Managed Accounts

Managed accounts offer a hands-off way to invest, with trades overseen by fund managers via a provider’s platform. This article covers how managed forex trading accounts work, their pros and cons, typical services available, and more. We also list the best brokers with managed accounts in the UK, plus tips on how to compare providers, from low minimums and fees to good results.

Top Brokers With Managed Accounts

-

Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

-

Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

-

Founded in 2008, NordFX is an offshore CFD broker offering forex, stock, commodities, indices and crypto trading to over 1.7 million clients in 190 countries. Traders access markets through the MT4 and MT5 platforms and benefit from low commissions, spreads from zero and decent extra features. Minimum deposits start from just $10 and very high leverage is available up to 1:1000.

-

FXDD is an established forex and CFD broker founded in 2002. Regulated in Malta, Mauritius, Peru and Malaysia, the broker provides secure trading platforms, competitive ECN spreads and reliable 24/7 customer support. Competitive pricing and ultra-low latency is also offered via the broker's Direct Market Access execution model and tier 1 aggregated liquidity.

-

Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

-

Trade.com is a trustworthy online broker with a global presence. The broker offers 2,100+ CFDs in major markets, as well as futures, options and more. The broker offers best-in-class platforms and superior analysis tools for experienced traders. The broker is also regulated by top-tier authorities including the FCA and CySEC.

-

Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

-

Just2Trade is a reliable multi-regulated broker registered with FINRA, NFA and CySEC. The company has 155,000 clients from 130 countries and stands out for its huge suite of instruments and additional features, including a social network, robo advisors and a funded trader programme.

What Are Managed Accounts?

Managed trading accounts, also known as separately managed accounts (SMAs), are individual investment profiles owned by a retail trader but managed by a professional. Typically, an experienced fund manager will make trade decisions for the account based on the needs and goals of the user.

Managed investment accounts are often associated with high-net-worth investors looking for someone to lead the allocation of their capital. The fund manager is permitted to purchase, sell or trade financial products without prior approval, so long as it is in accordance with the pre-defined criteria set by the client.

The key difference between this account type and multi-account manager (MAM) accounts is that investor funds are not pooled together with other traders’ money. Instead, clients of managed accounts receive a personalised, one-on-one service.

Managed account managers can create diverse portfolios for customers, including financial assets such as forex and CFDs, as well as property, retirement funds, crypto, options, and more. They aim to earn significant returns for their customers and earn profit-based commissions or fees for themselves.

Recent advances in machine learning have also made it possible for robo-advisor platforms to provide automated account management and online investing with little to no human input.

How Do Managed Trading Accounts Work?

A managed account fund manager has permission to make decisions based on an investor’s attitude to risk, personal capital, and investment goals. Retail traders communicate their preferences via an online questionnaire-style application form or through direct telephone or video-call meetings with the allocated investment manager.

All managed accounts in the UK have a degree of financial safeguarding duty, meaning money managers must trade and invest in the interests of their customers. This means that account managers must aim to increase their clients’ wealth through sensible and considered trading decisions; failure to act responsibly can result in loss of license or even lawsuits.

The best managed account advisors provide regular performance reports and investment updates. Similar to unmanaged accounts, investors have the flexibility to specify specific assets or instruments to be allocated within a portfolio. An investor who values sustainability may select UK stocks following ESG initiatives, for instance.

Trade.com Managed Accounts

Some providers offer a range of hands-off account types with different features. J.P. Morgan, for example, offers managed accounts alongside managed exchange-traded funds (ETFs) and mutual fund portfolios. J.P. Morgan’s managed accounts have a higher minimum investment amount at £50,000 vs £1000 for a mutual funds managed account; the benefits of managed accounts vs the alternatives include tax benefits, portfolio customisation and direct ownership of securities.

Benefits Of Managed Trading Accounts

- Expertise – Professional money managers should be well-informed and able to make educated investment decisions. They have the time and qualifications necessary to seek out good investments and are generally better able to weigh risk and reward than individual retail investors.

- Personalised Advice – The best managed account advisors in the UK provide one-to-one support and guidance. This may include detailed explanations of portfolio asset allocations and performance results and growth. Managed accounts offered by BlackRock, for example, propose fixed income, equity, and multi-asset SMA solutions guided by a team of financial experts.

- Tax Efficiency – Account managers can use various approaches such as tax loss harvesting to minimise capital gains tax liabilities. This process works by selling failing investments at a loss and using these losses to offset some of the capital gains from investments sold at a profit.

- Degree Of Control – Although managed accounts provide a hands-off approach to trading, retail traders maintain a level of flexibility to choose how their capital is invested. The best managed account advisors will welcome trading goal submission, alongside risk attitude and timeline desires. You may also be able to suggest financial instruments that interest you or align with your social or environmental passions.

Disadvantages Of Managed Trading Accounts

- Account Minimums – Brokers with managed accounts may have a high minimum investment requirement. Typically, firms will have an entry requirement in the region of £50,000 to £100,000, which is unrealistic for many retail traders. There are some more affordable alternatives, however, such as Vanguard’s managed ISA accounts, which can be opened with a single payment of just £500.

- Fees – Managed account fund managers charge fees in return for creating and monitoring financial portfolios. The best brokers with managed accounts will provide transparent fee structures. They generally either charge a fee or a percentage of the total dollar value of assets under management (AUM), but they may also charge commissions per order. Fidelity, for example, charges a maximum 0.35% service fee for their full suite of managed account services.

- Not Suitable For Short-Term Trading – Typically, separately managed accounts are designed to prosper over a longer period with yield often planned for a timeframe that could run from 5 to 10 years. This is one of the key disadvantages for those seeking short-term trading opportunities.

How To Get Started With A Managed Account

- Research and compare managed account advisors;

- Register for an account with the provider or broker;

- Determine your investment goals, attitude to risk, and timeframes;

- Deposit capital;

- Monitor positions and portfolio performance regularly;

- Amend investment goals as and when required.

Comparing Brokers With Managed Accounts

The features offered by managed accounts vary; so too do fees, customer support, and minimum investment amounts. Spend some time comparing brokers that offer managed accounts to secure the right one for your goals:

Past Performance

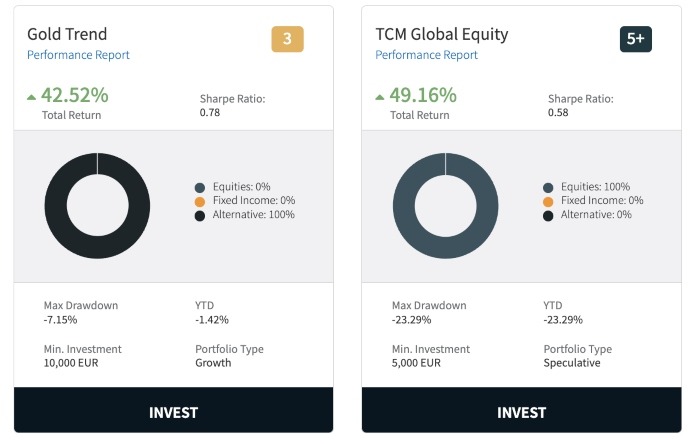

Access to the financial advisor’s performance history and average portfolio yield is key when comparing the best brokers with managed accounts. You should be able to view the manager’s previous trading data and see how they formulate their strategy, manage risk, as well as the number of investors.

Fees Explained

Fund managers are typically compensated with annual fees based on the total cash value of assets under management (AUM). Costs vary significantly between brokers but most average between 1% and 5%. Higher net-worth individuals may be rewarded with reduced fees for larger investment deposits. You should also compare whether the broker imposes additional account charges such as deposit and withdrawal fees or commissions per transaction.

It is arguably better to trade with a fee-based managed account than one that charges a commission per trade. In a commission-based approach, the manager will earn more by making more trades regardless of the account’s performance, whereas the fee-based approach incentivises them to perform well and increase the account size and, consequently, their own fees.

Robo-advisors generally have cheaper fees than human wealth managers. Nutmeg, for example, offers a robo advisor-managed profile with a 0.75% fee for investments up to £100,000.

Interface

You should look for managed accounts with an intuitive dashboard interface and unlimited access to performance reports, definitions and portfolio overviews so you know how your funds are being managed.

Interactive Brokers, for example, provides an easy-to-use client dashboard with a full portfolio overview displaying recent transactions made by the fund manager, rate of return trends, available cash, and more.

Range Of Assets

Not all brokers with managed accounts provide access to the same assets and markets, so if you want to trade stocks or funds on a specific stock exchange you will need to choose the right managed account provider.

Customer Support

A major advantage of managed accounts is access to a personalised wealth manager for portfolio performance updates and investment advice. If you are paying a premium for this service, you should ensure you can speak to a human advisor as and when required.

You should also make sure you can contact customer support for general enquiries by telephone, live chat, or email.

Account Rules

Some brokers with managed accounts have rules, and you may incur charges if you withdraw your funds before a certain period elapses or if you want to transfer your investments to another account.

Check each managed account broker’s terms and conditions before you sign up.

Automation

Some brokers provide managed accounts through AI, also known as robo-advisors. These platforms use algorithms and machine learning to allocate investment funds, and often involve little or no human interaction. These typically have lower initial investment amounts and also have lower fees compared to a human advisor.

Mobile App & Other Extras

Mobile application compatibility may be important for investors who want to stay up-to-date with investments while on the go. Some managed account brokers also offer other extras such as educational resources and copy trading.

Regulation

The managed account providers in the UK are regulated by the Financial Conduct Authority (FCA). The best brokers with managed accounts will also have strict requirements that professional investors must meet before they are eligible to manage clients’ funds. This may include a proven track record of trading success as well as a specific number of years of industry experience.

Ensure you are provided with a detailed contract stipulating your rights over investment choices and withdrawal eligibility before signing up with a managed account broker.

Managed Account Alternatives

Managed accounts should not be confused with managed funds. When you invest in a managed fund, your money is put into a ‘pool’ with other investors, and a manager will make the decision on how the pooled funds are invested. However, unlike a managed account, you don’t own the underlying securities.

Another alternative is index funds. These are investments that track a market index, typically made up of stocks or bonds. An index fund portfolio is constructed to follow a specific financial index, typically offering broad market exposure and lower fees compared to managed accounts.

The main difference between managed accounts and index funds is that index funds are a type of passive mutual fund. This means when you purchase shares in a fund, you are essentially duplicating the performance of the index via a pooled account with other traders. Index fund trading lacks flexibility compared to managed accounts, as they track a single index rather.

Should You Invest In Managed Accounts?

Managed accounts can be a profitable, hands-off approach to trading. They typically come with high initial investment requirements and additional fees, but the money you spend on an investment manager buys you personalised service and a tailored portfolio based on your financial goals.

Investors with less capital on hand may turn to robo-advisors, a cheaper alternative to human advisors that usually involves a lower minimum investment requirement.

Spend time comparing brokers that offer managed accounts, in particular the fees, your rights, and the customer support available. Alternatively, choose from our list of the best managed accounts in the UK.

FAQ

How Can I Compare Brokers With Managed Accounts?

Consider fees, access to customer support, regulation/security, performance reporting, and average returns. Also make sure you understand the level of control you will maintain throughout the process, plus your withdrawal eligibility and payment terms.

Are Managed Accounts Worth The Fees?

Managed account fees vary between providers. The charges are often based on the value of assets under management (AUM) and could be in the region of 1% to 5%. Robo-advisors offer similar managed investment services, though for a fraction of the price of a human fund manager, which may be more suitable for those with less capital.

Are Managed Accounts Worth It?

Managed accounts can be a good solution for hands-off investors with a long-term perspective. A skilled and experienced financial advisor can trade a multi-asset portfolio on your behalf and invest your capital based on your personal goals and risk appetite.

What Are The Differences Between Managed Accounts Vs Separately Managed Accounts?

The terms managed accounts and separately managed accounts are used interchangeably. Both offer a financial advisor with the expertise and knowledge to create multi-asset portfolios for long-term trading.

Do Managed Accounts Have A Minimum Investment Amount?

Initial investment values vary between brokers that offer managed accounts. This can be anywhere in the region of £50,000 to £100,000, though there are some exceptions that welcome individuals with limited investment capital. See our ranking of managed trading accounts with low minimums.