Luno Review 2025

|

|

Luno is #82 in our rankings of crypto brokers. |

| Top 3 alternatives to Luno |

| Luno Facts & Figures |

|---|

Established in 2013, Luno has a mission to make crypto investments simple and accessible for all. The brand has a customer base of 9+ million across 43 countries. Trading fees are competitive, with no market maker charges and access to popular tokens like Bitcoin. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | No |

| Min. Deposit | £1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | £10 |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Cryptocurrency | Luno supports cryptocurrency trading, staking and transferring on major tokens, including Bitcoin, Ethereum, Ripple and Cardano. There are no maker fees and taker fees vary by trading volume starting from 0.10%. 95% of cryptocurrencies are held in 'deep freeze' multi-signature, encrypted wallets. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | Yes |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | Yes |

Luno is a crypto exchange, offering UK customers Bitcoin and 10+ alternative tokens to buy, sell, send, and store. The mobile app-based platform offers a secure investing environment and wallet service, though funding options are lacking. Our review will cover the pros and cons of trading with Luno, from investment limits and transaction fees to account verification levels.

Our Take

- Luno offers impressive 0% maker and 0.10% taker fees on some of the world’s most popular cryptocurrencies

- The app is feature-rich with TradingView integration, technical tools and market sentiment data

- Clients can receive up to 2% interest on holding tokens in the Luno Savings Wallet

- The firm lacks a demo account and payment options are very limited for UK clients

Market Access

UK investors can only access 11 digital currencies. This list is far from extensive if you compare Luno with other major exchanges such as OKX, which offers dozens of popular and emerging cryptos. On a lighter note, leading tokens like Bitcoin, Ripple and Ethereum are available.

- Avalanche (AVAX)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Chainlink (LINK)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Solana (SOL)

- Uniswap (UNI)

- USD Coin (USDC)

You can buy and sell crypto, store digital tokens in the Luno Wallet, stay up to date with the latest news, send cryptocurrency, and trade.

Minimum buy/sell amounts apply, ranging from £1 to £100,000 or equivalent crypto. The £1 minimum will appeal to newer crypto investors, in particular, reducing entry barriers.

Luno Fees

Luno is transparent when it comes to trading fees and service charges. We liked that you can view all applicable charges by country of residency before signing up for an account.

UK clients can expect to incur the following charges:

- Crypto Receive – Free

- Crypto Send – Dynamic depending on network traffic

- Buy And Sell Via The Luno Wallet – 1.5%

- Instant Buy And Sell Crypto/Fiat Pairs- From £1

- Instant Buy And Sell Crypto/Crypto Pairs- Varies by tokens

The brand essentially follows a market maker/taker fee schedule. The good news is Luno offers 0% maker fees, which is competitive vs Coinbase (between 0% and 0.40%).

Taker fees vary by token and value. These range from 0.10% for trades between £0 and £250,000 to 0.03% for trades over £16 million based on your past 30-day trading volume. This is quite a big step-up, meaning you are only really rewarded once your investment balance is substantial.

When we used Luno, we did not come across any additional charges. There are no deposit and withdrawal fees or a cost to have a wallet. With that said, you may be liable for tax repayments on any profits made.

Accounts

All retail investors will be registered under a standard account. There are no profiles for high-volume traders which I thought was a shame.

However, I did find that there are three ID verification levels, which unlock benefits depending on the amount of personal information provided. Level 3, the highest tier, offers unlimited deposit and withdrawal limits.

Our experts came across a weekly ‘send’ limit of up to £10,000 (equivalent in crypto). This will be removed after a few months of activity.

A 14-day wait period also applies after registration, which means you cannot send any crypto. Although this is intended to protect customers, I found it frustrating as I wanted to get started.

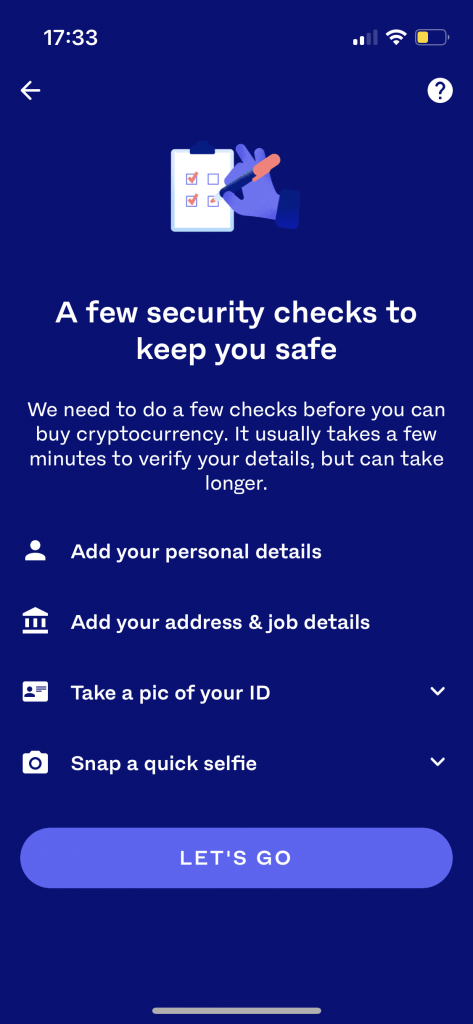

How To Open A Luno Account

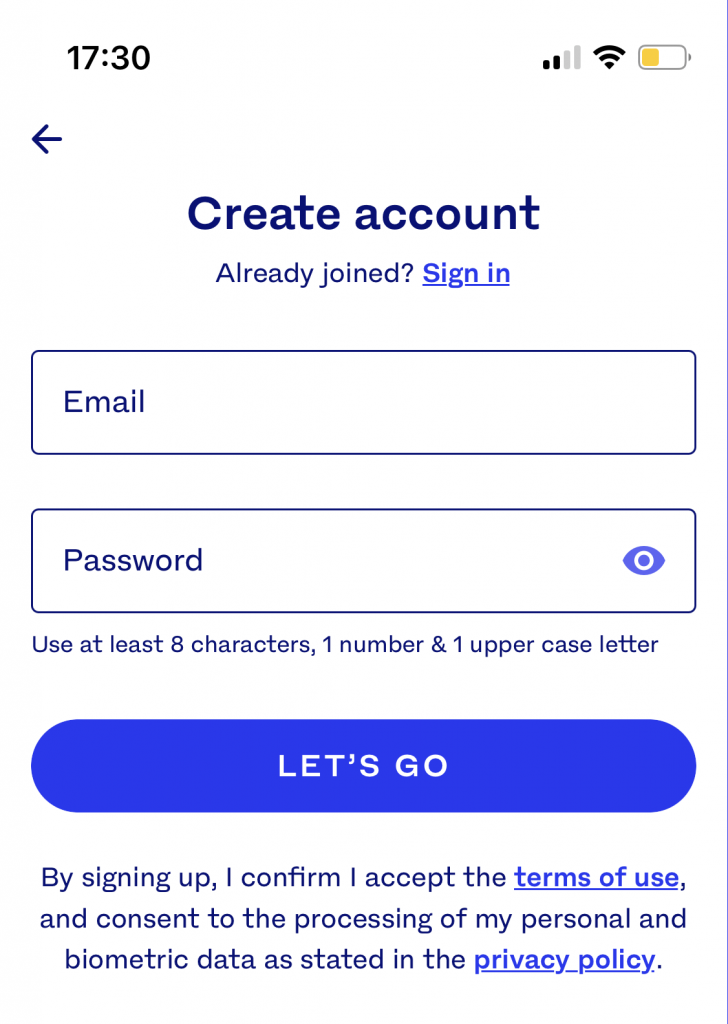

I rated that you can open a Luno account via the web or mobile app. It only takes a few minutes if you have a stable internet connection.

- To sign up from mobile, download the application from the Apple App Store or Google Play

- Click on the ‘Profile’ logo from the menu and then choose ‘Sign In’

- Choose ‘Join In’ on the following screen

- Add your email address and create a password. Click ‘Let’s Go’

- Confirm your account registration by selecting ‘Confirm My Email’ from the verification message

- Create a 4-digit pin

- Add your mobile number and add the 4-digit verification code

- Confirm your country of residency from the dropdown menu

- Complete the identity verification requirements (personal details, address, employment status, ID image, and selfie upload)

Funding Options

Unfortunately, Luno only accepts bank wire transfer deposits for UK traders. However, the brand offers instant funding via TrueLayer, which is competitive vs alternative brands which have typical processing times of up to five working days.

Additionally, I was pleased to see that Luno does not charge any fees.

We feel reassured that transactions are processed safely. TrueLayer is ISO27001 compliant and data transmissions are fully encrypted.

How To Make A Deposit

- Sign in to your Luno platform and open your GBP wallet from the ‘Wallets’ tab

- Choose ‘Deposit’ and select ‘Instant Bank Transfer’ from the payment method options

- Click on ‘Connect Account’ and select from the list of institutions (e.g. Barclays)

- Choose ‘Allow’ from the TrueLayer policy screen. You will be redirected to the third-party terminal

- Follow the on-screen instructions to initiate the payment

I was pleased to see that Luno processes withdrawals Monday to Friday, though it can take up to three working days to be available in your bank account.

The minimum withdrawal limit is just £1, which I think is very reasonable, but maximum limits vary depending on your account verification limit. Level 1 status enables a total of £1,000 withdrawal overall.

The exchange also does not charge any fees which is competitive vs Kraken with a £1.95 charge.

Luno App

Luno is primarily a mobile app-based platform, available for free download to iOS and Android (APK) devices. We found the application has a modern interface, with a sleek design and simple navigation. I like that you can seamlessly switch between your crypto storage wallets, education, news, price charts, and more.

We are confident that the app will be easy enough for new investors. More experienced traders looking for analysis features and custom tools will also feel reassured thanks to the brand’s partnership with TradingView. I did, however, find the charts easier to view on the web terminal.

I liked that the platform offers automated investment functionality, so you can repeatedly purchase your favourite token. You can also select a range of different cryptos, to purchase in a single transaction.

In addition, price alerts are available, with custom notifications to alert you about specific currencies of interest.

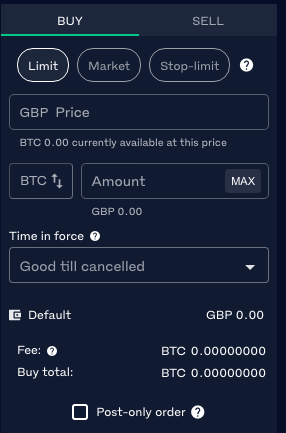

The Luno app offers three orders types:

- Limit

- Market

- Stop- Limit

How To Buy Bitcoin

It is quick and easy to buy Bitcoin on the app:

- Open the Luno mobile app and sign in

- Select ‘Wallets’ from the menu and choose the wallet you want to purchase Bitcoin

- Select ‘Buy’ from the top of the specific wallet screen

- Choose to make a one-off purchase or set up an auto reinvestment (in this example we will choose a one-off purchase)

- Click on the fiat currency you want to exchange for Bitcoin

- Enter the amount to purchase and click ‘Next’

- Review the order screen and select ‘Confirm’ if happy with the applicable fees

You can then choose whether to store it, sell it, or send it to a friend.

Demo Account

It is disappointing that Luno does not offer a demo account. You can access and explore the app without adding funds, but you cannot practise trading in real-time.

Having said this, minimum deposits are competitive, at only £1. This makes the brand very accessible to new investors with limited initial funding.

We are also impressed that Luno provides a testing community portal. You can sign up to put new features or coins to the test before they are launched in live mode. Visit ’Luno Labs’ in the settings screen and choose the features you want to use.

Is Luno Regulated?

Luno is not regulated by the Financial Conduct Authority (FCA). This is common for cryptocurrency firms given the difficulties in overseeing the complex market. It does raise some safety concerns for British traders, however.

The brand is registered as a reporting entity with the United Kingdom Financial Intelligence Unit. This means Luno has a responsibility to report suspicious activities and data to the agency.

Luno also publishes quarterly proof of reserves statements and undertakes an annual year-end audit process, conducted by third-party firm, Mazars.

The brand is also required to comply with CFT, KYC, and AML protocols, which are common standards at FCA-regulated brokers.

Security

We felt reassured that Luno operates with security in mind. There are several safety measures offered to customers, including 2-factor authentication (2FA), hashed passwords and real-time platform status communication.

A multi-signature hot wallet is used to execute Bitcoin transactions and all digital currencies are held in ‘deep freeze’ storage wallets. We also appreciated that access is supervised by Bitgo Custody and Fireblocks, industry-recognised custodial solutions.

Importantly, our experts found no reports of scams or hacks directly through the Luno platform, however, the cryptocurrency market is prone to fraudulent activity. Be cautious of phishing emails and never share your wallet information online.

Bonus Deals

While using Luno, I did not find any bonus rewards, promo codes, or other financial incentives.

That said, our UK team did find the brand provides a tiered Bitcoin rewards programme. You can earn Bitcoin by referring friends and family using a unique link. On the downside, it was a shame to see that the digital currency payments are not received until 30 days later and an initial transaction is required.

To participate:

- Sign in to your Luno account

- Select ‘Rewards’ from the menu and then choose ‘Refer Friends’

- Click ‘Share Your Code’ to copy the link. Sharing options will be displayed on the screen

- Once your referral signs up, uses the unique code, and purchases the required digital currency, the Bitcoin reward will be provided 30 days later

Extra Tools & Features

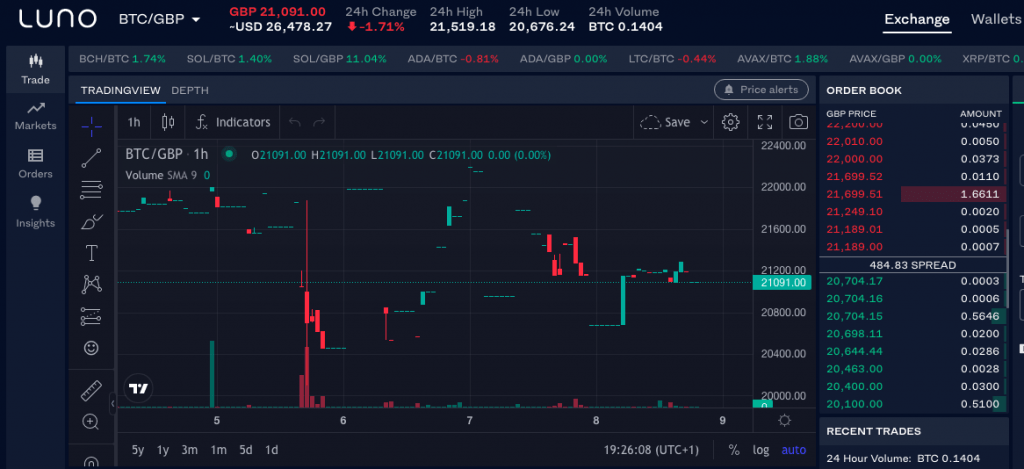

Luno Exchange

The Luno Exchange is the main proprietary software. Here you can trade 25+ fiat/crypto and crypto/crypto pairs such as BTC/GBP, ETH/XRP, BCH/BTC, and ETH/GBP.

At first glance, the terminal interface looks quite complex, but the TradingView integration provides clear charting views and customisation. You can access 25+ technical indicators such as RSI and Bollinger Bands, 11 timeframes from one minute to one week, and depth of market data.

TradingView

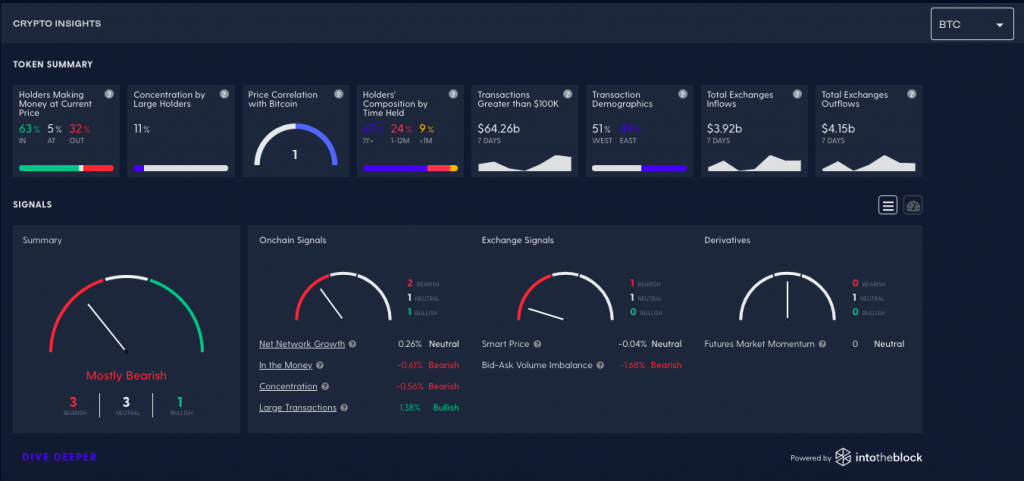

I particularly liked the exchange’s ‘Insights’ tab, which you can filter by asset, and view market sentiment data and key order metrics of peer users.

The ‘Markets’ tab offers pricing history by token, including 24-hour average price and percentage change. I found this easy to read and digest the relevant information.

Crypto Insights Tool

Luno Savings

I was impressed to find an additional passive revenue driver, via their Savings Wallet. Customers can participate in staking, meaning you can lend out tokens in exchange for a financial reward. Payments are made on the first day of every month. This money can be withdrawn or held in the wallet to earn interest.

One of the main advantages of the Luno Savings Wallet is the ability to earn. You can receive up to 1.5% interest on your Bitcoin holdings and 2% on your Ethereum tokens.

Send/Receive

Another key feature offered by Luno is the option to send and receive cryptocurrency from friends and family. We liked how simple the process is, with just an email address, phone number, or account QR code needed.

To get started:

- Sign in to your Luno account

- Choose ‘Wallets’ and then the relevant token (e.g. Bitcoin)

- Select the ‘Send’ icon

- Add the phone number or email address of the individual you want to send to

- Enter the value of the crypto token to send (in fiat currency or crypto value)

- Add a reference note

- Review the transaction details and enter your 2FA code

- Click ‘Send’

Remember, due to the nature of digital currencies, transactions are irreversible. Be careful when submitting a transfer.

Customer Service

Aside from the in-app live chat service, there are limited support options available at Luno with no email address or UK telephone contact number. There is an online contact form to request support from an agent, however, this function was disabled when we tried to use it.

We did find a comprehensive online help centre, with a good selection of detailed Q&As. I like that you can use the navigation search bar or use the six category topics to filter through the information. Queries include how to deposit, what to do if you experience an unconfirmed transaction, identity verification guidance, and how to open or delete a Luno Bitcoin account.

We liked that the help centre also offers video guidance, with step-by-step assistance.

Company Details & History

Luno was established in 2013 and operates as a subsidiary of Digital Currency Group (DCG). The brand is global and has a London head office address. The mission of the company is to make digital currency accessible to everyone, via an inclusive and efficient financial scheme.

Today, Luno has had over 10 million customers sign up, with a presence in 40+ markets worldwide including the UK, Europe, Africa, and North America.

The brand is registered and licensed in all countries of operation, including registration as a reporting entity with the United Kingdom Financial Intelligence Unit.

James Lanigan was announced as Luno CEO and co-founder Marcus Swanepoel moved to Executive Chairman in March 2023.

Trading Hours

You can trade cryptocurrency 24/7, with no market closures or public holiday dates. This is a notable advantage of investing in this asset class.

You can also enable the ‘send’ function which permits this service 24 hours a day. Luno aims to complete 99% of the customer ‘send’ requests in less than one minute.

Should You Invest With Luno?

The Luno exchange is sleek and suitable for beginners. Experienced traders may be disappointed with such a small cryptocurrency list, which is not ideal for creating a diverse portfolio.

Having said that, we were pleased to see staking, automated trading, and a wallet available. Trading fees are also competitive, including 0% maker fees, and the brand adheres to strict security guidelines.

FAQ

Is Luno Safe And Legit?

Luno is a legitimate crypto exchange. The brand adheres to KYC, AML, and CFT procedures. Additionally, your account is protected with 2FA for both login attempts and activities such as withdrawal requests. Cryptocurrency is also held in ‘deep freeze’ storage wallets, controlled by Bitgo Custody and Fireblocks.

Is It Easy To Create A Luno Account?

Yes, we found it easy to sign up for a Luno account, and we completed the application requirements in under 10 minutes. All information can be submitted online, including ID verification.

Is Luno Customer Service Reliable?

Luno does not offer a telephone contact number, email, or postal address at the firm’s head office in London. However, there is a reliable in-app live chat feature. Help can also be sourced via the online Q&A section, where we were pleased to see plenty of information and guidance.

Are Withdrawals Fast From A Luno Trading Account?

Luno processes withdrawal requests daily, though only from Monday to Friday. UK investors will be liable for standard processing times for bank wire transfers, which can take up to three working days.

Are Fees At Luno Low?

Luno’s trading fees are relatively competitive. The brand operates with a market maker/taker fee structure, though no maker fees apply which is a plus. Taker fees vary by cryptocurrency and trade volume. This ranges from 0.10% for trades between £0 and £250,000 to 0.03% for trades over £16 million based on your past 30-day trading volume.

Article Sources

Top 3 Luno Alternatives

These brokers are the most similar to Luno:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

Luno Feature Comparison

| Luno | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| Rating | 2 | 4 | 4.3 | 4.7 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Minimum Deposit | £1 | $1,000 | $0 | $0 |

| Minimum Trade | £10 | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | - | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 | 1:50 | 1:30 (Retail), 1:222 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Luno Review |

Swissquote Review |

Interactive Brokers Review |

IG Index Review |

Trading Instruments Comparison

| Luno | Swissquote | Interactive Brokers | IG Index | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | No | Yes |

Luno vs Other Brokers

Compare Luno with any other broker by selecting the other broker below.

Popular Luno comparisons: