MultiBank FX Review 2025

|

|

MultiBank FX is #68 in our rankings of CFD brokers. |

| Top 3 alternatives to MultiBank FX |

| MultiBank FX Facts & Figures |

|---|

MultiBank FX is an established broker offering forex and CFD products since 2005. With 20,000+ instruments, plenty of local payment methods and 24/7 multilingual customer support, the broker is a popular choice among traders globally. New clients can also access a variety of bonus offers and access the hugely popular MT4 and MT5 trading platforms. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | Yes |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.1 Lots |

| Regulated By | SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, VFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Yes (APIs) |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Access thousands of CFDs with competitive pricing and leverage up to 1:500. A range of asset classes are available, including currencies, shares, indices, metals and commodities. CFDs can be traded on the market-leading MetaTrader platforms. |

| Leverage | 1:500 |

| FTSE Spread | Not offered |

| GBPUSD Spread | 0.8 |

| Oil Spread | 0.03 |

| Stocks Spread | Variable |

| Forex | MultiBank FX offers trading on 50+ major, minor and exotic currency pairs. Spreads are tighter than many competitors and the broker offers higher leverage than most alternatives. Automated trading strategies are also permitted. |

| GBPUSD Spread | 0.8 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.8 |

| Assets | 45+ |

| Stocks | Trade 20,000+ global equities with margins as low as 5% and powerful trading platforms. The selection of shares outstrips nearly all competitors and includes access to blue chip stocks. |

| Cryptocurrency | Trade a selection of the top cryptos against the US Dollar, including Bitcoin, Polkadot and Stellar with 50% leverage. Traders also benefit from fast execution speeds of <20ms. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

MultiBank FX is a no-dealing desk multi-asset broker with 20,000 financial instruments available on the MT4 and MT5 trading platforms. In this MultiBank FX review, we investigate the broker’s main features including account types, deposit and withdrawal options, trading fees, and everything you need to know to sign up and start trading. We also share the pros and cons of trading with MultiBank FX.

Verdict

We were impressed by MultiBank FX’s flexible offering for traders of all experience levels, with a choice of three accounts, reliable platforms and social trading. We also rated the low fees, particularly with the ECN account, though we did note that a hefty $5000 deposit is required.

On the downside, there is no license from the Financial Conduct Authority (FCA). With that said, the firm is regulated by multiple reputable financial agencies, so we are comfortable that MultiBank FX is still legitimate and trustworthy.

Market Access

MultiBank FX’s substantial asset list is a strong point, particularly for traders with an interest in shares, who are catered for with an extensive list of stocks and exchanges. I was also happy to see a sizeable offering of currency pairs, a decent choice of commodities, as well as the most popular cryptocurrencies. Overall, the MultiBank group offers thousands more instruments than many rival brokers.

Tradable instruments include:

- Shares – 14,000+ company stocks listed on 17 exchanges

- Indices – 14 major index funds including FTSE100, S&P500 and CAC40. Seven of these can also be traded as futures contracts including the FTSE and US Volatility Index

- Forex – 55+ major, minor, and exotic currency pairs including GBP/USD, EUR/GBP, and USD/JPY

- Commodities – 10+ soft and hard commodities including gold, natural gas, and UK Crude Oil

- Cryptocurrency – 11 digital currencies including Bitcoin, Ethereum and Litecoin

MultiBank FX Fees

I found that MultiBank FX offered the best spreads and fees on the ECN account. The ECN profile offers raw spreads from 0 pips with a $3 commission per round turn, which is decent.

Unfortunately, fees on the other accounts were less competitive. The Standard and Pro accounts are both commission-free with floating spreads from 1.5 pips on the Standard profile and 0.8 pips on the Pro account. I thought the Standard account, in particular, was disappointing, offering higher than average spreads if you opt for the entry-level account.

To highlight the difference in fees between each account, I was offered these spreads on the GBP/USD:

- ECN – 0.5 pips

- Pro – 0.8 pips

- Standard – 1.6 pips

It is also worth noting that a $60 inactivity fee applies after 3 months of no activity. This is reasonable as some brands implement these charges after just three months. Swap fees will also apply to positions held overnight.

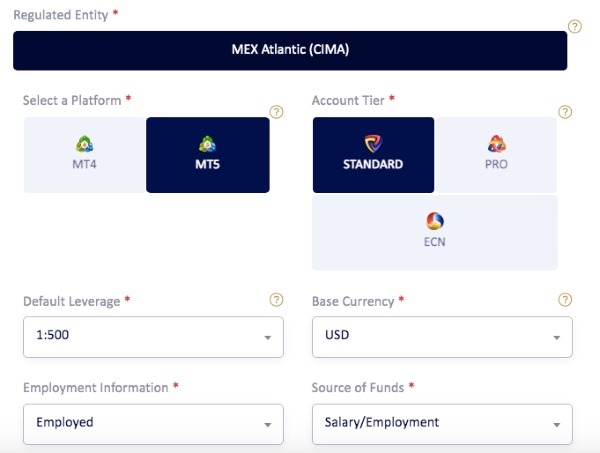

Account Types

When I signed up with MultiBank FX, I could choose from three live account options; Standard, Pro, and ECN, each of which offers GBP as the base currency, a notable plus for UK traders.

I was pleased to see all profiles providing access to all instruments, with the main difference being the pricing models. This essentially makes them suitable for different strategies and experience levels. For example, beginners can get started with a £50 deposit on the Standard account.

On the negative side, I thought it was a shame that MultiBank FX requires such high minimum deposits to access the Pro and ECN accounts, making the best pricing out of reach for many new traders.

- Standard – £50 minimum deposit, spreads from 1.5 pips

- Pro – £1000 minimum deposit, spreads from 0.8 pips

- ECN – £5000 minimum deposit, spreads from 0 pips

Muslim traders will be pleased to see that an Islamic account is also available.

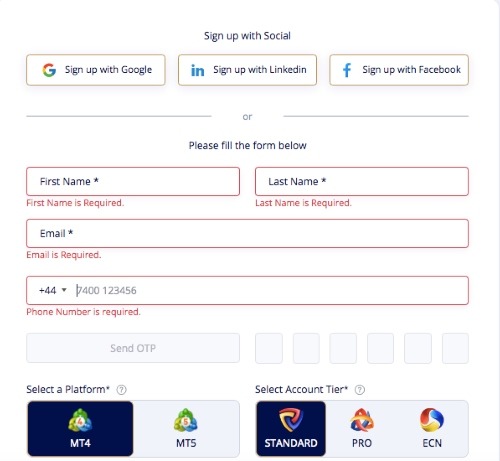

How To Open A Live Account

I managed to sign up for a live MultiBank FX account in around two minutes. My tip is to have a copy of your ID and proof of address to hand as you will need to submit these to complete the registration.

- Complete the application form with your name, email, phone number, nationality, base currency, and password

- Click ‘Send OTP’ and add the six-digit code to the boxes

- Create a password

- Select the MT4 or MT5 icon to choose a trading platform

- Select ‘Real Money Account’ to confirm the registration

Payment Methods

Deposits

I was satisfied with the number of deposit options available to UK traders, including debit/credit cards, bank wire transfer, Google Pay, Apple Pay, and cryptocurrency. The only popular solution missing is PayPal.

Importantly, I was pleased to see the broker limiting costs by supporting GBP as an account base currency, which cuts out sometimes-costly conversion fees, and by not charging any deposit fees.

For the fastest deposits, I would recommend credit/debit cards and e-money solutions, which are typically instant. In contrast, bank wire transfers can take up to three days.

How To Make A Deposit

Once you have opened a live account with the group and complied with verification requirements:

- Login to the Multibankfx.com client dashboard

- Select ‘Deposits’ from the left menu or click the ‘Quick Deposits’ icon from the top of the interface

- Choose a payment method

- Select the account to deposit to from the dropdown menu and input the amount

- Select ‘Next’

- Follow the on-screen instructions depending on the payment method

- Select ‘Confirm’ to proceed with the payment

Withdrawals

I was pleased to find that MultiBank FX does not charge any withdrawal fees, meaning traders can withdraw funds as often as required.

While it is generally standard practice today, I do appreciate the ease and speed of being able to arrange withdrawals directly through the client dashboard. Alternatively, you can email withdraw@multibankfx.com to request a withdrawal.

MultiBank FX Platforms

I was reassured to find that both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are available. They are available for desktop download, as a WebTrader, or as a mobile app. While I do like to see brokers providing proprietary apps, which can be easier for rookie traders to pick up, I am confident that most traders will be content with the tools and functionality of MT4 and MT5.

These industry-favourite platforms are considered among the best globally, with stable software connections and automated trading features. I particularly like the fully customisable interface that can be adapted to suit my trading strategy and investment style.

MetaTrader 4

I found that the copy trading solution and easy-to-use charts were top-tier features, particularly for beginners, while advanced traders benefit from access to a library of advanced technical indicators and algorithmic trading functions. The latter is a feature that the MetaTrader platforms are particularly well known for, with their Expert Advisor bots widely regarded.

I have pulled out some of the best features of each platform:

MT4

- Drawing tools

- Nine timeframes

- One-click trading

- Three chart types

- Alerts and notifications

- 30+ in-built technical indicators

MT5

- Drawing tools

- 21 timeframes

- One-click trading

- Three chart types

- Integrated economic calendar

- 38+ in-built technical indicators

- Access to Expert Advisors (EAs)

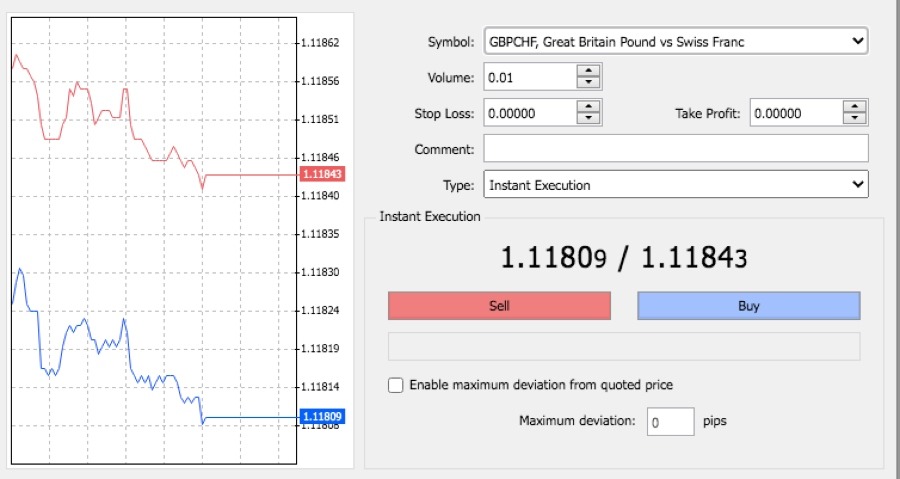

How To Place A Trade

One thing I like about the MetaTrader platforms is the flexible approach to placing trades. Both platforms offer one-click trading directly from charts, investing from the instrument lists, or you can use the traditional order window.

To make a trade:

- Sign in to the MT4/MT5 terminal

- Navigate to the ‘Market Watch’ window

- Double-click on the instrument – this will automatically open the ‘New Order’ window

- Complete the order details including volume, plus stop-loss/take profit risk parameters and a comment (optional)

- Click ‘Buy’ or ‘Sell’ to finalise the trade

Mobile App

Another thing I rate highly about the MT4 and MT5 platforms is their mobile apps. You can access your account details and trade with all the stability and reliability of the desktop software on your small-screen mobile or tablet device.

I also like that you can still use some of the best features including one-click trading, customisable charting, and personalised alerts and notifications.

So while it is a shame that there is no proprietary app, the MT4 and MT5 mobile solutions provide everything you need while trading on the go.

Leverage

As MultiBankFX isn’t regulated in the UK, you can trade with high leverage. The 1:500 leverage available is way above the 1:30 maximum from UK or EU-regulated brokers. But while this greatly boosts trading power, I urge traders to practice good risk management to prevent excessive losses.

Leverage also varies between asset classes:

- Precious Metals – Up to 1:500

- Forex – Up to 1:500

- Indices – Up to 1:100

- Cryptocurrency – Up to 1:50

- Shares – Up to 1:20

It is worth noting that the stop-out level will be triggered if your account equity falls below 50% of the required margin.

Demo Account

I was glad to see MultiBank FX offers a demo account, which is available on both MT4 and MT5, and can be set to replicate the trading conditions of the Standard, Pro, or ECN accounts.

The simulator profile comes loaded with $100,000 in virtual funds, and when I tested it, I was able to trade all instruments with leverage up to 1:500. The only real shame was that there was no GBP virtual account funding option.

How To Open A Demo Account

The registration process for the test account is straightforward:

- Click the ‘Demo Account’ icon on the top of the broker’s webpage

- Complete the application form or sign up with an existing account (Google, Facebook, or LinkedIn)

- Add the one-time passcode sent to your registered mobile number

- Select a platform and account type

- Click ‘Submit’

- Verify your registration via the email link

- Follow the link to create a password and select ‘Proceed’

UK Regulation

While MultiBank Group has regulatory oversight from 10+ financial watchdogs, it is important to note these are less stringent organisations and will not provide as much cover as the Financial Conduct Authority (FCA).

The lack of FCA oversight is a noticeable negative for UK traders. Instead, British traders will be registered under the Cayman Islands Monetary Authority (CIMA), license number 1811316, which will leave you without FSCS insurance in the case of business insolvency.

I do, however, feel reassured by the broker’s security measures, which include segregated client funds in tier-one banks, negative balance protection, and a £1 million insurance policy per customer account with Lloyd’s of London.

The brand has also been assigned a B rating with Standard & Poor, alongside $322 million of paid-up capital, indicating financial stability. Moreover, as this review did not uncover any historical reports of MultiBank FX scams, I think the brand is relatively secure.

Bonuses

While MultiBank FX has some enticing offers, I found that the eligibility requirements will make it difficult for some traders to benefit from them.

I was offered a 20% deposit bonus with up to £40,000 or a cashback programme based on trading volumes. While reviewing the terms and conditions for the deposit bonus, I noted that withdrawals are only available at a rate of $200 for every 80 lots traded. Additionally, it is only applicable to forex and metals, with CFDs excluded.

And, while the cashback programme may appear appealing, the terms will be challenging for many traders. The lowest tier requires a notional trade value of up to $25 million. Rebates then range from $5 per million traded to $50 per million.

Extra Tools & Features

I rated the extras available, and while the range may not be the best on offer, the impressive social trading features make up for this.

Education

The educational content is strong, including video courses and e-books with topics organised by experience level.

I found the comprehensive MetaTrader tutorials particularly useful, with step-by-step video guidance on placing orders, adding technical indicators, and managing your account on the mobile app. The e-books are also easy to follow with clear descriptions and supporting images, and I rate the whole package as an excellent resource for beginners.

Tools

There are several additional tools available to MultiBank FX traders which are useful, including an economic calendar, calculators, and FIX API. All are provided for no fee and are designed to improve the overall trading experience. The latter is the best for high-volume traders, providing direct market access and seamless information transfer.

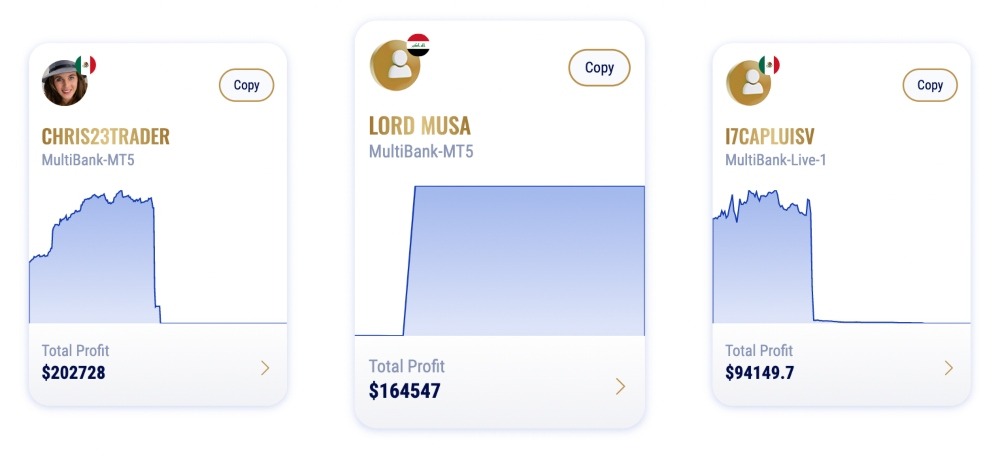

Social Trading

I was pleased to find a copy trading service available to UK traders, with a catalogue of experienced traders whose performance is tracked on a leaderboard and who can be chosen according to your capital availability and risk appetite. I particularly like that you maintain control of positions, meaning you can choose to close trades when required.

If you’re looking to save time, diversify a portfolio without extensive market knowledge or learn whilst trading, I think this could be worth considering.

VPS

MultiBank FX’s free VPS hosting service is great for traders using automated strategies, and I especially like that it can be accessed for free and with no minimum deposit requirement or minimum trade sizes.

It essentially allows MultiBank FX traders to benefit from a 24/7 server connection with no latency, and no requirement to connect to the MT4/MT5 terminal.

Customer Service

For me, a major advantage of the MultiBank Group is that their customer support team is available 24/7.

Contact methods include telephone, email, WhatsApp, live chat, and online contact forms. I am pleased to report that when I tested the online chat I received a response immediately, with no time-consuming bot hurdles to get through to speak to a human advisor.

The only downside is that UK customers are required to use an international phone number, with no local telephone contact, and this may entail charges.

- Email – cs@multibankfx.com

- Telephone – +1 646-568-9702

- Live Chat – Bottom right of the broker’s website

- Online Contact Form – Submit via the ‘Contact Us’ webpage

- Social media – Including Facebook, Twitter, LinkedIn and Instagram

Company History

MultiBank Group, also known as MultiBank FX, is a US-based broker established in 2005. Today, the company operates on a global scale with regulation from 10+ financial authorities and 25 office locations including its current HQ address in Dubai. MultiBank FX is an international corporation with a large client base of 1+ million from 90+ countries.

In 2020, the company achieved an impressive notional turnover of more than $5 trillion in the value of derivatives traded. The brand also operates with a no-dealing desk execution model, providing direct access to the interbank market.

MultiBank FX has been recognised with various industry awards including the Best Forex Broker at the 2023 FinTech & Crypto Summit Bahrain and the Best Crypto Broker Europe & Asia at the Global Brands Magazine Awards 2022.

The CEO is Yahya Taher and the chairman is Naser Taher.

Trading Hours

MultiBank Group trading platforms follow industry-standard opening times. You can trade between 12 AM (GMT +3) on Monday to 11:59 PM (GMT +3) on Friday. Within this, trading hours will vary by instrument. For example, gold and silver can be traded between 1:05 AM and 11:59 PM whereas forex pairs can be traded between 12:05 AM and 11:59 PM. The UK stock market is open for trading between 8 AM and 4:30 PM.

I appreciated that you can view an updated list of upcoming holidays and market closures easily on the broker’s website. Alternatively, this information is reflected in the MT4/MT5 trading terminals.

Should You Trade With MultiBankFX?

I think MultiBankFX is an excellent broker with some excellent tools to enhance the trading experience, including copy trading, 24/7 customer support, a demo account, and VPS hosting. The brand also has a long track record and an established presence in multiple jurisdictions, including the UK.

My main criticisms are that the Standard account offers fairly wide spreads. The lack of FCA oversight may also deter some UK traders.

All in all, MultiBank FX is a good broker with a diverse range of products, a choice of account types, and powerful trading software.

FAQ

Is MultiBank FX Regulated In The UK?

No, MultiBank FX Group is not regulated in the UK. The firm does not hold a license with the Financial Conduct Authority (FCA). Instead, British traders will be registered under the Cayman Islands Monetary Authority (CIMA).

Does MultiBank FX Offer Low Fees?

Fees on the ECN account are the most competitive, with raw spreads from 0 pips plus a $3 commission charge per round turn. Fees on the Pro account are also reasonable, with spreads from 0.8 pips. On the downside, spreads are higher than competitors with the Standard account, starting at 1.5 pips.

Is MultiBank FX A Good Broker?

MultiBank FX is a decent broker for UK investors, though it would be good to see regulation from the FCA. Despite this, the brand provides industry-leading platforms in MT4 and MT5, a low deposit, copy trading, and thousands of tradable instruments. Overall, MultiBank FX rivals many online brokers.

Does MultiBank FX Offer A Mobile App?

MultiBank FX does not offer a proprietary mobile app, however, MetaTrader 4 and MetaTrader 5 are available as mobile applications that can be downloaded to iOS and Android (APK) devices. You can access all the features and functions of the desktop versions including full account management and analysis tools.

How Long Do Withdrawals Take From A MultiBank FX Account?

Withdrawals from a MultiBank FX account will vary by payment method. Credit/debit cards often provide the quickest processing times, whilst bank wire transfer payments can take up to five days. Importantly, the broker is in line with many competitors in terms of withdrawal timelines.

Article Sources

Top 3 MultiBank FX Alternatives

These brokers are the most similar to MultiBank FX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Vantage FX - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

MultiBank FX Feature Comparison

| MultiBank FX | Pepperstone | Vantage FX | FP Markets | |

|---|---|---|---|---|

| Rating | 4.7 | 4.8 | 4.7 | 4 |

| Markets | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $50 | $0 | $50 | $40 |

| Minimum Trade | 0.1 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, VFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, FSCA, VFSC | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:500 | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | MultiBank FX Review |

Pepperstone Review |

Vantage FX Review |

FP Markets Review |

Trading Instruments Comparison

| MultiBank FX | Pepperstone | Vantage FX | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | No | Yes |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

MultiBank FX vs Other Brokers

Compare MultiBank FX with any other broker by selecting the other broker below.

Popular MultiBank FX comparisons: