Pepperstone Review 2026

Pepperstone is an award-winning forex, CFD, and spread betting broker. With about 620,000 users globally, it is one of the most popular in the industry. Our UK Pepperstone review will explore the key details you need to know, including platform options, fees, regulation, customer support, and more. Find out if becoming a Pepperstone trader is right for you.

Pepperstone Headlines

Pepperstone was founded in 2010 and was originally located in Australia. Since then, the brokerage has expanded internationally and now has multiple branches registered under the Pepperstone Group, all of which are heavily regulated in their respective countries.

Its UK headquarters are based in London, next to the Bank of England, and were set up in 2016. On the path to global expansion, Pepperstone has excelled, picking up multiple industry awards and establishing itself as one of the leading CFD and forex brokers.

Trading Platforms

Pepperstone offers three industry-leading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. All the platforms offer comprehensive access to trading markets and can be run on desktop, WebTrader, or mobile apps.

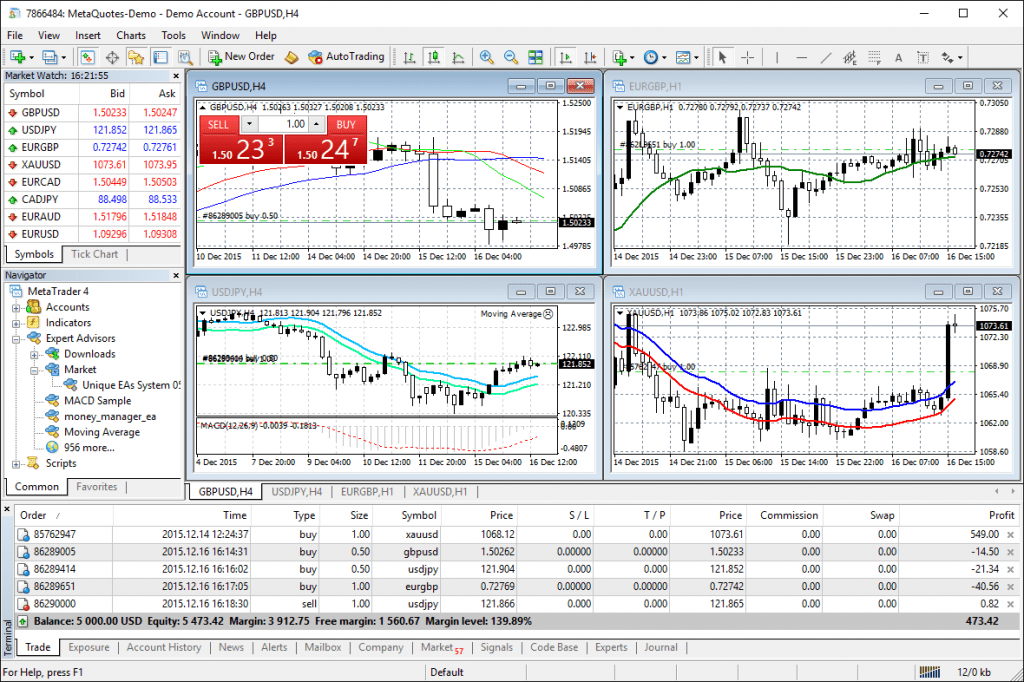

MetaTrader 4

Key features of the MT4 platform include:

- Price signals

- Historical price data

- Multi-screen interface

- Automated trading via APIs

- Range of chart timeframe options

- Integrated daily news reports with live updates

MT4

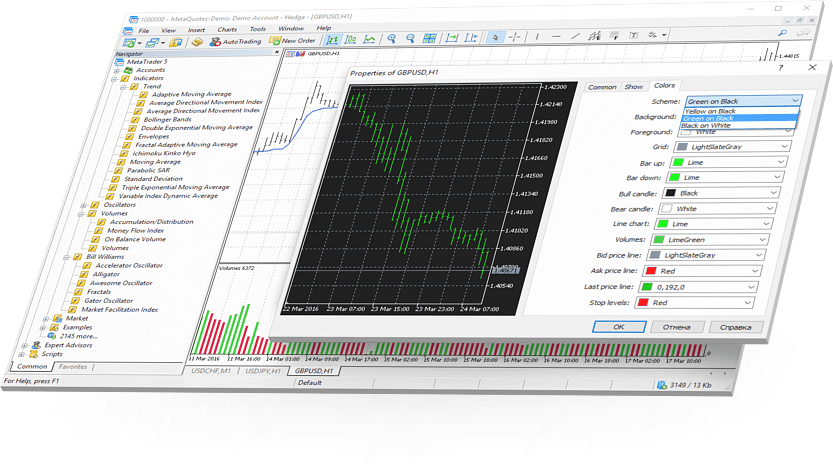

MetaTrader 5

In addition to the MT4 capabilities, MetaTrader 5 also includes the following features:

- Stop-loss alerts

- 21-time frames

- Strategy development and testing

- Highly customisable to fit any trading style

- Numerous pending order and execution types

- Advanced technical indicators and analysis tools

MT5

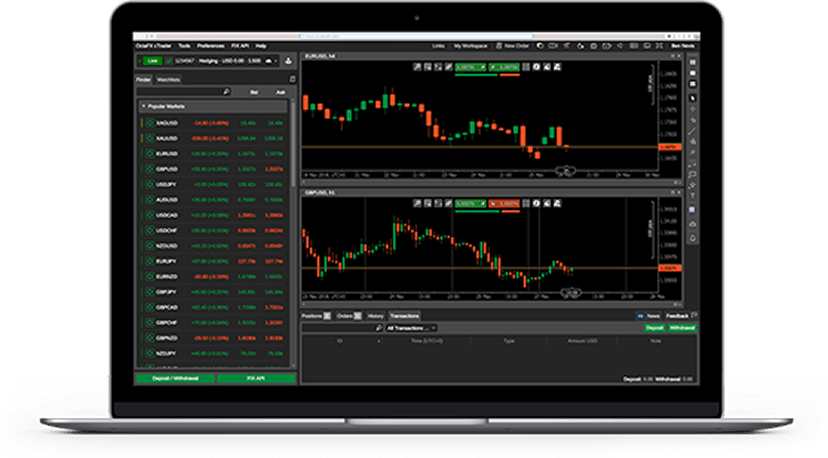

cTrader

cTrader offers a more user-friendly interface, and is straightforward enough for beginners to use. Clients benefit from:

- 26 built-in chart views

- Programmable algorithms

- 50+ customisable trading templates

- Selection of technical indicators and timeframes

cTrader

Products

Pepperstone has several asset classes available to trade, these include:

- 14 index CFDs, including UK100 and US30

- 20+ commodities including gold, silver, and oil

- Five cryptocurrency CFDs, including Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC)

- 60+ forex pairs, including majors, minors and exotics, notably: GBP/USD and EUR/USD

Plus, Peppperstone provides spread betting on stocks, currencies, indices and commodities.

Commission & Fees

Pepperstone offers competitive spreads vs many of its industry alternatives. In particular, on the Razor account, spreads start at zero pips on major forex pairs. The Razor account has lower spreads compared to the standard account, for example on EUR/USD, the Razor account comes in at 0.09 pips, compared with 0.75 pips on the Standard. However, Razor account holders are subject to commission. On MT4 and MT5, a commission of GBP 0.02 (GBP 0.05 round turn) per 1000 units is applied. But on cTrader, commission is charged at 0.0035%.

Spreads on indices, such as the UK100 and Nas100, are 1.0 pip.

Pepperstone also charges fees for positions held overnight (known as the swap rate) and commissions on CFDs depending on currency traded and the platform used.

UK Leverage

In line with FCA regulations, Pepperstone applies a maximum leverage restriction. This is variable by asset class:

- Equities – 1:5

- Commodities – 1:10

- Major forex pairs – 1:30

- Non-major forex pairs and major indices – 1:20

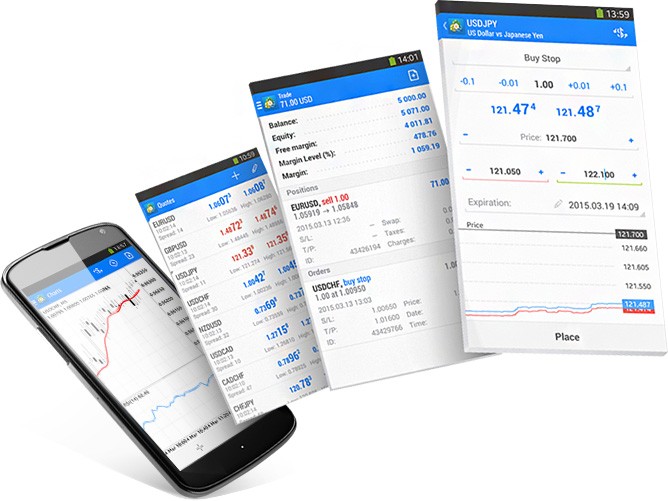

Mobile Trading

All three of Pepperstone’s trading platforms offer a mobile app and are available to download on Android and iOS devices. This means that investors can execute trades and track strategies on the go. Clients can utilise a suite of drawing and analysis tools and implement automated trading algorithms. Push notifications also mean traders are kept up to date with the latest price changes and market movements.

Mobile Trading on MetaTrader 4

Deposits & Withdrawals

Pepperstone offers a range of deposit and withdrawal options to UK traders. These include:

- Visa

- PoLi

- BPay

- Skrill

- PayPal

- Neteller

- Union Pay

- Mastercard

- Bank Transfer

All funding and withdrawals can be made via the Pepperstone secure client login area. However, the payment methods available may vary depending on account type. The broker has a minimum deposit of £0. Typically, deposits are instant and withdrawals requested before 08:00 GMT will be processed the same day. After 8 am GMT, withdrawals can take up to 3-5 working days.

Demo Account

Pepperstone offers a 30-day free demo account where traders can practice with £50,000 of virtual funds. Here, investors can familiarise themselves with the platforms available before committing themselves to a live account.

Regulation Review

Pepperstone is one of the most highly regulated brokers in the industry. It’s registered with the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia, and The Dubai Financial Services Authority (DFSA). This level of regulation should offer UK traders confidence when investing.

Additional Features

Pepperstone offers a range of additional features to enhance the trading experience, these include:

- Copy trading

- Market analysis

- Economic calendar

- Trading guides with webinars and tutorials

- Unique trading tools, including VPS trading and Autochartist

Account Types

Pepperstone offers two account types: the Standard and Razor account. Both offer the following key features:

- 180+ asset classes

- Access to MT4 and MT5

- Social/copy trading tools

- Mobile, desktop, and web trading

- No minimum account deposit anymore

- Leverage capped at 1:30 in line with FCA regulations

Plus, when comparing the Standard account vs the Razor account, there are some advantages to selecting the latter:

- Access to cTrader

- Faster execution

- Generally lower fees

Islamic, swap-free trading is only available on the Standard account.

Whilst both trading accounts provide a comprehensive suite of features, the Standard account is best suited to new traders. The Razor account will be attractive to more experienced investors looking to employ more technical strategies, such as scalping or algorithmic trading.

Pros & Cons

Advantages

- Demo account

- Range of payment methods

- Multiple additional features including copy trading

- Regulated by reputable bodies, including the FCA

- Access to industry-leading trading platforms: MT4 and MT5

- Focus on consumer protection, with negative balance protection and segregated funds

Disadvantages

- No live chat service

- Limited account options

- No bonus scheme (a condition of FCA regulation)

- Fewer assets available compared to other brokers

Trading Hours

Pepperstone trading hours vary depending on the asset being traded. However, most FX pairs are available to trade 24/5. Information on specific asset trading hours is available on the company’s website.

The Pepperstone server time is set at GMT + 3 hours during US daylight saving and GMT +2 outside of this period. This aligns Pepperstone’s chart candles to close in conjunction with the New York Stock Exchange (NYSE).

Customer Support

Pepperstone offers many customer support options:

- Contact email – support@pepperstone.com

- UK toll-free phone number – 0800 046 5473

- Email enquiry form with a 24-hour response rate

Most brokers offer a live chat service, enabling customers to access support instantly. Unfortunately, Pepperstone does not provide this, but it does offer a comprehensive FAQ section with in-depth answers. Customers will find they can self-serve many of the most popular queries.

Security

As well as being heavily regulated, Pepperstone also prioritises client security. All retail funds are kept in a segregated bank account to protect their account balance in the event of liquidation. Plus, Pepperstone is signed up to the Financial Services Compensation Scheme (FSCS) and for those trading on margin, negative balance protection is available.

Should You Trade With Pepperstone?

Pepperstone is popular with traders and it’s easy to see why. Regulated with the FCA, it prioritises client trust, while offering industry-leading platforms in MetaTrader 4 and 5. The option of both Razor and Standard account, means the needs of traders of all levels of expertise are met. Plus, with bespoke features such as copy trading and APIs, there’s sufficient functionality for most trading strategies.

FAQs

Is Pepperstone A Good Broker?

Pepperstone is a popular broker among traders due to its solid trading platform options, focus on customer security, and strong customer support.

Is Pepperstone An ECN Broker?

Yes, Pepperstone is an ECN broker in that it sources its pricing directly from liquidity providers. These prices are then passed onto the customer without dealing desk intervention.

Is Pepperstone Safe?

Pepperstone is considered a safe broker to trade with. It is regulated by the FCA in the UK, meaning that clients can benefit from negative balance protection and the security of knowing client funds are segregated. Plus, Pepperstone is part of the Financial Service Compensation Scheme (FSCS) which protects traders’ funds in the event the broker goes into liquidation.

Is Pepperstone Good For Scalping?

Pepperstone allows scalping on both Razor and Standard accounts. However, due to the tighter spreads on offer, the Razor account is recommended.

Does Pepperstone Accept PayPal And Bitcoin?

Pepperstone has several payment options, including PayPal. Currently, Bitcoin payments are not accepted. However, this could change as cryptocurrencies become a more popular form of payment.

Top 3 Pepperstone Alternatives

These brokers are the most similar to Pepperstone:

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Fusion Markets - Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

Pepperstone Feature Comparison

| Pepperstone | IC Markets | IG | Fusion Markets | |

|---|---|---|---|---|

| Rating | 4.8 | 4.8 | 4.5 | 4.6 |

| Markets | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Minimum Deposit | $0 | $200 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, CMA, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | ASIC, VFSC, FSA |

| Education | Yes | Yes | Yes | No |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4 | MT4, MT5, cTrader |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:222 (Pro) | 1:500 |

| Visit | 72% of retail investor accounts lose money when trading CFDs |

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | Pepperstone Review |

IC Markets Review |

IG Review |

Fusion Markets Review |

Trading Instruments Comparison

| Pepperstone | IC Markets | IG | Fusion Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | No | Yes | No |

| ETFs | Yes | No | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | Yes | No | Yes | No |

| Volatility Index | Yes | Yes | Yes | No |

Pepperstone vs Other Brokers

Compare Pepperstone with any other broker by selecting the other broker below.

Popular Pepperstone comparisons:

|

|

Pepperstone is #1 in our rankings of CFD brokers. |

| Top 3 alternatives to Pepperstone |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Trading Platforms | MT4, MT5, cTrader |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Apple Pay, Credit Card, Debit Card, Google Pay, Mastercard, Neteller, PayPal, Skrill, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes (Via Chartist Software) |

| Islamic Account | Yes |

| Commodities | Aluminium, Cocoa, Coffee, Copper, Corn, Cotton, Gasoline, Gold, Livestock, Natural Gas, Nickel, Oil, Orange Juice, Palladium, Platinum, Precious Metals, Silver, Soybeans, Sugar, Wheat, Zinc |

| CFD FTSE Spread | 1.0 |

| CFD GBPUSD Spread | 0.4 |

| CFD Oil Spread | 2.5 |

| CFD Stocks Spread | 0.02 |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.1 |

| GBPEUR Spread | 0.4 |

| Assets | 100+ |

| Currency Indices | EUR, JPY, USD |

| Crypto Coins | ADA, BCH, BNB, BTC, DASH, DOGE, DOT, EOS, ETH, LINK, LTC, UNI, XLM, XRP, XTZ |

| Crypto Spreads | BTC 30, ETH 0 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |