Optimus Futures Review 2025

|

|

Optimus Futures is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Optimus Futures |

| Optimus Futures Facts & Figures |

|---|

Optimus Futures is an introducing broker partnering with numerous FCM services. It offers hundred of global assets across 40+ trading platforms. |

| Instruments | Futures, options |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $500 |

| Mobile Apps | Yes (iOS & Android) |

| Payments | |

| Min. Trade | Variable |

| Regulated By | CFTC, NFA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | None |

| Islamic Account | No |

| Commodities |

|

| Forex | Offers 80+ spot forex pairs to US traders, plus futures from multiple global exchanges, including ICE, ASX and Eurex |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Assets | Varies with provider |

| Stocks | Offers stocks and shares futures from numerous global exchanges, including SGX. |

| Cryptocurrency | Optimus Futures offer micro Bitcoin futures with competitive rates. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Optimus Futures is a futures broker that provides traders with access to 15 exchanges, several futures commission merchants (FCMs), and over 25 trading platforms. In this review, we will look at the available markets and tools, how to open an account, deposit and withdrawal methods, fee structure and everything else traders should consider before signing up with Optimus Futures.

Our Take

- Optimus Futures offers a bespoke futures trading platform, alongside several other tools, plus excellent tailored educational resources

- This is a strongly regulated broker overseen by the US’s CFTC, but not by the UK’s FCA

- The broker has limited funding methods – bank wire transfers, ACH deposits and checks

- Fees are fairly high compared to alternatives

Market Access

Optimus Futures is not a typical broker, but we were impressed with its offering. If you are looking to trade futures and options, Optimus Futures will be difficult to beat.

Since this broker gives traders access to derivative contracts from the 15 different exchanges listed below, clients will be able to trade a huge number of assets.

- New York Mercantile Exchange (NYMEX)

- Chicago Board Options Exchange (CBOE)

- Australian Securities Exchange (ASX)

- Chicago Mercantile Exchange (CME)

- The Commodity Exchange (COMEX)

- Chicago Board of Trade (CBOT)

- London Metal Exchange (LME)

- Minneapolis Grain Exchange

- Kansas City Board of Trade

- Singapore Exchange (SGX)

- ICE Futures Europe

- ICE Futures US

- NYSE Liffe US

- NYSE Liffe

- Eurex

On the downside, traders looking for CFDs will be disappointed.

Optimus Futures Fees

Optimus Futures charges fees in several different ways. Fees differ depending on the chosen account type/data-feed provider.

The broker charges commissions between $0.05 and $0.75 (£0.04 to £0.60) depending on the type of asset and the size of the contract. Technology fees are also charged by some of the data feed providers. Exchange execution and NFA fees also apply, depending on the market and product being traded. Exchange data fees are also charged monthly to traders who want access to top-of-book and market-depth information.

Finally, account fees apply, particularly for certain withdrawal methods and margin calls.

Commissions

Separate commission rates are charged between micros and futures. Micro commission rates range from $0.05 to $0.25 (£0.04 to £0.20) depending on the size of the contracts (0-20 contracts up to 1000+ contracts). Futures commission rates range from $0.10 to $0.75 (£0.08 to £0.60) for the same range of contract sizes.

Technology Fees

We like the range of data and tech available to Optimus Futures traders and were especially impressed at the amount that is offered for free. The data providers and fees include:

- GAIN Futures (Stone X): Free

- Rithmic: $0.10 (£0.08) per side

- CQG: $0.10 (£0.08) per side

- Optimus Futures: Free

- CTS: Varies by platform

- TradeStation: Free

- TT: $0.50 (£0.40)

- Firetip: Free

Optimus Futures Accounts

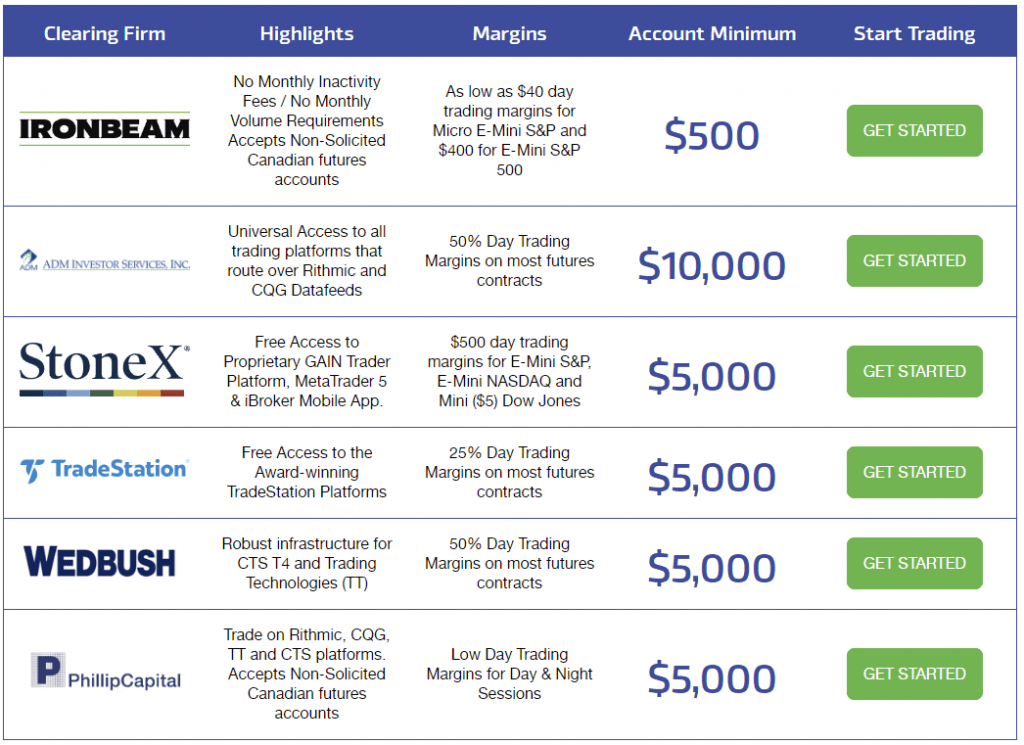

Optimus Futures allows traders to open several different account types that cover a wide range of trading styles. We’re confident these will satisfy futures and options traders of diverse experience levels and budgets.

The major differing factor between these is the clearing firm (FCM) used. Each clearing firm charges its own technology fees, margins, account minimums and trading platforms.

Available account types are:

- ADM Investor Services Account

- Optimus Futures Account

- TradeStation Account

- PhilipCapital Account

- IRONBEAM Account

- WedBush Account

- StoneX Account

Each of these account types offers different services and features. For example, the IRONBEAM account has a minimum deposit of $500 (£400) while the TradeStation Account has a minimum of $5,000 (£4,000). IRONBEAM does not charge inactivity fees while StoneX provides access to the MetaTrader 5 platform.

With such diverse choices available, we are glad to see that Optimus Futures offers a free consultation on its website to find the right combination of trading platforms, features, costs, and technology to suit each trader’s investing style.

FCMs

How To Open An Account

The account opening process is fairly typical, taking a few minutes to get started with and requiring basic contact and background information.

- Go to the Optimus Futures website

- Click the ‘Open Account’ button at the top of the webpage

- Click the ‘Start Application’ button to begin the process

- Fill out the forms with the personal details necessary to open your account

- Enter information including account specification, personal information, employment information, identification, etc

- Once this process is complete, your application will be reviewed

- If accepted, you will be emailed with the details needed to log into the Optimus Futures portal

Funding Options

We were disappointed to find that Optimus Futures only offers three deposit methods – bank wire transfers, ACH deposits and physical checks with its clearing firms.

As the broker does not support SEPA transfers with European Banks, this can leave non-US traders without many options to fund their trading accounts, and the fees for these traders can also be expensive.

Each account type charges different amounts depending on the method used, but overall, fees are quite high for international clients including UK-based traders, with currency conversions into USD required, also incurring quite high costs in some cases.

IRONBEAM

- Wire Transfer In: Free

- Wire Transfer Out (Domestic – USA): $40 (£31)

- Wire Transfer Out (International): $60 (£47)

- Checks Issued: Free

- Check Issued Overnight (USA): $40 (£31)

- Checks Issued Overnight (International): $60 (£47)

TradeStation

- Wire Transfer In: Free

- Wire Transfer Out (Domestic – USA): $25 (£20)

- Wire Transfer Out (International): $35 (£27)

- Checks Issued: Free

- Check Issued Overnight: $15 (£12)

StoneX

- Wire Transfer In: Free

- Wire Transfer Out (Domestic – USA): $25 (£20)

- Wire Transfer Out (International): $30 (£24)

- Checks Issued: Free

- Check Issued Overnight (USA): $35 (£27)

- Checks Issued Overnight (International): $60 (£47)

WedBush

- Wire Transfer In: Free

- Wire Transfer Out (Domestic – USA): $20 (£15)

- Wire Transfer Out (International): $75 (£60)

- Checks Issued: Free

- Check Issued Overnight (USA): $30 (£24)

- Checks Issued Overnight (International): Determined by FedEx

- Outgoing Transfer: $50 (£39)

PhillipCapital

- Wire Transfer In: Free

- Wire Transfer Out: $25 (£20)

- Checks Issued: $4 (£3)

- ACH: Free

- Outgoing Transfer: $25 / $50 (£19 / £39) – Partial/Full

ADMIS

- Wire Transfer In: Free

- Wire Transfer Out (Domestic – USA): $20 (£15)

- Wire Transfer Out (International): $30 (£24)

- Checks Issued (Domestic): $15 (£12)

- ACH (Domestic): Free

Optimus Futures Regulation

Optimus Futures is a member of the National Futures Association (NFA) and is registered with the Commodity Futures Trading Commission (CFTC). Optimus Futures LLC is registered with NFA ID: 0481133.

We are confident that the oversight from these US regulatory bodies goes a long way toward ensuring the security of clients. Both bodies regulate and enforce rules to protect traders from fraud, manipulation, and abusive practices.

On the downside, Optimus Futures is not FCA-regulated, reducing the legal protections for UK traders.

Trading Platforms

Optimus Futures offers an impressive 25+ trading platforms. The platforms available are dependent on the FCM the trader has chosen, but overall, we found the range extremely impressive. We were also happy to see the bespoke Optimus Flow platform.

Platforms offered include:

- Optimus Flow

- MetaTrader 5

- TradeStation

- TradingView

- TT Platform

- iBroker

- CQG

We are impressed by the sheer number of options available to traders, with many popular platforms like MT5 and TradingView being offered. Each FCM offers a different range of tradable platforms.

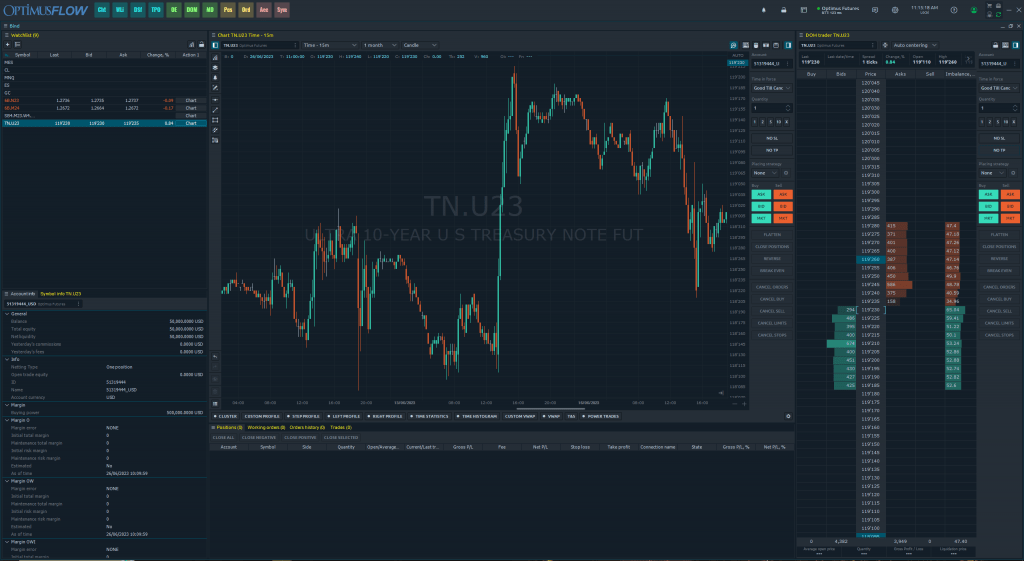

Optimus Flow

Optimus Flow is Optimus Future’s bespoke trading platform, offering a range of tools, level 2 data, chart drawing tools, strategy backtesting, simulated trading, custom timeframes, 30+ technical indicators and market depth.

The platform has advanced features and a professional design to accommodate high-level traders and experienced investors. Overall, we are very impressed with this platform but we think it may be difficult for newer investors to get the hang of it. Luckily, traders can open a free $500,000 demo account on the platform to test it out.

Optimus Flow

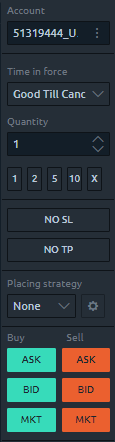

How To Place A Trade

- Log in to the Optimus Flow trading platform

- Choose which asset you would like to trade from the “Watchlist” window

- Open the asset price chart and perform analysis to find the best time to trade

- Fill in the details of your trade in the window attached to the chart, including the size of your trade, stop loss, take profit, placing strategy, time in force and optional details

- Choose the “ASK”, “BID” or “MKT” button under “Buy” or “Sell” to place your trade

Mobile App

Optimus Futures does not offer its own mobile app, though many of the platforms offered do offer their own applications available on Android and iOS devices.

As far as we are aware, the Optimus Flow platform does not have its own mobile app either, and we found this a disappointing oversight from the broker.

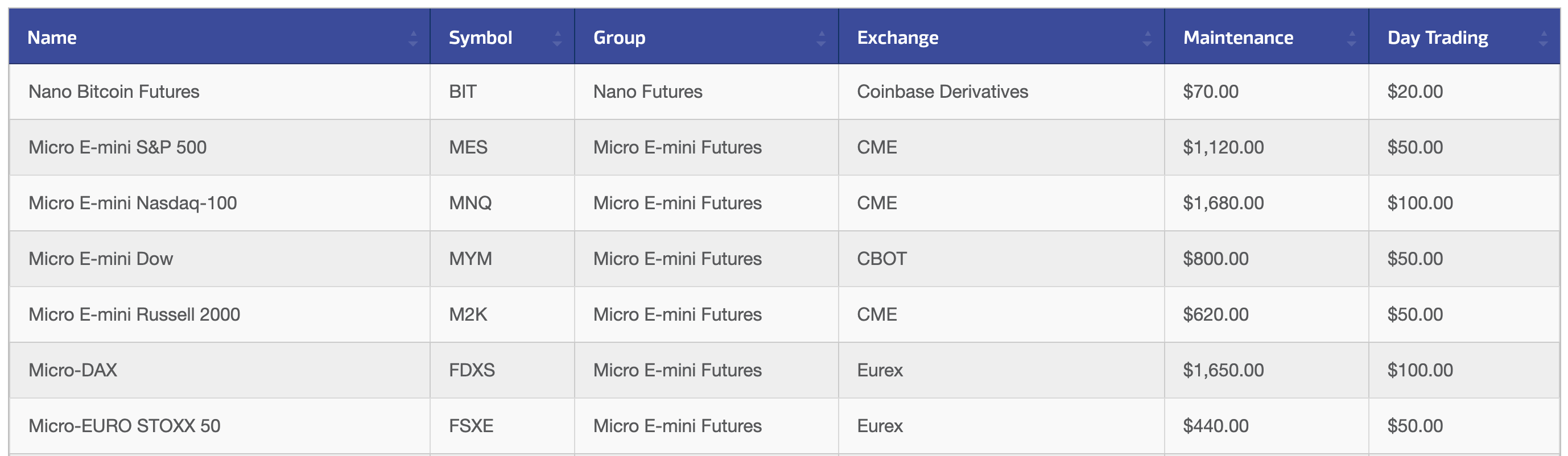

Leverage

Margin requirements for each futures contract can be found on the broker’s website. These vary greatly by asset and are all given as a nominal value.

Margin Requirements

Demo Account

Optimus Futures offers a free trading account, and we were pleased to find that this account is easy to set up. We think this is always a great feature, but especially for a broker like Optimus Futures which has an unusually deep and complex offering.

The demo account starts traders off with $500,000 in virtual funds and provides access to all of the assets Optimus Futures offers. This is a great way for traders to get accustomed to the trading platform and understand how the fee structure works when trading.

We highly recommend all traders practice on a demo account before committing funds to a live account. Testing trading strategies here before using them on a live account will help protect your funds.

How To Open A Demo Account

- Click ‘Open a Demo Account’ on the Optimus Futures website

- Complete the registration form with your personal and account information

- Optimus Futures will send you an email with your login details and a link to download the platform

- Install the platform and create an account

- Log into Optimus Future’s data feed and begin paper trading

Bonus Deals

Optimus Futures offers a referral program to traders which will earn them $50 (£39) the first time they refer a new member. The referred party must set up an account with a minimum of $5,000 (£3,900) for the referrer to be eligible for this bonus.

The broker also offers to match or beat your current rates with other futures trading brokers. The broker promises to do this by finding the best combination of order routing, execution and clearing to minimise. Although the broker includes a disclaimer that it is unable to beat all rates depending on the account size and trading volume, we do feel this is an excellent statement of intent that demonstrates Optimus Futures’ commitment to competitive pricing.

Extra Tools & Features

Overall, we found the extra features provided by Optimus Futures to be useful, with an extensive list of tools and content available to support traders. These include a knowledge base, trading platform guides, trading lessons, a trading podcast, a community blog, a video library, webinars, an FAQ, automated trading, and a remote desktop.

The educational and support features provided are extensive and accessible, and we think they will prove more than sufficient to get new traders started and sharpen more experienced traders’ skills.

Company Details & History

Optimus Futures is an independent introducing broker based in Florida and founded by Matt Zimberg. It has been operating for over 10 years, providing access to a wide range of FCMs and trading platforms. The broker aims to use its wide reach and personal support to nurture traders to invest seriously and diligently.

The broker is registered with the CFTC and is a member of the NFA, providing high-quality, secure services to investors.

Customer Service

We were happy with Optimus Futures’ customer support, which can be contacted by social media, an online chat window, an email address, telephone contact and a physical address. Details are given below:

- Social Media – @optimusfutures

- Phone Number – 1 800 771 6748

- Email – general@optimusfutures.com

- Physical Address: 4160 NW 1st Avenue, Suite 17, Boca Raton, FL 33431, United States of America

Security

We are confident that Optimus Futures is a relatively secure broker to trade with, as a member of the NFA and a registered broker with the CFTC.

Furthermore, the website is encrypted, the broker segregates client funds from company funds, and the trading platforms offered are reputable and secure.

Trading Hours

The trading hours for each asset differ depending on the underlying market and exchange. For example, GBP can be traded from Sunday at 10:00 pm to Friday at 9:00 pm GMT, while European Liquid Milk can be traded from Sunday at 6:45 am to Sunday at 4:00 pm GMT.

A full list of trading times can be found on the Optimus Futures website.

Should You Trade With Optimus Futures?

Optimus Futures provides a strong offering to futures traders. The broker is partnered with several FCMs, granting access to a wide range of markets and trading platforms. This makes the broker accessible to a good breadth of investors, and it is especially good for experienced derivatives traders.

Beginners may find it difficult to get to grips with an offering that can be deep and complex compared to many other retail-focused alternatives, but there is plenty of educational support to help them along.

However, UK traders may be put off by the USD base currency, limited funding methods, and lack of FCA regulation.

FAQ

Can UK Traders Invest With Optimus Futures?

UK traders can invest with Optimus Futures, who provide their services to traders across the globe. However, they should note that the broker’s accounts are based in USD and charge conversion fees. Furthermore, deposit methods are limited. Beginners looking for a more accessible route into the market might want to consider a traditional forex broker that offers futures instruments, such as IG Index or IC Markets.

Does Optimus Futures Offer Good Trading Software?

Optimus Futures offers a huge range of trading platforms, including its own bespoke platform, Optimus Flow, in conjunction with several popular online platforms like MetaTrader 5. The broker’s selection of tools is impressive and outperforms most competitors.

Which Optimus Futures Account Is Best?

Optimus Futures offers account types for each of the available FCMs. Each FCM charges its own fees and provides different features and access to different platforms. Optimus Futures offers a free consultation to help traders find the FCM and platform combination that best fits their style.

How Can I Contact Optimus Futures?

The broker is based in Florida, USA, with no office in the UK. This makes the broker physically difficult to contact for UK traders. However, there are many online avenues to contact the broker, such as through email, online chatbots or social media, like Twitter, Facebook, and LinkedIn.

Is Optimus Futures Safe?

Optimus Futures is a member of the NFA and registered with the CFTC. These are both US regulators that provide strong oversight of futures trading brokers. The CFTC has partnered with the Bank of England on projects before, ensuring its competency. As a result, we consider Optimus Futures to be secure and legitimate.

Article Sources

Optimus Futures NFA Membership

Top 3 Optimus Futures Alternatives

These brokers are the most similar to Optimus Futures:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FXPrimus - FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

Optimus Futures Feature Comparison

| Optimus Futures | Swissquote | IG Index | FXPrimus | |

|---|---|---|---|---|

| Rating | - | 4 | 4.7 | 2.3 |

| Markets | Futures, options | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities, Bonds |

| Minimum Deposit | $500 | $1,000 | $0 | $15 |

| Minimum Trade | Variable | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CFTC, NFA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | CYSEC, MIFID, ICF, FCA, BaFin, VFSC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | - | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:1000 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Optimus Futures Review |

Swissquote Review |

IG Index Review |

FXPrimus Review |

Trading Instruments Comparison

| Optimus Futures | Swissquote | IG Index | FXPrimus | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

Optimus Futures vs Other Brokers

Compare Optimus Futures with any other broker by selecting the other broker below.

Popular Optimus Futures comparisons: