Lirunex Review 2025

|

|

Lirunex is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to Lirunex |

| Lirunex Facts & Figures |

|---|

Lirunex is an award-winning CFD brokerage with $10 billion in trading volume. We like the firm's wide range of markets, account types, execution models, payment methods and fee structures, allowing users to develop an individual setup that works best for them. Aspiring investors will likely be drawn in by the opportunity for a deposit bonus of up to $2,000 and the simple copy trading features. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Metals, Energies |

| Demo Account | Yes |

| Min. Deposit | $25 |

| Mobile Apps | iOS & Android |

| Trading App |

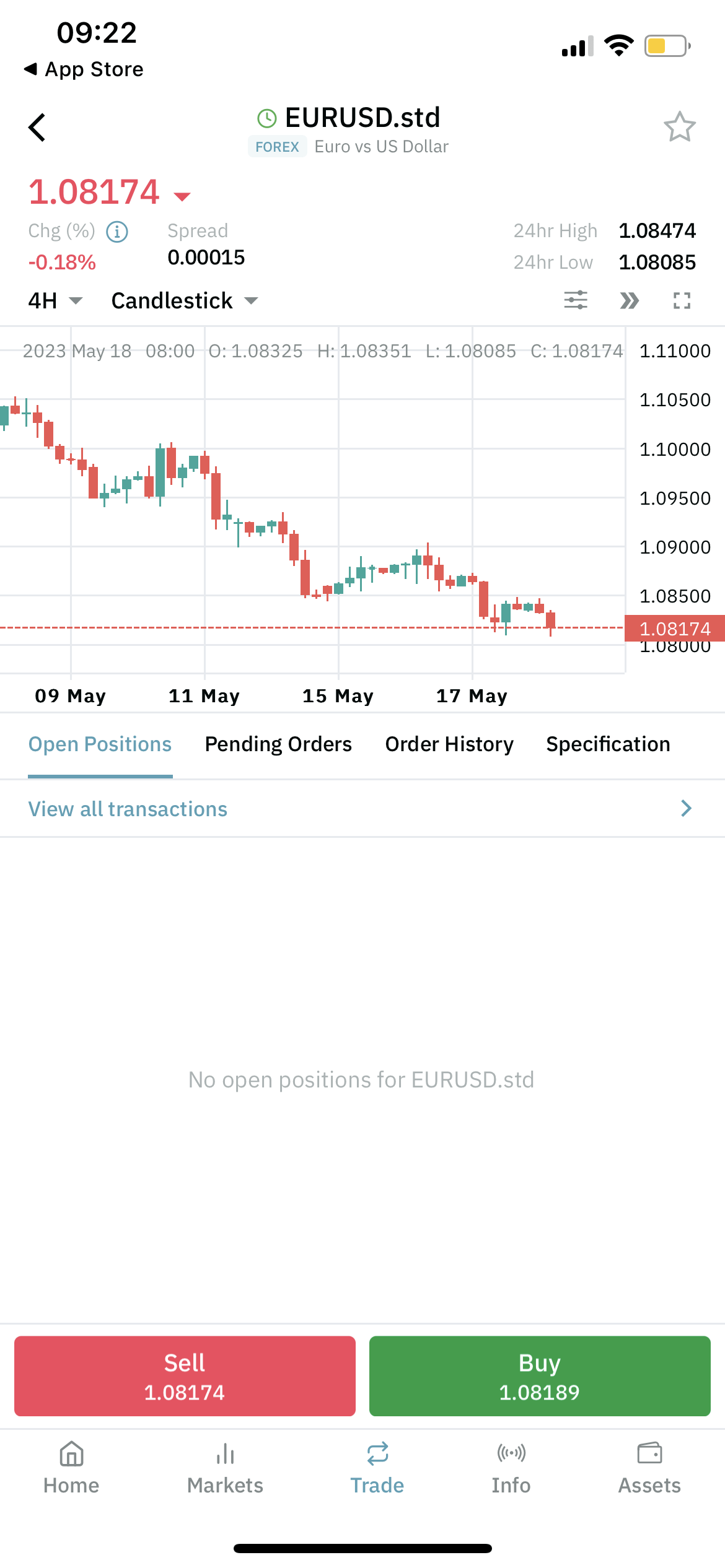

Lirunex offers a user-friendly mobile app with CFD trading on 100+ global assets. Copy trading, plus straightforward deposits and withdrawals are also available. The app is available on Apple and Android devices. |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC, LFSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | All of Lirunex's products are CFDs, comprising 100 products derived from currency pairs, indices, stocks, cryptos and commodities. This is a relatively short list that will limit the ability of experienced traders to diversify portfolios and explore less popular markets. |

| Leverage | 1:2000 |

| FTSE Spread | 1.8 |

| GBPUSD Spread | 1.5 |

| Oil Spread | 6.0 |

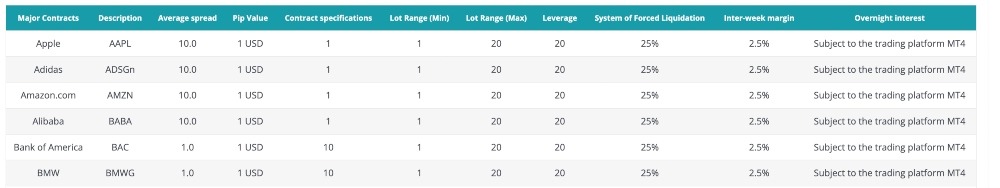

| Stocks Spread | 10.0 |

| Forex | Lirunex offers 48 forex pairs, available from MT4 and the firm's proprietary trading platform. Forex traders get reliable STP execution, though spreads trail some competitors. |

| GBPUSD Spread | 1.5 Pips |

| EURUSD Spread | 1.5 Pips |

| GBPEUR Spread | 1.9 |

| Assets | 48 |

| Stocks | Lirunex's equity products are limited to CFDs of 14 major US company shares, including Netflix, Apple and Meta. We would prefer to see stocks from a wider range of countries, industries and markets to match many alternatives. |

| Cryptocurrency | Lirunex backs DeFi technology, offering six digital currency CFDs upon which to speculate, along with the neat ability to fund and empty your account using USDT (ERC20). |

| Coins |

|

| Spreads | 20.0 (Bitcoin) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Lirunex is an offshore CFD broker that provides UK investors with access to some of the most popular financial markets by way of CFDs. The firm boasts more than 100 instruments and five account types to suit different strategies and budgets. This review will explore Lirunex’s services, extracting key details on the firm’s trading platforms, customer service, fees and security to establish whether it is a suitable brokerage for UK traders.

Our Verdict

Lirunex is an award-winning broker with a welcome bonus and copy trading. However, its trading conditions aren’t the best with high spreads on STP accounts and a large minimum deposit to access competitive conditions. And while the broker offers access to MT4 and a proprietary app for speculation on 100+ assets, Lirunex lacks the UK regulatory oversight offered by the top brokers.

Market Access

We were pleased to see a wide range of markets offered by Lirunex, including cryptocurrencies, which can be hard to find at UK-authorised brokers. The forex and stock products on offer are also quite competitive, though the list of commodities is somewhat limited.

Importantly, all products offered by the firm are contracts for difference (CFDs), so clients can go both long and short on underlying assets.

The instruments available include:

- Two Precious Metals: silver and gold

- Two Commodities: Brent Crude and WTI Crude Oil

- Six Cryptos: including Bitcoin, Ethereum and Litecoin

- 11 Indices: including the FTSE 100, Nasdaq 100 and S&P 500

- 48 Stocks: including blue chips like Apple, Amazon and Netflix

- 40 Forex Pairs: including EUR/USD, EUR/GBP and GBP/USD

Major Lirunex Stocks

Fees

Trading fees at Lirunex depend on the account type you hold. While using the platform, we found that the average spread on the LX-Standard account for EUR/USD was 1.5 pips and was slightly higher for EUR/GBP at 1.9 pips. Unfortunately, these spreads are wider than we would like to see, even for a basic STP account with no commission.

That being said, investors can access lower spreads from 0.0 pips through the LX-Prime and LX-Pro accounts, though these accounts have commissions of £6.50 per lot and £3.25 per lot, respectively. These also have higher minimum deposits, particularly the LX-Pro account, which requires an initial deposit of £8,000. Depending on the markets you trade and your throughput, this could still be worth it – our experts found that the average spread for Brent Crude/US Dollar is 6.0 pips on the LX-Standard but only 0.5 pips on the LX-Prime account.

Swap fees are also applicable for positions held overnight unless trading through Islamic accounts, which are swap-free and include all fees in the spread.

It is also worth noting that conversion fees may apply for UK traders as GBP is not one of the accepted currencies for any deposit method at Lirunex. This is very unfortunate as it makes the company less attractive for UK investors.

Lirunex Accounts

We liked that all account types at Lirunex, apart from the Islamic accounts, have the following features in common:

- 0.01 minimum lot size

- Maximum leverage ratios

- Access to the same instruments

- Scalping and hedging are allowed

On the downside, we were disappointed to find that Islamic accounts have a smaller range of instruments available. This means Lirunex isn’t the best pick for Muslim traders looking to speculate on stocks and crypto.

The key differences between each account are:

LX-Standard

- Zero commission

- Spreads from 1.5 pips

- £20 minimum deposit

LX-Prime

- Spreads from 0.0 pips

- £6.50 per lot commission

- £160 minimum deposit

LX-Pro

- Spreads from 0.0 pips

- £3.25 per lot commission

- £8,000 minimum deposit

Islamic Standard

- Zero commission

- Spreads from 1.5 pips

- £20 minimum deposit

- Up to 1:2000 leverage

- Sharia-compliant and swap-free

- Forex, precious metals and commodities

Islamic Prime

- Spreads from 0 pips

- £6.50 per lot commission

- Up to 1:2,000 leverage

- £160 minimum deposit

- Sharia-compliant and swap-free

- Forex, precious metals and commodities

How To Register For An Account With Lirunex

- Complete the registration form on the app or website

- Verify your email address via the link sent to you

- Fill in additional personal details and submit your KYC verification documents

- Sign into the client dashboard when your account has been activated

Funding Methods

Deposits

When we used Lirunex, we were pleased to see that there are no deposit fees for fiat methods. However, investors may encounter gas fees if using cryptocurrency as a deposit method. Banks may also charge third-party fees.

There is a reasonable £20 minimum deposit, although this does depend on the method chosen; some deposit options have considerably larger minimum limits.

Disappointingly, no deposit options support the transfer of GBP funds, so currency conversion fees may be applied for UK investors. Most methods support USD currencies only, though bitwallet transfers can also be made in JPY, EUR and AUD, while ThunderXpay supports LAK, MMK, KHR and THB.

Deposit transactions are processed by Lirunex Monday-Friday 09:00-15:00 (GMT+8). For UK traders, deposit methods include:

- BitPay: £800 minimum

- TRC-20: £80 minimum

- ERC-20: £80 minimum

- bitwallet: £80 minimum

- ThunderXpay: £20 minimum

- Global Transfer: £1,600 minimum

- Mastercard/Visa Payment Cards: £20 minimum

These deposit methods all take 24 hours, except global transfers, which take three to five banking days and ThunderXpay, which is instant.

How To Deposit

I found the account funding process straightforward:

- Login to the client portal

- Select My Wallet and then Deposit Funds

- Enter the amount and currency desired

- Choose the payment method

- Click Proceed

- Enter the required payment information

- Click Submit

Withdrawals

Similar to other brokers, the same method as the deposit must be used to withdraw money, although withdrawing to a different account in your name may be possible if the relevant compliance and anti-money laundering (AML) checks are completed.

We appreciated that all withdrawal requests are processed within one business day by Lirunex, although the actual time taken for the funds to reach your account depends on your bank’s policy. We were also pleased to see no withdrawal fees, except for global transfers, which are £28. However, withdrawals are likewise limited in terms of GBP support, so UK clients may still see conversion charges eat into their profits.

The minimum withdrawal amounts and processing times are as follows:

- BitPay: £16 minimum and 24 hours

- TRC-20: £16 minimum and 24 hours

- ERC-20: £160 minimum and 24 hours

- bitwallet: £16 minimum and 24 hours

- ThunderXpay: £16 minimum and 1-2 banking days

- Global Transfer: £160 minimum and 3-5 banking days

- Mastercard/Visa Payment Cards: £16 minimum and 7-10 banking days

UK Regulation

Lirunex Limited is incorporated and registered offshore in the Republic of the Marshall Islands and re-registered in the Republic of Maldives under the Companies Act of the same jurisdiction.

We recommend that traders approach offshore brokers with caution as the regulatory oversight they fall under is often significantly limited compared to FCA-regulated firms. Additionally, investors will usually not have access to investor compensation schemes like the UK’s FSCS, which provides insurance for customer deposits should member brokers not be able to meet their obligations.

Lirunex does have an EU entity, which has a license with and is regulated by CySEC. While this does go some way to reassure us about the firm’s legitimacy, this entity does not provide services to UK traders.

The broker also has an entity regulated by the Labuan Financial Services Authority (LFSA).

Trading Platforms

There are two trading platforms for investors to choose from: the industry-leading MetaTrader 4 (MT4) or the in-house trading app.

MT4 is our favourite with plenty of features for advanced technical and fundamental analysis. It is one of the best platforms that an trader of any ability can use.

The Lirunex platform is easy to pick up but comes with more basic features and customisation capabilities. With that said, I like that it comes with a Web Trader option to avoid the need for any software downloads.

I have pulled out the key features and differences between the two platforms:

MT4

- Copy trading

- Trading signals

- Nine timeframes

- PC, iOS and Android

- 23 analytical objects

- 30 technical indicators

- Three execution modes

- Financial news and alerts

- Algorithmic trading using expert advisors (EAs)

Lirunex App

- Trading signals

- Nine timeframes

- Profit/loss statistics

- Market news and analysis

- Line and candlestick charts

- Web Trader, iOS and Android

- Stop loss and take profit order types

Lirunex Mobile App

How To Place An Order On The Lirunex App

I thought making a trade on the Lirunex app was intuitive and straightforward:

- Navigate to your chosen instrument

- Click on Buy or Sell at the bottom of the screen

- Choose your order type, size and stop loss/take profit (if necessary)

- Confirm the order

Mobile App

The Lirunex app is intuitive and has been built with the user in mind. Our team particularly liked that it allows both demo and live trading, as well as featuring expert forex signals and an economic calendar.

MT4 also offers a mobile app, providing many of the same features that are on the desktop version with the added benefit of being able to trade on the go. However, some of the more advanced capabilities, such as creating algorithmic trading strategies using MQL4, are limited to the desktop platform. As a result, I recommend using the desktop solution for any heavy lifting.

Lirunex Leverage

Maximum leverage levels at Lirunex are much higher than you would find at many other brokers. This is because the firm has the regulatory freedom to offer such rates.

- Precious Metals: 1:2000

- Commodities: 1:100

- Forex: 1:2000

- Indices: 1:200

- Equities: 1:20

- Cryptos: 1:5

Note that the leverage of the HK Hang Seng Index is fixed at 1:20.

Investors should also be aware that Lirunex leverage is tiered, meaning that smaller account balances will have access to higher leverage rates than those with larger account balances. For example, we found that account balances comprised of less than or equal to £400 are eligible for rates up to 1:2000, whereas account balances of £36,000 and above have a maximum leverage rate of 1:100. Other leverage limits apply for balances in between these amounts.

Demo Account

As is the case with most brokers, Lirunex has a free demo account that can be used on both the MT4 platform and the broker’s trading app. This allowed us to get to grips with all the trading features before risking real money. Paper trading accounts are also useful for experienced traders as they provide a means to test and develop new strategies with zero risk.

Clients can request that their virtual balance be changed by sending an email to the broker’s support team with their demo account number and their preferred balance.

We were quite disappointed to see that the trading conditions on the demo account are not quite the same as those on the live account. Moreover, you cannot access the WebTrader without first opening and approving a live account. Therefore, any new and prospective clients that wish to trial the broker would need to download the MT4 desktop client or one of the mobile apps.

How To Open A Demo Account

- Complete the demo account registration form on the broker’s website

- Check your email for the login details

- Enter the details on either MT4 or the Lirunex mobile app

Lirunex Bonuses

As a broker not regulated by a top financial authority, Lirunex has the freedom to offer a range of attractive promotions. However, investors should carefully check the terms and conditions of each promotion. There will usually be a minimum number of lots that need to be traded before bonus funds can be withdrawn (or even your initial deposit). Also, some promotions are only available on certain account types or to new customers.

Promotions include:

- 20% Trading Bonus – £80 minimum deposit, £400 maximum bonus, application form required

- Predict NFP Contest – Predict the correct price and win a gold bar or cash credit to your account, requires live account signup

- 100% First-Time Deposit Bonus – £80 minimum deposit, £16,000 maximum bonus, application form required

- Super Trader Contest 2023 – Win a range of prizes, £40 deposit within the competition period, requires live account signup

- Let’s Gold Promotion – New accounts only, rewards in the form of gold bars, no withdrawals during the promotional period, application form required

Previous Lirunex promotions have also included a copytrade bonus for those with a successful strategy that others are willing to follow.

Extra Tools & Features

The broker’s news page contains details of events around the globe for traders, as well as news of changes that the broker has made to trading conditions, such as leverage limit adjustments. Market news and analysis can be found on the Lirunex trading app.

Disappointingly, when we used the education section we found it mediocre. Although it did contain informative guides, these were quite generic and did not have sufficient detail to enable newer investors to properly understand how to implement various strategies. There were also no video tutorials or webinars.

On a lighter note, Lirunex has a PAMM/MAM programme, so clients can have their money invested for them by experienced investors. This is great for those with minimal experience or those lacking the time needed to properly analyse the markets. It also creates opportunities for those with the skills required to manage such portfolios to earn commission from this.

Additionally, the broker has prop trading, where it will financially support undercapitalised investors that can demonstrate that they have the skills to successfully make consistent profits.

We were also pleased to see that the broker has partnered with VPS providers so that investors can achieve lower latency and continuous automated trading using less power. FIX API support is also available for professional investors to get direct access to the investing servers without using third-party software like MetaTrader 4.

Company Background

Lirunex was founded in 2017 and now has upwards of £8bn in trading volume. The broker is registered and regulated offshore. Lirunex Limited is the official company name and this entity is registered in the Republic of the Marshall Islands and re-registered in the Republic of Maldives.

Unfortunately, there are limited details regarding the personnel running the company or who it is regulated by, although there is a reference to the Ministry of Economic Development (MED), Republic of Maldives, being its regulator.

On the positive side, the broker has won multiple awards, although our review found that these are mainly in the Asia-Pacific region, such as ‘Traders Awards Best Broker in Thailand 2022’ and the award for ‘Fastest Growing Forex Broker Asia 2022’.

Customer Service

Our experts found that Lirunex has a good set of customer contact options. Our only criticism is that there is no UK phone number, which is a downside vs popular UK brokers.

You can get in contact through:

- Online Contact Form

- Live Chat/Virtual Assistant

- Phone Number: +603 22421878

- Email Address: support@lirunex.com

Security

With limited regulatory oversight and the broker being registered offshore, we recommend that investors approach Lirunex with caution as the protection of consumer interests appears more limited than for an FCA-regulated UK broker. Traders should remember that brokers have access to lots of sensitive personal information. That being said, funds are claimed to be kept in segregated accounts.

Personal account security could also be enhanced by the use of two-factor authentication (2FA), which has become a mainstay of reputable firms.

MT4 is trusted by many brokers and traders around the world and part of the reason for this is because of the platform’s reputation for security. Measures that MetaTrader has implemented in this area include encryption between servers and client terminals, as well as the encryption of traders’ IP addresses.

Trading Hours

Trading hours vary depending on the market. Crypto is accessible 24/7, whereas other markets like stocks and indices will usually have more restricted hours. Lirunex has helpfully provided a page on its website that shows upcoming market holidays.

Should You Invest With Lirunex?

Lirunex has a decent range of instruments and very high leverage, as well as some low-spread and zero-commission accounts that can also make use of the reliable and feature-rich MetaTrader 4 platform.

However, the firm’s offshore status is cause for concern and any investor not willing to commit a large initial deposit will suffer from wide spreads and poor trading conditions. Moreover, UK investors will need to convert their money to and from a supported currency or lose out to currency conversion costs when making deposits and withdrawals.

FAQ

Is Lirunex Safe & Legit?

Lirunex is an offshore broker, meaning that it does not offer the same level of protection for customers as many FCA-regulated brokers do. Although it does claim to use segregated bank accounts, we recommend investors approach this broker with caution.

Is Lirunex Good For Beginners?

This broker has a low minimum deposit level and a free demo account, although fees are very high for beginner accounts and the website does not provide comprehensive help for those getting started. As a result, Lirunex is not the best pick for beginners.

Is Lirunex Good For Advanced Traders?

Lirunex allows clients to use the MetaTrader 4 platform, which has a wealth of features for technical and fundamental analysis. Traders can also choose to incorporate a VPS to remove latency and downtime. On the other hand, the lack of insurance for customer deposits may be a concern for high-capital traders. MetaTrader 5 is also a faster, more advanced platform that may better meet the needs of seasoned traders.

What Is Stop-Out Liquidation At Lirunex?

Stop-out liquidation occurs when your account margin hits 25% or lower. The largest losing trade still open will be liquidated first, followed by the rest in this fashion until the account is brought back over the 25% margin level.

Why Is The Minimum Deposit On The Lirunex LX-Pro Account Higher?

The LX-Pro account has a higher minimum deposit of £8,000 because it provides access to lower spreads from 0.0 pips and a better commission of £3.25 per lot. Yet while these account fees are attractive, some alternatives offer equally competitive fees with a smaller starting deposit.

Article Sources

Top 3 Lirunex Alternatives

These brokers are the most similar to Lirunex:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Lirunex Feature Comparison

| Lirunex | Pepperstone | IC Markets | FP Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 4.8 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Metals, Energies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | $25 | $0 | $200 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, LFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:2000 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | Lirunex Review |

Pepperstone Review |

IC Markets Review |

FP Markets Review |

Trading Instruments Comparison

| Lirunex | Pepperstone | IC Markets | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | Yes |

Lirunex vs Other Brokers

Compare Lirunex with any other broker by selecting the other broker below.

Popular Lirunex comparisons: