LBLV Review 2025

|

|

LBLV is #93 in our rankings of CFD brokers. |

| Top 3 alternatives to LBLV |

| LBLV Facts & Figures |

|---|

LBLV is an offshore forex and CFD broker offering 1400+ financial instruments and a range of high-deposit accounts. Founded in 2017, the brokerage claims to offer competitive fees, fast execution and advanced resources, though the weak regulatory status makes the broker less reliable than regulated alternatives. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, shares, commodities |

| Demo Account | Yes |

| Min. Deposit | $5000 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA (Seychelles) |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | CFDs are available on key asset classes with high leverage up to 1:400. You can also access the broker's platform on multiple devices, though we are disappointed with the lack of additional trading tools and research. |

| Leverage | 1:400 |

| FTSE Spread | Vairable |

| GBPUSD Spread | 0.3 |

| Oil Spread | Variable |

| Stocks Spread | Variable |

| Forex | LBLV offers major and minor pairs but fails to offer prospective clients any transparency on forex spreads and fees. Beginners will also struggle to access the high-deposit forex trading accounts. |

| GBPUSD Spread | 0.3 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.3 |

| Assets | 50+ |

| Stocks | Trade major shares including Apple and Microsoft. We like the detailed economic calendar, however the lack of market news and research is disappointing. |

| Cryptocurrency | Go long or short on a handful of popular cryptos, including Bitcoin. However, the suite of digital tokens is limited vs alternatives so we don't recommend LBLV for dedicated crypto traders. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

LBLV is an offshore broker incorporated in the Comoros Union that offers forex, commodities, stocks and other instruments. But with limited transparency about fees and payment methods – as well as a warning about this broker from the FCA – we are suspicious about LBLV’s activities.

This review will assess the broker in more detail, outlining key trading products, account security, and more.

Our Take

- Our experts had trouble using the brokerage’s services, including opening an account, accessing educational material and contacting customer support

- The firm is not regulated by a reputable authority such as the FCA raising safety concerns

- The very high minimum deposit of $5000 will put this out of reach for many beginner traders

- We think LBLV should be avoided by UK investors, though some high-net-worth traders may be attracted to the private bank accounts offered at the top account levels

Market Access

LBLV offers over 1,400 investment products. The range of instruments advertised is fairly decent and includes cryptocurrency assets like Bitcoin, which many UK brokers do not offer. Also, clients looking for a low-cost way to diversify their portfolios may benefit from indices like the FTSE 100.

Still, we recommend higher-rated alternatives like Plus500 or eToro. They offer many thousands of instruments including portfolio diversification opportunities. Trading conditions and account security are also higher at these firms.

The full list of assets is as follows:

- Metals, including gold and silver

- Forex, including major and minor pairs

- Indices, including the FTSE 100 and S&P 500

- Stock CFDs, including Apple, Amazon and Microsoft

- Commodities, including Brent Crude oil, coffee and gas

- Cryptocurrencies, including Bitcoin, Ethereum and Ripple

Fees

LBLV claims to have low trading commissions, although no further details regarding spreads, commission charges or non-trading fees are given.

We find this extremely disappointing, making it difficult for traders to make an informed decision as to the profitability of investing with this broker.

The broker also fails to provide information about other trading costs, such as inactivity and swap fees.

Account Types

Our experts were pleased to see that all account types at LBLV have Islamic/Sharia-compliant options and mobile trading support.

However, accounts can only be opened in USD and EUR, which means UK investors may be subject to additional fees when converting from GBP.

Rookie

Although the Rookie account has the lowest minimum deposit, traders must still deposit £4,000 to open one. This will certainly exclude many novices. Our team were disappointed with this high minimum deposit requirement, finding it unnecessary and almost predatory. This account is also very basic and comes with no additional features.

Basic

The Basic account requires a £20,000 minimum deposit and, unlike the Rookie account, features access to an account manager. However, for such a large minimum deposit, we think this LBLV account should come with a much wider range of features.

Premier

The Premier account has a £40,000 minimum deposit and comes with an account manager and ‘technical indicator’. Our experts could find no detail as to the nature of this technical indicator given by the broker.

As the trading platform has built-in technical indicators, we think this account may be lacking relative to its high minimum deposit requirement.

Elite

This account at LBLV has all the features of the Premier account, as well as what the broker calls ‘technical analysis’. Again, no detail is given as to what this means. The account also has a hefty £80,000 minimum deposit.

Elite Plus

The Elite Plus account is only appropriate for serious traders as it has a £200,000 minimum deposit. It contains all the features of the Elite account, plus an EU private bank account.

VIP

The VIP account is the most premium account type at LBLV with an £800,000 minimum deposit and the broadest range of features. It includes everything that the Elite Plus account has to offer, as well as a personal banker.

However, we are still not convinced that this account offers value for money, particularly as there is no indication by the broker that the high minimum deposits result in any discounted fees.

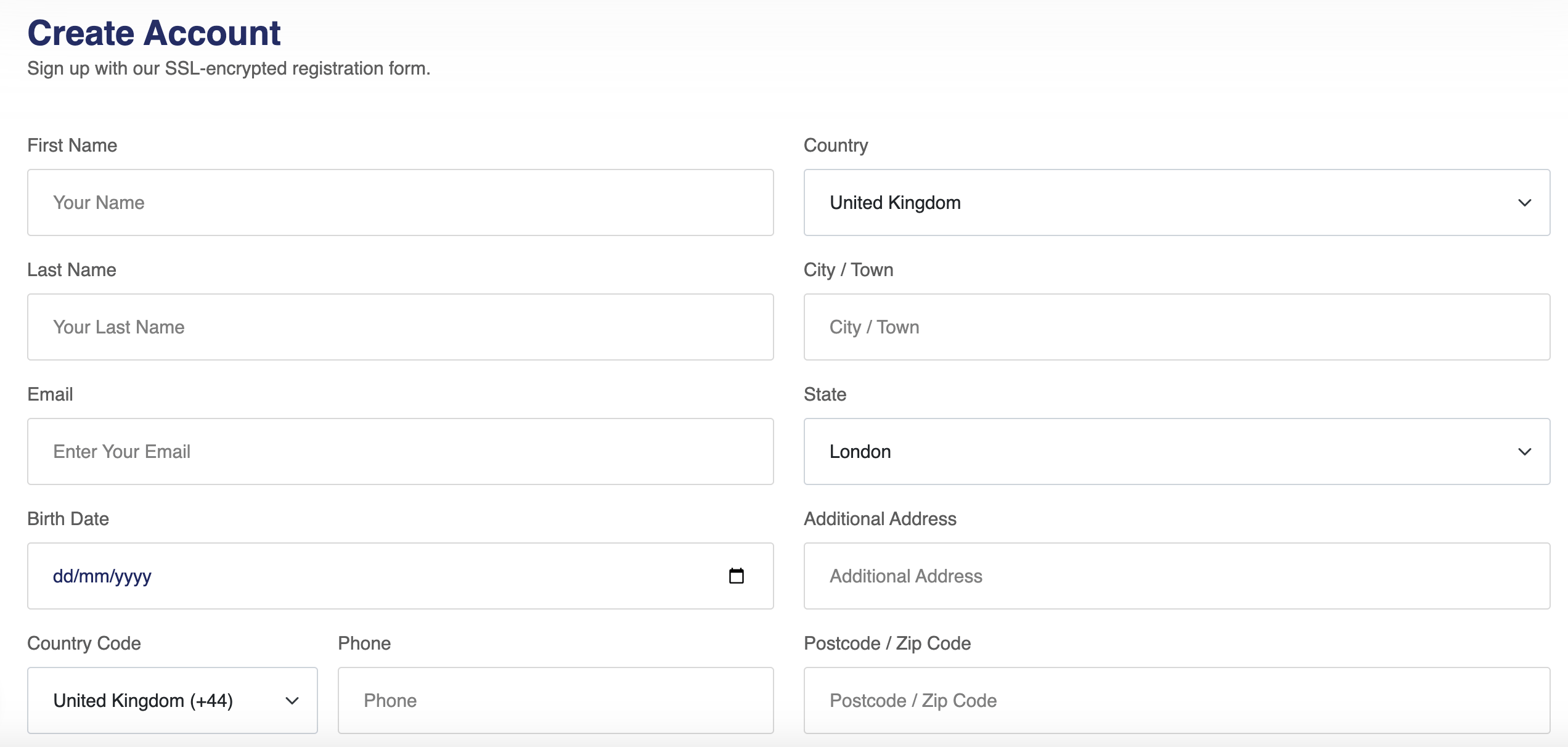

How To Sign Up For An LBLV Account

- Click Create Account on the broker’s website

- Complete the form including name, address and account currency

- Click Register Account

Note that proof of identity and residence may also need to be submitted.

LBLV Account Registration Form

Funding Option

No detail as to any deposit or withdrawal methods is given by LBLV. Again, this makes it difficult for traders to account for the costs of investing with this broker, given that wome brokers charge deposit and withdrawal fees, which can rack up if making regular transactions.

The lack of information on payment options and withdrawal times is also concerning, as this does not reassure us that investors will be able to access their money quickly and easily, if at all.

Regulation

LBLV is incorporated offshore in the Comoros Union, which is in the Indian Ocean off the Eastern Coast of Africa. It has an International Brokerage license and is regulated by the Mwali International Services Authority (MISA).

As this is not a top-tier regulator, we advise traders to approach this broker with caution as they may find themselves without the same protections offered by other regulators.

In January 2021, the Financial Conduct Authority (FCA) in the UK published an article stating that a firm named LBLV registered in Seychelles may be providing financial services or products in the UK without their authorisation. The email address given for this broker on the FCA website is the same as the email address on LBLV’s website.

The absence of FCA authorisation also means that UK clients will not have access to the UK’s Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS).

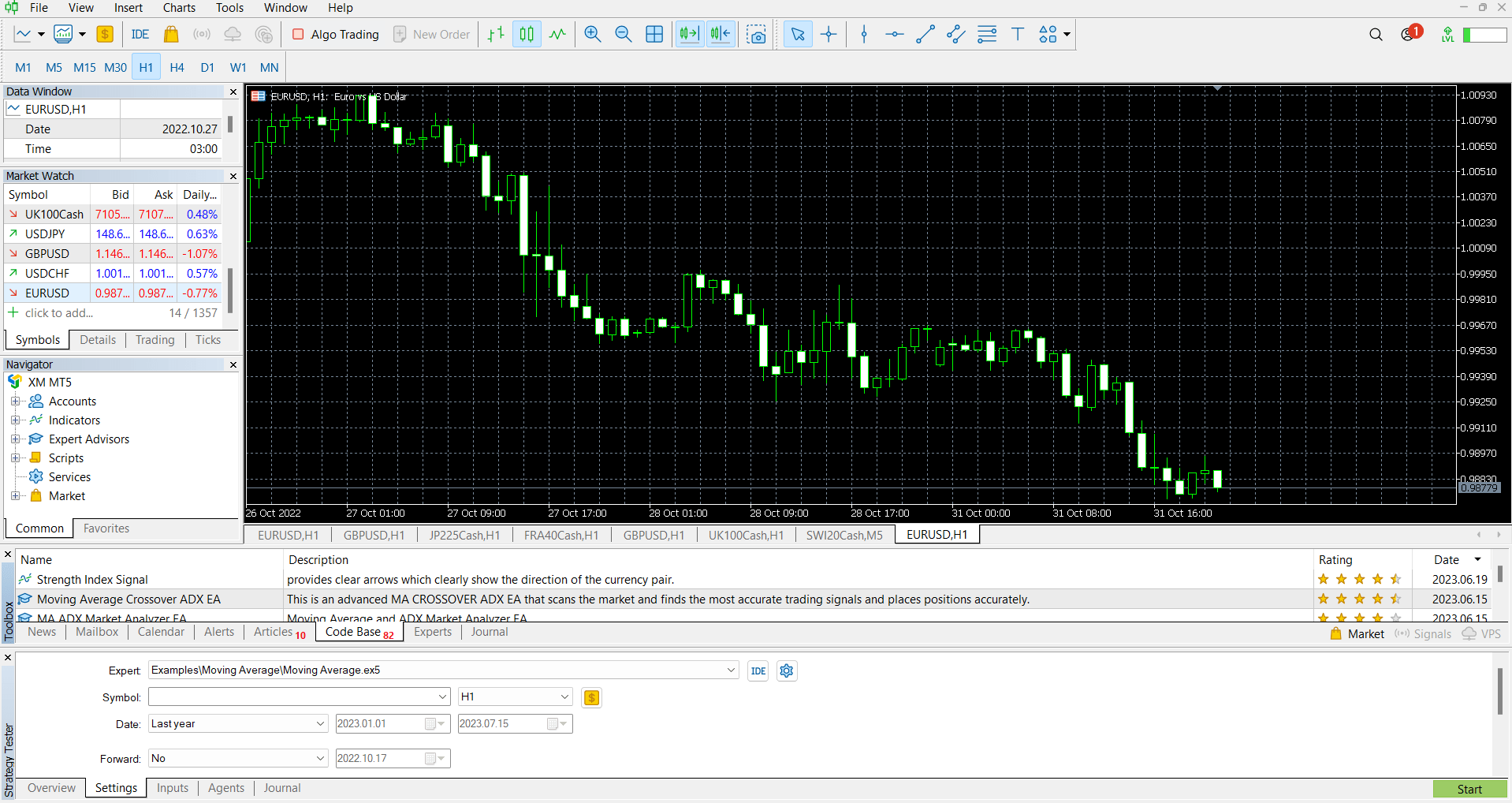

Trading Platform

LBLV integrates with the industry-leading MetaTrader 5 (MT5) platform, which suits both beginners and seasoned traders and has a range of built-in technical and fundamental analysis tools. However, some traders may find that other brokers’ proprietary platforms have a more straightforward design and more user-friendly layout, such as eToro.

There is a desktop version free download link on the broker’s website, as well as a web trader option, with the latter helpfully avoiding the need to download and install any software.

Our team have listed some of the main features of the MT5 platform:

- News reports

- 21 timeframes

- Expert Advisors (EAs)

- 38 technical indicators

- Copy trading capabilities

- Built-in economic calendar

- Unlimited number of charts

- MQL5 automated trading language

MetaTrader 5

Mobile App

MT5 has a mobile app that can be downloaded onto Apple (iOS) and Android (APK) devices. It is an intuitive application with many of the same features available on the desktop version, although the app allows investors to trade while on the go.

LBLV states that the MT5 app has a fast trade execution speed of just 0.02s. It also has 0.01 micro lot trading, making it more accessible to lower-capital traders who invest in smaller quantities.

LBLV Leverage

UK investors can access leverage rates of up to 1:400 at LBLV. This is significantly higher than the maximum rates found at many UK-regulated brokers, typically limited to 1:30.

Although higher leverage capacity creates opportunities to magnify any profits, it can also lead to higher losses. Only experienced investors should trade with leverage due to the risk involved.

Demo Account

We were unable to find access to a demo account. This is disappointing as most top brokers, including Pepperstone and CMC Markets, have easily-accessible demo accounts so that beginners can familiarise themselves with the trading platform.

They can also assist seasoned traders to test and refine strategies – as long as the account replicates real market conditions.

Bonuses Deals

We found it unusual for an offshore broker like LBLV not to advertise a no-deposit or deposit welcome bonus/offer. The regulatory freedom that such brokers have often means they use attractive bonuses and promotions to entice new clients.

Extra Tools & Features

Although LBLV has named pages on its website relating to e-books, video courses, a glossary and forex forecasts, we were unable to access any of these resources. When our experts attempted to view the content of these pages, they were met with a server error message. This may indicate that the broker lacks legitimacy and is a serious drawback for beginners who often rely on such resources to make informed trading decisions. The news page and economic calendar cannot be accessed either.

There are no details of any additional investing resources such as a VPS or a social trading forum for connecting traders.

Customer Service

LBLV advertises the following customer support contact options:

- Live Chat

- Telephone – +18447924568

- Email – clientservices@lblv.com

The broker claims to provide 24-hour support. However, we did not receive a response when we tested the live chat, although we did get a reply to our email. The lack of efficiency in the live chat service is concerning and it is unclear whether it works at all. It is important that traders can easily get help if they experience technical issues or have queries as it is their money on the line.

The broker also has Facebook, Instagram and YouTube accounts.

Company Details & History

LBLV was founded in Seychelles in 2017, though few company details are provided on its website. We find this lack of transparency to be very concerning. There is also no information regarding its number of users, trading volume and where its offices (if any) are located.

Many other brokers willingly provide such information to show that they are an active, legitimate and popular company.

Trading Hours

Trading hours are usually 24/7 for crypto and 24/5 for forex, although our team would prefer the broker to confirm these hours as there are sometimes variations that can seriously restrict speculative opportunities.

It would also be useful to know the server time, so UK traders can plan their investment strategies.

Safety

We have strong concerns about the security and legitimacy of the LBLV platform. Our experts attempted to register for an account but we encountered technical issues, which meant it was not possible to get online login details. The inaccessible web pages and weak customer support are also worrying.

The only security features we found were that the trading platform has 256-bit encryption and the registration form is encrypted.

As for the security of investor funds, we would advise traders to be very cautious if using this broker.

Should You Trade With LBLV?

LBLV lacks much of the information and resources on its website that we would expect from a reputable and reliable brokerage. We were not able to access any educational material or market analysis and the minimum deposit requirements are significantly higher than many other brokers.

LBLV’s unresponsive customer support and lack of top-tier regulation are also causes for concern, not to mention the FCA itself condemning the sale of its services to UK clients.

Our experts recommend that readers avoid this brokerage and explore legitimate, FCA-regulated brokers with transparent pricing, low minimum deposits and a suite of helpful features.

FAQ

Is LBLV A Good Broker For UK Investors?

Although LBLV claims to have a wide range of instruments, it is seriously lacking in other areas. We were unable to access any educational material or market analysis and there is limited public information about fees. We do not recommend this broker for UK traders.

Is LBLV Regulated?

LBLV is registered offshore by the Mwali International Services Authority (MISA). We do not consider this is a top-tier regulator, which means traders may have more limited protection should things go wrong. We recommend that traders approach such brokers with caution.

Is LBLV Legit & Safe?

LBLV is not regulated by a top-tier authority like the FCA. It also lacks the information on its website that we would expect from a reputable broker and many webpages are not functional. Moreover, we could not open an account with the firm and found it very difficult to get in touch.

Is LBLV Accessible To Beginners?

LBLV has very high minimum deposits on all its accounts, which does not make it a realistic option for many beginner traders. We have also found the website’s educational pages to be unavailable and customer support lacking.

Does LBLV Have A Demo Account?

We were not able to find any mention of a demo account, however, we were also unable to register for an account. Anyone that does manage to successfully register may be able to open a demo account at that stage, although we are unable to verify this.

Article Sources

Mwali International Services Authority (MISA)

Top 3 LBLV Alternatives

These brokers are the most similar to LBLV:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FXPrimus - FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

LBLV Feature Comparison

| LBLV | Swissquote | IG Index | FXPrimus | |

|---|---|---|---|---|

| Rating | 0.5 | 4 | 4.7 | 2.3 |

| Markets | Forex, CFDs, indices, shares, commodities | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities, Bonds |

| Minimum Deposit | $5000 | $1,000 | $0 | $15 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA (Seychelles) | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | CYSEC, MIFID, ICF, FCA, BaFin, VFSC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | MT4, MT5 | MT4 | MT4, MT5, cTrader |

| Leverage | 1:400 | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:1000 |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | LBLV Review |

Swissquote Review |

IG Index Review |

FXPrimus Review |

Trading Instruments Comparison

| LBLV | Swissquote | IG Index | FXPrimus | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | No | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | No |

LBLV vs Other Brokers

Compare LBLV with any other broker by selecting the other broker below.

Popular LBLV comparisons: