MogaFX Review 2025

|

|

MogaFX is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to MogaFX |

| MogaFX Facts & Figures |

|---|

MogaFX is a multi-asset broker regulated in Australia and St Vincent and the Grenadines. The broker offers leverage up to 1:500 on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The 6 account types are mainly aimed at experienced traders, with minimum deposits starting from $1000. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Indices, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $1000 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, SVGFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | MogaFX offers a very narrow line-up of assets, covering only 50+ CFDs. However, it is good to see a strong range of trading tools alongside the MetaTrader terminals, including Autochartist analysis, an economic calendar and a forex heatmap powered by TradingView. |

| Leverage | 1:500 |

| FTSE Spread | From 2.5 Pips (Standard) |

| GBPUSD Spread | From 2.5 Pips (Standard) |

| Oil Spread | From 2.5 Pips (Standard) |

| Stocks Spread | NA |

| Forex | I found the broker’s 35+ currency pairs a little underwhelming, though not the smallest range I have seen. Raw spreads from 0.0 pips are accessible, but only with a minimum deposit of $10000. Otherwise, a minimum deposit of $1000 will only get you disappointingly wide spreads from 2.5 pips. That said, experienced traders will appreciate the high leverage up to 1:500. |

| GBPUSD Spread | 2.8 Pips (Standard) |

| EURUSD Spread | 2.6 Pips (Standard) |

| GBPEUR Spread | 2.9 Pips (Standard) |

| Assets | 38 |

| Stocks | I was disappointed to find only a small range of stock indices available to trade at MogaFX, so traders won’t find many opportunities to diversify their portfolios. That said, it’s reassuring to see the MT4 and MT5 platforms available, allowing traders to explore various strategies and tools. |

| Cryptocurrency | MogaFX only offers a handful of crypto assets but it’s good to see that Bitcoin deposits and withdrawals are permitted with fast processing times. On the negative side, anyone looking to practise their crypto strategies in the demo will only be able to do so for 30 days. |

| Coins |

|

| Spreads | From 2.5 Pips (Standard) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

MogaFX is an online CFD broker offering powerful platforms and six different account types. The firm consists of both an Australian and international entity, providing a range of trading services accessible to UK investors. This review will explore whether MogaFX is worth signing up with, covering the assets offered, accounts available, deposit and withdrawal methods, trading tools, fees and more.

Our Take

- MogaFX offers three leading platforms and apps; MetaTrader 4, MetaTrader 5 and cTrader

- The choice of account types will suit various trading strategies, especially day trading

- The minimum deposit with the entry account is higher than most alternatives at £800

- The broker is not regulated by the UK’s FCA, reducing its safety score for British traders

Market Access

MogaFX’s international branch offers over 60 different instruments to UK traders, including forex, indices and commodities. Available instruments include:

- Metal CFDs – gold and silver spot products pegged against the US Dollar

- Energy CFDs – US (WTI) and UK (Brent) crude oil assets pegged against the US Dollar

- Index CFDs – 11 indices from all over the world, including the FTSE 100, S&P 500, Euro 50 and Dow Jones

- Forex – 44 major, minor and exotic pairs, including GBP/USD, EUR/NOK and USD/TRY

However, this is a fairly short list vs alternatives like Pepperstone and XTB, which offer thousands of instruments. The key asset class missing for us is stocks and shares.

On the positive side, many of the most popular forex pairs and indices are available, so those without the capital nor desire for great levels of diversification may find what they need.

Fees

MogaFX has many free or low-cost payment methods, and zero account fees. However, the firm’s trading fees aren’t the most competitive.

Commission and spreads vary by account type, with the lowest spreads offered by the ECN and Raw-Spread accounts, starting at 0.0 pips. The Standard account’s spreads start from 2.5 pips, while both the VIP and M1 accounts have spreads starting from 1.5 pips. The widest spreads are found in the swap-free account, starting from 2.8 pips.

Only the ECN and Raw-Spread account types charge a commission per trade (£6), all other accounts have zero commission charges.

In general, we found the spreads for the Standard and VIP accounts are higher than the regular and premium account types of many similar brokers, making this broker relatively expensive.

MogaFX Accounts

Six different account types are offered by MogaFX, each available as an individual, joint or corporate account.

We appreciated the varied account solutions. Investors have the choice to go for zero commission trading with higher spreads or very tight spreads but by paying commissions.

An Islamic swap-free account is also a welcome sight for Muslim traders. However, it is worth noting the very high minimum deposits required for each of the account types. Even the Standard account requires an £800 deposit, making this much less accessible to newer traders.

Our team have pulled out the key differences between the profiles below:

Standard

- Leverage up to 1:500

- Spreads from 2.5 pips

- Minimum deposit of £800

- Standard lot size of 100,000

- Minimum position size of 0.01 lots

VIP

- Leverage up to 1:500

- Spreads from 1.5 pips

- Standard lot size of 100,000

- Minimum deposit of £8,000

- Minimum position size of 0.01 lots

ECN

- Leverage up to 1:500

- Spreads from 0.0 pips

- Standard lot size of 100,000

- Minimum deposit of £40,000

- Minimum position size of 0.01 lots

Raw-Spread

- Leverage up to 1:500

- Spreads from 0.0 pips

- Standard lot size of 100,000

- Minimum deposit of £8,000

- Minimum position size of 0.01 lots

M1

- Leverage up to 1:500

- Spreads from 1.5 pips

- Standard lot size of 100,000

- Minimum deposit of £8,000

- Minimum position size of 0.01 lots

Islamic Swap-Free

- Leverage up to 1:100

- Spreads from 2.8 pips

- Standard lot size of 100,000

- Minimum deposit of £4,000

- Minimum position size of 0.01 lots

Funding Methods

We were impressed by MogaFX’s wide range of payment methods available to UK investors. These include bank wire transfers, Perfect Money, Fasapay, crypto tokens, GCPAY, B2Bin PAY, Sticpay, Skrill and Neteller. Deposits and withdrawals are also paid fairly quickly, while charges are reasonable or zero.

Bank Wire Transfers

- Free deposits

- £32 per withdrawal

- Deposits processed in 1-3 business days

- Withdrawals processed in 3-5 business days

Perfect Money

- Free deposits

- £32 per withdrawal

- Deposits processed in one business day

- Withdrawals processed in 3-5 business days

Fasapay

- Free deposits

- Free withdrawals

- Deposits processed instantly

- Withdrawals processed in 3-5 business days

CoinPayments (BTC, USDT-OMNI, USDT.ERC20)

- 0.5% deposit fee

- £8 per withdrawal + crypto gas fee

- Deposits processed within 30 minutes

- Withdrawals processed in 3-5 business days

GCPAY

- Free deposits

- Variable withdrawal fees

- Deposits processed instantly

- Withdrawals processed in 3-5 business days

B2Bin PAY (BTC)

- £8 withdrawal fee

- 1% deposit fee < 1 lot

- Deposits processed within 30 minutes

- Withdrawals processed in 3-5 business days

B2Bin PAY (USDT-OMNI & ETH)

- £8 withdrawal fee

- £81 minimum deposit

- £8 deposit fee < £200, 1% < 1 lot

- Deposits processed within 30 minutes

- Withdrawals processed in 3-5 business days

Sticpay

- Variable deposit fee

- Variable withdrawal fee

- Deposits processed within five business days

- Withdrawals processed within five business days

Skrill

- 1% withdrawal fee

- Variable deposit fee

- Deposits processed instantly

- No deposit surcharge from the UK

- No withdrawal surcharge from the UK

- Withdrawals processed in 3-5 business days

Neteller

- 1% withdrawal fee

- Variable deposit fee

- Deposits processed instantly

- No deposit surcharge from the UK

- No withdrawal surcharge from the UK

- Withdrawals processed in 3-5 business days

Overall, we are pleased by the number of payment methods available, and how low-cost most of them are. However, we do think that the inclusion of debit/credit card transfers would have been welcome as this is a standard method for many other brokers.

UK Regulation

The different Moga entities are each regulated or registered by different financial regulators.

MOGA AU is regulated by the Australian Securities and Investments Commission (ASIC), while MOGA NZL is licensed by the FSP of New Zealand under licence number FSP1002414. MOGA SV is registered with Saint Vincent and the Grenadines’ Financial Services Authority (FSA) under company number FSA:532LLC2020 and is regulated by the Mwali International Services Authority with license number T2023187.

Importantly MOGA SV is the entity that upholds international traders, such as those from the UK, and is thus the entity that our review focuses on. MOGA SV is not strongly regulated, with oversight coming from MISA and licensing under the SV FSA, neither of which are stringent regulators. Weak regulation ultimately means that UK investors may not be properly protected from financial foul play, insolvency or fraud.

Our experts generally recommend investors trade with highly-regulated brokers like those regulated by the UK’s own FCA. These ensure that brokers segregate client funds from their own, implement a non-negative balance system and provide access to a compensation scheme (like the FSCS).

Trading Platforms

MogaFX offers three different trading platforms, MetaTrader 4, MetaTrader 5 and cTrader. This is a great selection of sophisticated and customisable trading platforms that covers the bases from beginner to expert traders.

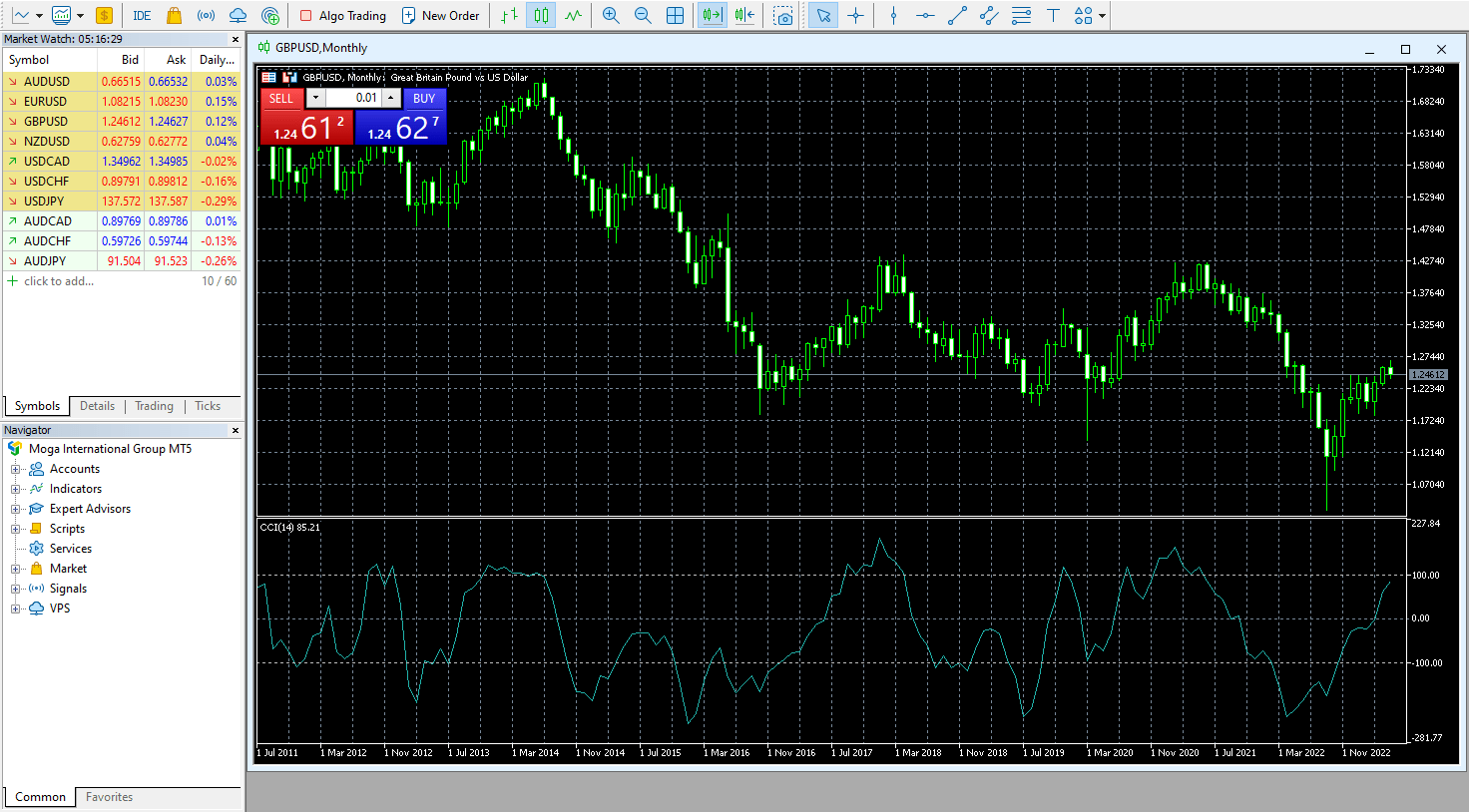

MetaTrader 4

MetaTrader 4 (MT4) is one of the most popular online trading platforms out there. We have long touted the platform to be sophisticated, with many built-in indicators that are fully customisable, as well as access to complex plug-ins and tools written in the bespoke MQL4 programming language. This customisability allows traders to integrate more complex indicators, helping to build more specialised investing strategies.

However, there are plenty of built-in features that newer traders can use from the get-go. These include:

- Nine timeframes

- One-click trading

- 31 graphical objects

- Hedging capabilities

- 30 technical indicators

- Four pending order types

- MQL4 programming language

- Expert advisor (EA) automated trading

MetaTrader 5

MetaTrader 5 (MT5) is the latest MetaTrader platform released by MetaQuotes. It is also a highly popular trading platform, with several notable upgrades over MT4. The platform has a very similar look and feel to its predecessor but comes with more features straight out of the box.

MT5 has more indicators, graphical objects, timeframes, order types, extra features and strategy support than MT4. It also facilitates expert advisors via the improved MQL5 language. It is our pick for experienced traders.

Our top features include:

- Sleek design

- 21 timeframes

- One-click trading

- Economic calendar

- 44 graphical objects

- 38 technical indicators

- Six pending order types

- MQL5 programming language

- Hedging & netting capabilities

- Expert advisor (EA) automated trading

MetaTrader 5

Both MetaTrader platforms can be accessed via a desktop application, browser web trader and both Apple (iOS) and Android (APK) mobile devices.

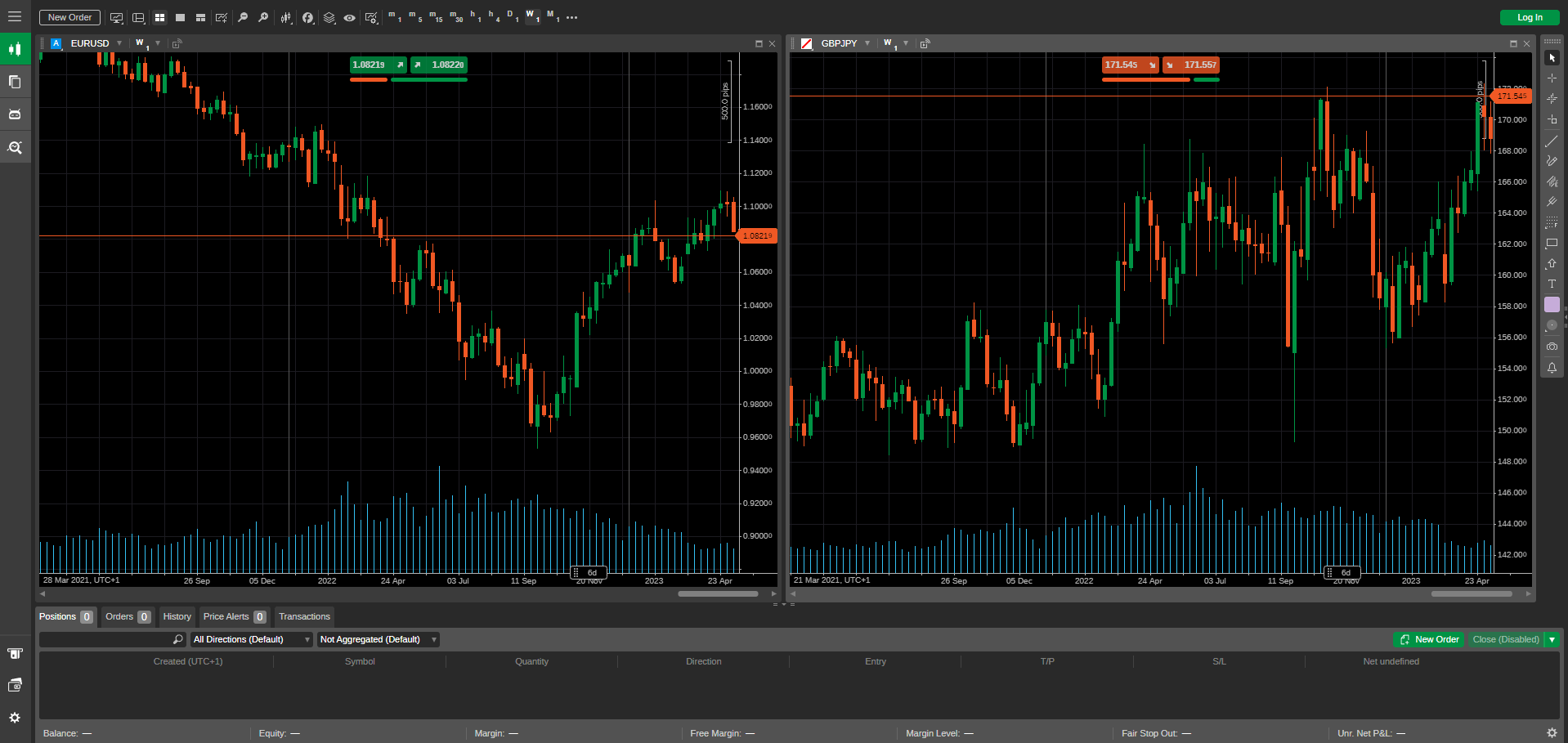

cTrader

cTrader is a feature-rich online platform built to provide efficient, transparent order executions. The modern, intuitive interface makes this a great platform for newer traders, while the huge amount of customisability also entices experienced traders.

The tools we found particularly useful include:

- 6 zoom levels

- 54 timeframes

- Over 70 technical indicators

- Copy trading via cTrader Copy

- Automated trading via cTrader Automate

- Level 2 depth of market data

- C# programming language

cTrader is ultimately a highly flexible platform that comes with a vast array of tools straight out of the box. The platform can also be accessed on mobile devices through the Apple and Android app stores.

cTrader

Overall, we are impressed by the quality of all three platforms provided by MogaFX, each providing value for newer and experienced traders. In this aspect, MogaFX matches or betters many competitors.

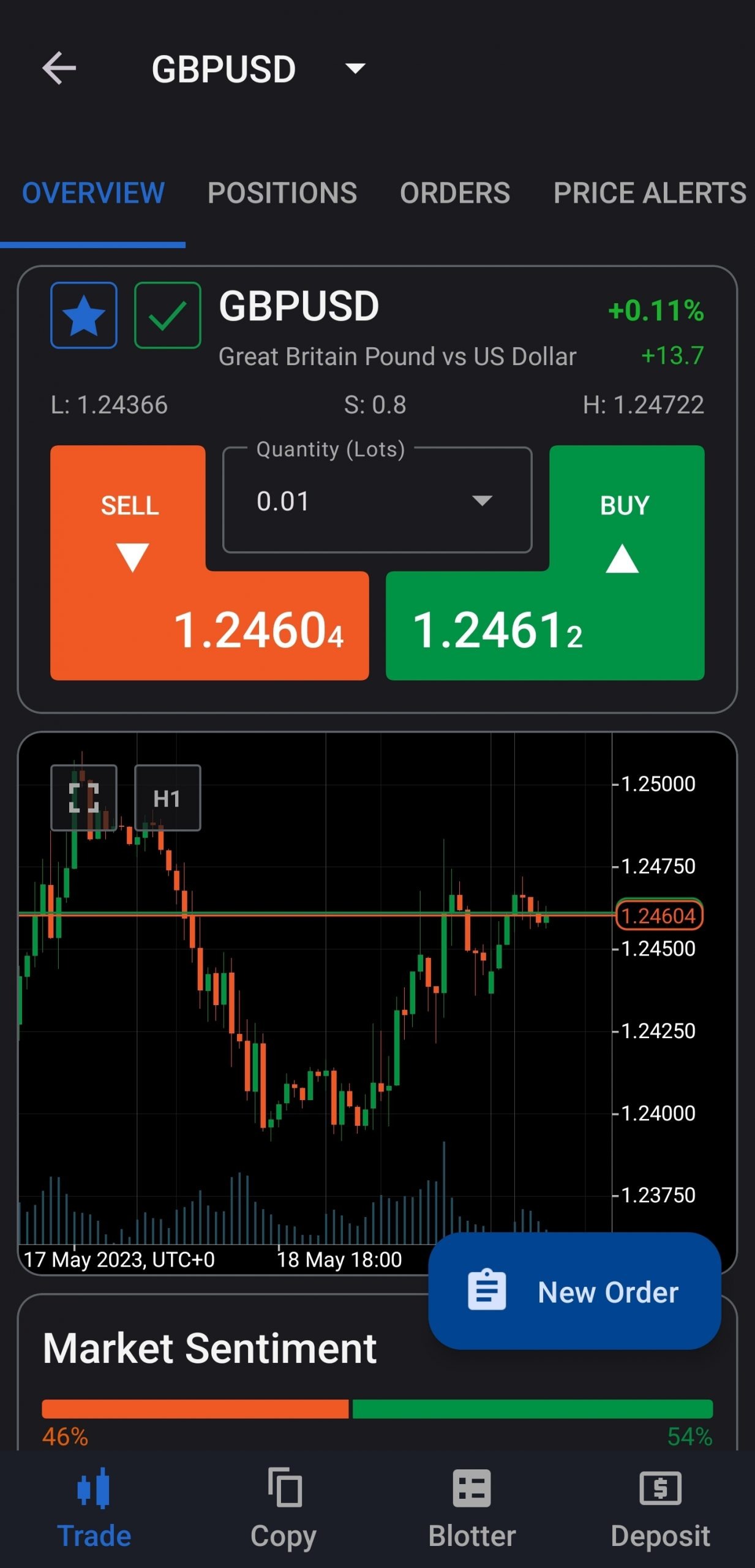

Mobile App

All three trading platforms offered by MogaFX have iOS and Android mobile applications available for download. These platforms provide users with the ability to monitor assets and place orders on the go.

All three mobile apps have sleek designs with ease of use in mind, though some advanced features like algorithm development cannot be accessed on a mobile device.

cTrader Mobile

Leverage

We were quite impressed with the leverage opportunities provided by MogaFX. Clients can access levels of up to 1:500 on all accounts, except the Islamic Swap-Fre Account, which is limited to 1:100.

Those accounts that can access higher leverage rates can do so in steps, with levels of 1:100, 1:200, 1:400 and 1:500 on offer. However, our recommendation is to implement stop loss and take profit levels if trading with high leverage – these can help protect against large losses.

Demo Account

To help choose which MogaFX trading platform to use, you can practise investing using a demo account.

We were impressed to see that the broker offers demo accounts for all three of its platforms, allowing users to trial each toolset before investing any capital. It is also a great way to test new strategies before implementing them in your live account.

How To Open A Demo Account

It only took me a few minutes to sign up for a demo account on each platform. To do so:

MetaTrader 4/5

- Go to the MogaFX website

- Scroll down and click on the Try Demo button

- Input the details requested (name, email, phone number, etc.)

- Click Submit

- Your account details will then be given to you via email

- Download the chosen platform

- Input your account details to login

- Get practising

cTrader

- Go to the MogaFX website

- Click the Platforms & Tools tab and choose your chosen cTrader platform (Desktop or Web)

- Clicking the Desktop option will automatically download cTrader to your computer

- Install the application and login to automatically open a demo account

- Clicking the Web option will redirect you to a cTrader demo account

- Get practising

MogaFX Bonuses

MogaFX offers several bonuses and rewards to existing and prospective investors, shown in the Promotions tab of its website. Here, you can find details on all current promotions, such as the account opening bonus of £40, the summertime cashback bonus and the daily settlement bonus.

Importantly, different account types have access to different bonuses and the deals change and expire over time. We also recommend checking bonus terms and conditions as we found hefty volume requirements with some offers that can make it hard to get your hands on bonus credit.

Extra Tools & Features

MogaFX has an impressive education tab that covers a wide range of topics for both new and experienced traders. All investors have access to a glossary, economic calendar, account opening guide, blog, basic trading guide and the MogaFX Education Series. This series is a structured course designed to help new traders learn how to successfully speculate on the financial markets.

Topics include explanations of currency pairs, quantitative easing, slippage and leverage, alongside more advanced topics like supports and resistances and Elliot Wave theory. Each of these topics is presented through an online & YouTube video a couple of minutes long and provides a brief explanation of the topic at hand.

The Autochartist tool is also offered to those who have deposited £4,000 or more and it was our favourite extra while using MogaFX. This tool is a plugin for MT4 and MT5 that provides you with a host of additional trading tools and features. These include a customisable technical analysis solution with trading suggestions, multiple-market monitoring, sector reports and auto analysis.

Overall, the tools and features offered by the broker are very good, though we think there is room to improve. The educational materials are sufficient for new traders to learn the basics of online trading and expose them to the higher-level technical side, though it does not cover everything. Experienced traders in particular may feel hard done by.

Company Background

MogaFX is an international CFD broker with its main office locations based in Sydney, Australia and Saint Vincent & the Grenadines.

The firm was founded in 2018 with the goal of providing transparent, reliable and high-quality trading services to investors. The Moga group has since established three major entities in Australia, New Zealand and globally.

The broker is regulated in Saint Vincent and the Grenadines for all international clients, including traders from the UK.

Customer Service

MogaFX customer support can be contacted 24/7 in several different ways, outside of liaising with your appointed account manager. These are via email and phone contact number. Alternatively, you can make use of the live chat function on the broker’s website, found on the right side of every page.

- Email: service@mogainternational.com

- Phone: +61 291379799

We were disappointed by the lack of international contact methods for British traders. Many brokers offer contact enquiry forms and callback requests.

Security

MogaFX, while regulated by a less-stringent authority, must still abide by regulations regarding capital holdings, risk management procedures, staff training, auditing and accounting.

We were also impressed to see that the broker ensures negative balance protection is in place for its clients, stopping leveraged positions from creating large amounts of debt.

Trading Hours

The opening hours vary for each asset class on offer. Instruments will be available as long as the underlying market is open.

For example, the FTSE 100 is available when the London Stock Exchange (LSE) is open, while forex instruments are available 24/5, given their international nature.

Should You Trade With MogaFX?

MogaFX is an online broker that offers a good range of account options, three powerful trading platforms, free demo accounts, a vast array of payment methods and generally low fees.

However, the broker is let down by its poor regulation, a limited number of assets and high account deposits. This combination is a major setback for newer investors looking to try out trading with smaller amounts or on a more casual basis.

FAQ

Is MogaFX Trustworthy?

MogaFX is a MISA-regulated broker available to all clients not from Australia, including the UK. MISA is one of the weaker regulators, with few rules in place and a limited focus on protecting retail investors vs the FCA. As a result, MogaFX does not get a high trust and safety score from our experts.

Does MogaFX Offer Good Trading Platforms?

MogaFX offers access to three popular trading platforms, MT4, MT5 and cTrader. All are reliable and versatile toolsets that are popular amongst beginners and experienced traders. You can download these from the MogaFX website.

Is MogaFX A Legit Forex Broker For UK Investors?

MogaFX is a mixed bag, with quite low fees, high leverage rates and an impressive range of accounts, balanced out by limited assets, weak regulation and high minimum deposit levels.

To ensure greater levels of security from the risks of online scams, a UK-based brokerage that is regulated by the Financial Conduct Authority is the safest bet.

Does MogaFX Have Deposit Bonuses?

MogaFX offers many types of bonuses that change and update regularly. Notably, there is a deposit bonus, summer cashback bonus and a daily settlement promotion on offer.

Can UK Traders Trade With MogaFX?

UK traders are unable to trade with MogaFX’s Australian branch but can open an account with the Moga International entity. Beware, this firm is weakly regulated. We recommend considering a brokerage regulated by the UK’s FCA for maximum protection.

What Accounts Does MogaFX Offer?

There are six account types available, Standard, VIP, ECN, Raw-Spreads, M1 and Swap-Free. Each account can be opened as an individual, joint or corporate account. The Standard account is the best pick for beginners, though the starting deposit is £800.

Article Sources

MogaFX SV FSA Licence (Registration Number 532)

Top 3 MogaFX Alternatives

These brokers are the most similar to MogaFX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

MogaFX Feature Comparison

| MogaFX | Pepperstone | FP Markets | Swissquote | |

|---|---|---|---|---|

| Rating | 2.5 | 4.8 | 4 | 4 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Minimum Deposit | $1000 | $0 | $40 | $1,000 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, SVGFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | MogaFX Review |

Pepperstone Review |

FP Markets Review |

Swissquote Review |

Trading Instruments Comparison

| MogaFX | Pepperstone | FP Markets | Swissquote | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

MogaFX vs Other Brokers

Compare MogaFX with any other broker by selecting the other broker below.