Margin Trading

Margin trading enhances gains and losses with investors borrowing funds from their broker to make trades. However, the level of margin and leverage available varies in line with UK rules and requirements. This guide to trading on margin unpacks examples, interest rates and fees, plus risk management strategies.

Margin Trading Brokers UK

Margin Trading Explained

Margin trading lets you buy securities using funds borrowed from a brokerage. Platforms typically express leverage either as a ratio or percentage to indicate the required margin you must stake. For example, a 1:10 or 10% leverage says that your exposure is equal to 10x your initial investment. In this instance, you would only need to stake £100 to open a £1000 position.

This means you can make significant profits even from small, short-term price movements. If you opened a position with £100 and the price moved in your favour by 1%, you would earn a profit of £1 (£100 x 0.1%). If you opened the same position with 1:10 leverage, you would earn £10 in profit (£1000 x 0.1%), minus any fees.

However, the same features also make it risky as losses are magnified. Returning to the example, the reverse is true if the price moved against you – your losses would be £1 and £10, respectively. As a result, the amount of leverage available varies depending on the volatility of the asset and your status as a retail or pro trader.

Several top-rated UK brokers offer margin trading calculators. Use the margin calculator at XM to determine the margin needed to open and maintain positions.

FCA Rules

For retail investors in the UK, there are restrictions placed on the maximum leverage available when trading on margin. These are limits imposed by the Financial Conduct Authority (FCA) that all registered brokers must abide by.

- Major forex pairs: 1:30 / 3.33% / 30x

- Minor and exotic currency pairs, major stock market indices and gold: 1:20 / 5% / 20x

- Minor stock market indices and non-gold commodities: 1:10 / 10% / 10x

- Stocks and government bonds: 1:5 / 20% / 5x

Note, the FCA placed a ban on cryptocurrency derivatives in 2021, meaning that crypto margin trading is not possible at brokers authorised in the UK. With that said, British traders can turn to offshore platforms, though they may lose the protections afforded by the FCA.

Also, traders that qualify for a professional account may be able to access higher rates up to 1:500.

Negative Balance Protection

In 2015, the Swiss National Bank surprised investors by taking the decision to rescind a cap on the Swiss Franc (CHF) that had held it to a rate of 1.20 CHF to 1 Euro (EUR). The move shocked the markets, and as CHF prices rapidly soared, many traders with leveraged positions found themselves indebted to their brokers as the price moved beyond expectations.

The FCA introduced negative balance protection for all retail clients in response to the CHF debacle. This protective measure states that clients cannot make losses exceeding the funds that have been deposited into their brokerage account.

Note that this does not include other investments and unrealised profits – it is limited to the cash in the client’s account only. Also, while all FCA-regulated brokers must implement negative balance protection, brokers that aren’t regulated by the FCA may not.

Margin Call

There are limits to the amount you can lose when margin trading before the broker takes action and potentially closes your positions. The mechanism that happens in this situation is called a margin call.

A margin call occurs when the margin level across your open positions declines past a minimum maintenance requirement. This will happen if your losses grow to such a degree that your broker believes them to be too large in proportion to your account equity.

Equity is equal to the funds deposited in the account plus securities as well as the profits and losses from currently leveraged positions. Note that brokers have different margin requirements. For instance, Pepperstone has a maintenance margin level of 90%, whereas CMC Markets set their maintenance level at 80%.

Importantly, a margin call is a notification or warning. You will be asked by your broker to either deposit additional funds or sell other assets to increase the margin level. If that does not happen, the broker will close open positions until your margin level comes back within the maintenance requirement.

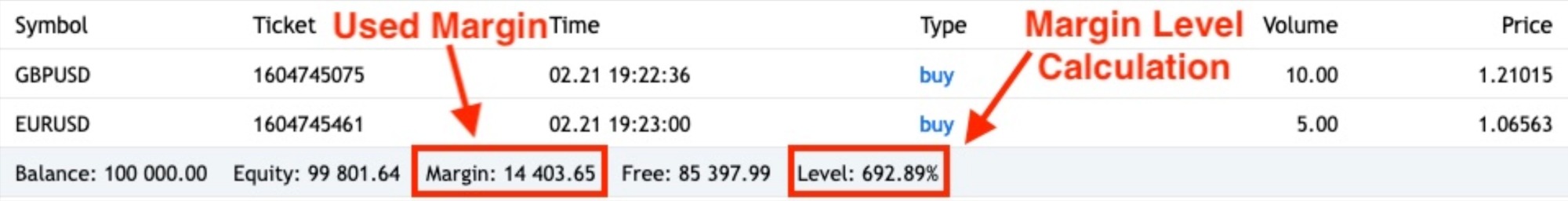

Margin Levels on MT5

Stop-Out Level

Stop out is the process by which a broker closes positions if a trader is unable to sustain the margin. This happens after a margin call if you are unable to add funds to reach the minimum requirement. Typically, the broker will begin the liquidation process by closing your worst positions.

The margin stop-out level is usually set to 50%.

Pros Of Margin Trading

- More buying power to speculate on popular financial markets

- The best brokers offer competitive margin rates and fees

- Many brokers and platforms facilitate margin trading

- Opportunities to generate larger profits

Cons Of Margin Trading

- Increases risk exposure

- Limits on the maximum leverage you can access with FCA-regulated brokers

- Margin trading with brokers that do not offer negative balance protection can lead to losses that exceed your capital

Risk Management

Because of the potential to accumulate significant losses in heavily leveraged positions, practising good risk management is key while margin trading.

Stop loss and take profit orders are two ways to reduce your risk exposure. Some traders also use wallet-management strategies such as the 1% method to avoid staking too much of their capital on a single position.

Stop Loss

Stop loss orders will automatically close a trade once losses reach a certain level. The trader decides the amount of loss they will tolerate before the stop loss is triggered. The aim is to prevent losses from becoming unmanageable, potentially leading to a margin call.

Stop loss strike prices are determined either using a percentage or number of points away from the current price. To demonstrate how a stop loss order works, here is an example on AstraZeneca…

Assume that you open a long CFD position on AZN stock at 12:10pm on 15 February 2023. At this time, AZN is priced at 11,455 GBx and you place a stop loss 55 GBx lower at 11,400 GBx. In this example, the order is triggered at 10:00am the following day, causing a loss of 55 GBx. In this case, the stop loss saved the trader further losses, as over the next few hours the price of AZN continued to decline.

One popular variant often used in margin trading is a trailing stop loss. This order will make an adjustment to the strike price if the market moves favourably.

Let’s take the previous example and the original strike price with a gap of 55 GBx. After the order is opened, the price of AZN increases and reaches a peak value of 11,605 GBx just after the market opens on 16 February.

The trailing stop loss trigger could have followed this trend and increased to a value of 11,550 GBx. As this is higher than the price of AZN at contract open, you would secure a profit a few minutes later when the stock’s value drops. The difference between using a trailing stop loss and a normal stop loss in this example is a profit of 95GBx rather than a loss of 55 GBx.

Take Profit

A take profit order will secure returns from a winning position. If the market moves favourably, your position will be automatically closed, in part or in full, if the asset’s price reaches a certain amount.

The chart below is a graph of Lloyds stock (LLOY) traded on the London Stock Exchange. Assume you open a long CFD trade at the beginning of the trading day on 10 February 2023 at 08:00 when LLOY is valued at 53.2 GBx with a take profit order set at 53.9 GBx. Soon after this, the market trends upwards and LLOY increases until it reaches the 53.9 strike price around 08:30. At this point, your platform would automatically close the trade and secure the profit, protecting you against the bearish trend that reverses LLOY’s stock, bringing its price to 53.0 GBx by 11:00.

Note that while stop loss orders work under normal market conditions, they are not guaranteed. If the market lacks liquidity, it may not be possible to fill your order at the price you set.

One Percent System

A trader who practices the 1% money management strategy will only ever stake a maximum of 1% of their total capital on a single trade. This limits the amount of capital at risk in any one position, with the tradeoff that it will also limit the profit potential of each position. Nonetheless, it can help reduces the risk involved when trading frequently and with high volatility.

Bottom Line

Margin trading can be profitable, but it also carries risks. For this reason, make sure you understand the advantages and disadvantages of trading on margin before you start. Register for a demo account with your chosen broker to test out different strategies, whether you are investing in crypto, stocks or any other market. Many brokers also provide free liquidation, profit and margin calculators.

FAQs

How Much Can I Borrow When Trading On Margin?

If you are a retail trader using FCA-regulated brokers then the maximum leverage you can typically access is 1:30, which is limited to major forex pairs only. Other markets and instruments, however, have different limits. For example, if you are interested in margin trading on the stock market, the maximum leverage is normally 1:5.

Note, professional accounts often provide higher leverage up to 1:400 and 1:500 but without the protection of negative balance protection.

Is Margin Trading A Good Or Bad Idea?

To determine if margin trading is a good or bad idea for you, you need to ensure that you properly understand the risks as well as the benefits. Use our guide to find out how margin trading works, the taxation rules (income vs capital gains tax) and potential strategies. Then sign up for a demo account so you can practise margin trading to help see if it is right for you.

Can You Use Trading Bots With Margin Trading?

Yes, you can use an expert advisor trading robot system to enhance the margin trading experience. Keep in mind that introducing an EA will not necessarily change the gains and losses you experience as it will only execute a given strategy. You can find EAs from various providers and integrate them onto popular platforms like MT4 and MT5.

Is Margin Trading Worth It?

Whether margin trading is right for you is something you need to evaluate yourself. To do so, you should weigh up the risks vs the rewards and consider the differences between margin trading and other ways of investing such as spot trading and cash trading without leverage.

Where Can I Learn About Margin Trading?

Our full guide to understanding margin explains the basics and different types of margin trading available.

Other resources include books such as the ‘For Dummies’ series, PDF guides offering tips and tricks as well as videos and online classes for beginners.

What Is Free Margin In Trading?

Free margin in trading relates to the available funds you have deposited into the brokerage account that you can use for trading. For this, you need to add up the money in your account, also taking into account any paper profits and losses from currently open positions.

What Is Your Required Margin In Trading?

The required margin is the minimum margin level you must maintain. This is the margin level for your account across all open positions. If your margin level drops below this minimum maintenance level, you may be at risk of a margin call.

Is Margin Trading Halal Or Haram?

According to some Muslim scholars, margin trading is haram and therefore not in accordance with Sharia Law. However, some margin trading brokers offer Islamic-friendly accounts. You can also consult a local religious leader for guidance.