M4Markets Review 2025

|

|

M4Markets is #37 in our rankings of CFD brokers. |

| Top 3 alternatives to M4Markets |

| M4Markets Facts & Figures |

|---|

M4Markets is an award-winning broker regulated by the CySEC, FSA and DFSA. Although relatively new, the broker continues to improve its offering with a range of innovative tools, platforms and accounts. Beginners can start with just $5, whilst experienced investors can access leverage up to 1:5000. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Cryptos |

| Demo Account | Yes |

| Min. Deposit | $5 |

| Mobile Apps | Yes |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA, CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Yes (APIs) |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | M4Markets offers CFD trading across forex, stocks, indices, commodities and cryptocurrencies. Traders can access powerful charting platforms with multiple order types and built-in indicators. There’s also a good selection of data-driven analysis tools supplied by reputable provider, Acuity. |

| Leverage | 1:1000 |

| FTSE Spread | From 0.01 |

| GBPUSD Spread | Raw from 0.0 pips |

| Oil Spread | From 0.01 |

| Stocks Spread | N/A |

| Forex | M4Markets offers 45+ currencies with zero pip spreads. The low latency and 30-millisecond execution speeds makes the broker a decent choice for forex traders. Additionally, there are no restrictions on trading strategies, including scalping. |

| GBPUSD Spread | Raw from 0.0 pips |

| EURUSD Spread | Raw from 0.0 pips |

| GBPEUR Spread | Raw from 0.0 pips |

| Assets | 50 |

| Stocks | You can trade a modest range of 140+ US and EU shares, including Amazon and Pfizer. There are also 13 major indices, providing exposure to other global economies. Average spreads are competitive, coming in at 0.12 pips for the Apple stock and 1.9 pips for NASDAQ. |

| Cryptocurrency | M4Markets offers a decent range of 15 crypto CFDs paired with USD. Traders can get started with as little as $5 and enjoy zero commissions on crypto trades. Spreads on BTCUSD average around 14.1 which is competitive and in line with the top low-cost crypto brokers. |

| Coins |

|

| Spreads | From 0.0 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

M4Markets is a global online CFD broker offering trading opportunities in forex, commodities, indices, and shares. Investors can access 120+ trading instruments on the industry-established MT4 and MT5. Our M4Markets UK review will cover account registration and login, bonuses and promotions, trading platform features, payment methods, fees, and more.

M4Markets Headlines

M4Markets was established in 2019, under the trading name Trinota Markets Global Limited. The broker is regulated by the Financial Services Authority (FSA) in the Seychelles, with its global headquarters in the same location. The broker offers fast execution speeds and low latency using cutting-edge technology to create a fair and safe trading environment.

Platforms

M4Markets supports the MetaTrader 4 and MetaTrader 5 platforms, both available in GBP. These are industry-recognised terminals available for free download to your desktop. Alternatively, the Web Trader is compatible with all major browsers. A comparison table is available on the broker’s website to assist in choosing the right platform for your trading needs.

MetaTrader 4

The industry benchmark for forex and CFD trading, MT4 is suitable for both new and experienced traders. Features include:

- 9 timeframes

- Hedging available

- 4 order execution types

- Available in 40 languages

- Access to Expert Advisors

- Interactive tables and graphs

- 30+ built-in technical indicators

- Fully customisable user interface

- Compatible with third-party signal providers

MetaTrader 4

MetaTrader 5

While MT4 is the bread and butter of forex traders, MT5 offers more advanced functionality and allows for multiple asset trading. Features include:

- MQL5 chat

- 21 timeframes

- Unlimited symbols

- 3 order execution types

- Built-in economic calendar

- Interactive charts and tables

- Hedging and netting available

- 38 built-in technical indicators

- Market signals and copy trading supported

Products

M4Markets offers UK traders investment opportunities in the following markets:

- Indices – access to 14 global index CFDs including UK100 and US30

- Commodities – 5 metal and energy commodities, including gold and oil

- Forex – 50+ currency pairs, major, minor and exotic, including GBP/USD and EUR/GBP

- Shares – trade 55+ EU and US company CFD shares, such as Apple, Uber, Tesla, and JPMorgan

Cryptocurrency trading is not currently available.

Fees

Forex pricing is derived from M4Markets’ major liquidity providers. Commodities, indices and shares pricing are based on the spot price of the asset.

The broker provides competitive spreads. The Raw Spread and Premium accounts offer spreads from 0.0 pips across all asset classes. Spreads start from 1.1 pips on the Standard Account. Forex pairs, including EUR/USD, were offered at 1.1 pips and GBP/USD at 1.2 pips respectively. Commodities such as UK Oil were offered at 3.6 pips.

M4Markets does not charge a commission for forex and commodities trading under the Standard Account. The Raw Spread and Premium accounts are subject to a maximum £3.50 fee per side. Equities trading across all accounts is charged at 0.05% on each side. The broker charges swap rates for positions held overnight.

Leverage Review

With M4Markets, leverage varies by account type. The Standard Account offers leverage up to 1:1000. This is beyond most competitor offerings, therefore risk management strategies should be employed if trading with such a high multiplier.

- EUR/GBP and GBP/JPY – 1:1000

- Indices, such as UK100 and US100 – 1:100

- Commodity trading, including UKOIL – 1:50

Raw Spread and Premium accounts offer leverage up to 1:500. See the broker’s website for the detailed breakdown by instrument.

Note, as the broker is not licensed in the EU, it is not subject to ESMA leverage capping regulations.

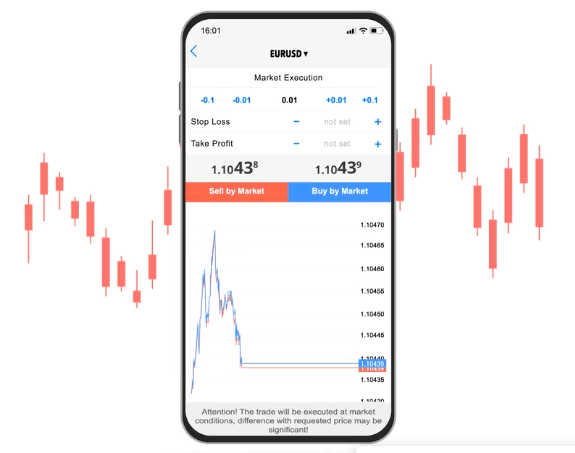

Mobile Trading

MetaTrader 4 and MetaTrader 5 are both available as mobile applications. A free download can be secured through your app store and is compatible with iOS and Android devices. Traders can access the full list of desktop platform features, analytical tools, customisable charts and graphs while on-the-go.

M4Markets mobile app

Payments

Deposits

Minimum deposits vary by account type and the broker does not charge a fee for any payment method. The Standard Account requires a £5 deposit to start trading. There are many deposit methods available, however only bank wire transfers are available in the GBP base currency, subject to a single working day processing time. Other methods available to UK clients but with alternative currency requirements include:

- Skrill

- SticPay

- Fasapay

- Neteller

- Bitwallet

- UnionPay

- Perfect Money

Local online banking transfers are processed within one working day.

Minimum deposit amounts vary by payment method. Bank wire transfers, for example, require a £100 minimum deposit. Visit the Client Portal for more information on deposit options for UK traders.

Withdrawals

The broker does not charge a withdrawal fee for any payment method. Similar to deposits, bank wire transfers are the only applicable payment method that supports GBP as the base currency. Withdrawals must be processed back to the original deposit method. A one working day processing time applies to all methods.

Demo Account

M4Markets does offer a demo account available on the MT4 and MT5 platforms. This is a good way for new and experienced traders to test strategies risk-free in real market conditions. Users can utilise virtual funds to understand the features of the platforms, improve risk management strategies and learn how to execute trades. A simple online registration form is required, allowing clients to select the value of virtual funds and leverage to practise trading.

M4Markets Bonuses

At the time of writing, M4Markets provides a 50% credit bonus up to $5,000 or equivalent currency when you deposit into a live account. This is only available on the MT5 platform. A no deposit bonus is not available. Always check the terms and conditions before signing up.

Regulation Review

M4Markets is authorised and regulated by the Financial Services Authority (FSA). Clients should be assured of segregated funds, best execution policies and negative balance protection. With that being said, this regulator does not provide the same level of protection as other financial bodies such as the UK’s Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC). Always review the license and available protection before investing.

Additional Features

The additional features and tools offered by the broker are limited. Our review was disappointed to see no educational information, particularly for new traders. An economic calendar is available on the broker’s website and is integrated into both trading platforms. Weekly market news and trading forecast updates are also available on the M4Markets website and LinkedIn page.

Live Accounts

M4Markets offers three trading account options; Standard, Raw Spread, and Premium (previously Elite). All accounts benefit from four account currency choices and minimum trade volumes from 0.01. The features of each are as follows:

- Standard – £5 minimum deposit, maximum leverage 1:1000, 20% stop out

- Raw Spread – £500 minimum deposit, maximum leverage 1:500, 40% stop out

- Premium – £10,000 minimum deposit, maximum leverage 1:500, 40% stop out

To open an account, UK traders must complete the online registration form. Individual economic profiles and identity documentation are required. Islamic accounts are available on all three account options. Simply open an account and convert to a swap-free version via the Client Portal.

An M4Markets PAMM account is available to trade and manage multiple accounts from a single interface under one master account. Traders will need to submit an application to participate.

Pros

- Deposit bonus

- Mobile applications

- £5 minimum deposit

- Islamic accounts available

- Negative balance protection

- Live chat support and UK telephone number

- The industry established MT4 and MT5 platform options

Cons

- Not regulated by the FCA

- Limited educational information

- No cryptocurrency trading available

Trading Hours

M4Markets follows standard office opening times with 24-hour trading Monday to Friday. Typically forex pairs open for trading on Monday at 00:05 and close on Friday at 23:55. The MT4 server time is GMT and the MT5 server time is GMT +2. Timings vary by instrument, all details can be found on the broker’s website.

Customer Support

There are several customer contact options offered by the broker. These are available 24/5:

- Live chat

- Callback request form

- UK telephone +442035197268

- Email support@m4markets.com

- Address – JUC Building, Office No.F4, Providence Zone 18, Mahé, Seychelles

The M4Markets website also supports a comprehensive FAQ section.

Security

All M4Market accounts are password protected. Account registration requires profile verification to comply with KYC validation. The MT4 and MT5 platforms assure high-tech encryptions, secure logins and industry-standard data privacy.

Should You Trade With M4Markets?

M4Markets provides UK traders opportunities to invest in various asset classes. Provision of the MetaTrader platforms, low minimum deposit requirements, demo accounts, and customer service options are key benefits. The main drawback is that the broker is not regulated by a reputable body. Traders should consider whether a regulated broker is more appropriate for their needs and whether leverage up to 1:1000 is needed. When trading on margin, it’s crucial to implement careful risk management tools.

FAQ

Does M4Markets Offer A Demo Account?

Yes, M4Markets offers a demo account on the MT4 and MT5 trading platforms. Traders can access virtual funds to test strategies risk-free in real market conditions.

What Are The Minimum Deposit Requirements To Open An M4Markets Trading Account?

The minimum deposit to open a live trading account with M4Markets is £5. This makes the broker a good low-cost option for beginners.

Is M4Markets Regulated?

Yes, M4Markets is regulated as a Securities Dealer by the Financial Services Authority (FSA), license number SD035. The broker is not licensed with the UK’s FCA.

Does M4Markets Offer Live Chat Support?

M4Markets offers live chat support available 24/5. Other customer services options include email support@m4markets.com and UK telephone number +442035197268.

What Account Types Does M4Markets Offer?

M4Markets offers three live account types; Standard, Raw Spread, and Premium. Features such as leverage, minimum deposits, and spreads vary.

Top 3 M4Markets Alternatives

These brokers are the most similar to M4Markets:

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

M4Markets Feature Comparison

| M4Markets | FP Markets | Pepperstone | IC Markets | |

|---|---|---|---|---|

| Rating | 3.6 | 4 | 4.8 | 4.8 |

| Markets | Forex, CFDs, Indices, Shares, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $5 | $40 | $0 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA, CySEC | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | M4Markets Review |

FP Markets Review |

Pepperstone Review |

IC Markets Review |

Trading Instruments Comparison

| M4Markets | FP Markets | Pepperstone | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

M4Markets vs Other Brokers

Compare M4Markets with any other broker by selecting the other broker below.

Popular M4Markets comparisons: