Perpetual Swaps

Perpetual swaps are a crypto derivative that provides traders with an interesting way to speculate on digital currency markets through peer-to-peer contracts. This guide will explain what perpetual swaps are, how to trade them, funding rates and pricing, strategy considerations, plus their pros and cons. Our team have also ranked the best exchanges and brokers with perpetual swaps for traders in the UK.

Note, in January 2021, the Financial Conduct Authority (FCA) banned the sale of cryptocurrency derivatives to retail consumers in the UK, including perpetual swaps. However, they are still available to trade for professional traders, or on exchanges and platforms not regulated by the FCA.

Best Perpetual Swaps Providers

-

BitMEX is a crypto exchange and derivatives trading platform, launched in 2014. The firm offers a fiat–crypto onramp, spot trading, and crypto derivatives including perpetual contracts, traditional futures and quanto futures. BitMEX offers amongst the largest market liquidity of any cryptocurrency exchange.

-

OKX is a respected cryptocurrency firm, established in 2017, that offers a large suite of products, from mining pools to NFTs. Traders can access over 400 crypto tokens via OTC trading and derivatives. With an excellent web platform, developer tools and dynamic charts, OKX is a popular choice for technical traders.

-

Established in 2012, Hong Kong-based Bitfinex is a formidable player in the crypto industry. It boasts a powerful proprietary platform, 180 cryptocurrencies and more than 430 market pairs available for spot or perpetual swaps derivatives trading. With new payment methods, lower entry barriers and fresh products like crypto futures, Bitfinex is attracting a wider range of active crypto traders.

-

Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

-

Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

-

Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining.

-

Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators.

-

Binance is one of the best-known crypto exchanges. The company is available in more than 180 countries with over 120 million registered customers. The platform offers a suite of crypto trading products, from staking and NFTs to derivatives.

How Perpetual Swaps Work

Perpetual swaps, also known as perpetual futures, are a relatively new cryptocurrency derivative. First proposed in 1992 by Robert Shiller, they were designed to enable derivatives for illiquid assets. However, it took until 13 May 2016 for Shiller’s plans to be realised by the BitMEX crypto exchange. Since then, perpetual swaps have been used exclusively with cryptocurrency assets, typically with high leverage and auto-deleveraging.

Importantly, derivatives are financial instruments that derive their value from an underlying asset. The classic derivative instrument, futures, are agreements to buy or sell an asset at a certain price at a pre-agreed time. The profit – or loss – comes from the difference in value between the price specified in the contract and the real market price when the contract ends.

Cryptocurrency derivatives derive their value from underlying digital assets, such as Bitcoin. They allow you to speculate on the price movement of a cryptocurrency without having to store or hold the token yourself.

For example, a trader who believes the price of Bitcoin is likely to rise over the next month could buy a Bitcoin futures contract to purchase the token at today’s market price of £18,5000 with an expiry date a month from now. If the price has risen to £20,000 when the contract expires, the trader still pays £18,500 and could make £1,500 in profit. Alternatively, a trader could adopt a short position by entering a contract to sell the asset at expiry.

Perpetual swaps work similarly to regular futures contracts, allowing traders to speculate on future price movements. However, they do not have a set expiration date and can be closed whenever the parties choose, unlike futures contracts.

There are a couple of key advantages to perpetual swaps:

- Perpetual swaps give traders access to margin trading, allowing them to boost their trading position. Some crypto brokers offering perpetual swaps offer leverage of 100x or more, allowing traders to make significant profits from relatively small stakes – though they must take care, as losses from leveraged positions are also amplified.

- Traders who buy perpetual swaps do not need to buy and hold any actual cryptocurrencies, removing the need to pay gas fees or other charges, and taking away the risk that they could lose their assets if they are hacked or lose their keys.

Funding Rate Explained

Perpetual swaps need to be pegged to the spot price of the underlying cryptocurrency, and this is done through the funding rate mechanism.

Exchanges usually use an oscillating price marker to determine whether the long or short investor needs to pay a fee or receive a rebate.

If the perpetual swap price is above the spot price, the funding rate is positive and the trader holding the long position would have to pay a fee to the short trader. If the perpetual swap price is below the spot price, the funding rate is negative and the trader holding the short position would have to pay a fee to the long trader.

These funding rate fees are paid at set intervals. And, predicted funding rates are usually provided by exchanges. For example, when trading perpetual swaps on OKX (formerly OKEx), fees must be paid every 8 hours at the stated funding rate.

The amount paid is dependent on the size of the traders’ positions. For example, suppose you invest £10,000 into a long position on BTC/GBP with a funding rate of +0.050%. You will have to pay £10,000 times 0.050%, or £5.00, in fees to the short trader.

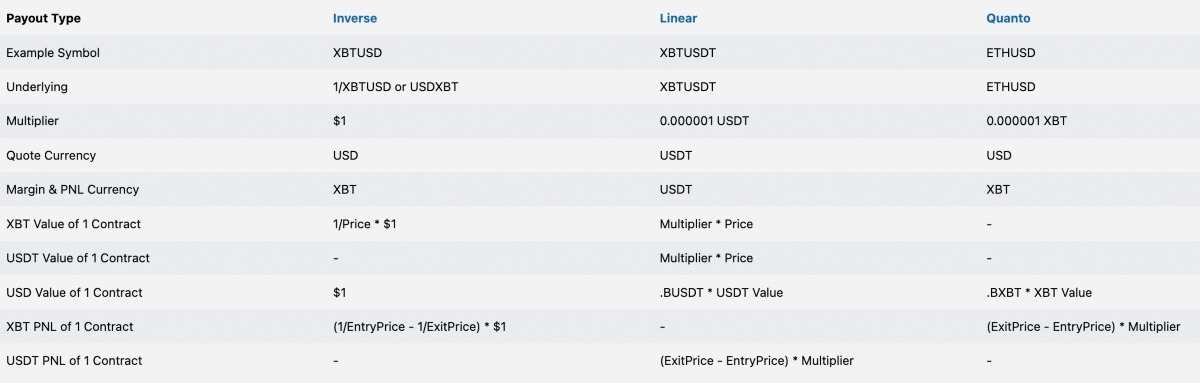

BitMEX Perpetual Swaps

Perpetual Swaps Vs CFDs

Essentially, perpetual swaps are futures contracts with no expiry date. This allows traders to open positions without worrying about settlement dates or re-establishing positions. In this way, perpetual swaps are somewhat similar to crypto CFDs.

However, there are some key differences. Firstly, CFDs are more widely available, while perpetual swaps are limited to cryptos. Furthermore, unlike CFDs, which are contracts held between the trader and broker, perpetual swaps are peer-to-peer contracts typically traded on decentralised exchanges.

This is a major drawback as crypto exchanges have been embroiled in scandals in recent years, with high-profile bankruptcy proceedings, such as FTX. As a result, many aspiring investors prefer established crypto brokers.

Pros Of Trading Perpetual Swaps

- Straightforward – Perpetual swaps are easy to understand. You don’t need to worry about expiry dates or storing cryptocurrencies. Most exchanges also automatically transfer funding rates.

- DeFi (Decentralised Finance) – Perpetual swaps are traded on decentralised exchanges, giving traders greater flexibility with things like trading hours (24/7).

- Leverage – Perpetual swaps contracts characteristically offer high leverage, allowing traders to open positions much larger than their deposit amount. This allows for greater profit potential.

Cons Of Trading Perpetual Swaps

- Leverage Risk – When trading with leverage, while your earning potential increases, so does your loss potential. This can lead to large losses quickly.

- Funding Rate Fees – Funding rates are constantly changing and are usually evaluated every 8 hours. As a result, you may end up having to frequently pay fees to keep the position open if the funding rate is not in your favour.

- FCA Regulation – The FCA has banned cryptocurrency derivatives in the UK, making it more difficult for retail traders to safely trade crypto perpetual swaps.

- Exchanges vs Brokers – Perpetual swaps are typically offered on exchanges which have a track record of mismanagement and subpar accounting practices. As a result, crypto brokers are favoured by investors looking for a more secure trading environment.

How To Start Trading Perpetual Swaps

Choose A Trading Firm

There are many factors to take into account when choosing a broker or exchange. Key things to consider:

Available Cryptos

Not every platform will offer every cryptocurrency, especially if they are more exotic. As such, you will need to make sure that the broker offers the digital assets you are interested in trading.

It should be relatively easy to find perpetual swaps for the biggest players in the crypto markets, including Bitcoin, Ethereum, Dogecoin, Solana and others. Firms such as OKX also offer a far wider range of cryptocurrencies to traders, including altcoins from Apecoin to Zilliqa.

Platform

Brands may offer different platforms. Some come with sophisticated technical analysis features, like Bitfinex’s MT4/5 platforms, while others are specialised for crypto trading, like Kraken’s in-house terminal.

Ultimately, finding the platform that offers the features you need will be the best course of action. Mobile apps are another bonus as they allow investors to trade on the go.

Tip: create demo accounts to test new platforms.

Fee Structure

Crypto firms may charge users differently. For example, some brokers charge a handling fee for perpetual swap pegging, usually placing a small fee on funding rate transfers. Others may have deposit or withdrawal fees or follow freemium models.

Make sure to familiarise yourself with each brand’s fee structure so you don’t unnecessarily raise your costs.

Open A Trading Account

Open an account with your chosen firm and complete any KYC checks. This often requires some sort of official identification, for example, a passport, driver’s license, etc.

You will also need to deposit currency into your perpetual swaps trading account. This may be a fiat currency through a debit/credit card or a cryptocurrency from your digital wallet. You can usually do this from the Transfer tab in the trading account portal.

Note, some providers won’t allow you to deposit with fiat currency, so you may need to buy crypto to transfer in from a wallet. Most firms accept Bitcoin and/or Ethereum.

Set Up Your Trade

It is time to choose which contract you would like to trade. This will involve selecting the underlying asset and a leverage amount and order size.

Two prices are shown for perpetual contracts: the last price and the mark price. The last price is the trading price of the contract while the mark price is an estimate of its value.

Also consider whether you want to implement risk management tools, such as stop losses or take profits.

Watch The Market

Follow the market closely to ensure you close your trade at the right time. Cryptocurrency is especially volatile, so being prepared to react to major shifts will increase your chance of maximising profits or minimising losses.

Remember, perpetual swaps have no expiry date, so stick to your strategy and close when you need to.

Bottom Line On Perpetual Swaps

UK traders looking to invest in crypto derivatives may want to consider perpetual swaps contracts. They offer flexible speculative trading of cryptocurrencies with leverage and without the hassle of storing the tokens themselves.

While the FCA has banned crypto derivatives, UK investors can still access these financial instruments by trading on foreign crypto platforms. Use our list of the best perpetual swap firms.

FAQ

What Are Perpetual Swaps?

Perpetual swaps are a type of crypto derivative typically traded on decentralised crypto exchanges. Sometimes called perpetual futures, they are a popular derivative offering a flexible way to speculate on cryptocurrencies, such as Bitcoin and Ethereum. Importantly, they are peer-to-peer contracts.

What Is The Difference Between Perpetual Swaps And Futures?

Perpetual swaps are essentially futures contracts with no expiry date. They are peer-to-peer contracts speculating on the future price of an underlying cryptocurrency, such as Bitcoin. However, because they have no expiry date, the price is pegged to that of the underlying asset.

What Is The Funding Rate In A Perpetual Swap?

The funding rate is a mechanism that allows the perpetual swaps contract to be pegged to the underlying asset’s price. When the price is higher than the underlying asset, the funding rate is positive and the long trader must pay a fee to the short trader, and vice versa.

Can You Trade Perpetual Swaps In The UK?

What Are The Best UK Perpetual Swaps Exchanges?

There is no “best” perpetual swaps exchange. Each firm offers different conditions that may appeal to some traders more than others. Key things to consider are trading platforms, fees, available digital assets and app integration. Some of the biggest perpetual swaps exchanges available to UK traders include OKX, Kucoin and BitMEX.