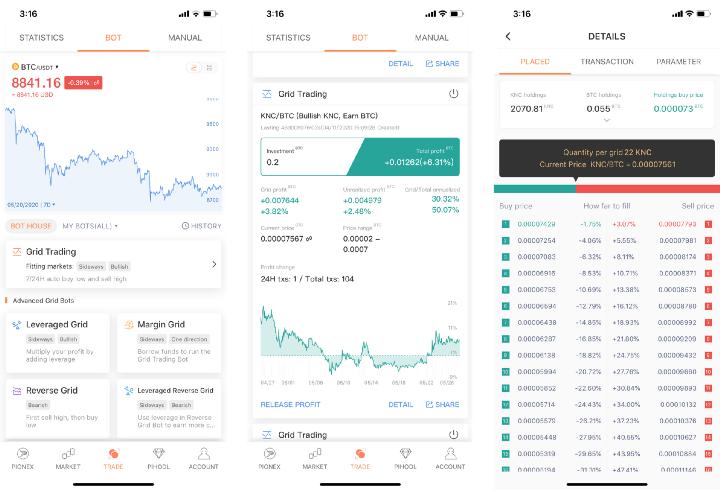

Mobile Apps

The company has two mobile apps – Pionex and Pionex Lite. The former aims to replicate as much of the functionality of the PC-based platform as possible, while the Lite offering was created to make it easier for beginners to get into crypto.

One key advantage of Pionex Lite is that fiat deposits are available. This is unlike the web platform and standard app, to which crypto tokens must be transferred from other exchanges or an external crypto wallet.

The apps are available on the Google Play and Apple (iOS) App stores. Alternatively, you can download apk or Testflight versions to trial new features using a QR code on the main website. As with the experimental version of the standard app, Pionex Lite must be downloaded in apk form directly from the website.

Pionex Mobile

Unfortunately, neither version of the app supports push notifications, which can leave traders in the dark about major price movements.

Pionex Trading Bots

The sixteen trading bots offered by Pionex are the exchange’s main selling point. The firm’s website includes a detailed tutorial for each bot, while additional information and reviews can be found on YouTube and dedicated blogs.

While these bots are not guaranteed to produce profits, the use of automation does reduce emotional trading. This is where impulsive purchases or sales can backfire on traders, leading to yet more emotional behaviour. Additionally, purchase and sale speeds are enhanced and the bots can be left to run for extended periods without the need for constant market monitoring.

Below, we have explained each bot, complete with scenarios in which a specific program may be the best bot for you.

Simple Grid Trading Bot

The Pionex automated grid trading bot follows the simplest idea in trading: buy low sell high. The bot attempts to replicate this throughout a set period and between preset upper and lower limits, which are often referred to as a corridor. This should be one of the easiest bots for beginners to use.

Best suited to volatile markets with a sideways trading sentiment, the simple grid trading bot removes the emotion and human error from day trading crypto. Clients can choose their level of control, with options for complete AI algorithmic determination of strategy or the ability to set custom parameters. Stop-loss and take-profit order values can also be specified.

Martingale Bot

This bot is built upon the Martingale strategy, often utilised within gambling and casino games. This strategy involves doubling your stake after each losing hand in the casino to ensure that, on your winning hand, you make an overall profit. However, while this can work in a fixed-odds card game, it requires some adaptation to be used in the world of financial speculation.

The Pionex Martingale bot increases its purchase quantities following every price drop. This form of enhanced DCA (dollar-cost averaging) means that small upticks in token value can lead to profit, no matter the previous cost movements. While the broker recommends this bot for bullish markets. Volatile sideways and bear markets may also be suitable for the Martingale bot.

Pionex Spot Futures Arbitrage Bot

The Pionex arbitrage bot is one of the most complex instruments available on the platform and even experienced traders may need to take some time to review its function.

This bot takes advantage of perpetual futures contracts, which are offered by many exchanges on crypto tokens. The algorithm split your capital between spot market tokens, a long position and short positions on the futures trading market. The bot balances these positions so that traders will almost always maintain their staked capital.

Trading profits for this form of passive investing come from the funding rate. This is the difference between the spot and futures values and is paid by whichever market is trading higher. Pionex claims that clients can make between 15% and 50% APR when using its arbitrage bot and that it is completely flexible in terms of market application.

Rebalancing Bot

The Pionex rebalancing bot is a tool that automatically distributes capital equally amongst up to ten selected coins. The bot aims to maintain the USDT value of these tokens. If one coin rises in price and another remains static when in dual-coin mode, the bot will sell off enough of the higher-priced coin to rebalance the traders’ fund distribution equally.

This bot should only be used on coins for which a trader has a long-term bullish prediction, as a dramatic fall in value can lead to the sale of large quantities of a profitable token and redistribution into a plunging crypto.

Pionex Smart Trade Bots

The standard smart trade bot allows clients to set a buy price for a token on a rapid ascent, with an inbuilt trailing sell level to shield from sudden drops. Once the asset reverses and declines to the trailing stop limit, the position is closed.

The individual trailing buy and sell functions are also available with dedicated trading bots to best help you make secure profits in pumping or dumping markets.

DCA Bot

Pionex offers a specific bot for 24/7 DCA. This algorithm will automatically buy stock on your behalf at user-set intervals. Ensure that you have enough funds in your account to cover the total cost of your investment and avoid being hit with the “not enough balance” error message.

TWAP Bot

The time-weighted average price (TWAP) bot uses a traditional investing strategy. The bot will exchange a set amount of funds for crypto at regular intervals, regardless of the asset value. This bot is best suited for “crypto whales” that wish to reduce market impact when either buying or selling significant quantities of a token.

Stop Level

The stop level bot is primarily used for trading around resistance levels. Clients can set a trigger price at which to either buy or sell tokens, releasing them from the daunting prospect of continually watching the market.

Advanced Grid Bot Variants

In addition to the standard grid bot, Pionex offers advanced grid trading tools for more complex requirements. Clients can browse and review these bots alongside all the other algorithms:

- Infinity Grid: No upper and lower price range, buying low and selling high for extended periods without restrictions

- Reverse Grid: Sells positions before re-purchasing at a later, lower price. This is aimed at bearish markets.

- Leverage Grid: Amplify the outcome of your positions using borrowed capital.

- Leveraged Reverse Grid: Amplifies the outcomes of the Reverse Grid bot.

- Margin Grid: Mortgage your capital to take a long or short position.

Pionex Markets

Pionex supports a significant number of coins, with traders able to choose from over 250 swap markets. Crypto front-runners Bitcoin and Ethereum are included in many swap pairs, with significant altcoin representation also featured.

The majority of tokens exist in USDT pair form but Pionex is slowly expanding into other stablecoins like USDC and BUSD.

Leveraged Tokens

In addition to the leverage and margin facilities through bots, Pionex provides leveraged token options for a wide range of crypto pairs. This additional service provides clients with more options, whether investing manually or with an algorithmic trading bot.

Leveraged tokens are treated as separate pairs for long and short instruments. Long leverage can either be 1:2, as signified by the “2l” designation, or 1:3 (3l). Short positions can also be taken with 1:2 or 1:3 leverage, referred to by 2s and 3s respectively.

Account Types

Pionex Lite

Pionex Lite is only available through the broker’s mobile app and is treated as a separate exchange to the main platform. Funds must be manually transferred between the two exchanges if changing account types or platforms. Lite traders miss out on the PC platform but can still use the trading bots from the mobile app.

Additionally, Lite accounts registered in the USA can purchase crypto directly with USD, whereas standard and market maker accounts must swap USD to USDT elsewhere before depositing onto the platform. Unfortunately, traders in other countries like the UK are unable to purchase crypto using fiat currency.

Standard Account

This account is accessed via the standard mobile application or the browser-based platform on PC or Mac. Standard accounts follow the regular pricing structure and have access to all bots and functions.

Market Maker

The Pionex market maker program rewards high volume traders with lower fees. Charges are reduced to 0.05% for taker transactions, which involve placing a trade that is immediately matched by the market. Maker transaction fees are completely waived with the market maker account. This means that if a trader places an order that is not immediately matched by the market, their transaction is free.

To qualify for the market maker account level, clients must average a daily trading volume equivalent to USDT 300,000 over one month. Upon meeting this requirement, traders must contact the broker to manually apply the advantages to their accounts.

Pionex Trading Fees

Pionex charges regular and lite account holders a 0.05% fee for both maker and taker transactions. However, market makers can access taker fees of 0.005% and avoid maker fees altogether.

This pricing level is noticeably lower than many rival exchanges, with the standard account rates coming in three times lower than leading competitors.

Arbitrage Bot Fees

While almost all of the bots are free to use, the spot futures arbitrage program does incur a cost. While there is no direct fee for using the bot, Pionex takes 10% of any profits made using this tool. Half of this is put into the SAFU fund, which aims to compensate arbitrage bot traders in the event of market events causing failures in the trading method.

Payment Methods

Pionex is not an entry-level exchange, so newcomers to the crypto space must first go elsewhere to exchange fiat money for USDT. Whilst the use this stablecoin can protect against potential volatility during the transfer, this added step and requirement to first hold crypto without trading may present a challenge.

There are no other deposit restrictions, including minimum investment limits. However, there are minimum and maximum withdrawal limits imposed by the platform. These will vary from token to token and a complete table can be found on the broker’s website. There is no funding fee structure in place but withdrawals incur charges that vary for different token holdings, starting at 1 USDT.

Higher daily withdrawal limits can be unlocked by completing the know-your-customer (KYC) checks.

Pros Of Pionex

Here are some of the benefits of trading crypto with Pionex:

- Crypto deposits

- Competitive fees

- Wide array of tokens

- Leveraged crypto trading

- Fully licensed & regulated

- Free, advanced trading bots

- Non-compulsory KYC checks

Cons Of Pionex

There are a few factors that may put traders off Pionex:

- No demo account

- Limited deposit options

- Limited customer support

- No bonuses or promotions

Regulation & Security

Pionex is a completely legitimate exchange and holds a regulatory licence with FinCEN in the USA. A secure login portal protects your trading wallet from fraudulent access, while the broker further enhances login security by offering two-factor authentication (2FA) through Google Authenticator or Apple Passwords. This service is straightforward to set up and we recommend it be considered, especially if trading with significant funds in your wallet.

Trading Hours

The Pionex platform operates around the clock, with its bots running 24 hours a day, seven days a week. This is a significant advantage in the crypto space, as token trading markets run continuously.

Contact & Support

If you are looking for help on the platform, whether it be a guide on how to deposit, support with a frozen quantity error or how to view unrealized profit, there are several resources available to you.

The first is the Pionex blog, which features guides on all of the supported trading bots, as well as articles explaining recent news in the world of crypto trading. While this section is well-stocked, finding an answer to a specific query can be tricky.

Next is the FAQ section, which sadly only has four topics. The broker also operates a YouTube channel, with palatable video guides on how to use several bots.

In terms of active support, traders have the option of an email ticket, live chat or community help. Compared to other platforms, this is a little lacklustre but, fortunately, plenty of guidance is available online to help troubleshoot issues.

Pionex Verdict

Overall, Pionex is a reliable and unique crypto exchange platform that offers free, integrated trading bots for hundreds of token pairs. The firm boasts competitive low fees, 16 algorithms and leveraged tokens with all features available to beginner and high-net-worth clients alike. However, the platform is let down slightly by its crypto-only deposit and withdrawal methods and its lack of a paper trading demo account. That being said, traders from New York to London may nonetheless be attracted by the myriad of features provided by Pionex.

FAQ

How Many Grid Bots (Grids) Does Pionex Support?

Pionex has six grid trading bots, ranging from a simple version of the algorithm to the advanced infinity grid and leveraged reverse grid bots.

What Is The Pionex Dust Collector?

The Pionex dust collector is a handy tool that allows traders to consolidate small, residual values of tokens into USDT.

Does The Pionex Platform Show Coin Market Cap?

Unfortunately, the Pionex trading platform and market view section do not display token market capitalisations. Instead, traders can rank coins by 24-hour trading volume, fiat price and 24-hour percentage price change.

Does Pionex Have A Minimum Balance?

No, the standard Pionex platform does not enforce a minimum balance for traders. To qualify for the market maker program, however, traders must maintain a minimum trading volume of over 300,000 USDT per day for a month.

Does Pionex Support API Integration?

Pionex does not allow API integration with third-party software. Instead, users can trade using any of the 16 free trading bots included on the platform.

Is Pionex Legit & Safe?

Pionex is a regulated broker that holds a licence with FinCEN in the USA. The firm also implements a range of security features, including two-factor authentication.

Top 3 Pionex Alternatives

These brokers are the most similar to Pionex:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- KuCoin - Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining.

- eToro - eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

Pionex Feature Comparison

| Pionex | Swissquote | KuCoin | eToro | |

|---|---|---|---|---|

| Rating | 3.4 | 4 | 2.6 | 3.5 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | ETFs, Cryptos, Futures | CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs |

| Minimum Deposit | $0 | $1,000 | $0 | $50 |

| Minimum Trade | 0.1 USDT | 0.01 Lots | 0.0001 Lots | $10 |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FinCEN | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | - | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | - | MT4, MT5 | - | - |

| Leverage | - | 1:30 | - | 1:30 |

| Visit | 51% of retail CFD accounts lose money. eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. |

|||

| Review | Pionex Review |

Swissquote Review |

KuCoin Review |

eToro Review |

Trading Instruments Comparison

| Pionex | Swissquote | KuCoin | eToro | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | No | Yes | No | Yes |

| Stocks | No | Yes | No | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | No | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | No | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

Pionex vs Other Brokers

Compare Pionex with any other broker by selecting the other broker below.

Popular Pionex comparisons: