NordFX Review 2026

NordFX is a global ECN broker that offers a range of CFDs on forex, commodities, indices, stocks and cryptocurrencies. Using the MetaTrader 4 (MT4) platform, the reputable firm gives investors access to low spreads and fast execution speeds. This 2026 review of NordFX will explore the firm’s services, prices and limitations.

NordFX History & Overview

Established in 2008, NordFX has built a solid reputation in the online trading industry. It has won more than 60 awards, including the 2021 World Forex Award for The Most Transparent Broker. With over 1.7 million accounts opened across almost 190 countries, this is a worldwide company that provides investment services to the UK and beyond.

The broker is owned and operated by NFX CAPITAL VU INC and has its headquarters/head office location in Vanuatu. It is regulated by the Vanuatu Financial Services Commission (VFSC). Unfortunately, we were unable to find details of the broker’s founder or owner.

Trading Platform

NordFX only has one trading platform: MetaTrader 4. MT4 is one of the most reliable and trusted platforms in the industry, with a range of features suited to both beginners and veterans. Our experts have reviewed the software package and revealed the main features below:

MT4

- Nine timeframes

- 23 analytical tools

- Multiple order types

- Financial news alerts

- 30 technical indicators

- Thousands of free and paid trading signals

- Algorithmic trading using expert advisors (EAs)

- Mobile trading on Apple (iOS) and Android (APK) devices

Clients at NordFX can also choose to access MT4 MultiTerminal, where you can link multiple trading accounts to the same server. This means that, when you place a trade, the order is made across all your accounts simultaneously.

Markets

There are more than 120 instruments available on NordFX:

- 33 forex pairs

- 68 CFD stocks

- Five CFD indices

- 11 cryptocurrencies

- CFD commodities including gold, silver and oil

Note that binary options are not available with this broker.

NordFX Fees

Trading fees are generally low at NordFX, although this does depend on the account type. The Zero account has spreads from 0.0 pips and a competitive commission of 0.0035% per trade per side. However, this account requires a $500 minimum deposit. Beginners are likely to be more attracted to the Fix Account ($10 minimum deposit), which has spreads from 2.0 pips and no commissions. While the Fix Account spreads are higher, they are fixed, which means that they are not exposed to market volatility. Note that the commission on crypto is 0.06%.

NordFX accounts support three base currencies: USD, BTC & ETH. Any deposits or withdrawals made using another currency will result in conversion fees. Swap fees are charged on long positions held overnight.

Leverage

As NordFX is not regulated by a major watchdog like the FCA, its leverage limits are higher. Clients can access up to 1:1,000 in leverage rates. It is important to note that this is a maximum and we recommend that only experienced investors with comprehensive knowledge of the market and associated risk should invest with this level of additional exposure.

Mobile Trading

Although NordFX does not have its own mobile app, MT4 is available on mobile and tablet devices from the Apple App Store and Google Play Store. This means that investors can monitor the market and make trades on the go from anywhere in the world. The app is laid out in a simple interface and is easy to use.

Payment Methods

How To Deposit Money At NordFX

The minimum deposit for NordFX is competitive at just $10 (Fix Account). The deposit options available include the following (with their associated processing times):

- Neteller – instant deposits, USD support, no commissions

- PayToday – instant deposits, THB support, 4% commissions

- Dragonpay – 1-24hr deposits, PHP support, no commissions

- Skrill – instant deposits, USD & EUR support, no commissions

- Ngan Luong – instant deposits, VND support, no commissions

- Visa & Mastercard – instant deposits, USD & EUR support, no commissions

- WebMoney – instant deposits, USD & EUR support, 0.8% commissions up to £50

- Bank Wire Transfer – 3-5 business day deposits, USD & EUR support, no commissions

- Perfect Money – instant deposits, USD & EUR support, 0.5% commissions (1.99% for unverified accounts)

Investors can also use ERC-20 and BEP-20 cryptocurrencies to make deposits. Note that third-party fees may be charged by the bank for a bank transfer and commission is applied to certain online payment system methods.

How To Withdraw Money From NordFX

Our experts undertook a review of withdrawal options and found that all deposit methods can also be used for withdrawing from NordFX. However, there is a relatively high 4% + £7.50 charge for Visa and Mastercard withdrawals. Third-party fees are also often charged for bank transfers. Processing times are generally slower than deposits, with bank transfers typically taking 3-6 business days and the withdrawal time for Visa/Mastercard at 5-6 business days.

Demo Account

NordFX has a demo account that traders can login to on the MT4 platform. It comes with £10,000 of virtual funds and you can choose your account leverage rate. The paper trading account can help beginners learn how to use the platform. More experienced clients may also find it useful to practice their investing strategy, whether looking to hedge, scalp or swing trade.

Bonuses & Promotions

NordFX boasts a Super Lottery, with cash prizes available for investors that both replenish their account with at least $200 during the lottery period and then achieve a two-lot turnover for forex pairs and gold plus four lots for silver. The more you replenish and invest with, the more lottery tickets you get and the higher your chance of winning. Our team was unable to find details of any no deposit welcome bonus schemes, which are common amongst competitors.

NordFX Regulation

This broker is regulated by and has a license with the Vanuatu Financial Services Commission (VFSC). As an offshore broker, NordFX clients receive less protection than those with firms regulated by the FCA, for example. That being said, this broker does have an established history in the online investing market; being regulated by an offshore body does not necessarily indicate illegitimacy.

Account Types

Accounts at NordFX can be funded using USD, Bitcoin (BTC) or Ethereum (ETH). There are usually no documents required for account registration, although this may be necessary for specific situations. The details of each main account type are listed below, though clients should note that there is also a Savings Account based on DeFi technology with which investors can get a passive income of about 30% per annum.

Fix Account

- 28 forex pairs

- No commissions

- $10 minimum deposit

- Spreads from 2.0 pips

- Four-digit quote precision

- Minimum lot size of 0.01 for forex, gold and silver

Pro Account

- 33 forex pairs

- No commissions

- Spreads from 0.9 pips

- $250 minimum deposit

- Five-digit quote precision

- Minimum lot size of 0.01 for forex, gold and silver

Zero Account

- 33 forex pairs

- Spreads from 0 pips

- $500 minimum deposit

- Five-digit quote precision

- Access to interbank liquidity

- Commission of 0.0035% per trade per side

- Minimum lot size of 0.01 for forex, gold and silver

How To Get Started With NordFX

1) Register

The first step is to register, which can be done in a minute or two without the need usually to upload any verification documents. Simply click on the ‘Open an Account’ button at the top of the webpage and enter your details. This will also involve setting your account leverage ratio. Once complete, you will receive login details and can access your account on the MT4 platform. It is also possible to open a demo account if you first want to test your trading strategy using virtual funds.

2) Access MT4

Next, you need to download MT4 (which is free) either from the web or from the App Store/Google Play if you want the mobile application. However, investors that do not wish to download any software can use MetaTrader 4’s web platform through any major browser.

3) Choose A Market

A key choice to be made is a market you wish to speculate upon. Our team recommends selecting one you are familiar with and for which you understand the factors influencing the price. For example, if you choose the forex market, it is important to understand the influence that interest rate decisions made by central banks like the Bank of England and the Federal Reserve will have on currency pairs. Many significant political events will do the same, as can major tax and spending decisions made by governments. Investors can use NordFX’s educational material to learn more about investing or read the forecasts and analysis each week to become familiar with the markets.

4) Open, Monitor & Close Your Position

Trades can be opened in a few clicks on the MT4 platform. Timing the opening of a position can be tricky and depends on whether your strategy focuses on fundamental or technical analysis. For example, a technical analysis forex trader may open a position when two different moving averages cross each other on their chart.

Once opened, positions need to be closely monitored and investors should check NordFX’s economic calendar to see whether any market events may influence the price and/or create volatility. Positions can be closed manually or investors may wish to set up a stop loss or take profit order, which will automatically close the position once the market reaches a certain price.

Benefits Of NordFX

- Regulated

- MT4 access

- ECN brokerage

- Easy to register

- 1:1,000 leverage

- Fast order execution

- Low minimum deposit

- Spreads from zero pips

- Cryptocurrency trading

- Range of deposit methods

Drawbacks Of NordFX

- No UK contact number

- Regulated offshore

- No MT5 access

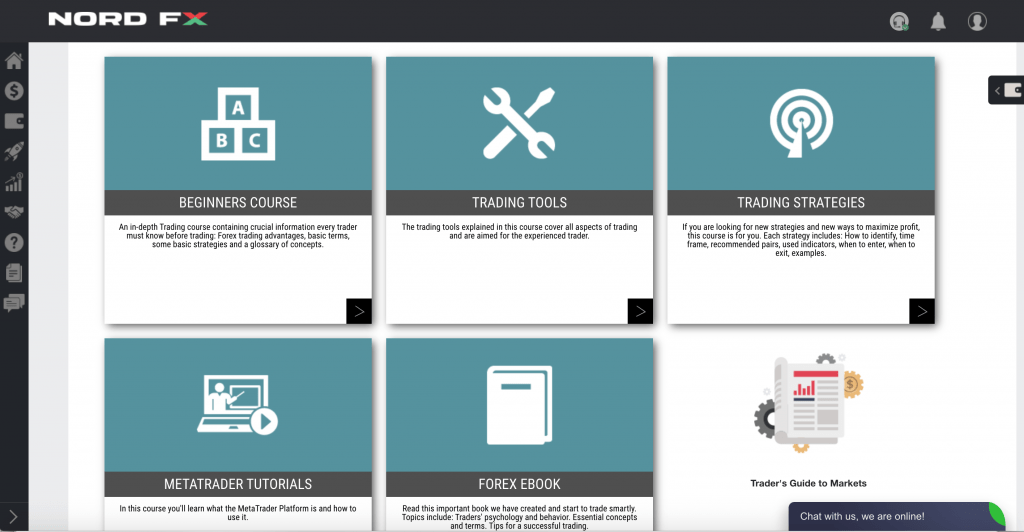

Additional Features

NordFX provides weekly articles, usually released on a Saturday, with market analysis and forecasts. There is also a wealth of material in the training section, including videos, articles and a glossary.

An investing signals and copy trading service is available for those that wish to copy the trades of more experienced traders or do not have the time to constantly monitor the market. In addition, there is a PAMM (Percentage Allocation Money Management) service, which is similar to copy trading except that the manager pools the funds of each follower with their own. This can provide added protection to those investing. Anyone can become a signals provider; the more successful you are as an investor, the more subscribers you will get (and the more money you can earn).

NordFX Services

Those wishing to run EAs for extensive periods whilst offline or who require a fast connection to the platform can use a Virtual Private Server (VPS). The hosting provider is Fozzy and, although there is a charge, a discount is available for NordFX customers. The locations of the servers are geographically close, making speeds even faster.

In addition, there is a Trader’s Calculator on the broker’s website to work out profit and total margin for a given price movement, number of pips and leverage.

Trading Hours

Trading hours vary on NordFX depending on the market being speculated upon. For example, the hours for stocks will usually be restricted to the hours of the exchange they trade on (be it the London Stock Exchange (LSE) or the New York Stock Exchange (NYSE)) whereas the forex market is generally 24/5 running from Sunday evening to Friday evening.

Customer Support

There is 24/5 customer support on NordFX. This is very useful if you have a withdrawal issue or want to know how to close your account. The following contact options are available:

- Live chat portal

- Online contact form

- European phone number (+357-25030262)

The broker also has social media accounts on Facebook, Twitter, Instagram, LinkedIn, Pinterest, YouTube and Telegram. These can be useful sources of information; the Facebook account gives details of upcoming economic events and weekly market forecasts.

NordFX Verdict

NordFX has an established track record of delivering online ECN brokerage services to clients across the world for several years. The broker has a competitive range of assets and account types, also offering a promotional lottery and 24/5 customer support. While the firm is regulated offshore, this means that it can offer leverage rates as high as 1:1,000.

FAQs

Is NordFX Genuine Or A Scammer?

NordFX is a genuine brokerage that has won multiple awards and has opened around 1.7 million accounts for customers. The firm is registered in Vanuatu and licenced by the VSFC.

Is NordFX A Market Maker?

No. NordFX is an Electronic Communication Network (ECN) broker. This means it pulls its market data and spreads directly from the financial markets.

Is NordFX Legit, Legal And Trusted?

Although regulated offshore, NordFX is a legal broker that is properly registered and has existed since 2008.

How Does Trading On NordFX Work?

Investors will need to use MetaTrader 4 to trade on NordFX. MetaTrader 4 can be accessed on a PC or mobile/tablet device.

Is NordFX Regulated?

Yes. NordFX is regulated offshore by the Vanuatu Financial Services Commission (VFSC).

How Trustworthy And Safe Is NordFX?

Although offshore regulators generally do not impose as stringent requirements on brokers as firms regulated in the UK, NordFX is still an established company that operates without major issues in most countries across the world.

What Is NordFX And Is It Good Or Not?

NordFX is a broker that specialises in the forex, stock, indices, commodities and crypto markets. It has a low minimum deposit requirement, uses the well-respected MT4 trading platform, provides access to a range of markets and has a good education section.

Top 3 NordFX Alternatives

These brokers are the most similar to NordFX:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- Fusion Markets - Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

NordFX Feature Comparison

| NordFX | Pepperstone | Fusion Markets | IC Markets | |

|---|---|---|---|---|

| Rating | 3.9 | 4.8 | 4.6 | 4.8 |

| Markets | Forex, CFDs, indices, commodities, cryptos, stocks | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Minimum Deposit | $10 | $0 | $0 | $200 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSC (Mauritius), FSA (Seychelles) | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, VFSC, FSA | ASIC, CySEC, CMA, FSA |

| Education | Yes | Yes | No | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:500 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Visit | 72% of retail investor accounts lose money when trading CFDs |

|||

| Review | NordFX Review |

Pepperstone Review |

Fusion Markets Review |

IC Markets Review |

Trading Instruments Comparison

| NordFX | Pepperstone | Fusion Markets | IC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | No | No |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

NordFX vs Other Brokers

Compare NordFX with any other broker by selecting the other broker below.

Popular NordFX comparisons:

|

|

NordFX is #21 in our rankings of CFD brokers. |

| Top 3 alternatives to NordFX |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, indices, commodities, cryptos, stocks |

| Demo Account | Yes |

| Minimum Deposit | $10 |

| Minimum Trade | $1 |

| Regulated By | FSC (Mauritius), FSA (Seychelles) |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:1000 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Mastercard, Neteller, Perfect Money, Skrill, Visa, WebMoney, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes (via MetaQuotes Software Corp - MT4) |

| Islamic Account | No |

| Commodities | Gold, Oil, Silver |

| CFD FTSE Spread | - |

| CFD GBPUSD Spread | 0.1 |

| CFD Oil Spread | 0.0 |

| CFD Stocks Spread | 0.0 |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.0 |

| GBPEUR Spread | 0.2 |

| Assets | 30+ |