NSFX Review 2025

|

|

NSFX is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to NSFX |

| NSFX Facts & Figures |

|---|

NSFX delivers tight spreads across FX and CFDs on the JForex & MT4 platforms. |

| Instruments | Forex, CFDs, indices, commodities |

|---|---|

| Demo Account | Yes |

| Min. Deposit | $300 |

| Mobile Apps | MT4 & JForex |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | MFSA, CONSOB |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Speculate on a range of financial markets with leveraged CFDs at NSFX. |

| Leverage | 1:30 |

| FTSE Spread | 1.3 |

| GBPUSD Spread | 1.2 |

| Oil Spread | 3.0 |

| Stocks Spread | Variable |

| Forex | Buy and sell over 50 currencies with competitive floating spreads. |

| GBPUSD Spread | 1.2 |

| EURUSD Spread | 0.5 |

| GBPEUR Spread | 1.1 |

| Assets | 50+ |

| Stocks | NSFX faclitates trading on the largest indices from around the world, including in the US, UK, Europe and Asia. |

NSFX is a CFD broker that offers UK investors access to two powerful trading platforms, fee-free deposits and a range of useful tools. On the downside, the broker is not regulated by the FCA and its education does not match rivals.

Our expert review will cover the broker’s market access, fee structure, account types, funding methods, leverage and more, with a focus on UK-facing services and experience. We also share our verdict on trading with NSFX.

Our Take

- NSFX supports both MetaTrader 4 and JForex, both of which are popular platforms with advanced technical analysis capabilities

- We found the broker’s fees to be competitive, with free deposits and a fixed spread account for simpler cost forecasting

- Our team was pleased to see that GBP is supported as a base currency, so UK investors can avoid currency conversion issues

- However, the depth and quality of educational materials and market research do not compete with the top UK brokers

- NSFX is ultimately best suited to newer traders seeking popular instruments and fixed spreads with the relative security of EU (not FCA) regulation

Market Access

We found that the overall selection of assets is relatively limited at NSFX. UK investors can access a couple of commodity products, eight indices and a decent variety of forex pairs. Furthermore, only a handful of stocks and cryptocurrency assets are offered by the firm. Ultimately, only the suite of currencies is particularly competitive.

- Energies – Both WTI US Oil and Brent UK Oil assets

- Metals – NSFX users can speculate on gold and silver pairs against the USD

- Indices – Eight index CFDs are offered, including the FTSE 100, DAX 40 and NASDAQ 100

- Forex – Over 50 major, minor and exotic forex pairs, including GBP/USD, EUR/NZD, CAD/JPY and CHF/JPY

- Equities – A small range of popular US stock CFDs are available, including Apple, Alphabet, McDonald’s and Netflix

- Cryptocurrencies – A handful of the most popular crypto coins are available to trade against USD/USDT, including Bitcoin, Dogecoin, Ethereum, Litecoin, Ripple and Cardano

Fees

Our team found that the broker’s fee structure differs depending on the account type you open. Commission rates and bid-ask spreads vary between the MT4 Fixed, MT4 ECN and JForex accounts.

All three account types incorporate bid-ask spreads. The MT4 Fixed account has fixed spreads, while the MT4 ECN and JForex accounts have variable spreads, changing with market conditions.

Unfortunately, our experts had trouble attaining live market spreads and data during our tests, although we found commission rates for each account type, given below per lot per round turn. These are relatively standard commission fees in the industry.

- MT4 Fixed Spreads – No commission

- MT4 ECN – £6

- JForex – £6

The broker also charges overnight swap fees on its main account types. However, Muslim users can request a swap-free, Islamic account that has no swap fees or interest payments on short derivatives held open overnight.

Deposits are free at the firm but we were disappointed to see that some withdrawal methods incur additional charges. This is a noticeable drawback over popular alternatives in the UK, such as Pepperstone and CMC Markets.

NSFX Accounts

NSFX offers three main account types, the MT4 Fixed Spread account, the MT4 ECN Account, and the JForex Account. Beyond offering different platforms, these also have different trading conditions and execution models.

All account types have:

- Hedging: Allowed

- Lot Size: 100,000 units

- Margin Call: 20%/50%

- Maximum Leverage: 1:50

- Minimum Trade Size: 0.01 lot

- Base Currency: GBP, USD, EUR

MT4 Fixed

The fixed spread account is the most accessible to new investors, with the lowest minimum deposit and zero commission fees to keep pricing simple.

- Spreads: Fixed

- Execution: Instant

- Commission: Zero

- Scalping: Not Allowed

- Minimum Deposit: £230

- Instruments: Forex Majors

- Expert Advisors: Unavailable

MT4 ECN

The ECN account provides market execution to investors, alongside access to all supported assets and automated trading. This will serve active short-term traders looking to keep spreads tight.

- Instruments: All

- Spreads: Variable

- Scalping: Allowed

- Execution: Market

- Minimum Deposit: £2,300

- Commission: £6 per lot round turn

- Expert Advisors: Available via MQL4

JForex

The JForex account offers a different trading platform but is the least accessible in terms of minimum deposit limits. This account type also comes with a dedicated account manager. This is best for experienced traders interested in the JForex platform.

- Instruments: All

- Spreads: Variable

- Scalping: Allowed

- Execution: Market

- Minimum Deposit: £3,800

- Commission: £6 per lot round turn

- Expert Advisors: Available via Java

Overall, we think the account types offered are fairly competitive, providing a varied experience for different types of traders, albeit with rather high minimum deposit limits.

Less experienced traders may want to open a fixed spread account, providing a fixed, predictable fee structure. Higher-worth investors may want to open one of the market execution accounts with their standard commission rates and variable spreads.

How To Open An Account With NSFX

I didn’t run into any issues opening an NSFX account. It was fairly quick and straightforward.

- Go to the NSFX website

- Click the Open Live Account button

- Fill in your details (including name, email address, phone number, platform/account details, etc.)

- Submit the application

- You will then be directed to the KYC questionnaire to complete your live account registration

- Provide the required personal information, contact details, employment information and identification (passport, driver’s license, etc.)

- When this information is accepted and verified, your account will be open for deposits, allowing you to fund your account and start investing

Funding Methods

NSFX offers seven popular funding methods for transferring capital into and out of your trading account. These are bank wire transfers, MasterCard, Maestro, Visa, Skrill, Neteller and Fast Bank Transfer.

All deposits are free, though Skrill and Neteller charge withdrawal fees of 2.9%. As such, we recommend avoiding these payment methods.

Transfer speeds are as follows:

- Visa: Deposit – Instant, Withdrawal – Up to 2 Business Days

- Skrill: Deposit – Instant, Withdrawal – Up to 1 Business Day

- Neteller: Deposit – Instant, Withdrawal – Up to 1 Business Day

- Maestro: Deposit – Instant, Withdrawal – Up to 1 Business Day

- MasterCard: Deposit – Instant, Withdrawal – Up to 1 Business Day

- Bank Wire Transfer: Deposit – 2-3 Business Days, Withdrawal – Up to 2 Business Days

- Fast Bank Transfer: Deposit – Up to 10 Business Days, Withdrawal – Up to 2 Business Days

Overall, we were satisfied by the range of funding methods available, providing popular options for traders. And while processing times are relatively standard, the withdrawal charges are a noticeable disadvantage.

Regulation

NSFX is a regulated broker, overseen by the Malta Financial Services Authority (MFSA), the independent financial regulator in Malta. The broker is also MiFID II compliant, meaning it complies with the regulatory rules to operate within the European Economic Area. This ensures that the brokerage is transparent and provides investor protection protocols.

The broker is registered under the name ALCHEMY MARKETS LTD, with MFSA MBR registration code C 56519. The authorisation also shows the other EEA member countries authorising the firm.

Overall, this ensures the broker upholds various client safety features, including transparency, segregation of funds, negative balance protection, access to an investor compensation scheme and collaboration with Tier 1 international banks. This includes compensation for clients of 90% of their invested funds up to £17,000 in the case of NSFX’s insolvency.

The brokerage has been approved to operate in Germany by the BaFin, in France by the ACP, in Italy by the Consob, in Spain by the CNMV and in Denmark by the FINANSTILSYNET.

While authorisation and regulation within the European Economic Area are not easily achieved, our experts stress that firms regulated by the FCA in London are usually the safest bet for UK investors. Such brokers, including the likes of Plus500 and IG Index, provide access to the Financial Services Compensation Scheme (FSCS) for up to £85,000, as well as support from the UK financial ombudsman if any disagreement should arise.

Trading Platforms

Our team was impressed to see that NSFX supports the popular MetaTrader 4, alongside the more specialised JForex platform. Both are powerful platforms that offer a large range of tools for advanced strategies and sophisticated analysis.

However, newer traders may have to face a slight learning curve due to the relative complexity of these platforms.

MetaTrader 4

MetaTrader 4 is one of the most popular online trading platforms, providing high levels of customisation, advanced technical analysis tools, impressive accessibility and a wide range of features.

The platform has heaps of resources available across the web to help you learn how to use the platform and get the most from its functionality. It also has a specialised programming language, MQL4, which allows savvy investors to integrate additional features, plugins and tools into the platform.

Our favourite features of the platform include:

- Nine timeframes

- One-click trading

- 31 graphical objects

- 30 technical indicators

- MQL4 programming language

- Customisable interface layouts

- Automated trading via Expert Advisors

MetaTrader 4 Web Trader

MetaTrader 4 is available to download for free from the NSFX client portal or direct access via the webtrader platform.

JForex

JForex is a powerful trading platform from Swiss Forex Bank that provides sophisticated analysis tools, universal support (Windows, Mac, Linux, Android, iOS, Web) and an advanced, intuitive interface design.

The platform comes with:

- 13 timeframes

- Scalping support

- Automated trading via Java

- 270+ indicators and chart studies

- Built-in documentation and support

JForex

JForex is an advanced platform that can be downloaded for free from the NSFX client portal. Investors can also access the web trader directly through their web browser for a no-download experience.

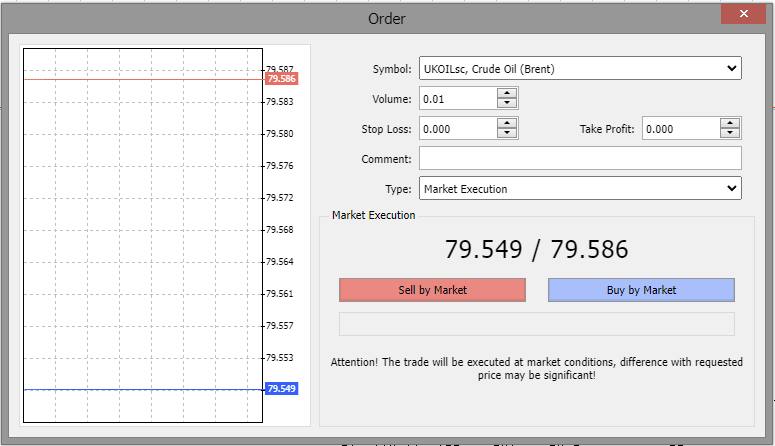

How To Place A Trade With NSFX

Traders of all experience levels will be able to navigate the new order process:

- Login to your chosen trading platform

- Choose the asset you would like to trade and open the chart window

- Perform your analysis to find the right time to trade

- Open the order window: New Order for MT4 or on the left-hand side for JForex

- Fill in the details of your trade (volume, stop loss, take profit, order type, etc.)

- Select Buy or Sell to pick the direction and open your position

MT4 Order Window

Mobile App

MetaTrader 4 and JForex also support dedicated mobile applications on iOS and Android devices. These essentially mimic the capabilities of their desktop and web-based versions, allowing investors to track assets, perform analysis and place trades on the go.

While using NSFX, our experts found that both apps have an intuitive design and powerful tools, although they do miss out on some of the more advanced functionality, such as Expert Advisor design. As a result, it is best for supplementing the desktop experience.

NSFX Leverage

NSFX supports leveraged trading with rates of up to 1:30, the maximum allowed under the MiFID II regulations. This means that margin requirements of up to 3.33% can be used for speculation. It also aligns with FCA regulations designed to protect UK traders from amassing large losses when trading on margin.

The broker has a margin call limit of 50%, meaning that the broker will liquidate any open positions in your account should your total equity fall below half of the used margin.

Demo Account

We were pleased to see that NSFX offers free demo accounts for all three of its trading accounts. This allows investors to practice with the fixed spreads and commission-based accounts through MetaTrader 4 or the JForex platform before opening a live account and risking real capital.

Our experts recommend that all traders start with a practice account before opening a live account to become accustomed to the trading platform, market conditions and fee structure of the firm.

These accounts also provide a good chance to test and develop trading strategies.

Bonus Deals

We were not offered any financial incentives, welcome bonus deals or sign-on promotions when we used NFSX. This is expected for a firm based within the EEA as European regulators have banned the use of such deals to entice new clients to risk their money. This is also the case for FCA-regulated firms like FXCM and XM.

Ultimately, we don’t consider the lack of promotions a significant drawback – we don’t recommend choosing a firm based on bonus offers.

Extra Tools & Features

When we traded with NSFX, our team found that the firm provides several additional tools and features to enhance the user experience. These include an economic calendar, daily fundamental analysis, daily technical analysis, technical overviews, forex news, guides, video courses and eBooks.

We found these tools to be useful, incorporating lots of market information and analysis for investors of all levels. We always like to see a variety of educational resources, such as eBooks, web guides and video courses, as they are great for learning the basics of online investing and how to make the most of the different trading platforms.

Overall, we were impressed by the range of resources provided. However, some brokers like eToro boast more comprehensive educational tools, making them more attractive to beginner traders.

Company Details & History

NSFX Limited was founded in 2012 in Malta and is directed by John Torreggiani and David Griscti.

It was founded by a group of professionals in the financial industry to provide global trading services that fit traders’ needs.

The broker aims to provide three key services: innovative trading platforms, innovative trading tools and excellent trading conditions.

Customer Service

We found that the broker offers all the major contact methods provided by other popular brokers. These include international contact phone numbers, support email addresses, social media accounts and an online chatbot.

Yet while we appreciate that this is a decent range of methods, we would prefer to see a 24/7 live chat window with real people on the other side, rather than an AI-powered bot. Upon testing, it was difficult to get the information we need from a chatbot.

- UK Phone Number: +44 330 8080 098

- Support Email Address: support@nsfx.com

Security

Our experts confirm that the broker’s website and client portal are encrypted, helping to protect traders’ personal information. Furthermore, the MetaTrader 4 platform fully encrypts users’ information, and incorporates two-factor authentication (2FA).

However, our team found some safety concerns with the JForex download and web trader links. These sites did not have valid web certificates.

Trading Hours

From our experience with NSFX, trading hours vary between assets.

Typically, products are available when their underlying markets are open. However, some assets, such as forex, are open 24/5 Monday to Friday. Gold can be traded from 23:00 GMT Sunday to 20:00 GMT Friday, while cryptocurrency products are online 24/7 due to their decentralised nature.

Should You Trade With NSFX?

Overall, we think that NSFX provides a mediocre range of assets, supported on some powerful platforms while being MiFID II-compliant. Furthermore, UK investors can deposit GBP directly into their accounts through a variety of low-cost funding methods, avoiding any conversion fees.

However, our team identified several weaknesses of the firm, such as withdrawal fees with some payment methods, limited assets available on the fixed spread account, and no UK regulation.. Ultimately, we think that the advantages of NSFX can be found in most major FCA-regulated firms.

FAQ

Is NSFX Legit Or A Scam?

It appears that NSFX is a legitimate brokerage. It is regulated by the MFSA, whilst also being MiFID II-compliant. As such, the firm must follow many investor protection protocols to retain its license.

Does NSFX Offer Good Trading Tools?

The trading platforms offered by NSFX are competitive and powerful. MetaTrader 4 is one of the most popular online trading platforms, with advanced tools and features suitable for all technical trading strategies. JForex also comes loaded with a huge number of technical and charting tools. Both software options support automated trading.

Is NFX A Regulated Broker?

While not regulated in the UK, NSFX does hold a license with the Malta Financial Services Authority (MFSA). The broker follows regulatory rules similar to those imposed by the FCA, including negative balance protection, access to an investor compensation scheme and the segregation of clients’ funds from operating funds.

Does NSFX Offer A Free Demo Account?

NSFX traders can open demo accounts for any of the three account types offered by the firm. This allows traders to test all the platforms and fee structures available before committing capital to a live account. Users can easily open demo accounts from the NSFX client portal.

Is NSFX A Good Broker For UK Traders?

NSFX is a decent broker, providing a reasonable range of instruments, competitive fees and decent platform support. However, the broker falls short in several areas, with limited assets available on its fixed spreads account, mediocre web security and lack of regulation by the FCA. We would recommend that UK investors look towards top, FCA-regulated brokers.

Article Sources

Top 3 NSFX Alternatives

These brokers are the most similar to NSFX:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- GO Markets - GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

NSFX Feature Comparison

| NSFX | Swissquote | IG Index | GO Markets | |

|---|---|---|---|---|

| Rating | 2.5 | 4 | 4.7 | 3.9 |

| Markets | Forex, CFDs, indices, commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, forex, indices, shares, energies, metals, cryptocurrencies |

| Minimum Deposit | $300 | $1,000 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | MFSA, CONSOB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | ASIC, CySEC, FSC of Mauritius |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | MT4 | MT4, MT5 |

| Leverage | 1:30 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:500 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | NSFX Review |

Swissquote Review |

IG Index Review |

GO Markets Review |

Trading Instruments Comparison

| NSFX | Swissquote | IG Index | GO Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

NSFX vs Other Brokers

Compare NSFX with any other broker by selecting the other broker below.

Popular NSFX comparisons: