Moneta Markets Review 2025

|

|

Moneta Markets is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Moneta Markets |

| Moneta Markets Facts & Figures |

|---|

Founded in 2019 and headquartered in Johannesburg, South Africa, Moneta Markets offers over 1000 instruments for short-term trading. New traders can choose between STP and ECN accounts while the smooth sign-up process has helped attract 70,000 registered traders. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | iOS & Android |

| Trading App |

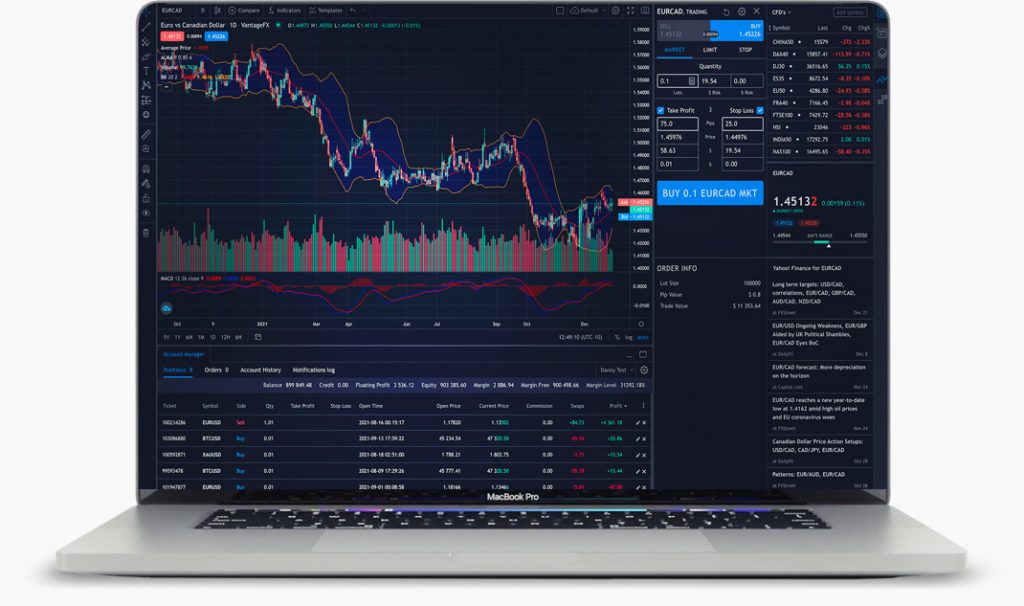

Moneta Markets supports the MT4 and MT5 applications but has stepped up its game by introducing a proprietary AppTrader. Powered by TradingView, it has a strong focus on technical analysis. It also sports a more intuitive interface and comprehensive functionality, including full-screen chart viewing and an integrated news stream. The added advantage is straightforward account management, allowing you to deposit, withdraw and access 24/7 chat support directly in the app. |

| iOS App Rating | |

| Android App Rating | |

| Payments | Wire Transfer, Credit Card, FasaPay, JCB, Sticpay, Crypto, local regional deposit methods |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, FSCA, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | CFD traders have the opportunity to speculate on short-term movements across a wide range of assets, including forex, stocks, indices, commodities, bonds, and ETFs. Where Moneta Markets stands out is its high leverage up to 1:1000 for seasoned traders, though this seriously amplifies the risk of large losses for inexperienced investors. |

| Leverage | 1:1000 |

| FTSE Spread | 13.33 |

| GBPUSD Spread | 0.56 |

| Oil Spread | 2.90 |

| Stocks Spread | 0.3 |

| Forex | Moneta Markets provides an extensive selection of over 45 forex pairs, featuring leverage ratios that surpass those offered by the vast majority of brokers, reaching up to 1:1000. The HokoCloud VPS can also enhance automated forex trading strategies and is free if you deposit $500 and trade 5 forex lots per month. |

| GBPUSD Spread | 0.56 |

| EURUSD Spread | 0.26 |

| GBPEUR Spread | 0.36 |

| Assets | 45+ |

| Currency Indices |

|

| Stocks | Stock CFDs can be traded on over 800 leading global corporations from prominent exchanges in Europe, the UK, the US, Australia and Hong Kong. These companies represent diverse sectors such as fuel, technology, and banking, providing ample trading opportunities. The minimum trading volume is set at 1 full lot, but there’s no option to invest in real stocks. |

Moneta Markets is an international forex and CFD broker that offers more than 300 trading instruments across a wide range of asset classes. The firm boasts competitive leverage rates, popular trading platforms and even copy trading facilities. This 2025 Moneta Markets review will delve into the broker’s account types, pricing models, spreads and payment methods.

About Moneta Markets

Created in 2018 as a subsidiary of Australian owned Vantage Group, Moneta Markets is an easy to use forex and CFD brokerage for retail traders worldwide. Based in Vanuatu and licensed by the regulator VFSC, the firm supports both straight-through processing (STP) and electronic communications network (ECN) trading. This provides its clients with the choice between raw spreads and zero commissions.

Trading Assets

Forex CFDs

A total of 46 currency swap markets are available, encompassing seven major, 21 minor and 18 exotic pairs. These are traded at a precision of up to five digits for selected pairs, while a minimum trade size of 0.01 lots is required across all assets.

Commodity CFDs

Moneta Markets supports a total of 17 commodities instruments, including precious metals, energies and soft commodities.

The brokerage shows its Australian roots by offering gold and silver spot-price CFDs in both AUD and USD. CME copper futures round out the precious metals markets. The minimum trading volume stands at 0.01 lots.

Seven oil and fuel variants, such as UK Brent Oil and natural gas, on top of five soft commodities markets, including coffee and cocoa futures, provide clients with ample commodities trading options. Minimum volume ranges from 0.01 lots to 0.1 lots depending on the specific asset.

Index CFDs

Speculating with index CFDs is a popular way to bet on the overall health of an economy or market sector. Moneta Markets provides more than 23 index instruments, with spot and futures variants of the world’s most prominent indices, such as the FTSE 100 and S&P 500. Minimum trade volume ranges from 0.01 lots for the India 50 up to 50 lots for the Nikkei 225.

Share CFDs

Over 135 of the world’s leading corporations are available as CFDs, with shares from major exchanges in Europe, the UK and US all provided. Companies on offer span various sectors, including fuel, tech and banking, although some may be disappointed by the lack of ETF assets. Minimum trading volume is one full lot, while all assets are tracked to two decimal digits.

Crypto CFDs

Six of the most popular cryptocurrencies are provided for speculation as CFDs: Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Ripple (XRP), Dash (DASH) and Litecoin (LTC).

While UK based traders are banned from crypto derivatives by the FCA, VFSC regulation does not prohibit this type of trading.

Trading Platforms

Moneta Markets licences two trading platforms for client use: ProTrader and MetaTrader 4. The broker ensures that every trader is accommodated by supporting web trading, mobile app and standalone program platforms.

Pro Trader

The first Moneta Markets platform is the Pro Trader web-based system. Powered by reliable TradingView architecture, Pro Trader provides access to 300+ CFD products, with a strong focus on charting tools and indicators. In addition, the order module is complete with advanced features like preset stop loss and take profit levels, while recent asset news and analysis is also displayed.

Pro Trader Platform

In addition to its trading capabilities, this easy to use platform features integrated account management tools, allowing clients to monitor P/L, deposit funds and withdraw profits, all from one place.

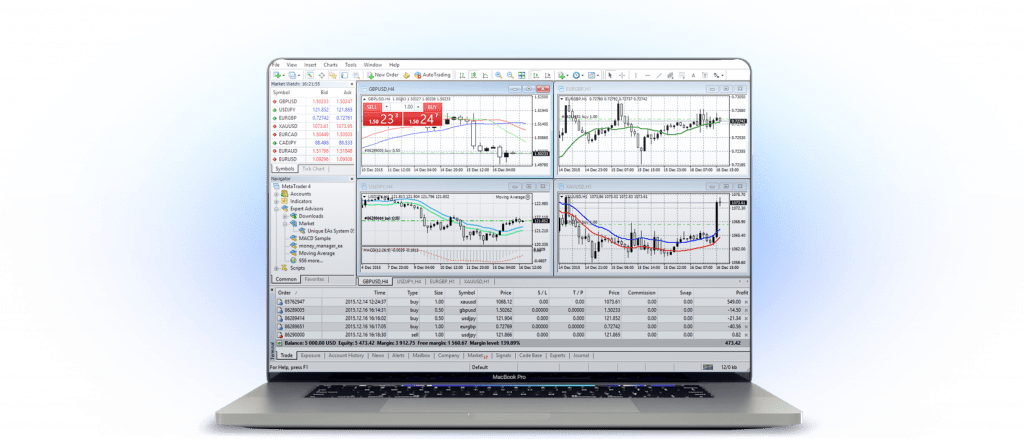

MetaTrader 4

Experienced traders will likely be familiar with the MetaTrader 4 (MT4) platform as a staple in the forex and CFD trading sphere. Popular with traders, investors and brokers alike, MT4 has been the go-to platform for many for over 15 years.

MetaTrader 4 Platform

MetaTrader 4 is perfect for the advanced trader, with ultrafast execution speeds of as little as 1 ms, ensuring that users never miss an opportunity. Moreover, user-designed indicators and expert advisors (EAs) are easy to integrate via the well-populated MQL4 marketplace. Available to download for Windows, Mac and Linux, this platform also boasts impressive accessibility.

Mobile Apps

A solid mobile app offering is becoming more and more crucial to a brokerage and Moneta Markets has several options for completing deals on the go. While a proprietary application is available for Android and iOS, clients would be well advised to pick the tried-and-tested MT4 mobile app. Many complaints about the Moneta Markets app are posted online, with crucial issues cited regarding signing in and trade placement.

Leverage

Moneta Markets offers class-leading leverage rates of up to 1:500 for all retail clients. The brokerage is not regulated by the FCA, allowing it the capacity to provide ratios far above the limits imposed on UK and EU brokers.

The highest level is available on most major forex pairs and several notable minor swaps, though some minor and exotic pairs are capped at levels as low as 1:10. 1:500 is also supported for index CFDs based on futures, while cash indices are limited to 1:333.

European and UK share CFDs can be leveraged for up to 1:20, while US companies support 1:33.

For commodities, leverage rates are capped at 1:500 for gold, 1:100 for silver and 1:30 for copper. Soft commodities can be traded with 1:50, while energies are limited to 1:333.

Moneta Markets does not offer margin trading on its crypto-based CFDs.

Account Types

Different speculative styles may rely on either zero commission or tight spreads and Moneta Markets offers both STP and ECN routing methods to empower clients to choose between the two.

The direct STP account harnesses direct access to the interbank market for fast deals, best for those that favour zero-commission trading. However, the payoff is that the spread is marked up by the broker. For these accounts, spreads start at 1.2 pips. With a minimum deposit amount of $50, low-net-worth traders may want to consider the advantages of an STP account.

ECN accounts boast spreads that start at 0.0 pips on leading assets, with the network automatically finding traders the best deals from a range of liquidity providers. This account is marketed towards scalpers, high-volume traders and expert advisor users due to its raw spreads. Moneta Markets charges a $3 commission per lot per side for ECN trades, while a $200 minimum deposit is required.

Demo Account

Paper trading with a demo account is an excellent way to practise investing in unfamiliar markets, hone new strategies and discover new platforms. Moneta provides a risk-free demo account that is compatible with both the MetaTrader 4 and Pro Trader platforms. Clients can use this account for up to 30 days from its initial creation.

Swap-Free Accounts

Moneta Markets offers a swap-free account for clients whose religious beliefs prohibit interest payments. Instead of paying overnight interest charges, a daily administration fee is levied on a traders’ account balance.

Additional Features

Moneta offers several extra account features to offer its clients additional advantages. For example, those with over $2,000 in account funds gain unrestricted access to the Duplitrade copy trading system. This facility provides a range of options for copy trading across several trading strategies, markets and risk tolerance levels.

Moreover, clients with more than five forex lots of volume per month can utilise free VPS hosting from HokoCloud. As the forex markets trade 24/5, a VPS ensures that traders never miss an opportunity via round-the-clock automated orders.

Fees

Moneta Markets ensures that clients are under no pressure to trade or maintain certain capital levels by not levying account opening or maintenance fees across all its accounts.

Specific swap fees for overnight CFD and forex positions will vary from asset to asset. However, you can ensure you understand these charges by previewing them at any time within the MetaTrader 4 platform.

Payment Methods

Managing the liquidity of a brokerage account quickly and securely is a priority for many prospective traders. A solid range of reputable transaction methods is key for this, whatever the platform. Additionally, as trading often has fine margins, many are averse to paying fees on deposits and withdrawals.

Moneta Markets supports deposits through wire transfer, credit and debit cards, FasaPay, JCB and Sticpay. Payments are entirely free and can be made in GBP, USD, EUR, AUD, JPY, CAD and NZD. Wire transfers take 2-5 business days to clear, while all other deposits are instant.

Withdrawals are available through all the same methods, though international wire transfers are subject to a £20/$20 minimum withdrawal fee. Processing times can be up to one business day for most of these payment methods, though this will be slightly longer for wire transfers.

Security & Regulation

Many brokers recognise the importance of keeping client funds and information safe and employ significant security measures. For example, Moneta Markets provides its clients with negative balance protection, an important feature when trading highly leveraged CFDs. Furthermore, its platforms use high-level encryption to ensure data security, though two-factor authentication (2FA) support is notably absent.

While Moneta Markets is licensed as a subsidiary of Vantage Global Limited by the VFSC, this regulator lacks the reputability of alternatives such as the FCA or ASIC. While less stringent regulation means that UK traders can use greater leverage, redeem deposit bonuses and trade crypto CFDs, the trade-off is the lack of client fund protection schemes and guaranteed broker reputability.

Advantages

- Leverage

- Asset range

- Copy trading

- Demo trading

- No account fees

- Deposit bonuses

- STP & ECN support

Disadvantages

- No ETFs

- CFDs only

- Weak regulation

- High STP spreads

- Limited payment options

Customer Support

The best brokers provide a range of support options to suit every client. To this end, Moneta Markets offers several lines of communication for queries and complaints. The award-winning support staff are helpful, friendly and available at any time during the forex and CFD markets’ 24/5 opening hours. Clients can reach help through email, a UK and international telephone contact number and a live chat feature.

- Email Address: support@monetamarkets.com

- Phone No.: +44 (113) 3204 819

Educational Content

Clients with over $500 in account funds gain complimentary access to the Moneta Markets Masters course, which covers over 100 advanced trading tutorials. With videos on trading fundamentals, technical analysis and various techniques, this course provides clients with a solid foundation upon which to build real investment experience.

Deals & Promotions

Moneta Markets offers two bonus offers for both first time and subsequent deposits:

Initially, the broker will match up to a $1,000 deposit with 50% bonus funds. A further 10% of any initial deposit exceeding $1,000 is matched, up to a total bonus of $20,000.

After this offer, all subsequent deposits over $500 are eligible for a 10% bonus up to $20,000.

These types of deposit promos are known as lock-ins, as losses are deducted from real funds before bonus credits. Before opting into these bonus offers, clients should carefully read each promotion’s terms and conditions to prevent withdrawal issues regarding wagering requirements.

Trading Hours

Moneta Markets trading hours run 24/5, parallel with the forex market opening times. While specific markets, such as indices and shares, trade according to their local exchange opening times, CFD contracts on other instruments can be purchased and sold at any time throughout the working week.

Clients can review their account history and carry out deposit and withdrawal transactions on the platforms at any time.

Moneta Markets Verdict

Moneta Markets provides comprehensive forex and CFD speculation to traders and investors worldwide, with a 50% deposit bonus and high leverage capacity available to all clients. Moreover, ECN and STP account offerings allow clients to pick between tight spreads and zero commission trading, while copy and demo trading are also welcome features. However, despite the positive reputation of Moneta Markets’ owner Vantage Group and its VFSC licence, some may not be willing to forgo the more robust protection offered by a reputable regulator like the FCA.

FAQ

Does Moneta Markets Have Any Bonus Offers?

Initial deposits into Moneta Markets accounts are matched at 50% for up to $1,000 and 10% further up to a maximum $20,000 bonus. In addition, traders receive a 10% bonus on all subsequent deposits.

Is Moneta Markets Safe?

While Moneta Markets prioritises the security of its clients’ information and funds, traders seeking the safest platforms may opt for an FCA-regulated broker or one that offers 2FA, instead.

Does Moneta Markets Charge Commission?

While the Moneta Markets STP account is commission-free, fees for the ECN account are $3 per lot per side: $6 per round turn lot.

What Trading Platforms Does Moneta Markets Use?

Clients can choose between Moneta Markets Pro Trader, which runs on TradingView architecture, or MetaTrader 4. Both platforms feature mobile variants, though Pro Trader has more user complaints.

What Are The Moneta Markets Account Types?

Moneta Markets offers an STP account for zero commission trading and an ECN account for tight spreads. These accounts are available in swap-free variants and a 30-day demo account is also provided.

Top 3 Moneta Markets Alternatives

These brokers are the most similar to Moneta Markets:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Moneta Markets Feature Comparison

| Moneta Markets | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 4.4 | 4.8 | 4.8 | 4.7 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $50 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, FSCA, FSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | - | MT4 |

| Leverage | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

70% of retail CFD accounts lose money. |

||

| Review | Moneta Markets Review |

Pepperstone Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Moneta Markets | Pepperstone | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | No | No | No |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Moneta Markets vs Other Brokers

Compare Moneta Markets with any other broker by selecting the other broker below.

Popular Moneta Markets comparisons: