OKX Review 2025

|

|

OKX is #3 in our rankings of crypto brokers. |

| Top 3 alternatives to OKX |

| OKX Facts & Figures |

|---|

OKX is a respected cryptocurrency firm, established in 2017, that offers a large suite of products, from mining pools to NFTs. Traders can access over 400 crypto tokens via OTC trading and derivatives. With an excellent web platform, developer tools and dynamic charts, OKX is a popular choice for technical traders. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Spot, futures, perpetual swaps, options |

| Demo Account | Yes |

| Min. Deposit | 10 USDT |

| Mobile Apps | Android & iOS |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | Variable |

| Regulated By | VARA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Islamic Account | No |

| Cryptocurrency | OKX continues to offer a superb selection of 400+ tokens including Bitcoin and Ripple. You can buy and sell tokens or trade cryptos on margin via derivatives, including perpetual swaps, options and futures. OKX stands out for its low fees, extensive range of tokens and speedy crypto transactions. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | Yes |

| Crypto Mining | Yes |

| Crypto Staking | No |

| Auto Market Maker | No |

OKX (formerly OKEx) is a global crypto exchange providing OTC trading, yield farming and DeFi services. This 2025 broker review will explore more about what OKX has to offer to UK investors, including its trading platform, fees, mobile app and deposit/withdrawal options.

Company History & Overview

Founded in 2017, OKX is a cryptocurrency exchange (registered location and headquarters in Seychelles) with a number of users now in the millions. The firm operates in more than 100 countries. Its CEO is Jay Hao and its owner is Ok Group, which also owns the cryptocurrency exchange Okcoin. The company is now one of the largest crypto exchanges in the world, though, as a result of more robust cryptocurrency regulations, UK retail customers are unable to access derivative-related services.

However, the services offered by this exchange extend far beyond spot and derivatives trading. OKX Earn allows clients to receive additional money by funding online crypto-margin loans at a provided interest rate. Investors can also get earning tokens online from mining pools and staking on the Web3 Yield platform, as well as from decentralised exchanges and lending platforms. Other services available include dual investment, crypto-collateralised loans, bridging crypto between two blockchains, DApps and the NFT Marketplace.

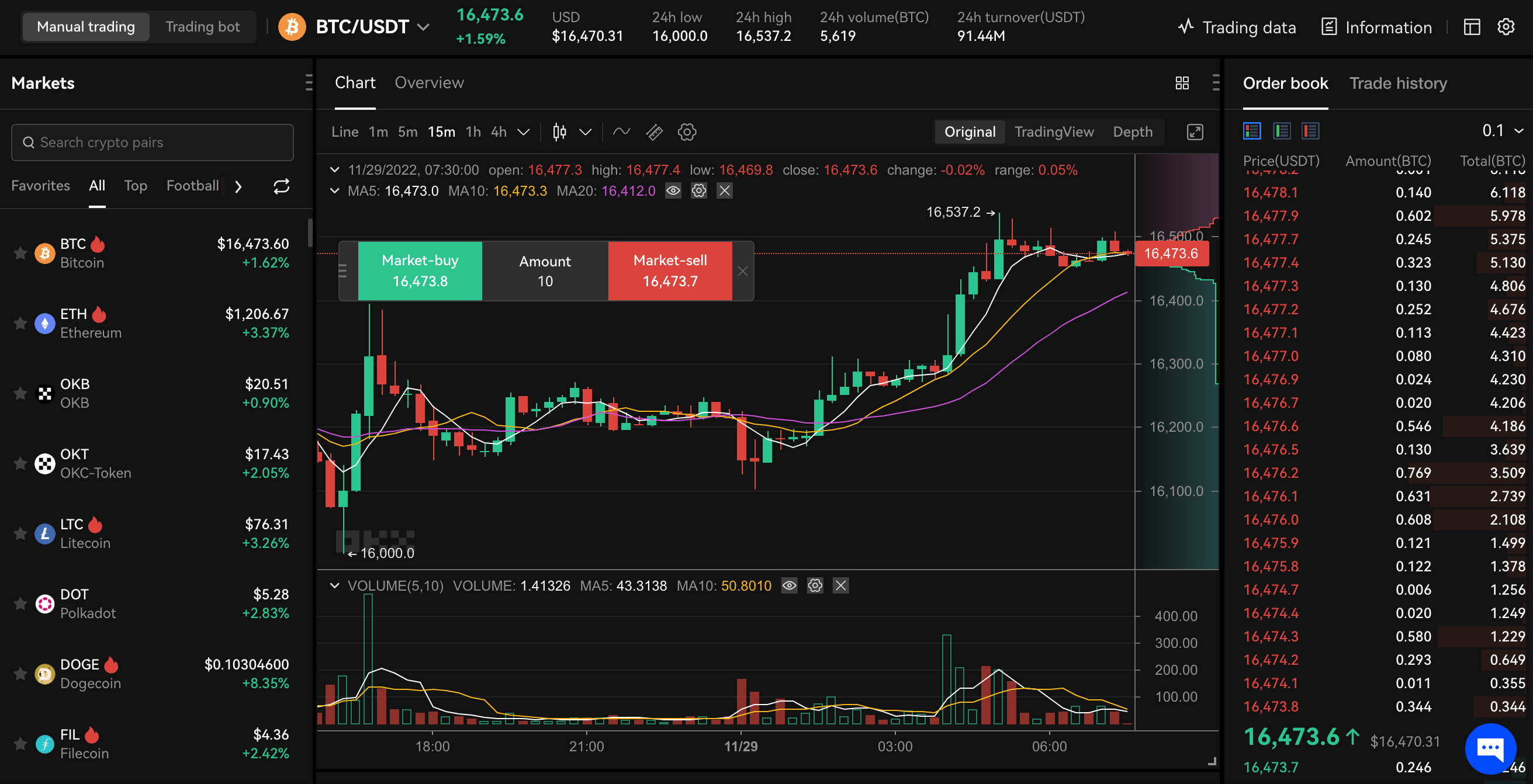

Trading Platform

A proprietary browser-based trading platform is available through OKX. Our experts found it to be intuitive whilst also providing more advanced technical analysis tools to better interpret coin price movement. The following key features are available:

- Drawing tools

- Order book data

- TradingView chart option

- 15 timeframes, from one minute to three months

- Multiple indicators, including moving averages and Bollinger bands

OKX Trading Platform

In addition, when we used the platform, we noticed that investors can use trading bots to automate their strategies and take advantage of arbitrage opportunities.

Markets

OKX’s crypto offering is split into the spot, margin and derivatives markets (although note that derivatives are not available for UK retail traders). Derivatives can be further broken down into options, bi-quarterly futures and perpetual swaps, which are similar to futures but without an expiration date.

There are hundreds of tokens and trading pairs available and the list of cryptocurrencies constantly changes as system updates bring new listings. Cryptos available to invest in include popular assets like Bitcoin (BTC) and Ethereum (ETH), as well as more obscure ones like MXC and NAS. Over 85 cryptocurrencies can be purchased with GBP.

Fees

Around 350 cryptocurrencies and stablecoins, from Bitcoin to Dogecoin, can be converted at any time for free on OKX. The crypto converter is separate from trading and also provides a mechanism for investors to avoid slippage.

Fees for cryptocurrency trading depend on the tier at which you trade. Those with more assets and higher volumes will generally have access to lower investment fees. For the USDT and crypto pairs spot markets, a user with less than 500 OKB and less than $100,000 in assets or a 30-day trading volume of less than $10,000,000, will incur a maker fee of 0.08% and a taker fee of 0.1%. Taker fees are usually larger than maker fees as they involve the removal of liquidity from the market.

Investors holding the OKB utility token can get 40% off trading fees on OKX but keep an eye on the price forecast and prediction for this asset to ensure it maintains its value. There are also VIP tiers that provide access to even lower fees but clients must have at least $100,000 in assets or a minimum $10,000,000 30-day trading volume. The company has looked to reduce the cost of Bitcoin transfers by introducing the BTC Lightning Network.

Fees vary for other markets. Those holding less than 500 OKB and who have assets under $100,000 or a 30-day trading volume of less than $5,000,000 will incur option fees of 0.02% (maker fee) and 0.03% (taker fee).

Perpetual swaps incur a funding fee at designated times on OKX to keep the price of the perpetual market anchored to the spot index price. Depending on the rate, this can be either a credit or debit. Investors can look at historical funding rates to get an indication of the amount.

Borrowing rates depend on your trading tier and the asset.

Leverage

Margin trading is possible with OKX. Leverage is available at 1:10 or 1:20 under full liquidation mode and partial liquidation mode has leverage up to 1:100, which is very high for the crypto market.

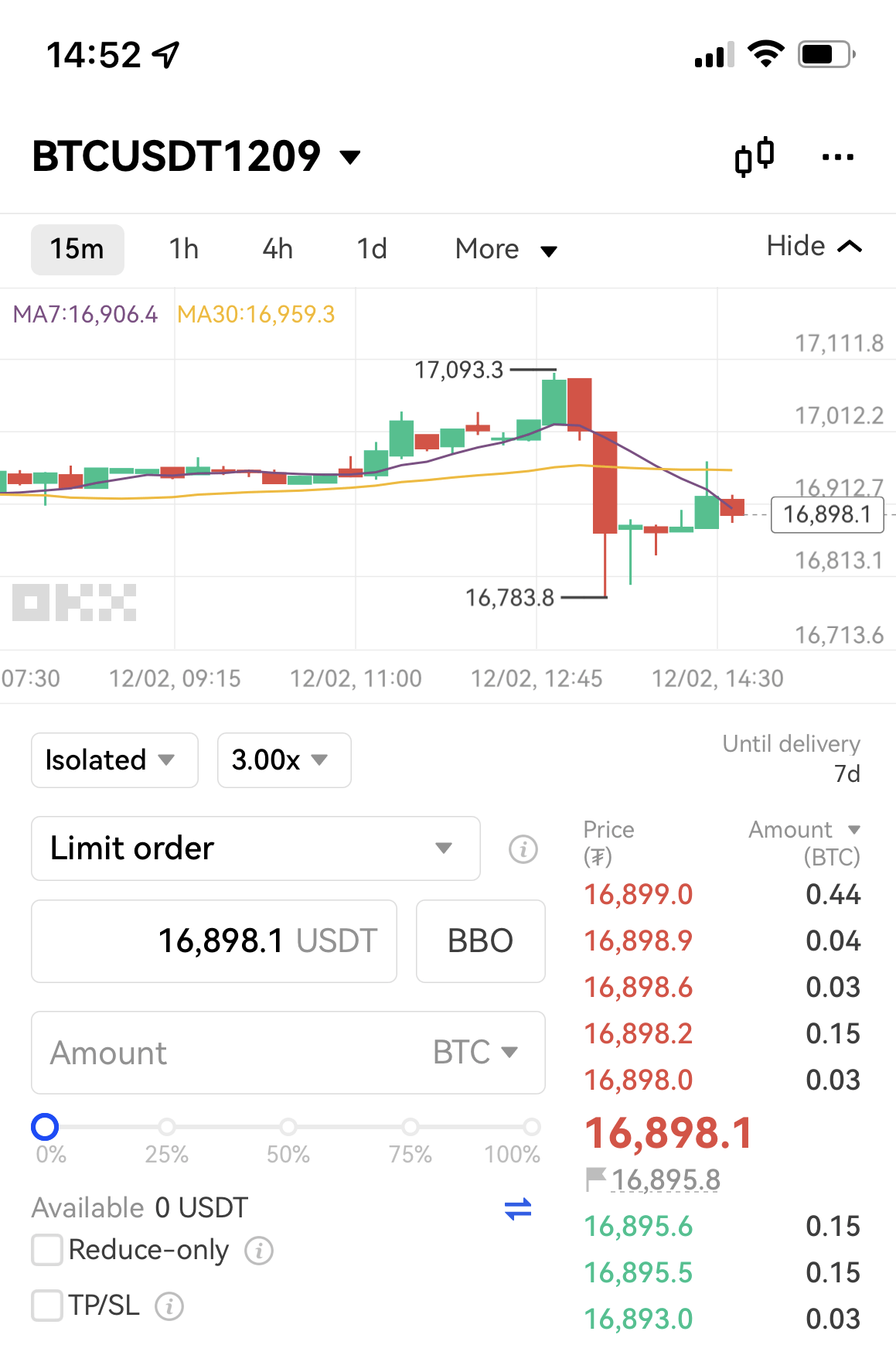

Mobile Trading

The OKX mobile app is available for download on iOS and Android (APK) devices. Like the web platform, the mobile app is easy to use and contains many of the same features, including charts and order book data. Investors can also manage their accounts from the exchange’s app by depositing or purchasing crypto. Face and touch ID systems can be used to login.

OKX Mobile App

Payment Methods

Cryptocurrency on OKX can be purchased using fiat currency deposited from an external wallet or bought through P2P trading. Crypto can be purchased in over 90 fiat currencies, including GBP, EUR and USD. In addition, it can be bought through a third-party payment service such as Mercuryo, Banxa or MoonPay (the type of crypto being bought will dictate which payment options are available).

Deposits

When funding your OKX account by purchasing cryptocurrency using fiat money, the following payment methods are available (note that PayPal is only accepted on P2P trading):

- Visa

- Apple Pay

- Mastercard

- Bank transfer

Fees may be applicable for these purchases. Note that card deposits made in a currency other than USD may also incur bank currency conversion charges.

There are no fees charged by OKX for deposits made in crypto, such as Bitcoin from a wallet, although minimum deposits may apply. Ensure you have the correct wallet address.

It usually takes 30 minutes to process a payment for crypto made through a fiat provider. When transferring crypto from a third-party exchange, the speed often depends on the network and blockchain traffic.

Withdrawals

Clients can either make an internal or on-chain withdrawal. Minimum withdrawals depend on the token. For ‘regular’ users of OKX (i.e non-VIP customers), the 24-hour withdrawal limit is 500 BTC. Higher limits are available on VIP accounts.

Withdrawal fees (gas fees) are usually charged, although these are paid to miners rather than the exchange. The fee will be shown before you confirm the withdrawal. Withdrawal fees can change; for example, in 2020, an announcement confirmed that multiple cryptos, including BTC, ETH and USDT-ERC20 were to have their fees lowered. Note that higher withdrawal fees may mean faster processing times as miners are incentivised to prioritise your transfer request. To withdraw fiat money to your bank account, use P2P trading to convert crypto into a fiat currency.

Demo Account

A demo account is available on OKX. This is useful for beginners to familiarise themselves with the platform without risking their own funds. More experienced clients may wish to use the demo account to practice a new investing strategy.

Bonuses & Promotions

There is currently an APY bonus offer on savings where clients can receive an increased fixed yield on their uninvested funds. For USDT, a fixed APY rate of 10% is available up to 2,000 USDT. Other promotions on OKX include a free football cup NFTs giveaway. Traders may also receive new tokens through an airdrop.

Regulation

Although OKX recently obtained a provisional license from the Virtual Assets Regulatory Authority (VARA) in Dubai, there is generally little regulatory oversight of this exchange. Although that has previously been the case for the crypto industry as a whole, regulators are beginning to take a tougher stance, which is why crypto derivatives trading is not available to UK traders.

Account Types

OKX now provides a Unified Account that allows traders to invest in the spot and derivatives markets without having to transfer funds between different accounts. The different Unified Account modes are listed below.

Simple

- Default option

- No margin available

- Trade the spot market and options (long)

Single-Currency Margin

- Required to take a quiz before activating this mode

- Trade the spot, margin, options, perpetual and futures markets

- With single-currency cross margin, the margin is shared between financial products settled in the same currency (i.e the profits and losses can offset each other)

Multi-Currency Margin

- Account equity must be at least $50,000

- Required to take a quiz before activating this mode

- Trade the spot, margin, options, perpetual and futures markets

- Multi-currency cross mode allows margin to be shared between derivatives

Portfolio Margin

- Account equity must be at least $100,000

- Trade the spot, margin, options, perpetual and futures markets

- Portfolio margin cross mode allows traders to share margin between derivatives and the margin for derivatives under the same index can offset each other

How To Trade On OKX

1) Register For An Account

Users can register for a new OKX account through the mobile app or the webpage using the ‘Sign Up’ button. The initial registration process is very fast with only an email/phone number and password required to join. These will be the details required to sign in to OKX later. Users will need to verify their email or phone number. Many account activities are restricted until identity verification has been completed as part of the KYC process. Also, note that there are different verification levels – for example, Level 2 KYC will lead to higher withdrawal limits.

2) Deposit Funds

Traders can either deposit funds by purchasing crypto (using a bank card, Apple Pay, bank transfer, payment provider or P2P trading) or deposit directly from an external wallet or exchange. Beginners that have never invested in crypto before will need to purchase it. Our review found that others may find it cheaper to deposit directly from their own wallet, as OKX does not charge fees for this.

3) Choose Your Account Mode

Under the OKX Unified Account, there are multiple account modes: Simple, Single-Currency Margin, Multi-Currency Margin and Portfolio Margin. The accounts provide different access to assets and dictate how margin is ‘shared’ across your positions. The Simple mode is the default but investors may be able to change to a different mode if they meet the requirements.

4) Start Investing

As the derivatives market is restricted for UK retail traders, most investors will focus on the spot market. There is a wide range of cryptocurrencies and altcoins to choose from on OKX. Although all cryptos carry a certain level of risk, the more obscure altcoins can be more volatile. Traders should approach these with caution, particularly if using leverage. Make use of the technical analysis and charting tools on the trading platform to better understand any trends or patterns for a particular asset. When opening a position, advanced order types are available, including regular stop orders, trailing stops, triggers orders and advanced limit orders to ensure you sell the crypto at the right time.

Benefits Of OKX

- Low fees

- P2P trading

- VARA licence

- Intuitive platform

- High leverage rates

- Good range of assets

- 24/7 trading experience

- Earn on uninvested cryptocurrency

Drawbacks Of OKX

- No phone number

- Registered offshore

- Limited education section

- No UK derivatives trading

Additional Features

The OKX Rankings are useful for traders unsure of which crypto to invest in. These provide multiple lists of cryptos based on turnover, market cap, changes in price and a list of new entries into the market.

Although the education section is limited, there are helpful articles on various topics, including API investing and dollar-cost averaging. There is also a blockchain glossary dealing with questions such as ‘What is a private key?’. However, while using the website, we were disappointed to not be able to locate market news or a blog with an analysis of the crypto market. That said, users may find some news insights on OKX’s social media pages.

More experienced traders may want to build their own investment bot, in addition to copying pre-built ones. Those with at least $100,000 in assets can also engage in block trading to reduce price slippage when making high-volume trades.

Trading Hours

There are no restrictions on trading hours at OKX. The crypto market is 24/7, meaning investors can trade overnight and at weekends.

Customer Support

The customer support options at OKX are fairly limited. There is a live chat function, which could be useful for various queries from Jumpstart mining rules to questions about staking pools. Users can also connect with the company on social media, including Facebook and Twitter.

The support centre includes FAQs to help traders with more standard enquiries. These cover themes like how to close or delete your account, how to use the platform, how to trade and how to deposit/withdraw. OKX Status informs investors of system maintenance and upgrades to keep disruption to a minimum.

Security

OKX implements multiple security measures to protect user data and funds, including withdrawal passwords, two-factor authentication (2FA) using Google Authenticator and anti-phishing codes. The company also stores a portion of funds in cold wallet storage to increase its protection from malicious attacks and hacks. Semi-offline wallet storage is used in addition to this to combine convenience with security.

Proof of reserves is publicly available on the OKX website, with user funds backed 1:1 by real assets. The asset risk reserve fund stands at over $700 million.

In 2020, customers’ funds at OKEx were frozen and people were prevented from withdrawing their equity for nearly a week after Chinese police launched an investigation linked to the company.

OKX Verdict

OKX is a global crypto exchange that is now high up in the rankings of the world’s largest. It provides users with an enriching investing experience through a well-equipped trading platform and an excellent range of tokens and trading pairs. There is always a risk with investing in cryptocurrency but OKX appears a legitimate exchange with a large trading volume and lots of returning customers.

FAQ

Is OKX A Wallet?

OKX is an exchange on which traders can invest in crypto tokens and currency pairs. The platform supports the Web3 wallet, which allows users to manage digital assets across multiple networks.

Is OKX Real Or Fake?

OKX seems a legit broker with clients around the world, although it is registered offshore and mostly unregulated.

Is OKX A Good & Safe Exchange?

OKX provides access to hundreds of crypto tokens and trading pairs. There is always a risk when investing in crypto that the exchange could be hacked and funds lost. However, the firm has implemented various security measures to mitigate this risk.

Can I Withdraw Funds In Fiat Currency On OKX?

Although it is easier to withdraw crypto, one way that traders can withdraw fiat money is to convert their crypto back into fiat using the P2P service.

Can I Transfer Crypto From OKX To My Personal Wallet?

Yes. Cryptocurrency can be transferred to your own wallet, whether that is a web, hardware or mobile wallet.

Top 3 OKX Alternatives

These brokers are the most similar to OKX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- KuCoin - Kucoin is a crypto exchange that offers trading on 1000+ tokens as well as leveraged trading opportunities via futures and perpetual swaps. This exchange has a slick trading platform that supports robots, allowing traders to implement automated strategies. Other attractive features include a demo account, flexible funding methods and DeFi features like staking and mining.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

OKX Feature Comparison

| OKX | Swissquote | KuCoin | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 4.1 | 4 | 2.6 | 4.3 |

| Markets | Spot, futures, perpetual swaps, options | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | ETFs, Cryptos, Futures | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | 10 USDT | $1,000 | $0 | $0 |

| Minimum Trade | Variable | 0.01 Lots | 0.0001 Lots | $100 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | VARA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | - | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | - | MT4, MT5 | - | - |

| Leverage | - | 1:30 | - | 1:50 |

| Visit | ||||

| Review | OKX Review |

Swissquote Review |

KuCoin Review |

Interactive Brokers Review |

Trading Instruments Comparison

| OKX | Swissquote | KuCoin | Interactive Brokers | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | No | Yes | No | Yes |

| Stocks | No | Yes | No | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | No | Yes | No | Yes |

| Oil | No | Yes | No | No |

| Gold | No | Yes | No | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | No |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

OKX vs Other Brokers

Compare OKX with any other broker by selecting the other broker below.

Popular OKX comparisons: