Nutmeg Review 2025

|

|

Nutmeg is #115 in our rankings of UK brokers. |

| Top 3 alternatives to Nutmeg |

| Nutmeg Facts & Figures |

|---|

Nutmeg is a UK-based investment platform offering ISAs, SIPPs and general investment accounts. With four investment styles and access to over 30 portfolios, investors can receive tailored investment support with transparent pricing. The FCA-regulated firm is the most popular robo-advisor in the UK. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | ETFs |

| Demo Account | No |

| Min. Deposit | £100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | £100 |

| Regulated By | FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Robo-Advisor |

| Islamic Account | No |

| Stocks | With access to over 1,800 ETFs, Nutmeg investors can access globally diversified portfolios with varying risk levels. You can also access socially responsible investments, covering criteria such as climate change or board diversity, which aren't available at some alternatives. |

Nutmeg is a popular broker with UK investors due to its wide range of accounts, FCA regulation and transparent approach to fees. In this Nutmeg review, we will cover the investment options available, the broker’s robo-advisor facilities, trading fees, security and more. Our experts also look at how Nutmeg stacks up against popular UK alternatives.

Our Verdict On Nutmeg

Nutmeg is good for investors that want to avoid researching the markets and having to pick their own products. With 4 investing styles and 5 to 10 risk levels for each solution, Nutmeg’s 30 total portfolio options also stack up well against alternatives.

However, with annual fees of over 1% for all of its actively managed portfolios, we found that Nutmeg’s charges are notably higher than alternatives.

Investors must also have over £100,000 in their Nutmeg account to gain a fee discount while competitors like Moneyfarm offer discounts to investors with a more reasonable £20,000+ in assets.

Finally, our team noted that the £500 minimum investment is significantly higher than the £0 minimum deposit at platforms like Interactive Investor.

Overall, Nutmeg is not the best robo-advisor and passive investing platform in the UK.

What Is Nutmeg?

Nutmeg is a UK-based online investment brand that offers several UK-focused investment, savings and retirement accounts.

Co-founded in 2011 by Nick Hungerford and William Todd, the firm was acquired by the major US bank JP Morgan in 2021.

Nutmeg boasts over 200,000 clients which it serves via a web platform and mobile app. Clients can choose from a range of Nutmeg ETF portfolios, depending on their preference for active or passive management, risk tolerance and investing goals.

Accounts

Nutmeg offers five types of accounts to investors, most with UK-specific tax advantages.

Stocks & Shares ISA

The stocks and shares ISA is a UK-specific trading account that shields investment profits from capital gains tax.

Some things to consider: there is a £20,000 limit on deposits across all ISA accounts within a single tax year and investors cannot open more than one of each type of ISA (like a stocks and shares ISA) within a tax year.

Stocks and shares ISAs are particularly popular with longer-term investors and the offering from Nutmeg is competitive.

General Investment Account

Nutmeg also offers a general investment account to its clients. This account has no tax benefits and dividends, while interest and profits on asset sales may be subject to capital gains tax.

However, there is no yearly limit on how much can be deposited into a general investment account, nor is there any restriction on how many accounts can be opened in a tax year.

A general investment account can be attractive to those who have exceeded or plan to exceed their ISA allowance. They also provide flexibility for those who want to take a more active role in choosing their investments.

Lifetime ISA (LISA)

With a Nutmeg Lifetime ISA (LISA), clients can invest up to £4,000 per tax year account and receive a 25% government cash top-up on deposits. These funds can then be used towards a first home or retirement, with the invested funds freely becoming accessible when the holder reaches 60.

Like the stocks and shares ISA, deposits to a LISA count towards the £20,000 per tax year total ISA deposit limit. Early withdrawals are subject to a 25% charge, which is often greater than the government bonus.

LISA holders are also limited to only one account, though investors can switch between providers.

Self-Invested Personal Pension (SIPP)

With most of its services aimed at long-term investing, we were not surprised to discover that Nutmeg offered a Self-Invested Personal Pension (SIPP).

Clients can either invest in this pension alongside a workplace or private pension or transfer an existing scheme into Nutmeg for enhanced control and on-demand monitoring.

We believe that pensions need to be more transparent and easier to monitor, so we were impressed with the detailed and transparent fund performance and fee structure data on the site.

Junior ISA

Nutmeg offers a Junior ISA account for parents looking to invest in their child’s name.

Clients can open a Junior ISA until the beneficiary turns 16 with as little as £100. The account unlocks when the beneficiary turns 18 – the parent can make no withdrawals at any point.

Verdict

Versatility

Despite its UK-specific advantages, we were disappointed that Nutmeg accounts are only suitable for long-term investing rather than short-term trading.

This is because clients cannot actively manage their investments and instead must rely on pre-set or managed portfolios – more on this later.

Also, funds in accounts such as the Pension and Lifetime ISA are only available for withdrawal once specific requirements are met, or they will be subject to substantial early withdrawal penalties.

Minimum Investments

We also noted that Nutmeg accounts could have significant minimum investment requirements – a £500 minimum deposit is required to open a stocks and shares ISA, general savings account or LISA.

When we compared Nutmeg’s figures vs competitors, we found that other brokers have far lower minimum investment requirements, with Interactive Investor clients able to open an ISA or investment account with no minimum investment.

Portfolio Options

Nutmeg clients cannot directly control their investments. Instead, investors can choose one of four portfolio management options and a risk level from one to five or one to ten, depending on the account.

Investments are either actively managed by Nutmeg experts or the JP Morgan Smart Alpha robo advisor, with products chosen from over 1,800 ETFs.

These ETFs track a wide selection of global markets, including different sectors, equities, indices, commodities, government bonds and corporate bonds.

Here is our breakdown of the different portfolio options, including fees, fund performance and risk options.

Fully Managed

The Nutmeg fully managed portfolio is controlled by a team of investment experts, with regular adjustments and rebalancing made based on market events and conditions.

Risk & Return

Investors can choose from ten risk levels, with lower risk levels distributing funds heavily in bonds and currency markets and higher risk levels investing over 80% in developed market equities.

The lowest risk level (level one) has a 1.2% total return minus fees over ten years. However, this fund’s performance is pretty poor, and investors may often be better off with a high-interest cash ISA or savings account.

A medium risk level (level five) has a far more respectable 34.4% total return minus fees over ten years. However, Nutmeg’s own figures show this figure to be behind the 38.9% return offered by alternative brokers.

The highest risk level (level ten) has produced a lucrative 100.4% total return minus fees over the last ten years, working out as a 7.2% annualised rate of return.

Fees

One of our favourite things about Nutmeg is the transparency of its fee structures. The broker provides a yearly representative charge of 1% for a fully managed portfolio.

The most significant percentage of this figure consists of a 0.75% management fee for amounts up to £100,000. This fee is reduced to 0.35% on invested capital over £100,000.

Nutmeg provides a figure of 0.21% for its fund charge, based on an asset-weighted 3-year annualised investment fund cost. There is also a 0.04% market spread charge, covering the buying and selling of ETFs.

Smart Alpha

As a JP Morgan brand, Nutmeg draws upon the investment expertise of its parent company to offer its Smart Alpha portfolio.

Launched in November 2020, this solution combines passive investing with actively managed JP Morgan ETFs, such as the Global Research Enhanced Index Equity ESG ETF.

Risk & Return

Nutmeg Smart Alpha investors can choose from five risk levels, though all levels invest substantially in the actively managed Global Research Enhanced Index Equity ESG. Unfortunately, as the portfolio was launched in late 2020, we have limited fund performance data to draw upon.

The lowest risk level (level one) has had a net return of approximately -7% since its launch. This is problematic as investors that choose supposedly low-risk investments won’t want to lose large amounts of money.

A medium risk level (level three) has had a better net return of around 5% since its launch.

The highest risk level (level five) boasted a net return of close to 18% in less than three years, working out as a 7.2% annualised rate of return – the same as the level ten risk fully managed portfolio.

Fees

For a Smart Alpha portfolio, the broker provides a yearly representative charge of 1.15% – the highest fee of any of its portfolio options.

There is an 0.75% management fee for amounts up to £100,000. This fee is reduced to 0.35% on invested capital over £100,000.

The average fund charge is higher than other portfolios at 0.36%, while the 0.04% market spread fee remains the same.

Socially Responsible

The socially responsible portfolio is aimed at investors that want to grow their capital while supporting ethical businesses. This portfolio invests in ETFs that require high environmental, social and governance (ESG) standards to be included.

Risk & Return

The Nutmeg socially responsible investment portfolio is divided into ten risk levels. We have five years’ worth of data to track the fund performance of each risk level.

As with the Smart Alpha portfolio, the socially responsible portfolio’s lowest risk level (level one) has lost money since its launch, posting a net return of -1.8%.

There is better news for the medium risk option (level five), where the fund has made 12.3% post fees, which is 2.7% per year.

But the best annual fund performance we’ve seen so far is from the high-risk portfolio (level ten), with a net gain of 39.7% – an impressive 7.9% yearly performance.

Fees

The Nutmeg socially responsible portfolio has a representative annual fee of 1.1%, placing it between the Smart Alpha and fully managed charges.

This consists of a 0.75% flat fee on amounts up to £100,000 (then a 0.35% fee for additional capital over £100,000), a 0.31% fund cost and a 0.04% market spread.

Fixed Allocation

The final portfolio available to Nutmeg clients is the fixed allocation fund. This investment type benefits from significantly lower fees, but only features passively managed funds and is only adjusted once per year.

Risk & Return

There are four risk levels available with a fixed allocation portfolio. As with the socially responsible portfolio, we have five years of performance data to track its returns.

The low-risk option (level one) netted 2.0% over five years. While still outclassed by many savings accounts or Cash ISAs, we were happy to see that with this portfolio type, the low-risk option did not lose investors money.

The medium-risk option (level three) gained 20.2% net profit over five years – a relatively reasonable return of 3% per year.

As with many of these Nutmeg portfolios, the high-risk option delivered the best returns, with 50.1% netted over five years – a 6.8% annual return.

Fees

The advantage of choosing the Nutmeg fixed allocation fund is a considerable fee discount compared to the other portfolios.

The representative charge was just 0.69%, with a 0.45% flat charge up to £100,000 (and 0.25% on amounts over £100,000), a 0.20% fund cost and a 0.04% market spread fee.

Verdict

Risk Levels

For every Nutmeg portfolio we reviewed, the higher the risk rating, the higher the payout. While past performance is never a predictor of future performance, there has been surprisingly little downside to picking the riskier options (so far).

We were surprised to discover that in some cases, supposedly lower-risk portfolios had lost clients up to 7.1% of their capital. As a result, investors may want to consider whether they wish to allow the “investment experts” that oversee these portfolios to have complete control over their capital.

Autonomy

When choosing between a broker like Nutmeg or Interactive Investor (ii), investors should consider how much autonomy they want over their investments.

Those that prefer greater autonomy may want to opt for a more hands-on trading experience with brokers like Interactive Investor, where clients can create their own portfolio of shares, ETFs and mutual funds.

UK residents that prefer having experts manage their investments may be better suited to Nutmeg’s asset management options.

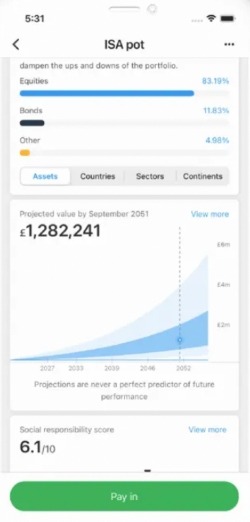

Platform & App

As Nutmeg controls all of its clients’ investments, only a basic web-based trading platform is required.

While using Nutmeg, we found that the platform is capable and versatile, allowing clients to view and make changes to their accounts from most devices.

Clients can also login to the broker’s mobile app on Android and iOS devices to add or withdraw funds, monitor their investments or alter portfolio risk levels.

Funding Options

Our experts found that Nutmeg offers a solid range of payment options when adding or withdrawing funds from an account.

Investors can transfer funds fee-free from UK bank accounts or set up regular direct debit payments for automatic periodic investments.

Other options include debit card payments, Google Pay, Apple Pay and even transferring existing ISA balances into a Nutmeg LISA or stocks and shares ISA.

We were pleased to see that bank transfers are usually credited within one working day, while debit cards and mobile payment options may be available sooner. However, it is worth remembering that funds are only invested by Nutmeg on a regular fortnightly schedule.

UK Regulation

One of the best qualities of Nutmeg is its robust security and regulation. The JP Morgan-owned brand is regulated in the UK by the FCA, which is renowned for its stringent protection measures.

Investors benefit from client fund segregation through tier-one global banks and the Financial Services Compensation Scheme (FSCS), which can compensate clients up to £85,000 per person per firm if the firm becomes insolvent or ceases trading.

In addition, Nutmeg employs login protection through 2-factor authentication, which adds an extra layer of security to client accounts.

When comparing Nutmeg vs any of the biggest global brokers, including Vanguard, its security measures are equal to or better than any online investment service.

Education & Guidance

Despite taking care of its clients’ investments, Nutmeg prioritises keeping clients informed and educated about investing. The website provides a comprehensive guide to investing through its “Nutmegonomics” section.

Here, I can find articles on Nutmeg’s account types, such as the LISA and stocks and shares ISA, information on the different types of pension schemes available in the UK and resources regarding the principles of investing.

Guidance & Advice

We liked that Nutmeg offers a financial guidance service where potential clients can speak directly with an expert who will recommend products based on their goals, resources and risk tolerance.

The company provides a formal financial planning and advice service for investors that require extra assistance. The broker conducts investment reviews and helps structure outgoings and general finances for a fee of £575.

This additional service gives Nutmeg an advantage vs competitors such as Moneyfarm, which do not offer a comprehensive advice package.

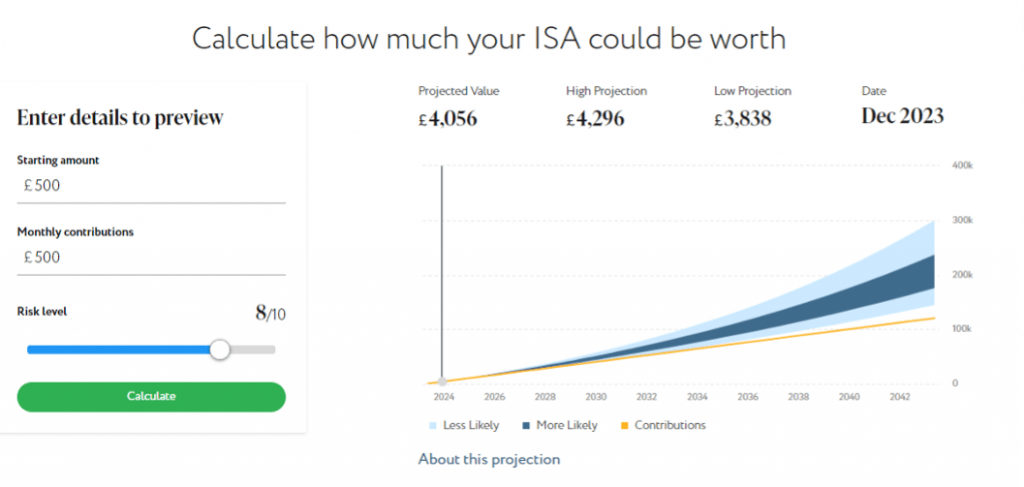

Investing Tools

I like that Nutmeg offers a range of helpful investing calculators to clients and non-clients alike.

These include a pension calculator, capital gains tax calculator, self-employed tax calculator and ISA performance calculator. Importantly, I found them all easy to use, though it’s worth pointing out that competitors also offer these tools for free.

Customer Support

Our team was impressed with the customer service available. Nutmeg provides several avenues to contact its award-winning customer support team.

- Email – support@nutmeg.com

- UK phone number – 020 3598 1515

- Website live chat

The team can provide support from 9 am until 5:30 pm GMT/GMT+1 from Monday to Thursday and from 9 am until 4:30 pm GMT/GMT+1 on Friday.

Registered clients can also access the “Nutmail” support system for queries and guidance specific to their personal accounts.

The broker also offers a comprehensive support section with FAQs and practical guides on all of its accounts for on-demand general help.

Should You Invest With Nutmeg?

Our Nutmeg review found many positive aspects, including transparent fees, UK-specific accounts and excellent security and regulatory oversight. In addition, our experts believe that for relatively new investors, the platform and app are easy to use.

However, the lack of autonomy and high account fees will deter many prospective clients. Furthermore, we found some returns lower than a savings account. The high initial investment of £500 is also larger than popular alternatives.

FAQ

Is Nutmeg A Good Choice For UK Investors?

Nutmeg is a well-regulated broker that offers 30 fully-managed portfolio options and several UK tax-advantaged investing accounts. But, on the other hand, fees are high and low-risk portfolio returns have been relatively poor in recent years. The steep minimum investment may also deter new traders.

How Does Nutmeg Secure Its Login?

In addition to password protection, Nutmeg employs 2-factor authentication to secure its users’ accounts. Overall, we are comfortable that the broker offers a secure online investing environment.

Who Owns Nutmeg?

In 2021, Nutmeg was acquired by JP Morgan, whose Smart Alpha portfolio makes up one of the broker’s four portfolio options.

What Account Types Does Nutmeg Offer?

Nutmeg offers UK investors five accounts – the stocks and shares ISA, general investment account, Lifetime ISA, SIPP and Junior ISA. This is in line with alternatives and ultimately makes the brand a better pick for longer-term investors.

How Can I Contact Nutmeg Support?

For investors with queries such as how to withdraw funds or change their risk level, Nutmeg has a helpful FAQ section as well as phone support, email address and live chat available during UK working hours.

Article Sources

Top 3 Nutmeg Alternatives

These brokers are the most similar to Nutmeg:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Nutmeg Feature Comparison

| Nutmeg | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| Rating | 3.3 | 4.3 | 4.7 | 4 |

| Markets | ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | £100 | $0 | $0 | $1,000 |

| Minimum Trade | £100 | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | - | MT4 | MT4, MT5 |

| Leverage | - | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Nutmeg Review |

Interactive Brokers Review |

IG Index Review |

Swissquote Review |

Trading Instruments Comparison

| Nutmeg | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

Nutmeg vs Other Brokers

Compare Nutmeg with any other broker by selecting the other broker below.

Popular Nutmeg comparisons: