Markets.com Review 2025

|

|

Markets.com is #26 in our rankings of CFD brokers. |

| Top 3 alternatives to Markets.com |

| Markets.com Facts & Figures |

|---|

Markets.com is a respected broker, offering multi-asset trading opportunities through CFDs or spread betting (UK only). Established in 2008, the brand has an impressive 4.3 million registered customers and is overseen by trusted regulators, including the FCA, ASIC and CySEC. 79.1% of retail accounts lose money. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds, Spread Betting (UK Only) |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS, Android |

| Trading App |

Markets.com operate MarketsX – the bespoke platform, both on WebTrader and mobile applications. The app, available on android and iOS has been downloaded over a million times. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, CySEC, ASIC, FSCA, FSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Signals Service | Trading Insights |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Markets.com offers a strong variety of CFD products, not only covering popular asset classes but also more interesting markets such as IPOs and Bonds. The low fees and educational resources will appeal to beginners, whilst seasoned CFD traders will appreciate the feature-rich charting platforms. |

| Leverage | 1:30 |

| FTSE Spread | 2 pips |

| GBPUSD Spread | 1.3 pips (var) |

| Oil Spread | 0.05 |

| Stocks Spread | 4 pips |

| Forex | Markets.com offers 43 major, minor and exotic currency pairs. The range is around the industry average, though spreads are fairly competitive, starting from 0.6 pips for EUR/USD. There’s also an excellent range of tools and education, including forex calculators and trading videos. |

| GBPUSD Spread | 1.3 pips (var) |

| EURUSD Spread | 0.70 pips (var) |

| GBPEUR Spread | 1.0 pip (var) |

| Assets | 67 |

| Stocks | You can trade a decent range of US and European share CFDs, with 1:5 leverage. There’s also a competitive choice of ETFs and indices across the three available platforms. It’s easy to stay updated with the stock market using the broker’s customizable trading alerts and the in-platform news feed. |

| Spreadbetting | With just a $100 deposit to get started, spread betting at Markets.com should appeal to both beginners and more experienced investors. There’s a superb range of asset classes to trade, including IPOs, commodities and ‘blends’, a selection of pre-constructed stock portfolios. You can also trade on both MT4 and the proprietary terminal, which offers advanced analysis tools that we love using, including trading tips provided by XRay. |

Markets.com are a leading financial services brand, offering CFD and Forex trading, via a bespoke trading platform. Operating in 15 languages with clients in over 100 countries. They provide an unparalleled asset list, and are one of the fastest growing brands online. The brand is operated by SafeCap, and they are a subsidiary of Playtech, a company listed on the London Stock Exchange, forming part of the FTSE 250.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

79.9 % of retail investor accounts lose money when trading CFDs with this provider.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Markets.com is operated by Safecap Investments Limited, a regulated investment services firm authorised by CySEC (under license no. 092/08).

Signing up needs just two pieces on information – an email address and a password. You then get access to the demo account with a £100,000 virtual balance.

Here are some of the key details about the Markets.com brand;

- Demo Account – Yes. Available instantly on sign-up.

- Minimum Deposit – £100

- Minimum trade – No Minimum

- Offer details – No current deposit bonus promo

- Mobile App – Yes. See more detail below.

Trading Platform

As a leading CFD brand, Markets.com delivers a trading platform which goes way beyond that of a conventional options website. It represents a “step up” from basic trading platforms, providing leverage and charting options only available at more established CFD brokers.

The feature rich platform does provide an additional layer of flexibility. The management of risk is not as straight forward as with something like binary options, but traders get far more choice. They can utilise stop losses, control their level of leverage, and of course close trades (assuming the markets are open for that particular asset).

The trading platform presents trades clearly, and traders can see exactly what leverage they are using.

Step one for traders to complete is to find their desired asset. There is a simple search function, or traders can select a category of asset (Bonds, Currencies, Stock, Commodities and Indices). These can also be filtered further via sub-choices, such as as ‘major’ or ‘minor’ for currency pairs, or alphabetic grouping for stocks.

Charts At Markets.com

Selecting the asset then brings up the price graph on the right hand side. There is also a star icon that adds that asset to the user’s ‘favourites’. This provides a handy short cut to frequently traded assets. The charting is a real strength at Markets.com – traders can perform a huge range of technical analysis using the advanced charts.

Here is a sample of just some of the charting features;

- Scale the charts over a range of time frames – from 1 minute intervals, to 1 month – and then scale the chart over longer or shorter periods.

- Overlay Technical analysis – Switch on Bollinger bands, RSI, or moving averages etc – importantly, Markets.com give the user the ability to configure the analysis to their own needs. Traders can set their own moving average time frames for example, or set the MACD to whatever settings they want. The flexibility is very, very impressive.

- Configure the layout – Set the background and colours as required, and turn on, or off, different features such as trade volume or the grid. Create your own look and feel.

- Annotate by hand – Add bespoke trend lines, channels or support and resistance lines as required.

Some brokers provide the most basic charts, almost assuming their traders will have done their research elsewhere – not so at Markets.com – they provide some of the best charting and research resources we have seen. All these features are present on the demo account, so you can try them out risk free.

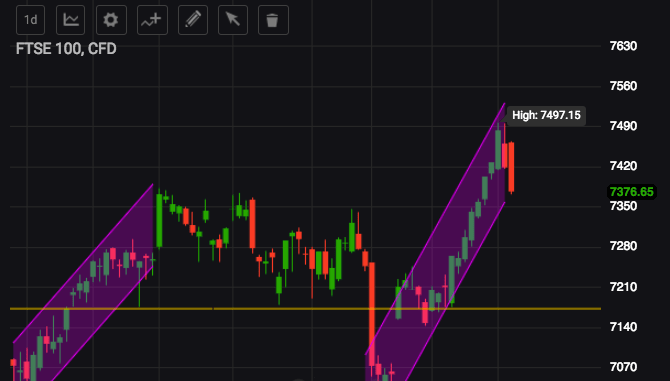

Examples Of Manual Technical Chart Drawings;

Opening Trades

To open a trade and take a position, you select the ‘Buy‘ or ‘Sell‘ buttons above the graph. This will open a new window where the exact figures of the trade can be entered.

This area shows;

- Level of investment

- Leverage

- Stop loss or Take profit figures (where used).

The total value of the security is displayed, just above the ‘required margin‘ – this is where traders need to manage their risk and liabilities.

Clicking the ‘Confirm Order’ button will rubber stamp the deal and a popup will appear confirming the order is placed. Once confirmed, the trade will be visible in the ‘Open Positions’ tab. The trade details will also be visible on the chart itself (details of the trade, including the live position, are shown beneath the relevant asset in the asset list) and also in the account overview table, in the bottom left of the trading area.

Edit Or Close A Position

At any point an open position can be edited or closed (assuming the market is open). The Edit and Close buttons are available alongside the asset in the menu on the left. Clicking either will allow you to amend the stop loss or take profit levels, or close the trade. A live ‘Profit/Loss’ tally informs the trader how that particular trade is performing.

There is also on overall account window. This displays the consolidated position of the account as a whole, including a balance which includes all open trades.

Trader choice

Markets.com offer a very large range of assets. As a Forex and CFD website, they offer trading on commodities, stocks, forex and indices – but they also offer trading on bonds, which might be useful for some investors. The search facility simplifies finding the required asset. Frequently traded assets can be added to the ‘favourites’ list for easy access in future.

One other note on the trading choice, is that the stock list at Markets.com is dominated by US firms, with not so much attention given to FTSE 100 stocks. This will doubtless change over time as more assets are added regularly.

Mobile App

Markets.com provide a free mobile trading app. Applications have been written for both iOS (version 6.0 or later required) and android (version 4.0 and up). Both are very well established with a large number of downloads. Users have rated them at 4 out of 5 for iOS and 3.8 out of 5 for the android version.

The application reflects the trading platform at the full site. The full range of assets are available via mobile and the trading mechanism is the same. The display is clear but still displays all the relevant detail and the power of the charting tools remain – though a full screen is desirable for that kind of analysis. The asset search facility remains, and the trade confirmation screen is the same – allowing full use of stop losses and take profit options.

Spread

Markets.com offer very competitive spreads and zero commission. Spreads are generally very tight, particularly on the frequently traded assets that attract high volume. Markets.com margins compare favourably with their CFD and Spread betting rivals.

Spread comparison on popular assets:

- FTSE 1.2 Points

- GBP/USD 2 Points

- Stocks 0.1%

Markets.com spreads are better (smaller) than most rivals, though slightly larger than one or two leading brands

Withdrawal and Deposit Options

Markets.com accept deposits via most sources, including; wire bank transfer, credit cards, e-wallets (such as Skrill and Neteller) and debit cards. Making a deposit is a swift process and those deposits are commission free with no fees.

As with the majority of brokers, any withdrawals are made back to the same method as the original deposit. This is a fairly standard anti-money laundering policy. Again, there are no fees for withdrawals and they can be made any time. Traders funds are segregated from the business funds, as per regulation guidelines.

Other Features

Markets.com offer their clients a range of training and benefits:

- Risk Management – Markets.com offer risk management tutorials, as well as additional tools such as the Entry Limit, Stop Loss and Take Profit functions. With leveraged products, this training is key.

- eBook Library – These provide information on a range of products and assets, and can open up additional investment ideas you may not have considered.

- Live Webinars – Hugely useful for getting the most out of the platform, or understanding particular assets.

- Huge range of Assets – Including CFDs on Bonds, which are not always available elsewhere.

- Real Time Analytics – Up to date charting and analytics, over a range of timescales.

Top 3 Markets.com Alternatives

These brokers are the most similar to Markets.com:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- City Index - Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Markets.com Feature Comparison

| Markets.com | IG Index | City Index | CMC Markets | |

|---|---|---|---|---|

| Rating | 4.4 | 4.7 | 4.4 | 4.7 |

| Markets | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds, Spread Betting (UK Only) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Minimum Deposit | $100 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, ASIC, FSCA, FSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, ASIC, CySEC, MAS | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4 | MT4 | MT4 |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

70% of retail CFD accounts lose money. |

||

| Review | Markets.com Review |

IG Index Review |

City Index Review |

CMC Markets Review |

Trading Instruments Comparison

| Markets.com | IG Index | City Index | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | No | No | No |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | Yes | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Markets.com vs Other Brokers

Compare Markets.com with any other broker by selecting the other broker below.

Popular Markets.com comparisons: