News Trading

News trading uses analysis of economic reports and events to predict market prices. Using the news for trading is a versatile strategy that can be applied to all market types, though specific events to look out for will vary between assets.

Whether you’re considering news trading forex, stocks or oil, read our guide to find out how you can benefit from today’s wealth of news sources to predict prices. We’ll walk through an example news trading strategy, as well as explaining how you can use algorithmic bots to capitalise on the release of economic data.

Trading Brokers

-

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

-

Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

-

Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

-

FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

-

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

What Is News Trading?

Trading on the news is based on analysis of economic news and events, unlike technical analysis which uses charts and indicators to predict patterns. However, technical analysis can be used in combination with news-driven trading to confirm any predicted trends. News trading involves reacting to events that are both scheduled and unscheduled.

Scheduled news trading uses reports from recurring or one-off events with predictable timings, such as company announcements or general elections. Day traders take advantage of the volatility that often surrounds stocks just before and after an announcement, unlike longer-term investors who will be interested in whether the overall trend is likely to reverse. Speculation can be just as important, if not more important, than the reported figures themselves. The most successful scheduled trading will come from traders who have carried out in-depth research of the company, asset or market they are trading.

Unscheduled events are ‘one-off’ occurrences. These are the unpredictable events such as the 2008 financial crisis or Covid-19 pandemic, that a trader will likely be unprepared for. However, the potentially significant impact of these events means there can be high profits to be made.

News Trading Markets

News affects everything and can therefore be applied to all markets including forex, stocks cryptos, oil, futures, gold and binary options, though certain news events will have a stronger effect on specific market directions.

Forex

When trading news on forex now, central bank announcements and political news can have large influences on price. UK news traders should consider the effect of a general election or Bank of England online announcements on the FTSE100 and USD/GBP when developing indices and forex news trading strategies. The EU referendum result in 2016 saw a strong breakout of EUR/GBP, for example.

2016 Brexit referendum impact on EUR GBP

Stocks

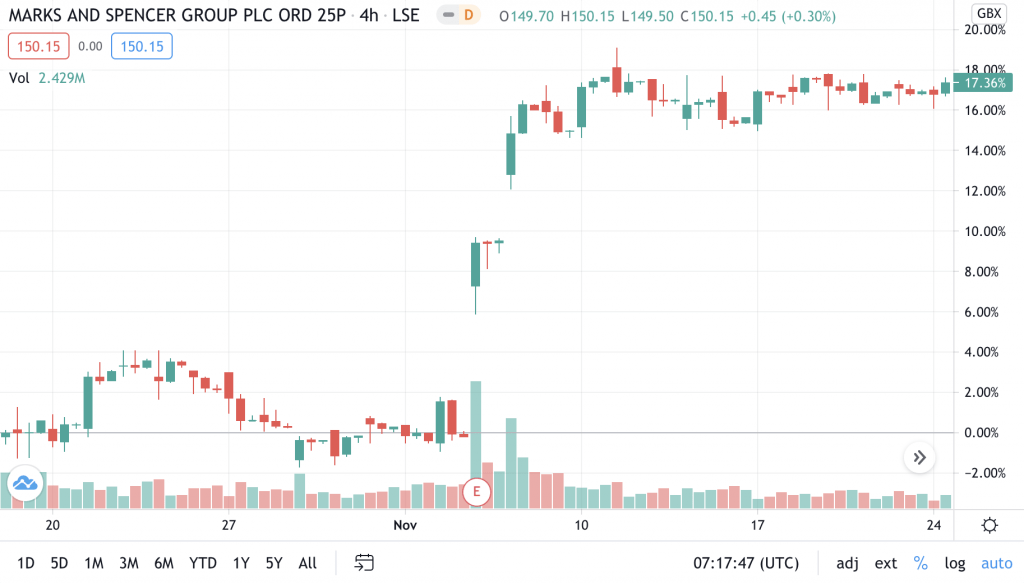

Company share price is likely to be impacted by periodic company announcements and annual reports. Stock news trading strategies can be developed based on patterns seen around these news releases.

M&S trading news effect on trading volume and share price

Cryptos

Cryptos are primarily affected by supply and demand and are not influenced by monetary policy. News reports about trading regulation and competing altcoins are significant when news trading cryptocurrency.

Commodities

Gold news traders should keep on top of updates regarding inflation, deflation and supply and demand. Supply and demand are also extremely influential on the price of oil and gas, along with any news relating to OPEC (Organisation of the Petroleum Exporting Countries).

How To Trade On The News

Trading on the news involves three key steps: find a suitable broker, conduct research and establish a trading strategy.

Choosing A Broker

First, you’ll need to decide on a broker to execute your trades. Basic checks include whether they offer access to the market you are interested in, the associated spreads and fees, and if they are regulated. The FCA is a reputable regulator in the UK, which ensures protection of funds up to £85,000 through the FSCS.

The tools offered by the broker should also be a deciding factor. In particular, review their trading platform, which might be proprietary or a popular third-party platform such as MetaTrader. Either way, an easily accessible economic news calendar and the ability to place pending orders to lock profit and minimise losses is crucial. Check if the broker has an app so you can keep up-to-date with news and execute trades on the go.

Many brokers offer demo accounts which allow traders to practice using virtual funds first. Practising with yesterday’s trending news is a great way to get familiar with news trading.

Though Trading 212 is an FCA regulated broker, its mobile app ratings are poor. Pepperstone is a great FCA regulated broker which excels in its platform choices, offering 11 types including MetaTrader and cTrader. OctaFX, which is regulated by CySEC, is also a good option for news traders looking to use the MetaTrader platforms.

Research Markets

Taking the time to conduct in-depth research is essential for news-based trading. Books provide the framework for news trading strategies, while subscribing to a trading newspaper, newsletter or podcast will keep you up to date with today’s trading news around the world.

The top websites for news trading include Bloomberg (which also has a radio channel) and Reuters, covering events that impact various markets from brent crude oil to gold. They are also great sources of international news, including US NFP reports and stock exchange information about Nasdaq, ASX, DAX and NSE. The TradingView news feed provides a great free source of events and analysis today, while Telegram has a host of trading channels to pick up tips.

For forex specific trading news releases and updates this week, check out websites such as XM. YouTube is a rich source of information for the best forex secrets and insider tips, which also provides live demos of news trading.

Crude Oil News Trading Strategy Example

The latest crude oil price crash of 2014 was a combination of multiple factors that could have been predicted using news trading. Here, we discuss the specific events to look out for when oil news trading, in addition to how technical analysis can be used to confirm price predictions.

A range of economic news sources provided indications of the oil price decline in 2014:

- GDP reports – Countries such as China, which had pushed up oil prices due to increasing demand in the lead up to the financial crisis of 2008, had weakening economies. This could be observed in their GDP reporting from 2008 onwards.

- Forex analysis – The US Dollar is also important when news trading oil, due to its correlation with oil commodities which are generally traded in USD. Forex analysis shows the US dollar was strong in 2013, encouraging oil production.

- Supply and demand reports – An extended period of high oil prices resulted in overproduction, as captured in the International Oil Agency report which details oil supply and demand.

- OPEC news – The overproduction led the price of oil to drop, subsequently raising the question about whether OPEC would cut production in response. By following OPEC news, traders would have been made aware of the announcement in November that Saudi Arabia were to maintain their oil production levels, leading to a further decline in oil price.

These news reports are backed up by technical analysis including Moving Average (MA) indicators and the Relative Strength Index (RSI). A longer-term MA with a 200 day period can be used in combination with a shorter-term MA with a 20 day period. The shorter-term MA (blue line) crossing below the longer-term MA (green line) is an indication that the trend is moving downwards and is therefore a sell signal. The RSI (purple graph) indicates whether an asset is oversold or overbought, using a scale of 0 to 100. A reading above 80 is considered to be overbought, further confirming the sell signal.

2014 Brent crude oil crash

Algorithmic News Trading

Robots can be used to automate news trading, enabling quicker trading reactions based on vast sources of information. However, training the bot to distinguish which news is relevant can be difficult and may require more complex artificial intelligence methods. Reacting to news announcements such as interest rates at high speed is one example of a simple way to get value from using software algorithms for news trading.

Example news trading robots include Expert Advisors (EAs) and indicators which are available on MetaTrader platforms such as MT4. Many are available for free download from the MetaTrader code library, while traders can also develop bespoke news trading bots using the MQL programming language. News based trading algorithms can be designed to simply set alerts, apply pending orders or carry out more specific trades based on signals. Developers of bespoke bots can use APIs to connect their algorithms to a broker platform, enabling tracking of real-time prices.

Final Word On News Trading

News trading is a popular strategy based on the research of economic events to predict asset prices, across all markets. With traders able to access more news sources than ever, in-depth research of relevant reporting is key. Algorithmic bots can provide the trader with an advantage over manual trading methods, by enabling analysis of vast amounts of economic news data and reacting to events extremely quickly.

FAQ

What Is News Trading Vs Technical Trading?

News trading decisions are based on economic news and events, unlike technical analysis which uses charts and indicators to predict patterns. Technical analysis can be used in combination with news driven trading to confirm predicted trends.

What Is News Based Day Trading?

Day traders can take advantage of the short-term volatility surrounding markets just before and after economic events, such as central bank reports and company announcements.

Which UK Broker Is The Best For News Trading?

Pepperstone is one of the best UK broker choices for news trading. As well as being FCA regulated, it offers a huge range of platform options including MetaTrader and cTrader.

Where Can I Find Trading News Now?

The top news trading websites include Bloomberg and Reuters, covering events that impact various markets including forex. A series of other websites, such as Zerodha, have breaking news pages for traders looking to find information on assets such as gold and oil right now.

What Is a News Trading Forex Strategy?

News trading forex strategies should prepare for the impact of events such as central bank announcements and political news, including general elections. In the UK, these are likely to have the largest impact on USD/GBP and EUR/GBP forex pairs.