OspreyFX Review 2025

|

|

OspreyFX is #58 in our rankings of CFD brokers. |

| Top 3 alternatives to OspreyFX |

| OspreyFX Facts & Figures |

|---|

OspreyFX is an ECN broker headquartered in St. Vincent and the Grenadines. Established in 2019, the firm offers 120+ forex and CFD assets with high leverage up to 1:500, tight spreads from 0.1 pips and round-the-clock customer support. OspreyFX also stands out for its funded trading accounts where traders can keep up to 70% of profits. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, Cryptos, Indices, Stocks, Commodities |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| Trading App |

The Forex Squad app is a free education tool with beginner-friendly training and content on a range of topics, including fundamental analysis, forex strategy and trading psychology. The app is free to download. |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | OspreyFX offers leveraged CFDs on forex, commodities, stocks, cryptos and indices. Deep liquidity is available from 50+ providers with a competitive ECN account that will suit active trading strategies, including scalping. |

| Leverage | 1:500 |

| FTSE Spread | 0.5 pts |

| GBPUSD Spread | 0.8 pips |

| Oil Spread | 0.09 pips |

| Stocks Spread | 0.4 pips |

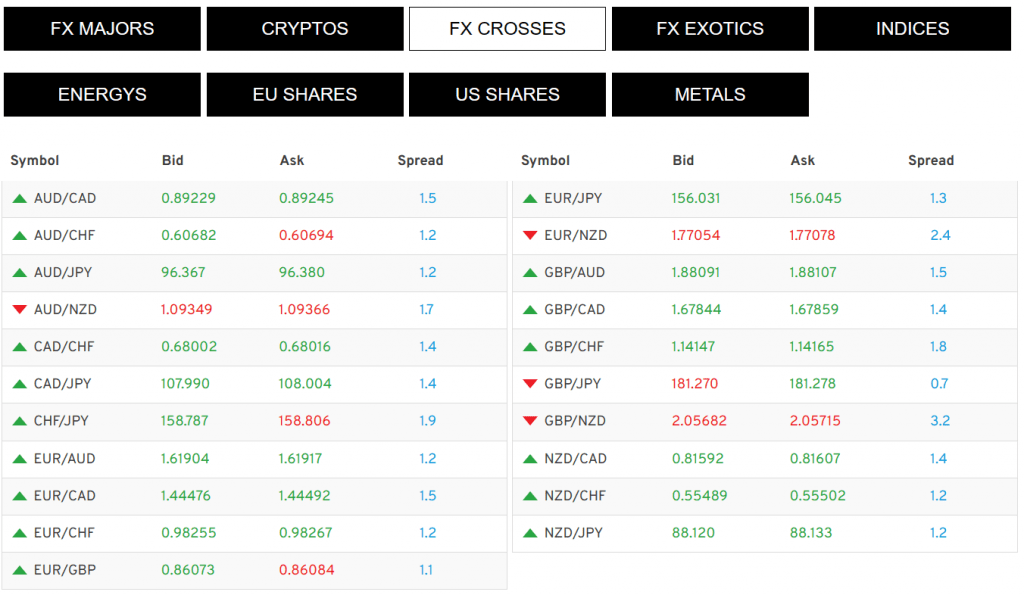

| Forex | OspreyFX offers more than 50 major, minor and exotic currency pairs. Spreads start from just 0.1 pips on the EUR/USD and the broker provides a suite of forex trading education for beginners, including partnering with Forex Squad for fresh insights. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.5 |

| GBPEUR Spread | 0.8 |

| Assets | 55+ |

| Currency Indices |

|

| Stocks | OspreyFX offers leveraged trading on US and European stocks and shares. There are no restrictions on strategies and traders benefit from competitive, real-time pricing and access to industry-leading software from MetaTrader. |

| Cryptocurrency | OspreyFX offers a decent selection of crypto coins paired with USD, including Bitcoin. 1:10 leverage is available with starting deposits from just $10 and support for Expert Advisors (EAs). |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

OspreyFX is a multi-asset forex broker offering competitive spreads and low commissions. This review will provide prospective traders with key information on fees, available assets, trading platforms and more. Our UK team also reveals their verdict after testing OspreyFX.

Our Take

- OspreyFX will appeal to experienced traders looking to invest in forex with high leverage up to 1:500

- The ECN account offers competitive trading conditions with low spreads from 0.1 pips and fast order execution

- The broker’s three-step funded trading accounts up to $200k separate the brand from competitors

- OspreyFX’s customer service falls short compared to alternatives

- UK traders may be deterred by the lack of FCA oversight

Market Access

OspreyFX has a reasonable variety of assets available, but we think it lacks depth with just 120+ instruments in total including forex, crypto and stocks. Forex is the main offering with 55 pairs, and this plus the 31 crypto assets are competitive.

We were sorry to see a limited selection of alternative assets with just 37 stocks and a handful of indices and commodities.

Available instruments include:

- 55 forex pairs including GBP/USD, EUR/USD and GBP/CHF

- 31 cryptocurrencies including Bitcoin, Ethereum and Litecoin

- 9 indices including FTSE 100, IBEX 35 and Dow Jones 30

- 37 stocks including Apple, Amazon and Adidas

- Metals including gold, silver and platinum

- Commodities including gas and oil

- Futures

Live Accounts

Our team was pleased to find that OspreyFX offers four different account types – Mini, Standard, Pro and VAR – to suit different trading styles, which competes well with other brokers such as IC Markets.

I liked that there was a Mini account option with lower fees and minimum deposit which makes it more accessible for newer traders. However, I would have liked to see an even lower spread on this beginner-friendly account, with the 1.2 starting point fairly high vs alternatives.

All account types have a margin call of 100% and a stop-out level of 70% which traders should be aware of.

We have highlighted the key differences between the accounts

Mini Account

Best for beginners

- Spreads from 1.0 pips

- 29 forex pairs available

- Minimum deposit of $25

- Commission fees of $1 per lot

Standard Account

Best for intermediate traders

- Spreads from 0.8 pips

- 55 forex pairs available

- Minimum deposit of $50

- Commission fees of $7 per lot

PRO Account

Best for experienced traders

- Spreads from 0.4 pips

- 55 forex pairs available

- Minimum deposit of $500

- Commission fees of $8 per lot

VAR Account

Best for commission-free trading

- Spreads from 1.2 pips

- 55 forex pairs available

- Minimum deposit of $250

- Commission fees of $0 per lot

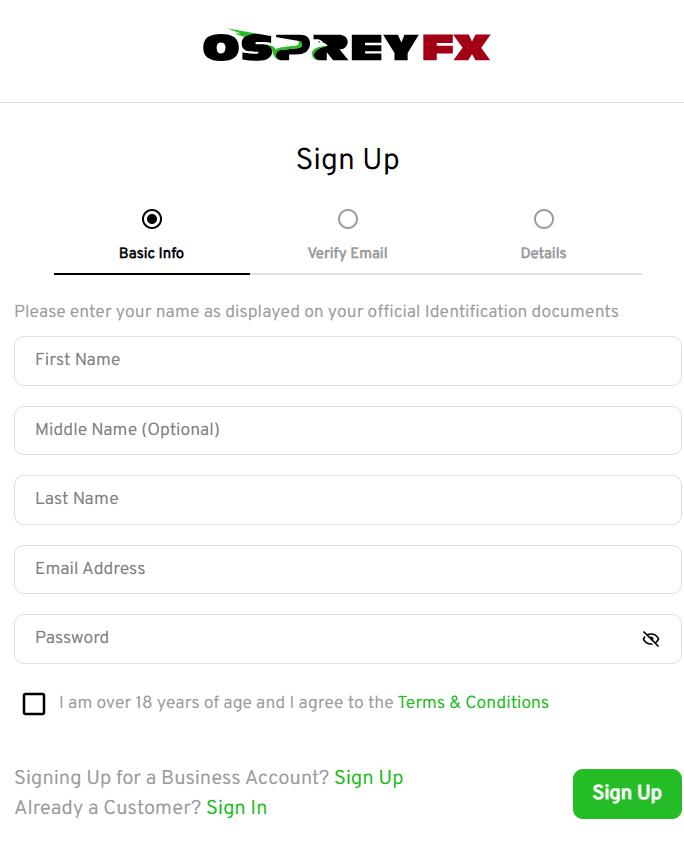

How To Open An OspreyFX Account

I didn’t run into any problems creating an account with OspreyFX. The process is straightforward and should be completed in a matter of hours if you have the required documentation to hand:

- Enter your email address and basic personal information on the sign-up form and confirm you are over 18 years old

- Click the ‘Complete Sign-up’ button in the verification email from OspreyFX

- Enter the detailed personal info and submit verification documents (proof of identity and proof of address)

- Click the ‘Create Your Account’ button

- Set up two-factor authentication via your email or SMS

- Login to your account and click the My Accounts icon from the dashboard on the left of the screen

- Select the trading platform, account type, currency and leverage you want to use

- You will receive an email with your account number and password

Note that the sign-up process may be delayed if your documents cannot be verified.

OspreyFX Fees

Spreads are OspreyFX are competitive, averaging around 0.7 pips for the EUR/USD pair when we tested the platform. Commissions are also reasonable at $7 per lot in the Standard account and just 1$ per lot in the Mini account.

OspreyFX is an ECN broker aggregating liquidity from over 50 different banks meaning it suits higher volume traders looking for low pricing.

We were also pleased to see that OspreyFX has zero deposit fees and no withdrawal fees which allows this broker to compete with other firms such as Opofinance.

Muslim traders can also open a swap-free account, removing overnight fees and reducing non-trading fees to zero.

Funding Methods

Our team were reassured to find a variety of payment methods are supported by this broker making it quick and easy to get started. We are also pleased to find that broker accepts GBP payments, meaning UK traders can avoid conversion charges.

OspreyFX supports debit/credit cards, PayRedeem and a selection of cryptos including Bitcoin, Litecoin, Ethereum, USDT, USD Coin, Dogecoin, and Ripple. On the negative side, there is a 6.5% transaction fee if you deposit funds with PayRedeem so we recommend choosing a different option.

Deposits take a maximum of three hours to enter your account, which is reasonable.

Unfortunately, fewer methods are supported for withdrawals. Only credit/debit cards, Bitcoin and PayRedeem are available which is a disadvantage, especially when compared to competitors such as Pepperstone.

How To Make A Deposit

- Sign into your account

- Click the ‘Deposit’ section from the drop-down menu

- Choose the method you wish to use, the wallet and the amount

- Click the ‘Redirect Me to Payments Page’ icon

- Follow the instructions for the type of payment method you chose

Regulation

The key disadvantage of this broker is its lack of regulation, and we were disappointed to find that, while the company is registered in St Vincent and the Grenadines, OspreyFX is not regulated by the FCA.

While this is not unusual for offshore brokers, traders should be aware that this lack of regulation leaves them short of any serious legal protection in the event of scams. For example, you won’t have access to up to £85,000 from the FSCS in the event of business failure.

Trading Platforms

I was happy to see that OspreyFX offers the reliable MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which means traders will have access to market-leading platforms offered by many of the best brokers.

The MT4 and MT5 platforms are simple to use and very popular with traders. Both offer a huge range of customisable tools and are available as a desktop program or mobile app. Alternatively, you can access them via WebTrader providing access without having to install software.

MT4 is a good choice for forex-focused trading with 23 analytical objects and 30 technical indicators. The trading terminal offers four types of pending orders: buy limit, buy stop, sell limit and sell stop. I like the intuitibe charting tools and the copy trading signals as they make the program easy for beginners to learn and use.

We recommend more experienced traders use the MT5 platform as it is as reliable and versatile as MT4 but offers more advanced analytical tools and a broader range of order types, as well as faster processing.

Additionally, OspreyFX offers traders the opportunity to access the TradeLocker platform’s beta phase to help uncover any bugs before the platform is released for general use. This early access aims to allow traders to guide the product’s development so it can be optimised for users. TradeLocker Beta offers features such as advanced customisable charts, technical analysis tools and one-click trading.

OspreyFX Leverage

The maximum leverage offered by OspreyFX is 1:500 which is significantly higher than the 1:30 cap placed by UK and EU governing bodies. This leverage can be an advantage of offshore brokers as it offers high trading power, but it also greatly increases risk.

We advise traders to exercise caution and take a sensible approach to managing risk.

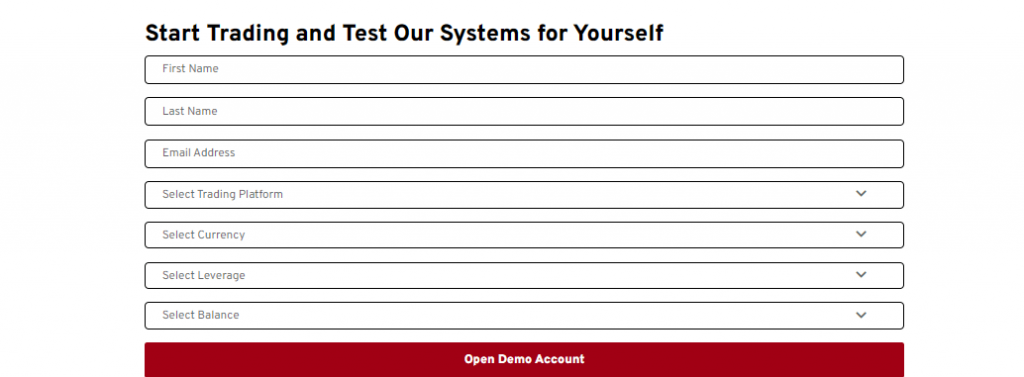

Demo Account

We were pleased to see that OspreyFX offers a demo account to traders on MT4, MT5 and TradeLocker with a balance of up to £100,000.

These accounts are an excellent way for beginners to learn about trading without financial risk, and they also help traders decide whether a broker is a good fit before investing capital.

When we used OspreyFX, our experts found that you can sign up for a simulation account in a few simple steps:

- Hover over the ‘Trading’ icon on the broker’s website and select ‘Demo Account’

- Enter your basic personal information, the trading platform you wish to use and your chosen amount of leverage

- Click the ‘Open Demo Account’ icon

Security

We were pleased to see that all client funds are kept in segregated accounts which adds a degree of protection if OspreyFX goes into administration. Additionally, two-factor authentication is applied when logging into your account which offers an extra layer of account protection.

However, since OspreyFX is an unregulated broker, traders should keep in mind that there is no financial body ensuring that they stick to various safety policies.

Bonus Deals

I was intrigued to find a 20% withdrawal bonus available to traders at OspreyFX. The promotion presented me with an option during the withdrawal process offering 20% extra credit in trading funds if I agreed to hold the funds in my trading account rather than withdraw them.

We think this could be a decent feature, though we are wary of any promotion that discourages traders from withdrawing their money from a broker. Generally, bonuses are credited during sign-up or when you deposit funds, rather than when you withdraw to realise profits or cut losses.

Extra Tools & Features

One of my favourite features of OspreyFX is the demo trading competition which allows traders to challenge themselves and enjoy competitive trading with no financial risk. The broker offers decent cash prizes to the top three competitors making the challenge rewarding for traders.

OspreyFX has a reasonable variety of educational resources which I found to stand up fairly well against similar brokers. There are guides to online trading and various assets which can be customised to the trader’s experience level.

Additionally, the broker offers traders the opportunity to join the forex squad which is an educational resource specifically for forex traders. The forex squad includes training on forex strategy, technical analysis and advanced forex trading.

There is also a news page on the broker’s website allowing investors to keep up to date with markets and strategies. Unfortunately, OspreyFX does not offer resources such as webinars or video tutorials which are available from competitors such as AvaTrade.

Funded Accounts

Another key feature is the funded trading accounts available to clients who aim to push their trading to a more professional level.

If the trader signs up and demonstrates via demo accounts that they are profitable in their strategies, they can access a maximum of £200,000 funded by OspreyFX and will receive 70% of the profits they make. This might be lower than the funding level or profit splits of some alternatives like City Traders Imperium, but it will still appeal to many aspiring traders.

Full conditions are listed on the broker’s website and it should be noted that one of the stages of verification has a fee.

Company Details & History

OspreyFX is a forex broker set up in 2019 and registered in St Vincent and the Grenadines. Unfortunately, we found very little information available about the company’s history or team.

The broker provides access to a reasonable range of instruments including forex, stock and commodities. It aims to attract both beginner and experienced traders by offering a variety of account types and trading platforms.

Customer Service

Our experts were disappointed by the customer service offered by OspreyFX. The broker offers a live chat option on their website and an extensive FAQs page. Additionally, you can submit a support ticket with any issues you have on the broker’s website or contact them via social media such as Facebook and Twitter.

However, no email address, telephone number or office address is listed on the website, nor are the open hours of the broker’s office. I was not impressed with the lack of avenues to contact the broker if you encounter any issues.

Trading Hours

Trading hours vary depending on the instrument you chose to trade. There is a trading hours page on the broker’s website which allows you to input the date and time zone of your choice and then the trading hours of each instrument appear. I found this feature useful as it makes finding any irregular hours easy.

Should I Trade With OspreyFX?

Overall, we found that OspreyFX has some good points such as high leverage, a range of account types to suit different traders and the reliable MT4 and MT5 platforms. We found the range of available assets below average, although the fees and trading terms were competitive.

However, we were disappointed to find the broker has no FCA regulation which UK traders should bear in mind. Additionally, I found the range of customer service options limited and the variety of educational resources does not compete with the top brokers.

FAQ

Is OspreyFX Good For UK Traders?

OspreyFX offers UK traders a reasonable variety of instruments, especially in terms of forex, with tight spreads and high leverage. Multiple payment options are available making deposits and withdrawals easy and quick for UK investors. GBP is also an accepted account currency meaning traders will not face currency conversion fees.

However, the broker is not regulated by the FCA, which makes it less secure than some alternatives.

Is OspreyFX A Good Broker For Beginners?

OspreyFX has some features that make it a good option for new traders. There are several account types, such as the Micro or Standard accounts, with low minimum deposits and low or no commission fees. There is also the option of opening a demo account allowing beginners to learn more about trading without financial risk.

Yet while there are some useful educational resources available from the broker, they do not compete with other beginner-friendly brokers like eToro.

Is OspreyFX Halal?

Does OspreyFX Have A Low Minimum Deposit?

OspreyFX offers four account types with a variety of minimum deposits to match different budgets. The lowest minimum deposit is $25 for a Micro account and the highest is $500 for a PRO account. These deposit levels stand up well when compared to other brokers in the market, though there are leading brands such as Pepperstone that have no minimum deposit requirement.

Is OspreyFX Safe And Legit?

While OspreyFX does say it segregates client funds providing traders some security against company bankruptcy, the broker is not regulated by a top-tier financial body like the UK’s FCA. This makes it less secure than other brokers in the market and traders should consider the safety of their capital before investing funds.

Article Sources

Top 3 OspreyFX Alternatives

These brokers are the most similar to OspreyFX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

OspreyFX Feature Comparison

| OspreyFX | Swissquote | Pepperstone | IG Index | |

|---|---|---|---|---|

| Rating | 3 | 4 | 4.8 | 4.7 |

| Markets | Forex, Cryptos, Indices, Stocks, Commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | $10 | $1,000 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4 |

| Leverage | 1:500 | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | OspreyFX Review |

Swissquote Review |

Pepperstone Review |

IG Index Review |

Trading Instruments Comparison

| OspreyFX | Swissquote | Pepperstone | IG Index | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

OspreyFX vs Other Brokers

Compare OspreyFX with any other broker by selecting the other broker below.

Popular OspreyFX comparisons: