LCG Review 2025

|

|

LCG is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to LCG |

| LCG Facts & Figures |

|---|

London Capital Group was established in 1996 and is regulated by the FCA and CySEC. Today the firm is a popular CFD and spread betting provider, with $20+ trillion in executed trading volume, 24/5 customer support, and a number of industry awards. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Futures |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Min. Trade | Lots vary by asset |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| CFDs | Trade thousands of CFDs on reliable trading software. Leverage up to 1:30 is available in line with regulatory restrictions. Beginners can also utilize the firm's training videos. |

| Leverage | 1:30 |

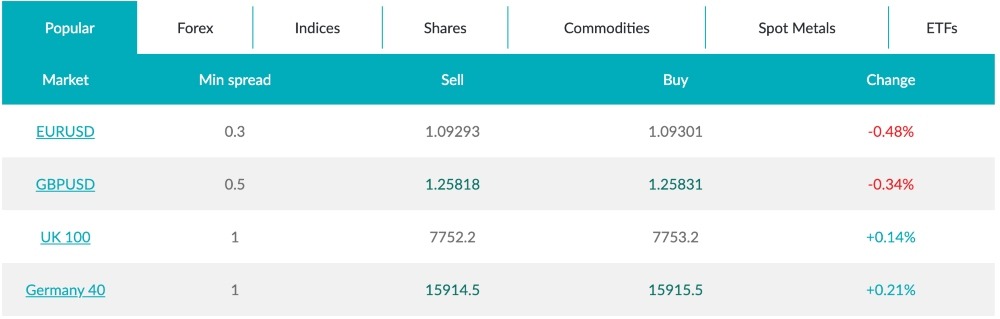

| FTSE Spread | 1 pt |

| GBPUSD Spread | 0.5 pips |

| Oil Spread | 3 pips (Variable) |

| Stocks Spread | 0.3% Var |

| Forex | LCG offers 60+ major, minor and exotic currency pairs on MT4 or LCG Trader. Leverage is available up to 1:30 with average spreads of 1.5 pips on key currency pairs. |

| GBPUSD Spread | 0.5 pips |

| EURUSD Spread | 0.3 pips |

| GBPEUR Spread | 0.4 pips |

| Assets | 60+ |

| Stocks | Speculate on hundreds of shares from international markets including Germany, US and the UK with leverage up to 1:5. Average 0.10% spreads apply to stock positions. |

London Capital Group (LCG) is a UK-based CFD broker offering thousands of tradable instruments via MT4 or its bespoke trading platform. We were generally impressed by this long-running broker’s market access and fees, which we will detail in this LCG review, as well as the payment methods available, account options, and regulatory position.

LCG is a trustworthy broker regulated by the Financial Conduct Authority (FCA). We rated the broker’s wide range of products and stable trading platforms. Another bonus for our team was the high-quality customer support. On the downside, the broker falls short in terms of education and copy trading. We were also disappointed to find a £15 inactivity fee.

Market Access

London Capital Group has an impressive offering of over 7000 instruments from nine asset classes, including stocks, forex, indices, commodities, metals, bonds, and ETFs. Securities are available from an array of markets from the LSE to NASDAQ.

We found this to be a diverse asset list that stands up to the competition in the core areas while also offering a few lesser-known options.

Available instruments:

- Over 3500 shares, including Barclays and Apple

- Over 60 index products, including FTSE 100, DAX 40 and S&P 500-inspired indices

- Nine+ bond and interest rate products, including the Gilt, Bund and Euribor

- A range of commodities including US crude oil and natural gas

- Over 60 forex pairs, including EUR/USD, GBP/USD and GBP/JPY

- Several ETFs covering the UK, US, and EU

- Spot metals such as gold

- Vanilla options

LCG Accounts

We were pleased to see four account types offered to LCG customers – CFD Trading, Spread Betting, ECN, and Islamic.

It is good to find both the zero-interest, halal Islamic account and an option for serious traders to achieve direct market access through the ECN account. Moreover, we feel that separating spread betting and CFD trading into separate accounts is straightforward and sensible.

CFD Trading

The CFD account is the standard account, giving traders their choice of the MetaTrader 4 platform and the LCG Trader platform.

In this review, our experts found that 7000 instruments can be traded through this account, which we found to also provide adequate analysis, research, and educational materials.

Spread Betting

Spread betting is offered through the dedicated account. With this profile, traders can spread bet on over 5000 different assets using either of the available trading platforms. Market analysis functions are also offered with this account type.

While the asset range is less broad than the CFD account’s offering, some traders will prefer spread betting – particularly given that it is a tax-efficient option for UK traders.

ECN

The ECN account offers direct market access to qualifying traders. This account must be requested from the LCG customer service email address and must maintain a balance of $10,000 (£7,900).

While we feel this may price out some retail traders, higher rollers will appreciate the tighter spreads, which start at 0 pips with no requotes on orders. With that said, ECN traders will also need to pay a commission (as detailed in the “Fees” section below).

Islamic

A swap-free, Sharia-compliant Islamic account gives access to far fewer tradable assets but ensures that there are no swaps or rollover interest on overnight positions.

Traders who are interested in signing up for an Islamic account can apply by emailing the London Capital Group support team.

How To Register For An Account

LCG’s registration process is quick and simple, only taking us a few minutes to complete.

- On the LCG website click the ‘START TRADING NOW’ button

- Here you can open an account with LCG. Provide the requested details (email address, password, etc.)

- Verify your account through the link sent to your email

- Login to the My LCG dashboard

- Provide your KYC details (including identification, address, etc.)

- Click “Add account”

- Fill in the details, choosing the account type you would like to open (demo, spread betting, CFD) and the platform/currency you would like to use

- Submit to open your account

Fees

We have a mostly positive view of LCG’s fee structure.

On all account types except ECN, fees are charged through bid-ask spreads on positions. The ECN account has spreads starting from 0 but charges a commission per lot depending on the size of the order:

- $30/m (£24) for orders up to $100m (£79m)

- $21/m (£16) for orders up to $500m (£395m)

- $15/m (£11) for orders up to $1bn (£790m)

- $12/m (£9.50) for orders up to $2bn (£1.5bn)

- $10/m (£7.90) for orders over $2bn (£1.5bn)

There are also guaranteed stop charges that vary between instruments. It is also worth being aware that swap fees must be paid on non-Islamic accounts.

We were less happy to see deposit fees of 2% that apply to Visa/Mastercard credit card transfers – though traders with access to a supported e-wallet can avoid this as no other deposit methods have any charge.

We also found it disappointing to learn of LCN’s £15 inactivity fee, which kicks in after six months without any trades.

Funding Methods

We were pleased with the variety of payment methods supported by LCG, though we do think that crypto deposits and a wider range of e-wallets such as PayPal would be welcome additions, as well as a free credit card option.

- Bank Transfer – Deposits are free and can take up to 3 days to be processed. Withdrawals are free and take 2–5 working days to process.

- Visa/Mastercard – Deposits are free through debit cards and cost 2% through credit cards. They are usually processed within 30 minutes but may take up to 2 hours. Withdrawals are free and take 2–5 working days to process.

- Skrill – Deposits are free and are usually processed within 30 minutes (but could take up to 2 hours). Withdrawals are free and take 2–5 working days to process.

- Neteller – Deposits are free and are usually processed within 30 minutes (but could take up to 2 hours). Withdrawals are free and take 2–5 working days to process.

Trading Platforms

With both the popular MetaTrader 4 (MT4) and London Capital Group’s proprietary platform on offer, we can find little fault with LCG’s trading software.

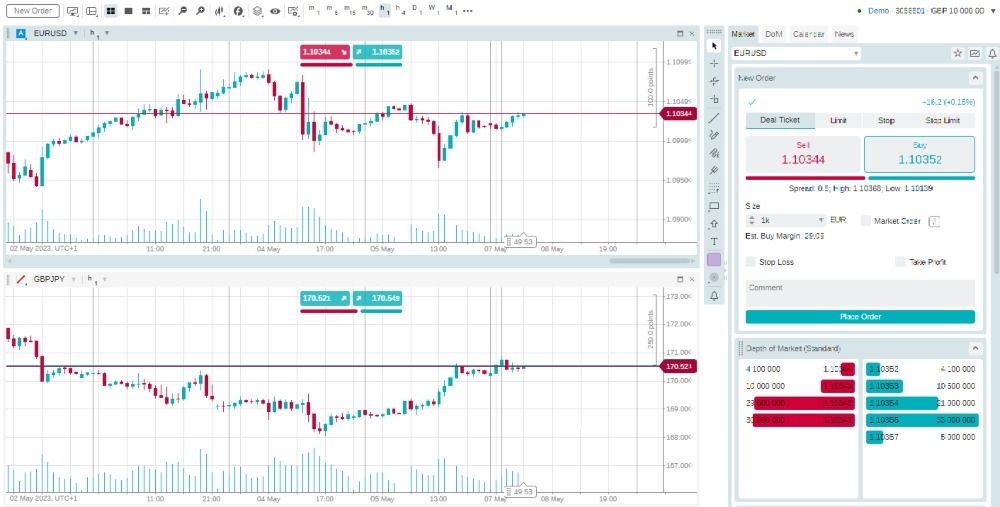

LCG Trader

We have a good impression of LCG’s web-based trading platform, which focuses on ease of use and integration with LCG’s other offerings to enhance the trader’s experience.

The user interface is sleek and easy to navigate, with an intuitive design that is suited to beginner traders. However, it also provides an array of technical tools for more experienced traders to use, including many different oscillators, trend lines and volatility trackers.

While the platform lacks some of the features that MT4 offers (like Expert Advisors), LCG Trader provides a more streamlined and intuitive experience, making it a better choice for newer traders.

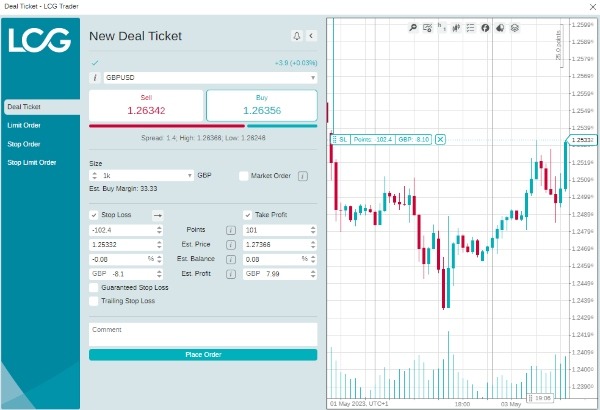

How To Place A Trade

- Log in to your LCG account on your trading platform

- Choose the instrument you would like to trade from the left-hand side

- Click “New Order”

- Fill out the details of your desired order (size, stop loss, take profit, etc.)

- Choose whether to buy/sell and place your order

MetaTrader 4

MT4 is an industry-leading platform that is built to be accessible to beginners but powerful enough for professional investors – especially those with a penchant for automated trading. The platform comes with a range of features including:

- 30 technical indicators

- 23 analytical objects

- 9 timeframes

- Automated trading bots (Expert Advisors)

- Supports custom plugins (MQL4)

The platform is available to download directly from the LCG website for desktop PC, Google Play Android devices, and Apple iOS devices. You can also launch the in-browser web trader.

We were a little disappointed that MetaTrader 5 (MT5) is not on offer, as many other brokers also provide this, though many will be comfortable enough using the classic MT4.

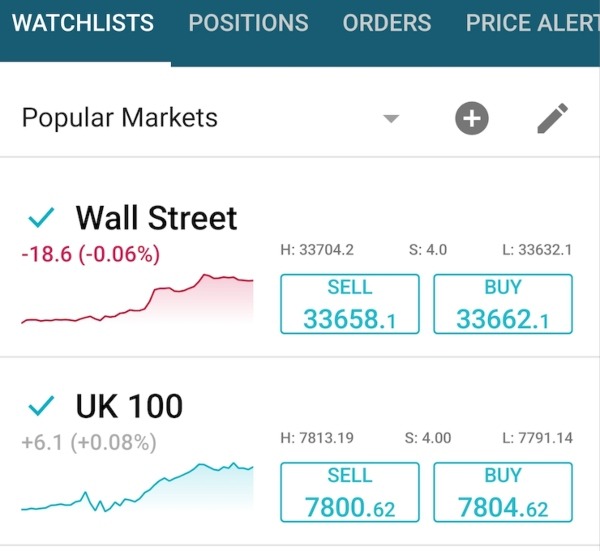

LCG App

Both the MT4 trading platform and LCG Trader offer mobile applications for Android and iOS devices.

These apps give traders the ability to track the markets and perform trades from anywhere. Charting and drawing tools are also available on mobile platforms, giving traders many of the tools available to them with desktop platforms.

We found the MT4 app particularly reliable with a seamless transition between the desktop software and mobile trader.

Demo Account

We were relieved to find one of our top features, a demo account, available on LCG for both the MetaTrader 4 and LCG Trader platforms.

Traders can choose the type of demo account they would like to open (CFD or spread betting), as well as customising the initial starting capital.

How To Open An LCG Demo Account

- Go to the London Capital Group website and click on the tab of the platform you like

- Click the “Open Demo Account” button

- Input the required information (name, email address, etc.)

- You will now have the demo account information emailed to you

Alternatively, log into the My LCG client portal and click the “Add Account” button. Next, choose the demo account option and input the required information to receive your demo account information by email.

UK Regulation

We are confident that LCG’s oversight by the UK Financial Conduct Authority (FCA) is sufficient to protect retail traders. The broker is listed under the London Capital Group Ltd registration, with reference number 182110 and registered company number 03218125.

Under FCA regulations, customers will be protected by the FSCS, ensuring up to £85,000 of compensation can be claimed if LCG is unable to meet its financial commitments.

Furthermore, the broker must also store its and customers’ funds in segregated accounts and provide other safeguards to traders including negative balance protection.

LCG Bonuses

We were not surprised to find that LCG offers no bonuses or rewards, since the FCA prohibits this type of incentive.

Extra Tools & Features

London Capital Group provides a suite of additional tools and features, but we do not feel the offering here stands up well in comparison to other brokers.

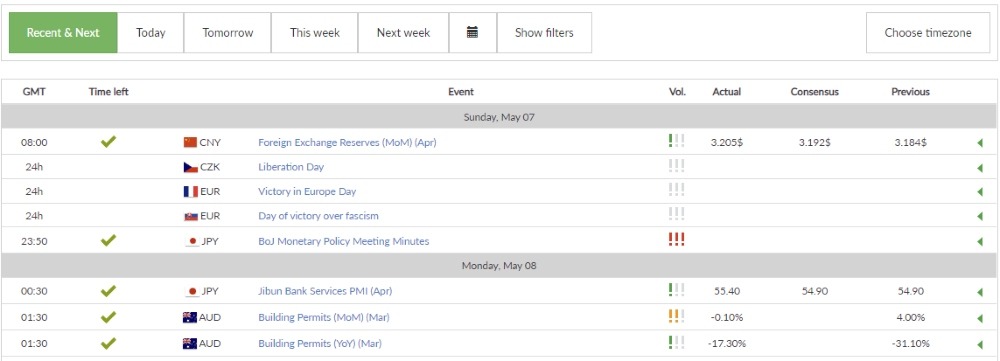

The content includes an economic calendar, Trading Central analysis, corporate and economic news, analysis videos produced by LCG’s research team, educational trading videos, webinars, support guides, and a glossary.

While using LCG, it was good to see a mix of text and video content, but we were disappointed to note the lack of up-to-date analysis – the last ‘week ahead’ video update was shot in 2020 – and the educational content will offer very little to experienced traders.

We feel this puts LCG at a disadvantage given the depth and breadth of analysis and educational resources provided by companies like eToro.

Customer Service

LCG’s customer service options are good, and we were pleased to see the range of different contact options available, including separate email addresses for the customer service and dealing desk teams. However, we were less impressed by the live chat option, which was unavailable when we tried to contact it during UK trading hours.

- Address: LCG, 3rd Floor, 80 Cheapside, London, EX2V 6EE

- Contact Phone Number: +44 (0) 207 456 7020 (Mon-Fri 09:00 to 17:00 (GMT))

- E-mail Address: customerservices.uk@lcg.com

London Capital Group’s website also has an FAQ page to cover a range of general queries.

Company History & Overview

Our experts were reassured to find that LCG’s company details are transparent and readily available online. This established, FCA-regulated CFD and spread betting brokerage is based in London, UK, and has amassed more than 20 years of experience in the industry since its foundation in 1996.

LCG has taken in over £700m worth of deposits and executed £15 trillion in trading volume since it was established, winning many trading awards in that time, including those from the Investors Chronicle/FT, MoneyAM, and the UK forex awards.

Trading Hours

Trading hours vary between assets, with forex tradable 24/5. Other assets have varying trading hours depending on the market.

Fortunately, London Capital Group keeps users updated with any market closures and holidays on its website and trading platforms.

Should You Invest With LCG Brokers?

We were impressed by LCG’s wide range of tradable assets, good choice of platforms and long history in the sector. The broker also offers a clear pricing structure and a range of additional features, though we felt the educational content on offer compares poorly to the competition.

Overall, London Capital Group is a relatively safe pick due to the FCA authorisation, however traders who want deep educational and analytical resources might want to look elsewhere.

FAQ

Is LCG Trustworthy?

London Capital Group is a long-running broker that is regulated by the FCA, one of the most reputable financial regulators. As such, UK traders can be assured that LCG is legitimate and safe to trade with.

Does London Capital Group Charge Commission?

There is no commission for most of LCG’s orders. Only trading through an ECN account comes with a commission, in exchange for tighter spreads and direct market access. In the other account types, you will trade with wider spreads but with no commission charges.

Does LCG Offer A Stable Trading Platform?

We were pleased to find both the popular MetaTrader 4 software and the user-friendly LCG Trader platform available. MT4 provides active traders with plenty of tools to implement manual and automated trading strategies. LCG Trader, on the other hand, is better designed for newer investors looking for an easy-to-understand platform.

Does London Capital Group Offer A Demo Account?

Yes, traders can open demo accounts with London Capital Group, either through the website or directly in the client portal. The simulator account comes funded with virtual cash and replicates the live trading environment.

Does LCG Offer A Good Mobile App?

The MT4 and LCG Trader platforms have high-quality mobile app alternatives. Both are available on Android and iOS devices, giving traders the ability to perform analysis and place orders while on the go. Both platforms can also be downloaded from the LCG website, or found on their respective app stores.

Article Sources

Top 3 LCG Alternatives

These brokers are the most similar to LCG:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

LCG Feature Comparison

| LCG | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 2.8 | 4.7 | 4 | 4.3 |

| Markets | CFDs, Forex, Stocks, Futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Minimum Deposit | $0 | $0 | $1,000 | $0 |

| Minimum Trade | Lots vary by asset | 0.01 Lots | 0.01 Lots | $100 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4 | MT4, MT5 | - |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:30 | 1:50 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | LCG Review |

IG Index Review |

Swissquote Review |

Interactive Brokers Review |

Trading Instruments Comparison

| LCG | IG Index | Swissquote | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | No |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | No | Yes | Yes | No |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

LCG vs Other Brokers

Compare LCG with any other broker by selecting the other broker below.

Popular LCG comparisons: