Opofinance Review 2025

|

|

Opofinance is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to Opofinance |

| Opofinance Facts & Figures |

|---|

Opofinance is an offshore forex and CFD broker, offering copy trading services and the MT4 platform. |

| Instruments | Forex, commodities, cryptocurrencies, stocks, indices |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FINACOM |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | No |

| Commodities |

|

| CFDs | Opofinance offers leveraged CFDs on stocks, indices and commodities. |

| Leverage | 1:1000 |

| FTSE Spread | Variable |

| GBPUSD Spread | Variable |

| Oil Spread | Variable |

| Stocks Spread | Variable |

| Forex | Opofinance offers 35+ spot currency pairs, covering all majors and top minors. |

| GBPUSD Spread | Variable |

| EURUSD Spread | Variable |

| GBPEUR Spread | Variable |

| Assets | 35+ |

| Stocks | Opofinance offers CFDs on 60+ US and European stocks. |

| Cryptocurrency | Opofinance offers trading on crypto/spot currency pairs, including BTC/USD. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Opofinance (formerly OpoForex) is a Seychelles-based Forex and CFD broker that offers UK traders 300+ assets. The company offers four different account types and high leverage to investors. This review will provide you with key information on fees, trading platforms, available instruments and more. Our UK team also reveal their verdict after testing Opofinance.

Our Take

- Opofinance will appeal to experienced traders looking to invest in forex or commodities with high leverage up to 1:2000

- The broker lacks FCA regulation and does not offer negative balance protection

- The educational resources offered by this broker do not compete with the top brokers

- USD is the only accepted account currency meaning UK traders may be subject to currency conversion fees

Market Access

Opofinance offers a respectable 300+ instruments with assets in forex, commodities, metals, indices, cryptocurrencies and stocks. However, our team was disappointed to find that this broker does not offer trading in bonds, options or futures which could dissuade traders who are looking for a more diverse portfolio.

Available instruments include:

- Metal CFDs in gold, silver and platinum

- Energy CFDs such as natural gas and oil

- Index CFDs including Dow Jones, S&P 500 and DAX

- Forex pairs including GBP/USD, GBP/CAD and EUR/USD

- Stocks in popular companies including Apple, Tesla and Nike

- Cryptocurrencies such as Bitcoin, Ethereum and Binance Coin

Accounts

We were pleased to find that Opofinance offers four different account types which compete well with other brokers such as IC Markets. The accounts are Standard, ECN, Social Trade and ECN Pro.

The profiles are tailored to suit traders with different experience levels and strategies. For professional or experienced traders, we would recommend the ECN or ECN Pro accounts which offer lower spreads on trades but have a higher commission fee. However, I would like to see an account more suited to beginners with a lower spread as this is an option offered by many competitors.

All account types have access to all trading platforms offered by the broker. The only supported account currency on all accounts is USD, which we found disappointing as it means UK traders could be subject to currency conversion charges.

The minimum deposit for Standard and ECN accounts is $100, the minimum deposit for a Social Trade account is $200 and for an ECN Pro account, the minimum deposit is $5,000.

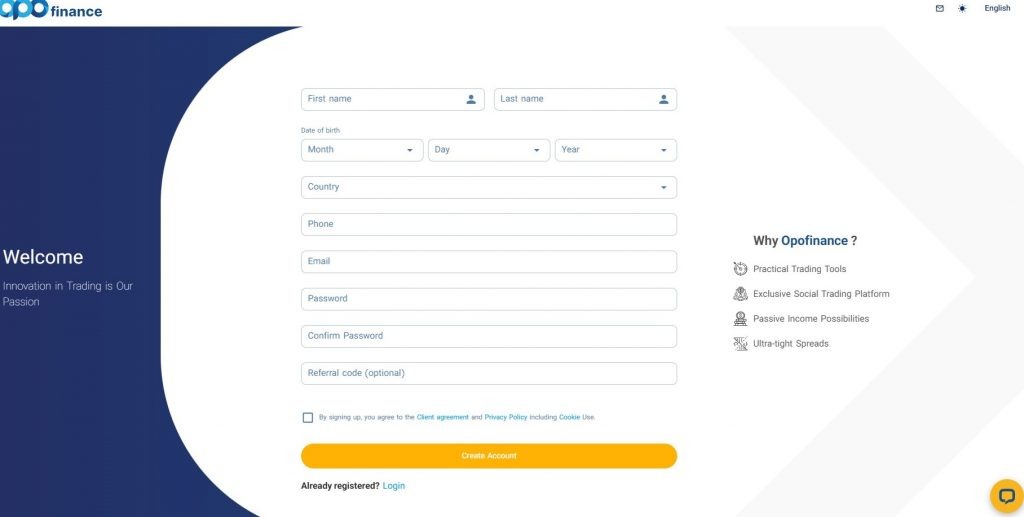

How To Open An Account

I didn’t run into any problems registering for an account. The process only takes a few minutes:

- Enter details such as name, email and date of birth to create a profile

- Enter the PIN sent to your registered email address

- Fill in the information required and provide the supporting documents (proof of identity and proof of address)

- Once verified, log in and click on the ‘Open a Live Account’ icon in the dashboard

- Select the trading platform you want to use and the account type and click ‘Continue’

- Click the ‘Continue’ icon again and your account will be displayed

Note the whole process will take longer if your supporting documents are rejected

Registration Form

Opofinance Fees

When testing the platform, we found that Opofinance’s fees were transparent. However, while spreads of 0.0 pips are advertised these are only available to the ECN Pro accounts with a $5,000 minimum deposit.

For the other account types the spreads are as follows: the Standard account provides spreads from 1.8 pips, Social Trade accounts from 1.5 pips, and ECN accounts from 0.8 pips. These aren’t the most competitive rates in the market as many leading brokers offer accounts with tighter overall spreads and lower entry requirements.

Commission fees also vary between account types: Standard and Social Trade accounts have no commission fees, ECN accounts have $6 fees and ECN Pro accounts have $4 fees.

Our team liked that you could choose an account without commission fees as it allows access for traders with different budgets and goals. This is also in line with leading brokers such as Pepperstone.

We were pleased to see that Opofinance, unlike some competitors, does not charge any inactivity fees.

Funding Options

Our experts were reassured to find a wide variety of supported payment methods available to make deposits and withdrawals. These include cryptocurrencies, bank wire transfer, Visa/Mastercard, and e-wallets such as Perfect Money.

The minimum deposit is $100 for Standard and ECN accounts but is more for the other account types. As such, we would recommend newer traders stick with the Standard or ECN profiles.

Withdrawals are processed within 24 hours by the broker, which is in line with top brokers. The time it takes to receive funds in your account will vary depending on the method you choose.

Making A Deposit

I thought the payment process was intuitive:

- Login to your Opofinance account in the client portal

- Click the ‘Funds’ icon on the sections menu

- Click the ‘Deposit Funds’ icon

- Select the payment method you would like to use in the ‘Payment Type’ section

- Enter the amount you wish to deposit

Making A Withdrawal

The withdrawal process is equally straightforward:

- Login to your account through the client portal

- Click the ‘Funds’ icon on the sections menu

- Click the ‘Payment Details’ icon and click ‘Upload Payment Details’ on the right-hand-side of the page

- Select the withdrawal method, the network type and the wallet address

- Your request is then in Pending Mode and will be approved within 24 hours

- Once approved click ‘Transfer Funds’, then ‘Withdraw Funds’ and click the ‘Continue’ icon

- Select ‘Fiat Wallet’ as the source of money and withdraw your funds

UK Regulation

On the negative side, we weren’t impressed by the firm’s regulatory status. Opofinance is regulated by the Seychelles Financial Services Authority (FSA) with license number SD124.

Traders should be aware that this is an offshore regulator that does not offer the same regulation and protection as authorities such as the UK’s FCA. For this reason, we find this broker to be less trustworthy than competitors like AvaTrade who is regulated by multiple top-tier authorities.

However, we were pleased to find that Opofinance is a member of The Financial Commission, which protects the interests of traders, to a degree, and provides up to EUR 20,000 insurance per case.

Trading Platforms

I was pleased to see that Opofinance offers the reliable MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, comparable to top brokers like Eightcap.

The MT4 and MT5 platforms are easy to use and popular with many traders. Both platforms have a huge range of customisable tools and are available to download as a desktop program or mobile app. Alternatively, they can be directly accessed via the webtrader, allowing traders access without installing the software. I found all versions of the platforms well-optimised and easy to use across devices.

The MT4 platform is a forex-focused trading terminal which offers four types of pending orders: buy limit, buy stop, sell limit and sell stop. The platform offers 23 analytical objects and 30 technical indicators. I like the in-depth pricing history and the option to build and import your own Expert Advisors (EAs).

I would recommend more experienced traders use the MT5 platform as it is more advanced and offers a broader range of analytical tools and technical indicators than MT4. It also has a multi-threaded strategy tester vs the single-thread on MT4.

It is also worth flagging that Opofinance does not have its own trading platform, which would have helped the broker to stand out against competitors.

Opofinance Leverage

Leverage varies depending on the instrument you choose to trade. Opofinance offers leverage up to 1:2000, which is much higher than the 1:30 cap placed by UK and EU governing bodies.

On commodities and indices, leverage is set between 1:100 – 1:300. On metals leverage is between 1:50 – 1:500, whilst crypto leverage is between 1:10 – 1:50.

We recommend that traders consider using stop loss and take profit orders when using high leverage to protect against large losses.

Demo Account

We were happy to see that Opofinance offers a demo account option to traders on both MT4 and MT5. Simulation accounts are a great way for beginners to learn more about trading without financial risk. They are also a good way for traders to decide whether the broker is a good fit for them before investing funds.

Creating A Demo Account In MT4

You can sign up for a simulator account in a few straightforward steps:

- Login to the Opofinance account via the client portal

- From the dashboard click the ‘Open Demo Account’ icon and select MetaTrader 4 as the platform

- Select the account type you want and the leverage and click ‘Continue’

- On the MetaTrader 4 platform click on the ‘File’ section then go to ‘Open an Account’

- Click on the ‘+’ icon and then ‘Add a New Broker’

- Search for the OPOGROUP and select the ‘OpogroupLLC-Demo’ server

- Click the ‘Existing Trade Account’ icon and enter your account details

Bonuses Deals

When I used Opofinance, I was not offered any bonuses or promotions which, while some traders may find disappointing, is not a reason to rank this broker down.

The broker’s website does have a promotions tab which traders can monitor to see if new promotions are introduced in the future.

Extra Tools & Features

One of the features worth mentioning at Opofinance is the Social Trade solution. This feature allows users to directly copy the trades of high-performance traders.

Whilst this feature is useful to some newer traders, it must be noted that it has a higher minimum deposit of $200 compared to the ECN and Standard accounts. We were a little disappointed in this as it will price out some beginners who were wanting to learn from seasoned investors.

One of the more unique extra tools offered by Opofinance is its connection to Metaverse with its virtual office. I thought this was an interesting addition, as it shows a dedication to customer service as well as progressive technology. Beginners may find the feature fun to use while allowing them to collaborate and learn remotely in a more interactive way.

Opofinance Metaverse

As with most brokers, Opofinance offers some educational and analytical resources to help traders make the most of their investing experience.

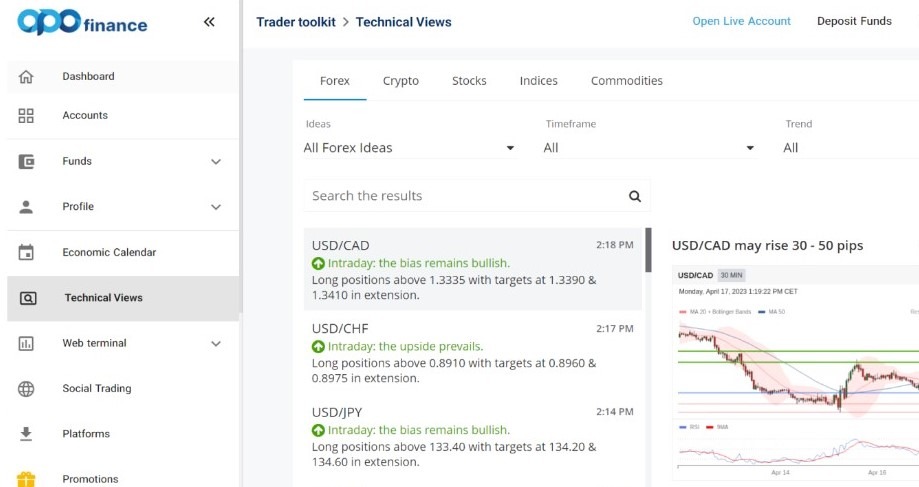

There is an excellent technical analysis tool that includes clear charts, trend lines and alternative scenarios and can easily be accessed on trader accounts. They also provide a newsletter with daily updates and overviews and an economic calendar with real-time data for 38 countries, as well as historical and forecast events.

While we liked that some educational resources were available, we were disappointed with the lack of variety. Competitors such as CMC Markets provide a greater range of resources as well as video and webinar tutorials which were missing from this broker.

Opofinance Technical Views

Company Details & History

Opofinance (rebranded from OpoForex) was set up in 2021 and is part of the Opo Group LTD. It has three offices globally and is based offshore in Seychelles. Unfortunately, there is not a lot of information available about the company’s history or team.

The broker has 70,000+ active clients and offers traders access to a variety of instruments including forex, commodities and cryptocurrencies.

The broker is registered in Seychelles with registration number 8430865-1.

Customer Service

We were pleased to find that customer service is available 24/7 through a variety of methods. Opofinance’s customer support team can be contacted via email using support@opofinance.com or KYC@opofinance.com.

Traders can also call between 8:00 am and 5:00 pm (GMT +3) on +44 7312 763 042 or send a telegram to @opofinancesupport. There is also a message board on the broker’s website and a live chat button in the right corner of the homepage.

The company address is CT House, Office 9D, Providence, Mahe Seychelles. Help is available in over 8 languages including English, Persian and Arabic.

Overall, I found the variety and accessibility of the customer service team reassuring and competes well amongst competitors. There is a frequently asked questions page on the website, although I did not find it to be particularly extensive.

Trading Hours

Trading hours vary depending on the instrument you want to trade. For example, forex trading is open from 12:00 am on Mondays to 11:59 pm on Fridays (GMT+3). The broker also includes a full list of product trading hours on the platform.

Should You Trade With Opofinance?

We found Opofinance to have some excellent features such as a wide selection of available assets, high leverage and a range of account types to suit different traders. The MT4 and MT5 platforms are reliable and easy to use and a wide variety of payment options are supported.

While we were disappointed with the small range of educational support and the lack of GBP account currency, overall, we found this to be a good broker. However, UK traders should bear in mind the lack of FCA regulation.

FAQ

Is Opofinace Safe And Legit?

Opofinance has regulatory oversight from the FSA Seychelles. This is not a top-tier regulator like the FCA so UK traders should consider the safety concerns before investing.

However, the broker is a member of The Financial Commission which is based in Hong Kong and London and protects trader funds which can give traders some confidence in the security of their money.

Is Opofinance Good For Beginners?

Opofinance is suitable for beginners with relatively low minimum deposits and a free demo account. However, beginners should be aware that fewer educational resources are offered by this broker compared to competitors and to take part in copy trading, the minimum deposit doubles to $200.

Is Opofinance Halal?

Is Opofinance Good For UK Investors?

Opofinance offers UK traders a good variety of instruments with tight spreads and high leverage. Multiple payment options are also available making deposits and withdrawals easy and quick for UK investors.

However, the broker is not regulated by the UK’s FCA with makes it less secure than some competitors and the only account currency accepted is USD, meaning currency conversion fees may apply.

Does Opofinance Offer High Leverage?

Yes, Opofinance offers a variety of leverage rates depending on the instrument you chose but the maximum leverage is 1:2000 which is much higher than the UK and EU cap of 1:30.

However, traders should be aware of the risks of trading with high leverage as it can amplify losses drastically.

Article Sources

Opofinance FSA Seychelles License

Opofinance Financial Commission Membership

Top 3 Opofinance Alternatives

These brokers are the most similar to Opofinance:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Opofinance Feature Comparison

| Opofinance | FP Markets | IC Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 1.8 | 4 | 4.8 | 4.8 |

| Markets | Forex, commodities, cryptocurrencies, stocks, indices | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $100 | $40 | $200 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FINACOM | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (UK), 1:500 (Global) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Opofinance Review |

FP Markets Review |

IC Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| Opofinance | FP Markets | IC Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Opofinance vs Other Brokers

Compare Opofinance with any other broker by selecting the other broker below.

Popular Opofinance comparisons: