MCC Markets Review 2025

|

|

MCC Markets is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to MCC Markets |

| MCC Markets Facts & Figures |

|---|

MCC Markets is an offshore broker that offers high leverage and customized trading. |

| Pros |

|

|---|---|

| Instruments | CFDs, Forex, Indices, Metals, Energies |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Go long or short on global markets with leveraged CFDs. |

| Leverage | 1:500 |

| FTSE Spread | Floating |

| GBPUSD Spread | Floating |

| Oil Spread | Floating |

| Stocks Spread | NA |

| Forex | Speculate on a wide range of currency pairs with tight spreads. |

| GBPUSD Spread | Floating |

| EURUSD Spread | Floating |

| GBPEUR Spread | Floating |

| Assets | 40+ |

| Stocks | Trade eight global indices with no commissions. |

MCC Markets is an offshore forex and CFD broker that offers UK investors high leverage, ECN and STP execution options and a copy trading service. In this review, our experts take a close look at the broker’s credentials, analysing its trading conditions, product availability, security, trading hours and more. We also give our verdict on trading with MCC Markets.

Our Take

- Whether the brokers’ SCB licence has expired or the broker’s claim to be authorised is fraudulent is not clear. However, there is no record of the broker holding an active licence with the regulator.

- Despite the broker’s supposed support for credit cards, debit cards and several e-wallet solutions, UK investors have only one option for funding their account, which is through Tether (USDT) transfer.

- With limited support for energies and metals and soft commodities and stocks entirely absent, there are many better alternatives for CFD traders.

- The lack of encryption of passwords on the broker’s main login portal is worrying and, along with the widespread inaccuracies on its website, hints at a non-secure brokerage service.

Market Access

MCC Markets specialises in forex trading but also offers several global indices CFDs, metals CFDs and energy futures CFDs.

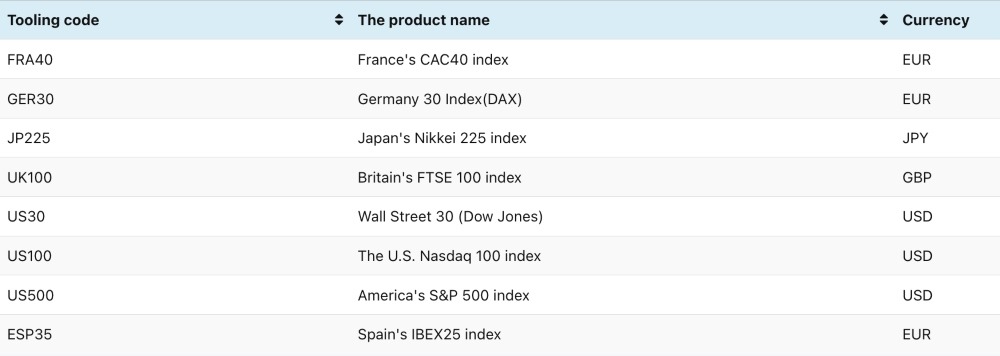

With a total of 42 forex products, spanning major, cross and minor pairs, MCC Markets offers a reasonable range of currency pairs to investors. Likewise, with eight global indices, including the FTSE 100, S&P 500, and Nikkei 225, index traders will likely be satisfied.

However, with only three metals products, three energies CFDs and no soft commodities, MCC Markets lacks market depth for commodity traders. UK brokers like CMC Markets offer a much better suite of commodities.

Furthermore, there are no stocks CFDs or direct share dealing available. So the broker isn’t a good pick for traders interested in stocks. Again, CMC Markets is a better pick here.

Fees & Commissions

MCC Markets operates a commission-free model for its STP execution-type accounts, with the broker’s cut taken through additional spreads.

Our experts found that traders who favour an ECN model are charged a highly competitive £1.60 per lot per side commission in the ECN account, while investors with the capital to qualify for a VIP account have this commission waived entirely.

MCC Markets is not upfront about any inactivity fees, so sporadic traders should look elsewhere.

Accounts

We thought that MCC Markets offers a solid range of accounts, catering to investors with all levels of capital and offering both STP and ECN execution types.

Unfortunately, the broker does not offer a Sharia-compliant Islamic account, though traders can open a demo account to trial the broker’s trading conditions before committing to a full account.

STD Account

The STD account is MCC Markets’ entry-level account offering, with just a £40 minimum deposit required to open. This will appeal to beginners.

The STD account uses the STP execution type to offer zero-commission trading. Traders benefit from leverage of up to 1:500, trades of up to 100 lots and access to the SoFinX copy trading platform.

STP Account

For tighter spreads, traders can opt for an STP account.

However, a far more substantial £1,600 minimum deposit is required to open this account, and other than the tighter spreads, the trading conditions are the same as the STD account.

ECN Account

The first of the two ECN execution-type accounts is MCC Markets’ ECN account.

With a minimum deposit of £4,000 or more, traders can access yet tighter spreads on forex, indices, metals and energies products in exchange for a competitive £1.60 per lot per side commission.

Maximum leverage is reduced to 1:100, though all other trading conditions remain the same.

VIP Account

The highest tier of account available from MCC Markets is the VIP account.

Using the ECN execution type, this account offers tight spreads in addition to zero commission trading for low-fee forex trading.

However, the maximum leverage is 1:100 and traders must stump up a £16,200 minimum deposit to open a VIP account.

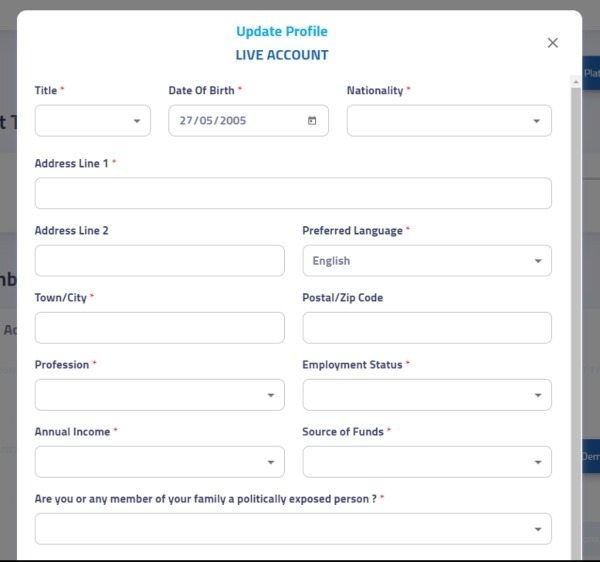

How To Open An MCC Markets Account

I didn’t have any issues registering for a real account.

To create an account, click the “Register” button in the top banner of the MCC Markets website. Enter your name, location, email and a unique password to register your login details.

You will be redirected to the client portal, where you can choose between a live or demo account.

Live Account

To open a live account, traders must provide additional details, including an address and professional status.

Once this step is complete, you are free to open any of the four available trading accounts, make an initial deposit and start trading.

Demo Account

To open a demo account, none of these details are required. Simply choose your account leverage, an initial balance and enter a password and you are ready to trial the broker’s trading conditions with paper funds.

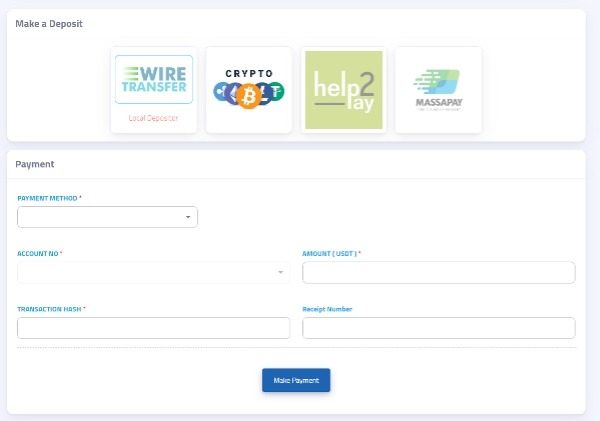

Funding Methods

Despite the broker’s claim that a good range of funding methods are available to UK traders, when we used MCC Markets we discovered that many of the advertised methods were unsupported.

MCC Markets claims that traders can deposit and withdraw funds using Mastercard and Visa credit and debit cards or e-wallets Neteller and Skrill.

However, we found that UK investors were limited to payments using the crypto token Tether (USDT), an unregulated and untraceable form of fund transfer.

Furthermore, before withdrawals are processed, clients must verify their identity with MCC Markets using personal ID documents, which we imagine some clients would be hesitant to proceed with due to the broker’s sketchy overall image.

UK Regulation

While MCC Markets claims to be a regulated broker, licensed by the Securities Commission of the Bahamas (SCB), we found no record of the firm on the SCB’s register.

As a result, we strongly recommend investors avoid MCC Markets as there is no body overseeing the broker’s activities or providing avenues for trading complaints.

While the broker claims to hold investors’ funds in segregated accounts, the amount of misinformation on the firm’s site means that this claim should not be taken as fact.

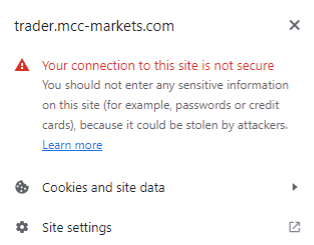

However, this is not the worst security risk on the forex broker’s site. Contrary to the broker’s claim to use “leading data encryption technology”, when pressing the “login” button, clients are taken to an unsecured portal.

Logging in transmits the password across the web in unencrypted plain text – easy for hackers to compromise. This presents a real risk not just to an investor’s account and funds, but to any other accounts on the internet that use the same email and password.

How To Login To MCC Markets Safely

While we recommend you look for a more secure broker, there is a way to login to an MCC Markets account using an encrypted login portal.

Instead of pressing the “login” button on the top banner, click the “register” button next to it. From here, click on “log in” at the top instead of register and you can enter your details through a secure login portal to access your account.

MCC Markets Leverage

We found that MCC Markets is free from the tight margin constraints of FCA-regulated brokers and can offer UK clients leverage of up to 1:500 through its STD and STP accounts, and leverage of up to 1:100 on its ECN and VIP accounts.

Similarly, investors benefit from looser margin call and stop-out requirements than other brokers, with a margin call enacted at 50% and a stop-out enforced at 20% margin.

While these levels allow the potential for greater profits, we want to emphasise that high leverage and looser capital restrictions can also lead to greater losses.

In addition, the lack of negative balance protection can mean that investors can lose more than the credit in their accounts.

Trading Platforms

MCC Markets supports the popular forex trading platform, MetaTrader 5. Traders can also access the forex markets via MetaTrader’s browser-based WebTrader service and the MT5 mobile app for on-the-go investing.

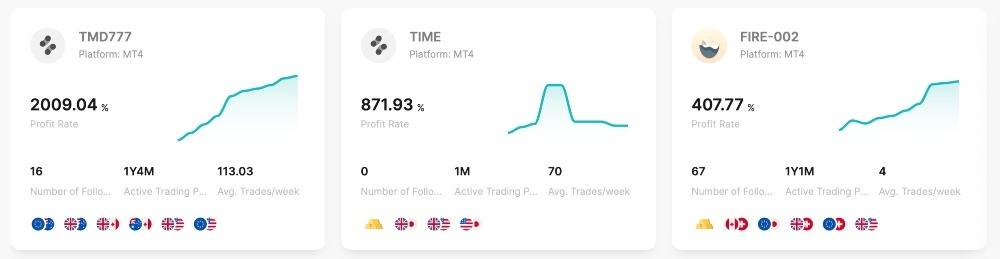

Traders can also access the SoFinX social trading platform where signals and ideas are shared alongside a full copy trading service.

MetaTrader 5

Launched in 2010, MetaTrader 5 offers an updated MQL5 coding language to enable the use of complex expert advisors and custom indicators, while the integrated depth of market data and a built-in economic calendar helps you identify key upcoming events.

A solid collection of 38 standard indicators, 44 graphical objects and 21 timeframes allow for comprehensive technical analysis, and six pending order types help clients execute intricate strategies.

MetaTrader 5 is available to download for Windows, Mac and Linux.

SoFinX

SoFinX is a social and copy trading platform supported by MCC Markets, allowing clients to crowdsource trading ideas and strategies as well as copy the trades of successful investors.

The platform also integrates AI to find signals matching an investor’s preferred market and risk tolerance for enhanced trading.

On the downside, it doesn’t compete with the best copy trading platforms, available at brokers like eToro, which offer a greater range of master traders and better risk management tools.

Customer Service

Traders can contact MCC Markets through several avenues. There is a live chat embedded in the website, an office in the Bahamas, an office in Dubai and several email addresses, including:

- Customer Support email – cs@mcc-markets.com

- General contact email – contact@mcc-markets.com

The broker also provides a blog section with guides on using the MT5 platform and making risk-managed trades. However, this is far from the comprehensive introduction to forex trading that new investors require. We would recommend brokers like AvaTrade for beginner-friendly education.

While using MCC Markets, we also found the chat support unresponsive at times and unhelpful. For instance, they were unable to provide details of the broker’s regulatory status. This is a major drawback for newer traders who may need assistance.

Bonus Deals

Due to its lack of regulation, MCC Markets can offer new clients a lucrative 50% deposit bonus. This welcome offer applies to initial deposits of over £40 and is added as bonus funds – however, no other detail on this promotion is offered by the broker.

We would advise contacting customer support to understand the full details of this offer before claiming this bonus, as there may be restrictive wagering requirements or your bonus funds may be locked together with real capital.

Company Details

MCC Markets, or MCCM, was founded in 2022 by CEO Michael Chen. Based in Dubai, the broker offers CFD trading to investors around the world, including the UK and the firm is marketed to all clients, from day traders to scalpers to beginners.

MCC Markets clients can trade forex and CFDs via MetaTrader 5 or the WebTrader – we rate these platforms highly for their dependability and potential for customisation.

Trading Hours

MCC Markets follows the standard forex opening hours and closing times, running 24/5.

For UK investors, the forex markets open at 10 pm on Sunday and then close at 9 pm on Friday.

Should You Trade With MCC Markets?

Despite some positives such as low commissions, high leverage and a good range of accounts, we do not recommend MCC Markets to online traders.

The broker’s website is plagued by widespread inaccurate information, including on payment methods and regulations. Security issues on its login portal and crypto-only payments are also red flags to our experts.

FAQ

Is MCC Markets Trustworthy?

No. The broker is supposedly regulated by the Securities Commission of the Bahamas (SCB), however we found no record of current regulation with the SCB on the agency’s website, so this licence has either expired or is fictitious. We highly recommend avoiding unregulated brokers like MCC Markets.

When trading with unregulated brokers, investors miss out on protections such as negative balance protection and fund insurance through schemes like the financial services compensation scheme (FSCS) in the UK.

Is MCC Markets Safe?

In the course of our review, we discovered a severe lack of security during the login process. The main MCC Markets login portal is completely unencrypted and processes emails and passwords in plain text – highly vulnerable to bad actors or hackers.

Where Do MCC Markets Show Upcoming Events?

MCC Markets has an economic calendar on its website displaying upcoming market events. Additionally, the broker’s supported MetaTrader 5 platform also has an integrated economic calendar.

Does MCC Markets Offer Good Market Access?

MCC Markets supports 42 currency pairs, eight global indices products, three metals CFDs and three energies CFDs. However, this is notably less than many popular alternatives. There is also no stock trading which will deter some investors.

Article Sources

Top 3 MCC Markets Alternatives

These brokers are the most similar to MCC Markets:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

MCC Markets Feature Comparison

| MCC Markets | FP Markets | Swissquote | Pepperstone | |

|---|---|---|---|---|

| Rating | 0.8 | 4 | 4 | 4.8 |

| Markets | CFDs, Forex, Indices, Metals, Energies | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $50 | $40 | $1,000 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | ASIC, CySEC, FSA, CMA | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | MCC Markets Review |

FP Markets Review |

Swissquote Review |

Pepperstone Review |

Trading Instruments Comparison

| MCC Markets | FP Markets | Swissquote | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | No | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

MCC Markets vs Other Brokers

Compare MCC Markets with any other broker by selecting the other broker below.

Popular MCC Markets comparisons: